Latin America

Related: About this forumUrged by Trump, U.S. Supreme Court rejects Argentina appeal over YPF energy firm

The U.S. Supreme Court on Monday rejected Argentina's bid to fend off a lawsuit by investment fund Petersen seeking retroactive compensation for shares in the now-nationalized energy firm YPF.

The cases, YPF v. Petersen, 18-575, and Argentine Republic v. Petersen, 18-581, involve a bankrupt Argentine investor (Petersen) suing Argentina and YPF for $1.74 billion over its 2012 renationalization.

The justices left in place a lower court ruling that allowed Petersen to sue after Argentina's government refused to buy back its shares. The Trump administration in May urged the Supreme Court not to take up the appeals.

Petersen, controlled by Argentina's Ezkenazi family but now based in Madrid, owned 25% of YPF stock at the time of its renationalization.

The Argentine Government expropriated 51% of YPF's shares (all from Madrid-based Repsol) for $5 billion; but declined to tender an offer to buy out other shareholders - something Petersen claims YPF's by-laws required.

Petersen later sold its stake in the lawsuit to London-based third-party litigation funder Burford Capital for $18 million; Burford took advantage of today's news to sell a 10% stake for $100 million.

Burford would reportedly net most the proceeds from the lawsuit (around $1 billion). They also own lawsuits from the former Spanish owners (some currently in prison) of Aerolíneas Argentinas, which was likewise renationalized in 2008 after years of mismanagement.

YPF, with $15.5 billion in annual revenue, produces 45% of Argentina's oil and gas, sells 56% of its gasoline and is the nation's largest firm of any type. Founded in 1922 as the first state-run oil company in the world, YPF grew to supply 75% of Argentina's oil needs by 1968 but was privatized in 1993.

Following Repsol's majority acquisition in 1999, investment and output at YPF fell even as profits rose - ultimately prompting former President Cristina Kirchner to renationalize the firm in 2012.

At: https://translate.google.com/translate?hl=en&tab=wT&sl=auto&tl=en&u=https%3A%2F%2Fwww.pagina12.com.ar%2F202307-fallo-contra-argentina-por-la-expropiacion-de-ypf

Former Argentine President Cristina Kirchner, with (from left) Petersen Group chair Sebastián Eskenazi and Repsol chair Antoni Brufau, shortly before YPF's 2012 renationalization.

Eskenazi, who controlled a 25% stake in YPF, claims his share should have been bought out when Repsol's was.

He later sold his lawsuit for $18 million to third-party litigation funder Burford Capital - which stands to net around $1 billion.

The case recalls Argentina's long-running vulture fund dispute, in which hedge funds led by Paul Singer's Caymans-based NML demanded payouts of up to 1600% for old, defaulted bonds bought from resellers (NML netted an estimated 1180%).

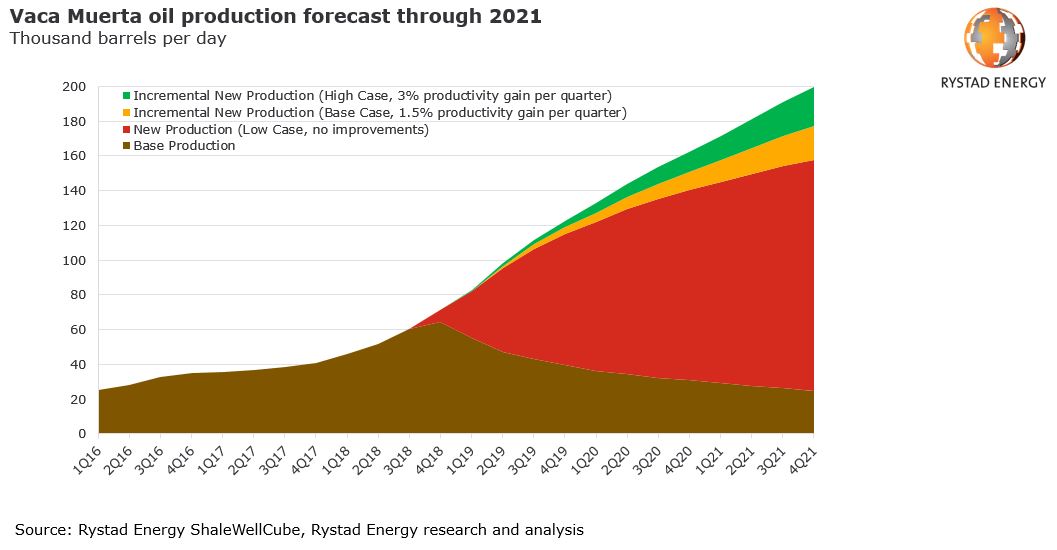

Local energy policy observers believe the Burford suit is being encouraged by the Trump administration to force YPF to sell its stake in the Vaca Muerta formation, whose technically recoverable 3,244 trillion ft³ of shale gas and 27 billion barrels of shale oil make it among the leading such sources in the world.

