General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsL0oniX

(31,493 posts)I call it "fair".

L0oniX

(31,493 posts)tokenlib

(4,186 posts)It's an equal opportunity/shared sacrifice thing.

Nye Bevan

(25,406 posts)if you raise the cap, do you also raise the maximum benefit correspondingly?

abumbyanyothername

(2,711 posts)means testing.

FogerRox

(13,211 posts)No, FDR has it right, paraphrasing

If we take nothing from capital we owe nothing to capital.

Robeysays

(673 posts)but the 1% can stuff it.

remove the cap.

Major Nikon

(36,827 posts)Higher income earners derive less benefit from SS already due to the formula used to calculate payment, which is not linear. Asking those at the top to kick in more is not really out of line with this.

FogerRox

(13,211 posts)IF we remove the cap on payments, this creates a huge monthly check for the uber rich. TO prevent that some want to cap benefits, that would be the means test.

The Formula fo rcomputing benefits is called AIME. Look it up.

Major Nikon

(36,827 posts)I've been earning above the max SS wage for over 25 years. And no it isn't a true means test, but no less so than a cap on benefits which isn't a true means test either. Those with higher wage income do receive less benefit per dollars paid due to bend points in the benefit formula. Look it up. So even if the uber rich did receive a huge check, they would still be paying in at a higher rate vs the befefit they would receive. Since most über rich earn most of their money from investment income, it's not all that relevant in the first place. I'm not in favor of this anyway. There's far better ways to improve the way SS is financed.

FogerRox

(13,211 posts)Fixing the economy fixes SS according to the 2012 SS Trustees report in the low cost scenario SS is good thru 2090:

The Trustees estimate that the trust fund will not be exhausted within the projection period.

http://www.ssa.gov/OACT/tr/2012/IV_B_LRest.html#219007

Major Nikon

(36,827 posts)However, I do think it could use improving. My vision of it would improve the standard of living for those who need it most, reduce the financing burden from the lower income levels, and increase the financing burden on those at the top to include more than just wage income.

FogerRox

(13,211 posts)The Income cap is supposed to be at the 90th percentile of income, now its 84% IIRC. Adjusting the income cap back to 90% would allow real COLA. 4k increase is not unreal.

The Earned Income Tax Credit could be increased/expanded.

I think that would relatively painless.

HiPointDem

(20,729 posts)income (single) or $42K (couple)

Bluenorthwest

(45,319 posts)Means testing is just that, a test of your means, not of just your income. The IRS has no interest in your means, just in your income. Means includes things you own, savings you hold, investments, as well as income. Income is just income.

And this 85% figure is also misunderstood. As much as 85% +4500 of the benefit amount can be subjected to taxation at the regular income tax rates, if one's income is high enough. No form of income in the US is taxed at 85%, not for anyone.

So you know...facts are important things at times. No means testing in Social Security, no one will ever ask you how much is in your accounts, if you own property or other valuable things. You can have millions, you still get your benefit, you will pay higher tax on your income, just as we all do when any form of income is higher, but you will never get a reduced benefit, and if your other income vanished, your benefit would no longer be taxed even if you owned six homes and a room filled with Rembrants.

HiPointDem

(20,729 posts)(up to 50% of benefits could be taxed) and intensified under clinton (up to 85%).

taxing of social security benefits is indeed means-testing in the context of the history of social security; instituting taxation of benefits changed the original design of the program that was in effect for 40-odd years.

when you've paid in for a government benefit that was originally universal and not subject to taxation, but later that benefit is taxed away in proportion with your income, it's means-testing. and retirees who paid in under the original framework later had benefits taxed away. the same thing is happening today, as people who paid in under the reagan standard will later have their benefits taxed away under the clinton standard.

it's also, for the record, yet another way to divert social security money paid exclusively by workers into the general fund.

Q3. Which political party started taxing Social Security annuities?

A3. The taxation of Social Security began in 1984 following passage of a set of Amendments in 1983, which were signed into law by President Reagan in April 1983. These amendments passed the Congress in 1983 on an overwhelmingly bi-partisan vote.

The basic rule put in place was that up to 50% of Social Security benefits could be added to taxable income, if the taxpayer's total income exceeded certain thresholds.

http://www.ssa.gov/history/InternetMyths2.html

FogerRox

(13,211 posts)Since benefits are formulated from payments.

