General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsMy wife & will owe the IRS just under $2,000 (2021 taxes). The reason why is infuriating

This may have come up before and not sure why it didn't become an issue last year for us (or earlier).

The reason is neither of had enough taken out of our paycheck. This has me furious.

I knew that the GOP tax "cut" was bullshit, but the issue here is that they forced this shell game on everyone where less is taken out. I don't want less taken out. I want whatever is supposed to be taken out to be taken out. I don't want to owe money back.

I lost my job in the spring of 2020. When I started a new job last year, I don't recall what I filled out, but I always used to claim zero.

I had no idea that the form changed and that apparently the default is a lower and insufficient amount taken out.

I also learned that tax payers should update the form annually (unlike in the past where you did it once unless wanted to make a change in one's time with a given employer).

We would have owed more if not for the child tax credit.

I know that we all should pay attention more, but this fuckery is just insane. We never owed money before. I get it, if one has gains etc., but for payroll, this is bullshit as a default way of happening.

lagomorph777

(30,613 posts)I knew they were pulling that trick. Junior Bush did it, too.

Celerity

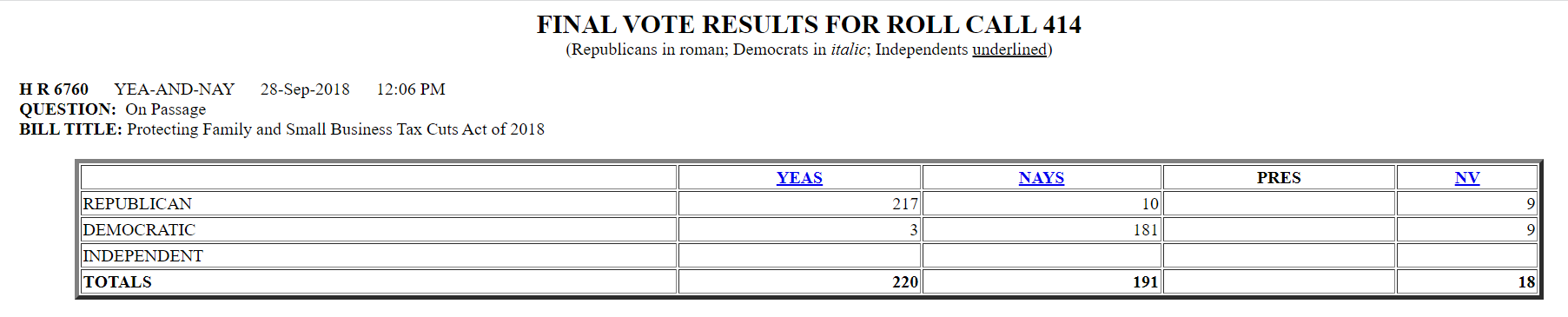

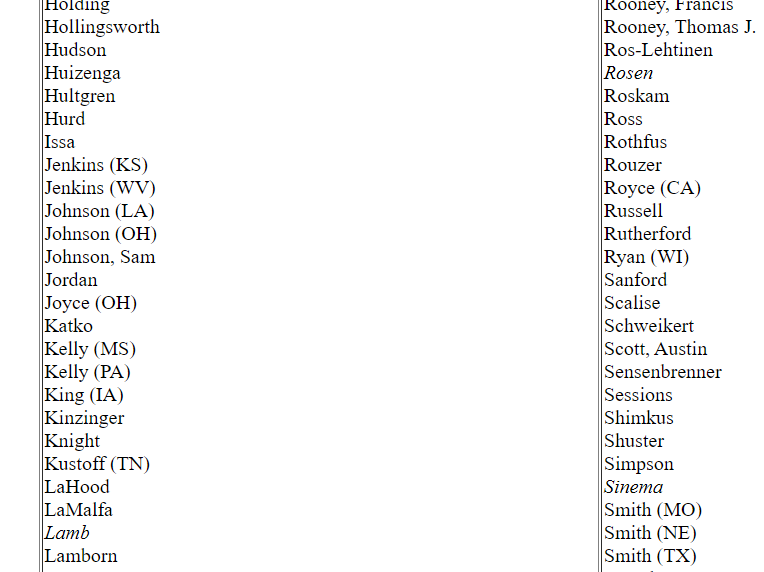

(43,499 posts)Btw, Conor Lamb, plus 2 now in the Senate (Sinema and Rosen) were the only 3 House Dems to vote to make the Trump individual tax cuts permanent.

