General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWARNING!!! The Market crash of the past two days, Friday and Monday appears to have been caused by

more risky hedge products dreamed up by Wall St to allow institutional investors to buy products on credit that they cannot afford to pay for when they come due which happened Friday and Monday. They're called ETFs and ETNs. I can't explain it any better, because I don't understand the lingo and they're talking like they expect their audience to understand all this crap, but I've just watched a roundtable of CNBC 'experts' discussing it for more than a half and hour. I think I have a reasonable amount of market sophistication, but I didn't quite understand it, so I backed up my DVR and watched it again, and I still don't understand it.

I think that Wall St has come up some more shenanigans and we need some regulation. FTR, Carl Icahn, just came on to the show and he just said that these leverage products are unregulated and need to be regulated and something needs to be done. I don't like Carl Icahn, but if he says these products and stuff shouldn't be happening, then something needs to be done before they crash the market again. He says there is a huge bubble caused by these products and it's very dangerous. We've only seen a little bit of the bubble and something big is coming if we don't do something soon.

Thank you Wall St for fucking up the Market once again.

spanone

(135,888 posts)lagomorph777

(30,613 posts)Perfect.

Proud Liberal Dem

(24,443 posts)and the CFPB has been neutralized as well.

![]()

C Moon

(12,221 posts)pansypoo53219

(21,000 posts)cilla4progress

(24,779 posts)analysis. I agree. Shenanigans. Thanks.

underthematrix

(5,811 posts)lastlib

(23,310 posts)Credit default swaps, interest-rate swaps, etc. were never subjected to the regulation they needed after 2008, thanks to that fuckwad Phil Gramm and his wife. (Gramm-Leach-Bliley...) "Let the *market* regulate them!" Yeah--see where that's gotten us. TRILLIONS of dolllars in notional principal on the table--and we. don't. know. where it's at! Unfathomable!! We're a nation of financial idiots, too ill-informed to see the risk these manipulators are exposing us to, and our lawmakers are paid-off tools of Wall Street. God. Help. Us.

appalachiablue

(41,177 posts)since 2008 will have serious impacts, as many have stressed for years now.

Today on CNBC Icahn also said this is like tremors of an Earthquake- that could happen in 2 months, 2 years, 5 years, whenever.

Bring back Glass-Steagall, break up the big banks, to start...that'll be the day.

Orrex

(63,225 posts)The crash is due to Mueller causing uncertainty with his witch hunt. Now more than ever we need deep tax cuts for billionaires and largescale deregulation of the petroleum and pharmaceutical industries.

Iliyah

(25,111 posts)BUT, it's Obama's fault!![]()

sarcasm noted

I stand corrected!

Saviolo

(3,283 posts)Hillary's busy pulling the strings from behind the scenes. Don't you know she secretly gives marching orders to Morgan Chase, Bear Stearns, Goldman Sachs, the Kochs, the Mercers, the Bilderbergs, and the Illuminati?

fantase56

(444 posts)after she plied them with child prostitutes and pizza

![]()

![]()

dchill

(38,547 posts)still_one

(92,427 posts)vlyons

(10,252 posts)Just like casinos don't want us to know that the odds favor the house, or let us count cards. It's rigged.

pansypoo53219

(21,000 posts)yellowcanine

(35,701 posts)It was Hillary's.

yellowcanine

(35,701 posts)Yep. Thanks for clearing that up.

Caliman73

(11,744 posts)I will say this here. We have learned little from the crashes of 1929, 1987, or 2007. In 29 it was speculation and deliberate market manipulation that caused the panic and crash. The wealthy gambling and bringing in the suckers (the rest of us) to supply them with money to play with. In 87 it was "junk bonds" or high yield/high volatility bonds that blew up the market. In 2007 it was the housing bubble and derivatives. The common theme, Wall St. and the High Rollers making up ways, right at the edge and many times way over the line of ethical behavior, to make money. The greed is astounding. They can't be content with a good sustainable model that keeps money growing at a decent rate, but with stability.

