Economy

Related: About this forumWeekend Economists Celebrate the Season! December 18-20, 2015

And boy, do we have lots to celebrate!

The Federal Reserve raised interest rates .25% and didn't crash the global economy.

Snow is accumulating in the West and North and Rockies again.

And the DNC has just given Bernie the opportunity of a lifetime for a career firebrand.

So, lower the lights, pour the drinks, nibble some cheese and crackers, and enjoy!

This tune was used to great effect in the first Home Alone flick which got Macaulay Culkin his phenomenal stardom.

Then, there's that other classic Xmas flick: Die Hard! which brought Brit actor Alan Rickman to the attention of millions of fan girls (to the regret of Bruce Willis, no doubt).

And the piece de resistance, the WWII Xmas nostalgia of Monuments Men:

Proserpina

(2,352 posts)Snow dusts the roofs like a sprinkling of powdered sugar....the wind chill is down to 23F (it was 60F a couple of days ago)...and our family is ready for it, by thunder!

Robert Reich offers this advice for Xmas gatherings:

Proserpina

(2,352 posts)Martin Shkreli, the boyish pharmaceutical entrepreneur who caused a public uproar after he drastically raised the price of a life-saving prescription drug, was arrested on Thursday for engaging in what U.S. prosecutors said was a Ponzi-like scheme at his former hedge fund and a pharmaceutical company he previously headed.

Shkreli, who has become a lightning rod for growing outrage over soaring prescription drug prices, was arrested before dawn at the tony Murray Hill Tower Apartments in midtown Manhattan. Clad in a grey hoodie, the 32-year old could be seen being escorted by a slew of law enforcement, including FBI, into a car.

It was a dramatic turn of events for Shkreli, who in recent months became a pariah for his controversial remarks in the press and taunts on social media outlets, including to Democratic presidential candidate Bernie Sanders.

Many on social media said Shkreli was getting what he deserved. On Twitter, the top hashtag and keyword related to his arrest was #Karma. But ironically his downfall was not related to expensive drug pricing...

more

Proserpina

(2,352 posts)Martin Shkreli resigned as chief executive officer of Turing Pharmaceuticals AG following his arrest Thursday on securities fraud charges.

Shkreli will be replaced on an interim basis by Chairman Ron Tilles, Turing said Friday in a statement.

“We wish to thank Martin for helping us build Turing Pharmaceuticals into the dynamic research focused company it is today, and wish him the best in his future endeavors,” Tilles said.

...“Shkreli essentially ran his company like a Ponzi scheme where he used each subsequent company to pay off defrauded investors from the prior company,” Brooklyn U.S. Attorney Robert Capers said at a press conference. Evan Greebel, a New York lawyer who was alleged in the federal indictment to have helped Shkreli in his schemes, was also arrested and charged. Like Shkreli, he pleaded not guilty and was freed on a $1 million bond...

Proserpina

(2,352 posts)Euro zone deputy finance ministers provisionally approved the payout of a 1 billion euro aid tranche for Greece on Thursday, an EU official said, after Athens withdrew a disputed package of social justice measures from parliament.

"It was approved subject to Greece completing two or three technical steps such as the publication of decisions in the official journal," the official said.

"That should be done by Friday so the board of the European Stability Mechanism can make the disbursement on Friday night."

Greece's leftist government was earlier forced by international lenders to withdraw a parallel economic program bill from parliament after they threatened to withhold the next slice of its bailout finance, EU and Greek sources said. Prime Minister Alexis Tsipras had submitted a package of social justice measures, intended to cope with what he calls the "humanitarian crisis" in Greece, to lawmakers to assuage criticism in his Syriza party of the tough reforms they had been forced to adopt under the country's third bailout program. A Greek parliament source said the bill had been removed from the agenda after the lenders and conservative opposition members questioned how the measures would be funded, and it would now be discussed in committee in early January.

The bailout agreed last August stipulates that all economic legislation be submitted for prior consultation to the institutions representing euro zone and International Monetary Fund creditors. The so-called parallel program was put to parliament late on Monday. It extends measures to tackle the humanitarian situation by a year and takes steps to help the jobless.

