An Alarming Percentage of Divorcees Say Student Loans Ended Their Marriage

Source: Business Insider

8 hrs. ago.

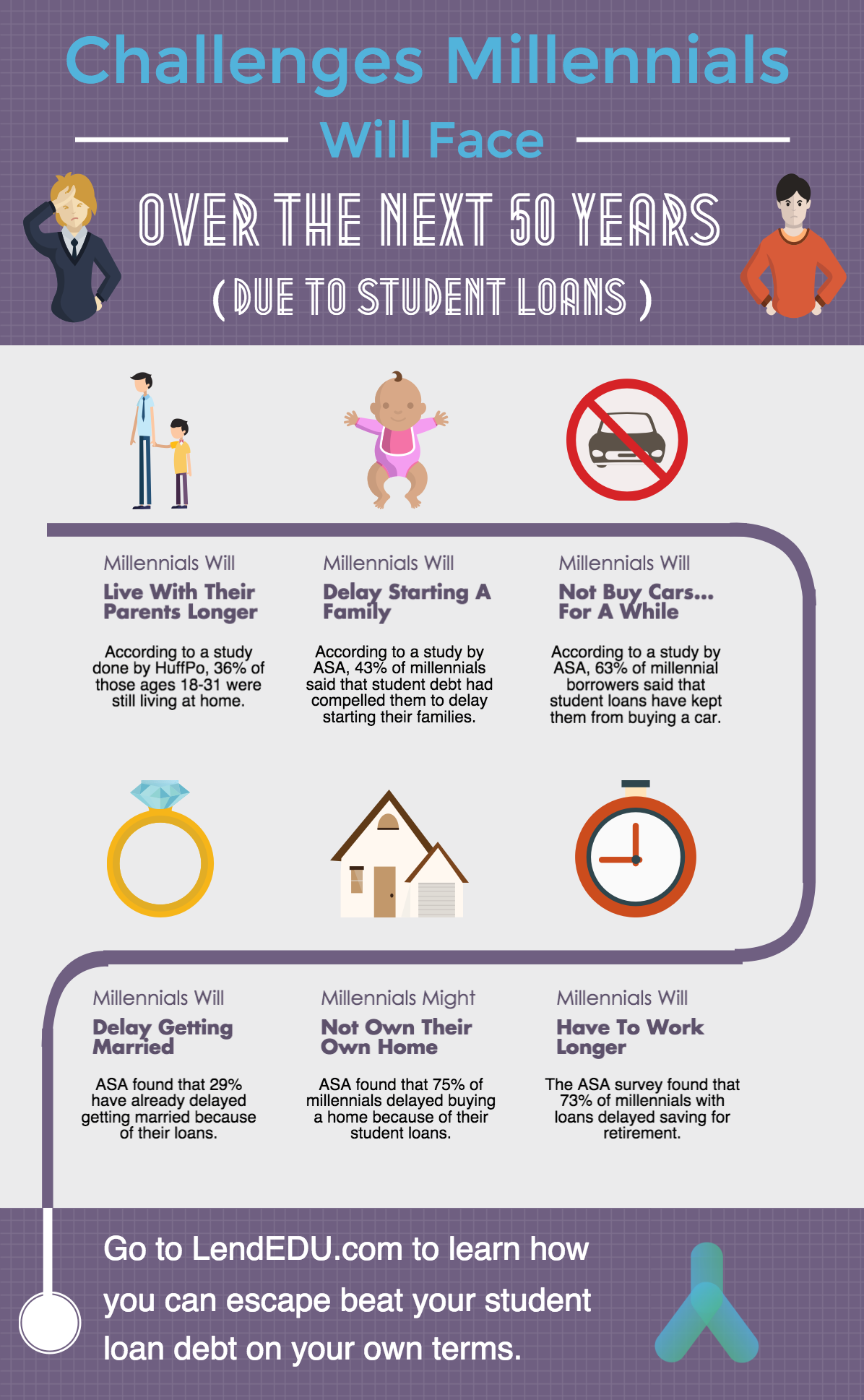

Financial problems have long been a common cause of divorce, but there's a new money factor wrecking marriages that arguably wasn't as prevalent a generation ago: student loan debt. According to a new report by Student Loan Hero, 13% of divorced borrowers cited their student loan debt in the dissolution of their marriages.

