Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 10 April 2015

[font size=3]STOCK MARKET WATCH, Friday, 10 April 2015[font color=black][/font]

SMW for 9 April 2015

AT THE CLOSING BELL ON 9 April 2015

[center][font color=green]

Dow Jones 17,958.73

S&P 500 2,091.18

Nasdaq 4,974.56

[font color=red]10 Year 1.96% +0.07 (3.70%)

30 Year 2.60% +0.08 (3.17%)[font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)We need new leadership--totally new, not a musical chairs game of survival amongst the usual suspects, nor a reshuffling of the seating on the Titanic.

If the 1% were put in jail, the rest of us could figure it out to everybody's benefit. If we had a functional democracy, they would be there already.

*******************************************************

To top off a perfectly awful week, we had a tornado warning....they ran the sirens, even. Nothing happened, as far as I can tell, other than it poured buckets and the lightning flashed. Good for the pansies!

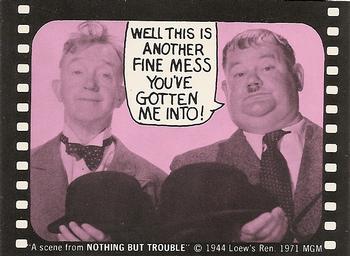

Tomorrow is Euchre Night, but we are having the Joke-Off, with a special historical figure guest star who has nothing to do with jokes. I can start before leaving....

Demeter

(85,373 posts)Jeffrey Sommers is an associate professor at the University of Wisconsin – Milwaukee and visiting faculty at the Stockholm School of Economics in Riga. His book with Charles Woolfson, The Contradictions of Austerity: The Socio-economic Costs of the Neoliberal Baltic Model is available from Routledge.

It has become increasingly fashionable to compare the results of Greece and the Baltic States’ response to the financial crisis of 2008, most recently last month with the Financial Times’ column with John Dizard. This, however, is a classic textbook case of comparing apples to oranges. Greece’s crisis was chiefly a public debt crisis enabled by membership in the eurozone and the cheap loans extended to the state this enabled that amounted to 107.4 percent of GDP in 2007 in the run up to the crisis. By contrast, the Baltic states had paltry public debt to GDP ratios of only 4.4, 10.7, 18 percent respectively in Estonia, Latvia and Lithuania in 2007, before the financial shock. Their crisis was a private sector one as banking capital ran for the door after creating a property bubble that burst.

Greece and the Baltic states did share one common feature. Tax evasion has been the national sport in their respective countries. For the Baltics states (especially Latvia) and their offshore banks, this is big business which their economies depend on. The Syriza government in Greece is attempting to tackle this pernicious problem, albeit with unknowable results at present.

Additionally, there was a wide gap in wages between Greece and the Baltic states following the crisis. For example, in 2009 Latvia’s per capita purchasing power (PPP) was $14,307 (in 2013 adjusted dollars). By contrast that year in Greece it was $29,512. Thus, given the ultra-low wages paid in the Baltics, there was much incentive for investors to take advantage of wage arbitrage opportunities. The real wage gaps were larger still, given that Baltic inequality is more extreme than in Greece. Now that wages have increased in the Baltic states to levels close to Greece’s, economic growth is flatlining as the wage arbitrage between them and Greece is no longer significant.

Oil prices rebounded quickly after the 2008 shock and by 2009 CIS offshore cash was racing into the Baltics from the east. More still came in as problems emerged in Cyprus’ offshore banking industry in 2012 and 2013. Now that oil prices have declined offshore financial flows to the Baltics have declined and with that (and the EU sanctions against Russia) their economic growth has dramatically slowed. So the jury is still out on the longer-term economic consequences of the kind of brutal austerity that Greece and the Baltics share in common. Furthermore, the Baltics did not cut taxes in response to the crisis. In fact, they introduced tax increases on the poorer sections of the population to repair their balance sheets. Immediately following the crisis, Latvia for example increased its VAT on many items (but not luxury goods). Some have praised the relatively flat tax rates of the Baltic states, but this doesn’t take into account the non-taxable minimum was cut dramatically in 2009, and represented the equivalent of a 7% tax increase on the bottom third of Latvians. In short, Baltic state taxes have been anything but flat, but have been regressive.