But why raise the cap if nothing is wrong with SS? Nothing except being in a 4 year recession. Fix the economy and you fix SS.

jwirr

(39,215 posts)Nye Bevan

(25,406 posts)is that SS will come to be perceived as a "welfare" program. The reason SS has survived so long is that everyone, even billionaires, get back a benefit that is based upon whatever they contributed. Because contributions are capped, benefits are also capped. But if you break the link between contributions and benefits, and people start to perceive SS as a welfare program, the near universal support for SS will vanish. We all know what tends to happen to welfare programs.

FogerRox

(13,211 posts)But as you properly describe Social Security is not the time and place. Raising income and cap gains taxes is the way to go IMHO.

Tp Paraphrase FDR of we take not from capital we then owe nothing to capital.

SS is insurance, we make insurance payments. in fact is is legally insurance. IT is administered as an insurance program.

Unfortunately some cant bring themselves to look past the surface of an issue.

Removing the CAP is really something the GOP wants as a route that leads to the dismantling of SS.

HiPointDem

(20,729 posts)dkf

(37,305 posts)That you have also disconnected your payments from your benefits.

It's conceivable that no matter how much you put in you may get only a subsistence payment.

humans are humans and should be subject to a mean (see average) COLA for their state and a "holiday" bonus each quarter.

eridani

(51,907 posts)Maximum benefits would have to increase much more slowly. That is actually done now, but with a flat upper limit. That could be replaced by an approach to the asymptote.

sabrina 1

(62,325 posts)DURHAM D

(32,609 posts)given that it is talked about repeatedly on DU.

still_one

(92,190 posts)FogerRox

(13,211 posts)create 20 million jobs, now how much more FICA is that?

According to the SS trustees, an average of about 2.8- 2.9% GDP growth, because of new jobs..some wage growth..... and SS is good thru 2085.

TO believe SS will go broke in 25 years, you have to believe there will be 25 years of GDP growth like we've seen over 3 years. A 25 year long recession...........

HiPointDem

(20,729 posts)abumbyanyothername

(2,711 posts)Any stress on Social Security because of longer lifespans is concentrated heavily in the wealthier classes of society.

FogerRox

(13,211 posts)earlier. According to the SS trustees.

FogerRox

(13,211 posts)if we take nothing from capital we wont owe anything to capital....

etherealtruth

(22,165 posts)... but that is just me.

FogerRox

(13,211 posts)1) TO tax the rich?, thats what high income cap gains and estate taxes are supposed to be, I think they are too low now.

2) Remove the cap makes SS welfare, the GOP then attacks SS as welfare. FDR knew this and structured SS the way it is for that purpose.

3) DO you want to remove the cap because you think SS is going to go broke?

4) We got the Earned income tax credit thru Congress to help working class families deal with the regressive FICA tax, remove the cap and you remove the reason for the EITC.

Logical

(22,457 posts)FogerRox

(13,211 posts)Remove the payment cap and you create a 15k monthly check, cap the benefit and you have welfare, administratively.

Fix the economy and you fix SS.

rhett o rick

(55,981 posts)Qutzupalotl

(14,311 posts)Since this requires congressional action, we will need a congress that is supportive. Let's give him one.

ProSense

(116,464 posts)Speaking by sattelite at the AARP's annual conference on Friday, President Obama took a subtle jab at Mitt Romney's claim that 47 percent of Americans were "victims" who saw themselves as "entitled" to food, housing, and health care, among other things.

"There's been a lot of talk about Medicare and Social Security in this campaign, as there should be," Obama said. "And these are bedrock commitments that Americas makes to its seniors, and I consider those commitments unshakable. But, given the conversations that have been out there in the political arena lately, I want to emphasize, Medicare and Social Security are not handouts. You've paid into these programs your whole lives. You've earned them."

Obama suggested that Social Security's finances could be "put on more stable footing" in part by raising the cap on taxable income. He dismissed as flatly "not true attacks from Romney on $716 billion in Medicare savings included in the Affordable Care Act (and Paul Ryan's budgets), saying that it "strengthened" the program.

http://livewire.talkingpointsmemo.com/entry/president-obama-medicare-social-security-are-not-handouts

From the President's DNC speech:

Now, I’m still eager to reach an agreement based on the principles of my bipartisan debt commission. No party has a monopoly on wisdom. No democracy works without compromise. I want to get this done, and we can get it done. But when Governor Romney and his friends in Congress tell us we can somehow lower our deficits by spending trillions more on new tax breaks for the wealthy, well, what did Bill Clinton call it -- you do the arithmetic. (Applause.) You do the math. (Applause.)

