Payrolls increased by 517,000 in January, crushing estimates, as unemployment rate hit 53-year low

Last edited Fri Feb 3, 2023, 09:23 PM - Edit history (4)

Source: CNBC

The employment picture started off 2023 on a stunningly strong note, with nonfarm payrolls posting their biggest gain since July 2022. Nonfarm payrolls increased by 517,000 for January, above the Dow Jones estimate of 187,000 and December's gain of 260,000, according to a Labor Department report Friday.

"It was a phenomenal report," said Michelle Meyer, chief U.S. economist at the Mastercard Economics Institute. "This brings into question how we're able to see that level of job growth despite some of the other rumblings in the economy. The reality is it shows there's still a lot of pent-up demand for workers were companies have really struggled to staff appropriately."

The unemployment rate fell to 3.4% versus the estimate for 3.6%. That is the lowest jobless level since May 1969. The labor force participation rate edged higher to 62.4%. A broader measure of unemployment that includes discouraged workers and those holding part-time jobs for economic reasons also edged higher to 6.6%. The household survey, which the Labor Department uses to compute the unemployment rate, showed an even bigger increase of 894,000.

"Today's jobs report is almost too good to be true," wrote Julia Pollak, chief economist at ZipRecruiter. "Like $20 bills on the sidewalk and free lunches, falling inflation paired with falling unemployment is the stuff of economics fiction." Markets, however, dropped following the report, with the Dow Jones Industrial Average down about 100 points in early trading.

Read more: https://www.cnbc.com/2023/02/03/jobs-report-january-2023-.html

I mean REALLY???? THIS is what I'm talking about when it comes to "prediction models" and how we are in a freak economic period. I expect this might be revised downwards some next month but this was an awful swing and a miss.

From the source -

Link to tweet

@BLS_gov

·

Follow

Payroll employment rises by 517,000 in January; unemployment rate changes little at 3.4% #BLSData https://bls.gov/news.release/empsit.nr0.htm

