General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsFor anyone who doesn't believe entitlements + interest on the debt will crowd out all other spending

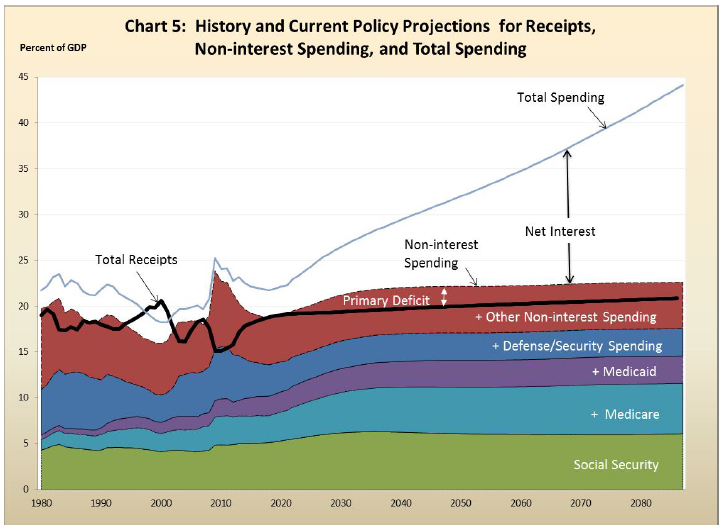

This chart is for you...

And if you doubt these numbers you can see its source page from the FEDERAL GOVERNMENT.

http://www.fms.treas.gov/fr/12frusg/12guide.pdf

On edit: And if you are concerned about interest on the debt you may want to reconsider the idea that the deficit doesn't mean anything.

unblock

(54,910 posts)First and foremost, federal budget projections 10 years out are notoriously guesswork even if you get away from politically motivated assumptions. Nevermind projections decades beyond that.

Second, why should we consider total receipts inflexible? This is based on no further changes in current law, but higher taxes are completely appropriate and necessary.

Third, why break the spending out that way and claim that any one thing crowns out any other thing? Why not say defense spending still crowds out other spending instead?

dkf

(37,305 posts)You can take defense and non entitlement spending down to zero and entitlements plus interest can still exceed projected revenue.

Moreover even in the days of 90% marginal tax rates, we didn't see revenues much above 20% of GDP.

And even if these numbers aren't perfect they are what we need to go by. What a nightmare if everyone decided to pick their own numbers.

unblock

(54,910 posts)And certainly higher revenue as a percent if GDP has been and impossible in other countries. It's certainly possibly here. Happenstance of the past is no bound on the future.

As for the assumptions and projections, administrations often use political assumptions depending on their agenda, new administrations use assumptions that differ from the previous administration, and yes, often there is some controversy over the assumptions. Shrub made overly optimistic GDP assumptions to keep his projected deficits down, e.g., to suggest his tax cuts weren't going to be the fiscal disaster that they were.

Is it challenging that we can't all agree on the assumptions? Sure, but that's one of the fundamental challenges of macroeconomics. You can't get away from it just by saying it's hard.

muriel_volestrangler

(103,377 posts)which would mean the public debt would be decreasing, not increasing, and the net interest would also be decreasing. The chart shows it getting to a balance between revenue and non-interest spending in about 2018 and 2019 anyway. The problem is that, after that, spending gradually increases, and revenue hardly does, so a primary deficit appears again, and so we find that - shock, horror - the government can't just sit on its ass after 2019 and say "everything is perfect, forever, there's nothing we need to change".

It could, for instance, decide to take a bit more revenue from the portion of the population that has had the vast majority of the increase in living standards over the past 30 years - the rich. It could cut defence spending a bit. Take in another 1% of GDP in taxes from the rich, and decrease defence spending by 1% of GDP, and you just about get there.

dkf

(37,305 posts)But how reasonable is that?

muriel_volestrangler

(103,377 posts)Eminently reasonable, I'd say. You don't have to collapse anything like all of discretionary spending to balance the budget; and you can increase revenue by a small amount (still leaving the US with a pretty low govt revenue % of GDP, for a developed country) and balance things even more easily.

2 suggested budgets: http://cpc.grijalva.house.gov/budget-for-all/ http://www.esquire.com/blogs/politics/how-not-to-make-america-great-0413?src=spr_TWITTER&spr_id=1456_7422116

Wounded Bear

(61,665 posts)and by the end of his term we were net postitive on income to payments and were paying down the debt.

It doesn't take that big of a bite to make it work.

dkf

(37,305 posts)He did it in the ACA. But it wasn't enough to make up for all of Bush's lost revenue that Obama made permanent under $450k/$400k.

I supported removing all the Bush cuts.

dawg

(10,777 posts)And last time I checked, neither of those countries was trying to maintain a dominant military presence across the entire globe.

While it is true that we never raised more than 20% or so of GDP back in those days, we could easily do so now, as every modern industrialized nation clearly demonstrates.

There is no modern nation today that is run "on the cheap" so much as the U.S.

If we simply raised taxes enough to cover our entire deficit and safety net, with no cuts at all, we would still be a relatively low tax nation.

Those are just the facts.

