Economy

Related: About this forumEF-0. Economy Stats with links to original sources. Links to LBN jobs threads thru 7/5/24

Last edited Sat Jul 6, 2024, 11:36 AM - Edit history (163)

7/6/24 - Added the June 2024 Jobs report link that came out 7/5/24Kick note - I have to Kick this about every 2 1/2 years in order to keep it from falling into the archives.

See the Updates page for a list of updates.

While most numbers aren't up to date, I do keep adding links, e.g. inflation, prime rate, FedFunds rate, Treasury bills/note/bonds rate.

The collection of hundreds of economic links is the main feature of this megathread, that I find personally quite handy. Given the number of views (150-250 a month), I suspect quite a number of others are finding it useful too.

Another feature is the "Beware the tricks of the economic pundits out there" section, which also includes a Myths section.

I also post a link every month to the latest Jobs reports thread (non-farm payroll employment, unemployment rate, and all that) at the top of this OP.

==== end Kick Note ===============================

LBN Threads that discuss the latest monthly jobs reports (the one with the unemployment rate and the payroll jobs numbers that usually comes out the first Friday of the month, but sometimes the second Friday)

For the June jobs report (dated 7/5/24) , see: https://www.democraticunderground.com/10143266715

Presidential jobs creation table (post WWII presidents) in January 2020 at near the height of the pre-Covid economy, and so is Trump at his best, and even then, 5 of 6 post-WWII Democratic presidents beat his record. (At the end of his term, he was the only one with a negative jobs creation record -- fewer jobs than when he started)

. . . https://www.democraticunderground.com/?com=view_post&forum=1014&pid=2880567

Since I'm not doing monthly updates anymore, the links below are the place to look for discussions of the numbers, usually in the Latest Breaking News Forum. I generally contribute to these threads, but it takes some time (like most of the Friday when they come out). I will at least add the latest link ASAP to the below. One can also look in the Latest Breaking News forum at shortly after 8:30 A.M. Eastern Time on the first Friday of the month (or the second Friday of some months) and find it.

When the jobs reports come out: https://www.bls.gov/schedule/news_release/empsit.htm

. . . for 2024: 1/5, 2/2, 3/8, 4/5, 6/3, 6/7, 7/5, 8/2, 9/6, 10/4, 11/1, 12/6 (so only exception to First Friday rule is 3/8),

REVERSE CHRONOLOGICAL ORDER - MOST RECENT FIRST:

JUNE 2024 (dated 7/5/24): https://www.democraticunderground.com/10143266715

MAY 2024 (dated 6/7/24): https://www.democraticunderground.com/10143253061

APRIL 2024 (dated 5/3/24): https://www.democraticunderground.com/10143235025

MARCH 2024 (dated 4/5/24): https://www.democraticunderground.com/10143221098

FEBRUARY 2024 (dated 3/8/24): https://www.democraticunderground.com/10143205866

JANUARY 2024 (dated 2/2/24): https://www.democraticunderground.com/10143188443

DECEMBER 2023 (dated 1/5/24): https://www.democraticunderground.com/10143175817

NOVEMBER 2023 (dated 12/8/23): https://www.democraticunderground.com/10143166174

OCTOBER 2023 (dated 11/3/23): https://www.democraticunderground.com/10143153410

SEPTEMBER 2023 (dated 10/6/23): https://www.democraticunderground.com/10143140332

AUGUST 2023 (dated 9/1/23): https://www.democraticunderground.com/10143123973

JULY 2023 (dated 8/4/23): https://www.democraticunderground.com/10143109301

JUNE 2023 (dated 7/7/23): https://www.democraticunderground.com/10143097688

MAY 2023 (dated 6/2/23): https://www.democraticunderground.com/10143082170

APRIL 2023 (dated 5/5/23): https://www.democraticunderground.com/10143070519

Archives of all Bureau of Labor Statistics Reports (BLS), -- besides the first Friday jobs report (called the "Employment Situation" ) that is the main subject of this megathread, there is also the CPI and Producer Price Index, Employment Cost Index, Productivity and Costs, Real Earnings, U.S. Import and Export Price Indexes, Job Openings and Labor Turnover (JOLTS), and much much more --

https://www.bls.gov/bls/news-release/

In the list up at the top, under Major Economic Indicators, select Employment Situation for the jobs report or whatever else for other reports.

For a list of updates (besides adding the link to the latest Latest Breaking News job report above), please click this link: EF-U. Updates List

Handy key links to BLS data series / graphs pages, (7/5/24) https://www.democraticunderground.com/10143266715#post3

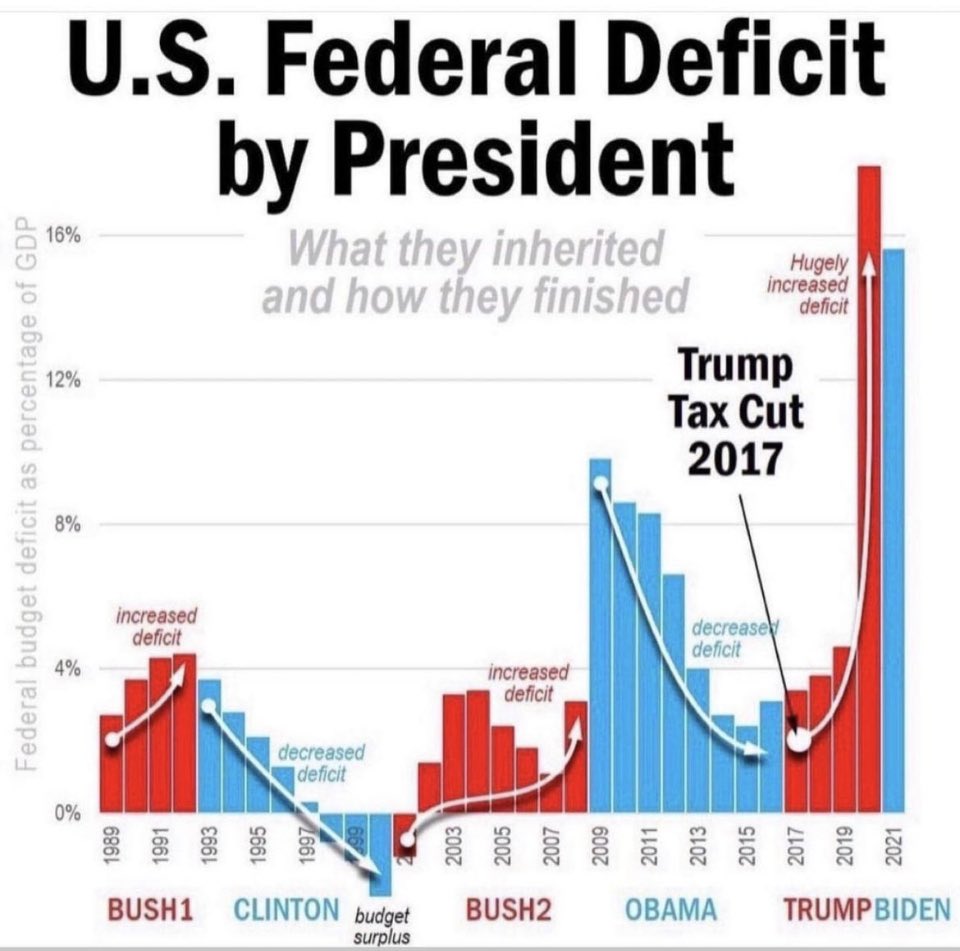

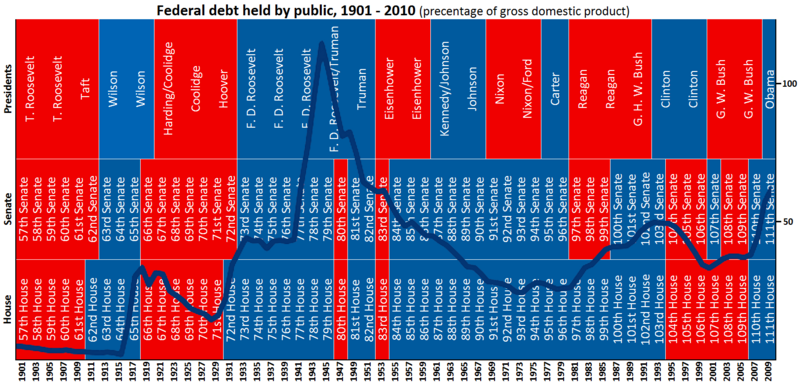

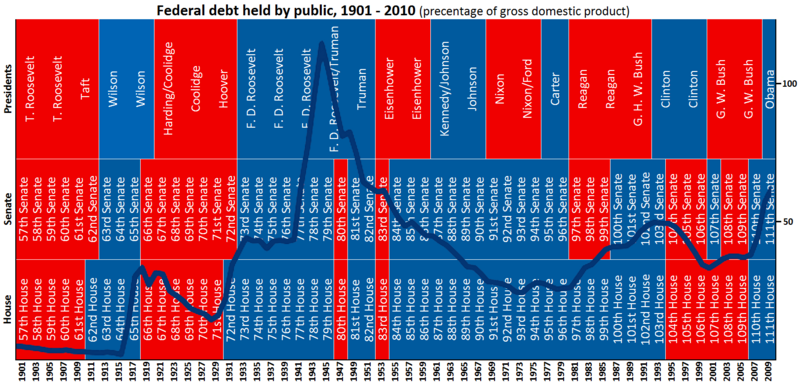

I won't be doing monthly updates, but rather annual updates of the jobs number, so if the job statistics are somewhat out of date in the future, I hope people will read "Beware the tricks of the economic pundits out there". The other pages (EF-1 through EF-10) also has information about the economy that is still relevant or relatively timeless. I also make occasional changes to some of the other pages, particularly the debt and deficit information on the EF-5 page http://www.democraticunderground.com/111622439#post5

and EF-9 Income and Inequality pages http://www.democraticunderground.com/111622439#post9

. Again, please check out the EF-U. Updates List

Another key purpose of this page is to provide links to the official sources of economic statistics and other resources for people to use in the message board / social media wars with the righties (and each other) about the economy.