8:30 AM · Feb 3, 2023

Have to add this -

Link to tweet

@POTUS

·

Follow

United States government official

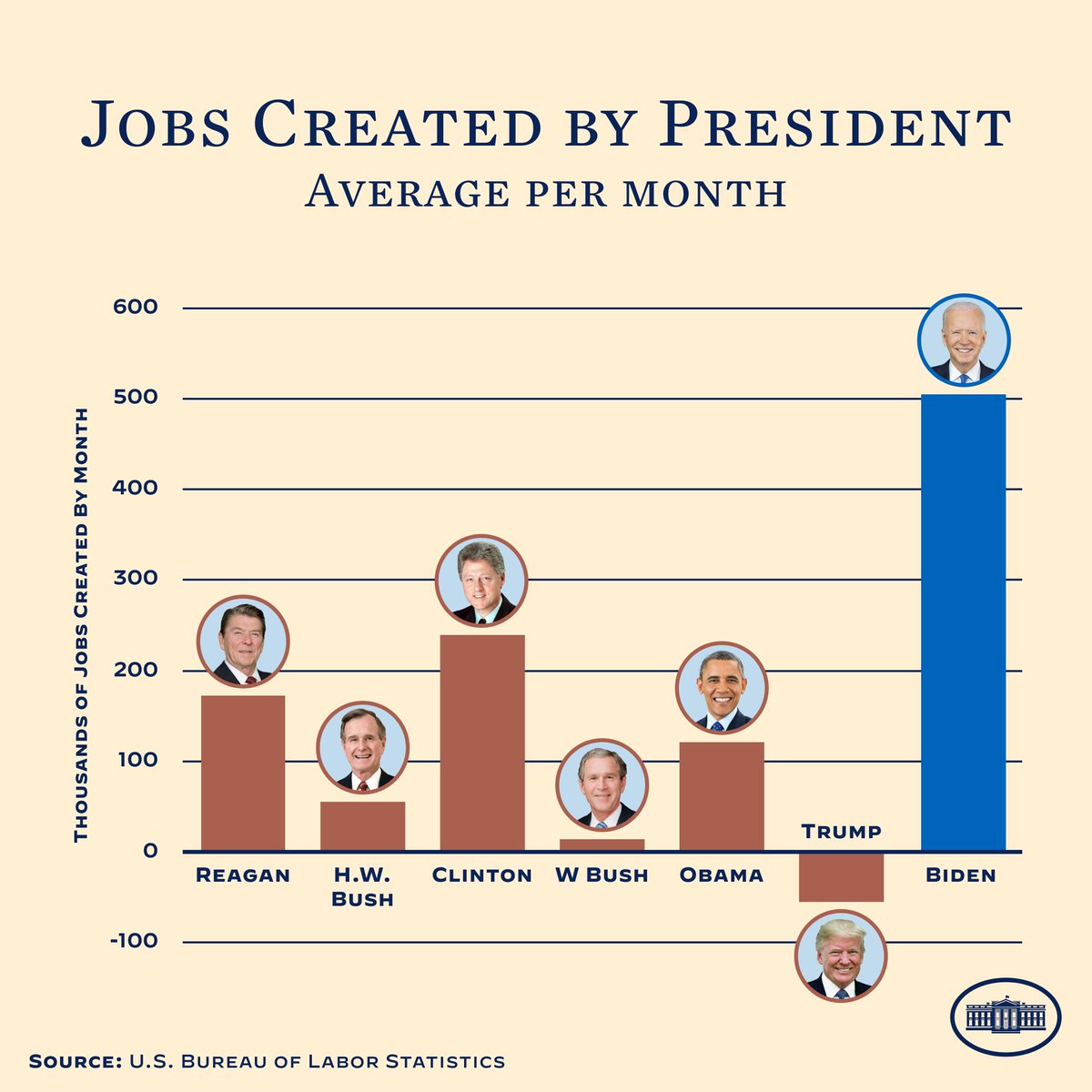

We added more than half a million jobs to our economy in January, exceeding expectations by a long shot.

We’re building an America we can take pride in – one where working families have good-paying jobs and more breathing room.

Chart depicting jobs created by president on average per month. President Biden's average per month is 504,300 jobs.

5:30 PM · Feb 3, 2023

Stay tuned for DU's economic analysts to provide all the deep dives of the data!

Article updated.

Previous articles/headlines -

"It was a phenomenal report," said Michelle Meyer, chief U.S. economist at the Mastercard Economics Institute. "This brings into question how we're able to see that level of job growth despite some of the other rumblings in the economy. The reality is it shows there's still a lot of pent-up demand for workers were companies have really struggled to staff appropriately."

The unemployment rate fell to 3.4% versus the estimate for 3.6%. That is the lowest jobless level since May 1969. The labor force participation rate edged higher to 62.4%. A broader measure of unemployment that includes discouraged workers and those holding part-time jobs for economic reasons also edged higher to 6.6%.

"Today's jobs report is almost too good to be true," wrote Julia Pollak, chief economist at ZipRecruiter. "Like $20 bills on the sidewalk and free lunches, falling inflation paired with falling unemployment is the stuff of economics fiction." Markets, however, dropped following the report, with the Dow Jones Industrial Average down about 100 points in early trading.

The unemployment rate fell to 3.4% versus the estimate for 3.6%. That is the lowest jobless level since May 1969. The labor force participation rate edged higher to 62.4%. A broader measure of unemployment that includes discouraged workers and those holding part-time jobs for economic reasons also edged higher to 6.6%.

"Today's jobs report is almost too good to be true," wrote Julia Pollak, chief economist at ZipRecruiter. "Like $20 bills on the sidewalk and free lunches, falling inflation paired with falling unemployment is the stuff of economics fiction."

Markets, however, fell following the report, with the Dow Jones Industrial Average down about 100 points in early trading.

The employment picture started off 2023 on a stunningly strong note, with nonfarm payrolls posting their strongest gain since July 2022. Nonfarm payrolls increased by 517,000 for January, above the Dow Jones estimate of 187,000 and December's gain of 260,000.

The unemployment rate fell to 3.4% versus the estimate for 3.6%. That is the lowest jobless level since May 1969. The labor force participation rate edged higher to 62.4%. A broader measure of unemployment that includes discouraged workers and those holding part-time jobs for economic reasons also edged higher to 6.6%. Markets slumped following the report, with futures tied to the Dow Jones Industrial Average down about 200 points.

Growth across a multitude of sectors helped propel the massive beat against the estimate. Leisure and hospitality added 128,000 jobs to lead all sectors. Other significant gainers were professional and business services (82,000), government (74,000) and health care (58,000). Retail was up 30,000 and construction added 25,000.

Wages also posted solid gains for the month. Average hourly earnings increased 0.3%, in line with the estimate, and 4.4% from a year ago, 0.1 percentage point higher than expectations. The surge in job creation comes despite the Federal Reserve's efforts to slow the economy and bring down inflation from its highest level since the early 1980s. The Fed has raised its benchmark interest rate eight times since March 2022.

Nonfarm payrolls increased by 517,000 for January, above the Dow Jones estimate of 187,000. The unemployment rate fell to 3.4% vs. the estimate for 3.6%. That is the lowest jobless level since May 1969.

Growth across a multitude of sectors helped propel the massive beat against the estimate.Leisure and hospitality added 128,000 jobs to lead all sectors. Other significant gainers were professional and business services (82,000), government (74,000) and health care (58,000).

Wages also posted solid gains for the month. Average hourly earnings increased 0.3%, in line with the estimate, and 4.4% from a year ago, 0.1 percentage point higher than expectations.

Nonfarm payrolls increased by 517,000 for January, above the Dow Jones estimate of 187,000. The unemployment rate fell to 3.4% vs. the estimate for 3.6%.

This is breaking news. Please check back here for updates.