But rich Americans think they are "entitled" to keep their ridiculously low tax rates. And they are willing to subject the "losers" of our society to conditions that any other first world country would consider barbaric and intolerable.

And many here on DU rush to defend them.

Recursion

(56,582 posts)Discretionary spending is, well, discretionary, and out of our current hands. Entitlement spending we can set today; discretionary spending we can't.

unblock

(54,910 posts)Why not say "non-discretionary spending and interest on the accumulated national debt, largely due to shrub's reckless tax cuts and extravagant and pointless foreign military adventures, will necessitate higher revenues as a percent of GDP"?

There's nothing here to justify the conclusion that we can't find revenue to support the national endowment of the arts, e.g.

sabrina 1

(62,325 posts)deficit. That chart is from some right wing sight this OP linked to earlier.

Remove the green part at the end of the chart. This OP has been asked over and over again in my thread on SS to explain how SS contributed to the deficit, it didn't, and how it costs the Fed Govt anything, it doesn't. The only response we got to those questions were the old Republican scare tactics 'What IF the SS fund runs out' THEN it will cost the Govt etc etc

This is a democratic forum. Bringing this right wing bs here is a waste of time as most of us know the FACTS about SS.

1) It did not contribute to the Deficit, that is a Republican lie,

2) It does not cost the Fed Govt anything so doesn't belong on that chart listing Govt obligations.

The chart is meaningless so long as retains the blatant lie that SS is a Gov Spending problem. That is a Republican lie, which can't be said often enough but I'm willing to do it.

Recursion

(56,582 posts)Period. There's no arguing that.

magical thyme

(14,881 posts)But then when the seniors stop spending, business declines and revenues decrease. And then the deficit will increase again, due to declining revenues.

Not to mention that when young people start to realize that they *won't* be cared for in their old age, they will start refusing to pay in their fair share now. Not to mention that more seniors will postpone retirement, making it harder still for young people to get started in their careers.

There is no reasonable argument to cut social security. It should be increased to make way for the upcoming generations by enable people to retire sooner.

Recursion

(56,582 posts)I'm just tired of this hand wringing "why are we even talking about Social Security?": because it's one of our biggest expenses. And, frankly, if making middle class and rich retirees' payments increase more slowly than current policy is the price of a larger deal, I'm not terribly worried about that.

magical thyme

(14,881 posts)And more could be accomplished by lifting the cap on the few very well off than cutting benefits for many.

Dragonfli

(10,622 posts)Decreasing SS expenses will only affect the SS trust fund, the effect will be that the trust fund's surplus will grow even larger than it already is. Only items that are actually part of the budget can affect that budget's deficit. Don't allow a lie to conflate the two, especially such a well known Republican lie.

The lie is based on claiming not paying a debt is a form of income that will help balance the budget, SS does not borrow from the general fund, it is the other way around, and the trust fund has a surplus, of well over two trillion dollars.

magical thyme

(14,881 posts)I'm trying to explain that stealing from Peter will not, over the long run, fix Paul's bottom line. Because Paul, flush with Peter's cash, will just run off and start yet another war with it, gamble it on the ponies, and etc.

Dragonfli

(10,622 posts)Dragonfli

(10,622 posts)Your complete lie as I recall, requires that I believe that a debt owed to the trust fund is really a debt owed to the lender by the trust fund or some other such nonsense. SS does not borrow money from the general budget, it is the other way around.

SS makes payments from it's own fund, not from the budget. If SS benefits were cut in half, all it would mean is the trust fund would increase it's already large surplus. IT IS NOT PART OF THE BUDGET AND HAS NOTHING TO DO WITH THE DEFICIT OF A BUDGET THAT IS NOT IT'S SOURCE OF FUNDING. repeat that until you understand the basic logic of the truth.

By your ridiculous logic, (and I remember your argument from previous discussions) you turn debt into income by declaration claiming that reneging on one's debt will turn that debt into income.

That Enron style of accounting was found to be fraud in their case, not surprising because changing red ink to black on a ledger to hide ones debt IS fraud.

former9thward

(33,424 posts)Because they don't agree with you.

The long-run actuarial deficits of the Social Security and Medicare programs worsened in 2012, though in each case for different reasons. The actuarial deficit in the Medicare Hospital Insurance program increased primarily because the Trustees incorporated recommendations of the 2010-11 Medicare Technical Panel that long-run health cost growth rate assumptions be somewhat increased. The actuarial deficit in Social Security increased largely because of the incorporation of updated economic data and assumptions. Both Medicare and Social Security cannot sustain projected long-run program costs under currently scheduled financing, and legislative modifications are necessary to avoid disruptive consequences for beneficiaries and taxpayers.

Social Security’s expenditures exceeded non-interest income in 2010 and 2011, the first such occurrences since 1983, and the Trustees estimate that these expenditures will remain greater than non-interest income throughout the 75-year projection period. The deficit of non-interest income relative to expenditures was about $49 billion in 2010 and $45 billion in 2011, and the Trustees project that it will average about $66 billion between 2012 and 2018 before rising steeply as the economy slows after the recovery is complete and the number of beneficiaries continues to grow at a substantially faster rate than the number of covered workers.

http://www.ssa.gov/oact/trsum/

Dragonfli

(10,622 posts)They did not change the law with those assumptions (that's all they are, extremely pessimistic assumptions)

It is a projection that assumes some really serious problems due to an accelerated increase of medical costs (the price of letting Drug companies, hospitals and Insurance companies set the price and encouraging them to rob us blind).