Meanwhile, the Baltic states have experienced new levels of mass poverty (40% of Latvia’s children were at risk of poverty in 2009). The results have been an exodus of the population with the highest levels of out-migration in the EU that threatens the longer-term sustainability of even the very partial recovery that has occurred. Also at risk given the magnitude of the emigration from Latvia and Lithuania, is their very demographic viability itself. Finally, many trumpet the virtues of ‘front-loading’ austerity cuts on the population, in line with the views of ‘shock-therapy architect’ Anders Aslund. Unlike Greece (at least until the Troika got to work), workplace rights and collective bargaining have all but disappeared in the Baltics. Up to 30 per cent of employees now exist within the informal economy in which workers have no rights whatsoever and if they are paid legal wages they are the legislated minimum, if not less. The Greek people are thus still in a more fortunate position compared to the Baltics and the push-back against austerity is growing. But here the comparison ends.

Warpy

(111,383 posts)It would probably scare him to death because they did it right: nationalized the banks, jailed the fraudsters, kept the social safety net intact, and let the dust settle. Now they're on to a solid recovery instead of ever increasing paper profits for their 1% while everybody else gets squeezed to death and the demand side of the economy gets throttled.

We're going to need a massive crash to get the banksters out of the government, no matter which party gets in.

Demeter

(85,373 posts)James Dimon says the regulatory cloud is lifting above J.P. Morgan Chase & Co. But the CEO still forecasts some squalls ahead. In his annual shareholder letter released late Wednesday, Mr. Dimon blamed legal and regulatory costs for weighing on the firm’s share price but said he expects the firm’s legal costs to “normalize” in 2016. The chief executive said the bank still faces legal uncertainty, highlighting continuing foreign-exchange settlement negotiations, but added that he thinks it will “diminish” over time. J.P. Morgan has paid more than $26 billion in recent years in fines and settlements.

The 59-year-old reiterated his stance that banks unfairly pay several regulators on the same issues. “This is an unprecedented approach that probably warrants a serious policy discussion—especially if those regulators (as at least some of them have acknowledged) don’t take into account what is being paid to the others,” he said in his 39-page shareholder letter.

Mr. Dimon noted that he spends more time talking to analysts and investors about regulatory issues than he does discussing client transactions or market-share gains. The J.P. Morgan chairman elsewhere had kind words for regulators, noting that he is a strong proponent of the Federal Reserve’s annual “stress tests” measuring how well banks would weather another financial crisis. But he also tweaked the results, saying it is “important for our shareholders to understand the difference between the Fed’s stress test and what we think actually would happen.” Mr. Dimon said J.P. Morgan has a plan in place that is not fully reflected in the Fed models. For instance, he said, the bank would be “far more aggressive” cutting expenses, specifically compensation; it would cut its dividend and stock buyback programs to conserve capital; it wouldn’t let its balance sheet grow quickly; and it wouldn’t allow trading losses to reach $20 billion, as the stress test predicted.

“The stress test assumes that dramatic market moves all take place on one day and that there is very little recovery of values. In the real world, prices drop over time,” he said. He also reminded shareholders that in the “actual” financial crisis of 2008 the bank didn’t lose money in any quarter.

A Fed spokesman declined to comment.

In its annual proxy filing, also released Wednesday, J.P. Morgan said Mr. Dimon’s compensation package totaled $20 million, unchanged from 2013. The bank explained that its board’s compensation committee decided that Mr. Dimon’s compensation was deserved because he maintained or improved market share in its four main businesses and the bank met or exceeded its capital, liquidity and expense targets, among other reasons. Mr. Dimon’s 2014 achievements were “significant, particularly in light of the revenue headwinds, the long-term low interest rate environment, mortgage business volatility, and the regulatory environment,” according to the filing. The Wall Street Journal previously said Mr. Dimon’s compensation was expected to be reported as $20 million. The bank also said that it would hold its annual shareholder meeting in Detroit on May 19.

