Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe Child Tax Credit Was a Little Too Subtle

Why doesn’t anyone care about the expanded child tax credit? A $100 billion policy—effective, important, elegantly designed, competently managed, and noncontroversial—is gone, at least for now. And nobody, save for a few politicians and wonks, seems to have noticed or to care.

https://www.theatlantic.com/ideas/archive/2022/12/child-tax-credit-democrats-inflation-postmaterialism/672543/

https://archive.ph/tCbhX

The expanded child tax credit (CTC) provided no-strings-attached cash payments to 39 million families in 2021 and 2022, lifting millions of kids over the poverty line. But Democrats have failed to get a renewal of the program into the $1.7 trillion spending bill making its way through Congress, just as they failed to get it into the Inflation Reduction Act they passed earlier this year. As a general point, the CTC has languished in policy obscurity. Did Democrats crow about it in their recent campaign ads? No. Did it sway many swing voters in the midterms? No. Have large protests pushed for the policy’s reinstatement? No. Many studies suggest, as does common sense, that handing out all that money should have helped Democrats at the polls. Somehow, it did not.

Many political stories end up being much ado about nothing. But the quiet demise of the CTC is one of the most baffling things I have witnessed in American politics: no ado about so, so much. How the policy failed to create its own constituency is the $100 billion question, of interest to the Democratic politicians hoping to reinstate it as well as to experts designing new social programs in the future. Politicians, the CTC shows, have enormous capacity to improve citizens’ lives. But don’t expect those citizens to thank them at the polls for doing so.

The expanded CTC was part of President Joe Biden’s American Rescue Plan, passed in the spring of 2021. The policy had three main features. First, it beefed up an existing tax credit paid to the parents of dependent children. Under the new provision, families got $3,600 a year for each kid under 5 and $3,000 for each kid ages 5 to 18. Second, it paid out that money in installments; parents received a couple hundred bucks per kid each month from July to December and a final, larger check this spring. Third, it made the credit fully refundable, meaning that families that did not owe any federal income tax still got the full amount.

In practical terms: Cash suddenly started showing up in tens of millions of bank accounts. The impact was enormous and instantaneous. The transfers, a kind of Social Security for kids, drove child poverty down to its lowest-ever level. The rate of food insecurity in recipient households fell by more than 25 percent. Those families were less reliant on friends and family for help, experienced fewer medical hardships, and were more on top of their utility bills. Studies showed that the recipients used the money for essentials—food, gas, rent, clothes, day care—and that the transfers did not lead parents to reduce their work hours or quit working.

snip

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

5 replies, 844 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (13)

ReplyReply to this post

5 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

The Child Tax Credit Was a Little Too Subtle (Original Post)

Celerity

Dec 2022

OP

My best guess is the vast majority of the public thought it was temporary COVID relief

Hugh_Lebowski

Dec 2022

#1

One of Manchin's excuses for nuking it was that he heard stories people used it for drugs, smdh

Celerity

Dec 2022

#3

I think the people it helped the most didn't really understand why they were receiving it

questionseverything

Dec 2022

#4

Hugh_Lebowski

(33,643 posts)1. My best guess is the vast majority of the public thought it was temporary COVID relief

that just ended.

Which would be another example of sub-par Dem messaging ... along with the corporate media not wanting to cover a Democratic/Biden success story of course ![]()

There's also the fact that there was virtually no 'grassroots' effort to make this happen in the first place, ergo very little emotional investment by the constituency.

Celerity

(43,749 posts)3. One of Manchin's excuses for nuking it was that he heard stories people used it for drugs, smdh

