Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Segami

Segami's Journal

Segami's Journal

April 8, 2013

Members of Congress won’t follow President Obama’s lead by giving back 5% of their salary because it’s tough to manage a two-city life on $174,000.00, according to the analysis of David Hawkings’ of Roll Call.

Eight of the President’s cabinet are also donating back, and a handful of lawmakers followed suit (the non-binding voice vote for show in the Senate doesn’t count, but thank Lindsey Graham for the show). While Hawkings doesn’t have anyone on the record (as if their silence doesn’t speak volumes), this is hardly the first time we’ve heard members of congress bemoaning their salaries.

After talk of a Republican imposed government shutdown in 2011, Democratic Senator Joe Manchin encouraged others to follow his lead in donating his earnings back to the Treasury. The Daily Caller asked Congressional members if they would chip in: House Republican Renee Ellmers (N.C.) wasn’t having it, “I need my paycheck.” Other members were non-plussed from both sides of the aisle, though Republican Pete King (N.Y.) took a stand for salaries that American workers would applaud if only his party weren’t gunning for theirs, “I’m going to take it. I’ll be working. You shouldn’t play games with salaries.” The Florida Capital News reported (courtesy of DCC, as FCN link is not working, second source PolitiFact) Republican Steve Southerland complaining to a Tallahassee retirement community in 2011:

cont'

http://www.politicususa.com/congress-follow-obamas-lead-give-salaries-struggling.html

Congress Claims They Are ‘FINANCIALLY STRUGGLING’, and REFUSES to Give Back Salary

Members of Congress won’t follow President Obama’s lead by giving back 5% of their salary because it’s tough to manage a two-city life on $174,000.00, according to the analysis of David Hawkings’ of Roll Call.

But beyond sticking by the salary freeze they imposed on themselves four years ago, don’t look for any legislative groundswell to reduce congressional paychecks across the board. So many members have such safe seats that they see no need to make such a move, plus many of them are having trouble managing their two-city lives on $174,000 a year.

http://blogs.rollcall.com/hawkings/pay-cut-solidarity-dont-look-for-congress-to-match-obamas-team/

http://blogs.rollcall.com/hawkings/pay-cut-solidarity-dont-look-for-congress-to-match-obamas-team/

Eight of the President’s cabinet are also donating back, and a handful of lawmakers followed suit (the non-binding voice vote for show in the Senate doesn’t count, but thank Lindsey Graham for the show). While Hawkings doesn’t have anyone on the record (as if their silence doesn’t speak volumes), this is hardly the first time we’ve heard members of congress bemoaning their salaries.

After talk of a Republican imposed government shutdown in 2011, Democratic Senator Joe Manchin encouraged others to follow his lead in donating his earnings back to the Treasury. The Daily Caller asked Congressional members if they would chip in: House Republican Renee Ellmers (N.C.) wasn’t having it, “I need my paycheck.” Other members were non-plussed from both sides of the aisle, though Republican Pete King (N.Y.) took a stand for salaries that American workers would applaud if only his party weren’t gunning for theirs, “I’m going to take it. I’ll be working. You shouldn’t play games with salaries.” The Florida Capital News reported (courtesy of DCC, as FCN link is not working, second source PolitiFact) Republican Steve Southerland complaining to a Tallahassee retirement community in 2011:

He said his $174,000 salary is not so much, considering the hours a member of the House puts in, and that he had to sever ties with his family business in Panama City. Southerland also said there are no instant pensions or free health insurance, as some of his constituents often ask him about in Congress. ..He added that ‘if you took the hours that I work and divided it into my pay,’ the $174,000 salary would not seem so high.”

http://www.dccc.org/races/district/floridas_2nd

http://www.dccc.org/races/district/floridas_2nd

cont'

http://www.politicususa.com/congress-follow-obamas-lead-give-salaries-struggling.html

April 7, 2013

"....This is not the President's ideal budget proposal,...it is a budget proposal that represents a ' good faith, compromise position ', that reflects the offer he made to the Speaker Of The House, that was 'widely seen as a compromise good faith effort' that met Republicans half way, and it ' reflected the People's Will ' that we address these challenges in a way thats ' balanced & fair '...."