A BIT MORE

Demeter

(85,373 posts)The European Union has presented Vladimir Putin with an irresistible strategic prize, on a platter. By insisting rigidly that Greece's radical-Left government repudiate its electoral pledges and submit to ritual fealty - even on demands of little economic merit, or that might be unwise in the particular anthropology of a post-Ottoman society - it has pushed the Greek premier into the arms of a revanchist Kremlin. The visit of Alexis Tsipras to Moscow has been a festival of fraternity. On Wednesday he laid a wreath at the Tomb of the Unknown Soldier and spoke of the joint struggle against Fascism, and the unstated foe. The squalid subject of money was of course avoided. "Greece is not a beggar," he said..."The visit could not have come at a better time,” said Mr Putin, purring like the cat who ate the cream.

EU sanctions against Russia will expire in June unless all 28 states agree to roll them over, and Mr Tsipras has already signalled his intent. "We need to leave behind this vicious cycle," he said. "Greece is a sovereign country with an unquestionable right to implement a multi-dimensional foreign policy and exploit its geopolitical role," he added, for good measure. A Greek veto on sanctions will embolden Hungary's Viktor Orban to join the revolt, this time in earnest. His country has just secured a €10bn credit line from Russia to expand its Paks nuclear power plant, a deal described as a "purchase of political influence" by a leading critic. Slovakia is quietly slipping away from what was once a united (if fractious) EU front to deter further Kremlin moves into Ukraine. There is safety in numbers for this evolving constellation, what Mr Putin's foes would call the EU's internal "Fifth Column". Brussels can bring one to heel, but not a clutch of rebels. It is becoming powerless.

Needless to say, a failure to renew sanctions at a time when the Donbass is still under the control of Mr Putin's proxy forces would drive a wedge between the US and Europe, further draining the life-blood from the Atlantic alliance and what remains of the Western security structure. But it does not stop there. The EU project is close to unravelling in the East. We thought we knew where we stood when the final decision was made in June of 2003 - in Athens of all places - to admit the former captive nations of the Soviet bloc, all clamouring to join what seemed to be an enlightened club of democracies under the rule of law. Now we have a government in Budapest that scoffs at press freedom and judicial independence, and a government in Athens that is desperately defending its own democracy against the EU itself. Mr Putin merely has to bide his time and the EU's southeastern flank will fall apart. Europe's creditor powers have warned Greece not to trifle with them, or to play off Brussels against Moscow, but seem strangely unaware that they too must make concessions to prevent matters spinning out of control, for them as well as for Greece.

*********************************************

Russia is not rich enough to rescue Greece. It is in a deep crisis of its own - facing economic contraction of 3pc this year - and risks Soviet-era stagnation if oil prices settle near $60 a barrel. Most of its $360bn foreign reserves are needed to plug holes and to help Russian companies roll over hard-currency debt. Yet it is not broke either....Syriza has enough money to pay the International Monetary Fund €458m on Thursday, but this leaves it short of money to meet €1.7bn of pensions and salaries five days later. They have already scratched the cupboard bare, though small sums can perhaps be conjured from hospital funds or by raiding accounts at the central bank...The EMU authorities have signalled that they may be willing to disburse some funds once the IMF has been paid, preserving the formal niceties of the EU-IMF Troika. But as The Telegraph reported last week, Syriza fears a trap. "They are trying to put us in a position where we either have to default to our own people or sign up to a deal that is politically toxic for us," said one official. The situation was so serious by then that finance minister Yanis Varoufakis flew to Washington on Easter Sunday to break the impasse with the IMF's Christine Lagarde. Greece agreed to meet its IMF payment: the IMF in turn agreed to show "utmost flexibility" over Syriza's reform plans. This looks like an IMF pledge that the Greeks will not be left high and dry on April 14.

Syriza has wisely decided that it would be dangerous to default on the IMF, or even to fall into arrears. No developed country has ever taken this step. Peru's Alan Garcia - the Tsipras of his age - did default in the 1980s and later said it was the worst mistake he ever made. If they have to default, they would rather pick their fight with EU creditors and above all the ECB, enemy number one after it took the pre-emptive political decision of cutting off a key lifeline for Greek banks within days of the Greek election. As it happens, Greece must pay the ECB €194m in interest on April 17. Even if Greece manages to cobble together enough money to meet rolling demands through the Spring, it cannot possibly cover €6.7bn in bond redemptions to the ECB in July and August unless there is a fresh bail-out programme. Nor does Syriza wish to pay, given that the ECB bought these bonds in 2010 to bail out German and French banks and to prevent an EMU-wide banking crisis, not to help Greece. The Greek parliament was never consulted. Nor too does Syriza see much advantage in delaying the agony. "If it is going to happen, what is the point of waiting?" said one minister.