The markets will always have risk and you should be able to get a reward for a risk you take, but this it too much. They just make it up as they go along, try to get away with as much as they can, then they come whining to the government and the people to bail them out when they crash.

lindysalsagal

(20,739 posts)THAT's why the orangatan was right when he said the system was rigged. IT.IS>

Cracklin Charlie

(12,904 posts)And I thought they were just robbing us before they show Assface the damn door.

Silly me.

GusBob

(7,286 posts)I think the market is over valued also by corporate buy back of stock.

procon

(15,805 posts)Would the casinos go bankrupt? I suppose Trump would know how that works, but seriously, why are wealthy wall street gamblers allowed to manipulate the market without regulations and put the whole country (if not the world) at risk to make themselves richer?

OhNo-Really

(3,985 posts)whathehell

(29,096 posts)It went down on Bill Clinton:s watch.

OhNo-Really

(3,985 posts)whathehell

(29,096 posts)OhNo-Really

(3,985 posts)Here's a link to the vote count

https://www.democraticunderground.com/discuss/duboard.php?az=view_all&address=439x2127466

Here is an article link

https://www.davemanuel.com/fact-check-did-bill-clinton-repeal-the-glass-steagall-act-120/

The final version of the Gramm-Leach-Bliley Act passed the House by a vote of 362-57 and the Senate by a vote of 90-8. This made the bill "veto proof", meaning that if Clinton had decided to veto, the bill would have been passed anyways. Having said that, if Clinton truly didn't want the bill to become law, he could have vetoed the bill in a symbolic gesture, but this did not happen.

Many people point to the Gramm-Leach-Bliley Act as a major reason why the financial sector imploded in 2008.

When it comes to pointing fingers, both parties get the blame. The Gramm-Leach-Bliley Act was co-sponsored by three Republicans, signed into law by a Democratic president and had the overwhelming support of both parties when it was eventually passed.

whathehell

(29,096 posts)Thanks for the links. ![]()

OhNo-Really

(3,985 posts)whathehell

(29,096 posts)global1

(25,275 posts)They are much bigger now - even a greater risk of failure.

You think they would learn their lesson - but if they are not penalized and are bailed out - their lesson is that they can go back and do what got them in trouble the last time - and we'll bail them out again. They have nothing to lose.

What's that saying: Fool me once - shame on you; fool me twice - shame on me.

Sometimes we never learn.

OhNo-Really

(3,985 posts)The rich bought tons of shares of banks in 2008

and our tax dollars kept the banks afloat at 0% interest while legally charging the little people up to 30% interest.

Nice racket.

global1

(25,275 posts)that they will be bailed out again should they get into trouble again - that's why they are up to their old tricks.

We - the American People - have not learned our lesson and we haven't pressed our so-called leaders in Congress to hold the banks responsible and as such we actually helped make them bigger and more powerful.

OhNo-Really

(3,985 posts)My favorite, albeit morbid, Wall Street Scheme, hatched when the housing market was crashing:

Betting on when old people will die.

LIFE INSURANCE BONDS

Wall Street offers old people CASH NOW by buying their life insurance policies at pennies on the dollar of pay out value, bundles policies into bonds, sells bonds, then, when old person dies, Wall Street collects the full value policy payout.

The longer the old person lives, the less investors make because Wall Street charges big fees to manage the bonds.

Want to sell me your $100,000 policy for $3,000, cash today? I'm Kidding!

"AIG loved the idea. Yes, the AIG we bailed out. And AIG paid us back by betting on WHEN OLD PEOPLE WILL DIE!

In 2009, AIG issued $8.4 billion worth of life settlement bonds to repay the $1.2 billion bailout loan it received from the Federal governments.

So why is it that, all of sudden after the Great $Multi-Trillion Mortgage Heist, Wall Street is so enamored by the prospect of securitizing life insurance polices?

The answer, quite simply, is that for both institutional and private investors alike, the recession has created a need for uncorrelated products.

Life insurance is not only independent of the whims of the economy, but represents $26 trillion in untapped resources."

