Thank you for the kind words, Ghost in the Machine! Really like the image of Bush.

The Masters of the Universe types on Wall Street, I am told, enjoyed playing "Liar's Poker" where they bet on hands based on the serial numbers of dollar bills.

The turds started out playing for $1,000, then $10,000, from which it headed to $500,000 per hand.

Bartcop is where I learned the phrase, Bush Family Evil Empire.

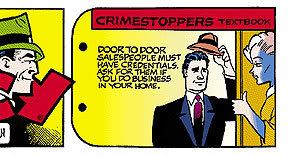

Chester Gould is where I learned the Know your Crimestoppers system:

A public education is everyone's right in a democracy.

'How Could Buyers Resist Taking Those Terms?'

Carlyle Founder on Cheap Debt, Credit Crunch and the New Buyout LandscapeBy HENNY SENDER

Wall Street Journal

Aug. 25, 2007

The buyout boom that saw a handful of investment firms snap up ever larger public companies seems to be fizzling as the debt market used to fuel these takeovers seizes up.

Carlyle Group's David Rubenstein says private equity is no longer too 'private.'

David Rubenstein, who co-founded Carlyle Group in 1987, has seen his share of deal cycles. With deals harder to finance, private-equity firms will have to live with their companies for longer now. In an interview with The Wall Street Journal, Mr. Rubenstein struck an optimistic tone despite the challenges facing the industry.

WSJ: How serious a setback for private equity is the turmoil in the debt markets?

Mr. Rubenstein: Cheap debt fooled people. Because financing was so cheap relatively in the past few years, many people think all we do is buy companies with cheap debt, wait a short while and then sell them. But most private-equity firms are about hard work, not just financial engineering.

In the near future, we won't see buyout deals of the size we saw 60 days ago due to the debt-market uncertainty. And available debt will be more expensive. The sellers will have to adjust to lower prices. This is not a calamity. What we have now is just a temporary imbalance of credit. When the debt market returns to equilibrium, a lot of companies will be available and there will be clear bargains. Private-equity firms will continue to buy companies with a bit more expensive debt but also a bit more pricing discipline.

WSJ: But isn't it true that in recent years, financial engineering was a big part of what drove deals? Your partner Bill Conway himself described cheap debt as the "rocket fuel" of this cycle.

Mr. Rubenstein: We got labeled with the financial engineering label because in the early days, the deals were done with only 5% to 7% equity and the companies were highly levered. Today, the average equity is between 32% and 35%. Deals aren't as heavily engineered or have as levered structures.

WSJ: How dramatic is the change in the debt market today?

Mr. Rubenstein: The banks found that providing financing to private-equity firms was very attractive and profitable, so the banks made it easier and easier to accept their financing. They offered us relatively low interest loans. They later said they didn't need "mac" clauses (which give the banks an out if circumstances change). Then they offered us covenant-lite loans and pik toggles (which give borrowers much more flexibility). And then they offered to bridge some of our equity. How could buyers resist taking those terms, knowing the result would be better returns for their investors.

And because of this favorable financing, we could pay a bit more for companies. For the last five years, there was almost no penalty for overpaying by 5-10%, for we were emboldened by these attractive loan features. Now these things are probably a relic of the past, or at least for the next few years. We won't see many covenant-lite or pik toggles. That will no doubt mean more discipline in assessing deals. But private equity can do quite well in this changed environment, as it has in previous times of retrenchment. Prices will return to more normal levels. And that will be quite helpful to the industry.

CONTINUED...

http://online.wsj.com/article/SB118799505991608357.html As you know, my Friend Ghost in the Machine, the Carlyle Group specialized in defense industry type companies. Its principals include John Major, Frank Carlucci, James Baker III, George Herbert Walker Bush, and the bin Laden family.

And if the U.S. taxpayers are supposed to come up with 700 billion for Wall Street, you'd think something would be available for it and us.