A former ECB official said the fear is that Greece will kick off with a selective default to Frankfurt, judging this the easiest political target. It would cover both bonds and €80bn of "Target2" liabilities to the rest of the ECB network that have built up automatically due to capital flight. "The crucial point is that Target2 liabilities are not backed by collateral. The Greeks can simply abolish the Bank of Greece on a Friday evening, and create a new central bank to be ready on the next Monday morning. There is no court in Europe that can enforce a payment against a Bank of Greece that no longer exists. This is their best chance of protecting the Greek people but it will not be pretty for the ECB," he said.

****************************************************

Mr Putin must surely be smiling that he has won such an easy trick with such a weak hand. He watched in horror as the Soviet Union went into self-destruction a quarter century ago. This time he has the satisfaction of watching his much richer enemies tear themselves apart over mere money.

Greece's April showdown

April 8

Alexis Tsipras meets Putin

Greek PM is due in Russia to visit his counterpart, Vladimir Putin. Greece has been making overtures towards its eastern giant

April 9

IMF payment

Greece is due to make a crucial €448m payment to the International Monetary Fund

April 10-13

Easter weekend

Greece celebrates Orthodox Easter weekend

April 14

Public sector wages and pensions

Estimated €1.7b in social security payments made by the state

April 14

Bond roll over

Government faces €1.4 billion in refunding 6-month T-bills

April 15

ECB Governing Council meets

Decision over providing emergency assistance (ELA) to Greek banks is reviewed

April 17

Bond rollover and interest payment

Government faces €1bn in refunding of 3-month T-bills and €194m in interest payments to private bondholders

April 20

Interest payment to ECB

Greece due to pay €80m interest bill on bonds held by the European Central Bank

April 24

Eurogroup meeting

Finance ministers convene in Riga

May 1

IMF payment

A €200m loan repayment to the IMF

May 1

Labour Day Bank Holiday

Demeter

(85,373 posts)Greece made a crucial payment to the International Monetary Fund and won extra emergency lending for its banks on Thursday but it remained unclear whether Athens can satisfy skeptical creditors on economic reforms before it runs out of money. Euro zone partners gave Greece six working days to improve a package of proposed reforms in time for finance ministers of the currency bloc to consider whether to release more funds to keep the country afloat when they meet on April 24...EU officials said the Greek delegate made an urgent plea for cash at a meeting of deputy finance ministers in Brussels on Wednesday evening but was told there must first be progress on a stalled list of measures to make public finances sustainable...

"We are restarting the privatization process as a program making rational use of existing public assets," Varoufakis told a conference in Paris. "What we are saying is the Greek state does not have the capacity to develop public assets."

He did not specify which tenders would go ahead and said the government wanted public-private joint ventures with a minimum investment commitment required from bidders, and the state retaining a stake to generate pension funds.

Demeter

(85,373 posts)The “Audit the Fed” debate is the latest manifestation of a conflict as old as the nation, between those who argue that a strong central bank improves economic stability, and those who see an overbearing government engaged in harmful meddling. Battles over central banking have historically pitted financial elites who wanted to limit the availability of money, thus preserving its value, against farmers, businessmen and other borrowers who wanted money to be plentiful — and cheap. Each side has sometimes regarded the central bank as its great ally in that fight, and sometimes as its bitter enemy. Since the Great Recession the Fed has mostly sided with the borrowers, creating vast amounts of new money and holding short-term interest rates near zero. Inevitably, that has angered creditors, and sparked efforts to swing the pendulum in the other direction.

The nation's first two central banks, both called the Bank of the United States, were private, for-profit organizations chartered by Congress. The first (1791-1811) was created to help the government pay its Revolutionary War debt, stabilize the country’s currency and raise money for the new government. It was the dream of Alexander Hamilton, secretary of the Treasury, who overcame resistance from Thomas Jefferson (who wrote “I believe that banking institutions are more dangerous to our liberties than standing armies”) and other Southern lawmakers. When its 20-year charter expired, Congress chose not to renew it.