JP Morgan patented the scheme.

https://www.dailykos.com/stories/2013/2/4/1184677/-Sickest-Wall-Street-Scam-Yet-Hello-SEC-Justice-Anyone-Beuhler

appalachiablue

(41,177 posts)on low-level employees w/o their knowledge, noted in Michael Moore's film, 'Capitalism: A Love Story.'

https://www.alternet.org/story/143064/michael_moore%27s_expose_of_%27dead_peasant%27_insurance_policies_too_shocking_even_for_good_morning_america_to_ignore

OhNo-Really

(3,985 posts)He didn't take out a policy because Tony Roma Restaurant, may they rot in hell, told him he had a Life Insurance Policy as a benefit.

He worked 18 years as head chef working 50-60 hours a week or more.

His handicapped wife didn't get a dime.

"The policy is to cover the expense of replacing Don" is what the manager told her.

True story.

BOYCOTT Tony Roma's

appalachiablue

(41,177 posts)and his disabled wife after that many years of hard work, and you.

Replacing humans like widgets is the major concern for too many.

How low can people go; I'll remember this place, TR.

Moore's exposure of DEAD PEASANT policies caused them to end I believe. But things have a way of reviving in less obvious forms so who knows.

OhNo-Really

(3,985 posts)Neema

(1,151 posts)I'm so confused.

robertpaulsen

(8,632 posts)Every time the Republicans take control, they remove regulations on Wall Street. When the regulations are removed, the market gets artificially inflated because the scam artists dream up sketchy products like the ones in the OP. The bubble always bursts, then the correction results in real people losing their jobs. The people say, "Hey, maybe we should get the Republicans who created this mess out of office," then the Democratic Party fixes the mess.

I wish it ended there, but somehow the people (or just barely enough people) forget this and put the Republicans in power imagining that a different result from the one I mentioned that always happens is somehow possible. It isn't, and I'm tired of this stupid cycle repeating itself again and again!

turnitup

(94 posts)we are so right that we vote very left and then we are so left that we vote very right. when in reality we really want the middle

Yes I made this up

LiberalLovinLug

(14,178 posts)That Republicans are the fiscally responsible party, because they are made up of conservative bottom line business friendly stewards.

And Democrats, will promise a lot of "free stuff". Mostly to people that don't deserve it, with no way of paying for it, and end up taxing everyone to death and stalling the economy and businesses under the strain. Basically...promoting the sister myth that they are terrible for the economy.

When history shows us the exact opposite.

Its all a perfect storm strategy for Rebublicans though. They can spend like thieves while in power. Debt be damned. Fill the trough to overflowing for themselves and their donors, throw out regulations, pollution standards, anything they can cut that helps their profits, economy and environment be damned.

Almost knowing they will ultimately lose another election once the truth catches up. But that's okay, its all part of the plan, they've fattened up their bank accounts and investment portfolios for the time being. And also, once it crashes, they can buy low and stock up. Democrats finally get in and are left with the massive cleanup. This accomplishes a couple things; one, it means the few years it takes to dig the country out from the mess, they and their RW media partners can blame the party in power for the economy...which can fool a lot of followers.

The second thing it accomplishes, is that Democrats enter their term with one hand or both hands, tied behind their backs fiscally and have no money to implement their campaign promises of redistributing some of the countries wealth back to the 99%. After school programs, women's shelters, Social Security, Medicare, public education, infrastructure...a lot of the help to those areas must be shelved in order to get the economy back and running.

And just when its looking better, which takes about 8 years, and they could actually have a bit of a nest egg to spend on the 99%, Republicans steal another victory, by hook or by crook. And the cycle starts over.

paleotn

(17,989 posts)this time it's different!!!!! Really and truly it's different!!!! ![]()

![]()

unblock

(52,339 posts)etfs are basically just mutual funds except that you trade them like individual stocks rather than like traditional mutual funds.

in and of itself that can hardly cause much problem. the biggest difference is that you can trade during the day rather than only once at the end of the day. but that's not the cause of the crash. it might affect the timing somewhat, but that's about it.

some etfs are leveraged, meaning they use options and futures and such to get double or triple the upside (and downside) of market activity. that can cause people to gain or lose money more quickly, but there's no margin calls involved, so there isn't an inherent need to panic sell (though people might bail if they lose a lot of money quickly).

