Octafish

Octafish's Journal''The issues are much too important for the Chilean voters to be left to decide for themselves...''

"... l don't see why we need to stand by and watch a country go communist because of the irresponsibility of its own people." -- Henry Kissinger on the US-backed coup d'etat in Chile.

The Nixon Administration’s Response to Salvador Allende and Chilean Expropriation

EXCERPT...

...Following a meeting regarding U.S. policy on expropriation on the Presidential yacht Sequoia on June 10, 1971 (details of which have yet to be declassified) the Administration’s hard-line position gradually began to take shape.

A number of important meetings took place the day after the Sequoia meeting. During this first meeting, Nixon and Kissinger discussed Chilean attempts to secure new loans and renegotiate their existing obligations. Nixon fumed over the unwillingness of the Congress to do more for Brazil, which, in contrast to Chile, was led by “friends” of the United States. Nixon and Kissinger also discussed the assassination of the former Chilean Cabinet Minister, Edmundo Pérez Zujovic, on June 8, 1971 by a Chilean anarchist group, Vanguard of the People. Nixon and Kissinger chuckled at the Allende’s accusation that the CIA had orchestrated the assassination, noting that Zujovic was a conservative opponent of Allende, and probably the last person the U.S. Government would want to assassinate. Besides, as Kissinger noted, the CIA was too “incompetent” to pull off such an operation, recalling that the last person whom the CIA assassinated had lingered for three weeks before expiring.(vi)

SOURCE w/details, tapes, yada...

http://nixontapes.org/chile.html

Wonder what "expropriation" they talked about? Cuba? Chile? Chicago? Wonder how many CIA victims took three weeks to expire? And that was back when assassination was still illegal, before the world changed on 9/11.

Operating on behalf of Nixon and Wall Street, the CIA and Milton Friedman & Friends perfected the art of turning the screws through austerity in Chile.

"The Chicago Boys in Chile: Economic Freedom's Awful Toll"

Orlando Letelier

August 28, 1976

EXCERPT...

The Economic Prescription and Chile's Reality

SNIP...

These are the basic principles of the economic model offered by Friedman and his followers and adopted by the Chilean junta: that the only possible framework for economic development is one within which the private sector can freely operate; that private enterprise is the most efficient form of economic organization and that, therefore, the private sector should be the predominant factor in the economy. Prices should fluctuate freely in accordance with the laws of competition. Inflation, the worst enemy of economic progress, is the direct result of monetary expansion and can be eliminated only by a drastic reduction of government spending.

Except in present-day Chile, no government in the world gives private enterprise an absolutely free hand. That is so because every economist (except Friedman and his followers) has known for decades that, in the real life of capitalism, there is no such thing as the perfect competition described by classical liberal economists. In March 1975, in Santiago, a newsman dared suggest to Friedman that even in more advanced capitalist countries, as for example the United States, the government applies various types of controls on the economy. Mr. Friedman answered: I have always been against it, I don't approve of them. I believe we should not apply them. I am against economic intervention by the government, in my own country, as well as in Chile or anywhere else (Que Pasa, Chilean weekly, April 3, 1975).

SNIP...

A Rationale tor Power

SNIP...

Until September 11, 1973, the date of the coup, Chilean society had been characterized by the increasing participation of the working class and its political parties in economic and social decision making. Since about 1900, employing the mechanisms of representative democracy, workers had steadily gained new economic, social and political power. The election of Salvador Allende as President of Chile was the culmination of this process. For the first time in history a society attempted to build socialism by peaceful means. During Allende's time in office, there was a marked improvement in the conditions of employment, health, housing, land tenure and education of the masses. And as this occurred, the privileged domestic groups and the dominant foreign interests perceived themselves to be seriously threatened.

Despite strong financial and political pressure from abroad and efforts to manipulate the attitudes of the middle class by propaganda, popular support for the Allende government increased significantly between 1970 and 1973. In March 1973, only five months before the military coup, there were Congressional elections in Chile. The political parties of the Popular Unity increased their share of the votes by more than 7 percentage points over their totals in the Presidential election of 1970. This was the first time in Chilean history that the political parties supporting the administration in power gained votes during a midterm election. The trend convinced the national bourgeoisie and its foreign supporters that they would be unable to recoup their privileges through the democratic process. That is why they resolved to destroy the democratic system and the institutions of the state, and, through an alliance with the military, to seize power by force.