The Second Bank of the United States was chartered a few years later, in the aftermath of the War of 1812, after Congress decided it had a mistake. But it lasted just 17 years. President Andrew Jackson said the bank concentrated too much economic power with a corrupt moneyed elite and vetoed a bill to extend its charter in 1832. Supporters of the the bank rallied around Henry Clay, Jackson’s opponent for reelection that year, but the “Bank War” ended when Jackson won easily. United States Treasury funds were withdrawn and deposited in state banks; the nation would be without a central bank for more than 70 years.

The headquarters of both banks still stand about a block apart in downtown Philadelphia.

A severe financial crisis drove the economy into a deep recession in 1837, just one year after the demise of the Second Bank. Such crises became a recurring event in American life and, as the economy grew, so did their size and the frequency. Banks created the New York Clearing House as a private-sector backstop, but it proved inadequate for the task. The government also was hamstrung. In the absence of a central bank, the United States regulated the value of its currency by guaranteeing that dollars could be exchanged for gold, and sometimes silver. This meant the government could not respond to financial crises, and the resulting economic downturns, by increasing the supply of money.

In 1907, yet another crisis was brought about by a failed attempt to corner the stock of the United Copper Company. Government officials and financial executives jerry-rigged a response: an emergency lending pool orchestrated by J. Pierpont Morgan. But the crisis proved to be a tipping point in the political debate about the need for a central bank. There was a growing political consensus that Wall Street needed a permanent fire department.

In November 1910, Senator Nelson Aldrich met with a group of bankers at a resort on Georgia’s Jekyll Island and hammered out a plan for a new central bank. The idea touched on many of the great political battles of the age: The states against Washington; Wall Street financiers against smaller banks, particularly in the South and West; populists against the Gilded Age elite. The bill that emerged from several years of debate, signed by President Woodrow Wilson, was an awkward compromise: There would be 12 privately owned reserve banks in major cities across the country, preserving the power of financial elites. But the banks would be overseen by a board of presidential appointees, including the Treasury secretary, granting the public a new measure of control over the financial system.

Before the Fed was fully established, however, the old system took a final bow. A financial crisis struck in 1914, and roughly twice as many banks failed as in 1907.

Instead of preventing crises, the Federal Reserve helped to cause the Great Depression. The Fed was supposed to manage the gold standard — to make sure the economy was not choked by a lack of money and a resulting spike in interest rates. Instead, the Fed was paralyzed by disagreements between regional banks and the central board. It let the money supply shrink by one-third. The result was the worst economic crisis in the nation’s history.

Congress responded to the Fed’s failure by greatly increasing its power and responsibilities. In 1934 it authorized the president to devalue the dollar, beginning the long process of replacing the gold standard with a currency whose value is managed by the Fed. In 1935 it gave the Fed responsibility for “the general credit situation of the country.” The act also removed the Treasury secretary from the Fed’s board and created a new policy-making committee where board members would outnumber reserve bank presidents.

FIVE MORE CHAPTERS TO GO...AT LINK

Demeter

(85,373 posts)By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

The minutes of the FOMC’s March meeting make clear just how hard it is for the Fed to even think about the possibility of unwinding what they’ve wrought. After six-plus years of interest-rate repression, absurdity has become the established norm. Now they can’t even figure out how to get out of it without bringing down the whole construct....They handed the fruits of their monetary policies to folks who bought assets with them. Assets values have skyrocketed, yields have plunged, and risks have disappeared from the calculus. You can still get run over by a car, but you can’t lose money in stocks or junk bonds. That’s the established norm. This stream of money created asset price inflation and funded the fracking boom, the tech bubble, and a million other things that produced a lot of supply. But demand remained lackluster because they didn’t hand this moolah to the folks who’d spend it on gadgets or food or gasoline, the folks who’d actually create demand. The economy languished, and consumer price inflation, though bad enough for consumers, remained mostly below the money printers’ lofty goals. Now the Fed is trying to figure out how to unscramble the omelet.