WH's Jay Carney GETS HIT On Social Security CUTS In President's Budget

"....This is not the President's ideal budget proposal,...it is a budget proposal that represents a ' good faith, compromise position ', that reflects the offer he made to the Speaker Of The House, that was 'widely seen as a compromise good faith effort' that met Republicans half way, and it ' reflected the People's Will ' that we address these challenges in a way thats ' balanced & fair '...."

April 7, 2013

The moment of truth has arrived. According to press reports, President Obama has openly embraced cutting Social Security and veterans benefits by imposing the "chained CPI" cut on cost of living increases, which is like signing in blood the idea that the federal government's priorities should be owned by the 1% rather than by the 99%. The war in Afghanistan will continue, the boondoggle F-35 "Bankrupter" fighter plane will continue, the $83 billion annual taxpayer subsidy to the "too big to fail" banks will continue, but the earned benefits of America's working families, including disabled veterans and their survivors, will be cut if President Obama has his way.

The only thing that can stop President Obama from cutting Social Security now is Congress. Therefore, the only thing that can stop President Obama from cutting Social Security now is public pressure on Congress to stand up to Obama and say no. The pressure that has been exerted so far was not sufficient to stop President Obama from doing this. Therefore, public pressure against Social Security cuts must significantly escalate. Let's be clear about what's not true. From the point of view of the interests of the 99%, there was no legitimate reason for President Obama to do this. The President's marketing strategy will be to say that Obama had to do this because it was necessary to get a deal with Congressional Republicans to raise taxes.

But from the point of view of the interests of the 99%, there is no urgency or benefit to getting a deal to raise taxes if Social Security cuts are the price of doing so. Raising taxes, even raising taxes on the 1%, isn't an intrinsic good. Raising taxes on the 1% is a good thing if it enables the government to do good things and avoid doing bad things. Raising taxes on the 1% is a bad thing if it enables the government to do bad things and avoid doing good things. If there is no "grand bargain," then under the sequester, the Pentagon budget will be cut and Social Security benefits will be protected. If there is a "grand bargain" - a "Grand Betrayal" - Social Security benefits will be cut and the Pentagon budget will be protected. Thus, to be only a little bit crude, the "grand bargain" is about cutting Social Security to protect the Pentagon budget. Raising taxes on the 1% as part of a deal to cut Social Security and veterans' benefits and protect the Pentagon budget for wars and useless military junk is a bad deal for the 99%.

In general, liberals who follow budget issues know this. We are at a fork in the road: one branch of the fork leads to cutting Social Security to protect the Pentagon budget and the other branch of the fork leads to cutting the Pentagon budget while protecting Social Security. The fact that cutting Social Security is even on the table, even though cutting Social Security is overwhelmingly unpopular among both Democrats and Republicans, and both Democrats and Republicans would rather cut the Pentagon budget and end the war in Afghanistan instead, is a barometer of 1% control of the political system. If not for the domination of the political system by the 1%, we wouldn't even be talking about cutting Social Security.

cont'

http://truth-out.org/opinion/item/15576-chainedcpi-for-every-social-security-judas-a-primary-challenge

#ChainedCPI? For Every SOCIAL SECURITY JUDAS, A Primary Challenge

Both Democrats and Republicans have expressed discontent at cutting Social Security but the option remains on the table. Robert Naiman suggests the 99% escalate their interest in the matter to have their voices heard against the 1% making the budget decisions.

The moment of truth has arrived. According to press reports, President Obama has openly embraced cutting Social Security and veterans benefits by imposing the "chained CPI" cut on cost of living increases, which is like signing in blood the idea that the federal government's priorities should be owned by the 1% rather than by the 99%. The war in Afghanistan will continue, the boondoggle F-35 "Bankrupter" fighter plane will continue, the $83 billion annual taxpayer subsidy to the "too big to fail" banks will continue, but the earned benefits of America's working families, including disabled veterans and their survivors, will be cut if President Obama has his way.

