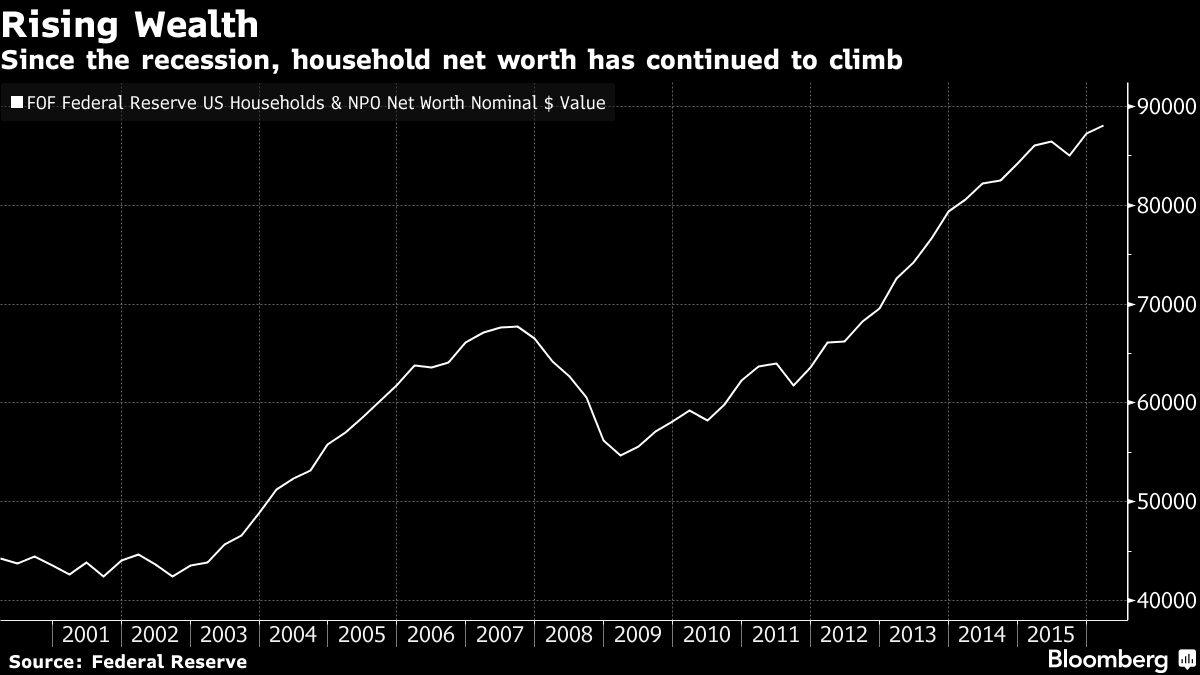

Household Worth in U.S. Rose by $837.4 Billion in First Quarter

Source: Bloomberg

Household wealth in the U.S. increased in the first quarter as rising real-estate values propped up Americans’ finances, figures from the Federal Reserve in Washington showed Thursday.

Key Points

Net worth for households and non-profit groups rose by $837.4 billion, or 1 percent, to $88.1 trillion in January through March from the previous three months, according to the Fed’s financial accounts report, previously known as the flow of funds survey

Value of financial assets, including stocks and pension fund holdings, increased by $299.5 billion

Household real-estate assets climbed by $477.5 billion; owner’s equity as a share of total real-estate holdings increased to 57.8 percent from 56.9 percent

Big Picture

With the Standard & Poor’s 500 Index up just 0.8 percent in the first quarter, household wealth was mostly supported by steadily increasing real-estate values as housing continues to recover from the financial crisis. However, a re-acceleration in job growth that also brings a significant pickup in wages will be needed to strengthen balance sheets further, especially for those without access to assets like stocks and homes

more...

http://www.bloomberg.com/news/articles/2016-06-09/household-worth-in-u-s-rose-by-837-4-billion-in-first-quarter

Read more: http://www.bloomberg.com/news/articles/2016-06-09/household-worth-in-u-s-rose-by-837-4-billion-in-first-quarter

jtuck004

(15,882 posts)Last edited Thu Jun 9, 2016, 06:47 PM - Edit history (1)

<G> I heard that here first.

This graph doesn't reflect at there are still nearly 50 million of our neighbors on food stamps,. Most of them working if they are able. And another 100 million who live either in poverty or among the "working poor", a number which is also increasing.

But that is probably good news for people with a lot of money who donated to political parties.

>"real-estate values as housing continues to recover"

Housing recovers, the people don't

https://newrepublic.com/article/112395/wall-street-hedge-funds-buy-rental-properties - Because then they can suck fees from you forever, making sure you NEVER own.

"Millennials and living at home: For the first time on record the most common living arrangement for young adults is living with a parent."

http://www.doctorhousingbubble.com/millennials-and-living-at-home-millennial-buying-homes-trends-money-housing/

Nearly 8 million FAMILIES have been foreclosed on since the politicians opened up the season on taxpayers for the bank$ter/jihadists, and from those foreclosures a small handful of companies are charging more than they should be for rentals - and keeping people from owning. Just like the black sharecroppers after the Civil War. And with much the same outcome.

newthinking

(3,982 posts)Also interesting: Why did they include non profit entities? To boost it up?

valerief

(53,235 posts)forest444

(5,902 posts)The U.S. is indeed still number one by far in terms of number of millionaire adults (14 million; compared to 2.5 million for the runner-up, France); but the median U.S. adult is now 27th in terms of net worth.

The number one cause for this lag (though certainly not the only one): astronomical health care costs.

Median net worth per adult (US$ 000), from the 2014 Credit Suisse Global Wealth Report:

Australia________225

Belgium_________173

France__________141

United Kingdom__131

Japan___________113

Singapore_______109

Switzerland______107

Canada__________99

Taiwan__________65

Germany________54

United States____53

Chile___________17

China___________7

Brazil___________5

South Africa_____4

World__________4

Russia__________2

Indonesia_______2

India___________1

http://s3.documentcloud.org/documents/1312773/credit-suisse-global-wealth-report-2014-1.pdf

elljay

(1,178 posts)but one of the most interesting. What I would like to know is whether this represents average or median net worth. I live in Silicon Valley where the price of housing has skyrocketed. You could truthfully say that the net worth of many of us has increased. However, to recognize that increase, we would need to quit our jobs, sell our homes and move to a different region or state. Our children will never be able to afford to buy homes in this area so our selling means that the entire family has to leave. And, when you average the appreciation of homes in places like the Bay Area, where starter homes cost at least 1M, with Idaho, South Dakota, Nebraska and other states that have substantially lower home prices, are we getting a "Bill Gates in the bar situation" (referring to the old joke about when Bill Gates and a homeless guy sit alone in a bar, the average net worth of bar patrons is 40 billion dollars)?

whatthehey

(3,660 posts)Instead of just assuming, it's here - and the change from 2000-2011 is an easy comparison

http://www.census.gov/people/wealth/data/disttables.html