'mark to model accounting' (versus a true 'mark to market' methodology) has done to fundamentally dislocate their books from all measures of reality. This type of purely fraudulent bookkeeping would have landed one in prison just 20 or 30 years ago, today it is standard operating procedure, and is rewarded with hundreds of billions in bonuses paid out by the banksters to themselves in just the short period of time since the $23.7 trillion dollar+

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aY0tX8UysIaM total bailout was rammed through congress by the Fed, the Treasury, and the robber barons.

The $700 billion TARP so talked about was chump change compared to true extent of the fiduciary transfers that actually occurred. The Congress had to sue the Fed and take it all the way to the Supreme Court

http://www.supremecourt.gov/orders/courtorders/032111zor.pdf just to get ONE section ($3.3 trillion) of the hidden bailouts exposed to the light of day.

http://www.bloomberg.com/news/2010-03-19/fed-loses-bid-for-review-of-disclosure-ruling-on-u-s-bank-bailout-records.htmlhttp://theeconomiccollapseblog.com/archives/trillions-in-secret-fed-bailouts-for-global-corporations-and-foreign-banks-has-the-federal-reserve-become-a-completely-unaccountable-global-bailout-machinehttp://www.unelected.org/the-federal-reserves-3-3-trillion-dollar-bailout-of-foreign-banks-and-corporations---------------------------------------------------

As for the hubris that they are healthy, viable institutions, remember that the same was said of Bear Stearns, Lehman, and Merrill Lynch right before they collapsed (actually assassinated in a derivative overhang pissing match).

In regards to the USA and wealth, sure it is a wealthy nation on paper in terms of assets (which are far outweighed by the total public/private debts), but that wealth is now concentrated in the hands of a few uber rich to a level unseen in modern history. At end of the day, the systemic controllers have consolidated this wealth utterly vertically, hollowing out the country, These schema have exploded under puppet Obama even faster than under puppet Bush. The top 1 percent in the USA now have over 50 percent all the wealth (in 1965, the top 5 percent (or 5 times as many) had only a 19 percent share) so the richest 1 percent have increased their share 13 times, and the top .1 percent (just 300,000 people) have increased their share over 100 times all in just 45 years.

The bottom 20 percent of Americans had 5 percent of the wealth in 1965 now, the BOTTOM 40 percent (over 130 million people) have only 0.3 percent of the wealth. The bottom 40 percent of the USA have had their share DECREASED more than 30-fold in last 45 years.

Also, you cannot separate the government's sovereign debts from the private sphere, as all massive losses in the private sector are simply dumped onto the backs of the citizens, whilst private profits are kept private. This is the quintessential definition of corporatist fascism.

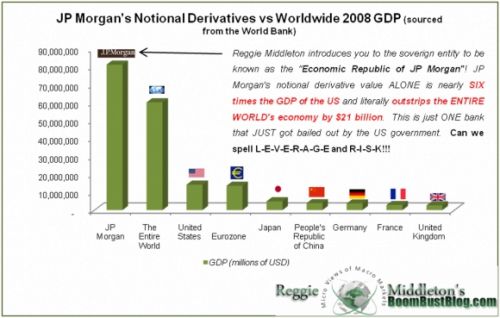

JP Morgan alone has a total notional value of $90 TRILLION in potential derivative debt on their books, and over 35% of that is BBB rated or less.

http://maxkeiser.com/2011/06/29/total-net-derivative-exposure-jpm/Total net derivative exposure rated below BBB on JP Morgan�s $90,000,000,000,000 ($90 trillion) books currently stands at 35.4% � MUCH WORSE than Bear Stearns and Lehman�s derivative portfolio just prior to their CRASH. JPM�s IMPLOSION will be 1000 X�s bigger than Enron!

What about JPM�s garden variety claim exposure to various lawsuits?

Whalen � $200 Billion in Claims Against JP Morgan & Banks

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/6/29_Whalen_-_%24200_Billion_in_Claims_Against_JP_Morgan_%26_Banks.htmlWhat�s JPM�s current market capitalization? About $160 billion

An Independent Look into JP Morgan

http://boombustblog.com/BoomBustBlog/An-Independent-Look-into-JP-Morgan.html The JP Morgan forensic preview is now available. Remember, this is not subscription material, but a "public preview" of the material to come. I thought non-subscribers would be interested in knowing what my opinion of the country's most respected bank was. There is some interesting stuff here, and the subscription analysis will have even more (in terms of data, analysis and valuation). As we have all been aware, the markets have been totally ignoring valuation for about two quarters now. It remains to be seen how long that continues.

Cute graphic above, eh? There is plenty of this in the public preview. When considering the staggering level of derivatives employed by JPM, it is frightening to even consider the fact that the quality of JPM's derivative exposure is even worse than Bear Stearns and Lehman�s derivative portfolio just prior to their fall. Total net derivative exposure rated below BBB and below for JP Morgan currently stands at 35.4% while the same stood at 17.0% for Bear Stearns (February 2008) and 9.2% for Lehman (May 2008).

We all know what happened to Bear Stearns and Lehman Brothers, don't we??? I warned all about Bear Stearns (Is this the Breaking of the Bear?:

http://boombustblog.com/index.php/20080127142/Is-this-the-Breaking-of-the-Bear.html On Sunday, 27 January 2008) and Lehman ("Is Lehman really a lemming in disguise?":

http://boombustblog.com/index.php/20080221162/Is-Lehman-really-a-lemming-in-disguise.html On February 20th, 2008) months before their collapse by taking a close, unbiased look at their balance sheet. Both of these companies were rated investment grade at the time, just like "you know who". Now, I am not saying JPM is about to collapse, since it is one of the anointed ones chosen by the government and guaranteed not to fail - unlike Bear Stearns and Lehman Brothers, and it is (after all) investment grade rated. Who would you put your faith in, the big ratings agencies or your favorite blogger? Then again, if it acts like a duck, walks like a duck, and quacks like a duck, is it a chicken??? I'll leave the rest up for my readers to decide.

snip

---------------------------------------------------------------------------------------

systemically healthy my arse