The only thing that can stop President Obama from cutting Social Security now is Congress. Therefore, the only thing that can stop President Obama from cutting Social Security now is public pressure on Congress to stand up to Obama and say no. The pressure that has been exerted so far was not sufficient to stop President Obama from doing this. Therefore, public pressure against Social Security cuts must significantly escalate. Let's be clear about what's not true. From the point of view of the interests of the 99%, there was no legitimate reason for President Obama to do this. The President's marketing strategy will be to say that Obama had to do this because it was necessary to get a deal with Congressional Republicans to raise taxes.

But from the point of view of the interests of the 99%, there is no urgency or benefit to getting a deal to raise taxes if Social Security cuts are the price of doing so. Raising taxes, even raising taxes on the 1%, isn't an intrinsic good. Raising taxes on the 1% is a good thing if it enables the government to do good things and avoid doing bad things. Raising taxes on the 1% is a bad thing if it enables the government to do bad things and avoid doing good things. If there is no "grand bargain," then under the sequester, the Pentagon budget will be cut and Social Security benefits will be protected. If there is a "grand bargain" - a "Grand Betrayal" - Social Security benefits will be cut and the Pentagon budget will be protected. Thus, to be only a little bit crude, the "grand bargain" is about cutting Social Security to protect the Pentagon budget. Raising taxes on the 1% as part of a deal to cut Social Security and veterans' benefits and protect the Pentagon budget for wars and useless military junk is a bad deal for the 99%.

In general, liberals who follow budget issues know this. We are at a fork in the road: one branch of the fork leads to cutting Social Security to protect the Pentagon budget and the other branch of the fork leads to cutting the Pentagon budget while protecting Social Security. The fact that cutting Social Security is even on the table, even though cutting Social Security is overwhelmingly unpopular among both Democrats and Republicans, and both Democrats and Republicans would rather cut the Pentagon budget and end the war in Afghanistan instead, is a barometer of 1% control of the political system. If not for the domination of the political system by the 1%, we wouldn't even be talking about cutting Social Security.

cont'

http://truth-out.org/opinion/item/15576-chainedcpi-for-every-social-security-judas-a-primary-challenge

April 6, 2013

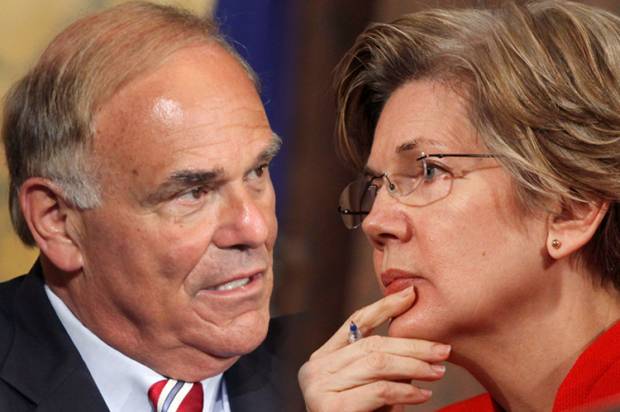

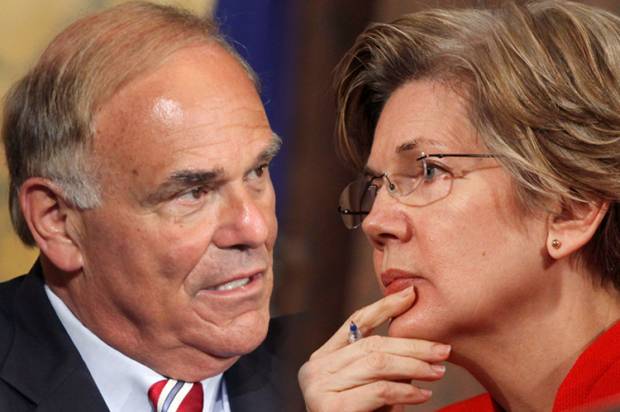

When it comes to economic issues, Democrats are not a united party. There are economic liberals, in the vein of Elizabeth Warren, who believe that very rich people who lead a good life can afford to pay more in taxes to support basic services for struggling people, seniors, and others who are vulnerable. And then there are “pro-business” Democrats, or what might be called SPECs (Socially Progressive Economic Conservatives). These are the pro-fracking, self-described “entitlement reformers” — like omnipresent former Gov. Ed Rendell — who talk about the need to keep taxes low and make “bold” decisions like cutting the social safety net, in an effort to fix the debt, restore “balance” and “get serious.” While the split is not discussed as often as it might be, these two camps stand far apart on economic issues, and, in some ways, are fighting for the soul of the Democratic Party. And, with President Obama’s newly reiterated proposal to cut Social Security through his chained CPI plan, a big test is approaching to see which wing of the party will prevail.

