Time for change

Time for change's Journal5 Myths that Are Destroying our Country

A recently produced document by Jacob Hacker and Nate Loewentheil, Prosperity Economics – Building an Economy for All, begins by discussing the five myths of austerity economics. That is an appropriate place to start a discussion of how to build a healthy economy because over the past four decades a widespread belief in those myths among the American people has been destroying our economy and our country. As long as Americans harbor a steadfast belief in those myths we will make no progress and our downward course will continue. Therefore recognizing those myths as the lies they are should be seen as a first step towards our recovery.

The five myths of austerity economics are:

Myth 2: Cutting taxes on the richest is an effective way to spur prosperity

Myth 3: Inequality is not a problem because social mobility is high

Myth 4: Markets are smart, governments are dumb

Myth 5: Those at the top are the ones who create wealth and are alone responsible for their good fortune

Actually, careful study of these five myths will reveal that they have a single purpose – the enrichment of the wealthy at the expense of everyone else. And indeed, they have served that very purpose and continue to do so. And they will continue to do so until they are exposed for the lies that they are. Think of the austerity myths and “trickle down” economics as part and parcel of the same idea. Give everything to the wealthy, and don’t do anything for anyone else because the wealthy know best, and they will take care of everything in the best interests of everyone.

It is easy to see how myth # 2 serves that purpose, and no further comment is necessary on that. Myth # 5 justifies myth # 2 by creating the impression that the rich deserve all the breaks they can get, no matter who gets hurt in the process. Myth # 3 justifies the inevitable result – a rapidly growing economic inequality. If inequality is not a problem then we need not do anything to correct it, and anyone who says otherwise is engaging in “class warfare”. Myth # 1 is a little tricky. If “spending”, leading to deficits, is seen as our # 1 problem, then we must decrease spending on social programs such as health care and Social Security. That enables tax cuts for the rich. And yet, anyone with an ounce of common sense will quickly see that massive tax cuts for the rich will itself contribute substantially to deficits. So the proponents of the austerity myth simply ignore that obvious fact or else claim that it isn’t true, by referring back to myth # 2. Myth number 4 is their way of telling us that our government should get out of the way and let them have a free hand to do whatever they want. If their activities lead to the destruction of our planet, don’t worry about it. Markets know what they are doing and must be left alone to produce their magic. Myth # 4 is the equivalent of a mafia king telling us that we don’t need police or courts of law because the mafia knows what is best for us and will shower us with prosperity (after all the evil-doers are sacrificed).

The Powell Manifesto in the context of U.S. history

Many historians see the beginnings of widespread American adherence to the austerity myths in the Powell Manifesto, written on August 23, 1971, by Louis Powell, a corporate lawyer. Less than a year later, Powell was appointed by President Nixon to the U.S. Supreme Court, where he served for 15 years and contributed substantially to the embedding of conservative economic ideas into our national culture and legal system. A few years following the appearance of the Powell Manifesto, the Reagan Revolution began with the election of Ronald Reagan to the U.S. Presidency, and we’ve gone mostly downhill ever since then.

I don’t recommend actually reading the Powell Manifesto. It’s a very dense read, as it is all written in code. An idea of the entire theme and purpose of the document can be gleaned from its last sentence, which notes that “… business and the enterprise system are in deep trouble, and the hour is late”. The body of the document blames this on leftists, Communists, etc.

What is so revealing about the statement that 'business and the enterprise system are in deep trouble" is that the memo was written during what Nobel Prize-winning economist Paul Krugman describes as the "greatest sustained economic boom in U.S. history", in his book, "The Conscience of a Liberal".

The greatest sustained economic boom in U.S. history and its roots in the New Deal

This great economic boom was largely the fruits of President Franklin Roosevelt’s New Deal, which was founded upon an economic philosophy that is directly opposite that of the austerity myths. In the view of FDR and others who brought us the New Deal, we are at our best when all Americans participate in our economy and share in its benefits, rather than passively sit by and wait for prosperity to trickle down to us from the rich, or become virtual slave laborers to those with the money to control our lives.

Krugman describes the economic boom in terms of median family income: Beginning in 1947, when accurate statistics on this issue first became available, with the top marginal tax rate approaching 90%, median family income rose steadily (in 2005 dollars) from $22,499 in 1947 to more than double that, $47,173 by 1980. Then, for the next 25 years, except for some moderate growth during the Clinton years, there was almost no growth in median income at all, which rose only to $56,194 by 2005 (85% of that growth accounted for during the Clinton years). However one wants to interpret those numbers, nobody could possibly conclude that they indicate overall bad financial consequences accruing from high tax rates on the wealthy. To the contrary, as Krugman notes, this period of record high tax rates on the rich coincides with "the greatest sustained economic boom in U.S. history".

So how could Powell complain about the business and enterprise system being in deep trouble during such an economic boom? The answer is simple. His memo was written to the Chamber of Commerce, right wing corporate titans, and other like minded groups and individuals. To them, shared economic benefits were not seen as a good thing. They were after something else. They wanted to go back to the days prior to the New Deal – the days that FDR railed against in setting the stage for the New Deal and the greatest sustained economic boom in U.S. history that followed.

FDR's speech at the 1936 Democratic National Convention came as our country was continuing to struggle out of the worst economic depression in our history. It was directed at those whom he referred to as "Economic Royalists" – the same type of people who today promote trickle down economics and all the austerity myths for their own benefit. Some excerpts from FDR’s great speech:

The privileged princes of these new economic dynasties, thirsting for power, reached out for control over Government itself. They created a new despotism and wrapped it in the robes of legal sanction. In its service new mercenaries sought to regiment the people, their labor, and their property. And as a result the average man once more confronts the problem that faced the Minute Man.

