House Budget Chair Signals Big Social Security Reforms A-Coming

Source: Talking Points Memo

The new House Budget Committee chairman hinted Monday that he had big plans for Social Security reform in the next two years, according to the Atlanta Journal-Constitution.

A week after the House voted on a rule that critics say could force a manufactured crisis in the disability program in late 2016, a potential leverage point for Republicans aiming for changes, Rep. Tom Price (R-GA) told a conservative audience that he wanted his committee to tackle Social Security.

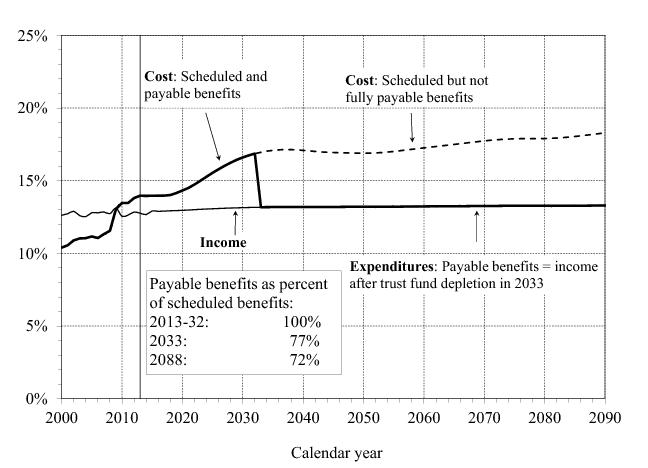

"What I’m hopeful is what the Budget Committee will be able do is to is begin to normalize the discussion and debate about Social Security. This is a program that right now on its current course will not be able to provide 75 or 80 percent of the benefits that individuals have paid into in a relatively short period of time," he said at a Heritage Action for America event in Washington, D.C., according to AJC. "That’s not a responsible position to say, ‘You don’t need to do anything to do it.’"

Price, whose predecessor Rep. Paul Ryan (R-WI) never put forward major reform proposals in his otherwise ambitious budgets, offered means-testing and increasing the eligibility age as possibilities. He also hinted at privatizing Social Security.

Read more: http://talkingpointsmemo.com/livewire/tom-price-social-security-reforms

n2doc

(47,953 posts)No "Grand Bargains"!

Yo_Mama

(8,303 posts)Because the problem is funding. And if the disability is extended the way we have always done it before, then the run-out date for SS is going to be sharply advanced.

It's time to figure out a revenue stream to properly fund DI and SS.

http://www.ssa.gov/OACT/TRSUM/index.html

The 2033 SS & DI benefit cut date should provide no one any comfort. That assumes that DI shortfall will be funded by taking money out of SS, which indeed must be legislated by Congress because otherwise it is illegal. Otherwise the SS trust fund might last considerably longer, or it might be exhausted a year later.

This should worry all those in their 40s, 50s and 60s. The longer we wait to fund the gap with increased taxes, the more difficult it will be to accomplish it:

Right now we need to raise payroll taxes (or get an equivalent amount through other taxes) by about 2.5-2.7%. Wait another ten years, and that number gets higher.

RunInCircles

(122 posts)This whole graph is propaganda tool. The graph represents how much working people in the year will underpay the current level of benefits with projections of declining numbers of working people and seniors living much much longer. A farer projection of Social "Security solvency is obtained by assessing whether enough money is contributed each year to cover the accrued benefit to the current worker. The answer to this question is that the fund is very nearly in balance. Any projected funding shortfall could be easily covered with a modest increase in the cap. So I disagree with the projection and the methodology behind this projection. More over any perceived deficit could be easily corrected by asking the extraordinarily wealthy to pay at the same rate the rest of us do.

cstanleytech

(26,319 posts)and I will laugh like hell over it.

24601

(3,962 posts)Security battles.

I'll expect proposals for changes that don't apply to anybody within 10 years of eligibility t, changes will o draw non-disability benefits. In other words, as long as you are 52+, you will be insulated from major program changes.

I've told my kids (21 & 19) not to feel bad but that the funding war is over and they lost. Don't feel bad, I tell them - just get ready to pay lots and lots because your mom and I will be receiving our Social Security as long as we continue to live.

When they ask why, I explain that we vote - always. Their generation? Not so much.

cstanleytech

(26,319 posts)msongs

(67,441 posts)blkmusclmachine

(16,149 posts)dixiegrrrrl

(60,010 posts)"now they are coming for your Soc. Sec.

And they will get it, too."

24601

(3,962 posts)brentspeak

(18,290 posts)If Obama actually gave a damn, he would've stood on the bully pulpit and been on the warpath six years ago to call for the raising and/or elimination of the FICA cap. A polite and mild suggestion he made about it three years ago just doesn't cut it. He knew full well that eventually the Repubs would grab the majority and be able to call the shots.

RandiFan1290

(6,242 posts)How did this happen!!!!

![]()

CrispyQ

(36,513 posts)CountAllVotes

(20,878 posts)Billions of dollars in aid/etc. for other countries.

What do they do to their own citizens that HAVE WORKED and HAVE PAID into this "disability" system for over 10 years?

Instead now everyone (yes everyone) must live in fear that the pittance received will be cut by 20%!!

Estimates say that about 9,000,000 persons receive SSDI in America with an average payment if $1100 a month or about $13,000 a year = poverty level in many cases.

This is not something to be proud of!

This is a moral disgrace! ![]()

I sincerely hope that President Obama uses that veto pen on this one!

![]()