Obama’s offer on Social Security is divisive for several reasons. First, there’s the very real effect it will have on Americans relying on their benefits to get by month to month. By revising downward the cost of living index used to compute benefits, the policy change would reduce the amount that some on fixed incomes – including disabled Americans, such as veterans — live on (precisely how many is unclear, as the administration reportedly supports “financial protections for low-income and very old beneficiaries”). This is something economic liberals cannot support; for the SPECs, this is tolerable if part of a larger deal. Second, there’s the symbolism and precedent of cutting into New Deal-style programs. The first cut to popular, essential programs is always the most difficult; once it’s been done, and that toe is in the water, there’s the concern that future reductions could be more easily achieved. That’s why the symbolism of a Democratic president attaching his name to – and owning – the cuts is so controversial and worrying for liberals. How hard would it be for Republicans to push future cuts through, when this is now a mainstream Democratic policy?

Beyond these issues lies a more philosophical one, which comes down to different conceptions of “balance.” For SPECs and many others in Washington, balance means a plan in which both political parties give up something they don’t want. If Democrats and Republicans are both unhappy, the thinking goes, that means the plan is balanced and good. Liberals see it differently. By their thinking, “balance” must incorporate the broader circumstances of those impacted by the policy in question. If rich people have every advantage in life – wealth, tax breaks and loopholes, healthcare, food security, the ability to influence political campaigns, etc. – and less well-off folks are disadvantaged in all the same categories, then balance calls for a policy that helps to shift things in the other direction a bit. In other words, one camp sees balance as a political end (which, incidentally, can be easily manipulated by positioning and negotiating strategies) and the other sees it as a policy imperative with real-world implications.

The question undergirding this particular debate is twofold. First, is more money actually needed to fund Social Security? And if so, how should one pay for a shortfall? In fact, Social Security is solvent and has not contributed to the debt. But pretend you don’t believe that. Then the question becomes: If you needed revenue to pay for Social Security, how would you generate it? This is the crux of the divide. One option is to cut benefits for those in need, which Obama has proposed to do, backed by groups like Fix the Debt, the outfit funded by billionaire Pete Peterson (Rendell sits on the board, along with other SPECs, Republicans, and Simpson and Bowles). Another option is to raise the cap on income that’s taxed by Social Security. Currently, that number is in the $110,000 range, meaning any income one makes over that amount is untaxed. That’s a very regressive policy and if one wanted to generate more revenue to “pay for” Social Security, raising this cap would be an alternative to cutting Grandma’s benefits.

cont'

http://www.salon.com/2013/04/06/who_controls_the_democratic_party/

Who’s Winning The Democrats’ CIVIL WAR?

Economic liberals or the "pro-business" crowd? As the president's budget drama plays out, we may soon find out

When it comes to economic issues, Democrats are not a united party. There are economic liberals, in the vein of Elizabeth Warren, who believe that very rich people who lead a good life can afford to pay more in taxes to support basic services for struggling people, seniors, and others who are vulnerable. And then there are “pro-business” Democrats, or what might be called SPECs (Socially Progressive Economic Conservatives). These are the pro-fracking, self-described “entitlement reformers” — like omnipresent former Gov. Ed Rendell — who talk about the need to keep taxes low and make “bold” decisions like cutting the social safety net, in an effort to fix the debt, restore “balance” and “get serious.” While the split is not discussed as often as it might be, these two camps stand far apart on economic issues, and, in some ways, are fighting for the soul of the Democratic Party. And, with President Obama’s newly reiterated proposal to cut Social Security through his chained CPI plan, a big test is approaching to see which wing of the party will prevail.