Link to tweet

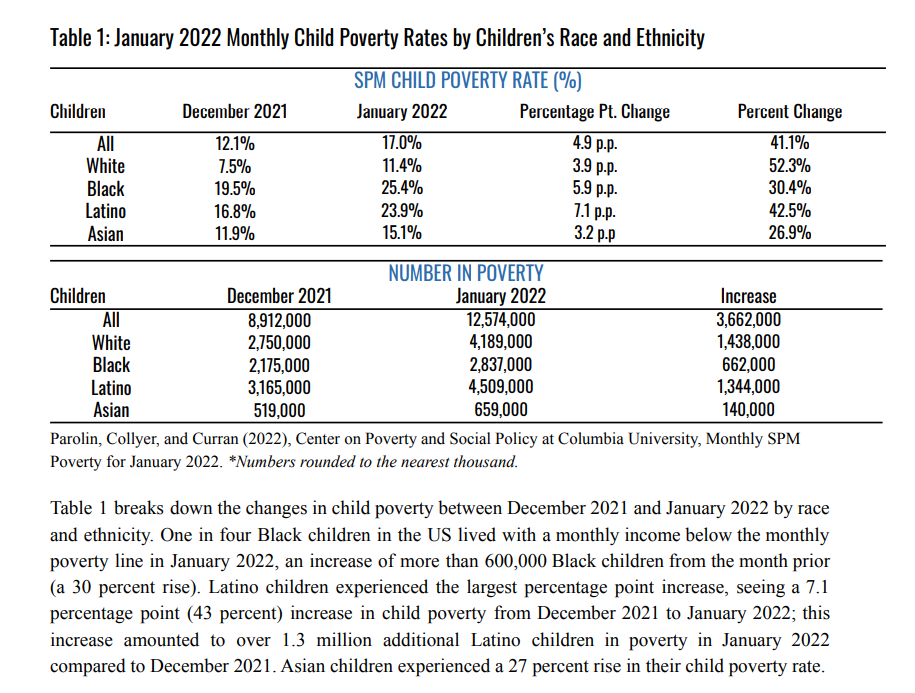

Absence of Monthly Child Tax Credit Leads to 3.7 Million More Children in Poverty in January 2022

Child Poverty Rises From 12.1% to 17%, Highest Rate Since December 2020

https://static1.squarespace.com/static/610831a16c95260dbd68934a/t/620ec869096c78179c7c4d3c/1645135978087/Monthly-poverty-January-CPSP-2022.pdf

Response to Celerity (Original post)

Chin music This message was self-deleted by its author.

questionseverything

(9,666 posts)4. I think the people it helped the most didn't really understand why they were receiving it

They were the people with the least power so when it expired no one listened to their complaints

I know here at du i unsuccessfully tried to build excitement to renew it

Celerity

(43,749 posts)5. Child tax credit changed my life as a single parent. Then it was gone.

https://eu.usatoday.com/story/opinion/voices/2022/12/21/child-tax-credit-helps-parents-like-me/10885590002/

Imagine what it’s like to raise three children alone, struggling to make ends meet. To put yourself through school, knowing that despite your best efforts, the jobs you need to provide for your kids require a college degree. Now imagine that you suddenly get a badly needed helping hand to pay the bills, to put gas in the car, to make sure your children have what they need. And that just as quickly, that hand gets yanked away. For me and so many others like me across the country, that’s the life we’re living every single day. Right now, I’m parenting an 11-year-old, a 4-year-old and my brand new baby boy alone, all while putting myself through college.

Not enough of a priority in the Senate

I’ve faced more than my fair share of challenges, but I’m determined to ensure that my children have a smoother path in life. That’s why it was such a remarkable moment when families like mine began receiving the expanded child tax credit last year. With so much on my plate, I wasn’t paying too much attention to how it got passed or who voted for it. All I knew was that it really helped me and my children. It gave me that little boost we needed to help make ends meet. And then, next thing I knew, it was gone. This time, I was paying attention.

I saw that members of the Senate traded away the expanded child tax credit, declaring that it wasn’t enough of a priority for them. That I, or my children, wasn’t enough of a priority for them. I do my best to put healthy food on my children’s plates, but that means spending more money and often leaving me eating whatever’s left or asking my son’s aftercare if they have any leftovers available. When I talk about needing the relief the child tax credit provides, that’s what I’m talking about – it’s not frivolous, it’s our life.

Tax credits for families vs. rich companies

It was incredible how much of an impact the child tax credit had. You hear how it helped drop child poverty to record lows, with millions of children benefitting. And the program’s popularity can’t be denied, with a new poll from Morning Consult and early childhood development nonprofit ZERO TO THREE showing that 85% of parents of babies and toddlers want to see Congress act to restore the enhanced credit. And if it’s between supporting families and offering even more tax breaks for rich companies, there’s no question: Almost three-fourths of respondents said Congress shouldn’t pass any more tax breaks for wealthy corporations until it acts to reinstate the expanded, fully refundable child tax credit. Maybe most important, 64% of parents said they oppose denying the expanded child tax credit to families without a working parent or who are in a lower tax bracket.

snip