up to a point, etfs can be bought on margin, whereas mutual funds cannot. for people who do this, it could cause some margin calls and panicky selling.

i don't disagree with regulation in general, and it's appropriate to look carefully at regulation of etfs. i wouldn't mind tighter restrictions on margin use of leveraged etfs, for example.

but to say these *caused* the crash is simply to find two problems and insist that one caused the other. if it weren't for etfs, the stock market would have been pumped up to the absurd heights it got to in other ways. interest rates too low for too long, combined with the hope of huge stimulus and corporate tax breaks, made markets go way too high. that was always going to happen, etfs or not.

then interest rates going up as people realize that wages have to rise at some point and suddenly people realize that corporate valuations aren't necessarily going straight to the moon.

a crash was happening regardless. etfs might be responsible for some specific gyrations (like the dow reaching -1500 at one point before quickly rebounding) but they didn't cause the crash itself.

politicaljunkie41910

(3,335 posts)They all concluded in their roundtable discussion that this area was a major factor in market volitility and the subsequent decline and needs to be regulated. Pete Njarian was one of their commentators who leading the discussion and stated that they have been able to go back and track the data and can show a correlation between the factors and it had nothing to do with the earlier speculations of rate increases and wage increases, etc on Friday when the declines began. They also thought that these products needed to be regulated. As I said earlier this discussion went of for about a half hour.

In a following segment, Carl Icahn came on and he took the regulation issue to the next degree. As I said in an earlier post, I'm not a fan of Carl Icahn, but he stated that these products had created a huge unregulated bubble in the system, and if something wasn't done soon, we were looking at a huge decline, but he couldn't say whether it would be 5 yrs, 5 months, or 5 days, but if something wasn't done soon to regulate these unleaverage products, a big decline was coming as a result of them.

FWIW, don't blame me, I'm just the messenger. Take it or leave it.

unblock

(52,339 posts)i still think it's horseshit.

it pretty much happens every time there's a big downward movement, they always find a way to blame speculators and/or specific products. these may or may not be *part* of the problem but they are rarely the lion's share of the problem.

note that cnbc has an interest it in promoting such theories as it helps deflect blame away from them touting the run-up for so long....

jmbar2

(4,909 posts)The ETFs and ETNs, probably have less to do with it than other factors.

The market has been overbought for so long that all participants have been expecting a correction. When it started to reverse, individuals and trading programs ran for the exits at the same time, causing a cascade of selling. We have far more programmed trading going on than in the past. However, there are also circuit breakers to stop a catastrophic collapse - they simply shut down the markets if the prices sink below a set threshhold. It's actually healthy that the markets pulled back to more reasonable levels.

Secondly, a lot of money is pouring into our market from overseas, including the Chinese middle class, which was not able to trade international stocks until just a few years go. When their markets or fears go bump in the middle of the night, it hits our markets the next morning.

Third, as expectations of interest rate rises increase, nervous investors will choose sell stocks and move to the safety of bonds over high-priced stocks.

Also, as employment recovers, more people are socking money away in company-sponsored 401Ks, etc. That money gets invested every day, and then sometimes moved in huge blocks to safety.

Basically, it's a complex system, with multiple factors causing market volatility. It's pretty fascinating if you are into geeky stuff.

still_one

(92,427 posts)Monday, there is no doubt a flash crash was part of this when the computers kicked in

It can also be argued that some of those factors led to the market going up so fast so far

If this continues, it will help push the U.S. into a recession

unblock

(52,339 posts)the market gradually got way, way ahead of itself.

if it weren't for some of these things, maybe the correction would have taken a week or two instead of a day or two.

is that really such a big deal? is it even such a bad thing for it to happen more quickly?

in any event, the real problem is the gradual building of the bubble, not that particulars of it popping.

IphengeniaBlumgarten

(328 posts)they are much like mutual stock funds, but with lower fees. When stocks go down, of course they do too. But they do own underlying assets.

ETNs do sound more risky, may just own promissory notes, I think.