Original article -

This is breaking news. Please check back here for updates.

mathematic

(1,439 posts)The weekly layoff numbers being historically low should have been the tip off that the payroll #s would be high but this is beyond all expectations.

mahatmakanejeeves

(57,600 posts)Fri Feb 3, 2023: U.S. layoffs surged in January as tech slashed thousands of jobs - report

2 minute read | February 2, 2023 | 8:15 AM EST | Last Updated a day ago

U.S. layoffs surged in January as tech slashed thousands of jobs - report

By Samrhitha Arunasalam

Feb 2 (Reuters) - Layoffs in the United States hit a more than two-year high in January as technology firms cut jobs at the second-highest pace on record to brace for a possible recession, a report showed on Thursday.

The layoffs impacted 102,943 workers, a more than two-fold jump from December and an over five-times surge from a year earlier, according to the report from employment firm Challenger, Gray & Christmas Inc.

Reuters Graphics

{snip}

Jan ’23 Recession or Correction? Highest January Since 2009, Highest Monthly Total Since September 2020

PUBLISHED FEBRUARY 2, 2023

U.S.-based employers announced 102,943 cuts in January, a 136% increase from the 43,651 cuts announced in December. It is 440% higher than the 19,064 cuts announced in the same month in 2022, according to a report released Thursday from global outplacement and business and executive coaching firm Challenger, Gray & Christmas, Inc.

Last month’s total is the highest January total since 2009, when 241,749 were announced in the first month of the year. It is the highest monthly total since September 2020 when 118,804 job cuts were reported.

“We’re now on the other side of the hiring frenzy of the pandemic years,” said Andrew Challenger, labor expert and Senior Vice President of Challenger, Gray & Christmas, Inc.

“Companies are preparing for an economic slowdown, cutting workers and slowing hiring,” he added.

{snip, and they don't have a paywall}

BumRushDaShow

(129,432 posts)and good morning! ![]()

(ETA - I know the tech people are saying it's "AI, AI, AI" but IMHO, that is also "post-pandemic" reductions after the huge ramp-ups to deal with all the remote work that had been going on, where that is no longer needed - at least at the same levels as 2021/2022)

mahatmakanejeeves

(57,600 posts)The number is way out of line. I can't recall what ADP came up with two days ago.

mathematic

(1,439 posts)For sure we're getting reports of layoffs. It's not really showing up in any of the major government statistics. It really seems like the people laid off from tech work are finding new jobs very quickly.

Over 500k jobs growth in Jan plus revisions upwards in Nov & Dec despite months of layoff talk and action in tech has left me with a "I'll believe it when I see it" view of labor market weakness.

mahatmakanejeeves

(57,600 posts)For reference, I put it in the Economy group.

And good morning.

Wed Feb 1, 2023: BLS Report: Number of job openings increase in December; hires and total separations change little

True Dough

(17,315 posts)While the job market is red-hot, it's not great news in terms of taming inflation. There's always a double-edged sword with economic data these days.

Alexander Of Assyria

(7,839 posts)Wall Street is sad! Don’t fall for the wages are high and unemployment low is a bad thing propaganda.

Other nations would kill for these kind of number and only 6% inflation??

Remarkable!

True Dough

(17,315 posts)I agree with you.

But gasoline is showing signs of moving up again and food prices are very stubborn. I'm hopeful, but I'm watching with eyes wide open. It's an interesting moment in history. Looks promising so far...

hot2na

(358 posts)They are all too happy about price gouging but not when peoples salaries increase as a result.

True Dough

(17,315 posts)price gouging has been in full effect in relation to gasoline and food prices. Surely other products as well, but gas and groceries in particular have risen so much that the producers and retailers are clearly fattening their profits. It's disgusting, especially when so many people are just struggling to get by.

Walleye

(31,045 posts)It’s bad when good news is bad news something is wrong

Alexander Of Assyria

(7,839 posts)Streets handwringing!

Justice matters.

(6,941 posts)Thanks to the remarkable negotiation skills of Democratic President Joe Biden and his Economic experts team!

But hey, let's vote in the House to ignore that and condemn Socialism (while the American Oligarch fat cats have never been more overweight!).

Botany

(70,578 posts)And yet the GOP and the corporate backed main stream media keep on yapping about the coming recession

because Americans are being hurt by the socialist policies of President Biden.

JohnSJ

(92,382 posts)bronxiteforever

(9,287 posts)Kick and recommend. Go Joe!!!!!

doc03

(35,363 posts)I hear this every day, in this bad economy, due to the slow down in the economy, in the current economic slowdown.

Then the nobody wants to work thing when 517,000 people taking a job in one month.

bronxiteforever

(9,287 posts)on Bloomberg praising the numbers. They are looking at wage growth and it is still in line with a lower risk of inflation. I am hoping that praise continues and POTUS gets the credit he deserves.

Your point about nobody wants to work is excellent and I will have to borrow that the next time I hear that “nobody wants to work anymore” argument.

doc03

(35,363 posts)Everyone is on welfare.

bronxiteforever

(9,287 posts)Bengus81

(6,932 posts)James48

(4,440 posts)THANK YOU JOE BIDEN, THE NUMBER OF AMERICAS WORKING IS THE LARGEST EVER.