Almost all sections have where to find the original-source numbers, such as the Bureau of Labor Statistics and Treasury.gov, or widely cited non-partisan sources. Hopefully people will find these pages a useful reference for finding information. These are the numbers that are cited, and which virtually all analysis of the U.S. economy derive from. The rest is pretty much anecdotal (like "the prices in my grocery store have doubled in the past year" )

There are some amazingly distorted presentations of what their numbers are and what they mean that you find on the web, and yes, DU too. Please see the "Beware the tricks of the economic pundits out there" section in the bottom half of this page for examples of what I mean by distorted presentations of BLS statistics.

I don't claim that the BLS and other government sources are inerrant, or even unbiased, e.g. whoever came up with some of the definitions like the official (U-3) unemployment rate being a count of jobless people who looked for work sometime in the past 4 weeks. And it is obvious that most of the Household Survey numbers have a lot of statistical error, considering how they wildly bounce around from month to month.

I'm just saying all of this is a presentation of the actual BLS and Commerce Department numbers (for the most part) with links to the statistics being discussed, so that you can check it out for yourself.

Most of what you read about economic statistics, including those skeptical of the BLS and Commerce Dept numbers (e.g. GDP), rely on these same statistics, since there aren't many comprehensive non-governmental sources of economic statistics available. In other words, they use these statistics to criticize these statistics. So by giving you the links, you can see the full context -- as many polemicists cherry pick here and there to give a misleading picture.

Again, see the "Beware the tricks of the economic pundits out there" section in the bottom half of this page for examples of what to watch for.

Unfortunately, a lot of the formatting has been lost because of the May 2017 hack of the DU website. For the latest version at archive.org -- WHICH SHOWS THE ORIGINAL FORMATTING -- see:

https://web.archive.org/web/20160411173355/http://www.democraticunderground.com/111622439

Unfortunately the latest archive.org snapshot that shows the original formatting is April 2016. Oh well. There is a way to ask archive.org to save a current snapshot ... the "Save Page Now" feature at https://archive.org/web. But unfortunately any snapshots made after the May 2017 hack of the DU website appear the same as what you are looking at -- with only selected formatting restored.

For more on what formatting does and does not work at DU, see https://www.democraticunderground.com/?com=view_post&forum=1256&pid=13211

Here is a table of contents of this thread:

{#} EF-0. Economic Statistics with links to official sources (this post)

{#} EF-1. Job Loss and Creation - Payroll Employment. At the bottom all post-WWII presidents with completed terms are compared

{#} EF-2. Unemployment Rate, Labor Force Participation Rate, Unemployment Insurance Claims

{#} EF-3. Recessions and Expansions - Official (NBER.org). Also GDP (Gross Domestic Product)

{#} EF-4. U.S. Stock Market as measured by the S&P 500 and the Dow Jones Industrial Avg

{#} EF-5. National Debt. Budget Deficits and Surpluses

{#} EF-6. U.S. Dollar Index (DXY). Oil Prices

{#} EF-7. In Progress (mostly Dem presidencies v. Repub presidencies. Also Inequality)

{#} EF-8. In Progress - Some canned excerpts to use in the message board wars

{#} EF-9. Incomes and Inequality and Consumer Prices and Poverty (in progress)

{#) EF-10. Definitions, Links (In Progress)

{#) EF-U. Updates List

I use facts from these in mixed message boards and in comments on news articles such as at news.yahoo.com. Be aware that I have included a few statistics that are not so pleasant as far as Obama's record, ones that anyone debating with others should be aware of because occasionally you will see these points or they will come back at you with these statistics (forewarned is forearmed).

##################################################################################

##################################################################################

Here are some key jobs reports links that I used to use for my reports:

PLEASE NOTE THAT THE NUMBERS IN THE TABLES BELOW (if any) ARE SEASONALLY ADJUSTED unless otherwise stated.

The links to the data below in the "over the last year" etc. tables

# Nonfarm Employment (Establishment Survey), https://data.bls.gov/timeseries/CES0000000001 monthly change

# . . . the raw (not seasonally adjusted numbers) are at http://data.bls.gov/timeseries/CEU0000000001 monthly change

# INFLATION ADJUSTED Weekly Earnings of Production and Non-Supervisory Workers http://data.bls.gov/timeseries/CES0500000031

# Labor Force http://data.bls.gov/timeseries/LNS11000000 monthly change

# Employed http://data.bls.gov/timeseries/LNS12000000 monthly change

# . . . the raw (not seasonally adjusted numbers) are at https://data.bls.gov/timeseries/LNU02000000 monthly change

# Unemployed http://data.bls.gov/timeseries/LNS13000000 monthly change

# ETPR (Employment-To-Population Ratio) aka Employment Rate http://data.bls.gov/timeseries/LNS12300000

# LFPR (Labor Force Participation rate) http://data.bls.gov/timeseries/LNS11300000

# Unemployment rate http://data.bls.gov/timeseries/LNS14000000

# U-6 unemployment rate http://data.bls.gov/timeseries/LNS13327709

# NILF -- Not in Labor Forcehttp://data.bls.gov/timeseries/LNS15000000 monthly change

# NILF-WJ -- Not in Labor Force, Wants Job http://data.bls.gov/timeseries/LNS15026639 monthly change

# Part-Time Workers who want Full-Time Jobs (Table A-8's Part-Time For Economic Reasons) http://data.bls.gov/timeseries/LNS12032194 monthly change

# Part-Time Workers (Table A-9) http://data.bls.gov/timeseries/LNS12600000 monthly change

# Full-Time Workers (Table A-9) http://data.bls.gov/timeseries/LNS12500000 monthly change

# Multiple Jobholders as a Percent of Employed (Table A-9) https://data.bls.gov/timeseries/LNS12026620 monthly change

# Civilian non-institutional population https://data.bls.gov/timeseries/LNU00000000 monthly change

Note: The above are Not Seasonally Adjusted. There is no Seasonally Adjusted version of this anymore.

In Table A-1 https://www.bls.gov/news.release/empsit.t01.htm they show the same numbers for seasonally adjusted and non-seasonally adjusted. So I guess they decided the seasonal adjustment of this number was not particularly valid or useful.

There used to be a separate seasonally adjusted series at https://data.bls.gov/timeseries/LNS10000000

Some statistics by age group

The ones beginning with "LNS" are seasonally adjusted (SA).

The ones beginning with "LNU" are not seasonally adjusted (NSA)

16+ is the default one that the BLS and the media report.

16+ means every civilian non-institutionalized person age 16 and over, including centenarians. So it is misleading -- the population is aging and there are about 10,000 boomer retirements a day (which comes to 3.6 million/year). That's why I show other age groups.

Age 25-54 is what the BLS calls the "prime age". It isn't contaminated by a lot of voluntary retirements.

By default, the graphs are 10 - 11 years, specifically they begin in the January of the year that was 10 years ago -- meaning in this case they begin January 2009 (which happens to be near the bottom of Great Recession job market -- well actually the job count fell for another 13 months to its lowest point in February 2010)

You might want to set the start date of the calendar back to, oh, whatever. 1989? 1979? 1969? In order to get a more historic view. 1989 is about when the rapid growth of female workforce participation began to level off

LFPR - Labor Force Participation Rate for some age groups

The LFPR is the Employed + jobless people who have looked for work in the last 4 weeks (and say they want a job and are able to take one if offered. Looking for work involves more than just looking at job listings). All divided by the civilian non-institutional population age 16+ (in the case of the regular LFPR, or divided by the civilian non-institutional population of whatever age, gender, race etc. for the various sub-demographic measures. For example. the LFPR of age 25-54 females is the number of those employed or actively seeking work divided by the civilian non-institutional population of age 25-54 females.)

SA means Seasonally adjusted. NSA means Not Seasonally Adjusted

16+: SA: LNS11300000 NSA: LNU01300000

25-34: SA: LNS11300089 NSA: LNU01300089

25-54: SA: LNS11300060 NSA: LNU01300060

55+: SA: LNS11324230 NSA: LNU01324230

65+: SA: ---------------- NSA: LNU01300097

ETPR - Employment to Population Ratio for some age groups

SA means Seasonally adjusted. NSA means Not Seasonally Adjusted

16+: SA: LNS12300000 NSA: LNU02300000

25-34: SA: LNS12300089 NSA:

25-54: SA: LNS12300060 NSA: LNU02300060

55+: SA: LNS12324230 NSA: LNU02324230

65+: SA: ---------------- NSA: LNU02300097

Aren't most of the new jobs part-time?