The hours men and women worked, the wages they received, the conditions of their labor – these had passed beyond the control of the people, and were imposed by this new industrial dictatorship. The savings of the average family, the capital of the small business man, the investments set aside for old age – other people's money – these were tools which the new economic royalty used to dig itself in.

Necessitous men are not free men. Liberty requires opportunity to make a living – a living decent according to the standard of the time, a living which gives man not only enough to live by, but something to live for.

For too many of us the political equality we once had won was meaningless in the face of economic inequality. A small group had concentrated into their own hands an almost complete control over other people's property, other people's money, other people's labor - other people's lives. For too many of us life was no longer free; liberty no longer real; men could no longer follow the pursuit of happiness... These economic royalists complain that we seek to overthrow the institutions of America. What they really complain of is that we seek to take away their power…

We seek not merely to make government a mechanical implement, but to give it the vibrant personal character that is the very embodiment of human charity. We are poor indeed if this nation cannot afford to lift from every recess of American life the dread fear of the unemployed that they are not needed in the world. We cannot afford to accumulate a deficit in the books of human fortitude.

During the New Deal and the greatest sustained economic boom in U.S. history that followed, the American people made great progress towards a shared prosperity. A robust middle class evolved that sustained itself for many decades. But for almost the past four decades we have been regressing in the opposite direction. Wealthy individuals and corporations have united against us and infused their propaganda into our political system and our culture. U.S. Supreme Court decisions have legitimized the use of huge amounts of money to influence our electoral process. The Economic Royalists are back. We fall for their propaganda at our own peril.

A brief look at the economic effects

In their introduction to austerity economics, Hacker and Loewentheil show us three charts that pretty much tell the whole story of the last few decades. Figure A shows us that from 1973 to 2011, the hourly productivity of the American worker rose 80.4%, but in return, median hourly compensation rose only 10.7%. What could cause such a disconnect between production and earnings? Answer: The Economic Royalists have used their massive wealth to buy their own politicians and produce the propaganda needed to get them elected and re-elected. They then direct their puppet politicians to do their bidding, rigging our economic (and political) system for their own private benefit.

Figure B is a graphic illustration of growing economic inequality from 1979 to 2007. While the top 1% of income households have increased their average after-tax annual income by 278%, for an average increase of about a million dollars per household, the poorest fifth of American households have increased their after-tax annual income by only 18%, for an average of about…. well, it’s too small an amount to visualize on the chart with any accuracy.

Figure C is a “Social Health Report Card” for the United States. It shows that among 20 industrialized countries of somewhat comparable wealth to us (Canada, Austria, Belgium, France, Germany, Greece, Ireland, Italy, Netherland, Spain, Switzerland, United Kingdom, Denmark, Sweden, Finland, Norway, Japan, Australia, New Zealand, and us), we rank first in income inequality, relative poverty, health expenditures, and infant mortality, and lowest in life expectancy, health insurance coverage, and environmental performance index. Yet we keep hearing that we are the greatest country on earth – the implication being that it is unpatriotic to criticize our economic or political system.

Counteracting the austerity myths

Hacker and Loweentheil go into much detail to counteract the austerity myths. I’ll just say a few words about them here:

Myth 1 – Spending and deficits are our # 1 problem

Myth 2 – Cutting taxes on the richest is an effective way to spur prosperity

Just prior to the Stock Market Crash of 1929 that led to the Great Depression, top marginal tax rates were very low, at 25%. As noted above, the greatest sustained economic boom in U.S. history took place in the midst of the highest top marginal tax rates on the wealthy in the history of our country – over 90% from 1950 to 1963. That should be enough by itself to shut up all the yapping about the benefits of reducing tax rates on the wealthy. But if not, consider where the George W. Bush tax cuts for the wealthy have gotten us. In the face of the economic disaster that followed several years of massive tax cuts for the rich, how gullible do you have to be to continue to believe that tax cuts for the rich are good for our economy? And finally, take a look at these two charts, which show respectively: 1) the relationship of income inequality to the two worst economic catastrophes of our history – the Great Depression of the 1930s and our current recession. It is titled “Re-creating the Gap that Gave us the Great Depression”; and 2) how top marginal tax rates for the wealthy have varied over time.

The first chart plots income inequality, measured as the ratio between the average income of the top 0.01% of U.S. families, compared to the bottom 90%. The most important thing to note about this chart is that just preceding the great stock market crash of 1929, which plunged us into the Great Depression, and again preceding the great recession of 2008 (in which we are still mired), the inequality ratio hit peak levels, whereas it was at its lowest levels during the long economic boom that Paul Krugman speaks about. The second chart shows that income inequality plotted over time is inversely proportional to top marginal tax rates.

Myth 3 – Inequality is not a problem because social mobility is high

Figure F in “Prosperity Economics” shows that among nations, social mobility declines in proportion to economic inequality. The United States demonstrates very low mobility and very high inequality compared to similarly wealthy nations. End of story.