This may come as no surprise in an age where student loan debt is climbing -- more than 44 million Americans are saddled with student loan debt, contributing to a whopping national total of $1.5 trillion. Not only has the percentage of students taking out student loans increased over the past decade, but so too has the amount of money they've been borrowing, Business Insider previously reported.

According to the Student Loan Hero report, the class of 2017 graduated with an average of $39,400 in student loan debt. It's easy to see how a number like that can take a toll on marriage. "Student loans can really hold you back," Jacqueline Newman, managing partner of Berkman Bottger Newman & Rodd in New York, told CNBC, adding that the burden can especially influence a newly married couple's lifestyle and delay buying a home or having kids.

The stats back Newman up. Millennials are waiting longer to buy homes, not only because the cost of housing has gone up by 39% since the 1980s but also because they're saddled with student loan debt....More...

Read more: https://www.msn.com/en-us/money/bills-to-pay/an-alarming-percentage-of-divorcees-say-student-loans-ended-their-marriage/ar-BBLk4d5

"I don't feel comfortable taking a loan on a house while having student loans," said one respondent who owes $32,645 in debt and is on a five-year payment plan to pay it off before buying a house.

The same for starting a family. Based on a NYT survey, respondents who didn't want children or were unsure about having children 13% said it was because they had too much student debt. Many others said they couldn't afford more children.

In a previous Student Loan Hero study, 36% of respondents lied to their partner about money and nearly one-fourth kept their student loans a secret from their partner.

gopiscrap

(23,758 posts)dalton99a

(81,475 posts)ProudLib72

(17,984 posts)I'm going through a divorce right now, and I know that student loan debt contributed at least indirectly.

Crutchez_CuiBono

(7,725 posts)From the sounds of things, a good 4 year undergrad degree is 100k+

And dt is unleashing the hounds on the borrowers.

A life choice shouldn't be school or a family, or a degree without food.

We need a big big change. Glad I'm not young anymore, and so sorry it's come to this for our children.

Drahthaardogs

(6,843 posts)You can attend a Jr. College for almost nothing and then transfer into a state University. My kids did it and had no loans.

The problem is kids want the out of state college experience. Times have changed and that is no longer an option.

CozyMystery

(652 posts)She finished at community college ($6K per year for a full-time student).

She transferred to a crappy public university because it was "cheap".

Her student aid and Pell grant left $16,000 a year to be paid by her. The government student loan approved was $5K. She couldn't get a private student loan because she didn't have a credit rating (no credit cards or other loans). We couldn't co-sign for her.

The cost of the school, noted above, included a dorm room shared by 3 other students.

The school is only an hour away, but we don't have a second car to give or loan to her.

So she's been working since, saving for a car. There are no full-time jobs -- just part-time low wage jobs that have no benefits. She got fired from the last job, which she loved, for reporting various workers for neglecting nursing home residents. Now she is working part-time as a maid at a hotel and part-time at a retail store.

My mother suggested that she work to pay for school. She doesn't make $16,000 a year after taxes, so it will take a long time before she can return to school.

To top it off, she is making monthly payments on a $9,000 hospital bill to a collection agency -- her deductible on the health insurance we paid (at the time) $1500 a month for, for 4 members of our family, under the ACA last year.

This year she got a Pell grant and she is going back to community college to take more courses. That's if the community college will approve her grant -- it's always jump through hoops time, and now they want tax transcripts from us (her parents) and her -- before they decide whether she gets the grant she was awarded. The school sent her a letter about this yesterday, and school starts in a couple of weeks.

Why they want a tax transcript is beyond me -- we already gave them access to our tax returns through FAFSA, but that isn't good enough.

It's a mess. And no, scholarships aren't readily available and neither are colleges with more financial aid money.

