Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 9 November 2015

[font size=3]STOCK MARKET WATCH, Monday, 9 November 2015[font color=black][/font]

SMW for 6 November 2015

AT THE CLOSING BELL ON 6 November 2015

[center][font color=green]

Dow Jones 17,910.33 +46.90 (0.26%)

[font color=red]S&P 500 2,099.20 -0.73 (-0.03%)

[font color=green]Nasdaq 5,147.12 +19.38 (0.38%)

[font color=red]10 Year 2.32% +0.02 (0.87%)

30 Year 3.09% +0.04 (1.31%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)were there any auto manufacturing left there....

Demeter

(85,373 posts)The entire discussion about America’s infrastructure needs seems to come down to a single word: money. And almost everyone seems to believe we need to spend more. That’s probably true. But what’s more important is spending smarter. The road ahead leads to the futuristic world of George Jetson, a world of autonomous vehicles, hovercars, heaven only knows what else. But most of the money we’re spending today is being used to rehabilitate infrastructure designed for Fred Flintstone...

I raise this issue because government, like business, needs to anticipate the future. How can lawmakers in Austin, Albany, Sacramento and Washington project future outlays if they have no idea what the future might look like? If millions of electric vehicles are going to be on America’s roads in 10 or 20 years, highway rest stops will need charging facilities as well as toilet facilities. This won’t happen by accident.

The American Society of Civil Engineers (ASCE) in its most recent infrastructure report card, published two years ago, said it would take about $3.6 trillion in total infrastructure spending by 2020 – some $500 billion a year by my calculation – to bring America’s infrastructure up to speed. While this may sound like a pie-in-the-sky number, it’s only marginally more than we’re already spending. According to a March 2015 Congressional Budget Office report, federal, state and local governments spent $416 billion last year on transportation and water infrastructure alone. Some 43% of the total was spent on capital projects, 57% on operations and maintenance.

The CBO spending figures don’t include several categories of infrastructure that ASCE includes in its tally, such as spending on the electric grid, oil and natural gas transportation and storage infrastructure, and other energy-related assets. More importantly, the question that the spending figures don’t answer is whether the money we’re spending is being spent on the right things. Are we planning ahead or just plowing ahead?

THAT'S A LOT OF HAND-WRINGING FOR NO GOOD PURPOSE. WE WILL NEED ROADS, PERIOD. THE ROMANS HAD ROADS, AND THE ROADS THEY BUILT WERE SO GOOD, THE ROADS ARE STILL IN USE, 2000 YEARS LATER. ROADS ARE NOT GOING AWAY.

WE WILL NEED A POWER GRID, PIPELINES, SEWAGE TREATMENT PLANTS, ALL THE STUFF WE HAVE TODAY.

THERE ARE ONLY TWO ITEMS WE CAN SEE DISCONTINUING RIGHT NOW: COAL GENERATED ELECTRICITY/HEAT, AND NUCLEAR POWER OF ANY KIND.

AND AS FOR FUTURE INFRASTRUCTURE: INTERNET, CELL PHONE TOWERS, AND FIBER OPTIC CABLE SHOULD COVER IT. ELECTRIC CARS ARE NOT GOING TO BE THE WAVE OF THE FUTURE AND NEED CHARGING STATIONS....THEY ARE INHERENTLY TOYS, STUPIDLY DESIGNED TO BE UNSUITED FOR MORE THAN A SHORT TRIP FROM HOME. ELECTRIC MASS TRANSIT TS NOT ONLY MORE FEASIBLE, WE CAN DO IT TODAY, IF THE WILL IS THERE.

HOVERCARS? GET A CLUE. EVEN THE TINY DRONES ARE A BIG HEADACHE; WE ARE GOING TO LET EITHER MACHINES OR PEOPLE TO FLY SMALL PERSONAL BOMBS INTO BUILDINGS LIKE 9/11? NOT A CHANCE!

Demeter

(85,373 posts)No one wants to be 95 years old and realize that there's no money left to pay for basic needs. Just at the moment when medical bills might start piling up, you need to ask for help from family and friends to make ends meet. Though many would be OK with help from their "tribes," few want to put themselves or their loved ones in that situation, and many won't even have the option.

So, how much money can you pull out of your retirement savings every year and still be able to count on the money being there when you are in your 90s? For a long time, retirees have been encouraged to follow the "4% Rule": During your first year of retirement, withdraw an amount equal to 4% of your retirement savings, and adjust this number for inflation every year thereafter. But recently, this 4% figure has come under attack:

- The CEO of Betterment said that with bonds yielding so little right now, a 60/40 stock-to-bond blend won't offer enough return to make the 4% rule work.

- The Wall Street Journal encouraged readers to "Say Goodbye to the 4% Rule" because of uncertainty surrounding stock returns -- specifically if you retired in 2000.

- NBC News claimed that the 4% rule only worked for the wealthy.