Myth 4 – Markets are smart, government are dumb

While noting that “markets have enormous virtues”, Hacker and Loewentheil go into great detail in describing the many problems that can plague markets unregulated by a democratic government that is responsive to the needs of its citizens. They conclude:

Myth 5 – Those at the top are the ones who create wealth and are alone responsible for their great fortune

Again, this flies in the face of the fact that the greatest sustained economic boom in the history of our country occurred concurrently with the greatest levels of economic equality. We don’t need to shower the wealthy with gifts in order to have a strong economy. To the contrary, history shows just the opposite of that. Economic prosperity occurs when everyone contributes and shares in the benefits of their labors.

Furthermore, the recent wave of high-level financial fraud that led to our recent economic crisis has shown that, far from creating wealth, many of the wealthiest financial titans in our country have merely found ways to transfer wealth from the American taxpayers to themselves.

Growth for whom

The authors conclude their discussion of the five myths of austerity economics with this common sense paragraph:

And the solution is:

And that is what the rest of their report is about.

Paul Ryan’s hypocrisy and the Romney/Ryan Vision for our Country

Mitt Romney chose Paul Ryan as his running mate hoping that his widely known advocacy for fiscal austerity would impress his conservative base, and perhaps fiscally conservative independents as well.

The introduction to Ryan’s proposed 2013 Budget Resolution, titled "Path to Prosperity – A Blueprint for American Renewal", reads like a fairy tale. It contains 7 major points, point number 7 being to “Lift the crushing burden of debt” from our country. To do that he proposes to “Prioritize defense spending to keep America safe” (point # 1), enact massive tax decreases (point # 5) for wealthy individuals (reducing the top marginal tax bracket to 25%) and corporations (from 35% to 25%), strengthen the social safety net (point # 3), and “fulfill the mission of health and retirement security” (point # 4). Hmmm. What part of this plan is designed to save money to “lift the crushing burden of debt”?

Ryan’s budget fantasy

Many have expressed admiration for Ryan for actually “crunching numbers” to come up with his proposals. But as William Black explains, Ryan did not “actually crunch the numbers”. Instead he “created fantasy numbers, instructing the Congressional Budget Office (CBO) to suspend disbelief and treat the fantasy numbers as real”. Specifically, here is the warning that the CBO issued in their treatment of Ryan’s budget numbers:

Nobel Prize-winning economist Paul Krugman had much the same thing to say about Ryan’s plan, but was a little more blunt about it:

Ryan’s hypocritical record

Ryan’s record during his 7-term tenure in the U.S. House of Representatives is even more damning with regard to his claim to be interested in balancing the budget. The only interest he’s shown in balancing the budget has been on the backs of the poor. When it comes to anything else, he hasn’t shown any restraint.

Despite all his severe anti-big government rhetoric, he has a history of lobbying for millions in federal money for Wisconsin’s 1st district, which he represents. That includes money from the Obama economic stimulus bill, which he attacked as "misses the mark on all accounts". Indeed, as John Nichols points out with respect to Ryan’s long Congressional record, far from being a budget balancer:

But this year Ryan might not get away with it – not only in his run for Vice President, but even getting re-elected to his House seat in Wisconsin. This year his Democratic opponent, Rob Zerban, is calling him on his hypocrisy]:

The impact of Ryan’s budget proposal if it becomes law

Ryan’s budget plan, which has the full support of Mitt Romney, would attempt – unsuccessfully – to balance the federal budget on the backs of the poor, who already are in dire straits, while offering huge advantages to the wealthy. First, his tax “reform” plan would greatly favor the wealthy and hurt the poor, as shown in this chart produced by the Center on Budget and Policy Priorities:

Note the much greater percent federal income tax decrease for those with half a million dollars or greater income, compared to those with incomes under $200,000. And on top of that, consider that even if the percents were identical, the money saved by a given percent tax decrease by a multimillionaire is orders of magnitude greater than the money saved by a family with an income of $200,000 or less with the same percent decrease. As an example of what this plan would mean for the wealthy (and the budget deficit), under the Ryan/Romney budget plan, Mitt Romney would have paid less than 1% in federal taxes, of the $21 million he made in 2010.

With Ryan’s proposed increases to our military budget, how would such a large reduction in federal taxes be paid for in an attempt to reduce the budget deficit? That would be paid for by deep slashes in spending for domestic programs. As Jamelle Bouie explains, in addition to deep cuts in Medicare, Medicaid, and Social Security, all other discretionary spending would have to be cut to less than 10% of what it is today, down to about $100 billion by 2050:

By transforming Medicare into a voucher program, seniors would essentially be on their own. While less federal spending would go to Medicare, out of pocket expenses for seniors would double, from about $6,000 to over $12,000 annually:

Yet despite all the painful cuts to social programs that so many Americans rely on for their livelihood, the budget deficit would rise under Ryan’s plan because of increased military spending and massive tax cuts for the wealthy:

Putting Romney’s choice of Ryan into perspective

Bouie summarizes Ryan’s vision and Romney’s decision to choose him as a running mate:

Romney chose Ryan to send a message: This election is about ideas, and if you elect me, these are the ideas I'll pursue. It's a radical vision for America, and it's now the official platform of the Republican Party. Romney's prior moderation shouldn't fool you into thinking otherwise.

The Irony and Cynicism of Mitt Romney’s Secrecy Surrounding his Tax Returns

Despite repeated requests for transparency regarding his tax returns, Mitt Romney has thus far released for public view only his 2010 tax returns, with promises to later additionally release only his 2011 tax returns. This is despite his requesting that his potential running mates release “several” years of their tax to him (He won’t say how many years he requested, but obviously “several” means more than one or two years).