Obama’s offer on Social Security is divisive for several reasons. First, there’s the very real effect it will have on Americans relying on their benefits to get by month to month. By revising downward the cost of living index used to compute benefits, the policy change would reduce the amount that some on fixed incomes – including disabled Americans, such as veterans — live on (precisely how many is unclear, as the administration reportedly supports “financial protections for low-income and very old beneficiaries”). This is something economic liberals cannot support; for the SPECs, this is tolerable if part of a larger deal. Second, there’s the symbolism and precedent of cutting into New Deal-style programs. The first cut to popular, essential programs is always the most difficult; once it’s been done, and that toe is in the water, there’s the concern that future reductions could be more easily achieved. That’s why the symbolism of a Democratic president attaching his name to – and owning – the cuts is so controversial and worrying for liberals. How hard would it be for Republicans to push future cuts through, when this is now a mainstream Democratic policy?

Beyond these issues lies a more philosophical one, which comes down to different conceptions of “balance.” For SPECs and many others in Washington, balance means a plan in which both political parties give up something they don’t want. If Democrats and Republicans are both unhappy, the thinking goes, that means the plan is balanced and good. Liberals see it differently. By their thinking, “balance” must incorporate the broader circumstances of those impacted by the policy in question. If rich people have every advantage in life – wealth, tax breaks and loopholes, healthcare, food security, the ability to influence political campaigns, etc. – and less well-off folks are disadvantaged in all the same categories, then balance calls for a policy that helps to shift things in the other direction a bit. In other words, one camp sees balance as a political end (which, incidentally, can be easily manipulated by positioning and negotiating strategies) and the other sees it as a policy imperative with real-world implications.

The question undergirding this particular debate is twofold. First, is more money actually needed to fund Social Security? And if so, how should one pay for a shortfall? In fact, Social Security is solvent and has not contributed to the debt. But pretend you don’t believe that. Then the question becomes: If you needed revenue to pay for Social Security, how would you generate it? This is the crux of the divide. One option is to cut benefits for those in need, which Obama has proposed to do, backed by groups like Fix the Debt, the outfit funded by billionaire Pete Peterson (Rendell sits on the board, along with other SPECs, Republicans, and Simpson and Bowles). Another option is to raise the cap on income that’s taxed by Social Security. Currently, that number is in the $110,000 range, meaning any income one makes over that amount is untaxed. That’s a very regressive policy and if one wanted to generate more revenue to “pay for” Social Security, raising this cap would be an alternative to cutting Grandma’s benefits.

cont'

http://www.salon.com/2013/04/06/who_controls_the_democratic_party/

April 6, 2013

President Obama reportedly is unveiling a budget using the chained CPI inflation measure to cheat elderly Americans out of the benefits they were promised. In two previous posts I’ve explained the perversity of the current debate about Social Security. The tax-favored private components of America’s mixed private-public retirement system — programs like employer pensions, 401Ks and IRAs — are inefficient, volatile and subject to manipulation by overcompensated, fee-extracting money managers. In contrast, the Social Security program is simple and efficient, and has low overhead costs. And yet the bipartisan establishment, including many “progressive” Democrats as well as Republicans, wants to cut Social Security — the part that works — and expand tax-favored private savings, the inefficient, unstable and inequitable part.

While cutting Social Security makes no sense at all in terms of economics or public policy, it makes excellent sense in terms of the selfish class interests of the super-rich. They have extracted about half the gains from economic growth in the U.S. in the last half-century and recycle some of their profits to fund politicians, and lobbyists, as well as mercenary propagandists who pose as neutral think tank experts. Social Security’s contribution to the retirement income of the rich is negligible, while the top 20 percent receives around 80 percent of the income from tax-favored private retirement savings accounts like 401Ks. Naturally many of America’s oligarchs want the public discussion to be solely about cutting Social Security benefits for the bottom 80 percent, rather than 401Ks for the top 20 percent. To paraphrase Leona Helmsley, Social Security is for the little people. And if we cannot afford all of our present public-plus-private retirement system … well, as the saying in Tsarist Russia had it, let any shortage be shared among the peasants.