U.S. Reps. Conor Lamb and Keith Rothfus vote to extend GOP tax cuts for individuals

The proposed 'Tax Reform 2.0' would overwhelmingly benefit wealthy individuals and add trillions to the national debt.

https://www.pghcitypaper.com/pittsburgh/us-reps-conor-lamb-and-keith-rothfus-vote-to-extend-gop-tax-cuts-for-individuals/Content?oid=11083357

Now with the passage of H.R. 6760, aka "Tax Reform 2.0," those temporary cuts for individuals are one step closer to becoming permanent. In addition to extending the reduced individual tax rates past 2025, the proposal would also double the Child Tax Credit and restore cuts to estate-tax filings of about 5,000 of the richest American families.

And two local representatives, U.S. Rep. Conor Lamb (D-Mount Lebanon) and Keith Rothfus (R-Sewickley), backed the bill. It passed 220-191. Lamb was one of only three Democrats to back the bill.

https://clerk.house.gov/evs/2018/roll414.xml

Emile

(22,914 posts)Celerity

(43,499 posts)multigraincracker

(32,715 posts)Corporate Democrats like a hawk.

Follow the money and see who is paying their way.

BluesRunTheGame

(1,620 posts)XanaDUer2

(10,728 posts)That happened to you.

I'm heartbroken because I owe over 1500 in state and federal taxes, and I quit work due to disability in June. I really needed money coming back to me.

themaguffin

(3,826 posts)I knew when this hit that many would have been hit and harder. This has me just so pissed.

XanaDUer2

(10,728 posts)I was hoping to break even. I'm disabled and was out-of-work 7 months

Achilleaze

(15,543 posts)it's a thing

Jerry2144

(2,111 posts)To the tune of $4000. And I hit the SALT limit. If only the Republiklan party didn’t force through their ucked fup tax hike in 2017

themaguffin

(3,826 posts)MiniMe

(21,718 posts)"See, you have more money in your paycheck" Well, you are right, it doesn't change what you owe at the end of the year, but you have cash now.

What's frustrating is that is works evert time. People just don't get the games they are playing. Yes, there are a few people, I think they call them the job creators who end up paying less. Those are the people who don't really get paychecks

jaxexpat

(6,849 posts)Wise enough to never vote for or trust the testimony of them when they use the word "taxes". Wise enough to perform some quick math and adjust ones W4 withholding to fit the new reality. We will fail if we assume things. I speak from hard experience. The MIC and Nixon tried to kill the poor young men of my generation and subsequent "conservatives" have endeavored to keep young men poor enough to hunger for the financial security of a military paycheck. They will stop at nothing except extinction. Theirs or ours, I think.

GopherGal

(2,009 posts)... They f up the withholding tables so that you "get more in your paycheck" so you go out and spend it. But it's just lowering the prepayment of your own taxes due, so you'll have to pay the IRS back on April 15. But they count on you forgetting about that part by election day.

Freddie

(9,273 posts)As soon as the TFG Tax Scam went through I knew this was going to happen. Changed mine and DH to S, 0 plus extra $ per pay.

There was a handy calculator on the IRS site that was actually fairly accurate about what to do with your W4. I emailed every employee in the district with a link and “you may want to consider changing your W4.” 2 people did.

SharonClark

(10,014 posts)Most everyone in my department appreciated the information.

drray23

(7,637 posts)captain queeg

(10,242 posts)underpants

(182,879 posts)New position. Filled out the form as usual. Didn’t check what was coming out of my check. Turns out a total of $187 was taken out for Fed taxes. My own fault for not checking it.

Freddie

(9,273 posts)My first payroll job (eons ago) a woman came into my office very upset and “we owe her $$” because she had 0 withheld for Federal tax all year and now she owed the IRS - it’s really easy to do if you’re PT as she was. Sorry it’s the employee’s job to look at their pay stub once in a while.