Retirement planning: Why the 2000 retirees are probably fine

Well-respected retirement planning guru Michael Kitces has shown that, by and large, the 4% rule is still imminently safe (special thanks to the Madfientist blog for bringing this work to my attention). In fact, Kitces went back to look at how those who retired in 2000 -- the very same ones that The Wall Street Journal used to question the rule -- are faring today. The results: If they retired in 2000 with $1 million, they would still have about $900,000 left.

However, we need to adjust that number for inflation: $900,000 today is worth about $650,000 in constant 2000 dollars. In other words, about one-third of the nest egg for these retirees has been depleted.

But, as Kitces points out, this assumes these couples truly did adjust their withdrawals for inflation every year. "A growing base of research suggests that retiree spending in real dollars tends to decline in later years," Kitces writes, "which means in practice, a 2000 retiree today is probably even better off and spending even less as a current withdrawal rate than these calculations would suggest."

In other words, while the theory of the 4% rule says these retirees need to tread lightly, the practice says they should be doing just fine....

SECRET TO A SECURE RETIREMENT IN AMERICA....FIRST GET A MILLION DOLLARS....

truedelphi

(32,324 posts)and even then, make sure you don't live too long.

People who live to be 88 and re still in relatively good health have no idea when their day will come.

Women especially seem to outlive their retirement monies - it is not uncommon for a woman who does live to be 88 to then be able to reach one hundred years of age. But it is very hard to have a way to pay for those extra years.

Demeter

(85,373 posts)Mariners' Church of Detroit was built in 1849 at what was then the corner of Woodward and Woodbridge streets. It now stands on Jefferson Avenue next to the Detroit-Windsor Tunnel.

A legendary folk song about the SS Edmund Fitzgerald's watery demise in Lake Superior tells of a rustic old hall in Detroit where bells chime to honor the 29 lives lost.

Forty years after the mysterious shipwreck, bells tolled Sunday at the church Canadian singer-songwriter Gordon Lightfoot referred to in "The Wreck of the Edmund Fitzgerald."

Demeter

(85,373 posts)Yves here. Tax is a major way to create incentives. New York City increased taxes dramatically on cigarettes, and has tough sanctions for trying to smuggle meaningful amounts of lower-taxed smokes in. Rates of smoking did indeed fall as intended.

Thus the debate about whether corporations should pay more taxes is not “naive” as the plutocrats would have you believe; in fact, they wouldn’t be making such a big deal over it if it were. In the 1950s, a much larger percentage of total tax collections fell on corporations than individuals. And the political message was clear: the capitalist classes needed to bear a fair share of the total tax burden. Similarly, what has been the result of the preservation of a loophole that allows the labor of hedge fund and private equity fund employees to be taxed at preferential capital gains rates? A flood of “talent” into those professions at the expense of productive enterprise.

And the result of having lower taxes on companies has been a record-high corporate profit share of GDP, with none of the supposed benefits of giving businesses a break. Contrary to their PR, large companies have been net saving, which means liquidating, since the early 2000s. The trend has become more obvious in recent years as companies have borrowed money to buy back their own stock.

http://www.taxjustice.net/2015/11/03/fifty-shades-of-tax-dodging-how-eu-helps-support-unjust-global-tax-system/

In the past year, scandal after scandal has exposed companies using loopholes in the tax system to avoid taxation. Now more than ever, it is becoming clear that citizens around the world are paying a high price for the crisis in the global tax system, and the discussion about multinational corporations and their tax tricks remains at the top of the agenda. There is also a growing awareness that the world’s poorest countries are even harder impacted than the richest countries. In effect, the poorest countries are paying the price for a global tax system they did not create.

A large number of the scandals that emerged over the past year have strong links to the EU and its Member States. Many eyes have therefore turned to the EU leaders, who claim that the problem is being solved and the public need not worry. But what is really going on? What is the role of the EU in the unjust global tax system, and are EU leaders really solving the problem?

This report – the third in a series of reports – scrutinises the role of the EU in the global tax crisis, analyses developments and suggests concrete solutions. It is written by civil society organisations (CSOs) in 14 countries across the EU. Experts in each CSO have examined their national governments’ commitments and actions in terms of combating tax dodging and ensuring transparency.

Each country is directly compared with its fellow EU Member States on four critical issues: the fairness of their tax treaties with developing countries; their willingness to put an end to anonymous shell companies and trusts; their support for increasing the transparency of economic activities and tax payments of multinational corporations; and their attitude towards letting the poorest countries have a seat at the table when global tax standards are negotiated. For the first time, this report not only rates the performance of EU Member States, but also turns the spotlight on the European Commission and Parliament too.

This report covers national policies and governments’ positions on existing and upcoming EU level laws, as well as global reform proposals.