Elite discourse on this subject is radically at odds with public opinion. According to a February 2013 Pew poll, only 10 percent of Americans want to cut Social Security while 41 percent want to increase Social Security benefits. It’s time to change the public conversation about retirement security in America to reflect the beliefs and interests of the struggling many, not the fortunate few. We need to change the subject from cutting Social Security while subsidizing luxury retirements for the elite to cutting retirement subsidies for upper-income groups while expanding Social Security benefits for the majority of American retirees. The simplest way to expand Social Security would be simply to expand the present Social Security program: Old Age and Survivors Insurance (OASI). But OASI is paid for solely by the payroll tax, a regressive tax that falls most heavily on lower-income workers. Today individuals pay the payroll tax only on wages up to$113,700. Raising the payroll tax cap could contribute to reducing the shortfall between payroll tax revenues and promised Social Security benefits that is expected to open up in the 2030s. Lifting the cap entirely might eliminate the shortfall entirely.

But even if the present system’s future funding needs are met, Social Security as it now exists is inadequate to compensate for the rapid disappearance of traditional pensions and the failure of 401Ks, IRA(s) and other tax-expenditure-subsidized private retirement savings. And Social Security is not very generous, by international standards. In the Natixis Global Retirement Index, the U.S. ranks 19th — behind countries like Slovakia and the Czech Republic. The gross replacement rate for the average earner (how much pre-retirement income is replaced by public or publicly mandated benefits) is only around 40 percent, while the average in the European Union is more than 60 percent.

cont'

sorry, ...forgot link

http://www.salon.com/2013/04/05/how_progressives_blew_the_social_security_argument/singleton/

Obama Making HISTORIC MISTAKE On Social Security

The President's proposal to cut the social safety net may someday look as retrograde as Clinton signing DOMA

President Obama reportedly is unveiling a budget using the chained CPI inflation measure to cheat elderly Americans out of the benefits they were promised. In two previous posts I’ve explained the perversity of the current debate about Social Security. The tax-favored private components of America’s mixed private-public retirement system — programs like employer pensions, 401Ks and IRAs — are inefficient, volatile and subject to manipulation by overcompensated, fee-extracting money managers. In contrast, the Social Security program is simple and efficient, and has low overhead costs. And yet the bipartisan establishment, including many “progressive” Democrats as well as Republicans, wants to cut Social Security — the part that works — and expand tax-favored private savings, the inefficient, unstable and inequitable part.

While cutting Social Security makes no sense at all in terms of economics or public policy, it makes excellent sense in terms of the selfish class interests of the super-rich. They have extracted about half the gains from economic growth in the U.S. in the last half-century and recycle some of their profits to fund politicians, and lobbyists, as well as mercenary propagandists who pose as neutral think tank experts. Social Security’s contribution to the retirement income of the rich is negligible, while the top 20 percent receives around 80 percent of the income from tax-favored private retirement savings accounts like 401Ks. Naturally many of America’s oligarchs want the public discussion to be solely about cutting Social Security benefits for the bottom 80 percent, rather than 401Ks for the top 20 percent. To paraphrase Leona Helmsley, Social Security is for the little people. And if we cannot afford all of our present public-plus-private retirement system … well, as the saying in Tsarist Russia had it, let any shortage be shared among the peasants.

Elite discourse on this subject is radically at odds with public opinion. According to a February 2013 Pew poll, only 10 percent of Americans want to cut Social Security while 41 percent want to increase Social Security benefits. It’s time to change the public conversation about retirement security in America to reflect the beliefs and interests of the struggling many, not the fortunate few. We need to change the subject from cutting Social Security while subsidizing luxury retirements for the elite to cutting retirement subsidies for upper-income groups while expanding Social Security benefits for the majority of American retirees. The simplest way to expand Social Security would be simply to expand the present Social Security program: Old Age and Survivors Insurance (OASI). But OASI is paid for solely by the payroll tax, a regressive tax that falls most heavily on lower-income workers. Today individuals pay the payroll tax only on wages up to$113,700. Raising the payroll tax cap could contribute to reducing the shortfall between payroll tax revenues and promised Social Security benefits that is expected to open up in the 2030s. Lifting the cap entirely might eliminate the shortfall entirely.