Meanwhile the ECB and other central banks are adding to it, accomplishing an absurd feat: even the crappiest sovereign bonds – except those of Greece – are soaring, and yields are plunging, many of them into the negative. Then on Wednesday, a new thing happened: Switzerland sold 10-year government debt at a negative yield. They’d been selling debt at negative yields for a while, but with a 10-year maturity. No country had. The little country with piles of money is defending itself against the influx of euros by repressing interest rates and making it in theory unpalatable to hold Swiss francs. But it isn’t working. What dreadful thoughts are rumbling through the heads of these investors that would scare them into lending their money to the Swiss government for ten years, not to earn a fair return, but for safekeeping apparently, and they’re even willing to pay for it! Germany’s 10-year debt is following closely behind, yielding a still positive but practically invisible 0.15%. About €1.8 trillion in Eurozone sovereign bonds entice “investors” – if you can call them that – with negative yields, which now includes Spanish 6-month T-bills...These inflated debt prices are great for borrowers. They’re flocking to Europe to sell debt to investors desperate to escape the negative yield trap laid out for them by Mario Draghi. Junk-rated corporate America caught on to it in no time. And Mexico, which had its share of debt crises by borrowing in foreign currencies, got wind of it. It is now hawking 100-year euro bonds to these desperate investors, enticing them with a yield of about 4.5%. “Pretty attractive,” is what Marco Oviedo, chief economist for Mexico at Barclays, called them. He expects healthy demand. An awesome deal in a risk-free environment.

Years of promised QE, actual QE, near-zero or negative interest rates, and the idée fixe that these conditions are permanent have sent asset prices soaring. Many, like German stocks, are disappearing from view. Same in Japan, where the Bank of Japan just voted 8-1 to push QE at full tilt. It’s buying every Japanese Government Bond that isn’t nailed down. It’s buying J-REITs and equity ETFs every time the market dips to make it head the other way. Absurdities are playing out with increasing intensity. The JGB market has dried up under the BOJ’s relentless bid. And even conservative pension funds are dumping JGBs into the lap of the BOJ to buy equities at inflated prices. And inflated they are: the Nikkei is up 135% in three years though the economy has languished. Real household incomes have been whittled down by a bout of inflation and a sales tax increase. The Olympics are coming, real estate values are soaring in Tokyo and some other places as foreign buyers and developers are pouring in, armed to the teeth with cheaply borrowed money, even as the hollowed-out middle class gets to hold the bag. Oh, and Chinese stocks! Shanghai’s SSE Composite Index has nearly doubled in 12 months.

Absurd monetary policies are easy to start, the announcements are fun, and the market rallies they engender are vertigo-inducing. Central bankers look like heroes, as if they’d single-handedly saved the economy or something. Now there are financial bubbles everywhere. Mega-fortunes are tied up in them. And home prices have soared. Unlike financial assets, homes are something people need. When prices get to the point where only free money makes ownership possible for the middle class, and when even rents become unaffordable for many people – then there are some serious problems in the main-street economy. But how the heck do you stop this madness before something BIG breaks? How do you get out of it without bringing down the whole construct? You’d think that six-plus years of these policies would have given central bankers enough time to figure it out. But no. The Fed doesn’t know how, according to the minutes from the March FOMC meeting. To its credit, it’s at least discussing it. But it doesn’t even know how to raise interest rates, now that the huge balances of excess reserves the banks keep at the Fed render the traditional way ineffective. So they’re playing with novel mechanisms. But they might pose “risks to financial stability” – market swoons, in Fed speak. One of these mechanisms would be to sell some assets that mature in a relatively short time. A minor move, a total no-brainer, you’d think. But even the mere announcement, according to the minutes, “would risk an outsized market reaction….”

The “public” – the speculators the Fed has been feeding with free money – might see this as a “signal of a tighter overall stance of monetary policy than they had anticipated.” And it could make this whole construct come unglued. The mere announcement of such a minor move!

MORE

Demeter

(85,373 posts)

Demeter

(85,373 posts)http://www.wsj.com/articles/ge-prepared-to-exit-the-bulk-of-ge-capital-1428662109?mod=WSJ_myyahoo_module

Exit from large-scale lending ops would address investor concerns, could take time

General Electric Co. has decided it no longer needs to be a bank.

