Trump May Owe $100 Million From Double-Dip Tax Breaks, Audit Shows

Last edited Sat May 11, 2024, 01:12 PM - Edit history (1)

Source: New York Times

May 11, 2024 Updated 11:08 a.m. ET

Former President Donald J. Trump used a dubious accounting maneuver to claim improper tax breaks from his troubled Chicago tower, according to an Internal Revenue Service inquiry uncovered by The New York Times and ProPublica. Losing a yearslong audit battle over the claim could mean a tax bill of more than $100 million.

The 92-story, glass-sheathed skyscraper along the Chicago River is the tallest and, at least for now, the last major construction project by Mr. Trump. Through a combination of cost overruns and the bad luck of opening in the teeth of the Great Recession, it was also a vast money loser. But when Mr. Trump sought to reap tax benefits from his losses, the I.R.S. has argued, he went too far and in effect wrote off the same losses twice.

The first write-off came on Mr. Trump’s tax return for 2008. With sales lagging far behind projections, he claimed that his investment in the condo-hotel tower met the tax code definition of “worthless,” because his debt on the project meant he would never see a profit. That move resulted in Mr. Trump reporting losses as high as $651 million for the year, The Times and ProPublica found.

There is no indication the I.R.S. challenged that initial claim, though that lack of scrutiny surprised tax experts consulted for this article. But in 2010, Mr. Trump and his tax advisers sought to extract further benefits from the Chicago project, executing a maneuver that would draw years of inquiry from the I.R.S. First, he shifted the company that owned the tower into a new partnership. Because he controlled both companies, it was like moving coins from one pocket to another. Then he used the shift as justification to declare $168 million in additional losses over the next decade.

Read more: https://www.nytimes.com/2024/05/11/us/trump-taxes-audit-chicago.html

No paywall (gift)

Link to ProPublica version (same as NYT) - https://www.propublica.org/article/trump-irs-audit-chicago-hotel-taxes

(

twodogsbarking

(10,071 posts)Mz Pip

(27,478 posts)I like that. Nice use of combining metaphors. 🤣

republianmushroom

(14,124 posts)Last edited Sat May 11, 2024, 01:23 PM - Edit history (1)

2021 to 2023 again where was the IRS ?

39 months and counting (includes foot dragging)