But even if the present system’s future funding needs are met, Social Security as it now exists is inadequate to compensate for the rapid disappearance of traditional pensions and the failure of 401Ks, IRA(s) and other tax-expenditure-subsidized private retirement savings. And Social Security is not very generous, by international standards. In the Natixis Global Retirement Index, the U.S. ranks 19th — behind countries like Slovakia and the Czech Republic. The gross replacement rate for the average earner (how much pre-retirement income is replaced by public or publicly mandated benefits) is only around 40 percent, while the average in the European Union is more than 60 percent.

cont'

sorry, ...forgot link

http://www.salon.com/2013/04/05/how_progressives_blew_the_social_security_argument/singleton/

April 6, 2013

I wonder if Mitt is sleeping well tonight.

WATCH VIDEO REPORT:

http://www.addictinginfo.org/2013/04/05/breaking-the-1-caught-hiding-trillions-in-tax-havens-100000-names-leaked-video/

The financial information for more than 100,000 wealthy people around the world was leaked via an anonymously submitted hard drive, and CBC News in Canada is breaking the information exclusively (and refusing to release all of the associated names). The data contains information ranging from tax evasion to Russian scam artists that caused a diplomatic problem between the U.S. and Russia when they stole $230 million from Russia’s treasury. Estimates of the total amount of money hidden range from $8 trillion to $32 trillion, with billions every year escaping government taxation worldwide.

It’ll be interesting to see what comes out as journalists continue sifting through the documents and publishing information. CBC News reports with their exclusive:

They go on to report comments by an associated researcher:

CBC News has also released specific stories based on data obtained, such as one Canadian senator and her husband, a famous class action lawyer, hiding money offshore while being investigated by the Canadian Revenue Agency.

cont'

.

BREAKING: The 1% CAUGHT Hiding Trillions In TAX HAVENS, 100,000 Names Leaked

I wonder if Mitt is sleeping well tonight.

WATCH VIDEO REPORT:

http://www.addictinginfo.org/2013/04/05/breaking-the-1-caught-hiding-trillions-in-tax-havens-100000-names-leaked-video/

The financial information for more than 100,000 wealthy people around the world was leaked via an anonymously submitted hard drive, and CBC News in Canada is breaking the information exclusively (and refusing to release all of the associated names). The data contains information ranging from tax evasion to Russian scam artists that caused a diplomatic problem between the U.S. and Russia when they stole $230 million from Russia’s treasury. Estimates of the total amount of money hidden range from $8 trillion to $32 trillion, with billions every year escaping government taxation worldwide.

It’ll be interesting to see what comes out as journalists continue sifting through the documents and publishing information. CBC News reports with their exclusive:

In what is believed to be one of the largest ever leaks of financial data, the Washington, D.C.-based International Consortium of Investigative Journalists has received nearly 30 years of data entries, emails and other confidential details from 10 offshore havens around the world.

CBC News has partnered with the ICIJ over the last seven months to gain exclusive Canadian access to the information. Thirty-seven media outlets in 35 other countries are also involved.

http://www.cbc.ca/news/world/story/2013/04/03/offshore-data-leak.html?autoplay=true

CBC News has partnered with the ICIJ over the last seven months to gain exclusive Canadian access to the information. Thirty-seven media outlets in 35 other countries are also involved.

http://www.cbc.ca/news/world/story/2013/04/03/offshore-data-leak.html?autoplay=true

They go on to report comments by an associated researcher:

“What we found as we started digging in the records is a pretty extensive collection of dodgy characters: Wall Street fraudsters, Ponzi schemers, figures connected to organized crime, to arms dealing, money launderers,” said Michael Hudson, a senior editor at the ICIJ, who worked with a team for months to sort through the information.

“We just found a lot of folks involved in questionable or outright illegal activities.”

“We just found a lot of folks involved in questionable or outright illegal activities.”