In the conglomerate’s most significant strategic move in years, GE has resolved to part ways with the bulk of GE Capital, the giant finance business that long accounted for around half the company’s profits but whose risks have rattled investors and weighed on its stock.

GE said it will hang on to its aircraft leasing operations, as well as financing for the...

GE to sell real estate holdings, sets $50 billion share buyback

http://www.reuters.com/article/2015/04/10/us-general-electric-divestiture-idUSKBN0N020420150410?feedType=RSS&feedName=businessNews

General Electric Co said it would sell the bulk of its real estate portfolio to investors including Blackstone Group and Wells Fargo & Co for $26.5 billion, in the biggest commercial real estate deal since 2007...Blackstone and Wells Fargo said they would buy most of the assets of GE Capital Real Estate in a deal valued at about $23 billion...GE has been selling off its property investments globally as it focuses on improving earnings from sales of products such as jet engines, generators, electric grid gear and oil field equipment...GE said it also had letters of intent to sell an additional $4 billion of commercial real estate assets to other buyers that it did not identify...The deal is the biggest commercial real estate deal since Blackstone's acquisition of office landlord Equity Office Properties Trust in 2007 for $39 billion, including debt.

GE, which has been refocusing on its industrial businesses, also said its board had authorized a share repurchase program of up to $50 billion. The plan allows GE to buy back nearly 2 billion of its outstanding shares, based on Thursday's close. GE's shares rose 2.2 percent to $26.30 in premarket trading on Friday. The stock rose nearly 2 percent on Thursday after the Wall Street Journal first reported that the company was close to selling its real estate holdings...The company said it expected to reduce its share count to 8 billion-8.5 billion by 2018. GE had 10.06 billion shares outstanding as of Jan. 31...

The company said on Friday it expected earnings from its aviation, power and water, and other industrial businesses to account for about 90 percent of total earnings by 2018. The units made up just over half of GE's profit in 2013. GE said it would take after-tax charges of about $16 billion related to the restructuring in the first quarter, of which about $12 billion would be non-cash.

Demeter

(85,373 posts)Oil edged further below $57 a barrel on Friday, pressured by evidence of ample supplies including the biggest jump in U.S. inventories since 2001 and Saudi Arabian output reaching a record high.

The market was still heading for a weekly gain, having rallied on Thursday in response to strong German economic data that lifted the oil demand outlook and easing concern about a rapid rise in Iranian oil supplies...

"Most of the fundamental factors are still pointing to lower prices," said Eugen Weinberg, analyst at Commerzbank. "At the moment, we have an oversupply of more than 1 million barrels per day."

The price of Brent has halved from $115 a barrel in June last year, a drop that deepened after OPEC refused to cut output, choosing to defend market share instead. Top exporter Saudi Arabia was the driving force behind the policy shift. While some OPEC members are urging output cuts to boost prices, Saudi Arabia has shown no sign of a rethink. Oil Minister Ali al-Naimi told reporters on Tuesday Riyadh has boosted its crude production to 10.3 million bpd, the highest rate on record.

Further pressuring prices, a U.S. government report on Wednesday said domestic crude stocks surged nearly 11 million barrels last week, the biggest gain in 14 years. A glut of unsold Nigerian crude is building up too, traders say. This is particularly bearish for Brent, because Nigerian crude is priced against it.

Demeter

(85,373 posts)ANOTHER SAD AND SORDID TALE OUT OF THE CLINTON-LED STATE DEPT.

Demeter

(85,373 posts)THE TRANSLATION IS VERY POOR...I HAVE TRIED TO MAKE IT READ MORE LIKE ENGLISH...

http://news.rin.ru/eng/news///102587/3/

Russia, together with Brazil, India, China and South Africa will create an international currency reserves that will be used to stabilize the local SLE, in case of their sudden depreciation. This total complexity will be allocated 100 billion. Russia's share in the reserves of the BRICS countries will amount to $ 18 billion...China will contribute to the pool of reserves of 41 billion dollars, Brazil and India similarly to that of Russia, at $18 billion. Another $5 billion would COME FROM South Africa...The decision to establish a joint inventory was taken in early July 2014 at the sixth BRICS summit in Brazil. Study of the mechanism involved in the Central banks and Finance ministries of the participating countries of the BRICS...