No. This excellent post from early July 2015 show two perspectives of the trends in part-time workers and full-time workers (not part-time jobs and full-time jobs). Thanks mahatmakanejeeves

http://www.democraticunderground.com/10141134306#post12

Since February 2010 (the bottom of the Great Recession job market) through January 2020, part-time workers have DEcreased by 98,000 while full-time workers have INcreased by 20,321,000. (Table A-9).

Chart 7 of the below link shows Part-time workers as a percent of total employed, Seasonally adjusted, 1990–2020. In recent years it has ranged from 20.1% at the height of the Great Recession to around 17% now.

https://data.bls.gov/timeseries/LNS12692153

https://www.bls.gov/web/empsit/cps_charts.pdf --this link seems to not work anymore, will have to check it out

# Multiple Jobholders as a Percent of Employed (Table A-9) https://data.bls.gov/timeseries/LNS12026620 monthly change

In January 2020, 5.1% of the employed were multiple job holders, according to this.

What kind of Wages?

INFLATION-ADJUSTED Average WEEKLY Earnings Of Production And Nonsupervisory Employees, Total Private, 1982-84 Dollars

http://data.bls.gov/timeseries/CES0500000031 ## (Hourly earnings: http://data.bls.gov/timeseries/CES0500000008 )

Unfortunately, the graph has expired. But the key thing is that, as of December 31, 2019, the INFLATION-ADJUSTED weekly earnings of production and non-supervisory workers is up 2.8% over the last 3 years, and up 7.9% since February 2010 (the jobs market bottom). However, in the past 11 months through December 31, 2019, this measure has declined slightly, by 0.16%, so call it a plateauing for now. (Note: December 31, 2019 is the latest available as I write this on February 8, 2020, because the CPI for January doesn't come out until mid-February).

Incidentally, over Obama's last 3 years this measure went up 4.48%. And over his entire 8 year presidency it went up 4.14%

Here is the nominal, i.e. not-inflation-adjusted version of the above:

Weekly: http://data.bls.gov/timeseries/CES0500000030

Hourly: http://data.bls.gov/timeseries/CES0500000008

See "Detailed Discussion" section below for a narrative discussion of the above statistics over the past year and the past three years (the past three years coincides with the Trump presidency. LATER, 2/8/20: there isn't a detailed narrative this time. Just a couple sentences in the "Commentary" after the "Over the Last THree Years" section ABOVE.

########################################################################

FFI on the most recent jobs report, straight from the Bureau of Labor Statistics: http://www.bls.gov/news.release/empsit.nr0.htm

Table A-1. Employment status of the civilian population by sex and age (household survey) http://www.bls.gov/news.release/empsit.t01.htm

Several graphs of the key economic stats -- http://www.bls.gov/web/empsit/cps_charts.pdf

Table of Contents as of 1/31/19

1. Civilian labor force

2. Civilian labor force participation rate

3. Civilian employment

4. Employment-population ratio

5. Nonagricultural wage and salary employment

6. Nonagricultural self-employed, unincorporated

7. Part-time workers as a percent of total employed

8. Employed part time for economic reasons

9. Civilian unemployment

10. Civilian unemployment rate

11. Duration of unemployment

12. Long-term unemployed as a percent of total unemployed

13. Reasons for unemployment

14. Job losers by layoff status

15. Unemployment rates for adult men, adult women, and teenagers

16. Unemployment rates by race and Hispanic or Latino ethnicity

17. Unemployment rates for persons 25 years and older by educational

attainment

18. Persons not in the labor force who want a job

19. Persons not in the labor force, selected indicators

20. Alternative measures of labor underutilization

The whole enchilada -- including all 16 "A" tables (the household survey) and all 9 "B" tables (the establishment survey) http://www.bls.gov/news.release/pdf/empsit.pdf

[font color = brown] ----------------------------------------------------------------------

Table A-1 and other tables can be found at the all-tables full jobs report at http://www.bls.gov/news.release/pdf/empsit.pdf, or gotten one-at-a-time from the bottom section of http://www.bls.gov/news.release/empsit.nr0.htm . For example, Table A-9 alone is at http://www.bls.gov/news.release/empsit.t09.htm )

----------------------------------------------------------------------[/font]

BLS Commissioner's Statement on The Employment Situation http://www.bls.gov/news.release/jec.nr0.htm

The Council of Economic Advisors' Take on the Jobs Report

https://www.whitehouse.gov/issues/economy-jobs/ (find this at

http://www.whitehouse.gov/administration/eop/cea )

The Council of Economic Advisors is a Trump admin propaganda organ now. Do not confuse it with the BLS (Bureau of Labor Statistics) which is supposed to be a non-partisan statistics-gathering government agency. On the other hand, the Council of Economic Advisors are all appointed by the president -- more specifically, the chairman is nominated by the president and approved by the Senate. The members are appointed by the president .

Bureau of Labor Statistics Commissioner's Corner: http://beta.bls.gov/labs/blogs/ Twitter Account: https://twitter.com/BLS_gov

BumRushDaShow / Mahatmakanejeeves thread - very comprehensive OP each month when the jobs report comes out, as well as additional material he posts to the thread in the following hours. Watch the OP for edits too. And the thread for more material. (In the January 2020 jobs report which came out on February 7, the thread was hosted by BumRushDaShow). https://www.democraticunderground.com/10142430036

Detailed Discussion

mm/dd/yy -

Nothing much more to add to the above. Usually I'm verbose as most job reports are a mix of good-and-bad when compared to the prior month. But I'm not doing monthly comparisons anymore since the monthly changes in the Household Survey numbers are mostly statistical noise.

Instead, I have been, and will be doing annual updates in early February after the January jobs report comes out (namely detailing the changes over the past 12 months, and since February 1, 2017 which is the beginning of the Trump administration's first full month in office).

However, I do update the non-jobs pages when new information comes out. See the "EF-U. Updates List" post below http://www.democraticunderground.com/111622439#post37 for updates.

##################################################################################

##################################################################################

Beware the tricks of the economic pundits out there, such as right-wingers slamming any gains the economy made under Obama (thanks in large part to Republican obstructionism in Congress, and Republican policies in the many states they control).

NOTE: MANY OF THE BELOW EXAMPLES WERE WRITTEN DURING THE OBAMA ADMINISTRATION WHEN RIGHT-WING GREEDBANGERS WERE DISPARAGING ANY PROGRESS THE ECONOMY WAS MAKING.. Of course they are making the opposite kinds of arguments now that the King of the Magats is president. But the techniques are the same. I have chosen not to spend an extraordinary amount of time re-writing all of the many examples below to illustrate how Magats would try to make the economy look better than it really is.

Tricks of the polemicists include:

(1). Highlighting adverse one-month or other short-term changes in some highly volatile component, and making it seem like it's the story of the whole Obama administration's job record such as, for example, the monthly changes in the civilian labor force, age 16+, seasonally adjusted. Here for example are the monthly changes for 2012 in thousands: (http://data.bls.gov/timeseries/LNS11000000?output_view=net_1mth ):

[font face = "courier new"]

Jan Feb Mar. Apr May June July Aug Sep Oct. Nov Dec

401 498 -15 -246 381 188 -164 -301 349 489 -228 206 (labor force, thousands) [/font]

Needless to say, whenever the president is Democratic, our good friends on the right highlight the drops in the labor force in the months when it drops, and make no mention of the rises when it rises. This is also known as cherry-picking the bad statistic of the month.

As you may know, under Obama, the righties and the media loved to pooh pooh any drop in the unemployment rate when the labor force drops, explaining that the unemployment rate dropped mostly because people gave up looking for work and left the labor force, and so are not counted. But how often have you heard them bring up a rise in the labor force in a month when it rose?

Another example: full-time jobs: [du/10026642259]

Awk! 252,000 full-time jobs were LOST in April! (April 2015, a month where the media was touting the 223,000 gain in payroll employment)

But note this statistic, coming from the Household Survey, is highly volatile from month to month:

Monthly changes in full-time workers (in thousands): http://data.bls.gov/timeseries/LNS12500000

[font face = "courier new"]

` ` ` Jan Feb Mar Apr May Jun July Aug Sep Oct Nov Dec

2014) 410 209 203 396 332 -538 196 310 552 371 -174 427

2015) 777 123 190 -252 (full time workers, thousands) [/font]

One could just as well have said 1,265,000 full-time employees were gained over the last 5 months (253,000/month average). Or 2,314,000 were gained in the last 12 months (193,000/month average). And note that nobody wrote OP's about full-time employment gains when the September report came out (+552,000), or December (+427,000) or January (+777,000)

(2). Cleverly mixing seasonally adjusted data with unadjusted data (without making that clear of course) Or using exclusively seasonally unadjusted data if that paints the picture they want to paint

(2a). Implying that a number is not seasonally adjusted -- for example disparaging a November or December payroll employment report of a good 250,000 increase in payroll employment by saying that's a paltry gain since there should be a lot of Christmas shopping season hiring going on. (Uh, no, like almost all BLS statistics reported in the media, the payroll employment numbers are seasonally adjusted. And, by the way, actually December is almost always a month when more jobs are lost than gained -- the raw (not-seasonally adjusted) payroll employment numbers are at http://data.bls.gov/timeseries/CEU0000000001?output_view=net_1mth )

Another example - saying a big increase of 0.5% in consumer spending in December is not a big deal, and ought to be way higher since December is after all the big Christmas spending month. (Uh, no, again, the numbers are seasonally adjusted)

(2b). Related -- using NOT seasonally adjusted numbers when that better makes their case, and saying that the unadjusted numbers are "the real numbers" untarnished by bureaucratic "adjustments" and "manipulations"

A great example is comparing not-seasonally-adjusted numbers for December and January, and making an enormous hoo-hah about the decline of the job count in January (when of course much of the extra Christmas season help is laid off, but the polemicists don't mention that explanation).