Overall, the report finds that:

• Although tweaks have been made and some loopholes have been closed, the complex and dysfunctional EU system of corporate tax rulings, treaties, letterbox companies and special corporate tax regimes still remains in place. On some matters, such as the controversial patent boxes, the damaging policies seem to be spreading in Europe. Defence mechanisms against ‘harmful tax practices’ that have been introduced by governments, only seem partially effective and are not available to most developing countries. They are also undermined by a strong political commitment to continue so-called ‘tax competition’ between governments trying to attract multinational corporations with lucrative tax reduction opportunities – also known as the ‘race to the bottom on corporate taxation’. The result is an EU tax system that still allows a wide range of options for tax dodging by multinational corporations.

• On the question of what multinational corporations pay in taxes and where they do business, EU citizens, parliamentarians and journalists are still left in the dark, as are developing countries. The political promises to introduce ‘transparency’ turned out to mean that tax administrations in developed countries, through cumbersome and highly secretive processes, will exchange information about multinational corporations that the public is not allowed to see. On a more positive note, some light is now being shed on the question of who actually owns the companies operating in our societies, as more and more countries introduce public or partially public registers of beneficial owners. Unfortunately, this positive development is being somewhat challenged by the emergence of new types of mechanisms to conceal ownership, such as new types of trusts.

• Leaked information has become the key source of public information about tax dodging by multinational corporations. But it comes at a high price for the people involved, as whistleblowers and even a journalist who revealed tax dodging by multinational corporations are now being prosecuted and could face years in prison. The stories of these ‘Tax Justice Heroes’ are a harsh illustration of the wider social cost of the secretive and opaque corporate tax system that currently prevails.

• More than 100 developing countries still remain excluded from decision-making processes when global tax standards and rules are being decided. In 2015, developing countries made the fight for global tax democracy their key battle during the Financing for Development conference (FfD) in Addis Ababa. But the EU took a hard line against this demand and played a key role in blocking the proposal for a truly global tax body.

Not one single EU Member State challenged this approach and, as a result, decision-making on global tax standards and rules remains within a closed ‘club of rich countries’. A direct comparison of the 15 EU countries covered in this report finds that:

• France, once a leader in the demand for public access to information about what multinational corporations pay in tax, is no longer pushing the demand for corporate transparency. Contrary to the promises of creating ‘transparency’, a growing number of EU countries are now proposing strict confidentiality to conceal what multinational corporations pay in taxes.

• Denmark and Slovenia are playing a leading role when it comes to transparency around the true owners of companies. They have not only announced that they are introducing public registers of company ownership, but have also decided to restrict, or in the case of Slovenia, avoided the temptation of introducing, opaque structures such as trusts, which can offer alternative options for hiding ownership. However, a number of EU countries, including in particular Luxembourgand Germany, still offer a diverse menu of options for concealing ownership and laundering money.

• Among the 15 countries covered in this report, Spain remains by far the most aggressive tax treaty negotiator, and has managed to lower developing country tax rates by an average 5.4 percentage points through its tax treaties with developing countries.

• The UK and France played the leading role in blocking developing countries’ demand for a seat at the table when global tax standards and rules are being decided.

SEE OP FOR SUPPORTING LINKS

Demeter

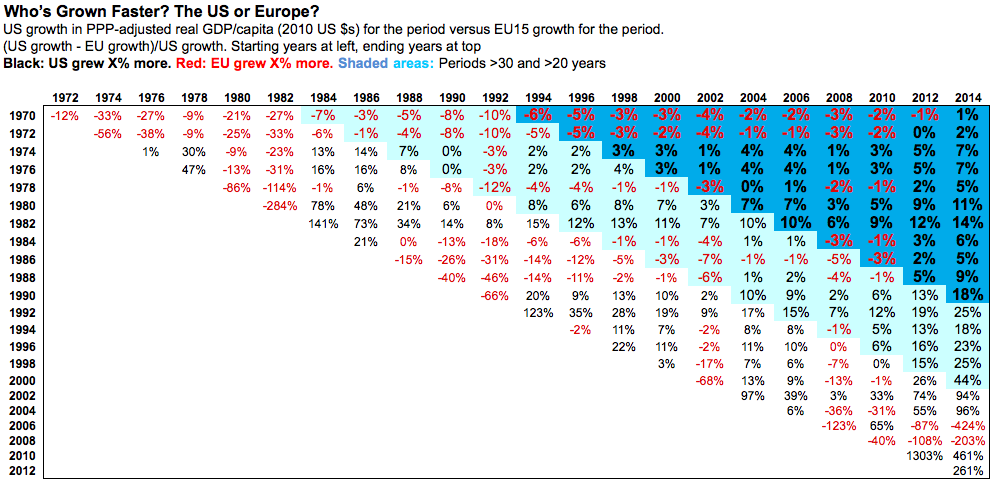

(85,373 posts)I’ve pointed out multiple times that despite Europe’s big, supposedly growth-strangling governments, Europe and the U.S. have grown at the same rate over the last 45 years. Here’s the latest data from the OECD, through 2014:

between 1970 and 2014, U.S. real GDP per capita grew 117%. The EU15 grew 115%. (Rounding explains the 1% difference shown above.) Statistically, we call that “the same.”