EVER.

honest.abe

(8,685 posts)The Fed will jack up interest rates even more to force a recession.

doc03

(35,363 posts)to slow down the economy when a Republican was president. It is always the Fed dropped interest rates to stimulate the economy.

IronLionZion

(45,525 posts)It's in their official public record that they did so on the request of President Trump. ![]()

They raised rates during W Bush too. I remember because I put everything in savings back then providing some protection for when W destroyed the economy

Bengus81

(6,932 posts)BumRushDaShow

(129,432 posts)through 2018 until the increases were paused, and then started slowly dropping, afterwhich the pandemic hit and BOOM. Back down to near 0.

(below as of Feb. 1, 2023)

https://www.macrotrends.net/2015/fed-funds-rate-historical-chart

Yellen started it up in 2015 when we finally moved out of Shrub's "Great Recession" and the increases continued until just before the pandemic - https://www.forbes.com/advisor/investing/fed-funds-rate-history/

(45 ERA)

March 16, 2020 | -100 | 0% to 0.25%

March 3, 2020 | -50 | 1.0% to 1.25%

October 31, 2019 | -25 | 1.50% to 1.75%

Sept. 19, 2019 | -25 | 1.75% to 2.0%

Aug. 1, 2019 | -25 | 2.0% to 2.25%

PAUSE

December 20, 2018 | +25 | 2.25% to 2.50%

Sept. 27, 2018 |+25 | 2.0% to 2.25%

Jun. 14, 2018 | +25 | 1.75% to 2.0%

March 22, 2018 | +25 | 1.50% to 1.75%

Dec. 14, 2017 | +25 | 1.25% to 1.50%

June 15, 2017 | +25 | 1.00% to 1.25%

March 16, 2017 | +25 | 0.75% to 1.00%

(OBAMA ERA)

Dec. 15, 2016 | +25 | 0.5% to 0.75%

Dec. 17, 2015 | +25 | 0.25% to 0.50%

doc03

(35,363 posts)from past years.

That is why it is concerning to hear the freak-out because the interest rates were always WAY higher in the recent past (i.e., past 40 years) and it wasn't until the "Great Recession" when the fed funds rates were actually slashed down to near 0 (~1/4%) and they stayed that way for 5 or so years, where people got used to the 3 - 4% mortgage rates (for those with good credit). Then the rates were slowly being taken back up again, had a pause, were slowly drifting down, but then the pandemic hit triggering a recession in 2020, so back down to near 0 they went in a thud. ![]()

Calista241

(5,586 posts)They'll view backing off before unemployment goes up as coming off the brakes too soon.

Alexander Of Assyria

(7,839 posts)Walleye

(31,045 posts)I hope the younger generation will stop with the resentment of us boomers now. I guess that’s wishful thinking

Johnny2X2X

(19,114 posts)I don't think the Fed has much more reason to jack up interest rates with Inflation easing so quickly now too. Might see another 25 basis points, but that's about it.

IronLionZion

(45,525 posts)GOP's hopes for a recession ![]()

![]()

![]()

![]()

Er, I mean, Nobody wants to work anymore! Egg prices! Gas prices! ![]()

Alexander Of Assyria

(7,839 posts)be able to prop up the fascists, not much on the bone! Stop the pretending! 2 more years? Long time dudes, join the célébration and kick the fascists to the curb, they offer nothing.

mcar

(42,372 posts)Way to go, Brandon. ![]()

Johnny2X2X

(19,114 posts)Nothing about this on their front page. Their business page has the headline, "US job growth unexpectedly surges as recession fears mount."

Recession fears aren't mounting, they're easing, and this jobs report will ease them further. Total clowns.

IronLionZion

(45,525 posts)so they focus on inflation instead

Alexander Of Assyria

(7,839 posts)Alexander Of Assyria

(7,839 posts)Historic NY

(37,453 posts)but Joe Biden's & the Democrats economic plan is still moving forward. More people are working than at anytime wages are up 4.4% in Jan. Hourly increases are up.

PSPS

(13,614 posts)Eventually, economists will get a handle on the new economy and how it works. They're still stuck in the 20th century pre-pandemic model.

IronLionZion

(45,525 posts)with no hope of recovery. They want a recession really bad

Johnny2X2X

(19,114 posts)“Any concern the economy is in recession or close to a recession should be completely dashed by these numbers,” Moody’s Analytics chief economist Mark Zandi told CNN.

mahatmakanejeeves

(57,600 posts)Total nonfarm payroll employment rose by 517,000 in January, and the unemployment rate changed little at 3.4 percent. Job growth was widespread, led by gains in leisure and hospitality, professional and business services, and health care.