Greek lawmakers approved on Tuesday a bill required by the creditors to deal with non-performing business loans, partially privatize the national electricity grid operator and reform the public sector wage grid to link pay to performance. That cleared the way for deputy finance ministers in the Eurogroup Working Group to release the next aid tranche. However, a euro zone source said Germany and some other countries threatened to call off the meeting if Athens went ahead with the parallel program without prior approval.

The Greeks are f***ed for good. They have nothing to lose but their chains.

Proserpina

(2,352 posts)The House on Thursday passed a sweeping $622 billion tax package, the first of two massive end-of-year measures Congress is rushing to conclude this week.

The “tax extenders” bill was approved in a 318-109 vote, with 241 Republicans joining 77 Democrats in backing the measure.

Only 3 Republicans (Reps. Justin Amash (Mich.), Chris Collins (N.Y.) and Walter Jones (N.C.)) voted against the bill, which permanently renews a range of tax provisions following years of short-term extensions while extending other tax breaks through 2016 or 2019.

The House is expected to vote Friday on a $1.1 trillion omnibus spending measure that would fund the government through September 2016.

House Republicans were expected to provide the lion’s share of votes on Thursday, while Democrats may provide more than half of the votes for the omnibus on Friday. But House Minority Leader Nancy Pelosi (D-Calif.) said Thursday that she is not confident there are enough Democratic votes to push the omnibus over the finish line at this point, although though she herself will support the bill...Of the two year-end bills, the tax measure is more controversial with Democrats, with many fearing it will increase pressure to reduce spending by raising the deficit. The measure makes permanent several business tax breaks such as the research and development tax credit and enhanced small business expensing under section 179 of the tax code...Tax breaks that would be cemented include the expansions of the earned income tax credit, the child tax credit and the American opportunity tax credit, which were all created under President Obama's stimulus law...and includes a two-year freeze of ObamaCare's medical-device tax...A separate ObamaCare change freezing the "Cadillac" tax on high-cost insurance plans is included in the omnibus package...

but did they reduce spending to pay for these cuts?

Proserpina

(2,352 posts)A deal to fund the U.S. government met resistance on Wednesday from conservative Republicans concerned about spending, as well as House of Representatives Democrats who complained about corporate tax breaks and a planned end to a ban on U.S. oil exports.

But House Speaker Paul Ryan said he was confident of a bipartisan compromise and that there is "no reason to believe we're going to have a shutdown" of the federal government, which would hurt the U.S. economy.

The deal, reached late on Tuesday after weeks of wrangling, includes a $1.15 trillion U.S. government spending bill and a companion $650 billion package of tax breaks.

The Republican-controlled House will vote on extending the tax breaks for corporations and individuals on Thursday and the "omnibus" spending bill which would fund the U.S. government through September 2016, on Friday, lawmakers said.

Meantime, the House and Senate passed and sent to President Barack Obama a temporary funding bill to keep the government running through next Tuesday, by which time leaders hope the massive funding measure will have been approved. Without the stopgap measure, money for federal programs and offices would have run out at midnight Wednesday...

Proserpina

(2,352 posts)Big names from the worlds of finance and technology such as Deutsche Boerse, JP Morgan, Cisco and IBM have come together to work on an open-source framework for using the "blockchain" technology that underpins the web-based cryptocurrency bitcoin. The new technology works as a huge, decentralized ledger of every bitcoin transaction ever made, which is verified and shared by a global network of computers and is therefore virtually tamper-proof. It has been drawing investment from banks and other financial players, who reckon it could save them money by making their operations faster, more efficient and more transparent.

The data that can be secured by the blockchain is not restricted to bitcoin transactions. Any two parties could use it to exchange other information, including stock deals, legal contracts and property records, within minutes and with no need for a central authority to verify it. The new project will be run by the not-for-profit Linux Foundation, and will focus on building industry-specific applications, platforms and hardware systems to support business transactions.

The initiative will include Digital Asset Holdings, the blockchain start-up run by former JP Morgan executive Blythe Masters, who has become something of an ambassador for the nascent technology. The initiative will also work with the blockchain consortium of banks run by financial technology firm R3, which on Thursday said it had added another 12 banks, including Santander and Nomura, and would soon include some of the world's biggest fund managers.