Changes do likely need to be made to slow the feeding frenzy encouraged by the last two administrations. How soon depends on more than pessimism and worse case scenario projections.

If changes aren't made and we don't rewrite laws written by lobbyists then eventually, disruptive consequences for beneficiaries and payroll taxpayers(FICA) will be the price.

You do realize that is a 75 year projection period right? You also realize that "The deficit of non-interest income relative to expenditures" refers to how much of the trust fund's surplus must be used beyond money earned by interest on it's bond investments of course? You must also realize the money (non interest or otherwise) projected to be paid IS STILL NOT A PART OF THE GENERAL BUDGET BUT ALL PART OF A PROGRAM FUNDING ITSELF.

You haven't given me anything new regarding the Republican lie, just your own slick misrepresentation of the most recent and most pessimistic projections the Republican think tanks can get their hands on.

Your schtick is old, Republicans have used that same crap for twenty years, they assured me by the same misrepresentation techniques at several different times that the entire fund would be gone over ten years ago and SS would be long dead by now.

The only thing new is the lies and misrepresentations are coming from alleged Democrats as well as Republican in this thread.

former9thward

(33,424 posts)This is not some think tank. It is the SS website.

The only thing new is the lies and misrepresentations are coming from alleged Democrats as well as Republican in this thread.

When everyone else is part of a conspiracy theory then it is time to look at your beliefs (and "facts"![]() .

.

Dragonfli

(10,622 posts)Actually reading more than the post title helps with reading comprehension. ![]()

Recursion

(56,582 posts)This has absolutely nothing to do with the trust fund. Zero. Get that out of your head.

That's a social security check. It's from the Treasury.

Just as FICA levies gave us a budget surplus in the 1990s, SS outlays can give us a budget deficit today.

Dragonfli

(10,622 posts)Why are you so insistent on continuing this Republican lie?

I can't state who and what I think you are.

I do have a pretty damn good idea by now.

FICA GAVE THE TRUST FUND A SURPLUS IN THE NINETIES.

You fucking know that and you sure as hell know that surplus was borrowed and that debt held in the form of treasury bonds bearing interest for the trust fund as An investment. It was not a gift but a fucking loan, you are not that stupid. I don't buy the fake obtuse angle

Vincardog

(20,234 posts)to do with the deficit. Everyone can have their own opinions but not their own FACTS.

Recursion

(56,582 posts)

That's a Social Security check.

It's from the Treasury. It takes money out of the General Fund and gives it to a recipient. The fact that some of that fund is notionally set aside for SS does not change the actual arithmetic involved.

Vincardog

(20,234 posts)bhikkhu

(10,775 posts)...because social security is an actual outflow of cash from the government.

The answer would be that it comes from the inflow of cash taken in FICA deductions from all current worker's paychecks. That works just fine as long as the inflow and outflow match. Once they don't, then SS payments are a net expense to the government, and they do have to be offset by something.

The only two "somethings" the government can do is take more in taxes, or it can sell treasury bonds. Raising the cap would increase the current inflow, but also, in a way, kick the can down the road a little by increasing payments to future retirees (assuming that benefits remain tied to contributions). Selling treasury bonds increases debt and interest payments.

The point where the cash going out exceeds the cash coming was somewhere around last year, a bit ahead of schedule due to the 2008 recession.

Dragonfli

(10,622 posts)"The answer would be that it comes from the inflow of cash taken in FICA deductions from all current worker's paychecks. That works just fine as long as the inflow and outflow match. Once they don't, then SS payments are a net expense to the government"

That is a well known Republican lie, when the inflow and outflow don't match they are not a net expense of the government, the difference is made up from SS's own surplus in such cases exactly as intended, to pay differences from the general fund would require that the law be changed, SS is not allowed by law to go outside it's own intakes and surplus.

I apologize that you were taken in by a Republican lie being repeated here by those I can only assume are trolling Republicans. Once, their lies were not repeated here and therefore did not become false axioms in discussions here.

bhikkhu

(10,775 posts)...so it depends on what kind of financial statement you look at as to what the difference is. On a balance sheet, bonds and cash are equivalent, so there's no impact.

On a cashflow statement, however, when the cash coming into the system is exceeded by the cash going out, the difference has to be made up somehow. In this case, its made up by selling US treasury bonds, or converting them to cash. Selling bonds is one of the ways we finance the deficit, and one way or another (and there are several ways to do it), raising cash to finance social security payments competes with raising cash to finance other government activities, now that we have turned the corner. It creates difficulties, that should be addressed one way or another in the long term.

Reducing SS benefits for the wealthy is one way of addressing it, reducing defence spending would be another, but doing nothing or saying there is nothing that needs done isn't sound policy.

