Economy

Related: About this forumThe Week End Economists Take The Card. Apr 16-17, 2016.

Is it possible?

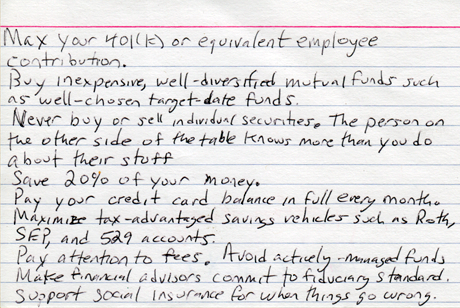

All the financial advice you’ll ever need fits on a single index card

April 14, 2016 at 8:32 PM EDT

"At first glance, fiscal planning can seem more complex and time-consuming than it’s worth. But according to Professor Harold Pollack of the University of Chicago, you can fit all the financial advice you’ll ever really need on a single index card. Economics correspondent Paul Solman takes a look at Pollack’s ten easy tips for simple and sensible money management."

From PBS Newshour: http://www.pbs.org/newshour/bb/all-the-financial-advice-youll-ever-need-fits-on-a-single-index-card/

From the video, personally, I find the most important point is this one:

"PAUL SOLMAN: Nine, the most controversial on the card: Do what you can to support the social safety net.

HAROLD POLLACK: To me, it’s incredibly important to appreciate that we all have to protect each other against some of the risks in life that would just crush any one of us if we had to face it alone. And when Vincent moved into our house, we would have absolutely been bankrupted without Medicare, and Medicaid, and Social Security, and all the programs that helped our family."

The wake up call for Harold Pollack was the need to care for a special needs relative and the financial challenges associated with doing so. He answered the call and in the process came up with some simple rules for fiscal personal planning.

Then he wrote an Index Card...

Then a book called:

The Index Card (with HELAINE OLEN).

He admits the rules are simple, the challenge is in finding the discipline and motivation to implement them in your life.

2naSalit

(86,597 posts)an income to make this managed money to begin with would be a good thing... unless you're a trust funder.

Hugin

(33,140 posts)To include discussing that having a smaller income is no excuse not to manage your money. These things aren't only for the trust funders.

antigop

(12,778 posts)However, most of the discussion in this video isn't about investing.

Hotler

(11,421 posts)your employer contribution to a 401(K). Yes it is free money, but from what I have read it is the fees when you go to use it is where you get screwed and that is one of the reasons I am hesitant to do it. I kind of know if should take advantage of it, but a side of me hates paying fees to the banksters.

Warpy

(111,255 posts)While income can come and go, that creditor's hand is always in your pocket. Make sure there is no alternative when you take debt on.

Hugin

(33,140 posts)Debt is poison.

Hotler

(11,421 posts)Spitfire of ATJ

(32,723 posts)Hotler

(11,421 posts)Hotler

(11,421 posts)I will be hard to pay it off if you have a big balance already, but try and not to use it and start paying it off, you will feel better when you do and it will free up more money to use as cash and a little extra to save away. Contrary to what the banksters say they DO NOT want you to pay your balance each month. The interest is their cash cow. The banksters refer to people that pay off their balance each month as "Dead Beats" because you get to use their money for free for 30days and that drives them crazy.![]()

One way we as a nation could stick it to the banksters would be for more of us to pay off our credit cars and pay them off each month and only use them once and awhile. Paying with cash helps out the little business man and the mom and pop stores. The biggest weapon we have against the banksters and "The Man" is our wallets and pocket books. Spending less and saving more (think credit union) will starve to beast. The banksters here and around the world have tons and tons of debt on their books and that is the bubble that is getting ready to break. They have more debt than us little people have (although our debt feels large to us.) and with us not using our credit cards and paying off our balance each month that mountain of debt will hurt them. This could a death of a thousand cuts for them if we do it.

Hotler

(11,421 posts)The word is 14" along the front range and up to 4'-0 in the mountains.

Gungnir

(242 posts)Wealthy Romans, says classical archaeologist Elaine Gazda of the University of Michigan, were likely the first in history to snap up waterfront properties and build spectacular, sumptuous summer homes overlooking the sea. The coastal real estate boom that followed was unprecedented in antiquity. “We don’t really have ruins resembling these in the Hellenistic world,” says Gazda, who has studied villas along the Bay of Naples. “It’s a completely new phenomenon.”