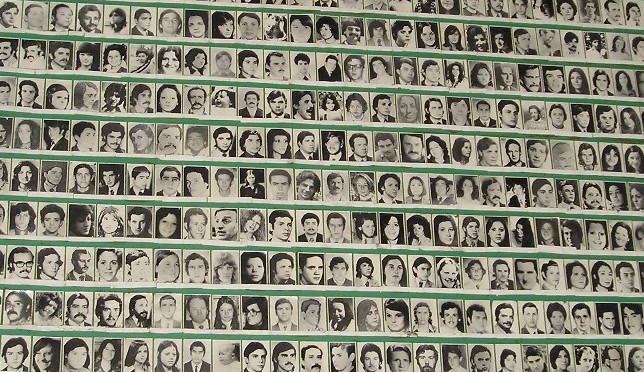

In such a context, concentration of wealth is no accident, but a rule; it is not the marginal outcome of a difficult situation -- as they would like the world to believe -- but the base for a social project; it is not an economic liability but a temporary political success. Their real failure is not their apparent inability to redistribute wealth or to generate a more even path of development (these are not their priorities) but their inability to convince the majority of Chileans that their policies are reasonable and necessary. In short, they have failed to destroy the consciousness of the Chilean people. The economic plan has had to be enforced, and in the Chilean context that could be done only by the killing of thousands, the establishment of concentration camps all over the country, the jailing of more than 100,000 persons in three years, the closing of trade unions and neighbourhood organizations, and the prohibition of all political activities and all forms of free expression.

While the Chicago boys have provided an appearance of technical respectability to the laissez-faire dreams and political greed of the old landowning oligarchy and upper bourgeoisie of monopolists and financial speculators, the military has applied the brutal force required to achieve those goals. Repression for the majorities and economic freedom for small privileged groups are in Chile two sides of the same coin.

CONTINUED...

http://www.ditext.com/letelier/chicago.html

Three weeks after this was published in The Nation (Aug. 28, 1976), Orlando Letelier was assassinated by a car bomb in Washington, D.C.

WHAT THE IMPERIALISTS DID TO CHILE IN 1973 THEY ARE DOING TO THE USA TODAY.

The author helped implement the privatization scam for Nixon, Pinochet, CIA and the globalist crowd. They want to do it here, of course:

President Clinton and the Chilean Model.

By José Piñera

Midnight at the House of Good and Evil

"It is 12:30 at night, and Bill Clinton asks me and Dottie: 'What do you know about the Chilean social-security system?'” recounted Richard Lamm, the three-term former governor of Colorado. It was March 1995, and Lamm and his wife were staying that weekend in the Lincoln Bedroom of the White House.

I read about this surprising midnight conversation in an article by Jonathan Alter (Newsweek, May 13, 1996), as I was waiting at Dulles International Airport for a flight to Europe. The article also said that early the next morning, before he left to go jogging, President Bill Clinton arranged for a special report about the Chilean reform produced by his staff to be slipped under Lamm's door.

That news piqued my interest, so as soon as I came back to the United States, I went to visit Richard Lamm. I wanted to know the exact circumstances in which the president of the world’s superpower engages a fellow former governor in a Saturday night exchange about the system I had implemented 15 years earlier.

Lamn and I shared a coffee on the terrace of his house in Denver. He not only was the most genial host to this curious Chilean, but he also proved to be deeply motivated by the issues surrounding aging and the future of America. So we had an engaging conversation. At the conclusion, I ventured to ask him for a copy of the report that Clinton had given him. He agreed to give it to me on the condition that I do not make it public while Clinton was president. He also gave me a copy of the handwritten note on White House stationery, dated 3-21-95, which accompanied the report slipped under his door. It read:

[font color="green"]Dick,

Sorry I missed you this morning.

It was great to have you and Dottie here.

Here's the stuff on Chile I mentioned.

Best,

Bill.[/font color]

Three months before that Clinton-Lamm conversation about the Chilean system, I had a long lunch in Santiago with journalist Joe Klein of Newsweek magazine. A few weeks afterwards, he wrote a compelling article entitled,[font color="green"] "If Chile can do it...couldn´t North America privatize its social-security system?" [/font color]He concluded by stating that "the Chilean system is perhaps the first significant social-policy idea to emanate from the Southern Hemisphere." (Newsweek, December 12, 1994).

I have reasons to think that probably this piece got Clinton’s attention and, given his passion for policy issues, he became a quasi expert on Chile’s Social Security reform. Clinton was familiar with Klein, as the journalist covered the 1992 presidential race and went on anonymously to write the bestseller Primary Colors, a thinly-veiled account of Clinton’s campaign.