The Bank for International Settlements, the central bank for central bankers, said in a report last month that blockchain technology could reduce the role of intermediaries such as banks or other financial players. But a senior executive at German exchange operator Deutsche Boerse, one member of the new Linux initiative, told Reuters in a recent interview that it does not see itself being made irrelevant by the new technology. Deutsche Boerse is actively involved in discussions with several fintech firms and financial institutions that are developing distributed ledger technology, said Ashwin Kumar, who took up his role as global product development head at Deutsche Boerse on Sept. 1.

"The blockchain technology won't make market infrastructure providers obsolete," he said. "

He said blockchain looked promising in addressing some problems such as settlement delays but it also faced constraints such as a lack of scalability and the potential for conflict between transparency and the confidentiality of information.

Other collaborators on the new project include international payment network SWIFT, Accenture, Intel, State Street, Wells Fargo, and the London Stock Exchange.

Proserpina

(2,352 posts)Amazing feats of stupidity and ugliness over on the political side. Take your waders with you!

Proserpina

(2,352 posts)President Barack Obama signed into law a measure easing a 35-year-old tax on foreign investment in U.S. real estate, potentially opening the door to greater purchases by overseas investors, a major source of capital since the financial crisis.

Contained in the $1.1 trillion spending measure that was passed to avoid a government shutdown is a provision that treats foreign pension funds the same as their U.S. counterparts for real estate investments. The provision waives the tax imposed on such investors under the 1980 Foreign Investment in Real Property Tax Act, known as FIRPTA.

“FIRPTA has historically made direct investment in U.S. property a non-starter for trillions of dollars worth of foreign pensions,” said James Corl, a managing director at private equity firm Siguler Guff & Co. “This tax-law modification is a game changer” that could result in hundreds of billions of new capital flows into U.S. real estate.

Foreign investors have flocked to U.S. real estate since the global economic meltdown, drawn by the relative yields and perceived safety of assets from office towers and shopping centers to apartments and warehouses. The demand has helped drive commercial real estate prices to record highs. Many foreign investors structured their purchases to make themselves minority investors and bypass FIRPTA. The new law also allows foreign pensions to buy as much as 10 percent of a U.S. publicly traded real estate investment trust without triggering FIRPTA liability, up from 5 percent previously...

Cross-border investment in U.S. real estate has totaled about $78.4 billion this year, or 16 percent of the total $483 billion investment in U.S. property, according to Real Capital Analytics Inc. Pension funds accounted for about $7.5 billion, or almost 10 percent, of the foreign total, according to the New York-based property research firm.

“Foreign pensions are such a low percentage of foreign investment in U.S. real estate because of FIRPTA,” Corl said.

and another asset bubble inflates, to spectacularly explode at a date to be later specified

more

Proserpina

(2,352 posts)http://www.bloomberg.com/news/articles/2015-12-18/more-companies-may-start-helping-employees-buy-homes

Facebook is reportedly offering cash to employees who move closer to work...Facebook wants to keep its workers close to the office, and it’s willing to pay for it. The social networking giant is offering workers $10,000 or more to move within 10 miles of the company’s Menlo Park, Calif., headquarters, according to a report from Reuters on Thursday. It's a move that has the potential to entice employees to work longer hours while easing the stresses caused by long commutes and the San Francisco Bay area’s staggering housing prices. Facebook did not respond to an e-mail requesting comment.

Sounds great. Why haven't more companies done it?

The simple answer has to do with taxes. Unlike with retirement funds, say, where the government provides an explicit tax benefit for companies to pay for employee benefits, housing stipends can be taxable for both the employer and employee, according to report this summer from Bloomberg BNA (subscription required). So employers operating in expensive housing markets have become accustomed to paying higher salaries, and letting workers decide how to spend the money.

The result is that while many employers have shouldered the costs of relocating employees from one city to another, they’ve less frequently helped employees pay for housing in cities where they already live. Just 3 percent of companies offer to help their employees with down payments on a home, according to a survey this year from the Society for Human Resource Management. By comparison, 32 percent offered lump sums for relocation.