She is seriously considering moving to Wyoming because after a year of residency, she can go to a much cheaper public university, compared to the costs of a public education here.

This whole situation pisses me off.

xmas74

(29,674 posts)They have access whenever but I had to a transcript for 2016. Classes start in two weeks and it can take that long to go through verfication. Btw-we filed our Fafsa in November and just now were informed about this .

a la izquierda

(11,794 posts)$50K in debt for four years. Then add a masters and PhD.

I’ll never pay mine off. I am a university professor at a large state school. I can’t afford a house and chose not to have children. All because I mortgages my future.

I regret it immensely.

smirkymonkey

(63,221 posts)was sick of working and didn't really think it through. I got a master's degree in a field that wasn't very lucrative and that I have never used, however it was an expensive mistake that I will always regret. I was an idiot and now I am paying for it. The biggest mistake of my life.

appalachiablue

(41,131 posts)people who are the future of the country. This isn't the case in many advanced nations in Europe, Canada and other places where college is mostly tuition free and it's recognized that educating the young will greatly benefit society overall.

American student loan debt on this scale never existed before Reagan and the 1980s when funding from taxes that previously supported US colleges became reduced more and more. I know from five people in my generation, plus their spouses who all left college, 1967-1985 with little to no student loan debt, even those who pursued graduate studies. It's poor policy, short sighted and unjust.

appalachiablue

(41,131 posts)Last edited Sat Aug 4, 2018, 10:03 PM - Edit history (1)

- ROLLING JUBILEE- A bailout of the people by the people:

Rolling Jubilee is a Strike Debt project that buys debt for pennies on the dollar, but instead of collecting it, abolishes it. Together we can liberate debtors at random through a campaign of mutual support, good will, and collective refusal.

Our latest project The Debt Collective aims to build collective power to challenge the way we finance and access basic necessities such as housing, medical care and education. Join us as we imagine and create a new world based on the common good, not Wall Street profits.

Learn more. http://rollingjubilee.org/

- STRIKE DEBT - You are not a loan:

Strike Debt is a nationwide movement of debt resisters fighting for economic justice and democratic freedom.

Debt is a tie that binds the 99%. With stagnant wages, systemic unemployment, and public service cuts, we are forced to go into debt for the basic things in life — and thus surrender our futures to the banks. Debt is major source of profit and power for Wall Street that works to keep us isolated, ashamed, and afraid. Using direct action, research, education, and the arts, we are coming together to challenge this illegitimate system while imagining and creating alternatives. We want an economy in which our debts are to our friends, families, and communities — and not to the 1%.

Learn more. http://strikedebt.org/

PoindexterOglethorpe

(25,853 posts)But I really must say this. That it simply isn't necessary to take on the kind of debt so many students take on. First off, start out at your local community college. Yeah, they cost more than they should but they are still a fraction of the local state university. Second, think REALLY hard about your major. Will it lead to a job? Really? How many jobs are there in that field? What are some alternatives?

I am beyond frustrated that so many young people are bedazzled by the bullshit about the necessity of a four year degree. Without ever considering what sorts of jobs are out there in their field.

Community colleges are amazing for many reasons, not the least of which is that they offer certificate programs (some as short as six months) and two year degrees in fields that lead to actual jobs that pay decent money. Alas, the bullshit meme in this country is that *everyone* must have a four year degree. Sigh. Not true.

I have more than once attempted to reality check parents about this, and almost always come up against a brick wall. It's a profound and essential problem of our culture.

JI7

(89,248 posts)such as trade schools.

Harker

(14,015 posts)The aura of "prestige" with any commodity is both alluring and costly.

EllieBC

(3,014 posts)I have seen it less in Canada but in the US, trade school is looked down upon while a pricey degree is held up as the better choice.

MariaCSR

(642 posts)Sunlei

(22,651 posts)plus when one has good grades in their local college classes, doors open for scholarships & Future Universities.

PoindexterOglethorpe

(25,853 posts)work full time and go to school part time. Especially while attending a community college. You should be able to support yourself and pay for school as you go along.