This secrecy is especially ironic given that it was Romney’s father, George, who engaged in path breaking transparency with regard to his finances in preparation for his run for the Republican Presidential nomination of 1968, when he turned over 12 years worth of tax returns to a journalist. Since that time, as noted by Edward Kleinbard:

Now it appears that the son of the man who inaugurated the practice of transparency in personal finances for Presidential candidates will be the one to terminate that practice – at least temporarily.

Why is transparency of the personal finances of Presidential candidates important?

One of the major responsibilities of a U.S. President is handling the national economy. The personal finances of a Presidential candidate could provide clues as to how that responsibility would be handled once in office.

Release of Romney’s 2010 tax returns showed that he paid less than 14% federal tax on an income of $21 million. That’s about half the tax rate of an average middle class family with two working spouses. Could it be possible that Romney paid far less than 14% federal tax in previous years? Tax experts have stated that it is indeed possible that Romney didn’t pay any taxes at all in one or more previous years, on multi-million dollar incomes, and that he remained within the law in doing so. But wouldn’t it be of interest to the American public to know if Romney paid obscenely low rates in federal taxes on multi-million dollar salaries over the years? That could raise issues of fairness in taxes that the American public would do well to consider. It is especially important to consider since under the budget plan of Romney’s running mate, Romney would have paid less than 1% in federal taxes in 2011. Furthermore, under Paul Ryan’s "Path to Prosperity" plan, Romney might not pay any federal taxes at all for the next ten years.

Other questions raised by Romney’s secrecy over his financial transactions

Financial experts have raised several additional questions posed by Romney’s secrecy over his financial transactions:

It is known from the release of Romney’s 2010 tax returns that he had a great deal of money in a Swiss bank account, which seems to have closed in 2010. In 2009 the IRS announced a partial tax amnesty for unreported foreign bank accounts. Did Romney avail himself of that amnesty program? If he did, might that emphasize the issue of whether some of the millions of Americans who have lost their homes or are currently in danger of losing their homes, largely as the result of fraudulent bank practices, be offered amnesty that would help them retain or regain their homes. Might it raise the question of whether these millions of Americans are as deserving as Mitt Romney? It has also been pointed out the ownership of a Swiss bank account could raise question of compliance with federal tax law, which could be resolved by release of the tax returns covering that period.

Romney is known to have an IRA of $102 million, which he accumulated during his tenure at Bain Capital. Yet Romney was restricted to contribution to the IRA during that time of $32,000 per year. How did annual contributions of $32,000 grow into $100 million? One possibility that has been mentioned is that Romney used some fallacious excuse to put in far more money that he was allowed to put in, in an effort to avoid taxes.

Nicholas Shaxson poses several questions about seemingly strange aspects of Romney’s financial history: It is known that Romney has sheltered much of his wealth in foreign tax havens, but nobody knows much about them. Why is Romney still being paid by Bain Capital, and could those payments constitute a conflict of interest as President? Are Romney’s blind trusts really blind, and if he knows what’s in them, could that create a conflict of interest as President? Did Bain serve as a tax haven for foreign criminals? Shaxson points out:

The bottom line

As noted above, Mitt Romney would accrue huge financial benefits under the type of national budget that he and his running mate are proposing. A public viewing of Romney’s financial transactions over the past several years – the financial transactions that have helped to make him an incredibly wealthy man – could shine a light and put in perspective the economic plans being put forth by Romney and Ryan.

As an abstract concept, I have no problem with people accumulating tremendous wealth. But as a result of huge tax breaks for multimillionaires, Paul Ryan’s plan would strip millions of Americans of basic health insurance, make severe cuts in college grants, and greatly reduce much of the federal safety walls that currently provide some protection to the low income Americans. As described in "Paul Ryan's 'Path to Prosperity' Budget":

The release of Romney’s tax records could generate a lot of national attention for these issues. Aren’t these issues important for the American public (and voter) to consider? In considering Ryan’s “Path to Prosperity” plan, the American voter might want to consider whose prosperity the plan refers to.

The Takeover of our Democracy and our Economy by Wall Street

It is no coincidence that as the influence of money in politics has exploded to levels not seen in our country since prior to the Great Depression of the 1930s, wealth inequality has also reached record high levels – with the giant financial institutions of Wall Street leading the way.

The roots of economic catastrophe

Nobel Prize-winning economist Paul Krugman sums up the anti-regulatory craze that led to our current crisis in his book, “The Return of Depression Economics and the Crisis of 2008” – in which he discusses the “shadow banking system”, which refers to the extreme deregulation of our banking system:

But this warning was ignored, and there was no move to extend regulation. On the contrary, the spirit of the times – and the ideology of the George W. Bush administration – was deeply anti-regulation. This attitude was symbolized by a photo-op… in which representatives of various agencies… used pruning shears and a chainsaw to cut up stacks of regulations. More concretely, the Bush administration used federal power… to block state-level efforts to impose some oversight on subprime lending…

So the growing risks of a crisis for the financial system and the economy as a whole were ignored or dismissed. And the crisis came.

This should not have been surprising. Why should we expect that the results of deregulating financial institutions – or any corporate sector of our economy – should be any different than deregulating organized crime (i.e. doing away with all laws used to control it), for example? Both organized crime and corporate America are focused primarily on a ruthless pursuit of profits and power, and neither is particularly concerned about who gets run over in the process. So when the barriers are purposely removed we should not be too surprised to see lots of people get run over.

It should not be surprising that when the wealthy few are given huge advantages over vast masses of people that they will use their powers to their own advantage. What we have seen in this country since the Reagan presidency is vast expansion of the income and wealth gap in our country, and consequently the accumulation into the hands of the wealthy few vast powers to shape national legislation to their advantage.