Employers that do help with housing have typically fallen into a couple of categories. Local governments have sometimes created incentives to help municipal workers live in the neighborhoods they serve, like the city of San Francisco, which announced plans earlier this year to spend up to $44 million over the next five years to help teachers buy homes. Academic institutions, like Washington University in St. Louis, and hospital centers have also dabbled in housing.

“Instead of giving a full sign-on bonus to doctors, we’ve looked at things like stipulating that some of the bonus has to be used on housing,” said Dawn Lane, executive director of Las Vegas-based Hope Home Foundation, a nonprofit that helps companies design housing benefits. The idea holds particular appeal for medical institutions, who want staff on hand to respond to emergencies, Lane said. "Without tax credits, it's going to be hard for a lot of employers to get involved."

more

Proserpina

(2,352 posts)A group of 24 investment management firms, including BlackRock Inc (BLK.N), Pimco and Eaton Vance (EV.N), will begin clearing certain credit default swaps in an effort to revive a flagging part of the market used to hedge risk, several trade groups said on Wednesday.

The effort comes amid renewed worries over the ability to trade debt following the collapse of Third Avenue's Focused Credit Fund on Dec. 7, which jolted Wall Street and sparked a sell-off in high-yield bonds. Low oil prices have also been putting pressure on some funds and companies.

The investment management firms will voluntarily clear CDS transactions connected to single companies and countries, the International Swaps and Derivatives Association, the Managed Funds Association and the Securities Industry and Financial Markets Association said. (For list of firms, see: bit.ly/1Yint04)

CDSs are contracts that let investors buy protection to hedge against the risk that corporate or sovereign debt issuers will not meet their payment obligations. Clearing involves sending the trade through a third party that guarantees its completion, backing the transaction using margin it collects, and recording the details.

There was $8.2 trillion in debt guaranteed against default, not including offsetting positions, through single-name CDSs as of June 30, down from a peak of $33.4 trillion in June 2008, according to the Bank for International Settlements.

"CDS liquidity has deteriorated sharply in recent years," Scott O'Malia, chief executive officer of ISDA, said in a statement.

"The commitment by the major buy-side firms to move to central clearing will create efficiencies and increase transparency in the single-name CDS market, which will encourage more participants to enter this important market," he said.

The 24 firms will also aim to migrating existing positions to cleared positions over time, the groups said.

Proserpina

(2,352 posts)http://oilprice.com/Energy/Energy-General/How-Much-Oil-Is-Needed-To-Power-Santas-Sleigh.html

By Michael McDonald, Michael, an assistant professor of finance and a frequent consultant to companies regarding capital structure decisions and investments.

Every year around the world, hundreds of millions of children wait anxiously for Santa Claus to arrive and bring presents and good cheer. But what if Santa never came? What if this year the reindeer all fall ill, perhaps due to Crazy Reindeer disease (the analog to Mad Cow) and Santa is forced to cancel Christmas? The result would be devastating. Fortunately, for any children reading, official word from the North Pole is that Santa’s sleigh has some new upgrades this year that allow it to run on good old fashioned jet fuel if the reindeer fail. And with the current glut of oil around the world, fuel prices are so affordable that even if the reindeer are feeling up to their usual task, Old Saint Nick might just give them the night off and choose to fly with fuel nonetheless.

So how much oil does Santa need for his rounds on the night of the 24th?

Well the answer is complicated by a number of factors most importantly, we just don’t know a lot of about Santa’s rounds, the shape of the sleigh, the air speed of the craft, or the weight of all those presents. But, we can take some educated guesses. One 42 gallon barrel of oil is typically used to make a variety of different products. About 51 percent of the average barrel ends up being used for gasoline, while 12 percent ends up being used for jet fuel. Let’s assume then that Santa’s going to use standard jet fuel, and that 12 percent ratio holds – so for each gallon of jet fuel, we need around 8 gallons of oil. Recognizing that the byproducts of a processed barrel of oil are greater than the original 42 gallons, this 2:1 ratio is still a good place to start as a rough rule of thumb.

