Economy

In reply to the discussion: Weekend Economists' SuperBawl Special: "NEVERMORE!" February 1-3, 2013 [View all]Demeter

(85,373 posts)Richard Koo of Nomura published an important piece earlier this week which got some attention in the financial blogosphere (Clusterstock, FT Alphaville). It takes issue with a critical part of the economist optimists’ case, namely, that consumer deleveraging is about done and therefore the economy is likely to perform much better in the next few years.

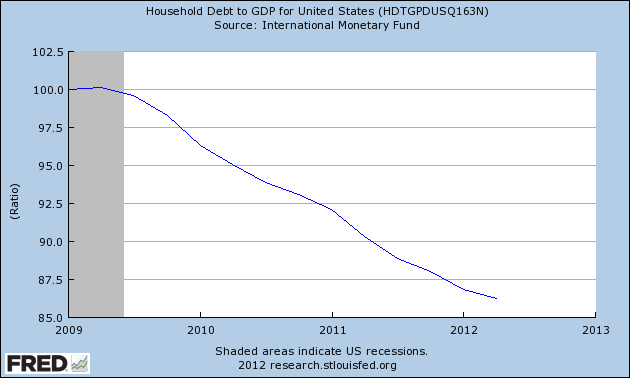

I have doubts even with the thesis as stated, given that the assumption is that having consumers releverage would be a good thing. We have stagnant wages and short job tenures and concerns that demographics will no longer drive growth in the US, combined with the fact that the BIS has found that household debt to GDP ratio of over 85% are associated with a negative impact on economic growth, and we are still above that level:

And that’s before you get into the issue of the composition of debt: a lot of the deleveraging has been involuntary (foreclosures and bankruptcies) and has been partially offset by rising levels of student, which is more pernicious than credit card or mortgage debt, since it can’t be discharged in bankruptcy, and is accumulated at the beginning of an adult’s income-earning years.

Koo makes a different point: that some of the figures that the bulls have cited as positive are anything but:

Koo refers to this chart to make his point:

http://www.nakedcapitalism.com/2013/01/richard-koo-debunks-the-deleveraging-is-almost-done-american-consumer-getting-ready-for-good-times-meme.html/screen-shot-2013-01-25-at-2-10-35-am

The white bars are financial assets and the red bars are liabilities. The blue line is the difference between the two. Koo again:

Inasmuch as this act of reducing financial liabilities in spite of zero interest rates runs counter to the principle of maximizing profits, it suggests that US households continue to undertake balance sheet adjustments.

And the implications…

The first instance (barely visible in the graph) was in 2000 Q4, when the Internet bubble collapsed. The second was in 2008 Q4, when the failure of Lehman Brothers sparked a global financial crisis. People faced cash flow problems in both periods andprobably were forced to draw down existing savings to make necessary payments.

During the bubble period towards the middle of Figure 1, much attention was paid to the fact that the US household savings rate had turned negative. While the sector did run a financial deficit during this period, the deficit was attributable to the fact that the increase in financial liabilities (ie growth in borrowing) was greater than the increase in financial assets (ie growth in savings). There was no drawdown of financial assets.

Hence we need to pay attention to the fact that the latest figure shows only the third drawdown of financial assets since 2000 and that this drawdown is responsible for the financial deficit in the broader household sector. The reason: if household consumption is being financed by the drawdown of financial assets, it is not likely to be sustainable.

This pattern of drawing down financial assets while reducing financial liabilities has been frequently observed in Greece during the last two years and is definitely not a positive development, in my view.

I know the plural of anecdote is not data, but I’m not hearing a lot of optimism in the cohorts I’m in contact with. Most people are less freaked out than they were in 2009 and 2010 but while you can say that trend-wise, it’s an improvement in confidence, that does not translate into confidence in the animal spirits sense. One telling story: a former client who was a partner in a financial firm that was sold at a very handsome price and has a net worth somewhere north of $15 million (how much I have no idea) was visiting New York. He and his wife live part of the year in Chicago and are renovating their apartment. She remarked that she had just been in the D&D Building because the showrooms for the Chicago decorators had become very spare since the downturn. I said I was surprised, prices at art auctions were hitting new highs. She said that the people at the top might be spending, but it was different at the next layer. For instance, when she called the contractor she had used before to ask about his schedule for the spring, he signaled he was wide open. Later he said that his 4th quarter had been “OK” and if the rest of the year had been as weak as his first quarter 2012 had suggested, he wouldn’t be in business...

MORE

Read more at http://www.nakedcapitalism.com/2013/01/richard-koo-debunks-the-deleveraging-is-almost-done-american-consumer-getting-ready-for-good-times-meme.html#7yHsOr3EQtggsALe.99