Dragonfli

(10,622 posts)Lets start by avoiding redeeming bonds held by foreign countries and private investors then shall we?

The surplus is still the surplus and SS is still funding itself, the deficit remains the same, if you add to a deficit to pay your bills it doesn't mean you can avoid that truth by refusing to pay what you owe.

At best it is a fraudulent accounting trick at worse it is a deliberate lie to claim your creditor is to blame for debt you incur to pay him as agreed.

You don't appear stupid so, what gives?

bhikkhu

(10,775 posts)Cash flow turning to negative in one area of the budget requires adjustment of some other area of the budget. Again, its not a balance sheet (debt) issue, its about cash flow.

As mentioned, there's no need to address it on the social security side of the equation, it could be addressed anywhere else on the spending side. Military spending is the really big ticket.

"Avoiding redeeming bonds" is not an option; do that once, or even talk about it officially, and immediately US treasuries go from rock-solid 1.5% investments to junk. We can finance the deficit wonderfully now because our bonds are deemed uniquely trustworthy. Default on bonds and, justifiably, we'd be down there with Spain and Greece trying to get loans on punitive terms, just to stay afloat.

Fraud, lying, refusing, stupid, etc, - none of those contribute to understanding the argument.

Dragonfli

(10,622 posts)"Avoiding redeeming bonds", when you talk about "adjusting" SS as an option to borrow less to redeem less as a means to balance the budget.

It is most certainly a lie, the only thing that is true is "Avoiding redeeming bonds" is not an option.

Stop spreading that Republican lie please.

muriel_volestrangler

(103,377 posts)"Discretionary spending is, well, discretionary, and out of our current hands."

No. Just stop, and think about the meaning of the word 'discretionary'. Discretionary spending is the spending that can be changed most easily. Far from being "out of our current hands", it's the first thing to examine. And over half of it is discretionary military spending - which, notoriously, the USA spends far too much on (at times approaching 50% of the world's military spending, and still typically measured as "more than the next X countries combined" - with X being around 10; and then we point out 7 or 8 of those countries are allies of the USA).

Entitlement spending, set by a formula, is what is harder to change. You can change the formula, by law - it's not in the constitution - but to do so is to break an implicit promise to US citizens. And so it's much harder.

Recursion

(56,582 posts)That's exactly what "discretionary" means. If Congress disappeared today, SS spending would continue forever.

muriel_volestrangler

(103,377 posts)Do you think that the idea is to say "they might go wild in 10 years' time, so we should not do anything with the discretion we have now, and instead try to restrict spending on the stuff that people will actually need to stay alive"?

It's not the job of the present to make it impossible for the future to be irresponsible. Cut defence spending now, and you then set an example for the future - they can say "oh, look, we cut defence spending, and no-one invaded the USA after all, looks like we can keep it cut".

Recursion

(56,582 posts)Congress passes future discretionary "cuts" all the time that future Congresses simply ignore, but changes to mandatory spending are more locked-in (not that the new Congress can't change them, but if they don't proactively change them they stay; each new Congress has to proactively authorize discretionary spending each year).

That said, if we keep just doing everything by Continuing Resolution, that distinction becomes less important...

Rex

(65,616 posts)Last edited Sun Apr 14, 2013, 03:13 PM - Edit history (1)

FUD.

EDIT - Oh and you got TORE UP in your own thread!!! ![]()

Maybe next time try skipping the RWing talking points...they are really sadz.

Lasher

(28,741 posts)Last edited Sun Apr 14, 2013, 06:41 AM - Edit history (1)

And you forgot to link your source: A Conservative Libertarian Think Tank that fronts for Microsoft and David Koch.

DreamGypsy

(2,252 posts)Yes, dkf did link to "A Conservative Libertarian Think Tank that fronts for Microsoft and David Koch." to get the diagram. However, the original diagrams shown on that page originated in the US Dept of the Treasury report, for which dkf provided a link to the pdf.

The Treasury Department also has an html version of the report and the two charts from the CL Think Tank website are on this page:

http://www.fms.treas.gov/finrep12/citizenguide/fr_citizen_guide_where_we_are_headed.html#chart5

The appearance of the charts in the html is different from the pdf versions, but the content is the same.

So, the original source of dkf's chart is the U.S. Treasury report, as he asserted.

Here's the link to the full set of quick links to the Treasury's html version of the report: http://www.fms.treas.gov/finrep12/citizenguide/fr_citizen_guide.html if you'd like to read it on line. There is also an eBook download available there.

Lasher

(28,741 posts)Figures don't lie, but liars figure. Here is a different take on the very same issue, from a website that doesn't get marching orders from David Koch:

The CBO's latest budget projections are out today. Here's the scary debt chart:

Hmmm. Not so scary after all. The CBO's projections are, of course, sensitive to both their economic forecasts and their reliance on current law. However, their economic forecast seems fairly conservative, and current law is a lot more reliable now than it was before we decided what to do about the Bush tax cuts. So CBO's projections are probably fairly reasonable.

You can decide for yourself, of course, whether you find this debt projection scary even though it's flat for the next decade. Maybe you think it needs to decline to give us more headroom for the future. Maybe you think it masks the problem of growing debt after 2023. Maybe you think we're likely to have another recession over the next decade, which will balloon the debt yet again.