Which brought me back to a question that’s been nagging me for years: why hasn’t Europe caught up? Basic growth theory tells us it should (convergence, Solow, all that). And it did, very impressively, in the thirty years after World War II (interestingly, this during a period when the world lay in tatters, and the U.S. utterly dominated global manufacturing, trade, and commerce). But then in the mid 70s Europe stopped catching up. U.S. GDP per capita today (2014) is $50,620. For Europe it’s $38,870 — only 77% of the U.S. figure, roughly what it’s been since the 70s. What’s with that? Small-government advocates will suggest that the big European governments built after World War II are the culprit; they finally started to bite in the 70s. But then, again: why has Europe grown just as fast as the U.S. since the 70s? It’s a conundrum.

I’m thinking the small-government types might be right: it’s about government. But they’ve got the wrong explanation. Think about how GDP is measured. Private-sector output is estimated by spending on final goods and services in the market. But that doesn’t work for government goods, because they aren’t sold in the market. So they’re estimated based on the cost of producing and delivering them.

Small-government advocates frequently make this point about the measurement of government production. But they then jump immediately to a foregone conclusion: that the value of government goods are services are being overestimated by this method. (You can see Tyler Cowen doing it here.) That makes no sense to me. What would private output look like if it was measured at the cost of production? Way lower. Is government really so inefficient that its production costs are higher than its output? It’s hard to say, but that seems wildly improbable, strikes me as a pure leap of faith, completely contrary to reasonable Bayesian priors about input versus output in production.

Imagine, rather, that the cost-of-production estimation method is underestimating the value of government goods — just as it would (wildly) underestimate private goods if they were measured that way. Now do the math: EU built out governments encompassing about 40% of GDP. The U.S. is about 25%. Think: America’s insanely expensive health care and higher education, much or most of it measured at market prices for GDP purposes, not cost of production as in Europe. Add in our extraordinary spending on financial services — spending which is far lower in Europe, with its more-comprehensive government pension and retirement programs. Feel free to add to the list.

All those European government services are measured at cost of production, while equivalent U.S. services are measured at (much higher) market cost. Is it any wonder that U.S. GDP looks higher? I’d be delighted to hear from readers about any measures or studies that have managed to quantify this difficult conundrum. What’s the value or “utility” of government services, designated in dollars (or whatever)?

Update: I can’t believe I failed to mention what’s probably the primary cause of the US/EU differential: Europeans work less. A lot less. Like four or six weeks a year less. They’ve chosen free time with their families, time to do things they love with people they love, over square footage and cubic inches.

Got family values?

I can’t believe I forgot to mention it, because I’ve written about it at least half a dozen times.

If Europeans worked as many hours as Americans, their GDP figures would still be roughly 14% below the U.S. But mis-measurement of government output, plus several other GDP-measurement discrepancies across countries, could easily explain that.

MattSh

(3,714 posts)The most effective thing Russian President Vladimir Putin did to destabilize Ukraine was the one thing the West was demanding: He leaned on pro-Russian separatists in the country's east to cease fire. Left without the much-used cover of a war, the internal divisions and dysfunctional core of the Ukrainian political elite didn't take long to reveal itself. Rather than the democratic hope it might have become after last year's "Revolution of Dignity," Ukraine now looks like just another incompetent and corrupt post-Soviet regime. It's no wonder cracks are appearing in Kiev's all-important relationship with the West.

The government is in turmoil: Prime Minister Arseniy Yatsenyuk is in danger of being fired as soon as that becomes legally possible in December, threatening the fragile ruling coalition, in which Yatsenyuk's party is the second strongest force. If the coalition falls apart -- a likely outcome if Yatsenyuk is forced to resign -- there will be an early parliamentary election. Pro-European Ukrainians might actually be relieved at that. Populists dominate the legislature, which would have made it difficult to push through meaningful reform -- if anyone were trying. On Thursday, the parliament rejected a bill specifically banning workplace discrimination against homosexuals.

Despite attempts at change by a new generation of bureaucrats, Ukraine's economy remains unreformed. Taxes are oppressive but widely evaded, the shadow economy is growing and the regulatory climate for business has barely improved. The International Monetary Fund, the country's biggest source of hard currency after a steep drop in exports, is optimistic about next year's economic growth prospects, forecasting a 2 percent expansion, but last month it revised this year's projection to an 11 percent decline. Ukraine's most popular politician -- not a Ukrainian but Mikheil Saakashvili, the former president of Georgia, appointed by Ukrainian President Petro Poroshenko to run the Odessa region -- has proposed a libertarian reform package, but Poroshenko hasn't given it his official backing and the current parliament is not likely to adopt it.