Privatizing benefits while socializing the responsibility for the consequences of risks should strike us as the most obvious of frauds. Yet those in power have managed to bamboozle millions of Americans into thinking of it as “throwing off the restraints on free enterprise”.

Behind the deregulation of our financial system – the corruption of democracy by money

Bill Moyers explains in his book, "Moyers on Democracy", that the root of the problem is that our elected representatives in Congress need huge sums of money to finance their campaigns and remain in office. As a result of this:

The Gilded ages – then and now – have one thing in common: audacious and shameless people for whom the very idea of the public trust is a cynical joke…Having cast our ballots in the sanctity of the voting booth, we go about our daily lives expecting the people we put in office to weight the competing interests and decide to the best of their ability what is right…

Twenty-five years ago Grover Norquist had said that “What Republicans need is 50 Jack Abramoffs in Washington…” Well, they got it, and the arc of the conservative takeover of government was completed… Money, politics, and ideology became one and the same in a juggernaut of power that crushed everything in sight…

This crowd in charge has a vision sharply at odds with the American People. They would arrange Washington and the world for the convenience of themselves and the transnational corporations that pay for their elections… The people who control the U.S. government today want “a society run by the powerful, oblivious to the weak, free of any oversight, enjoying a cozy relationship government, and thriving on crony capitalism

If Republicans are the cheerleaders for the 1%, Democrats are collaborationists

Goron Lafer makes it clear in an article titled "Why Occupy Wall Street Has Left Washington Behind" that, though the Republicans are worse, both parties are to blame:

Gifts by our government to Wall Street

Bush administration – the Bush-Paulson bailout

Robert Scheer explains, in “The Great American Stickup”, how the financial industry bailout began under President Bush’s Secretary of the Treasury, Henry Paulson, and worked for the benefit of Wall Street, especially for Goldman Sachs:

What we have here is a rare glimpse into the workings of the billionaires’ cub, that elite gang of perfectly legal loan sharks who in only the most egregious cases will be judged as criminals… These amoral sharks, who confiscated billions from shareholders and the 401(k) accounts of innocent victims, were rewarded handsomely, rarely needing to break the laws their lobbyists had purchased…

In September 2008 came {Paulson’s} infamous three-page, take-it-or-leave-it proposal to Congress that the government fork over $700 billion in bailout funds, and he was successful in insisting that no strings be attached in the form of punishment for CEOs, oversight or control on bonuses… Basically they gave Congress a ransom note: “We’ve got your 401(k) and if you want to see your 401(k) alive again, give us $700 billion in unmarked bills”. The threat worked, and the bailout intrusion into the ostensibly free market of a scope unprecedented in U.S. history passed by a wide margin in Congress, with few questions asked…

Obama administration

Continuation of the Bush bailout by the Obama administration

The bailout continued under the Obama administration. As the Obama administration was considering putting Treasury Secretary Tim Geithner’s plan into effect – which was largely a continuation of the Bush administration plan – several eminent non-corporate economists warned them and us of the consequences. They used different words, but their basic description of the Geithner plan was the same: a reverse Robin Hood scheme, conducted behind closed doors:

Paul Krugman wrote:

In other words, this is a gift from the American taxpayers to the banks. Krugman added:

What Joseph Stiglitz had to say about the Geithner bailout plan was very similar to what Krugman said:

Long after these warnings were ignored by the Obama administration, and the continued bailout of Wall Street was widely recognized as a dismal failure in which Wall Street used their taxpayer funded gift almost solely to enrich themselves, Robert Reich put the issue in perspective:

Homeowners can’t use bankruptcy to reorganize their mortgage loans because the banks have engineered laws to prohibit this. Banks have also made it extremely difficult for young people to use bankruptcy to reorganize their student loans. Yet corporations routinely use bankruptcy to renege on contracts.

Little help for homeowners

Given that home foreclosures were at the heart of our economic crisis, one would hope that government interventions would be targeted towards helping homeowners rather than relying on a trickle down sort of solution in which primarily banks were targeted for relief. But it didn’t work out like that. Help for homeowners would cut into Wall Street’s profits. As William Greider noted:

William Kuttner in his book, "A Presidency in Peril – The Inside Story of Obama’s Promise, Wall Street’s Power, and the Struggle to Control our Economic Future", describes how this crisis was handled by both the Bush and Obama administrations:

Obama’s solution was a program called "Making Home Affordable". Kuttner explains that this program had several fatal flaws. Perhaps the most fundamental flaw was that it was voluntary for the banks. Instead of mandating actions on the part of banks, they were given various “incentives”. But the incentives weren’t enough to make it worth the bank’s while to provide much help to homeowners. In fact, in many cases they had an incentive to foreclose rather than help the homeowner stay in the home. Consequently, the banks offered very little help for most homeowners.