BumRushDaShow

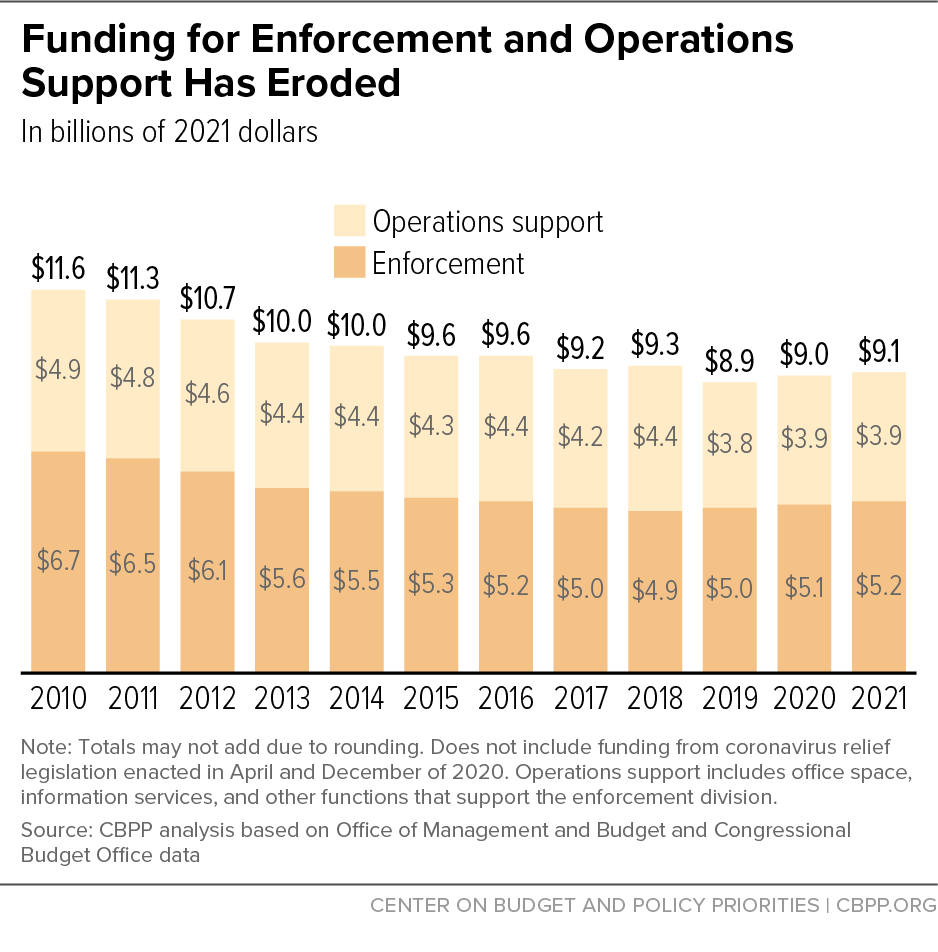

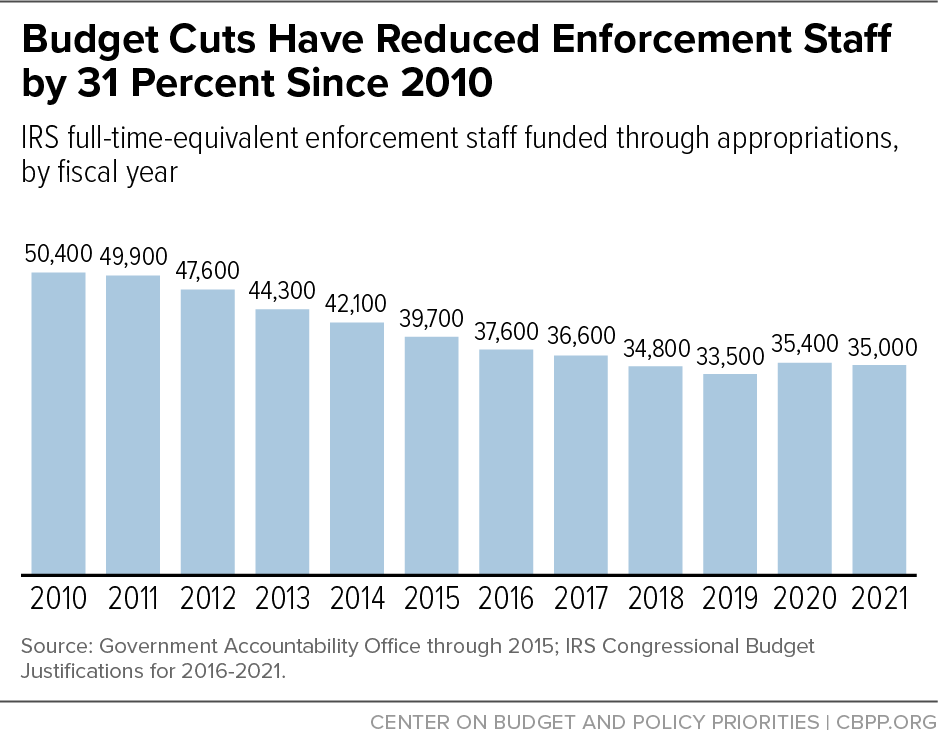

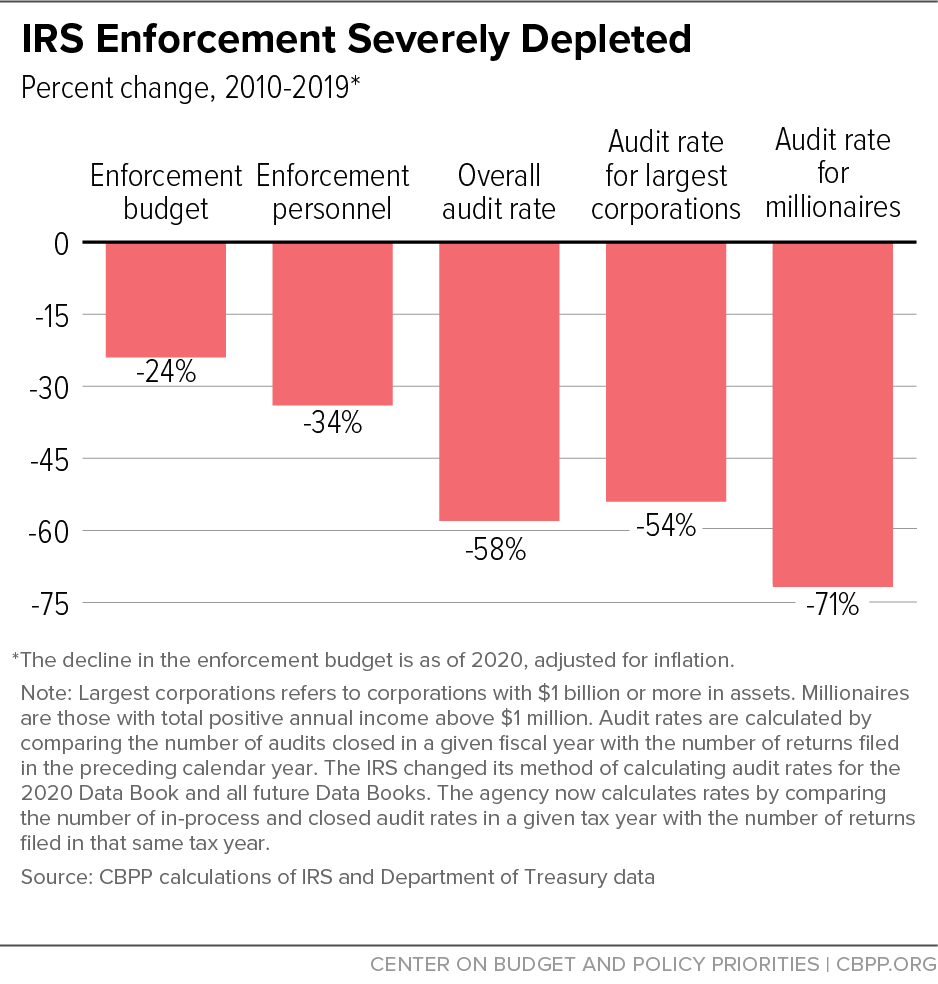