Those aren't entirely unreasonable concerns. Still, the fact remains that debt reduction just isn't a five-alarm fire kind of problem, no matter how loudly the Pete Petersons of the world claim otherwise. In fact, if you go to page 23 of the CBO report, you'll see that federal spending is on a downward slope in almost all categories. Aside from interest on the debt, the only spending that's projected to increase is Social Security (a little bit) and healthcare spending (a fair amount). Of those, the Social Security spending is baked in the cake and there's nothing much we can, or should, do about it. Seniors should get the pensions they've been promised.

http://www.motherjones.com/kevin-drum/2013/02/cbos-scary-debt-chart-not-looking-very-scary-these-days

DreamGypsy

(2,252 posts)...or that the Mother Jones article is spinning the data to support its purposes.

It just happens that the charts shown on the MyGovCost site, labeled Chart 5 and Chart 6, are exactly the same as the charts identically labeled on pages 5 and 6 of the pdf for A Citizen's Guide to the 2012 Financial Report of the U.S. Government downloaded from the US Treasury website. Did you happen to notice that? Yes, they made a copy of the graphics ... probably because they couldn't link directly to the pdf.

Both charts appear in the section of the report entitled Where We Are Headed, which begins on page 5 (well, actually page v - the page numbers are Roman numerals). The text on pages v and vi that surround the first graphic reads as follows:

Chart 5 shows historical and current policy projections for receipts, non-interest spending by major category, and total spending expressed as a percent of GDP. The difference between the receipts and noninterest spending shares of GDP - the primary deficit-to-GDP ratio, grew rapidly in 2009 due to the financial crisis and the recession, and the Federal Government’s response. The ratio stayed large from 2010 to 2012 despite shrinking in each successive year, but is projected to fall rapidly between 2013 and 2018 as the economy recovers and spending reductions called for in the BCA take effect, reaching primary balance in 2018, and remaining relatively flat and near zero until 2021. Between 2022 and 2039, however, increased spending for Social Security and health programs due to continued aging of the population and anticipated rising health costs is expected to cause the primary deficit- to-GDP ratio to steadily deteriorate, reaching 2.3 percent of GDP in 2039. After 2039, the ratio is projected to slowly decline to 1.7 percent of GDP in 2087 as the impact of the baby boom generation retiring dissipates. In these projections, the Affordable Care Act (ACA) 7 provision of health insurance subsidies and expanded Medicaid coverage boost federal spending, and other provisions significantly reduce per-beneficiary Medicare and Medicaid cost growth. Overall, the ACA is projected to substantially reduce

federal expenditures over the next 75 years. However, as noted in the Report, there is uncertainty about the effectiveness of the ACA’s provisions designed to reduce health care cost growth. Even if those provisions work as intended and as assumed in these projections, Chart 5 still shows a persistent gap between projected receipts and total non-interest spending.

The chart shown by Mother Jones is from http://www.motherjones.com/files, the file is blog_cbo_public_debt_february_2013.jpg

As I highlight in bold in the text excerpted from the report, the Chart 5 data falls a bit and is flat until 2021, which is basically what the Mother Jones chart shows AND what Kevin Drum was banging on in the article. So, looks like Treasure Department and the CBO were talking to each other....which is a good thing. However, the Citizen's Guide covers projections out to 2080 and beyond (probably 2090, but that last label is missing) where things get more dicey and, of course, more vague.

My bottom line: Everybody who cares about the debt debate should download and read the Citizen's Guide and at least attempt to understand the implications. The guide is only viii pages. A lot more reading background reading material is available on the Treasury website.

BTW: The link " target="_blank">Here's the scary debt chart in the Mother Jones article actually gets to this diagram on the cbo website:

which is different, but provides the same data, just vertically rescaled

AnnieK401

(541 posts)On top of that, the US SS benefit is relatively stingier than just about every other developed country. I have read from several sources that other countries replace closer to 60% of pre-retirement income, while we replace 40%. As for as Medicare, we are the only developed country PERIOD that does not have a Gov. sponsored health care program for every citizen. It is only guaranteed for those over 65. The costs shown are so high because, for one thing, we don't negotiate with big Pharma. There is also a lot of waste and fraud in the system.

freedom fighter jh

(1,784 posts)I know several people have said this above, but it bears repeating: The thing that's blowing up is interest. Why lump that together with entitlements and then point the finger?

Here's something else that bears repeating: Social security comes from a fund that is separate from the deficit. That fund comes from a tax that funded that is funded disproportionately by lower- and middle-income people. If you ask me, that arrangement is perverse in the first place. But the idea of taking that money away from the elderly and disabled who earned it and then using it for something else is more perverse. More perverse still is using it for the military to fund companies that build equipment to kill people.

Solution: Remove the cap on the payroll tax. Then the social security fund will be paid by everyone who has income. (Well, not everyone, but by people at all income levels.) And cut back on military spending because we aren't doing the world any good by spreading death all around. Those things should bring in and save enough money so that we can start paying down the debt and then have less interest to worry about.

dkf

(37,305 posts)So exactly who is arguing that increasing our debt level is fine? Not I.

freedom fighter jh

(1,784 posts)Why look to that program to fix the debt?