Every so often I'll meet someone who is completely convinced she must complete her degree within some tight time frame. And that's why she's taking 22 hours a semester and borrowing every penny needed to pay for everything. Unless there's a very lucrative job at the end (such as if you're in medical school or law school) you're vastly better off going part time and incurring little or no debt.

I've been preaching this for at least 25 years now, and it seems as if no one ever gets it.

Sunlei

(22,651 posts)spent a couple years working fulltime & took CC night classes, fall, spring & summer sessions. 2 classes at a time. Those CC transcripts (good grades!) paved the way into colleges like Baylor College of Medicine for more advanced classes.

I wish more people would take even one CC class, it's always good to learn!

PoindexterOglethorpe

(25,853 posts)offer most of their classes also at night and perhaps on weekends. Making it more than possible to get a degree if you work a regular day job.

What I liked best about attending community college vs a large public university, is that the quality of teaching is as good if not better, especially in the very basic core classes.

meadowlander

(4,395 posts)Eighteen year olds are crappy at working out what they want to do for the rest of their lives anyway.

I majored in Classics because of the Indiana Jones movies. And I got a masters degree in English because I was depressed and didn't think I'd be able to get a job in the "real world".

But I'm glad I studied those things now, even though neither degree directly led to a job, they led to who I am now. I still like to read poetry which has made my life more enjoyable. And I can write and argue well which is useful for more or less any professional career.

And I'm still paying off student loan debt in my 40s but I'm able to do it because my college degrees helped qualify me for a job where I make three times what I would have made without them. And I love my job to boot.

The point is that everyone should have the opportunity to study what they love until they're 21. If, because of longer lifespans, kids today are going to be expected to work until they're 80 (an extra 15 years), they should get an extra 4 years to work on their soul and decide what they want to do with their lives.

PoindexterOglethorpe

(25,853 posts)Just don't lose sight of the fact that once you're out of school you will need to earn a living.

Parents need to make it crystal clear to their kids that they'll pay for only a certain amount of college, and after that the kids are on their own. I am constantly amazed at the aging parents who continue to support their kids financially.

My younger son majored in psychology (and he told me when he chose that major that it was what students who didn't know what they wanted to do majored in) and minored in marketing. Summers he worked delivering pizza. After he graduated (cum laude, I will brag) he continued to earn his living delivering pizza. The important thing was that he earned his own way, because he knew perfectly well that if he asked his parents for money we'd tell him to get a second job. Or a different job.

And I really doubt that today's kids will be working until 80. Some, yes. But most of them? No. Even now, the commonest age to collect Social Security is 62. 42% of men, and 48% of women start collecting then. And only 4.6% of women and 2.9% of men hold out until age 70. Personally, I'm astonished at how many people rationalize collecting as early as possible.

meadowlander

(4,395 posts)the average lifespan is going to be twenty or thirty years longer than it is now. It won't be unusual for people to live over 100 or even 110-120. There's a pretty good chance that most cancers will either be cured or will be something you just live with instead of a death sentence. The prognosis for diseases like diabetes and heart disease are already much better than they were even ten years ago. Alzheimers is much closer to being manageable, etc.

Most people aren't going to be able to earn enough in a forty year working life to support a sixty year retirement especially as health care costs continue to increase.

While it would be nice to think we can hold the average retirement age to 62 or 65, I don't think that's realistic. I think semi-retirement is going to become more popular - people start cutting hours and tapering off for the last five or ten years instead of retiring altogether in their sixties.

So if we are anticipating that kids are going to be working much longer, they should get longer to work out what they want to do and train for it.

There's also the fact that there's a lot more stuff that kids need to learn now in order to be a functioning member of society. I think part of the reason we're stuck with Trump is that we've been squeezing out civics, philosophy, history, geography, foreign languages, etc. in favor of STEM. We need to give kids more time to learn what they need to be a good citizen and that should be publicly funded instead of saddling either kids or their parents with massive debt.