I refuse to go along with that and as long as I’m President, I never will. (Applause.) I refuse to ask middle-class families to give up their deductions for owning a home or raising their kids just to pay for another millionaire’s tax cut. (Applause.)

I refuse to ask students to pay more for college, or kick children out of Head Start programs, or eliminate health insurance for millions of Americans who are poor and elderly or disabled -- all so those with the most can pay less. I’m not going along with that. (Applause.)

And I will never -- I will never -- turn Medicare into a voucher. (Applause.) No American should ever have to spend their golden years at the mercy of insurance companies. They should retire with the care and the dignity that they have earned. Yes, we will reform and strengthen Medicare for the long haul, but we’ll do it by reducing the cost of health care -- not by asking seniors to pay thousands of dollars more. (Applause.)

And we will keep the promise of Social Security by taking the responsible steps to strengthen it, not by turning it over to Wall Street. (Applause.)

http://www.whitehouse.gov/the-press-office/2012/09/07/remarks-president-democratic-national-convention

FogerRox

(13,211 posts)Plus why do you feel the need to fix Social Security?

If we create 20 million jobs, SS will get an infusion of new FICA. The Trustees tell us SS would be good thru 2090 in a good economy.

SO fix the economy and leave SS alone.

Hands off SS.

truebluegreen

(9,033 posts)St Ronnie of Raygun doubled the percentage taken from our paychecks and employers in order to cover the massive Boomer generation.

Boomers have paid for their own retirement as well as current retirees (the first generation to do so). That's why there is a $2+ trillion surplus (in the form of govt bonds) in the SS trust fund.

I'd rather raise the cap (and extend it to ALL income, not just wages) so we can drop the rate. Yes, rich people will pay more, that's how we build and support a civilized society.

Edited to add: We know that small businesses are where most new jobs are created; how many more people would be willing to start their own businesses, etc. if the self-employment tax was 7.5% instead of 15%?

FogerRox

(13,211 posts)The purpose of the Earned Income Tax Credit was to make up for the regressive nature of FICA. Making FICA progressive gives a reason for the GOP to remove the Earned Income Tax Credit. Thats was the original deal made in Congress in 1975.

http://www.finweb.com/taxes/common-earned-income-tax-credit-questions-answered.html

http://en.wikipedia.org/wiki/Earned_Income_Tax_Credit

What your saying is important, you are absolutely right about doubling of payroll taxes in 1983. Working and middle class families are now taxed out of the economy, this needs to change.

But SS was never meant for that purpose of taxing the rich at a higher rate. SS is insurance, not a progressive tax. ITs not income estate or cap gains.

There are deductions for the self employed, so the 15% rate may not apply to many.

http://www.democraticunderground.com/10021485409

I would much rather raise the top income rates to 70%, adding 10 more brackets, cap gains to 30-33%, expand the Earned Income Tax Credit. Deductions for creating jobs here in the US in emerging sectors like solar wind HVDC.

The current FICA taxes would not be so overwhelming if folks had good jobs.

truebluegreen

(9,033 posts)and you clearly know a lot more on the subject than I do. I'm very much in favor of returning to the more progressive tax structure pre-Reagan. Too bad Senator Biden didn't jump on Ryan re the Kennedy tax structure (top rate 71%? cap gains 35%? Sold!) (I kid. Fox et al would have flayed him). Maybe then wages would catch up and keep up with productivity and we could all share in the fruits of our labors.

But I think perception is important: for people with lower incomes FICA is probably a big driver of the idea that they are over-taxed. I know it hit me really hard, as a not-long-out-of-college worker in the 80s. Later, as a self-employed person dealing with uneven cash flow in a start-up, quarterly tax payments were a strain.

FogerRox

(13,211 posts)It would have been nice if Biden also mentioned the tax cut was in 1964, LBJ signed off on it.

Yeah.

truebluegreen

(9,033 posts)said that Kennedy did not cut taxes, "never happened".

As I understand it, that is true: Kennedy cut the top marginal tax RATE, from 90% or so to 71%, while at the same time closing loopholes. He said that this was going to raise TAXES on people like himself. Tax revenue increased immediately, and even more when the economy grew.

Republicans always distort this into "Kennedy cut taxes and they paid for themselves." That's what rMoney and Ryan are trying to claim now.

Liars. ![]()

FogerRox

(13,211 posts)JFK died in Nov 63.

Republicans always distort this

Maybe they think they can play off onm the JFK fame.....

truebluegreen

(9,033 posts)it wouldn't take effect until the following year. Do you know for sure that LBJ signed it into law, or was it Kennedy? I know it was his policy...