Equally unreformed is Ukraine's incredibly corrupt justice system. In September, Christof Heyns, the United Nations special rapporteur on extrajudicial, summary or arbitrary executions, said after visiting Ukraine that the country lived in an "accountability vacuum." Heyns bemoaned the failure of the Ukrainian authorities to investigate the deaths of more than 100 people on the streets of Kiev in the final days of the revolution and of 48 pro-Russian protesters in a burning building in Odessa in May, 2014. Those investigations are stalled, and attempts by the victims' lawyers to speed them up have been stonewalled by authorities as some of the suspects in the Kiev shootings are still employed by the Interior Ministry.

-----> http://www.bloombergview.com/articles/2015-11-06/unreformed-ukraine-is-self-destructing

Other "highlights:"

It's officially OK to discriminate against gays; the government says it's fine. Funny how people here on DU were telling me that this so-called "revolution" would lead to an official acceptance of gays, as if Nazis are fans of that type of thing.

Poroshenko is the only oligarch who's net worth has increased during the last year and a half. Guess that's not too hard to do when you ignore the law that states you must divest yourself of business interests upon taking office.

Ukrainian politicians openly talk of appointments and dismissals being vetted by U.S. Ambassador Geoffrey Pyatt and even U.S. Vice President Joe Biden.

Yet people here still delude themselves into thinking things will soon get better. Guess that's not too hard to do when the state clamps down on what can and cannot be reported.

Demeter

(85,373 posts)Because Ukraine has been a failed state for a while...no offense, Matt.

Hard to believe it took Bloomberg this long to admit to the possibility.

And then, there is the bear-baiting....it is amazing, in this post-glaznost era, how many knee-jerk Putin and Russia haters there are, including here on DU. They have swallowed the Koolaid to wash the bitterness of Obama's betrayal, thus confusing fact and fancy, and putting the blame on the wrong foot.

MattSh

(3,714 posts)But hey, it's difficult to see reality when you're high in an ivory tower!

truedelphi

(32,324 posts)US Bailouts.

I still remembered a gret deal of it - but had no familiarity with this, from someone named "Steve Miller":

Steve Miller • 8 months ago

The Act of 1871 section 16 states-

And be it further enacted, That the District shall never pay, assume, or become responsible for the debts or liabilities of, or in any manner give, loan, or extend it's credit to, or in aid of any public or other corporation, association, or individual.

My question is, wouldn't section 16 of the Act of 1871 have to be rescinded in order to have loaned money to any of these Wall St. criminals? What was the loop hole? That none of the banks to receive a bailout were a publicly traded corporation? Or did they just think nobody would go as far back as 1871?

• Reply

Avatar

Earthisgettingcloser Steve Miller • 7 months ago

Steve, I'm pretty sure we're making it all up as we go along. Just run with it, they're on a roll, much like Bluto's motivational speech in Animal House.

By the way, when are you gonna make some new music?

####

DemReadingDU

(16,000 posts)I have never seen anything like that either. I tried to google a reference and found a few old laws referring to territories, and District of Columbia in 1871.

Demeter

(85,373 posts)and some hope of new buds forming, but I'm not sure just yet if my eyes are deceiving me...

And a heavy frost this morning, even heavier than yesterday's, which did touch the ground lightly. No avoiding winter's embrace now!

Right on time, too. November 2nd is the solar start of winter, and Feb. 2 the solar start of spring. The trick is to make it from here to there, and have the weather moderate on time.

The self-inflicted muscle strain has abated under continuous icing, mostly. It's horrible that any bodily movement triggers a searing pain that tears across the torso: like coughing, sneezing, using one's arms, rolling over....and all from coughing too hard with bronchitis. Well, I'd never had it before, but now I know: go for the cough suppressant!

Hard to find the right kind of news to post. Election and Primary fever dominates. Have a good Monday, regardless!

Demeter

(85,373 posts)It was an acronym that spawned a host of summits, a development bank and a $100 billion bailout fund. But Goldman Sachs, once the most energetic sponsor of the "Bric" investment theme, has quietly stepped away from it, merging its dedicated in-house fund into an all-purpose emerging markets vehicle.

The closure of the Bric fund — announced in a filing to the Securities and Exchange Commission in September and spotted by Bloomberg on Sunday — came after poor performance and consistent lagging of benchmarks. Assets under management had dwindled to about $100 million, from a peak of more than $800 million at the end of 2010.

By shutting the fund, the Wall Street bank has signalled an end of an era in which the four developing economies — Brazil, Russia, India and China — appeared to be shaping a new world order. The acronym had been coined in 2001 by Lord O'Neill, the UK Treasury minister and former chief economist at Goldman, who noted that real GDP growth among the quartet had surpassed that of the G7 group of mature economies. Goldman's Bric fund was born five years later, investing at least 80 per cent of its net assets in Bric equities.

However, stock markets have remained very volatile and the much-vaunted transfer of economic and political power is yet to come to pass. Brazil's economy is set to shrink 3 per cent this year, according to the latest International Monetary Fund forecasts, while Russia — grappling with a collapse in resources prices and the effects of international sanctions — should contract by 3.8 per cent...