Panic is not useful.

Suggest you put your money under the mattress, but mine is still largely in the market.

bucolic_frolic

(43,332 posts)is by computer algorithm. No humans.

I think they just sell the futures when its heading down, like a snowball.

The only real game left is to act like a hedge fund manager and focus on 1-3 months with undervalued stocks and pay close attention to charts. Everyone else is cole slaw.

Learn technical analysis with every candlestick you can muster.

Otherwise, buy index funds after a crash, then wait for a long term peak. Rinse and repeat.

Freelancer

(2,107 posts)And elsewhere, DT will call them "Hillary-towns" or "Obama-towns" in a thousand tweets (all good he claims and bad he blames Dems). Then the media will quote him, calling them Obama-towns, at first with air-quotes, then without air-quotes. Russian bots on Facebook will push some conspiracy, et-cetera-ellipsis-et-cetera. And the ratcheting down continues.

Let's hope none of the drama above happens.

The 2018 midterm just got much more important.

ffr

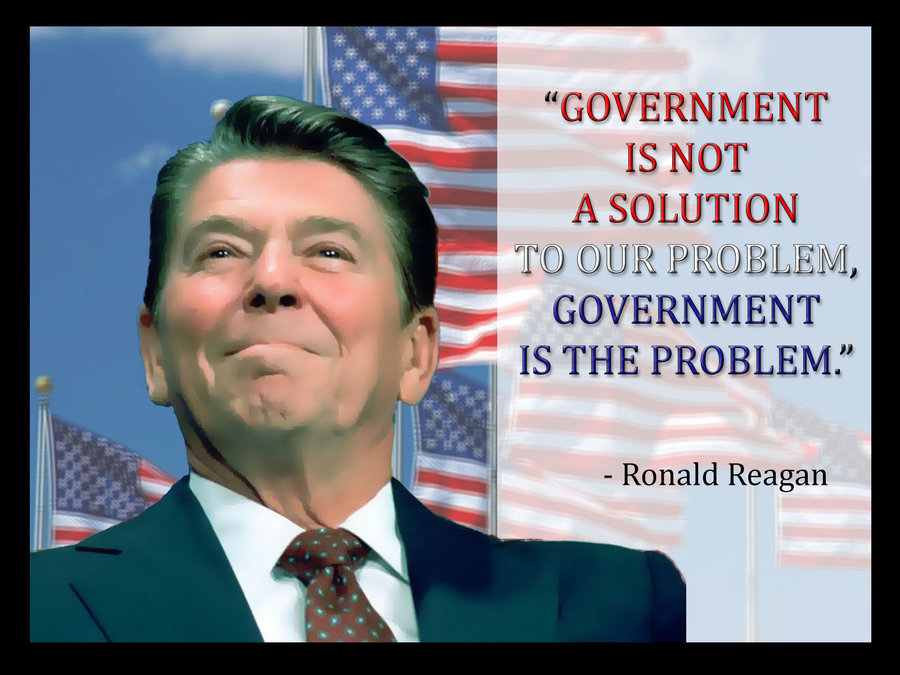

(22,672 posts)Conservatives love deregulation because then they can invent ponzi schemes to rip people off. You can thank them and their supporters for the $Trillions of dollars lost in the past two weeks.

Stock market crash of 1987, during conservative Ronald Reagan's presidency.

jmowreader

(50,566 posts)If I ever get elected mayor, I'm going to paint "We're from the government and we're here to help" on the side of the city fire engine.

jmowreader

(50,566 posts)The blackjack dealer is wearing a floor-length dress.

relayerbob

(6,559 posts)You don't understand it.

This is a correction, not a crash. The market was way over-valued and will likely lose some more valkue before it gets back on steady ground. Normal behavior after a bull run that has gone on so long.

Is there bad behavior? Likely. But ETFs are not based on "buying products on credit", then are essentially mutual funds as someone else noted. Heavy borrowing against margins is another issue altogether.

But this is all normal behavior in the stock market, people need to settle down.

Bernardo de La Paz

(49,046 posts)In 2006 and 2007, financial derivatives made from held mortgages totaled about $9 Trillion, so that was a bigger problem. But it is a risk that history might repeat itself.