There was one provision of Obama’s bill that had some teeth. That was the proposed authority of bankruptcy judges to compel banks to modify loans to prevent foreclosures. This provision was fiercely resisted by the financial industry, and therefore given very little support by the Obama administration. Kuttner explains:

The only provision of the bill that was opposed by the financial industry therefore died in the Senate. Kuttner commented on the difference in government solicitude for banks, compared with the rest of us – the bottom 99%:

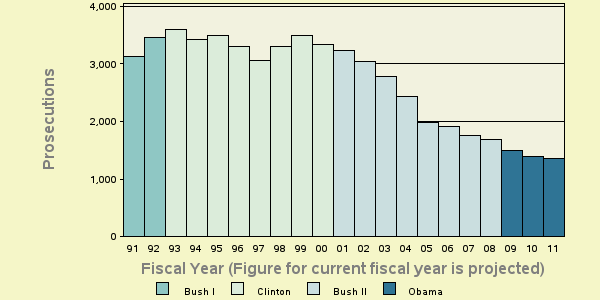

Declining prosecutions for financial institution fraud

One would hope that, with the wild excesses and evidence of fraud committed by our large financial institutions during the Bush and Obama administrations, that our federal government would have been especially active in prosecuting those responsible. But to the contrary, a simple chart that requires no comment tells the story:

[font color="red"]Criminal Financial Institution Fraud Prosecutions over the Last 20 Years[/font]

The money behind the gifts to Wall Street

Much was made about the large amounts of money that the Obama campaign amassed from small donors in 2008. It is true that the Obama campaign raised a great deal of money from small donors. In 2008, 30% of his record-breaking $745 million campaign donations came from small donors (defined as $200 or less). But what about the other 70 percent? Ari Berman puts the issue into perspective:

Of the $89 million raised in 2011 by the Obama Joint Victory Fund, a collaboration of the Democratic National Committee (DNC) and the Obama campaign, 74 percent came from donations of $20,000 or more and 99 percent from donations of $1,000 or more.

The campaign has 445 "bundlers" (dubbed “volunteer fundraisers” by the campaign), who gather money from their wealthy friends and package it for Obama. They have raised at least $74.4 million for Obama and the DNC in 2011. Sixty-one of those bundlers raised $500,000 or more. Obama held seventy-three fundraisers in 2011 and thirteen last month alone, where the price of admission was almost always $35,800 a head.

Three of Obama’s top seven contributors in 2008 were financial industry giants:

Goldman Sachs: $1,013 thousand

JP Morgan Chase: $809 thousand

Citigroup: $737 thousand

Morgan Stanley wasn’t far behind, at $512 thousand. By contrast, John McCain received less than a million dollars combined from those three institutions. Those contributions were not made with altruistic purposes in mind. As noted above, the financial giants were very well compensated by the Obama administration during his first presidential term.

Wall Street now loves Romney even more than Obama

Yet despite the Obama administration’s very generous treatment of Wall Street, the 2012 election cycle is turning out to be a very different matter. Five of Romney’s top six contributors so far have been financial industry giants:

Goldman Sachs: $636 thousand

JP Morgan Chase: $503 thousand

Morgan Stanley: $476 thousand

Bank of America: $466 thousand

Citigroup: $345 thousand

And this campaign is far from over. Undoubtedly, by the time it’s over, financial industry contributions to Romney’s campaign will dwarf even their huge contributions to the 2008 Obama campaign. And by contrast, the five institutions noted above aren’t even among Obama’s top 20 contributors in 2012, which ends at $127 thousand.

Why the desertion by Wall Street of Obama for Romney, after the Obama administration treated them so well? Obama did sign legislation requiring some regulation of the financial industry, and he did engage in some populist rhetoric against the excesses of Wall Street. Even that was too much for them. It’s hard to imagine, but a Romney administration is likely to dole out even more welfare to the financial industry that the Obama administration did.

The power of the 1% in American politics

Ari Berman summarizes the issue in "Occupy Wall Street Hits K Street":

The problem continues to worsen, accelerating with every election cycle. In 2008, Barack Obama became the first major party nominee to decline federal matching funds – in order to avoid limits on campaign spending. 2012 will mark the first Presidential election where both major party candidates refused federal matching funds for that reason.

In 2010, 1 percent of the 1 percent accounted for 25 percent of all campaign-related donations ($774 million) and 80% of all donations to the two major parties. Despite the severe unpopularity of the giant financial institutions in the United States today, the money they supply to political campaigns remains a major force in American politics. Stephen Colbert noted that half of the money raised by Super PACs in 2011 came from

just twenty-two people. That’s seven one-millionths of 1 percent of Americans.

Robert Reich’s suggestions on what needs to be done

In "'Big Government' Isn't the Problem, Big Money Is", Robert Reich, who resigned as Bill Clinton’s Secretary of Labor because of insufficient support for his recommendations, suggests what needs to be done:

Don’t focus solely on Washington or entirely on elections. Corporate campaigns – consumer boycotts of companies behind the largest political contributions, media attention to those that award top executives the fattest compensation packages while laying off the most workers – can play an important role. And when candidates are the targets, don’t wait for them to emerge with agendas and policy positions. Take an active role in creating those agendas – and get candidates to run on them.

We should demand, for example, that the marginal income tax on the top 1 percent return to what it was before 1981 – at least 70 percent; that a transactions tax be imposed on all Wall Street deals; that distressed homeowners be allowed to reorganize their mortgages under bankruptcy; that Medicare be available to all; that the basic military budget be cut by at least 25 percent over the next decade; that the Glass-Steagall Act be resurrected and Wall Street’s biggest banks be broken up; and that all political contributions be disclosed, public financing be made available to candidates in general elections and a constitutional amendment be enacted to reverse Citizens United.

Tell incumbents you’ll work your heart out to get them re-elected on condition they campaign on such an agenda… Newly elected officials must know that we will continue to mobilize support for a progressive agenda, reward them for pushing it and hold them accountable in the next election cycle if they don’t. We will even go so far as to run candidates against them in their next primary – candidates who will run on that agenda.