Yes, it is odd that Republicans are so fond of JFK now; too many of them cheered when he was murdered. I suppose it's just a useful dodge.

Another zombie lie about Kennedy is that he wouldn't have won without Daley stuffing ballots in Chicago...they always seem to miss that he had enough electoral votes even without Illinois.

People used to joke about the Soviet Union having a variable history...

FogerRox

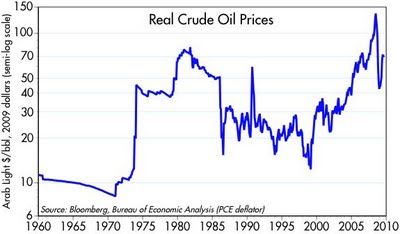

(13,211 posts)Heres the back ground info, when the recession of 1960 was, and the economic conditions thru 1965 including crude oil prices.

http://en.wikipedia.org/wiki/Revenue_Act_of_1964

Top marginal rates from 1913 to 2012.

http://www.taxpolicycenter.org/taxfacts/displayafact.cfm?Docid=213

Crude prices declined, $11 down to $7, helping economy

Job creation 1959 to 1965

[IMG]

[/IMG]

[/IMG]

GDP

http://www.google.com/publicdata/explore?ds=d5bncppjof8f9_&met_y=ny_gdp_mktp_kd_zg&idim=country:USA&dl=en&hl=en&q=us+gdp+growth

US business contractions and expansions

http://www.nber.org/cycles.html

truebluegreen

(9,033 posts)BTW, I don't need any reminders of when JFK died. I remember that day very well.

grantcart

(53,061 posts)Jim Lane

(11,175 posts)Projecting several decades out is a tricky business, but even before the recession, one scenario showed the depletion of the trust fund sometime in the 2040's. Furthermore, there's no realistic possibility of returning to full employment anytime soon. Obama never even proposed a large enough stimulus to "fix" the economy -- only to reduce the damage.

My prescription:

* eliminate the cap

* allow benefits to rise correspondingly, even if some retired CEO's get five-figure monthly checks

* reduce or eliminate the partial exemption from income tax for Social Security benefits

* adjust the Internal Revenue Code to restore the steeper progressivity that we had 60 years ago

The net result would be that the people getting huge Social Security checks would then have to repay much of the money anyway, just as a consequence of having higher overall income and therefore being able to afford a higher rate. (That's what the progressive income tax is all about.) A progressive structure would also shield the lower-income retirees from any adverse effect.

eridani

(51,907 posts)They would still rise, but much more slowly. Eliminating the income tax exemption would be a disaster for the vast majority of retirees.

FogerRox

(13,211 posts)Fixing the economy won't necessarily be enough.

Citation?

I've read every SS trustees report since 2005, I know the information quite well.

In the 2012 trustees report, in the low cost scenario, SS does not go broke thru 2090. The numbers they use are

2.8% GDP growth

.5 workforce growth

Job growth

Wage growth about .5% over inflation over 20 years.

These are moderate assumptions.

Jim Lane

(11,175 posts)I'll answer by referring to three specific points.

First, I said that economic recovery wouldn't "necessarily" fix Social Security. This relates to the difficulty of making projections many years into the future. For example, several years ago the Trustees were projecting exhaustion of the Trust Fund in 2042. Their most recent projection (intermediate assumptions) is for 2033. The reason for the change is that, in the middle of the last decade, projections didn't assume that there'd be a disastrous recession before the end of the decade. Obviously, the further out you go, the more uncertainty there is. Along with the condition of the economy, long-range projections depend on estimating several other factors, such as average life span and average working life.

Even before the Bush recession, there was concern about the long-range health of the system. This ranged from the realistic, such as Paul Krugman's view that a little tweaking was called for, to the hysterical, such as Bush's meme that Social Security was going bankrupt (and that the Trust Fund was worthless). Obviously the latter were ignorant or were lying for political purposes, but that's not a reason to ignore the more reasonable concerns.

The upshot is: Suppose we "fix" the economy in the sense of getting it back to where the projections from 2004 or so thought it would be. We're still no better off than a situation that was raising some legitimate concerns, and in fact are worse off because of the hit the system has taken (lower income and higher costs) during the recession.

I was in favor of raising or eliminating the cap before the recession began. Ending it wouldn't persuade me that we could stop talking about the cap.