GOLDMAN'S TOO ANTSY TO WAIT OUT THE GLOBAL ECONOMIC COLLAPSE...OF COURSE, WHEN PRICES COLLAPSE, IF THEY HAVE A VIABLE CURRENCY AT HAND, THEN THEY CAN SNAP UP BARGAINS....

I WOULD LIKE TO SEE THAT SNAPPING UP BARGAINS DOESN'T HAPPEN, THAT NATIONAL RESOURCES AND INDUSTRIES GO SMALL AND LOCAL. BUT SINCE I'M NOT GOD, I WILL HAVE TO RELY ON THE WISDOM OF THE BRICS TO KEEP THE VULTURES OUT.

Demeter

(85,373 posts)SAUDI PRINCE DELUSIONAL, THINKS HE'S GOT THE WORLD IN A HAMMERLOCK AND THE MIDDLE EAST (AND UNCLE STUPID) UNDER HIS THUMB

http://www.bloomberg.com/news/articles/2015-11-09/oil-investment-cuts-at-200-billion-as-saudi-prince-sees-rally?cmpid=yhoo.headline

The oil and gas industry has cut $200 billion from investments this year as low prices discourage new projects, leading to cuts in crude supplies equal to half the daily output of Saudi Arabia, according to the kingdom’s Prince Abdul Aziz bin Salman.

Nearly 5 million barrels a day of projects have been deferred or cancelled, Bin Salman, who is also vice oil minister for Saudi Arabia, said in prepared remarks set to be delivered to energy ministers meeting in Doha Monday. Saudi Arabia pumped 10.38 million barrels a day in October, according to data compiled by Bloomberg.

Oil prices have dropped 42 percent in the past year as Saudi Arabia led the Organization of Petroleum Exporting Countries in maintaining production in the face of a global glut rather than make way for booming U.S. output. Supply from outside the 12-member group will start to decline next year, after oil prices near $150 a barrel in 2008 proved unsustainable, Bin Salman said, according to the prepared remarks.

Saudi Commitment

“A prolonged period of low oil prices is also unsustainable, as it will induce large investment cuts and reduce the resilience of the oil industry, undermining the future security of supply and setting the scene for another sharp price rise,” Bin Salman said in the remarks. “As a responsible and reliable producer with long-term horizon, the kingdom is committed to continue to invest in its oil and gas sector, despite the drop in the oil price.”

Energy companies will probably reduce investments another 3 to 8 percent next year, making it the first time since the mid-1980s that the industry cut spending for two consecutive years, he said.

The vice oil minister said the impact of the current price instability is not just confined to the oil sector as "the spillovers are being strongly felt in other parts of the energy complex, such as renewables and natural gas," according to the prepared remarks...

MISTAKING THE SYMPTOMS FOR THE DISEASE

Demeter

(85,373 posts)THIS IS WHAT SALMAN DOESN'T GET--BUT IT WILL GET HIM!

http://www.bloomberg.com/news/articles/2015-11-08/global-gdp-worse-than-official-forecasts-show-maersk-ceo-says

The world’s economy is growing at a slower pace than the International Monetary Fund and other large forecasters are predicting. That’s according to Nils Smedegaard Andersen, chief executive officer at A.P. Moeller-Maersk. His company, owner of the world’s biggest shipping line, is a bellwether for global trade, handling about 15 percent of all consumer goods transported by sea.

“We believe that global growth is slowing down,” he said in a phone interview. “Trade is currently significantly weaker than it normally would be under the growth forecasts we see.”

The IMF on Oct. 6 lowered its 2015 global gross domestic product forecast to 3.1 percent from 3.3 percent previously, citing a slowdown in emerging markets driven by weak commodity prices. The Washington-based group also cut its 2016 forecast to 3.6 percent from 3.8 percent. But even the revised forecasts may be too optimistic, according to Andersen.

“We conduct a string of our own macro-economic forecasts and we see less growth -- particularly in developing nations, but perhaps also in Europe -- than other people expect in 2015,” Andersen said. Also for 2016, “we’re a little bit more pessimistic than most forecasters.”

Maersk’s container line on Friday reported a 61 percent slump in third-quarter profit as demand for ships to transport goods across the world hardly grew from a year earlier. The low growth rates are proving particularly painful for an industry that’s already struggling with excess capacity.

Trade from Asia to Europe has so far suffered most as a weaker euro makes it tougher for exporters like China to stay competitive, Andersen said. Still, there are no signs yet that the global economy is heading for a slump similar to one that followed the financial crisis of 2008, he said....