The below compares the monthly changes of the NOT-seasonally adjusted numbers ( http://data.bls.gov/timeseries/CEU0000000001?output_view=net_1mth ) to the seasonally adjusted numbers ( http://data.bls.gov/timeseries/CES0000000001?output_view=net_1mth ) for the 19 months from January 2014 through July 2015:

Payroll Jobs, Thousands:

[font face = "courier new"]the NOT-seasonally adjusted numbers

` ` ` Jan. Feb. Mar. Apr May June July Aug Sep Oct Nov Dec

2014: -2811 741 957 1163 920 594 -1050 391 687 1081 478 6

2015: -2813 848 779 1139 928 474 -1045

the Seasonally adjusted numbers

` ` ` Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2014: 166 188 225 330 236 286 249 213 250 221 423 329

2015: 201 266 119 187 260 231 215 [/font]

Of course, most people would see through such an obvious stunt like comparing raw job counts in December and January, so a RW polemicist would rarely try this particular stunt. But I've seen it done for July (a fall off after the hiring of June graduates that most people don't think about). Later: someone at DU actually tried to play this trick in January 2016, sigh.

And they certainly do similarly with other data series where seasonal changes are less understood.

(3). Cleverly mixing statistics from the household survey (CPS) and the establishment survey (CES) (without making that clear of course). The CPS survey of households ( http://www.bls.gov/cps/ ) produces the unemployment rate, the labor force participation rate, the number employed, and innumerable other statistics. The CES ( http://www.bls.gov/ces/ ), a completely separate survey of businesses, produces a number of statistics, most notably the headline payroll employment numbers (widely regarded as a better indicator of job changes than the CPS's Employed number because of the larger sample size among other reasons). Because of statistical noise and volatility, these 2 surveys often come up with seemingly incompatible results. Needless to say, right-wing polemicists mix and match statistics from both surveys to produce nonsense.

(4).Cherry-picking the start and end points of some data series

This is a generalization of item (1.) except that instead of highlighting the latest month of an adverse statistic, they may pick another starting point that is an outlier. For example in October 2013, someone mentioned that the latest U-6 unemployment measure is no better than it was in March 2013, 7 months ealier. True, but March was at a noisy zag low; its clear to see from the graph that there is a downward trend, not a 7-month plateau. U-6: http://data.bls.gov/timeseries/LNS13327709

Here are the 2013 values (the 2012 values are all above 14.4% BTW, it was 15.1% in January 2012)

[font face = "courier new"]

Jan Feb. March Apr. May. June July Aug. Sept Oct.

14.4 14.3 13.8 13.9 13.8 14.2 13.9 13.6 13.6 13.7 (2013, U-6 in percent)

. . . . . . ^-March: the cherry-picked low starting point the RW'er chose[/font]

(The U-6 unemployment rate (sometimes dubbed the underemployment rate) is now (January 2020) 6.9% by the way, down 1.1 percentage points in the last 12 months (and down 2.3 percentage points in the last 36 months). It is the broadest measure of unemployment that the BLS produces -- it includes part-time workers wanting full-time positions. It also counts as unemployed any jobless person who wants a job and has looked for work at any time in the past 12 months (whereas the headline U-3 unemployment rate counts those who have looked any time in just the last 4 weeks).

It's like global warming when the righties always pick 1998 -- an anomalously hot year because of a strong El Nino -- as their starting point to argue that there has been very little warming since.

That is why seeing the whole data series is so important, and not just accepting the time period and the statistic that a right-wing polemicist dishes out. However, finding the data series number is often quite a challenge, and something that in my experience involves a large bag of tricks. It is my intent to write more about how to find the data series you need. But for now, if there is one trick to mention, this one is the most helpful: http://data.bls.gov/pdq/querytool.jsp?survey=ln

(5). Comparing the current statistics to 2007's statistics, as if 2007 was a normal economy we should get back to - I see this all the time. Yes, today's economic statistics just about across the board suck compared to 2007's. But keep in mind that 2007 was not a normal economy. It was a very sick bubble economy with a very high fever -- people using their houses as ATMs to the tune of hundreds of billions of dollars a year. Anybody could get a mortgage, virtually no questions asked. The belief that housing prices never go down, at least not on a national average scale (thus the theory that a geographically diversified bundle of mortgages was always a safe bet).

The same for comparisons to 2000 -- that too was a very sick economy -- astronomical price/earnings ratios in the stock market, day trading and momentum investing. The belief that Alan Greenspan had mastered the "Goldilocks" economy (not too cool, not too warm) and that, now that we understood how to use the Fed's powers to control the economy, we will never have a recession again. That tech companies with huge negative earnings and no business plan were great investments. That we were all going to the moon, and we were all going to the stars (speaking of the economy and the stock market).

Well, I'm extremely very sorry to have to tell you -- we don't want to get back to the very sick high-fever bubble economies of 2000 or 2007. So quit the whining about how things now are so much worse than back then -- no they aren't when you consider the sickness and unsustainability of those economies back then.

(6). Talking about inflation-adjusted numbers as if they were not, e.g. "wages have been flat (or dropped) for the last 20 (or whatever) years while we all know that prices just keep going up" -- leaving off the word "real" or "inflation-adjusted" qualifier on wages (which takes into account rising prices).

Nominal wages, i.e. raw wage numbers unadjusted for inflation have definitely been rising for years and decades, whereas real wages (meaning adjusted for inflation) have indeed been roughly flat. For example:

(nominal, i.e not inflation adjusted) Average Hourly Earnings Of Production And Nonsupervisory Employees, total private, seasonally adjusted: http://data.bls.gov/timeseries/CES0500000008

(real, i.e. inflation adjusted) http://data.bls.gov/timeseries/CES0500000032 -- to get the long view, set the time period's beginning point from the default value a decade ago to 1964 - the earliest one can set it. The pull-down boxes for setting the time period is near the top, where it sets "Change Output Options". Be sure to check the "include graphs" checkbox, and then click the little dark blue "go" button

(7). Using government statistics and trickery (see above techniques) to make some point, and when you call them on the trickery, and give them the correct information, they tell you they don't trust government statistics! In other words, they are fine with government statistics (or studies that are derived from government statistics, which they all are) if they can twist them to fit their viewpoint, otherwise, they don't trust them!

----------------------------

As for postings by DU members, always check the source of the article they posted, for example one perhaps unintentionally posted a bunch of crap from a right-wing polemicist (Peter Morici) http://www.democraticunderground.com/1251259885#post3 (that's post #3 -- interestingly the poster was PPR'd about 4 months later). Note that sometimes the publication might be an OK mainstream source, but you should still check out the author.

SEE ALSO THE "MYTH:" SECTIONS IN THE PAGES BELOW. For example, the EF-2 page has a lot of myths about the job numbers, such as the myth that they don't count the jobless people that have exhausted their jobless insurance benefits in the unemployment numbers. Just search on the following and include the colon:

MYTH:

Here is a listing of Myth topics as of 1/25/2019

# Myth: "those who have exhausted their unemployment insurance benefits are not counted as unemployed. If they were counted, the official unemployment rate would be much higher" (you often hear this claim from the RepubliCONS when a Democratic president is in the White House, and vice versa when a RepubliCON is in the White House).

# Myth: "But the real unemployment rate is 15% (or 24% or whatever) and it keeps going up":

# Myth: There are 94 million involuntarily unemployed, so the real unemployment rate is about 40%

# Myth: In 1994, during the Clinton administration, they stopped counting the long-term unemployed, or the "long term discouraged worker". If we calculated the unemployment rate now the way we did before 1994, the unemployment rate would be double, triple (or whatever. One claimed that the unemployment rate in January 2015 calculated by the old method would be 23% instead of the officially reported 5.7%).

# Myth: most jobs created during the "so-called recovery" are part-time, especially after Obamacare became law

# Myth: "Those payroll job creation numbers the corporate media reports are just that: jobs created. They don't mention all of the jobs that were lost. To get the true picture, they should report the NET jobs created: jobs created less jobs lost"

# Myth: "The unemployment rate is low because so many people are working two or more jobs, and working 60,70,80 hours a week "

# Myth: "The ADP jobs numbers are much more reliable than the Bureau of Labor Statistics numbers because the ADP are actual payroll numbers, whereas the BLS numbers are 'just a survey'"

# Myth: "There was a big 225,000 increase in nonfarm payroll jobs, and yet the unemployment rate went up. This proves they are cooking the books, and the corporate media is playing along with their game"

END of "Beware the tricks" lecture

########################################################################

General notes from previous deleted job summaries - to be reorganized and refiled

I'm working on the wages things brought up in earlier DU posts -- for now, See: Real (i.e. inflation-adjusted) average weekly earnings, all employees (total private), 1982-1984 dollars, Seas Adj: http://data.bls.gov/timeseries/CES0500000012

And of production and non-supervisory workers: http://data.bls.gov/timeseries/CES0500000031

Note on statistical noise: As an example: non-farm employment increased by 113,000 in January 2014 in the establishment survey. But according to the household survey, employment that month increased by 638,000. Just goes to show how wild the statistical noise is, and not to get excited one way or another with any one month's particular numbers.