Second, the idea of "fixing" the economy is fairly vague. As just one example, a trend that's caused problems for Social Security since even before the recession is our growing income inequality. The original design was that FICA taxes would apply to about 90% of total wages and salaries. The cap, however, is set at a fixed dollar amount adjusted for inflation but not adjusted for the distribution of income. As the taxpayers in the highest income brackets grabbed a bigger piece of the pie for themselves, total FICA tax revenues as a percentage of total wages and salaries fell to the low 80's. If we "fix" the economy in the sense of significantly reducing the unemployment rate, the much less visible problem of income inequality would persist and quite possibly even increase. I could easily see a recovery that reduced unemployment by providing more jobs at the bottom of the pay scale and that did little or nothing to revitalize the labor movement. (The decline in the rate of unionization is part of what's driving the income inequality.) The result would be that the percentage of wages and salaries paid into the Social Security system would continue to decline even as unemployment declined.

Third, regardless of exactly how you define "fixing" the economy, it's clear that it won't happen overnight. Even a stimulus program enacted in 2009 of the size that liberal economists recommended (roughly three times what was actually enacted) would have taken time to work. Obama didn't even propose such a program, either because he thought (incorrectly) that it wasn't needed or because he saw no chance of getting it through Congress and thought that a losing effort would do more harm than good. More recently, his American Jobs Act sank with scarcely a bubble. Regardless of the election outcome, there's no realistic chance that the government will, even belatedly, undertake a major stimulus program.

Therefore, we can't put all our eggs in the economic-improvement basket. We need to look at other ways to strengthen the Social Security system's financial position. Raising or eliminating the cap should be at the top of that list.

HiPointDem

(20,729 posts)economy doesn't improve, no fix to social security will be worth shit anyway.

weasel talk.

FogerRox

(13,211 posts)The stimulus worked well 2010, no need to wait. GDP hit as high as 4%.

As far as what liberal economists tell us, lets try to represent this properly. U6 Unemployment has recent dipped under 15%, with a civilian workforce of 154 million thats 23 million people would take a full time year round job if offered. That is the size of the jobs problem.

Since infrastructure spending creates 2 to 2.5 million jobs per 100 billion. We used to spend 5-6% of GDP on infrastructure, last year we spent 1.3%. 5% of GDP would be 750 billion, and create between 14 and 18 million jobs. Tax breaks for domestic investment in emerging markets like solar wind HVDC that incentivize 250 billion in capital spent in these sectors.

SO what we have is 1 trillion spent, that would create between 20 and 25 million jobs.

FogerRox

(13,211 posts)Do you seriously think there will be a banking system thats recognizable in 2033 if that happens.

Predicting the worst depression in 400 yrs as the basis for your comment is insane... nutty.

A 25 year depression will destroy the world economy, there wont be dollars, or yen. Let alone industrial production as we've known it for 70 years.

Basically youre predicting a Mad Max scenario.

bornskeptic

(1,330 posts)From the 2012 Trustees Report Summary:

The financial outlooks for both OASDI and HI depend critically on a number of demographic and economic assumptions. Nevertheless, the projected actuarial deficit in each of these programs is large enough that continued solvency under current-law financing is extremely unlikely. An analysis that allows plausible random variations around the intermediate assumptions employed in the report indicates that OASDI trust fund exhaustion is highly probable by mid-century.

http://www.ssa.gov/oact/trsum/index.html

Now, how about a citation for your claim? I have never seen anything indicating that, under any feasible assumptions for economic growth, the OASDI Trust Fund would not at some point be depleted.

FogerRox

(13,211 posts)high cost, intermediate cost, low cost and a stohastic model.

Current workforce growth is about .9%, for SS to go broke one must assume .2 to .3%, Most publications predict .5 to .7%.

Most economists say that we can only expect 3 to 3.5% GDP growth in the decade or 2. TO believe SS will go broke we must maintain the recessionary growth rates ( 2% to 2.2%) of the last 3 years. You must predict a 25 yr recession.

AS far as citations, I have written extensively on SS, in my journal. I trust you know how to find it?

HiPointDem

(20,729 posts)retirement plan.

ss projections and actuarial balances are kinda like that.

FogerRox

(13,211 posts)The projections that say SS goes broke are based on low GDP growth, low job creation, low workforce growth and no wage growth.

A 25 yr recession, I think its rather silly to predict the longest economic collapse in the last 300 yrs. But that is what the Trustees do with the intermediate and high cost scenarios. THe low cost scenario says SS is good thru 2090. The Stohastic model says about 2050.

Sure 75 year projections are silly. Even 25 yr projections. Absolutely right.