DON'T WORRY, IT'S COMING. JUST LET JANET YELLEN PULL THE CORK AND WATCH THE BUBBLY FLY

Demeter

(85,373 posts)The State has been used to discipline Capital before. With climate change upon us, it’ll have to do so again...AND CAPITAL IS GOING TO BE ROYALLY PISSED OFF ABOUT THAT! UNLESS, OF COURSE, WE MANAGE TO GET CAPITAL REDISTRIBUTED TO THE PEOPLE.

https://www.jacobinmag.com/2015/10/developmentalism-neoliberalism-climate-change-hamilton/

The developmental state has come under fire from both left and right. Neoliberals see the state as a rent-seeking, corrupt, inefficient, market-distorting parasite. Some on the Left reject the very concept of “development” as normalizing and teleological, fixated on economic growth at the expense of the environment and human rights.

These are often valid points. Yet development — by which I mean economic transformation and technological change — and the developmental state have much to offer.

The ultimate problem our planet faces today is anthropogenic climate change, a problem created by one version of “development.” But the contradiction of development is that it produces both problems and solutions. The climate crisis demands “mitigation” (getting off fossil fuels) and “adaptation” (preparing for changes like rising sea levels and mass migration). Contradictory as it may seem, both require not less development but more and different forms of it. And, if history is any guide, it will have to be the state that forces capital to act.

The actual history of development reveals a pattern: the state does much to facilitate capitalist development; capitalist states can act autonomously and discipline capital, and foster large-scale and rapid technological change — indeed, they’ve been the driving force in this regard — but this only happens when the state’s elite personnel, the politicians and top officialdom, feel threatened. Below is a sketch of the comparative history of developmentalism. The examples are not meant as templates to emulate. Rather, in the tradition of state-theorizing scholars like Alice Amsden, Sven Beckert, Walden Bellow, Ha-Joon Chang, Peter Evans, Mariana Mazzucato, Frances Fox-Piven, Theda Stockpol, Charles Tilly, and Margret Weir, this history illustrates the central fact that for capital there is no before, after, or outside of the state...

YOU'LL HAVE TO GO TO THE LINK TO SEE

Demeter

(85,373 posts)Putin has taken an enormous risk in backing Syria’s Assad with military force. If his gamble pays off, Russia could be the peacemaker with only marginal military losses. If not, he invites destabilisation and threats from ISIS back home.

Russian Sukhoi Su-34 fighter-bombers and Kalbir cruise missiles fired from the Caspian Sea have changed the balance of power on the Syrian battlefield, at least in the short term. The intensity of the bombing has allowed the Syrian government forces to take the offensive again. It’s unsurprising that Putin is giving Bashar al-Assad this tactical support: Syria is the last vestige of Russia’s Middle East presence, a symbol of past glory. Russia’s steadfast support of the Assad regime led it to play a decisive role, in 2013, in dismantling Syria’s chemical arsenal, to avoid western intervention (1). It has proved wrong those who claimed Russia was now only a regional power, with no interests outside the post-Soviet space.

From the first armaments contracts in 1956, Syria maintained very close relations with the Soviet Union, strengthened by Syria’s short-lived political union with Egypt (United Arab Republic, 1958-61) and the rise to power in 1963 of the Baath Party, inspired by Arab socialism. President Hafez al-Assad, before his death in 2000, urged his son Bashar to maintain the relationship as vital to keeping his clan at the head of the country.

After the breakdown of Russia’s alliance with Egypt and the loss of support facilities at Alexandria and Mersa Matruh in 1977, the Syrian port of Tartus was the only base for Russian warships in the Mediterranean. Over the past few months, these have become a noticeable presence off the Syrian coast; in September the huge Typhoon-class nuclear submarine Dmitry Donskoy was in the area.

Russian aid to Syria has grown since the Arab Spring. The collapse of the Tunisian, Egyptian and Libyan regimes, the dismantling of Iraq and the emergence of ISIS in 2014 convinced Russia that it must continue to support Assad and strengthen its position in the region. Widespread instability and difficulty in reading the policies of the West, especially those of the US, have driven governments to diversify their alliances. France has sold arms to the Gulf states; Russia has recently signed trade, military and technical agreements with Egypt, Iraq and Jordan; Saudi Arabia finances Egyptian purchases of Russian arms, and the Saudi sovereign wealth fund decided in July to invest $10bn in Russia...

I DON'T THINK PUTIN HAD MUCH CHOICE. HE DIDN'T WANT BATTLE-HARDENED CHECHENS RETURNING HOME TO PURSUE JIHAD AGAIN.

Demeter

(85,373 posts)Ask any bond trader in Tokyo, London or New York what their view on the global economy is, and you’re likely to get a similar, decidedly downbeat answer.

That’s not just because fixed-income types are a dour bunch at the best of times. A quick scan across government debt markets suggests that investors are pricing in the likelihood that growth and inflation around the world will remain tepid for years to come.

In Europe, bonds yielding less than zero have ballooned to $1.9 trillion, with the average yield on securities in an index of euro-area sovereign notes due within five years turning negative for the first time. Worldwide, the bond market’s outlook for inflation is now close to levels last seen during the global recession. And even in the U.S., the bright spot in the global economy, 10-year Treasury yields are pinned near 2 percent -- well below what most on Wall Street expected by now.