The pool will be MANAGED BY the governing Council, the continuing Committee, and the Chairman of the BRICS. This year Russia takes the BRICS Chairman. Each nation will have access to shared cash in proportion to the volume of granted funds...

The RUSSIAN bill has been prepared jointly by the foreign Ministry and the Ministry of Finance. To be effective it needs to be approved by the government, passed by the state Duma and the Federation Council and signed by the President, according to "Rossiyskaya Gazeta".

Demeter

(85,373 posts)HIGH FREQUENCY TRADING IN T-BILLS AND TREASURY NOTES---WHAT COULD POSSIBLY GO WRONG?

www.reuters.com/article/2015/04/09/usa-bonds-algo-idUSL2N0X61FR20150409

The increasing role of computerized trading in the U.S. bond market has boosted the risk to U.S. Treasuries trade, potentially causing more turmoil like the wild price swing that erupted on Oct. 15, according to a paper from a bond industry group released on Thursday. Supporters see automated trading, in particular high frequency trading which uses complex models to almost instantaneously buy and sell huge volumes of bonds and other securities, as fostering liquidity and bringing down trading costs...On Oct. 15, 30-year Treasuries bond prices jumped 6 points in a matter of minutes, resulting in record trading volumes and a rarely seen degree of price and yield swings.

Critics said this type of trading strategy is disruptive and prone to be used to manipulate markets.

"The increased adoption of automated trading has also led market participants and regulators to articulate concerns about the potential for greater operational risk, disruptive market practices and trading strategies, and the risk of sharp, short-term disruptions to the Treasury securities market," Treasury Market Practices Group said in its "white paper" on automated trading. TMPG, which is sponsored by the New York Federal Reserve, has recommended a set of industry practices on automated trading for bonds. They include avoiding strategies that could be disruptive to the market and adopting policies aimed at getting rid of strategies to manipulate prices and liquidity...The "common thread" of what happened in October and bouts of turbulence linked to automatic trading in other markets is that automated trading could outpace manual detection and intervention, TMPG said. One of the main risks from automated trading cited by TMPG is operational, ranging from program malfunctions to algorithms reacting to wrong or unexpected data. Automated systems could offer "rogue" traders a faster set of tools to manipulate markets, TMPG said.

Electronic trading accounts for more than half of the overall trading volume of Treasuries, with the rest primarily done over the phone between dealers and investors or among dealers.

Daily Treasuries volume averaged $524.5 billion in March, down from $558.9 billion in February, according to data from the Securities Industry and Financial Markets Association.

Demeter

(85,373 posts)Deutsche Bank AG investors reacted with relief as the lender moved closer to reaching a settlement in the global interest-rate rigging probe.

Germany’s largest lender is set to pay more than $1.5 billion this month after an investigation into how traders colluded to rig the London interbank offered rate and related benchmarks to profit from their own derivatives bets, according to a person familiar with the matter, who asked not to be identified because the talks are private. The unit expected to plead is Deutsche Bank Group Services, according to one of the people. The U.K. unit is one of the lender’s main employers.

A settlement would remove a key legal threat that has haunted Deutsche Bank co-Chief Executive Officer Anshu Jain since 2012. The Libor scandal has forced at least one CEO, Barclays Plc’s Robert Diamond, to resign and cost banks billions of dollars in penalties. While Deutsche Bank’s fine would exceed those paid by any of the other seven banks that have settled with U.S. and U.K. regulators, analysts said it was in line or only marginally higher than their estimates.

The fine is “manageable and Deutsche Bank will be pleased to get it out of the way,” said Christopher Wheeler, a financial analyst at Atlantic Equities in London. Even so, it’s “seen as a reminder of the bad behavior of the investment bank which is linked to Jain,” the former head of the unit.

Deutsche Bank shares rose as much as 1.2 percent and were up 0.9 percent at 33.30 euros at 1:34 p.m. in Frankfurt. They have gained about 33 percent this year.

MORE

THEY DON'T DESERVE THIS "GET OUT OF JAIL RELATIVELY FREE" CARD

Demeter

(85,373 posts)It's the Optimist in me...or force of habit...or maybe I'm just hungry and want some breakfast.

See you on the Weekend! Dig out your groaners and shaggy dog stories for the Joke-Off!