Employment Situation Summary

Transmission of material in this news release is embargoed until 8:30 a.m. (ET) Friday, February 3, 2023

Technical information:

Household data: (202) 691-6378 * [email protected] * www.bls.gov/cps

Establishment data: (202) 691-6555 * [email protected] * www.bls.gov/ces

Media contact: (202) 691-5902 * [email protected]

THE EMPLOYMENT SITUATION -- JANUARY 2023

Total nonfarm payroll employment rose by 517,000 in January, and the unemployment rate changed little at 3.4 percent, the U.S. Bureau of Labor Statistics reported today. Job growth was widespread, led by gains in leisure and hospitality, professional and business services, and health care. Employment also increased in government, partially reflecting the return of workers from a strike.

This news release presents statistics from two monthly surveys. The household survey measures labor force status, including unemployment, by demographic characteristics. The establishment survey measures nonfarm employment, hours, and earnings by industry. For more information about the concepts and statistical methodology used in these two surveys, see the Technical Note.

_______________________________________________________________________

|

| Changes to The Employment Situation Data

|

| Establishment survey data have been revised as a result of the annual benchmarking

| process, the NAICS 2022 conversion, and the updating of seasonal adjustment factors.

| Also, household survey data for January 2023 reflect updated population estimates.

| See the notes at the end of this news release for more information.

|______________________________________________________________________

Household Survey Data

Both the unemployment rate, at 3.4 percent, and the number of unemployed persons, at 5.7 million, changed little in January. The unemployment rate has shown little net movement since early 2022. (See table A-1. See the note at the end of this news release and tables B and C for more information about annual population adjustments to the household survey estimates.)

Among the major worker groups, the unemployment rates for adult men (3.2 percent), adult women (3.1 percent), teenagers (10.3 percent), Whites (3.1 percent), Blacks (5.4 percent), Asians (2.8 percent), and Hispanics (4.5 percent) showed little change in January. (See tables A-1, A-2, and A-3.)

The number of persons jobless less than 5 weeks decreased to 1.9 million in January. The number of long-term unemployed (those jobless for 27 weeks or more) was essentially unchanged at 1.1 million. The long-term unemployed accounted for 19.4 percent of the total unemployed in January. (See table A-12.)

In January, both the labor force participation rate, at 62.4 percent, and the employment-population ratio, at 60.2 percent, were unchanged after removing the effects of the annual adjustments to the population controls. These measures have shown little net change since early 2022 and remain below their pre-pandemic February 2020 levels (63.3 percent and 61.1 percent, respectively). (See table A-1. For additional information about the effects of the population adjustments, see table C.)

The number of persons employed part time for economic reasons, at 4.1 million, was little changed in January. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs. (See table A-8.)

The number of persons not in the labor force who currently want a job was 5.3 million in January, little changed from the prior month. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job. (See table A-1.)

Among those not in the labor force who wanted a job, the number of persons marginally attached to the labor force, at 1.4 million, changed little in January. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, was also little changed over the month at 342,000. (See Summary table A.)

Establishment Survey Data

Total nonfarm payroll employment rose by 517,000 in January, compared with an average monthly gain of 401,000 in 2022. Job growth was widespread in January, led by gains in leisure and hospitality, professional and business services, and health care. Employment also increased in government, partially reflecting the return of workers from a strike. (See table B-1. See the note at the end of this new release and table A for more information about the annual benchmark process.)

Leisure and hospitality added 128,000 jobs in January compared with an average of 89,000 jobs per month in 2022. Over the month, food services and drinking places added 99,000 jobs, while employment continued to trend up in accommodation (+15,000). Employment in leisure and hospitality remains below its pre-pandemic February 2020 level by 495,000, or 2.9 percent.

In January, employment in professional and business services rose by 82,000, led by gains in professional, scientific, and technical services (+41,000). Job growth in professional and business services averaged 63,000 per month in 2022.

Government employment increased by 74,000 in January. Employment in state government education increased by 35,000, reflecting the return of university workers after a strike.

Health care added 58,000 jobs in January. Job growth occurred in ambulatory health care services (+30,000), nursing and residential care facilities (+17,000), and hospitals (+11,000). In 2022, health care added an average of 47,000 jobs per month.

Employment in retail trade rose by 30,000 in January, following little net growth in 2022 (an average of +7,000 per month). In January, job gains in general merchandise retailers (+16,000) and in furniture, home furnishings, electronics, and appliance retailers (+7,000) were partially offset by a decline in health and personal care retailers (-6,000).

Construction added 25,000 jobs in January, reflecting an employment gain in specialty trade contractors (+22,000). Employment in the construction industry grew by an average of 22,000 per month in 2022.

In January, transportation and warehousing added 23,000 jobs, the same as the industry's average monthly gain in 2022. Over the month, employment in support activities for transportation increased by 7,000.

Employment in social assistance increased by 21,000 in January, little different from the 2022 average gain of 19,000 per month.

Manufacturing employment continued to trend up in January (+19,000). In 2022, manufacturing added an average of 33,000 jobs per month.

Employment showed little change over the month in other major industries, including mining, quarrying, and oil and gas extraction; wholesale trade; information; financial activities; and other services.

In January, average hourly earnings for all employees on private nonfarm payrolls rose by 10 cents, or 0.3 percent, to $33.03. Over the past 12 months, average hourly earnings have increased by 4.4 percent. In January, average hourly earnings of private-sector production and nonsupervisory employees rose by 7 cents, or 0.2 percent, to $28.26. (See tables B-3 and B-8.)