Progressives must take back our economy and our democracy from a regressive right backed by a plutocracy that has taken over both.

The New Poll Tax – Restrictive Voting Laws Could Disenfranchise Millions

As the 2012 national elections approach, the Republican Party (and Democratic Party too, to a lesser extent) is so subservient to the interests of the American oligarchy – the wealthiest and most powerful corporations and individuals – that they routinely fail miserably to represent the interests of ordinary Americans. In order to preserve ever more money for the American oligarchy they strive to tear apart government programs that help ordinary working Americans, while providing every advantage they can for their wealthy donors. They bail out gigantic banks with trillions of dollars of tax payer money, while refusing to enact legislation that would prevent banks from the reckless activities that created their need for those bailouts. By comparison, the help they provide to distressed homeowners, who are losing their homes by the millions, is minimal. They are attempting to destroy the Social Security program that has served the needs of elderly Americans for so many decades, by turning it over to private for-profit corporations. They fight endlessly against public education. They demonize any government program that would help to make health care more affordable to the American people. The list goes on and on. The result has been recession, high unemployment, and a record high level of income inequality in the United States, exceeding even that which directly preceded the Great Depression of the 1930s.

No wonder polls show today that Congressional job approval has averaged a miserable 14% of the American people in 2012. How do incumbent Congresspersons overcome such unpopularity to stand a chance at re-election? For one thing, they use the money they receive from their wealthy donors to bombard their constituents with propaganda, especially lies about their opponents.

The barrage of voter ID laws

But that is not enough. They also have to make it extremely difficult or impossible for ordinary people to vote. Since 2003 they have been passing state voter ID laws for this purpose. This is the equivalent of the of the old poll tax, which was abolished in 1964 with the 24th Amendment to our Constitution, which reads in part “The right of citizens of the United States to vote in any… election… shall not be denied or abridged by the United States or any State by reason of failure to pay any poll tax or other tax”. The voter ID laws are the equivalent of the poll tax because the less money one has the more difficult it is to obtain the various voter IDs required by these laws. These laws also have the same purpose as the long abolished poll tax – to make it difficult to impossible for poor people, and especially black people, to vote.

As of September, 2011, 30 U.S. states required either photo ID or some other form of ID in order to vote. In 2012, more voter ID legislation, all with the purpose of making it difficult to impossible for those of little means to vote, was introduced in 34 states.

The excuse for voter ID laws – the “voter fraud” myth

To deflect attention from the real reasons for their disguised poll tax, they claim that the purpose of the voter ID laws is to prevent so-called “voter fraud”. Art Levine discusses the “voter fraud” movement in an article titled "The Republican War on Voting".

On Election Day 2000 in St. Louis, hundreds or thousands of voters were turned away from the polls because their names didn’t appear on the voting rolls, resulting in a court order to delay closing of the polls in St. Louis by 45 minutes. In that election John Ashcroft lost his bid for re-election to the U.S. Senate (from Missouri) to Mel Carnahan, who had recently died in a plane crash. Republican leaders were outraged over this turn of events, and Missouri’s remaining Republican Senator subsequently made the unsubstantiated charge that dogs and dead people voted in that election. Levine describes what happened then:

Later, in October 2002, Ashcroft initiated an effort to combat voter fraud – the "Ballot Access and Voting Integrity Initiative". Yet, though “voter fraud” was declared a high priority, only 24 people were convicted of illegal voting between 2002 and 2005. Not a single person was even charged with impersonating another voter – the claimed rationale for the restrictive voting laws. Fourteen of the 24 convictions were of noncitizens who were apparently confused about election laws.

Pennsylvania’s new voter ID law and its probable effects

The state of Pennsylvania passed an especially egregious voter ID law in 2012. According the Pennsylvania Transportation Department, 9.2 percent of registered voters in Pennsylvania lack the required ID to vote in 2012. Unless this law is successfully challenged (it is currently being taken to court), these voters will be turned away from the polls when they attempt to vote on Election Day 2012. Yet, according to a recent study by Matt Barreto, only 34% of currently registered Pennsylvania voters are aware of the law, and 98% believe that they have a currently valid ID. Barreto also identified certain demographic groups (of otherwise eligible voters) that are especially likely to lack the required ID. All of these groups tend to vote Democratic. Barreto found the following percentages of various groups of otherwise eligible Pennsylvania voters to lack an ID that is valid under current Pennsylvania law:

Females: 17.2%

Latinos: 18.3%

Over age 75: 17.8%

Age 18-34: 17.9%

Make less than $20,000 per year: 22%

No wonder Pennsylvania State House Republican leader Mike Turzai recently bragged soon after he led the passage of the 2012 Pennsylvania voter ID law, “Voter ID, which is gonna allow Governor Romney to win the state of Pennsylvania, done”.

The shame of restrictive voter ID laws

American voters who are homeless, do not own cars, or otherwise lack access to photo IDs are usually ordinary people who have fallen on hard times and gotten caught up in a system that is making life more and more difficult for ordinary people. The abolition of the poll tax in 1964 was a great step towards giving our most vulnerable citizens the right to vote. With the recent barrage of voter ID laws we are moving backwards. Time will tell if we let them get away with this.

Election Fraud 2012 – Voting Machine Fraud

As we all know, there are some very wealthy and powerful interests in this country who would hate to see us elect many candidates for public office who care about the interests and well-being of average Americans and are willing and courageous enough to use the power of their offices to benefit the American people. That would disrupt the status quo by reducing the power that the American oligarchy exerts over our lives.