This year I had a new teacher who had 0 withheld all year. I triple-checked his W4. Was expecting a phone call but not a word.

iemanja

(53,066 posts)Or total?

underpants

(182,879 posts)Like I said, my fault for not checking it.

haele

(12,676 posts)If I was making $200k more, it would just sting a bit, but with TFG fu**ing with taxes, an unexpected bonus, and adding that three months of forced "Don't need to pay your FICA and SS" because of the Pandemic "stimulus" in 2020; as our household income is just over $75k, the two at the same time cost us big time last year. The IRS still hasn't completed processing our 2020 return. We might owe some more, we might not.

And again this year because we had to pay that FICA/SS tax stimulus back in 2021, everything was still skewed and the IRS refused the electronic return to ensure we paid enough last year -and the year before.

We might even get money back this year.

But who knows?

Haele

sarcasmo

(23,968 posts)fescuerescue

(4,448 posts)Not sure who can you blame though.

W4's have been around for decades.

This happened to me last year, 2016, 2014, 2012, 2009, 1999, 1996, 1993, 1987 and 1984.

iscooterliberally

(2,863 posts)My wife signed up for health insurance last year, but didn't read the find print. She got a plan based on her income alone so it was subsidized. We come to find out now that we have to pay that back because of our combined income. We have been saving up to buy a new vehicle as the two we have are pretty old now. I have been saving up money for a nice down payment. It seems that every time I try to save up money to do something, some financial disaster comes along and wipes it all out. The republicans really fucked up the tax system that's for sure. We have been hit hard every year since 2017. We made sure our W4 forms had extra taken out and increased our monthly contributions to our IRA accounts. I don't know what else to do. So much for the "American Dream".

Celerity

(43,499 posts)Rebl2

(13,551 posts)it is

DanieRains

(4,619 posts)I could see this coming.

TFG was an asshole for screwing everyone like this.

Vinca

(50,303 posts)it seems the only people who ever make out are the gazillionaires.

iemanja

(53,066 posts)for that very reason. I changed it a couple of years ago, the year after the Trump tax increases. I'm surprised that you didn't notice the change in a previous year.

Tree Lady

(11,491 posts)They are very careful but she got a raise and worked more hours and didn't have enough taken out.

drray23

(7,637 posts)to check and do our taxes and answer questions like this. Over the years he saved me more money that I ever paid him (About 250 to 300 fees once a year). In Virginia, there is another problem which is, they never adjusted the Virginia tax code when those federal tax cuts were enacted.

Since the state taxes in Virginia are tied to the federal taxes (by law) every year I end up owing to Virginia while I get a small refund from the feds.

CaptainTruth

(6,601 posts)I got screwed when GW Bush did this same thing, so I stopped claiming deductions & started specifying a specific dollar amount to be withheld from every check.

My life situation was fairly stable, no wild changes in income or deductions year-to-year, so each year I just increased the amount withheld a little bit to account for an annual raise & usually came within $100 or less of the actual tax due.

I highly reccomend it, it really saves you from nasty surprises, & prevents you from giving the IRS an interest-free loan (overpaying).

ProfessorGAC

(65,168 posts)Because I work in several districts, it's likely that I would only work once or twice in a district in a month.

Extrapolating $120-165 over 12 months is an annual income under $2k. The withholding tables tell them to take nothing. The fact that I'm subbing 8 or 9 times a month, six or 7 months a year, and a high income from SS & retirement savings, means I'd owe 25% on $7-8k. And, we don't even need the extra money. I donate about a 40% pretax, to the local food bank.

So, I just filled out each W-4, and rounded to convenient number at 30% of daily pay. (If the district pays $135, i put in $40). Now, I'm overwithholding.

Once, when I took a 2+ week assignment to do 6-8 science, I redid the W-4 to take 30% of 11 days pay. Then changed it back, next time they called me in.

Have to stay up on this stuff, or it will rise up to bite you!

PurgedVoter

(2,220 posts)We were in debt to the IRS and struggling for three years. So when Republicans get in office we scream and look carefully at how they are going to rob us.