The average workweek for all employees on private nonfarm payrolls rose by 0.3 hour to 34.7 hours in January. In manufacturing, the average workweek increased by 0.4 hour to 40.5 hours, and overtime increased by 0.1 hour to 3.1 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls increased by 0.2 hour to 34.1 hours. (See tables B-2 and B-7.)

The change in total nonfarm payroll employment for November was revised up by 34,000, from +256,000 to +290,000, and the change for December was revised up by 37,000, from +223,000 to +260,000. With these revisions, employment gains in November and December combined were 71,000 higher than previously reported. (Monthly revisions result from additional reports received from businesses and government agencies since the last published estimates and from the recalculation of seasonal factors. The annual benchmark process also contributed to the November and December revisions.)

_____________

The Employment Situation for February is scheduled to be released on Friday, March 10, 2023, at 8:30 a.m. (ET).

{snip some fine print about "Revisions to Establishment Survey Data" and "Adjustments to Population Estimates for the Household Survey"}

BumRushDaShow

(129,432 posts)Justice matters.

(6,941 posts)SOCIALISM WORKS ![]()

mahatmakanejeeves

(57,600 posts)Fri Feb 3, 2023: Links to earlier reports: (this one)

Wed Feb 1, 2023: Links to earlier reports:

Fri Jan 7, 2023: Links to earlier reports:

Wed Jan 5, 2023: Links to earlier reports:

Fri Dec 2, 2022: Links to earlier reports:

Wed Nov 30, 2022: Links to earlier reports:

Fri Nov 4, 2022: Links to earlier reports:

Wed Nov 2, 2022: Links to earlier reports:

Fri Oct 7, 2022: Links to earlier reports:

Wed Oct 5, 2022: Links to earlier reports:

Fri Sep 2, 2022: Links to earlier reports:

Wed Aug 31, 2022: Links to earlier reports:

Fri Aug 5, 2022: Links to earlier reports:

Wed Aug 3, 2022: ADP has suspended its report until September.

Fri Jul 8, 2022: Links to earlier reports:

Wed Jul 6, 2022: ADP has suspended its report until September.

Fri Jun 3, 2022: Links to earlier reports:

Wed Jun 1, 2022: Links to earlier reports:

Fri May 6, 2022: Links to earlier reports

Wed May 4, 2022: Links to earlier reports:

Fri Apr 1, 2022: Links to earlier reports:

Wed Mar 30, 2022: Links to earlier reports:

Fri Mar 4, 2022: Links to earlier reports:

Wed Mar 2, 2022: Links to earlier reports:

Fri Feb 4, 2022: Links to earlier reports:

Wed Feb 2, 2022: Links to earlier reports:

Wed Jan 12, 2022: Links to earlier reports:

Wed Jan 5, 2022: Links to earlier reports:

Sat Dec 4, 2021: Links to earlier reports:

Wed Dec 1, 2021: Links to additional earlier reports:

Fri Nov 5, 2021: (I had to split the links into two posts, due to "Forbidden 403" issues)

Links to earlier reports:

Links to additional earlier reports:

Wed Nov 3, 2021: Links to earlier reports:

-- -- -- -- -- --

[center]Past Performance is Not a Guarantee of Future Results.[/center]

Nonetheless, what is important is not this month's results, but the trend. Let’s look at some earlier numbers:

Bureau of Labor Statistics, for employment in January 2023: (this one)

Fri Feb 3, 2023: Payrolls increased by 517,000 in January, crushing estimates, as unemployment rate hit 53-year low

ADP® (Automatic Data Processing), for employment in January 2023:

Wed Feb 1, 2023: Private payroll growth slowed to 106,000 in January as weather hit hiring, ADP says

Bureau of Labor Statistics, for employment in December 2022 (this one):

Fri Jan 7, 2023: Nonfarm payrolls rose 223,000 in December, as strong jobs market tops expectations

ADP® (Automatic Data Processing), for employment in December 2022:

Wed Jan 5, 2023: Private payroll growth surged by 235,000 in December, well above estimate, ADP reports

Bureau of Labor Statistics, for employment in November 2022:

Payrolls rose by 263,000 in November, more than expected despite Fed rate hikes

ADP® (Automatic Data Processing), for employment in November 2022:

Private hiring increased by just 127,000 jobs in November, well below estimate, ADP reports

Bureau of Labor Statistics, for employment in October 2022:

U.S. payrolls surged by 261,000 in October, better than expected as hiring remains strong

ADP® (Automatic Data Processing), for employment in October 2022:

Private payrolls rose 239,000 in October, better than expected, while wages increased 7.7%, ADP says

Bureau of Labor Statistics, for employment in September 2022:

Jobs report: U.S. payrolls grew by 263,000 in September, unemployment rate falls to 3.5%

ADP® (Automatic Data Processing), for employment in September 2022:

Businesses added 208,000 jobs in September, better than expected, ADP reports

Bureau of Labor Statistics, for employment in August 2022:

August jobs report: U.S. payrolls grew by 315,000 last month

ADP® (Automatic Data Processing), for employment in August 2022:

Private payrolls grew by just 132,000 in August, ADP says in reworked jobs report

Bureau of Labor Statistics, for employment in July 2022:

Employers added 528,000 jobs in July, as the hot labor market powers on

ADP® (Automatic Data Processing), for employment in July 2022:

ADP has suspended its report until September.