On statistical noise, I found this BLS technical note on sampling error -- http://www.bls.gov/news.release/empsit.tn.htm . Based on what it says, there is a 90% probability that the Establishment Survey's non-farm employment increase is within +/- 120,000 of the stated number. And a 10% chance that it is off by more than 120,000. Again, this is just the sampling error. There are other errors besides sampling error.

Correspondingly, again based on sampling error alone, there is a 50% chance that it is within +/- 49,200. So for example for a reported job gain of 200,000, there is a 50% chance that it is between 150,800 and 249,200, and a 50% chance that it is outside that range based on sampling error alone. Note there are errors other than sampling error that add to the uncertainty {1}

And in the Household Survey, there is a 90% chance that the monthly unemployment change is +/- 300,000 of the stated number (note this is 2.5 times the Establishment Survey's nonfarm employment's sampling error). Also, that there is a 90% chance that the unemployment rate is about +/- 0.2% of the stated number.

The above only covers sampling error. There are also many other sources of error (search the above link for "non-sampling error" )

The individual components that go into these numbers have an even larger sampling error. As explained above, right-wingers love to find the aberrant statistic or two of the month and make it out to be the story of the Obama administration, rather than what it really is -- just one month's number in a very statistically volatile data series.

{1} 90% of the area under the normal curve is between +/- 1.645 standard deviations. 50% of the area under the normal curve is between +/- 0.675 standard deviations. Thus if there is a 90% chance that it is within +/- 120,000, then there is a 50% chance that it is within +/- 49,200 (0.675/1.645 * 120,000 = 49,240 , then round to 49,200 ).

progree

(11,204 posts)Last edited Fri Jan 8, 2021, 01:05 PM - Edit history (40)

# Nonfarm Employment (Establishment Survey, https://data.bls.gov/timeseries/CES0000000001 monthly change

# Nonfarm Private Sector Payroll Employment: http://data.bls.gov/timeseries/CES0500000001 monthly change

# Federal employees (includes postal workers, excludes military): http://data.bls.gov/timeseries/CES9091000001 monthly change

# Manufacturing employees: https://data.bls.gov/timeseries/CES3000000001 monthly change

{#} Job Loss and Creation - Nonfarm Employment At the bottom all post-WWII presidents with completed terms are compared

Factoids (official sources are at the bottom of the page):

# To Do: Make some tables to help make this mass of numbers more coherent.

# Note that an annual revision (downard by 514,000 in the year ending March 2019) of payroll jobs, announced Feb 7, 2020 has been included in the official statistics and in the below.

# Under Obama there were 83 straight months of private sector job growth (since the February 2010 job market bottom), totaling 16.0 million private sector jobs. Total job growth during this period is 15.8 million jobs ( 0.2 million government jobs were lost ).

# The economy Bush handed to Obama lost 4.2 million jobs during the last 10 months of the Bush administration. Furthermore, at the end of the Bush administration the rate of job losses was accelerating -- losing 2.26 million jobs just in his last 3 months -- an average of 753,000 lost jobs a month (the average of the last 3 months of the Bush presidency).

The official sources for all these statistics are at the bottom of the page

# If some rightie says that Bush inherited an economic train wreck from Clinton, you can point out that that the economy (real GDP) was still growing in the last quarter of the Clinton administration at a 2.4% annual rate (Q4 2000), as opposed to the last quarter of the Bush II administration -- it was contracting at an 8.9% annual rate (Q4 2008). Real GDP quarterly percentage change figures are at: http://www.bea.gov/national/xls/gdpchg.xls.

And that in the last 3 months of the Clinton administration 329,000 jobs were created -- yes a slowdown, but not a meltdown. Contrast that to the meltdown in the last 3 months of the Bush administration when 2.3 million jobs were lost.

The numbers for the last 10 months of the Clinton administration: 1.1 million jobs were created. Contrast that to the last 10 months of the Bush administration when 4.3 million jobs were lost.

# 14.5 million nonfarm payroll jobs were created under Obama since June 2009 (that's when the recession ended according to the NBER (nber.org, the official arbiter of when the economic turning points occur) and only 5 months since Obama took office). Bush only created 1.3 million payroll jobs in his entire 8 year presidency.

(See posting EF-3 below for more on this recession thing -- roughly speaking, economists define the end of the recession as when the economy hits bottom, and the faintest signs of economic growth begins -- not when people start singing Happy Days Are Here Again. In other words, the recession is over when we're at the very bottom of the pit and beginning to tentatively claw our way upward. While that's nothing to gurgle ecstatically about, that's still better than falling falling falling like we were under Bush).

# 14.8 million private sector jobs were created under Obama since June 2009 (contrast that to Bush destroying 0.7 million private sector jobs during his presidency)

# Bush's entire 8 year record: 1.3 million payroll jobs were created - by creating 1.8 million government jobs and destroying 0.5 million private sector jobs. ( the actual numbers are, in thousands: Total: 1,347, Govt: 1,744, PrivateSector: -397, updated 1/31/18 ). Yes, it is ironic that a supposed "small government conservative" ended up creating government jobs and destroying private sector jobs.

# Obama's entire 8 year record (including the 4.3 million jobs lost during his first 13 months that was a momentum carry-over from the massive job losses during Bush's last several months): 11.5 million payroll jobs were created - by cutting 0.3 million government jobs and creating 11.8 million private sector jobs. ( the actual numbers are, in thousands: Total: 11,488, Govt: -268, PrivateSector: 11,756, updated 1/31/18 ).

(#.) And then there is this - Romney justifying his poor job creation record at the 3 1/2 year point of his administration as Massachusetts Governor -- by blaming the economy he inherited from his predecessor for the fact that his (Romney's) job numbers kept falling during the first 11 months of his administration -- and touting the number of jobs created (50,000) after his job numbers finally stopped falling. Note this is ironic considering how Romney and the Republicans have spent this campaign blaming Obama for doing the same thing -- pointing to the lousy economy he inherited and pointing to job growth figures since the turn-around. http://www.democraticunderground.com/125198174

Back to Romney's Massachusetts record (see above link for details): that 50,000 post-turnaround job creation record was a poor showing on a per-capita basis compared to the national average at the same time period, or the Obama record during the similar post-turnaround job-recovering period of the Obama administration. And consider that during Romney's entire 4-year term as governor, Massachusetts was 47th in job creation (in percentage increase terms) -- yes, only 3 states had a worse job-creation record.

.-------------------------------------------.

# The Clinton economy created 22.9 million payroll jobs of which 21.0 million were in the private sector [updated above on 5/6/16]

# Federal workforce If some rightie claims that Obama increased the federal workforce (as if that was bad), well actually that is true, but tiny: Under Obama the federal workforce increased by 31,000 employees which is a 1.1% increase (over 8 years), far below the rate of U.S. population increase. And note that Romney as governor increased the number of Massachusetts state employees by 5.5% (over 4 years). Also note that Bush II increased the federal workforce by 1.3% (over 8 years)

. . # Source of the Romney figure: "Government Job Loss: President Obama’s Catch 22", ABC News, 6/6/12 http://abcnews.go.com/blogs/politics/2012/06/government-jobs-loss-president-obamas-catch-22/

. . # Source of the Obama and Bush II figures: BLS data series: Federal employees, seasonally adjusted: http://data.bls.gov/timeseries/CES9091000001

. . . . It includes postal workers, and it excludes the military

. . . . Jan 2009: 2,786,000 , Jan 2017: 2,817,000 (preliminary) , increase: 31,000 (this is a 1.1% increase -- far below the growth in U.S. population)

Job Creation of record of post-WWII Presidents, Average Annual % Increases :

12/13/20 UPDATE: https://www.democraticunderground.com/100214706690#post4

THE BELOW WAS CREATED IN EARLY FEBRUARY AT NEAR THE PEAK OF THE PRE-COVID ECONOMY. Even so, it shows that Trump was a less-than-median job creator even at his high point. Now, according to the latest jobs report that came out October 2, Trump has lost 3.907 Million jobs since January 2017 when Obama left office, whch comes to 89,000 jobs lost per month during these 44 months. This of course, puts Trump last in the table as the only post WW-II loser

(Sorted from best to worst by average annual percentage increase in jobs. Republicans in red, Democrats in blue.)

Notice that -- with the tiny exception (0.2% difference) of Nixon to Kennedy -- the worst Democrat has a better record than the best Republican -- that is, until Obama, who inherited an economy that was losing several hundred thousand jobs a month And actually, Kennedy did not have a chance to complete his term -- had he done so, and had he had the same job creation numbers in December 1963 through January 1965 as Johnson had (a 3.48%/year annualized rate of increase), he would have easily topped Nixon.

Post-WWII Presidents ranked by Average Annual Percentage Increase In Jobs (the last column):

. . (updated 2/7/20 after new jobs report released - it has revisions going back decades.)

