California Doing a Rendition of the Housing Industry on the Budget $20 Billion Budget Deficit and Massive Amount of Distress Inventory. How Banks Raided the U.S. Treasury with the aid of the Federal Reserve and have Damaged Housing Further.

The banking system has captured our government and frustration is boiling over. Yet those in the housing and banking industry seem complacent and even self congratulatory that we have avoided Great Depression 2.0. Really? Now were taking advice from the same group of cronies that led the economy off the financial cliff. And the most troubling thing is we are at the height of unemployment even though the headline rate seems to have steadied out. Californias unemployment rate still continues to move upward hitting 12.5 percent. Yet all is well in delusional banking world since their idea of a solution is simply not foreclosing. What is even worse, these banking crooks are now offering fire sale deals to other banks and hedge fund investors! Ive contacted a few banks about short sales and in many cases, preference is being given to all cash investors. Glad those bailouts are supporting the crony banking system.

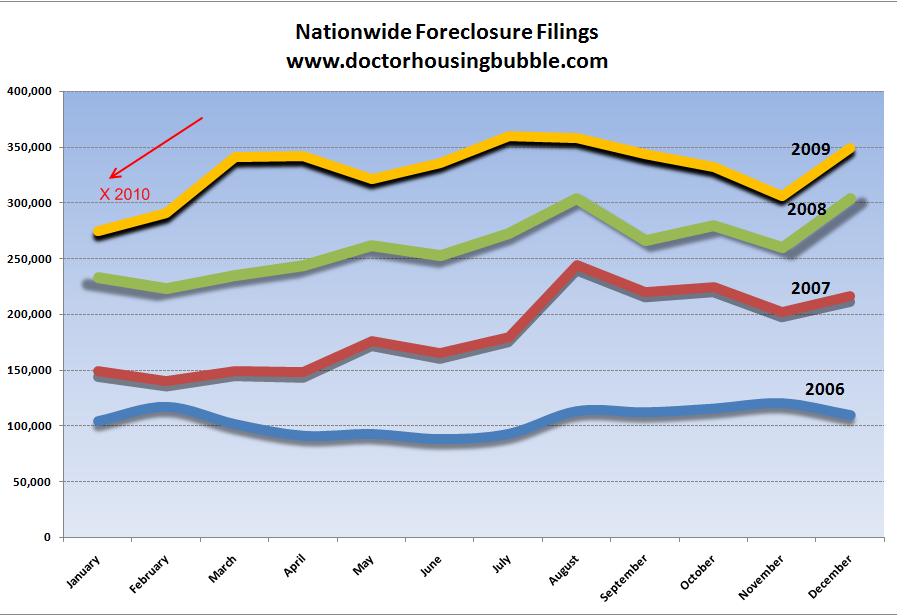

One of the most troubling trends is the belief that all is well because banks arent foreclosing on homes or the fact that there is no second wave. Really? Let us look at nationwide foreclosure filings shall we?

Who needs a second wave when the first wave is still in place? Some in the housing industry seem to be patting their back that there wont be a second wave of foreclosures (even though it is still high) and base this on the mounting distress inventory with Alt-A and option ARMs but no actual foreclosure filing. The wave is hitting as people stop paying their mortgage. Take for example option ARMs. Nearly 50 percent of all outstanding option ARMs are at least 30 days late. In other words, the borrower isnt paying the mortgage! Yet in some form of twisted abracadabra housing logic, this is avoiding the wave because banks are ignoring the problem. The wave was the distress. Foreclosures are still on the market. The bank balance sheet is still loaded with mortgage junk. But just because banks are putting their hands over their eyes doesnt mean the issue was avoided. In fact, it is corrupt to the core and the way they acknowledge this is absolutely stunning. The fact that we have no solid financial reform after 2 years of major crisis is incredible. Banks simply ignoring missed payments while taking trillions demonstrates what has become of our financial system and their idea of dealing with the problem.

http://www.doctorhousingbubble.com/california-doing-a-rendition-of-the-housing-industry-on-the-budget-20-billion-budget-deficit-and-massive-amount-of-distress-inventory-how-banks-raided-the-u-s-treasury-with-the-aid-of-the-federa/