Bureau of Labor Statistics, for employment in June 2022:

June jobs report: Payrolls rise by 372,000 as unemployment holds at 3.6%

ADP® (Automatic Data Processing), for employment in June 2022:

ADP has suspended its report until September.

Bureau of Labor Statistics, for employment in May 2022:

May jobs report: Payrolls rise by 390,000 as unemployment holds at 3.6%

ADP® (Automatic Data Processing), for employment in May 2022:

U.S. Treasury yields fall as data show slowest job growth in pandemic recovery

Bureau of Labor Statistics, for employment in April 2022:

April jobs report: Payrolls rise by 428,000 as unemployment rate holds at 3.6%

[ADP® (Automatic Data Processing), for employment in April 2022:

U.S. Companies Added 247,000 Jobs in April, ADP Data Show

Bureau of Labor Statistics, for employment in March 2022:

U.S. economy adds 431,000 jobs in March

ADP® (Automatic Data Processing), for employment in March 2022:

Private payrolls rose by 455,000 in March, topping expectations: ADP

Bureau of Labor Statistics, for employment in February 2022:

February jobs report: Payrolls rise by 678,000 as unemployment rate falls to 3.8%

ADP® (Automatic Data Processing), for employment in February 2022:

Private payrolls rose by 475,000 in February, topping expectations: ADP

Bureau of Labor Statistics, for employment in January 2022:

January jobs report: Payrolls jump by 467,000 as unemployment rate rises to 4.0%

ADP® (Automatic Data Processing), for employment in January 2022:

Companies unexpectedly cut 301,000 jobs in January as omicron slams jobs market, ADP says

republianmushroom

(13,677 posts)mahatmakanejeeves

(57,600 posts)Alexandra is back from vacation.

Jobs report: U.S. economy adds 517,000 jobs in January, unemployment rate falls to 3.4% as labor market stuns

The unemployment rate fell to the lowest level since May 1969.

Alexandra Semenova · Reporter

Fri, February 3, 2023 at 8:31 AM EST

U.S. job growth blew past expectations in the first month of the year as the labor market continued to breeze through inflation-fighting monetary tightening by the Federal Reserve.

The Labor Department released its monthly jobs report for January at 8:30 a.m. ET on Friday. Here are the numbers, compared to Wall Street estimates:

• Non-farm payrolls: +517,000 vs. +188,000 expected

• Unemployment rate: 3.4% vs. 3.6% expected

• Average hourly earnings, month-over-month: +0.3% vs +0.3% expected

• Average hourly earnings, year-over-year: +4.4% vs. +4.3% expected

Friday's shock numbers mark a sharp jump from the prior month, which saw payrolls rise by an upwardly revised 260,000. The unemployment rate slipped to 3.4% in January, the lowest since 1969.

The blowout figures come just as the employment picture began to show some signs of moderation, with monthly data on a downtrend in recent months before January's outlier report.

{snip}

Bayard

(22,148 posts)And probably not many of the others.

Inflation, inflation, inflation. That's what its all about.

![]()

mahatmakanejeeves

(57,600 posts)Please. How many seconds did it take me to find this?

"surge" "crush" "tumbles" You can tell that they're biased.

US job growth unexpectedly surges in January as economy adds 517,000 new positions

Unemployment rate tumbles to 50-year-low as job growth crushes expectations

{snip}

Bayard

(22,148 posts)That's why MAGAts won't see it.

progree

(10,918 posts)Nationally, the labor force participation rate has been dwindling from a high point of about 67.3% in 2000 to 62.4% now (BLS's January report). (It was also 62.4% in March, so there hasn't been any progress in the past 10 months).

Labor force participation rate: http://data.bls.gov/timeseries/LNS11300000

Labor force in thousands: http://data.bls.gov/timeseries/LNS11000000

The labor force = employed + officially unemployed as per the BLS's monthly Household Survey

The officially unemployed are jobless people who have looked for work in the past 4 weeks (must be more than just looking at job listings). That's why they are counted as part of the labor force: either employed or actively looking for work. BTW, the officially unemployed is not a count of people claiming unemployment insurance, it has nothing to do with that (a common myth unfortunately).