“The mother of all reforms”

While studying for a Masters and a Ph.D. in economics at Harvard University, I became enamored with America’s unique experiment in liberty and limited government. In 1835 Alexis de Tocqueville wrote the first volume of Democracy in America hoping that many of the salutary aspects of American society might be exported to his native France. I dreamed with exporting them to my native Chile.

So, upon finishing my Ph.D. in 1974 and while fully enjoying my position as a Teaching Fellow at Harvard University and a professor at Boston University, I took on the most difficult decision in my life: to go back to help my country rebuild its destroyed economy and democracy along the lines of the principles and institutions created in America by the Founding Fathers. Soon after I became Secretary of Labor and Social Security, and in 1980 I was able to create a fully funded system of personal retirement accounts. Historian Niall Ferguson has stated that this reform was “the most profound challenge to the welfare state in a generation. Thatcher and Reagan came later. The backlash against welfare started in Chile.”

But while de Tocqueville’s 1835 treatment contained largely effusive praise of American government, the second volume of Democracy in America, published five years later, strikes a more cautionary tone. He warned that “the American Republic will endure, until politicians realize they can bribe the people with their own money.” In fact at some point during the 20th century, the culture of self reliance and individual responsibility that had made America a great and free nation was diluted by the creation of [font color="green"] “an Entitlement State,”[/font color] reminiscent of the increasingly failed European welfare state. What America needed was a return to basics, to the founding tenets of limited government and personal responsibility.

[font color="green"]In a way, the principles America helped export so successfully to Chile through a group of free market economists needed to be reaffirmed through an emblematic reform. I felt that the Chilean solution to the impending Social Security crisis could be applied in the USA.[/font color]

CONTINUED...

http://www.josepinera.org/articles/articles_clinton_chilean_model.htm

Democratic solutions work because they are Democratic, not capitalist.

Right. Control Fraud along with repeal of Glass Steagall.

By William K. Black

New Economic Perspectives, June 9, 2015

EXCERPT...

The bailout of Goldman via AIG had two parts. The largely fraudulently-originated mortgages backing Goldman's CDOs suffered crushing defaults as the housing bubble burst and the bad loans could no longer be refinanced to delay the loss recognition. The credit rating agencies, whose managers became wealthy by selling enormously inflated ratings to toxic CDOs and mortgage-backed securities (MBS) finally began to recognize reality and engaged in, by far, the greatest and quickest rating downgrades in history. This should have triggered AIG's obligation to pay the CDS protection for vast amounts of toxic CDOs and MBS - but that would have rendered AIG insolvent and the CDO and MBS holders would have had to recognize vast losses. Other entities that sold CDS protection were in a similar position to AIG and they began negotiating deals to pay roughly 15 cents on the dollar of their obligation. It is better to get 15 cents on the dollar now than risk getting close to zero 18 months from now after the firm that sold you illusory CDS protection is liquidated in a bankruptcy proceeding. This kind of commercial workout is the norm in big finance.

Goldman had already received the twin direct bailouts provided by the Fed and Treasury (through the TARP program). Absent similar bailouts every one of the largest banks in the U.S. and the EU would have failed as the financial markets froze and the economy went into freefall.

But Goldman was the primary indirect beneficiary of two federal bailouts through AIG. The first bailout of AIG was the U.S. purchase of most of most of AIG's equity at a price far above market value. Absent this bailout AIG would have had to declare bankruptcy in Fall 2008. This bailout was strongly pushed by what became the U.S. bailout troika - Ben Bernanke (the Fed Chairman), Timothy Geithner (President of N.Y. Fed), and Hank Paulson (Treasury Secretary). Yes, the same Hank Paulson who was made even wealthier by leading Goldman's purchase of huge amounts of toxic CDOs and MBS and illusory CDS "protection" from AIG.

Goldman is known as "Government Sachs" because of its incestuous relationship with government. Bob Rubin had run Goldman before becoming President Clinton's Treasury Secretary. The Bush and Obama administration were infested with Goldman alums in key positions. The Obama administration also had Rubin protégés like Geithner controlling most of the top financial positions. Indeed, for extensive periods every top Obama economics official has been a Rubin protégé.

While Geithner is famous for his faux indignation that people believed from his slavish devotion to furthering the interests of the wealthiest and most criminal banksters that he had worked at a Wall Street firm, everyone knows that the NY Fed is Wall Street. It functions for Wall Street's CEOs, not the American people, regardless of what administration is in power. Geithner, who has now, formally, joined Wall Street and been made even wealthier, is one of the three most infamous financial regulators in U.S. history. He shares that dishonor with Bernanke and the worst-of-the-worst, Alan Greenspan. The Financial Crisis Inquiry Commission (and even the Fed's own external report) confirm what we all knew - even among the embarrassment that was "Fed Lite" regulation globally, the NY Fed stood out as uniquely terrible because of its servile approach to the elite banksters.