CBC News has also released specific stories based on data obtained, such as one Canadian senator and her husband, a famous class action lawyer, hiding money offshore while being investigated by the Canadian Revenue Agency.

cont'

.

April 5, 2013

WEED WINS - Majority Now FAVOR Marijuana Legalization

"For the first time in more than four decades of polling on the issue, a majority of Americans favor legalizing the use of marijuana. A national survey finds that 52% say that the use of marijuana should be made legal while 45% say it should not."*

Is the decision really over? Is marijuana legalization right on the horizon? According to a Pew research poll, it looks to be! The majority of people now favors legalization-- so how long until the next step? Cenk Uygur breaks it down.

Is the decision really over? Is marijuana legalization right on the horizon? According to a Pew research poll, it looks to be! The majority of people now favors legalization-- so how long until the next step? Cenk Uygur breaks it down.

April 5, 2013

The Most AMAZING VIDEO By A Christian You Will Ever See DEFENDING MARRIAGE EQUALITY

"...People called me "gay" after I came out in support of gay marriage legalization. So I made this..."

April 5, 2013

PAYBACK IS SUCH A B*TCH!!

Rep. Peter King (R-N.Y.) is still angry at Republicans who voted against a Superstorm Sandy relief package early this year — including Sen. Marco Rubio (R-Fla.), whom he attacked for raising money in New York after voting against the aid.

“My relationship with Congress will never be the same again,” King said on MSNBC’s “Morning Joe” Friday. “They made us wait 90 to 100 days to get the most basic human aid. It was absolutely disgraceful. And when I see these Republicans slap each other on the back, all the camaraderie, hey we’re great friends, all I know is that there were people who were close to dying in my district, and no one gave a damn, and that’s something I’m not going to forget.”

..“Guys like Marco Rubio in Florida, with all the money that your people have gotten in Florida over the years from every hurricane that came along, and this guy has got the nerve to vote against money for New York and then come up here and try to raise money? You know, he can forget it,” King said. “He can stay home.”

cont'

http://www.washingtonpost.com/blogs/post-politics/wp/2013/04/05/peter-king-marco-rubio-can-stay-home/

Peter King: Marco Rubio Can 'FORGET IT...HE CAN STAY HOME!' After Sandy Aid Vote

PAYBACK IS SUCH A B*TCH!!

Rep. Peter King (R-N.Y.) is still angry at Republicans who voted against a Superstorm Sandy relief package early this year — including Sen. Marco Rubio (R-Fla.), whom he attacked for raising money in New York after voting against the aid.

“My relationship with Congress will never be the same again,” King said on MSNBC’s “Morning Joe” Friday. “They made us wait 90 to 100 days to get the most basic human aid. It was absolutely disgraceful. And when I see these Republicans slap each other on the back, all the camaraderie, hey we’re great friends, all I know is that there were people who were close to dying in my district, and no one gave a damn, and that’s something I’m not going to forget.”

..“Guys like Marco Rubio in Florida, with all the money that your people have gotten in Florida over the years from every hurricane that came along, and this guy has got the nerve to vote against money for New York and then come up here and try to raise money? You know, he can forget it,” King said. “He can stay home.”

cont'

http://www.washingtonpost.com/blogs/post-politics/wp/2013/04/05/peter-king-marco-rubio-can-stay-home/

April 5, 2013

Bill Maher and others discuss GMO's.....

This is a Non-profit educational video with the purpose of promoting social, political and economic awareness. Videos which contain copyrighted material which use in accordance with US Copyright Law 17 U.S.C. Section 107 "Fair Use" is allowed for the purposes of criticism, commenting, news reporting, teaching, and or research and is not an infringement of copyright.

The TRUTH May SCARE You (Part17)

Bill Maher and others discuss GMO's.....

This is a Non-profit educational video with the purpose of promoting social, political and economic awareness. Videos which contain copyrighted material which use in accordance with US Copyright Law 17 U.S.C. Section 107 "Fair Use" is allowed for the purposes of criticism, commenting, news reporting, teaching, and or research and is not an infringement of copyright.

Profile Information

Member since: Tue May 13, 2008, 03:07 AMNumber of posts: 14,923