Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

Editorials & Other Articles

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

grahamhgreen

grahamhgreen's Journal

grahamhgreen's Journal

January 27, 2015

Irresponsible lending might have been one of the many causes of the financial crisis -- but not just irresponsible lending to poor people, according to a new study.

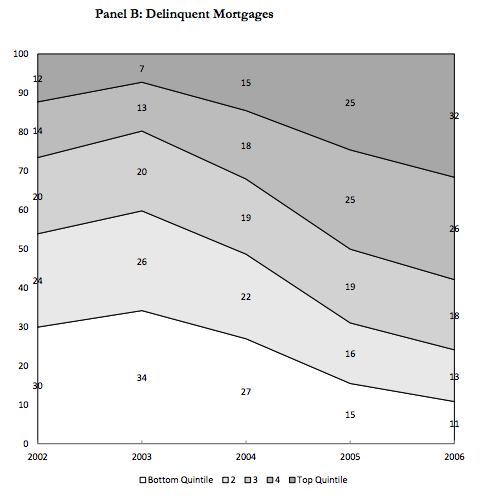

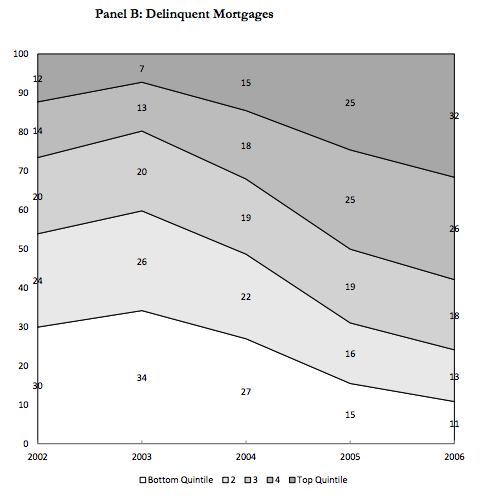

"The large majority of mortgage dollars originated between 2002 and 2006 are obtained by middle- and high-income borrowers (not the poor)," the authors write. "In addition, borrowers in the middle and top of the distribution are the ones that contributed most significantly to the increase in mortgages in default after 2007." Rich people tend to take out larger mortgages, of course, but the fact is that the amount of money poor borrowers failed to pay back was just never that significant, as this chart from the paper shows. In case you have a hard time believing that so many larger mortgages could have gone into default, The Washington Post just published a series of stories on subprime, sometimes predatory lending in relatively affluent places such as Prince George's County, Md., outside Washington, D.C.

The findings undermine criticism of recent modest efforts by the Obama administration to make housing more affordable for low-income borrowers by loosening federal credit standards. It's important to lend responsibly, even for the federal government, but the risks in this case might be exaggerated.

Affordable housing didnít cause the financial crisis

http://www.washingtonpost.com/blogs/wonkblog/wp/2015/01/27/wonkbook-affordable-housing-didnt-cause-the-financial-crisis/Irresponsible lending might have been one of the many causes of the financial crisis -- but not just irresponsible lending to poor people, according to a new study.

"The large majority of mortgage dollars originated between 2002 and 2006 are obtained by middle- and high-income borrowers (not the poor)," the authors write. "In addition, borrowers in the middle and top of the distribution are the ones that contributed most significantly to the increase in mortgages in default after 2007." Rich people tend to take out larger mortgages, of course, but the fact is that the amount of money poor borrowers failed to pay back was just never that significant, as this chart from the paper shows. In case you have a hard time believing that so many larger mortgages could have gone into default, The Washington Post just published a series of stories on subprime, sometimes predatory lending in relatively affluent places such as Prince George's County, Md., outside Washington, D.C.

The findings undermine criticism of recent modest efforts by the Obama administration to make housing more affordable for low-income borrowers by loosening federal credit standards. It's important to lend responsibly, even for the federal government, but the risks in this case might be exaggerated.

January 27, 2015

Rooftop solar is now cheaper than the grid in 42 American cities

http://www.utilitydive.com/news/rooftop-solar-is-now-cheaper-than-the-grid-in-42-american-cities/352799/New numbers show solar-generated electricity is ready for head-on competition with utility-delivered electricity.

Nearly 21 million single-family homeowners in 42 of the 50 biggest U.S. cities can now expect to pay less for electricity from solar than for electricity they buy from their utility. In fact, the numbers show money spent on a residential solar system earns a better return than investing in Standard and Poor’s 500 index fund.

“Solar is now not just an option for the rich, but a real opportunity for anyone looking to take greater control over their monthly utility bills and make a long-term, relatively low-risk investment,” explains "Going Solar in America: Ranking Solar’s Value to Consumers in America’s Largest Cities," a new study from the North Carolina Clean Energy Technology Center.

The information gap

To breach the “clear information gap” between the popular presumption that solar energy is an expensive indulgence and the new reality that it is a competitively priced source of electricity, the paper uses a range of National Renewable Energy Laboratory (NREL) System Advisor Model (SAM) parameters and other factors to calculate rankings. The list for the top 50 solar cities was based on:

Nearly 21 million single-family homeowners in 42 of the 50 biggest U.S. cities can now expect to pay less for electricity from solar than for electricity they buy from their utility. In fact, the numbers show money spent on a residential solar system earns a better return than investing in Standard and Poor’s 500 index fund.

“Solar is now not just an option for the rich, but a real opportunity for anyone looking to take greater control over their monthly utility bills and make a long-term, relatively low-risk investment,” explains "Going Solar in America: Ranking Solar’s Value to Consumers in America’s Largest Cities," a new study from the North Carolina Clean Energy Technology Center.

The information gap

To breach the “clear information gap” between the popular presumption that solar energy is an expensive indulgence and the new reality that it is a competitively priced source of electricity, the paper uses a range of National Renewable Energy Laboratory (NREL) System Advisor Model (SAM) parameters and other factors to calculate rankings. The list for the top 50 solar cities was based on:

January 21, 2015

Solar and wind power yield cheapest energy, say Finnish experts

http://www.adn.com/article/20150119/solar-and-wind-power-yield-cheapest-energy-say-finnish-expertsChina possesses significant wind and solar energy resources, so a power network based on renewable energy sources has the potential to become profitable very quickly. That’s why they should move to a system like this. China is already the world’s largest investor in solar and wind energy at present,” says lead researcher Pasi Vainikka from VTT.

The Finnish researchers are confident that renewable energy sources like solar and wind power will become the cheapest form of energy production in Asia within the next ten years. What is more, energy produced in this way provides the added benefits of being inexpensive, emission-free and promoting self-sufficiency. Professor of solar energy Christian Breyer from the Lappeenranta University says the project’s large-scale simulation of functioning renewable energy networks is the first of its kind.

“A network fully based on renewable energy is possible in Northeast Asia. Renewable energy is also the cheapest form of energy production available to them there. All of the other options are more expensive. It is a new insight,” says Breyer.

The Finnish researchers are confident that renewable energy sources like solar and wind power will become the cheapest form of energy production in Asia within the next ten years. What is more, energy produced in this way provides the added benefits of being inexpensive, emission-free and promoting self-sufficiency. Professor of solar energy Christian Breyer from the Lappeenranta University says the project’s large-scale simulation of functioning renewable energy networks is the first of its kind.

“A network fully based on renewable energy is possible in Northeast Asia. Renewable energy is also the cheapest form of energy production available to them there. All of the other options are more expensive. It is a new insight,” says Breyer.

Profile Information

Member since: Thu Dec 30, 2004, 03:05 PMNumber of posts: 15,741