Why look to other entitlements? Why not look to programs that do more harm than good, like the military? Why not have corporations and wealthy people pay more than they do now?

Coyotl

(15,262 posts)This scenario varies according to interest rate projections.

GeorgeGist

(25,498 posts)Refinancing?

CTyankee

(65,912 posts)As Paul Krugman so correctly points out, we have an unemployment problem, not a spending problem. Dr. Krugman also has some thoughts on the out of control health care costs and how those can be better controlled (some of those unnecessary costs are currently being addressed in the ACA). Stop keeping Medicare from having the same negotiating power with big pharma that the VA has, for instance. Spread the Medicare program out to younger and typically healthier recipients (if not everyone).

We can do this. And you know who is really standing in the way of getting this done, don't you, dfk?

dkf

(37,305 posts)Debt is mostly often solved through financial repression, not through growth. Moreover the most important thing is how you spend the funds.

Rogoff and Krugman have been debating this and Rogoff has the empirical data at least. Krugman is going on theory.

CTyankee

(65,912 posts)never been wrong in that entire time. At times I wanted him to be wrong but he wasn't. If those are the odds with just "theory" well, they are the winners. However, I doubt they give out Nobel Prizes based on flimsy "theory."

In terms of what you spend money for, Krugman has made it abundantly clear that he thinks more should be spent on creating jobs during a deep recession. In fact, we have seen the suicidal economics of austerity working its way in Europe. Krugman, right again!

And even Obama agrees on the importance of debt. Isn't it the percentage of debt to GDP that is the most important?

Scuba

(53,475 posts)... covering both payrol and capital gains.

Let's say 50% on earnings over a million and 90% on earnings over 20 million.

Thanks for posting.

Cosmocat

(15,121 posts)as some have noted, there is no revenue generated from the interest on the debt.

All of the "entitlements" have revenue that comes with them.

It absolutely makes sense to knock down the debt as much as possible.

But, SS, with MINOR adjustments will completely self fund as long as it exists.

We have to pay for our elderly health care one way or another.

The adult discussion involves single payer, controlling the exuberant costs of health care in this country and people accepting the need to pay for health care, especially ahead of retirement.

These are two TOTALLY separate issues.

magical thyme

(14,881 posts)As I remember from Krugman, I think, long-term government projections are based on lower growth rates (read lower revenue) than we've ever had.

hobbit709

(41,694 posts)trumad

(41,692 posts)Let's just cut to the chase.

Do you think we need to cut SS?

leveymg

(36,418 posts)This from Nate Silver's 538 Blog you cribbed from yesterday: http://fivethirtyeight.blogs.nytimes.com/2013/01/16/what-is-driving-growth-in-government-spending/

Another surprise is how little we are paying in interest on the federal debt, even though the debt is growing larger and larger. Right now, interest payments make up only about 6 percent of the federal budget. In addition, they have been decreasing as a share of the gross domestic product: the federal government spent about 1.5 percent of gross domestic product in paying interest on its debt on 2011, down from a peak of 3.3 percent in 1991.

How is this possible? The reason is that although the government is borrowing a lot of money, it is doing so very cheaply because interest rates are low both over all and on government debt specifically. We’re now spending less than 2 percent of the principal annually to service our debt, down from a peak of close to 7 percent in the early 1980s. Borrowing costs aren’t expected to remain this low forever, so this ratio is bound to increase some. Fortunately, much of the debt we have issued has relatively long maturities, meaning that we have locked in low rates. (This won’t necessarily apply to future deficit spending: one of the consequences of failing to raise the debt ceiling would be a significant rise in borrowing costs, which would compound our debt problems later on.)

Which is it, a major threat to the economy or a small and declining burden as a percent of GNP? I DON'T THINK YOU KNOW.

The only thing you don't seem to be alarmed by is the growth in defense spending (more than 80 percent), which has grown twice as fast over the last decade as major social programs. WHAT'S YOUR FRACKING AGENDA?

Rex

(65,616 posts)so I think I can guess his agenda.

djean111

(14,255 posts)Doesn't look like anyone is buying this stuff.

Laelth

(32,017 posts)SS benefits are paid from the SS Trust Fund, and that fund is, and rightly should be, completely separate from general revenue spending. If that chart shows debt that the Federal Government owes to SS for robbing the trust fund, then it has some credibility, but let us not pretend that the green part of the chart is anything more than the Federal Government paying back what it has already borrowed from the trust fund.

SS is not the problem. Reckless tax cuts and wars-of-choice are the problem. It is unjust to ask the American people to pay for said recklessness out of their retirement fund.

-Laelth

Tom Rinaldo

(23,082 posts)Until then it is simply a travesty of justice to key in on cutting economic safety net programs for all of us that enable Americans not only to survive in hard times, but live with a small sense of security in ordinary times. What do you think would happen to the private sector if Chapter 11 bankruptcies were eliminated? Do you think there would be all of those wonderful free market risk takers without that safety net in place for them?