I live in Texas so, I expect everything to rob us at every opportunity. Somalia has better health care, since I can't afford the deductible and I still have to pay. Nothing. Seriously, nothing would be better that what we have. We would then be able to afford doctors. Not hospitals, but simple emergencies and illness would be affordable.

multigraincracker

(32,715 posts)use the saving(forced) for extra things. This year we are taking a trip to San Diego with lots left over.

My brother figures his out to the nickel and thinks I'm crazy. Well, perhaps a little. ![]()

ProfessorGAC

(65,168 posts)With banks paying 1/8th percent on most accounts, getting zero interest only costs one about 60¢ on every $1,000 of added withholding. (Average balance being $500 over the course of the year.)

I'd rather not be surprised in April.

AllyCat

(16,222 posts)Because work didn’t take ANY tax out the first 2.5 months of the year. I didn’t notice because I was caring for my mom on hospice and it just wasn’t on my radar. We are really mad.

FakeNoose

(32,748 posts)If you don't do that, you'll be in the same boat for next year's taxes.

![]()

![]()

Crazyleftie

(458 posts)and I am retired

so with the standard deductions (I can no longer itemize because of the new tax laws) I will always owe the IRS

we got fucked and the rich got richer

mnhtnbb

(31,404 posts)the standard deduction is higher than your combined itemized deductions for mortgage interest, RE taxes, health care expenses, charitable deductions, etc.

I am retired. I bought a house at the end of 2020. So itemizing deductions for 2021 yielded a lower tax liability for me than when I was renting and was required to take the standard deduction because I didn't have enough qualified deductions to reach the threshold for itemizing.

Shermann

(7,429 posts)Crazyleftie

(458 posts)I received a refund due to the itemized deductions

my income DID NOT CHANGE

my deductions actually increased

now i owe instead of getting a refund

Shermann

(7,429 posts)It's a question of whether you are tying up the government's money all year, or they are tying up your money. I choose the former. There is no interest on it (generally speaking).

Also, if there is no refund to be had, there is no refund to be stolen.

I pay every April 1st with a smile. ![]()

themaguffin

(3,826 posts)I've heard that all my life. I don't give a shit.

I do not want to owe money at tax time. I want it adequately taken out of my check.

Shermann

(7,429 posts)The 2021 inflation rate was 7%. The equivalent monthly inflation rate would be approximately .05%.

So, divide your $2000 into 12 underpayments of $166. Assuming you paid your taxes in April, nominalize each of those shortfalls to April 2022 dollars

166.67 * (1.0005^15) + 166.67* (1.0005^14) + 166.67* (1.0005^13) + 166.67* (1.0005^12) + 166.67* (1.0005^11) + 166.67* (1.0005^10) + 166.67* (1.0005^9) + 166.67* (1.0005^8) + 166.67* (1.0005^7) + 166.67* (1.0005^6) + 166.67* (1.0005^5) + 166.67* (1.0005^4)

=$2009.55

That's what you should really owe the government assuming no additional interest on top. So, inflation alone worked in your favor by almost ten bucks! ![]()

themaguffin

(3,826 posts)Amishman

(5,559 posts)This is the root cause of most two income households not having enough withheld.

The two income worksheet is a pain in the butt, far more complicated than the usual W-4. People don't want to fill it out, and employers don't like helping their workers figure it out.

If you don't know what I'm talking about, their is a supplemental part of the W-4 to calculate how much additional withholding you should specify if you have two incomes. If you have two incomes and didn't fill anything in for additional withholding, you didn't follow instructions

Not meant as a direct criticism, the form is a pain and many many people don't want to do it or don't even realize they should. I caught a former employer not even giving out those additional pages unless requested

themaguffin

(3,826 posts)RobinA

(9,894 posts)what they take out twice now and I'm still only getting a small refund. I'm also getting killed with capitol gains. I have a couple of OK mutual funds that are killing me at tax time and not gaining all that much. Not sure exactly how that works. I'm not in high finance here.

I have 2 mutual funds that are doing okay. So, even though I had 5 months' salary in 2021, I was told I owed a small fortune. I'm trying to get SSDI the mutual funds don't even have that much, even