THE ABOVE WAS CREATED IN EARLY FEBRUARY AT NEAR THE PEAK OF THE PRE-COVID ECONOMY. Even so, it shows that Trump was a less-than-median job creator even at his high point. Now, according to the latest jobs report that came out October 2, Trump has lost 3.907 Million jobs since January 2017 when Obama left office, whch comes to 89,000 jobs lost per month during these 44 months. This of course, puts Trump last in the table as the only post WW-II loser

(Actually, the true jobs peak of the Trump economy was in February 2020 -- he gained another 251,000 jobs in February, which would make his 37 month record at the end of February 184,054 jobs/month, which comes to 1.52% average annual increase in jobs -- only trivially better than the 182,194 and 1.50% numbers shown in the table (which are at the end of January), and certainly doesn't affect his ranking from what is shown in the table).

Remember, Obama inherited the deepest recession since World War II, which lost 4.2 million jobs in the last 10 months of his predecessor, and in the last 3 months of his predecessor was losing 753,000 jobs a month. With that momentum, job losses continued for the first 13 months of the Obama presidency -- through February 2010 -- totalling 4.3 million jobs lost during those 13 months.

Anyway, despite the 4.3 million jobs lost in his first 13 months because of the Bush crash, Obama still beats 4 of the last 7 post-WWII Republican presidents (the count of 7 post-WWII Republican presidents includes Trump). Of these Republican presidents, only Nixon, Reagan, and Ford had better records than Obama, and Ford only edged him out by 0.01 percentage points.

In the above table, the average annual % increase in jobs (the last column) is a much fairer way to compare presidents than just the raw job creation figures in thousands because the latter is unfair to the earlier presidents who were working with much smaller labor forces to begin with. For example the number of job holders at the beginning of Truman's administration was only 38% as many as at the beginning of Clinton's administration, and 31% as many as at the beginning of G.W. Bush's administration. So Truman's pathetic-looking 93,570 jobs/month creation record turns out to be even better than Clinton's 238,521 jobs/month record when adjusted for the size of the labor force at the beginning of their terms.

In raw thousands of jobs created per year, both Reagan and Nixon beat Truman. But when adjusted for the size of the labor force -- again, by looking at average annual percentage increases in jobs -- Truman beats them both.

Official sources of information for the above:

# Payroll Jobs: http://data.bls.gov/timeseries/CES0000000001

# Monthly change of above: http://data.bls.gov/timeseries/CES0000000001?output_view=net_1mth

# . . Hint: to see both of the above two together on the same page, go to http://data.bls.gov/timeseries/CES0000000001 and click on the "More Formatting Options" link in the upper right and check the "Original Data Value" and the "1-Month Net Change" checkboxes and click the "Retrieve Data" button halfway down the page on the left

# Private Sector Payroll Employment: http://data.bls.gov/timeseries/CES0500000001

# Monthly change of above: http://data.bls.gov/timeseries/CES0500000001?output_view=net_1mth

# . . Hint: to see both of the above two together on the same page, go to http://data.bls.gov/timeseries/CES0500000001

and click on the "More Formatting Options" link in the upper right and check the "Original Data Value" and the "1-Month Net Change" checkboxes and click the "Retrieve Data" button halfway down the page on the left

The United States Unemployment Rate. Every Time The Democrats Fix It, The Republicans F*CK It Up (1960-2016)

This one USED TO compare all post-WWII presidents on a term by term basis, with and without an 8 month lag:

"The monthly statistics are quoted from January, as U.S. presidents take office at the end of that month, and from September (bold), as this is the last month of the federal fiscal year."

Unfortunately, they recently got rid of the 8-month lag figures. Also the numbers for Obama are a little bit out of date, my guess is that it doesn't incorporate the annual revisions the BLS makes to the past numbers. They show 145,554,000 payroll jobs at the end of Obama's presidency whereas I see 145,696,000 in January 2017 ( https://data.bls.gov/timeseries/CES0000000001 ), a difference of 142,000 jobs (although not a big whoop though when looking at average job creation over a 96 month presidency). And that might change again when the BLS makes their annual revision to past numbers again on 2/1/19, sigh.

The loss of the 8 month lag especially hurts Obama (3.8 million jobs were lost during the first 8 months of the Obama administration, thanks to carry-over of the Bush housing bubble burst recession -- 3.8 million jobs (coincidentally) were lost during the last 8 months of the Bush administration.

Anyway, an interesting page:

http://en.wikipedia.org/wiki/Jobs_created_during_U.S._presidential_terms

Current Employment Statistics Highlights - Detailed Industry Employment Analysis (employment changes by industry -- a summary followed by 4-5 year charts)

http://www.bls.gov/web/empsit/ceshighlights.pdf

progree

(11,204 posts)Last edited Thu Sep 1, 2022, 10:44 PM - Edit history (45)

{#} Job Loss and Creation - Unemployment Rate, Labor Force Participation Rate# Unemployment Rate, from 1948 on: http://data.bls.gov/timeseries/LNS14000000

# Labor Force Participation Rate from 1948 on: http://data.bls.gov/timeseries/LNS11300000

# Employment-To-Population Ratio aka Employment Rate http://data.bls.gov/timeseries/LNS12300000

# Labor Force Participation Rate, Prime Age (Ages 25-54) https://data.bls.gov/timeseries/LNS11300060

# Employment-To-Population Ratio, Prime Age (Ages 25-54) https://data.bls.gov/timeseries/LNS12300060

# Labor Force Participation Rate, Double Prime Age (Ages 25-34) http://data.bls.gov/timeseries/LNS11300089

# Employment-To-Population Ratio, Double Prime Age (Ages 25-34) http://data.bls.gov/timeseries/LNS12300089

(on all of the above, you can change the "From" and "To" dates to whatever you want at the top center pulldown boxes)

# Regional and state employment and unemployment http://www.bls.gov/news.release/laus.nr0.htm

# Unemployment rate, seas adjusted of recent presidents

All values are the unemployment rates, specifically Jan 1989, Jan 1993, Jan 2001, Jan 2009), with the exception of the current unemployment rate under Obama, which is the end of last month.

(If you get into discussions about Obama's unemployment rate, it is worthwhile to point out that if one starts from June 2009, when the recession ended according to the NBER (the official arbiter of economic turning points, NBER.org), and just 5 months after Obama took office, then the unemployment rate has been cut by 4.7 percentage points. Obama cannot be blamed for the job losses in his first 5 months, given that the economy Bush handed him was losing 753,000 jobs PER MONTH in his last 3 months, and it takes many months to enact and implement new policies and for them to take effect.)

Unemployment rates:

Bush I: 5.4% to 7.3%, Change= + 1.9%

Clinton: 7.3% to 4.2%, Change= - 3.1%

Bush II: 4.2% to 7.8%, Change= + 3.6%

Obama's first 5 months: 7.8% to 9.5%, Change= + 1.7% (Jan '09 - May '09)

Obama thereafter: 9.5% to 4.7%, Change= - 4.8% (Jun '09 - Jan '17)

Obama entire term: 7.8% to 4.7%, Change= - 3.1% (Jan '09 - Jan '17)

Trump so far: 4.7% to 3.6%, Change= - 1.1% (Jan '17 - Jan '20)

(June 2009, just 5 months after Obama took office, is when the recession ended, per NBER.org)

# Under Bush II, the unemployment rate rose by 3.6 pp (percentage points) while the Civilian Labor Force Participation rate fell 1.5 pp: from 67.2% to 65.7% (had the participation rate stayed the same, the unemployment rate would have risen even further.

Contrast Bush's record to Clinton's, where the unemployment rate dropped 3.1 pp while the Civilian Labor Force Participation rate rose by 1.0 pp.

Secret information: Under Obama the unemployment rate decreased by only 3.0 percentage points, from 7.8% to 4.8%, while the civilian labor force participation rate fell 2.8 percentage points, from 65.7% to 62.9%.

However, the more important Employment to Population Ratio fell by a much lesser 0.7 percentage points, from 60.6% to 59.9, thanks in large part to the aging of the population and boomer retirements.

Looking at the prime working age population (ages 25-54), their Employment to their Population Ratio ( http://data.bls.gov/timeseries/LNS12300060 ) during Obama's presidency has increased a bit (1.0 percentage points), from Jan 2009 (77.0%) to January 2017 (78.2%). Not much considering we're talking about over 7-1/2 years that began deep in the Great Recession (Obama took office 13 months after the start of the Great Recession, and 13 months before the job market bottom was reached in February 2010). And no retiring aging boomers to blame since we're talking about the age 25-54 workforce, not the entire age 16+ workforce.

BLS.GOV: "The labor force is the number of people ages 16 or older who are either working or looking for work. It does not include active-duty military personnel or the institutionalized population, such as prison inmates".

One reason for the decline in the labor force participation rate during the last several years is the retirement of large numbers of baby boomers. Remember that the population being counted is everyone 16 and over -- no matter how old (again excepting active duty military and institutionalized populations). Between 2000 and 2010, the number of Americans aged 62 and over increased by 21% while the U.S. population as a whole increased by 9.7%, according to the Population Connection Reporter 12/2012

In the 2000 Census, the number of Americans aged 60 to 69 -- that is, those who had recently hit retirement age or would do so within a few years -- was about 20 million. But thanks to the Baby Boomers, the number surged in the 2010 Census to more than 29 million, almost a 50 percent increase --Poltifact 10/8/12 http://www.politifact.com/truth-o-meter/statements/2012/oct/08/american-future-fund/ad-says-workforce-smaller-under-barack-obama-any-t/

Already, 1 in 5 boomers have retired, according to AARP The Magazine, February 2014.