Recursion

(56,582 posts)We're talking about increasing economic safety net programs at a somewhat slower rate for the richest 4/5ths or so of us.

Tom Rinaldo

(23,082 posts)Ultimately we raise Social Security benefits for the same reason that we raise the minimum wage, to keep up with inflation. My first job was unionized (at a supermarket) so lucky me I was paid at over the minimum wage from day one. $1.30 an hour instead of $1.25. One could argue that under Republican economic thinking, if the minimum wage were $5 an hour now that would be a real increase from 1966, only it would have increased at a somewhat slower rate than what has happened instead.

And I don't buy your assertion that the Chained CPI will only hit the top 1/5th. I haven't been back there for awhile but I never saw you back up that claim with real program details and actual figures on the earlier thread where you raised it.

And if the deficit is such a problem, and a good case can be made that it will become one if not dealt with, why your focus on saving 122 Billiion over 10 years through entitlement cuts? Were you out there screaming bloody murder for letting all of the temporary Bush Tax cuts expire on January 1st as they were intended to by law? Now THAT would have raised serious money - not chump change off the backs of Seniors like the Chained CPI attempts to do. Have you looked into the F-35 Fighter program lately? You should. Massive cost over runs, questionable technology, unproven need, BIG BUCKS. Given any thought to taxing stock transfers lately? Why not if you haven't. Over a trillion to be had there from those who can best afford it, and NO they will not stop buying and selling stock if a couple of pennies are added to a trade. It is not a job killer, but Chained CPI, that will be a people killer over time.

Recursion

(56,582 posts)There are various ways of defining "constant dollars" and Obama has suggested using a different one.

Tom Rinaldo

(23,082 posts)...that the shift he has proposed will cause senior citizen benefits to fall further behind inflationary costs than they do now. That is the corollary to this discussion. Most independent economists think that the current COLA formula is weighed in a manner that does not accurately reflect how hard inflation impacts the major areas of expenditures in senior citizen budgets relative to other age groups. Seniors are already falling behind inflation, Chained CPI increases the rate at which that happens. It sure as hell isn't "neutral" or there would be no savings realized by moving to it.

The only way Chained CPI can be sold as not cutting benefits is to argue that Seniors are more than keeping up with inflation using the current formula. Are you attempting to make that case? Do you believe that Seniors today are receiving more benefits as measured in 2003 dollars than they did in 2003? Are you asserting that the current formula inadvertently measures inflation in a way that overly compensates for inflationary pressures on retiree budgets? If not you are admitting that the Chained CPI would cause a cut in benefits as measured by constant dollars. That is where the "savings" come from.

Recursion

(56,582 posts)That's why this isn't as easy a question as people think. What is a constant dollar as standards of living improve for everybody?

Tom Rinaldo

(23,082 posts)And the closer you move that timeline to the present time the less I accept it. Now if you want to go way far out global history timeline there is always a case that the average person today lives better than Royalty did in the 17th century for example. And any elderly person, rich or poor, is more likely to survive a bout of pneumonia today than those who lived before antibiotics were discovered But that kind of relativism ignores the fundamental aspect of economic justice. 17th century Royalty lived privileged and ultimately exploitative lives relative to the lot of the common "man" then.

Income growth in America has flowed almost exclusively to the top 20% over the last 30 years, and of that top 20% income growth for the vast bulk of them has been modest aside from the top 1 or 2%. Meanwhile it has been stagnant or falling for everyone else. And Americans are now starting to live shorter rather than longer lives, and the extent of that regression magnifies as one moves lower on the economic ladder. That is not exactly progress.

But the real kicker is looking forward from here. The next generation of retirees won't be adding Social Security benefits to their U.S. Postal Service pensions. Very few will have pensions period. Ever since the Union movement in America got undermined workers no longer see their highest income years in the ten years before they retire. Built in seniority pay scales and protections once insured that, but no longer. Now anyone in their 50's who makes anything notably over the minimum has to constantly look over their shoulders for a pink slip notice on the way. No one is hiring recently unemployed workers in their 50's to anything remotely resembling good paying jobs. This is a trend that has deepened over the last 10 years, we have barely seen the full effects of it yet on those who soon will become eligible for Social Security.

For one thing, not only do people no longer have pensions, but they don't have real savings either. If they ever did they are burned through during those last ten years after they stop being "employable" for real living wage jobs. That means the next generation hitting Social Security will enter it from a lower wages baseline also - and that translates into a smaller monthly check even putting COLAs aside. And the number of people being forced to take early retirement Social Security rather than waiting for the full benefit level to kick in is skyrocketing. That means significantly smaller monthly checks still. Why? The same reason. They have no other source of income left by age 62, and they have already burned through their savings and often whatever equity they may have had in their homes - so 2nd mortgage loan payments must still be managed also when prior generations got to shrink their budgets once their homes were paid off.

We are only starting to see the full magnitude of the economic crisis our elderly will face in the coming decades - so of course it is time to cut Social Security benefits.

TheKentuckian

(26,314 posts)We don't want to cut the safety net for everyone, just everyone that isn't below a cruel and absurd poverty line.