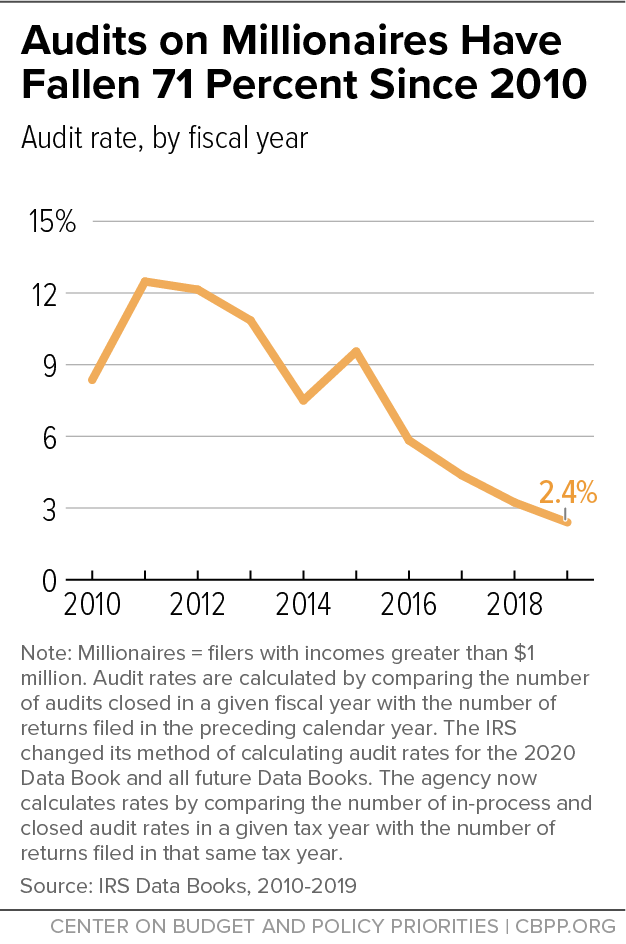

(130,651 posts)Defunded. Which is why what Biden pushed for so - to give them more $$$$ for operations - was so critical.