Update: 47% are in retirement according to this 4/9/2019 CNBC.com article

https://www.cnbc.com/2019/04/09/baby-boomers-face-retirement-crisis-little-savings-high-health-costs-and-unrealistic-expectations.html

Some point out that the labor force participation rate (LFPR) of elderly Americans is higher than in recent years. People erroneously conclude from that factoid that baby boomer retirements can't be contributing to the overall labor force participation rate decline. How can baby boomer retirements cause the overall LFPR to decline when the retirement age population's LFPR is increasing?

Answer: because the retirement age population is increasing so rapidly that it is an ever larger share of the age 16+ population (see above). And although the retirement age population has a higher LFPR than before (its been on a general rising trend since 1985 - hey, thanks Reagan!), still, their LFPR is far less than that of the non-elderly population. For example, the LFPR (not seas adjusted) for age 65+ was 20.3% in January 2020, and indeed it is up considerably from the 14.1% rate in December 2003 ( LNU01300097 ). But that LFPR is still far far below the average for the entire 16+ population (seas adj): 63.4% in January 2020 ( LNS11300000 )

In short, the rapid proportional increase in the age 65+ population (a population with less than 1/3 the LFPR of the rest of the population) overwhelms the effect of the increasing of the 65+ population's LFPR.

One quantitative estimate I've run across of the impact of baby boomer retirements is this from Marilyn Geewax from NPR National Public Radio, 1/21/14 ( http://www.mprnews.org/story/2014/01/21/business/whats-behind-the-falling-unemployment-rate ):

"Many economists say retirements are causing about half of the labor force shrinkage. Others say it's 60 percent, and yet others believe it's more like 40 percent."

In other words, 50% +/- 10%. Lets call it about half.

According to a July 2014 analysis by the Council of Economic Advisers, speaking of the 3.1 percentage point decline in the Labor Force Participation Rate from the final quarter of 2007 to the second quarter of 2014, "About half of the decline (1.6 percentage point) is due to the aging of the population. While older workers today are participating in the labor force at higher rates than older workers of previous generations, there is still a very large drop-off in participation when workers enter their early 60s."

For more on that, http://www.whitehouse.gov/sites/default/files/docs/labor_force_participation_report.pdf

Update 8/1/14: http://www.whitehouse.gov/blog/2014/08/01/employment-situation-july

The Commissioner of Labor Statistics at the Bureau of Labor Statistics also said the boomer retirements and aging workforce accounts for about half the drop in the LFPR. And about 1/4 due to the recession and 1/4 due to long term trends that preceded the recession ... sounded like she is on the same page as the Council of Economic Advisers and maybe she is using their analysis. - interviewed by Leslie Marshall around 1230a 7/23/14 (probably Dr. Erica L. Groshen - http://blogs.bls.gov/blog/commissioners_biography/ , http://blogs.bls.gov/blog/ ),

To be sure, the increasing of the retirement age population is not the only reason for the declining LFPR (it's about half the reason according to the above). For example, the LFPR of the age 25-34 year old population (seas adj) changed only slightly from 82.5% in December 2003 (and 83.1% in December 2007) to 83.8% in January 2020 ( http://data.bls.gov/timeseries/LNS11300089 ) while their Employment To Population Ratio ( http://data.bls.gov/timeseries/LNS12300089 ) changed from 77.6% in December 2003 (and 79.0% in December 2007) to 80.7% in January 2020 (well, its up only 3.1% from December 2003 to January 2020. But I discount or ignore comparisons to December 2007 as that was the height of the housing bubble-produced hyper-job market. Actually I'm pleased to see this statistic is up somewhat compared to December 2003 -- a point I chose as kind of a midpoint between the end of the dot-com crash and the beginning of the housing mania).

LATER, 2/8/20 - I'm going to have to rewrite a lot of the above. The LFPR and Employement-to-Population Ratio (ETPR) of the age 25-34 demographic had long been below their 2000 and 2007 peaks. But they have both essentially recovered:

For convenience the links to the labor force particpation rate and the employment to population ratio are:

LFPR, age 25-34: http://data.bls.gov/timeseries/LNS11300089

ETPR, age 25-34: http://data.bls.gov/timeseries/LNS12300089

LFPR, age 25-54: https://data.bls.gov/timeseries/LNS11300060

ETPR, age 25-54: https://data.bls.gov/timeseries/LNS12300060

For the graphs, a good start date to pick is 1987 -- before 1987 the LFPR and ETPR were much lower due to generally lower female workforce participation rates.

The ETPR of the 25-34 demographic is at 80.7% in January 2020. This is slightly down from the 80.0% housing bubble high in 2007, and 2.5% below the dotcom bubble high of 2000. It exceeds the only other peak, 80.1% in 1989. Before 1989, the ETPR was considerably lower than these levels because the female workforce participation was less than in recent decades. The current level is a bit above the highs of 1990 and the housing bubble high. But well below the dot-com bubble high. It looks like it’s a little bit above the 1987-2008 average. Anyway, the take-away is that the ETPR of this 25-34 age demographic is well above the average of the 1989-2020 period, even excluding the Great Recession crash and recovery years.

The LFPR of the age 25-34 demographic, 83.8% in January 2020, is only 0.2% down from its Housing Bubble high (84.0% in early 2008), and 1.5% down from the dotcom bubble high in 2000 (85.3%). It's down 0.6% from the 1989 peak (84.4%). Anyway, the take-away is that the LFPR of this 25-34 age demographic is about the same as the average of the 1989-2020 period, excluding two outlier periods: the 1996-2002 Dot-com peak years and excluding the Great Recession crash and recovery years.

(I deliberately selected a young population in the above paragraph because one hears a lot about the extra difficulty the young are having finding jobs. At the same time, I also chose a population that is for the most part well above college age because a population with a significant portion of high school and/or college age people would add to the complexity of the analysis and explanation when there exists a good productive choice other than work).

# Like the age 25-34 LFPR and ETPR, the age 25-54 LFPR and ETPR are considerably lower before 1987 due to less female workforce participation.

# I'll have to do much more analysis before I can determine what part of the overall LFPR decline is due to the increasing proportion of elderly people. The best way to find data series (that I have found) is this tool: http://data.bls.gov/pdq/querytool.jsp?survey=ln

A broader look at unmployment rates, by president, 1948-2016, and then with a graph of each presidency's unemployment rate

with a mini-explanation of each https://historyinpieces.com/research/us-unemployment-rates-president

Credit: UpInArms 4/9/20 https://www.democraticunderground.com/10142466757#post17

Unemployment rates, by ethnicity (white, Hispanic, black), age, and gender

. . http://www.bls.gov/news.release/empsit.t01.htm

. . http://www.bls.gov/news.release/empsit.t02.htm (race, then sex, some age)

. . http://www.bls.gov/news.release/empsit.t03.htm (continuation of t02.htm)

. . Here's a fascinating one showing the above over time: snapshots of 1998, 2008, 2018; and 2028 projection

. . . . https://www.bls.gov/emp/tables/civilian-labor-force-participation-rate.htm

Unemployment rate: U1, U2, U3, U4, U5, U6 - Table A-15. Alternative measures of labor underutitlization

http://www.bls.gov/news.release/empsit.t15.htm

Definitions: http://www.bls.gov/lau/stalt.htm

See U-1 thru U-6 together, each line a different color (scroll down to Chart # 20 ): http://www.bls.gov/web/empsit/cps_charts.pdf

. # U-1, U-2: U-1 is http://data.bls.gov/timeseries/LNS13025670 and U-2 is http://data.bls.gov/timeseries/LNS14023621 if anyone cares

. # U-3 Unemployment rate, seasonally adjusted (this is the headline official unemployment rate number) http://data.bls.gov/timeseries/LNS14000000

. # U-4 Total unemployed plus discouraged workers, as a percent of the civilian labor force plus discouraged workers, seasonally adjusted http://data.bls.gov/timeseries/LNS13327707

. # U-5 Total unemployed, plus discouraged workers, plus all other marginally attached workers, as a percent of the civilian labor force plus all marginally attached workers, seasonally adjusted

http://data.bls.gov/timeseries/LNS13327708

. # U-6 Total unemployed, plus all marginally attached workers plus total employed part time for economic reasons, as a percent of all civilian labor force plus all marginally attached workers, seasonally adjusted. This is the BLS's broadest measure of unemployment. http://data.bls.gov/timeseries/LNS13327709

{#} Job Loss and Creation - Unemployment Insurance Claims

# This week's unemployment insurance claims report: https://www.dol.gov/ui/data.pdf

# Unemployment insurance initial claims, week by week: http://workforcesecurity.doleta.gov/unemploy/claims.asp

Initial claims (FRED): https://fred.stlouisfed.org/series/ICSA

# It peaked at 667,000 initial claims 3/28/09 (2 months after Obama took office) and since then it has shown a steady improvement excepting relatively minor bumps until about December 2011. Since December 2011 it has been inching down slowly, but steadily, for example -- the average of the 4 weeks with ending dates in December 2011 was 377,000; while the last 4 weeks through week ending October 1, 2016 averaged 253,500. That was the lowest since December 8, 1973, almost 43 years ago). Since then, it has been pretty flat at very low levels (very near the lows of 1969, and remember this statistic is not adjusted for population size). In the 4 weeks ending February 1, 2020, it averaged 211,750 (down 8,500 from a year ago).