These wealthy and powerful interests are not going to just sit by and watch democracy take its course. Recent history has shown (and not so recent history as well) that they will go to great lengths to prevent the election of candidates who are antagonistic to their interests – that is, who act in the interests of the majority of their constituents – including the rigging of our election system to elect the candidates of their choice.

These people arranged for the election of George W. Bush in 2000, and did so again in 2004. You can bet that they will do whatever is within reach of their considerable power in 2012 to disrupt the democratic process. They have many methods at their disposal for that purpose. In this post I’ll discuss election fraud mediated by voting machines.

Vote switching on electronic machines that produce unverifiable results

Electronic voting machines that record and count your vote with no intervening process (for example, voters punching holes in or making marks on ballots prior to the ballot being read by a machine) are called direct recording electronic (DRE) machines. Unless they produce a paper record of your vote which you have the opportunity to verify, there is no way on earth to verify that the vote total claimed by the machine represents a true and accurate vote total. That’s why they call it “black box voting”.

In 2012, 25% of American voters residing in 17 U.S. states will be voting on these machines, with no accompanying paper record. The owners of these machines are private corporations – most of them with strong ties to the Republican Party. Voting experts unanimously agree (including even those who don’t agree that the 2000 or 2004 Presidential and other elections were stolen) that voting on these machines represents a travesty of democracy.

In addition to the 25% of American voters who will be voting on these machines in 2012 with no accompanying paper record, another 8% will be voting on the same kind of machines, but with an accompanying paper record that the machine produces and provides the voter with an opportunity to verify. This is called a "paper trail" or a "voter verified paper audit trail" (VVPAT). The VVPAT takes many different specific forms, some better than others. But all have problems. Some problems with the various VVPAT systems include: 1) some do not provide ballots directly to the voter for verification. When that is the case, the voting machine can be programmed to produce fake electronic votes that do not correspond to the image shown to the voter; 2) evidence has shown that even when the paper vote is provided directly to the voter, many voters don’t take the time to verify its accuracy; 3) paper trails are of use only when they are recounted (i.e. audited) by hand following an election. Many states have non-existent to poor procedures for doing this, and even when such procedures exist on the books, they may not be executed.

Potential solutions

By far the best solution to this problem is to disallow the use of DRE machines to count our votes. Period. Our elections are public functions that represent the heart of our democracy. To entrust that responsibility to private corporations with their own set of interests makes a mockery of democracy. But it is too late for 2012. Voting precincts in the United States have already established what methods of voting they will use on Election Day.

In the minority of cases where a VVPAT accompanies the use of a DRE machine, procedures should be in place to make sure that voters understand how to verify their vote and what to do when their paper record doesn’t match their intended vote. An audit system of routine recounting of a statistically valid sample of ballots should be in place to verify the accuracy of the machine count. The audit should be completed before the final results are certified.

Exit polls have often been used – in other countries – to verify the accuracy of machine produced vote counts. When the exit poll diverges substantially from the official vote count, that should signify a serious problem in need of investigation. Extensive hand vote recounts should then be performed (but of course are not possible where DRE machines without VVPAT are used). The use of exit polls to act as checks on national elections seemed to work very well in Yugoslavia in 2000 and in the Ukraine in 2004. A large discrepancy between exits polls and the official vote count in Yugoslavia was used, in part, to topple Slobodan Milosevik from power in 2000. A similar large discrepancy between exit polls and the official vote count in the Ukraine was used, in part, to elevate Victor Yanukovich to the Ukrainian Presidency over Victor Yushchenko in 2004. The government of the United States was happy to facilitate both processes, using the exit poll discrepancies as a major rationale. Yet in the United States, exit polls are not seriously considered as a means of monitoring elections. When exit polls in 2004 showed John Kerry winning the U.S. Presidency, our national news media was silent about it. Instead we were shown TV graphics of adjusted exit polls, indicating George W. Bush as the winner. TV viewers had no way of knowing that these weren’t really exit polls at all, but rather they were numbers statistically adjusted to fit the machine recorded vote count. When knowledgeable people pointed out the huge discrepancies between the official vote counts and the results of the exit polls, we were told that the exit polls were wrong – with almost no evidence shown us to back up that claim. Exit polls should be used in this country, as they are in other democracies, to monitor elections.

Tabulation of vote counts

Even when voters produce paper records of their vote, the vast majority of counties in the United States tabulate the final (and official) vote count by adding up the counts from each of their precincts by machine. These machines, just like the machines that register and count our individual votes, can be programmed for fraud. And as is the case with individual DRE machines, there is much evidence that these county “central tabulators” have been used for the purpose of election fraud.

Potential solutions

In theory, the solution to this problem is very simple. Just obtain the vote count for every precinct in every county as soon as the results are posted, before the final and official county vote count is tabulated. Then, when the official count is announced, see if it matches the totals from the individual precincts. But what is simple in concept can be very difficult in actual practice. We need airtight comprehensive systems for doing this. Whatever systems were in place for doing this in 2004 did not work. Election integrity organizations were unable to obtain the original (pre-tabulator) vote counts from way too many precincts following that election.

Where paper records are produced, hand recounts of the vote can be conducted to verify the results of the county tabulated votes. As discussed above, good thorough systems must be in place for doing this.

Profile Information

Gender: MaleHome country: United States

Current location: Winter Garden, Florida

Member since: Fri Dec 3, 2004, 12:01 AM

Number of posts: 13,714