PatSeg

(47,430 posts)last night Bill O'Reilly brought it up at The Rumble 2012 debate with Jon Stewart. Another huge surprise, he favors a national sales tax to pay for Medicare. It was rather stunning.

Of course, I pretty disagreed with almost everything else he said.

Fumesucker

(45,851 posts)So it shouldn't be a huge shock that O'Loofah is in favor of increased sales taxes since they fall more heavily on the poor and middle class than on the wealthy like him.

but it still was strange to hear him advocate for ANY kind of tax or for Medicare as well. He even suggested raising the cap for Social Security instead of the usual republican solution of raising the retirement age.

The rest of his positions were the same old conservative talking points, however.

doc03

(35,336 posts)expiration of the payroll tax cut.

Poiuyt

(18,123 posts)I wish more politicians would listen to Robert Reich.

bornskeptic

(1,330 posts)raising the cap to include 90% of earned income. Of course, less pleasantly, they also recommended raising the retirement age and going to chained CPI for calculating COLAs.

Jim Lane

(11,175 posts)Reich's solution is to raise the cap. That would be a good thing, but it would mean that the extra tax burden fell most heavily on those now making just above the cap (roughly, those with incomes in the $110-180,000 range). An alternative proposal, that might fly better politically, is to cap the cap -- keep the cap where it is now but create a "doughnut hole" so that income above $250,000 is again subject to the tax.

Or we could simplify matters by abolishing the cap. There's nothing sacred about the 90% figure.

FogerRox

(13,211 posts)currently its around 86%. IIRC.

HiPointDem

(20,729 posts)'welfare', in the same way 1%ers are currently saying that 47% are leeches because the top brackets pay most of the income taxes.

Jim Lane

(11,175 posts)We could apply FICA taxes to 100% of earned income and provide concomitant increased benefits to those paying the additional taxes. This would mean that some wealthy retirees would be getting a monthly Social Security check in the six figures. That's a strange image, to be sure. In practice, however, it would avert any charge that the system had become a "welfare" program. Because of the progressivity in the formula for the calculation of benefits, this change would still effect a significant improvement in the system's finances.

Obviously, removing the cap on the tax obligation while retaining the current maximum benefit would improve the finances even more. In that case, however, the redistributive aspect of the program would be much stronger, and it would more readily be attacked as "welfare" (which, I agree with you, we don't want).

HiPointDem

(20,729 posts)just like the top 10% of taxpayers currently pay most of the income tax.

that's the problem with an income distribution that disproportionately rewards those at the top.

2006:

Bottom 80% took home 38.6% of all income.

Top 20% got 61.4% of all income.

http://www2.ucsc.edu/whorulesamerica/power/wealth.html

Probably skewed a bit for capital income, but if you figure roughly the same distribution holds and you remove the cap, the top 20% will be paying for 60% of social security, while receiving < 20% of the benefits.

FogerRox

(13,211 posts)Administratively making SS welfare. Currently there is no benefit cap. But Benefits are based on payments, and payments or income is capped @ 110k. SO it seems as if benefits are capped, but from a legal standpoint they are not.

SS was never intended to redistribute. In fact I believe no US tax was meant to redistribute. New Deal Tax Policy allowed the working and middle class families to keep what they earned. High marginal income tax rates never redistributed anything.

In fact this study shows exactly that, high rates allow families to keep what they earn. Low rates increase wealth disparity and allow the uber rich to keep more.

http://www.democraticunderground.com/10021485409

A monthly 6 figure check? Ah no. 12k - 16k monthly, sure. Lookup AIME formula, if we remove the income we automatically create a benefits increase, thru the AIME formula.

Heres a chart showing the 2011 CBO scoring:

http://journals.democraticunderground.com/FogerRox/54

You can pick a change to SS and see the impact, the shortfall is projected at .6% of GDP, assuming economic conditions are the similar thru 2036 or so, as the last 3-4 yrs.

HiPointDem

(20,729 posts)still_one

(92,190 posts)bamacrat

(3,867 posts)And fairness in this country is called socialism.

elleng

(130,895 posts)orpupilofnature57

(15,472 posts)on Schools, kids and old people don't give they take, and WE have no gratitude or responsibility for what one group has given or what the other will have to give up .

Bluenorthwest

(45,319 posts)It is what needs to be done, and I've always supported elimination of that cap. Obama's idea is perhaps better, raise it with a 'doughnut hole' so that those making right around the current cap still get the break, while those making 100k beyond the gap would see that tax kick back in on every last dime.