CONTINUED...

http://www.econmatters.com/2015/06/goldman-aig-to-become-obamas-new-scandal.html

Even if AIG repaid every cent on the dollar, they were made whole courtesy of the US taxpayer, millions of whom were tossed from their homes in the process.

What has WikiLeaks ever taught us, apart from the corruption, warmongering and inside dealing?

"What has Wikileaks ever taught us?" ... Read on ...

How often have we been told in world-weary tones that Wikileaks has revealed nothing new - especially by those who want to appear to be in the know? Here is an aide-mémoire of a few of the highest profile revelations.

by Ryan Gallagher

17 February 2011

OpenDemocracy.net

Since 2006, whistleblower website WikiLeaks ? has published a mass of information we would otherwise not have known. The leaks have exposed dubious procedures at Guantanamo Bay ? and detailed meticulously the Iraq War's unprecedented civilian death-toll ? . They have highlighted the dumping of toxic waste in Africa ? as well as revealed America's clandestine military actions in Yemen and Pakistan ? .

The sheer scope and significance of the revelations is shocking. Among them are great abuses of power, corruption, lies and war crimes. Yet there are still some who insist WikiLeaks has "told us nothing new". This collection, sourced from a range of publications across the web, illustrates nothing could be further from the truth. Here, if there is still a grain of doubt in your mind, is just some of what WikiLeaks has told us:

SNIP...

• The Obama administration worked with Republicans to protect Bush administration officials facing a criminal investigation into torture (see Mother Jones ? )

SNIP...

• More than 66,000 civilians suffered “violent deaths” in Iraq between 2004 and the end of 2009 (see the Telegraph ? )

SNIP...

• The British government promised to protect America's interests during the Chilcot inquiry into the Iraq war (see the Guardian)

• The US government was acting on behalf of GM crop firm Monsanto in 2008, when the US embassy in Paris advised Washington to start a military-style trade war against any European Union country which opposed genetically modified (GM) crops (see the Guardian)

• Pfizer tested anti-biotics on Nigerian children, contravening national and international standards on medical ethics (see Medical News Today)

CONTINUED with LINKS...

http://www.opendemocracy.net/ryan-gallagher/what-has-wikileaks-ever-taught-us-read-on

Gee. No wonder they want to shut up Assange and the Internet he rode in on.

Didn't Washington make it illegal for Federal Employees to even look at WikiLeaks?

Seeing how they show inside crony dealing and war profiteering, it's understandable.

How often have we been told in world-weary tones that Wikileaks has revealed nothing new - especially by those who want to appear to be in the know? Here is an aide-mémoire of a few of the highest profile revelations.

by Ryan Gallagher

17 February 2011

OpenDemocracy.net

Since 2006, whistleblower website WikiLeaks ? has published a mass of information we would otherwise not have known. The leaks have exposed dubious procedures at Guantanamo Bay ? and detailed meticulously the Iraq War's unprecedented civilian death-toll ? . They have highlighted the dumping of toxic waste in Africa ? as well as revealed America's clandestine military actions in Yemen and Pakistan ? .

The sheer scope and significance of the revelations is shocking. Among them are great abuses of power, corruption, lies and war crimes. Yet there are still some who insist WikiLeaks has "told us nothing new". This collection, sourced from a range of publications across the web, illustrates nothing could be further from the truth. Here, if there is still a grain of doubt in your mind, is just some of what WikiLeaks has told us:

SNIP...

•The Obama administration worked with Republicans to protect Bush administration officials facing a criminal investigation into torture (see Mother Jones ? )

SNIP...

•More than 66,000 civilians suffered “violent deaths” in Iraq between 2004 and the end of 2009 (see the Telegraph ? )

CONTINUED with LINKS...

http://www.opendemocracy.net/ryan-gallagher/what-has-wikileaks-ever-taught-us-read-on

Gee. No wonder they want to shut up Assange and the Internet he rode in on.

PS: The picture above is of Jose Padilla in his sensory deprivation goggles.

How about that time The New York Times lied America into war?

Trick Question: The New York Times ALWAYS helps lie America into war.

The Gulf of Tonkin Incident.

The Newspaper of War

by Howard Friel

Published on Tuesday, May 13, 2014 by Common Dreams

Many years ago, Ho Chi Minh’s North Vietnam, Communist China, and Soviet Russia were saying one thing about what had happened in the Gulf of Tonkin in early August 1964, while President Johnson and top administration officials were all saying the exact opposite. How should the Times have responded to that situation, assuming a commitment to an independent press and an informed citizenry?