C Moon

(12,221 posts)BSdetect

(8,999 posts)That lead to the tea party crap and the GOP obstructionism.

blue-wave

(4,365 posts)A Trump depression or another great recession.....whatever the assholes who caused it want to call it. Let's see where this takes us, I hope I'm wrong. This and we need some regulation is an understatement. They need a lot of regulation made permanent, like in a constitutional amendment. They are destroying lives, fiscally and physically. Criminals who made their crimes "legal".

aggiesal

(8,935 posts)Thanks!

paleotn

(17,989 posts)margin call. Oh, and fire sale. And out of control, downward spiral caused by the first two.

They've been warned about ETFs, but do they listen? Only when they crater.

bearsfootball516

(6,377 posts)UCmeNdc

(9,601 posts)I will buy back in when the market drops. I am betting the bull has run.

scarytomcat

(1,706 posts)who would have thunk it

spinbaby

(15,090 posts)When AI makes the decisions, thing can get pretty flaky. They still don’t know what caused the flash crash of 2010. Yesterday wasn’t as steep and alarming but was probably exaggerated by bots that sold automatically because the market was going down.

Jim__

(14,083 posts)I can't embed the video - it's not the one you saw it's a 3 minute video - here.

On the right hand column at the linked site there is a short video of Carl Icahn talking about wacky funds, leverage, and a market implosion.

This may be a hint of what you saw.

bucolic_frolic

(43,332 posts)I think the after hours on Friday showed it about tripled in value

Fiendish Thingy

(15,667 posts)ETF’s are Exchange Traded Funds, and many are quite safe and conservative, with the added benefit of much lower fees, as they are algorithm driven rather than by a high priced hedge fund manager.

This market was overdue for a 10-15% correction, and we’re not quite there yet. It’s not a crash, despite the hyperbole.

Of course, Trump could start a war or any number of crazy things to unsettle the market, but we’re not at that point.

bearsfootball516

(6,377 posts)Awsi Dooger

(14,565 posts)I saw the segment live. Icahn was rambling all over the place. The host suggested indexing bubble and he agreed with that, focusing on ETFs. The old timers seem to be particularly scared about ETFs. I love them because it's easy to catch the swings on a day like today, unlike mutual funds with a fixed price at day's end only.

Today I made several trades based on the roller coaster ride.

Icahn was mostly bragging about betting on the market once Trump became president, saying that was an "easy" call due to deregulation. The financial networks always set up certain guests for lines like that. Kelly Evans practically feeds them the words.

former9thward

(32,083 posts)So now that you have explained Friday and Monday what is your explanation for Tuesday going up 567?

IronLionZion

(45,543 posts)instead of buying and selling individual stocks. Exchange traded just means you can buy them through an exchange instead of going through a mutual fund company.

There are some specific funds that are narrow in scope and offer leveraged investments (that amplify the up and down movements) or try to be the inverse of other securities in the market as a way to hedge investments. DUers, it's best to steer clear of these products. Hedge funds use it but it's best if normal people don't.

Normal people who want to invest are best served by well diversified mutual funds from reputable companies like Vanguard, Fidelity, T Rowe Price, etc. Put the same amount of money into your accounts each month no matter what the market is doing. Avoid reading financial news about the ups and downs of the market and you will feel much better and enjoy a good long life with healthy retirement savings while others die young of heart attacks and blood pressure. https://www.investopedia.com/articles/mutualfund/05/071305.asp

Yonnie3

(17,497 posts)An allocation is the portions of your portfolio put in stock, bonds and short term (CD, Money Market, etc.).

Re-balance periodically back to that allocation.

As your time horizon shortens you should adjust that allocation for less risk.

If you want this done for you, there are funds that change their allocations over time. At Vanguard they are called Target Retirement followed by the target year. Other reputable firms offer these, I just happen to know Vanguard's name.

riversedge

(70,321 posts)IronLionZion

(45,543 posts)it was all Hillary's fault. It's in her Benghazi emails from the pizza gate.