PoindexterOglethorpe

(25,853 posts)that much.

Keep in mind that the increase in life span over time has almost entirely come from a huge decrease in infant and childhood mortality. When you read that the average lifespan at some point in the past was 25 (as in perhaps Roman times), it wasn't that people were old by that age. It was because so very many of them died very young.

Our current lifespan is as great as it is because most babies born (at least in first world countries) live to grow up. Which is a good thing, in my opinion.

But in a lot of jobs, staying in the workplace to age 80, or even age 70 just isn't realistic. The very fact that so very many people start collecting Social Security at the earliest possible age is telling. The truly shocking thing, in my opinion, is that only 4% or women and 2% of men wait until age 70 to collect, despite a pretty impressive financial incentive to do so.

The other thing that bothers me a lot is the constant statement that at some point Social Security won't be there for younger workers. If you buy into that bullshit, you'll let it be taken from you. I am turning 70 this month (and will finally start collecting my own SS in September) and fifty years ago people my age were saying the same thing. It enraged me then, and it enrages me now. There are many solutions, starting with raising the cap on wages that are taxed.

I am not so sure that STEM subjects have actually squeezed out anything. (Although I wouldn't be surprised to be shown wrong here.) Schools have used lack of funding to eliminate art and music (but oddly enough, not sports). History has always been badly taught in this country. Too often the history teacher is called "Coach". Foreign languages are often poorly taught and seem no longer to be required to graduate from most public high schools, alas. No wonder so many ignorant Americans freak out when they hear someone speaking some other language.

It is, as we all recognize, a complicated problem that won't be solved quickly or easily.

Nash Teeth

(57 posts)Seems more realistic to assess quality of communication, empathy, conflict resolution, disregard for spousal input, or even just the "Four Horsemen of The Apocalypse" that emerged from Gottman's research on couples.

Those who blame their loans could have a pattern of choosing to blame outside influences instead of themselves. "External locus of control" people.

Maxheader

(4,373 posts)Went to college twice...didn't finish the first time,

finished the second..And made damn sure I got

a check to whoever..once a month. It wasn't easy,

it wasn't fun.

tblue37

(65,340 posts)christx30

(6,241 posts)My wife is doing an online college for a child development degree. Hasn’t worked a day since 2006. I don’t think she’s going to use that degree for anything. But the tutition bill is going to come due at some point. And that’s going to come out of the money I spend on rent and bills. Not looking forward to that.

Meanwhile I’m making close to $20/hr with no degree at all. Just being really good at my job.

hunter

(38,311 posts)My student fees were less than $1200 annually, thank you California, my housing was typically $80-125 a month, and I was pretty good at semi-skilled labor like loading and unloading trucks or maintaining crappy student housing, usually for $6 an hour or more. That was a lot of money then.

As a bonus, my grandma sent me $100 a month for food, and popcorn at the movies with a date, whenever I was actually enrolled in school. (My grandma was a hard ass about school, I was the first in her family to attend university, and she expected to make a good show of it, even though I was as bat-shit crazy as she was.) I also got a few grants for textbooks and the like along the way.

I once flunked organic chemistry because I could make too much money cutting o-chem classes Tuesday and Thursday to move furniture. My first hundred dollar working day was moving furniture deep into overtime when I should have been studying o-chem.

My kids had very hefty scholarships but they still graduated from college deep in debt, and the employment they found while in school paid considerably less than what I got in inflation adjusted dollars.

I think college and technical school should be free for anyone at any age. In this modern world of automation and other technological miracles there are simply not enough good paying no-skill and semi-skill jobs to go around. College keeps people out of trouble and has great potential for graduating people who will make the world a much better place, not just the science, medicine, and engineering people, but the language majors, artists, and philosophers too.

doc03

(35,328 posts)an hour as a shift manager in a restaurant. Why don't colleges steer the kids to a field that offers some chance to get a job.

They bullshit these kids into going to college and all it does is put them in debt for the rest of their lives. She could have a CDL license and be making over $100000 a year driving a frac water truck to the gas wells.