How the Government Measures Unemployment http://www.bls.gov/cps/cps_htgm.htm

TexasBushwhacker

(20,213 posts)Baby Boomers (born between 1946 and 1964) have been reaching traditional retirement age, 65, at a rate of 10K PER DAY! Sure, some people retire early, some later, but that is a huge number of people leaving the workforce and are unlikely to come back, at least not full time. So that "labor participation rate" is unlikely to budge, and it's not because "people don't want to work" (as my boss and his wife like to say). Most are leaving because they've worked over 40 years and they're DONE.

progree

(10,918 posts)title line because I would expect that with the headline nonfarm payroll jobs having increased by 3.65 million since March (365k/month average), that the labor force participation rate would have been nudged up somewhat. Or at least I would have guessed that, as in the past we've seen considerable LFPR growth with those kind of payroll job numbers.

Nonfarm payroll jobs: https://data.bls.gov/timeseries/CES0000000001

A lot of the discrepancy is that the Household Survey's "Employed" showed only a 1.81 million growth since March, about half the growth of the headline non-farm payroll jobs number. http://data.bls.gov/timeseries/LNS12000000

And the unemployed dropped by 0.28 million: http://data.bls.gov/timeseries/LNS13000000

For a net gain in the labor force of 1.53 million: http://data.bls.gov/timeseries/LNS11000000

(It's the Household Survey's Employed + Unemployed that make up the Labor Force number).

The nonfarm payroll jobs numbers comes from a completely separate survey of businesses, called the "Establishment Survey".

There's been a lot of ink spilled on why the historically wide discrepancy between nonfarm payroll and Employed. I could do a Google on that, but will leave that as an exercise for the interested reader.

Johnny2X2X

(19,114 posts)Just amazing.

mahatmakanejeeves

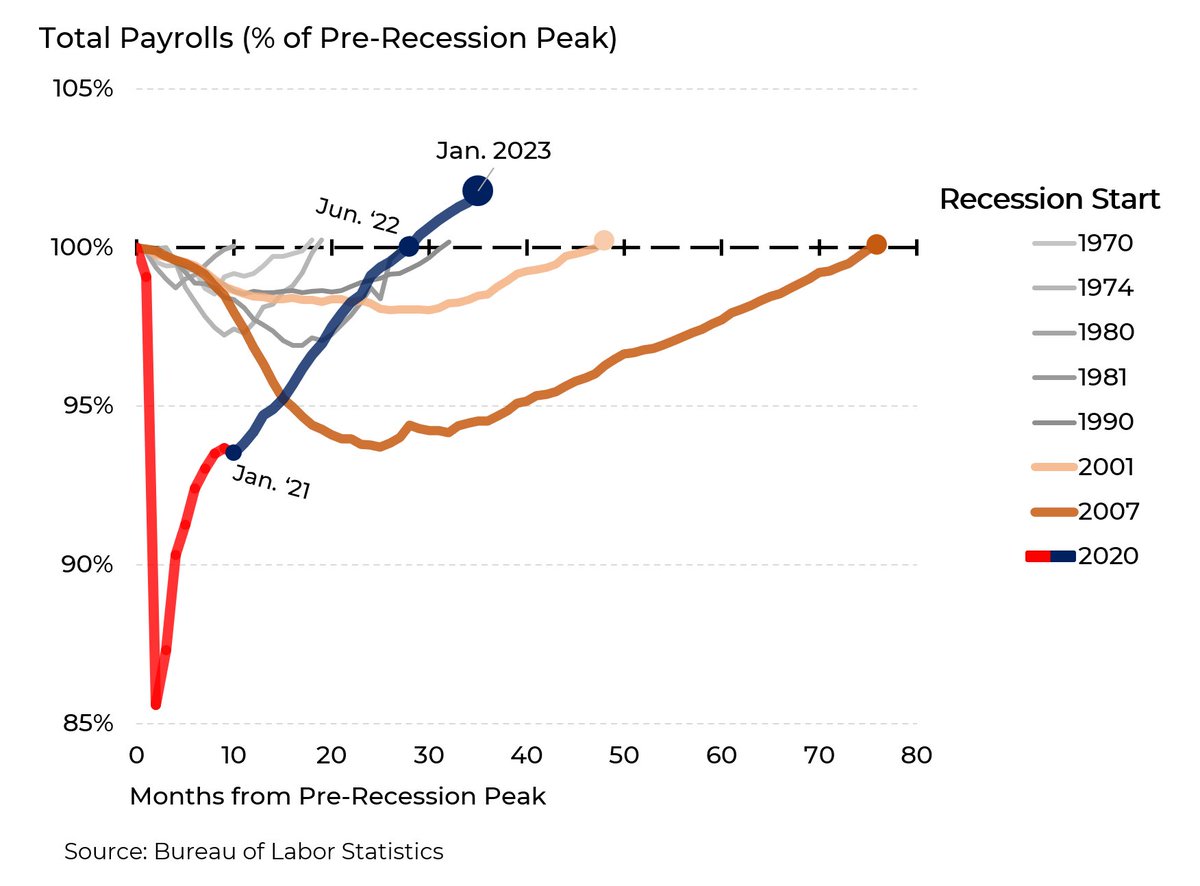

(57,600 posts)For comparison: at this point post-Great Recession, we were still 7.5M jobs *below* '07 levels.

@Morning_Joe

Link to tweet