But what exactly spurred this building boom? Why did Rome’s high society suddenly flock to the Bay of Naples and to many other coasts in the Roman Empire? The answer turns out to be far less obvious than one may think. The serene beauty of a waterfront view, the healthy sea air, the simple pleasure of boating during the hottest months of the year—these were all powerful draws. But new archaeological research suggests that many villa owners saw an economic opportunity, too, wringing profit from these coastal estates.

The great villas weren’t simply pleasure palaces, after all; studies suggest that many of the properties housed thriving fish farms that catered to the almost feverish passion among wealthy Romans for the freshest seafood possible. As Seneca, an adviser to the emperor Nero, once put it, “A surmullet, even if it is perfectly fresh, is little esteemed until it is allowed to die before the eyes of your guest.” And the desire to capitalize on this hunger for freshness eventually pitted the very rich against the working poor, sparking one of the world’s earliest-known battles for the coastline.

much more

...

Antoninus Pius seemed sympathetic, ruling that the fishers could fish where they chose in the ocean. According to Roman law, as one later scholar explained, “the sea is common to all and the shore too, just like the air. …” But the emperor added one curious caveat to his decision: he instructed the fishermen to stay away from the buildings and structures belonging to the villa owners.

This caveat has long puzzled experts in Roman law. Many scholars, says Marzano, think it was likely intended to protect the privacy and pristine waterfront views of patrician property owners. But Marzano’s research provides another explanation. She thinks the fishers were setting their nets along the seaward walls of the owners’ piscinae, intercepting wild fish that the wealthy were trying to lure into their aquaculture ponds.

Gungnir

(242 posts)Of course they aren't actually giving the $68,000/ year to the migrants/refugees/etc. it must be paid to all sorts of con-artists to "help" the "refugees".

Imagine what kind of life anyone could have if they were just given $68,000/yr! I'm going to go out on a limb and say they wouldn't become refugees, and their country would most likely be stable and a nice place to live.

Here's where all that came from: (can't people use a @%!$$@# calculator?)(34,000,000,000/500,000=68,000)

George Soros Warns Europe: Absorb 500k Refugees Costing $34Bn, Or Risk "Existential Threat"

http://www.zerohedge.com/news/2016-04-12/george-soros-warns-europe-absorb-500k-refugees-costing-34bn-or-risk-existential-thre

...

Most of the building blocks for an effective asylum system are available; they only need to be assembled into a comprehensive and coherent policy. Critically, refugees and the countries that contain them in the Middle East must receive enough financial support to make their lives there viable, allowing them to work and to send their children to school. That would help to keep the inflow of refugees to a level that Europe can absorb. This can be accomplished by establishing a firm and reliable target for the number of refugee arrivals: between 300,000 and 500,000 per year. This number is large enough to give refugees the assurance that many of them can eventually seek refuge in Europe, yet small enough to be accommodated by European governments even in the current unfavorable political climate.

There are established techniques for the voluntary balancing of supply and demand in other fields, such as with matching students to schools and junior doctors to hospitals. In this case, people determined to go to a particular destination would have to wait longer than those who accept the destination allotted to them. The asylum seekers could then be required to await their turn where they are currently located. This would be much cheaper and less painful than the current chaos, in which the migrants are the main victims. Those who jump the line would lose their place and have to start all over again. This should be sufficient inducement to obey the rules.

At least €30 billion ($34 billion) a year will be needed for the EU to carry out such a comprehensive plan. This includes providing Turkey and other “frontline” countries with adequate funding to maintain their very large refugee populations, creating a common EU asylum agency and security force for the EU’s external borders, addressing the humanitarian chaos in Greece, and establishing common standards across the Union for receiving and integrating refugees.

Thirty billion euros might sound like an enormous sum, but it is not when viewed in proper perspective. First, we must recognize that a failure to provide the necessary funds would cost the EU even more. There is a real threat that the refugee crisis could cause the collapse of Europe’s Schengen system of open internal borders among twenty-six European states. The Bertelsmann Foundation has estimated that abandoning Schengen would cost the EU between €47 billion ($53.5 million) and €140 billion ($160 million) in lost GDP each year; the French Commissioner for Policy Planning has estimated the losses at €100 billion ($114 billion) annually.

...

Full original letter from Soros:

Europe: A Better Plan for Refugees

http://www.nybooks.com/daily/2016/04/09/europe-how-pay-for-refugees/

Note: if going with 300,000 per year, that would be an astounding $113,333/ refugee/ yr. or $533,333/ family of 4!