It has actually resulted in what has become "buried news" - a BUDGET SURPLUS - the last year or so, this latest for April reported yesterday being $210 BILLION -

By Viktoria Dendrinou

May 10, 2024 at 2:00 PM EDT

The US government recorded a higher budget surplus for the month of April than a year ago thanks to a rise in tax receipts, while steeper debt-servicing costs continue to impose a major drag.

The surplus for April — when individual tax filings are due — was $210 billion, up 19% from the same month last year. For the seven months in the fiscal year to date, the budget recorded a deficit of $855 billion, down 8% from the year before.

(snip)

https://www.bloomberg.com/news/articles/2024-05-10/us-april-budget-surplus-hits-210-billion-on-higher-tax-receipts

I think when Biden got in, the budget deficit was like $1.3 trillion and now it's down to $855 billion.

republianmushroom

(14,124 posts)Eight to sixteen years ago, not in 2017 to 2021.

BumRushDaShow

(130,651 posts)Remember the Lois Lerner brouhaha? https://abcnews.go.com/blogs/politics/2013/05/irs-planted-question-about-tax-exempt-groups/

This was when the teabaggers were trying to game the system once the Kochs manufactured them in 2010 and that blew up what was left of the IRS.

republianmushroom

(14,124 posts)from 2008 to president.

BumRushDaShow

(130,651 posts)when the teabaggers came in and blew it all up. They had the Senate only until 2014 when they lost control and Turtle blew up almost every Obama appointee nomination.

onenote

(42,940 posts)2008: $11.09 billion/$31.1 billion

2009: $11.60 billion/$26.9 billion

2010: $12.15 billion/$29.1 billion

2011: $12.12 billion/$31.10 billion

2012: $11.82 billion/ $30.44 billion

2013: $11.20 billion/ $31.40 billion

2014: $11.29 billion/$33.20 billion

2015: $10.20 billion/ $35.74 billion

2016: $11.20 billion/ $37.26 billion

BumRushDaShow

(130,651 posts)Note the IRS staffing per capita during the past 20 years (through to 2021) that has taken a hit - https://www.taxpolicycenter.org/fiscal-fact/irs-workforce-over-time

Additional data/analysis - https://www.cbpp.org/research/federal-tax/the-need-to-rebuild-the-depleted-irs

Economy Feb 6, 2024 6:26 PM EDT

WASHINGTON (AP) — The IRS is poised to take in hundreds of billions of dollars more in overdue and unpaid taxes than previously anticipated, according to new analysis released Tuesday by the Treasury Department and the IRS.

Tax revenues are expected to rise by as much as $561 billion from 2024 to 2034, thanks to stepped-up enforcement made possible with money from the Democrats’ Inflation Reduction Act, which became law in August 2022.

The Congressional Budget Office in 2022 estimated that the tens of billions of new IRS funding provided by the IRA would increase revenues by $180.4 billion from 2022 to 2031. The IRS now says that if IRA funding is restored, renewed and diversified, estimated revenues could reach as much as $851 billion from 2024 to 2034.

Administration officials are using the report to promote President Joe Biden’s economic agenda as he campaigns for reelection — and as the IRS continually faces threats to its funding.

(snip)

https://www.pbs.org/newshour/economy/irs-expects-to-collect-hundreds-of-billions-more-in-unpaid-taxes-thanks-to-new-funding

IR-2024-130, May 2, 2024

(snip)

More audit focus on wealthiest taxpayers, large corporations, partnerships

The report also notes that the IRS anticipates increasing audits on the wealthiest taxpayers, large corporations and large, complex partnerships by sizable percentages for tax year 2026:

The plan highlights the IRS will nearly triple audit rates on large corporations with assets over $250 million to 22.6% in tax year 2026, up from 8.8% in tax year 2019. The IRS will increase audit rates by nearly ten-fold on large, complex partnerships with assets over $10 million, going from 0.1% in 2019 to 1% in tax year 2026. The IRS will increase audit rates by more than 50% on wealthy individual taxpayers with total positive income over $10 million, with audit rates going from an 11% coverage rate in 2019 to 16.5% in tax year 2026. At the same time, the IRS continues to emphasize the agency will not increase audit rates for small businesses and taxpayers making under $400,000, and those rates remain at historically low levels.

(snip)

https://www.irs.gov/newsroom/irs-releases-strategic-operating-plan-update-outlining-future-priorities-transformation-momentum-accelerating-following-long-list-of-successes-for-taxpayers

Underfunding meant squeezing blood from turnips.