# Continued Claims (Insured Unemployment) (CCSA) (FRED): https://fred.stlouisfed.org/series/CCSA

# Myth: "those who have exhausted their unemployment insurance benefits are not counted as unemployed. If they were counted, the official unemployment rate would be much higher" (you often hear this claim from the RepubliCONS when a Democratic president is in the White House, and vice versa when a RepubliCON is in the White House).

# Fact: The count of the unemployed and the unemployment rate is NOT a count of those receiving unemployment benefits, nor is unemployment benefit receiver status factored at all into any of the official national unemployment rate statistics (U1, U2, U3, U4, U5, U6). Rather, the national unemployment rate is based on a survey of 60,000 households chosen at random. See: http://www.bls.gov/cps/cps_htgm.htm"How the Government Measures Unemployment" cps_htgm.htm

and search the page for the word "insurance"

People in the survey are counted as unemployed (and thus part of the official (U3) unemployment rate) if they are jobless and looked for work some time in the past 4 weeks. They are counted as unemployed in the U4, U5, and U6 statistics if they looked for work some time in the past 12 months. It has nothing at all to do with whether they are collecting unemployment benefits or not, or how long they have been unemployed.

However, unemployment insurance data is used as one of the inputs for determining state and substate unemployment rates --"because the CPS survey of 60,000 households nationwide is insufficient for creating reliable monthly estimates for statewide and substate areas, LAUS (Local Area Unemployment Statistics) uses three different estimating procedures, each being the most appropriate for the level of geography being estimated. In general, estimates for the states are developed using statistical models that incorporate current and historical data from the CPS, the Current Employment Statistics (CES) program, and regular state unemployment insurance (UI) systems. These model-based state estimates are also controlled in "real time" to sum to the not seasonally adjusted national monthly CPS totals."(also from the above http://www.bls.gov/cps/cps_htgm.htm link).

Note the last part -- that the state totals are adjusted to sum up to the national total. So on average, any undercount bias resulting from using (in part) state unemployment insurance (UI) data is eliminated by adjusting the state totals to sum up to the national CPS result (which doesn't use state UI data at all)

---------------------------

However, over the longer term, undoubtedly a cut-off in benefits will affect the unemployment rate numbers, for example:

# People who lose benefits will be more likely to take any job out there, no matter how far below their education, training, and experience, thus lowering the unemployment rate (since they are no longer unemployed).

# Some people who were making some effort to look for work only in order to continue to receive unemployment benefits (looking for work is a requirement to receive benefits) will drop the charade of looking for work when their benefits are cut off. This will also lower the unemployment rate (people who have not looked for work in the last 4 weeks are not counted as unemployed (U-3) or the last 12 months (U-4 - U-6) ). It will also lower the labor force participation rate (officially the labor force is those employed or who have looked for work in the last 4 weeks).

(People in the above category are not necessarily "cheats" in my book -- for example people who may not really be looking right now because they are completing coursework in order to earn a certificate in order to improve their chances of getting a job that utilizes their education and experience is not Reagan's "welfare queen" IMHO)

{#} JOLTS - Job Opening and Labor Turnover Survey

# Job Openings and Labor Turnover SUMMARY - http://www.bls.gov/news.release/jolts.nr0.htm

# Job Openings and Labor Turnover Table of Contents - http://www.bls.gov/news.release/jolts.toc.htm

# State Jobs Openings and Labor Turnover Summary (State JOLTS) https://www.bls.gov/news.release/jltst.nr0.htm

# FRED graph of Job Openings, Total NonFarm (JTSJOL) -- https://fred.stlouisfed.org/series/JTSJOL

# Job Openings and Labor Turnover Technical Note -- https://www.bls.gov/news.release/jolts.tn.htmThe job openings are not a count of job postings. They are based on surveys of companies. It is not required that an opening be posted in order for it to be counted.

# This Mahatmakanejeeves thread (JOLTS report for October 2015 that came out December 8) has a graph of Job Openings, Hires, and Quits from January 2001 on, as well as a graph of Reasons Why People Leave Jobs ( Layoffs, Voluntary Quits, Other Separations ) from 2001 on -- http://www.democraticunderground.com/10141283919

# This Mahatmakanejeeves thread (JOLTS report for January 2016 that came out March 17) has a graph of Job Openings, Hires, and Quits from January 2007 on -- http://www.democraticunderground.com/10141283919

# Latest as of 2/7/20 - this one from 1/21/20

https://www.democraticunderground.com/111687284

# Number of unemployed persons per job opening, seasonally adjusted

Interesting graph: it was about 6.4 at the height of the Great Recession and is now about 0.95 (January 2020)

https://www.bls.gov/charts/job-openings-and-labor-turnover/unemp-per-job-opening.htm

{#} Multiple JobHolders

Table A-9: Multiple Jobholders: January 2020: 8,152,000 Percent of employed: 5.1%. -- So according to this and Politifact, it is a myth that most people are working 2 or 3 jobs.

. . . http://www.bls.gov/news.release/empsit.t09.htm

. . . Politifact-- https://www.politifact.com/truth-o-meter/statements/2018/jul/18/alexandria-ocasio-cortez/alexandria-ocasio-cortez-wrong-several-counts-abou/

This piece from a Forbes contributor explains why the number of multiple job holders might be underestimated by the BLS. (Caution: this is not Forbes' opinion, but rather the contributors' opinion. Right next to the word "contributor" after the author's name (Erik Sherman) is a little info icon. When one clicks on that, it says "Opinions expressed by Forbes contributors are their own".

It's the equivalent of an "op-ed" in say the New York Times and Washington Post where they try to have a variety of opinions to look "balanced" and, well, just to present a variety of opinions.

https://www.forbes.com/sites/eriksherman/2018/07/22/more-people-probably-work-multiple-jobs-than-the-government-realizes/#776e2d002a21

See Table A-9 ( http://www.bls.gov/news.release/empsit.t09.htm ) and Table A-16 (http://www.bls.gov/news.release/empsit.t09.htm ). Table A-16 has a breakdown into 4 categories: primary job full-time, secondary job part-time, etc. etc. Also by men and women.

# Multiple Job holders, thousands, seasonaly adjusted -

. . . https://research.stlouisfed.org/fred2/series/LNS12026619

. . . http://data.bls.gov/timeseries/LNS12026619

# Multiple Jobholders as a Percent of Employed, seasonally adjusted

. . . https://research.stlouisfed.org/fred2/series/LNS12026620

. . . http://data.bls.gov/timeseries/LNS12026620

# Multiple Job Holders - Fred -- several breakdowns, each with their BLS timeseries numbers, e.g. LNS12026620

. . . https://research.stlouisfed.org/fred2/categories/32450

# http://www.bls.gov/cps/cpsaat36.htm -- is only by year, e.g. 2014, 2015. lots of breakdowns -- by age, by race/ethnicity

# Myth: "But the real unemployment rate is 15% (or 24% or whatever) and it keeps going up":

# Facts: The broadest measure of unemployment rate that the Bureau of Labor Statistics publishes is the U-6 -- Total unemployed, plus all marginally attached workers plus total employed part time for economic reasons, as a percent of all civilian labor force plus all marginally attached workers, seasonally adjusted http://data.bls.gov/timeseries/LNS13327709

( Definitions of alternative meausres of unemployment: http://www.bls.gov/lau/stalt.htm )

U-6 counts as unemployed all who have looked for a job sometime, even just once, in the past year, and who are not employed and say they want a job now. And part-time workers who want full-time work. (Whereas the headline official (U-3) unemployment rate counts only those who have looked for work in the past 4 weeks, and counts all part-timers as employed).

The U-6 unemployment rate was 15.4% in January 2009 when Bush left office and Obama took office.

When Obama left office and Trump took office, it was 9.4% (January 2017).

Recently it was 6.9% in January 2020. It had been on a fairly steady decline since about April 2010 (when it peaked at 17.2%). ( LNS13327709 )

There are even broader measures of unemployment to be found on the Internet (where just about anything can be found and dressed up as reasonable) such as the Shadow Stats series unemployment rate. My understanding is that the BLS's U-6 includes people who have looked for a job sometime, even just once, in the past 12 months ( http://www.bls.gov/lau/stalt.htm ). I don't see any particular reason to broaden the definition of unemployment rate to those, who although they say they want a job now, haven't bothered to do any job-hunting for over a year. How far should we extend it?

Should we also count as unemployed the house spouse in a one-high-income household -- or the happily retired person -- who, if an ideal dream job came up, would consider it? See the next item on what if you counted everyone who says they want a job.

If you count everyone who says they want a job, even if they have made no effort to find one in many years...More specifically if you counted every jobless person who answers "yes" to the question "do you want a job" and every part-time worker that answers "yes" to the question, "do you want a full time job?" (even if they have made no effort to find a job in years), then the unemployment rate is 8.8% as of January 2020 -- This is 1.7 percentage points higher than the BLS's January U-6 unemployment rate of 6.9% ). .

Paul Solman of the PBS Newshour created this "U-7" indicator.

http://www.pbs.org/newshour/rundown/2011/02/a-disjointed-jobs-report-and-u-7-month-two.html