Ten years earlier, in July 1954, the governments of Britain, France, the Soviet Union, and China all signed the Final Declaration of the Geneva Accord on Vietnam, which formally concluded France’s U.S.-supported colonial war in Vietnam. The United States refused to sign, and thereafter proceeded to undermine the most important stipulation of the accord – that elections to unify the northern and southern zones of Vietnam take place in 1956. By what journalistic criteria should the New York Times have covered this refusal by the Eisenhower administration to sign and comply with the Geneva Accord on Vietnam, which opened the door to the twenty-year American military campaign in Vietnam?

When Bush, Cheney, Powell, Rumsfeld, and Rice claimed in 2001-2003 that Saddam Hussein possessed weapons of mass destruction, including an active nuclear weapons program, and when Saddam Hussein denied those claims, what journalistic standard did the Times apply in its response to those conflicting claims?

Journalism schools should teach a course focused on questions like these, given that over the past sixty years the Times and every other mainstream news organization has repeatedly flunked such tests, in each instance aiding the government’s efforts in its illegal interventions and wars.

CONTINUED...

http://www.commondreams.org/view/2014/05/13-0

This is the "paper of record" that gave us Judith Miller and aluminum tubes, while failing to mention word that George W Bush's illegal domestic spying operation until after Selection 2004. I also want to emphasize this paper has done all it can to keep up the fiction that Lee Harvey Oswald alone shot President John F. Kennedy, who had ordered withdrawal of the U.S. from Vietnam. In addition, this is an important read for those interested in seeing how Corporate McPravda exclusively serves the warmongers and not the People, as intended by the nation's Founders in the First Amendment to the Constitution.

Great Moments in Bi-Partisanship: The Signing of Gramm-Leach-Bliley Act of 1999

The Financial Services Modernization Act of 1999 repealed Glass-Steagall and the New Deal firewall protecting US taxpayer insured-deposits from Wall Street predation.

Thanks for the back story.

I remember him for "Segregation now! Segregation tomorrow! Segregation forever!" statements from his inaugural of Jan. 14, 1963.

Didn't know he had turned into such a liberal, especially considering the lengths to which Nixon's White House, in which Poppy Bush was a player, went to exploit his near-assassination.

E. Howard Hunt, Undercover (New York: Berkley Publishing Corporation, 1974), p. 217 via "Bremer & Wallace: It’s Déjà Vu All Over Again" by Lisa Pease.

UBS has paid Bill Clinton millions.

Kos must have missed that part.

The Clintons and the sordid UBS affair

By Ernest A. Canning

The Hill, March 10, 2016

The story, as originally recounted by James V. Grimaldi and Rebecca Ballhaus of The Wall Street Journal, was, of itself, deeply troubling. In March 2009, after meeting with Swiss Foreign Minister Micheline Calmy-Rey, then Secretary of State Hillary Clinton intervened with the U.S. Internal Revenue Service (IRS) on behalf of Switzerland's most powerful banking institution, UBS. The IRS, which at that time was seeking the identity of wealthy Americans who had stashed some $20 billion in 52,000 tax evading UBS accounts, then agreed that the Swiss bank need only turn over information on 4,450 accounts. Afterwards, UBS increased its previous $60,000 in donations to the Clinton Foundation ten-fold. By the end of 2014, UBS donations to the Clinton Foundation totaled $600,000. UBS also "paid former President Bill Clinton $1.5 million to participate in a series of question-and-answer sessions with UBS Wealth Management Chief Executive Bob McCann, making UBS his biggest single corporate source of speech income disclosed since he left the White House."

Those facts, of themselves, raise disturbing questions. Did a bank that still ranks as "the world's biggest wealth manager" and has at its disposal a bevy of economists and law firms have a legitimate reason for paying Bill Clinton $1.5 million in speaking fees? Or was the $1.5 million and the tenfold increase in Clinton Foundation donations a reward for the former secretary of State's intervention? If the latter, that reward would have, under federal law (18 U.S.C. § 201(c)(1)(A)), amounted to an illicit bribe.

CONTINUED...

http://thehill.com/blogs/congress-blog/presidential-campaign/272396-the-clintons-and-the-sordid-ubs-affair

So what if the link is five years old? It's UBS current web page.

http://financialservicesinc.ubs.com/revitalizingamerica/SenatorPhilGramm.html

Good for him. Nothing for me to enjoy.

Profile Information

Gender: MaleMember since: 2003 before July 6th

Number of posts: 55,745