“Where are the animal spirits to turn us around?” said Charles Diebel, the London-based head of rates at Aviva Investors, which oversees about $377 billion. What you see in the bond market is “a lack of confidence in the future.”

I'D SAY, AS A GUESS, THE FUTURE ISN'T IN BONDS....

Demeter

(85,373 posts)Banking behemoths led by HSBC Holdings Plc and JPMorgan Chase & Co. now know the cost they’ll have to shoulder so the global financial system doesn’t have another Lehman moment.

The Financial Stability Board, created by the Group of 20 nations in the aftermath of the crisis, published its plan for tackling banks seen as too big to fail. The most systemically important lenders must have total loss-absorbing capacity equivalent to at least 16 percent of risk-weighted assets in 2019, rising to 18 percent in 2022, the FSB said on Monday. A leverage ratio requirement will also be imposed, rising from 6 percent initially to 6.75 percent. Bloomberg reported these numbers on Oct. 2.

The shortfall banks face under the 18 percent measure ranges from 457 billion euros to 1.1 trillion euros ($1.2 trillion), depending on the instruments considered, according to the FSB. Excluding the three Chinese banks in the FSB’s 2014 list of the world’s most systemically important institutions, that range drops to 107 billion euros to 776 billion euros.

“The TLAC announcement is hugely important; it’s a milestone of the first order in bank reform and ending too big to fail,” Wilson Ervin, vice chairman of the Group Executive Office at Credit Suisse Group AG, said before the announcement. “There are a lot of important details to consider and hopefully improve, but the big picture is, if you have a bank rescue fund with $4 trillion to $5 trillion of resources, you can break the back of this problem.”

MORE HAND-WRINGING AT LINK

Demeter

(85,373 posts)Asia’s work force is set to shrink over coming decades with India overtaking economic rival China as the region’s biggest source of workers.

By 2050, the Asia Pacific region will have nearly 50 percent of the world’s total work force, down from 62 percent today, according to Bloomberg analysis of United Nations data.

The shifting patterns will see India account for 18.8 percent of the global work force compared with 17.8 percent today, toppling China from the top spot. China will account for 13 percent, down from 20.9 percent now.

The projections, which use working age population as a proxy for labor force, also show a push from Africa, with Nigeria jumping to third spot from ninth and Ethiopia and Congo making it to the top 10.

Demeter

(85,373 posts)Coal consumption is poised for its biggest decline in history, driven by China’s battle against pollution, economic reforms and its efforts to promote renewable energy.

QuickTake Confronting Coal

Global use of the most polluting fuel fell 2.3 percent to 4.6 percent in the first nine months of 2015 from the same period last year, according to a report released Monday by the environmental group Greenpeace. That’s a decline of as much as 180 million tons of standard coal, 40 million tons more than Japan used in the same period.

The report confirms that worldwide efforts to fight global warming are having a significant impact on the coal industry, the biggest source of carbon emissions. It comes a day before the International Energy Agency is scheduled to release its annual forecast detailing the ways the planet generates and uses electricity.

“These trends show that the so-called global coal boom in the first decade of the 21st century was a mirage,” said Lauri Myllyvirta, Greenpeace’s coal and energy campaigner.

MORE

Demeter

(85,373 posts)

DemReadingDU

(16,000 posts)11/9/15 Catalonia Lawmakers Approve Resolution for Secession Process From Spain

Vote sets up likely test of wills between wealthy region and Spanish institutions

MADRID—Catalonia’s parliament approved a resolution Monday to take steps to establish an independent republic, vowing it would begin ignoring Spanish institutions and setting up a potential standoff with the government in Madrid.

The proposal to commence a “democratic disconnection” passed by a vote of 72 to 63, after a two-hour debate. Prime Minister Mariano Rajoy, who has said the separatist push represents Spain’s major challenge ahead of Dec. 20 national elections, pledged Monday to use all of the authority of his office to halt the secession bid.

“I understand the anxiety that many Catalans can feel, but to all of them I say you can rest easy,” Mr. Rajoy said. “Catalonia isn’t separating from anywhere, nor will there be any rupture.”

Mr. Rajoy said his government would petition the Constitutional Court this week to have the resolution declared void.

Legal experts say the court will almost certainly bar Catalonia from taking any steps to put the resolution into effect, paving the way for a test of wills. The resolution singles out the Constitutional Court as being “delegitimized and without authority.”

The nine-point resolution calls on Catalonia’s parliament to start within 30 days to prepare laws to create independent social security and tax authorities. Pro-independence parties have said they hope to complete the separation process within 18 months.

more...

http://www.wsj.com/articles/catalonia-lawmakers-approve-resolution-for-secession-process-from-spain-1447070119

Demeter

(85,373 posts)but I wish the Catalans luck. I have a neighbor a few doors down from there...I think she's planning on staying here.