Most folks are struggling, exempting those with absolutely nothing as far as wealth and take of percentage of income but the rest do little better. Below the top 20% there isn't much and at 50% and under there is virtually nothing.

The wealth is at the top, trying to bring the working poor and lower middle class in to "the rich" the agenda becomes clear, pillage the broke to protect the actual wealthy.

99Forever

(14,524 posts)Why are these Republican lying talking points even allowed on this site?

Dragonfli

(10,622 posts)repeatedly and forcefully.

They are spreading the lie that cuts to SS are cuts to one area of the budget so it is just one way to cut the budget and reduce the deficit.

A fucking lie that once I thought only a freeper troll would bring here because we have been fighting that Republican lie for years and it is a Republican classic, well known as a lie to most Democrats.

They bring that lie into this house and also have the nerve to tell Sabrina she is spreading a myth by explaining that SS is self funded and not part of the budget.

99Forever

(14,524 posts)... this troll. One Republican lie post after another. I just don't understand why it is allowed.

ananda

(31,439 posts).. military spending don't account for ALL of our fiscal problems..

this finger is for you.

![]()

dawg

(10,777 posts)Most items look to be pretty stable as a percentage of GDP through 2080. The only thing that is rising exponentially is the interest component.

That relates directly to the fact that revenues are projected to remain below the level needed to fund the general government and a modest safety net.

The chart shows a picture of a problem that is entirely related to insufficient revenues. (And, possibly some silly predictions about interest rates as well).

bornskeptic

(1,330 posts)under current law when the trust fund is depleted sometime between 2030 and 2040. Assuming benefits continue to be paid according to the current schedule would raise Social Security expenditures by about 28% from that time on.

dawg

(10,777 posts)It's a picture of insufficient revenues.

Downwinder

(12,869 posts)cutting it will prolong the debt and increase the interest cost.

Social Security has been funding Defense, now that it is becoming time to pay it back they want to welsh on the deal. Talk about deadbeats.

dawg

(10,777 posts)The interest portion would not materialize because we would not be running deficits at that level of taxation.

Here are the percentages other countries already spend:

(The reason the US is shown as already being over 25% is that this chart includes state and local taxes as well as federal taxes)

dawg

(10,777 posts)If you were to tell an alien, "One of these countries maintains a dominant global military with the capability to successfully engage in two foreign theaters simultaneously", they would guess it must be Denmark. Certainly not one of those at the bottom of the list. But we just borrow the money so rich people won't have to pay taxes.

dawg

(10,777 posts)that whole global military hegemony thing might be part of the problem as well.

Oh yes, we also spend twice as much per capita on health care, despite getting worse outcomes. All because we insist in using market systems for nearly everything.

We intervene in free markets in order to benefit the "haves" (long-lived patents for drugs, bans on re-importation, bans on Medicare negotiating for drug costs); yet we insist on harshly applying market outcomes on the "have nots".

There is probably no single service less suited to well-functioning markets than health care.

And yet, with all this: the refusal of the American rich to pay anything approaching a modern first word tax rate; the fact that Americans are bearing an outsized burden for world defense/domination; and the fact that we have a uniquely expensive and underperforming health care system - some people are still insisting that the solution to our debt is for working class people to "eat our peas" and make do with less.

Rich folk are pretty damned lucky Americans are so docile.

dawg

(10,777 posts)I like how you think. ![]()

Dragonfli

(10,622 posts)MattBaggins

(7,944 posts)large grain of salt and all

Honeycombe8

(37,648 posts)So...I don't see how the interest spending can increase that much. Unless that is OLD borrowing at a high interest rate....like for the Iraq War or before.

1-Old-Man

(2,667 posts)after all, Social Security holds two-thirds of the national debt.

usGovOwesUs3Trillion

(2,022 posts)MIC

L0oniX

(31,493 posts)So defence funding comes from SS ...oh that's right ...your chart doesn't include revenue sources. O well better luck next time ...and thanks for playing.

Marr

(20,317 posts)cut the social safety net now shift gears into P for Pragmatic, explaining how oh-so-adult and necessary those unimaginable cuts are. And they do it with tired old Republican lies that were once universally understand to be such on this forum.

So shocking.

Doremus

(7,265 posts)I don't need to come to DU to read what could be headlines straight from Drudge, Faux, World Nutt Daily and any number of puke propaganda sites.

Should we really be giving posters who continually post RW drivel yet another platform to spew it all over us? I don't think so, and I think it's way past time to do something about it.

JDPriestly

(57,936 posts)The answer is to reinstate the taxes on things like income from capital gains, have that money paid into the general fund and then repay the money borrowed over the years to fund general fund expenses (like the War in Ira) from the reinstated taxes on those items to the Social Security Trust Fund to make good on promises made to seniors now retired and retiring.

The general fund owes that money to Social Security. See the RealNews discussion on this in the video section. There is no argument about the fact that the general fund owes Social Security. The question is where to find the money to repay it.

I make the suggestion above. It would work. And if it isn't enough, tax the Wall Street bonuses.

Repay the money owed to the Social Security Trust Fund.

Maybe we seniors should take a page out of the bankers' methods and foreclose on the general fund.