The funding that you show is "day to day operations" (FTEs for program work) with little or nothing to modernize/update systems which was dealt with through $80 billion from the IRA (some of which was removed with the last debt ceiling nonsense).

Jory Heckman@jheckmanWFED

March 21, 2024 2:27 pm

Congress is looking to make good on its promise to cut to the Internal Revenue Service’s multi-year modernization funds — as part of a bipartisan deal made last year. Lawmakers, in the second and final round of government spending bills for the rest of fiscal 2024, plan to cut $20 billion in funds the IRS got in the Inflation Reduction Act to rebuild its workforce and modernize its legacy IT. The agency still has roughly $60 billion to meet its modernization goals.

The Biden administration agreed to these IRS cuts, as part of a deal with congressional Republicans last year to raise the debt ceiling and avoid an unprecedented default on the federal government’s debts. Rather than spread the cuts to IRS modernization funds, as lawmakers originally agreed to, the 2024 spending bill includes the full $20 billion reduction.

Despite approving this deal, the Biden administration is asking Congress to reverse the $20 billion cut to IRS funding, as part of its 2025 budget request. Congress plans to keep the IRS at current funding levels for the rest of the year with a $12.3 billion annual budget for its day-to-day operations. The Biden administration also proposed keeping the IRS annual budget flat in its 2025 spending proposal.

Sen. Chris Van Hollen (D-Md.) said in a press release Thursday that the spending deal gives the IRS the funding it needs to keep improving customer service, replace outdated computer systems and crack down on tax cheats. “This bipartisan legislation invests in these critical priorities for our nation and more,” Van Hollen said. The IRS has used its Inflation Reduction Act funding to grow its workforce to 90,000 employees for the first time in a decade. Reuters recently reported the agency plans on reaching a 100,000-employee workforce within the next three years.

(snip)

https://federalnewsnetwork.com/budget/2024/03/congress-proceeds-with-20b-cut-to-irs-modernization-fund-in-fy-2024-spending-deal/

bhikkhu

(10,730 posts)...as far as the run-down on what forms I needed to file that under, how to handle depreciation and expenses and so forth. I had studied tax law back in the 90's, but they keep changing things, and I was able to call the basic information line and get routed to a help desk for business filings. The people were really nice and informative.

In 2022 I shut that down, and had a whole lot of questions on how to report various aspects on my taxes. Also, it came at a time of the year when tax people were all busy and I couldn't find anyone in town who was taking new clients. I decided I'd try to figure it out myself, and ask the IRS anything I didn't know.

It didn't work like it had before. As soon as I asked any kind of complicated question I got transferred to the "advanced tax matters desk", which, in fact, was just a recording telling me to go look at the FAQs online. Nobody worked there any more. It wound up taking two months to wade through my taxes. On the first try I messed up a form and they said I had to re-file, then they said I owed $2,000 more. But nobody there was able to explain why, and when I re-did the whole thing from scratch it looked like they owed me $2,000 instead; I sent an amended return in with a big long letter explaining the reasoning, and asking for them to explain there's if they didn't agree. Nine months later, after hearing nothing, they sent me a check for $2,000.

Then I got another letter from then saying they'd found an error, and I was getting another $1,700 back (which I still haven't got). Anyway, the short story is that it used to be easy to get help, and things weren't that complicated. Now it seems like nobody even works there that knows what they're doing.

BumRushDaShow

(130,651 posts)but for years and years, there was quite a bit of contracting-out of government services that used to be done by civil services FTEs like in the IRS and FBI (for background checks), and depending on that contractor, YMMV.

erronis

(15,595 posts)I haven't compared the contents of the stories but since this was a collaboration I'd expect a lot of consistencies.

BumRushDaShow

(130,651 posts)(just checked) ![]()

erronis

(15,595 posts)I thought that many references to their collaboration had the NYT author as first listed, then ProPublica's. My guess is that those references would be reversed in the other publication. Thanks for checking!

ZonkerHarris

(24,356 posts)oasis

(49,609 posts)FakeNoose

(33,051 posts)Somebody else could buy it, take his name off, and make it into a nice property.

They could afford to pay taxes on it too.

Just sayin'

![]()

![]()

Yo_Mama_Been_Loggin

(108,752 posts)Waiting for his "Go fund me" page.