Judi Lynn

(160,656 posts)Would NEVER have expected a U.S. President to be leading the conservative-controlled US Supreme Court in their decisions regarding foreign companies. This is blatantly wrong in every way. It makes one feel so sick, disgusted, angry. Somehow this all has to come to a screeching halt.

Thanks for the newest information, sandensea.

The Vaca Muerta shale field in Argentina.

sandensea

(21,697 posts)Many observers are urging Macri to request the U.S. courts for discovery as to who, exactly, would profit from the $1.7 billion payout.

It's widely suspected that Burford Capital has many smaller hangers-on in this suit, including some from Argentina itself - just as Paul Singer did in the vulture dispute.

Macri has not yet requested discovery (although he may still). But you can bet that if opposition leader Alberto Fernández wins in October, he almost certainly will. Names will be named.

Great photos of Vaca Muerta, btw.

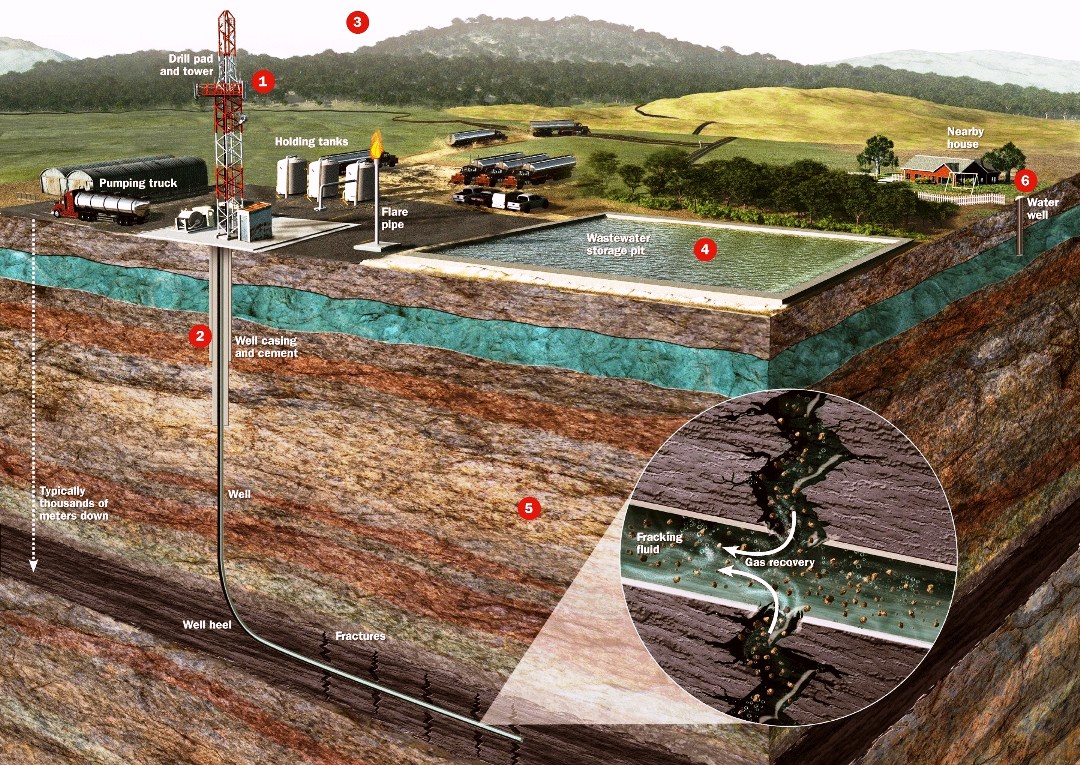

While fracking is involved, one upside is that very few people live there. And aside from a few orchards there's no agriculture or even ranching there.

This is a major advantage Vaca Muerta has over many other major fracking areas - which often overlap heavily populated and/or agricultural areas and major aquifers.

Most of the fracking is occurring in Añelo County in northern Neuquén Province. It's almost the size of Connecticut (4,500 mi²) - but with only 11,000 people.

Everything north of the town of Añelo is bone dry (as your photo shows). There are rivers flowing from the Andes range to the west but few significant aquifers.

Why this does not mean there aren't risks, or that it wouldn't be better if we could just dispense with fossil fuel almost entirely (someday, I hope), the fact is that demand for oil and gas isn't going anywhere anytime soon.

So while I'd rather have no fracking at all, if we must I'd rather it be in a barren desert where risks are relatively minimal, than in Pennsylvania or North Dakota - where the water supply for millions could be permanently ruined.

Thanks as always for adding to these articles with so much info and imagery, Judi. We'll see where this one goes (and a lot depends on the elections this October).