Next we need to get a rough idea of Santa’s fuel economy. How many miles does he go on a gallon of jet fuel? It’s not clear how much Santa’s sleigh weighs, or what it is shaped like, but we can probably envision it as something like a cross between a Suburban, a C-5 Galaxy fright aircraft, and an F-22 Raptor fighter jet. The sleigh looks blocky like a Suburban, carries about the same level of cargo as much as C-5 might, yet has the speed of a fighter jet. The fighter jet and c-5 achieve a fuel economy around the range of 0.1 miles per gallon to 0.5 miles per gallon. A 747 for instance burns around 5 gallons of fuel per mile.

But of course, those aircraft are all much larger than Santa’s sleigh. (Imagine poor Rudolph trying to pull a Dreamliner!) A Lear Jet uses around 1 gallon of fuel per 2.75 miles (based on a speed of 465 knots or 535 miles per hour). A Piper Cub uses about 1 gallon per 15 miles. Santa’s fuel economy is going to fall off the faster he goes, and to get to all the children of the world in one night, he is going to need to go a lot more than the Piper cub’s 65 knots per hour. Just to take off, Santa is going to need to hit about 180 miles an hour, and probably more than that given the sleigh designer’s seem to have a weak grasp on Bernoulli’s principle. Thus the Suburban is probably a good size comparison for Santa’s sleigh, and one might estimate the sleigh gets about 5 miles to 1 gallon of jet fuel (8 gallons of oil).

Now how far does Santa need to go? There are around 7.3 billion people in the world, which works out to around 1.5 billion households around the planet based on around 5 people per household. Now not everyone celebrates Christmas of course, but many Christians and non-Christians alike do. By some estimates, perhaps 45% of the world’s population celebrates Christmas. That means that Santa needs to visit about 675 million households. With about 7 households per square mile, and assuming that households celebrating Christmas are clustered (which seems logical given religious clustering), that means that Santa has to cover around 94 million square miles of households.

The most efficient mechanism for Santa to cover these households is a very complex mathematical problem. But assuming Santa wants to fly diagonally over each square mile (for a distance of 1.41 miles based on the Pythagorean Theorem), and households are on average distributed proportionally across this each 1 mile block, then Santa will have to fly over 2.41 miles of ground to cover each square mile as efficiently as possible. (You can use a variety of mathematical algorithms to model the most efficient flight path depending on population dispersion – this is just a reasonable approximation based on the assumptions outlined above).

As a result, Santa needs to travel around 226 million miles to deliver all of the presents to the world’s children. This assumes minimal idle time on each rooftop (he’s got to scarf down those cookies quickly), and abstracts away from the extra fuel needed for each takeoff.

Given our 5 miles per gallon of jet fuel efficiency calculated above, that means Santa needs around 45 million gallons of jet fuel for his annual voyage. With jet fuel going for around $1.20 a gallon right now on the spot market, and prices looking historically low, this puts the total fuel cost of Santa’s journey at a bit less than $54 million for one night. On second thought, maybe it’s time to break out the hay for those 8 reindeer.

Proserpina

(2,352 posts)Sometime in July 2012, Suzan Russaw and her husband, James, received a letter from their landlord asking them to vacate their $800-a-month one-bedroom apartment in Palo Alto, California. He gave them 60 days to leave. The “no-fault” eviction is a common way to clear out low-paying tenants without a legal hassle and bring in people willing to pay thousands more in rent. James was 83 at the time and suffering from the constellation of illnesses that affect the old: He had high blood pressure and was undergoing dialysis for kidney failure and experiencing the early stages of dementia.

Their rent was actually a couple of hundred dollars more than James’s monthly Social Security benefits, but he made up the rest by piecing together odd jobs. They looked for a new apartment for two months and didn’t find anything close to their price range. Their landlord gave them a six-week extension, but it yielded nothing. When mid-October came, Suzan and James had no choice but to leave. With hurried help from neighbors, they packed most of their belongings into two storage units and a ramshackle 1994 Ford Explorer which they called “the van.” They didn’t know where they were going.

A majority of the homeless population in Palo Alto—93 percent—ends up sleeping outside or in their cars. In part, that’s because Palo Alto, a technology boomtown that boasts a per capita income well over twice the average for California, has almost no shelter space: For the city’s homeless population, estimated to be at least 157, there are just 15 beds that rotate among city churches through a shelter program called Hotel de Zink; a charity organizes a loose network of 130 spare rooms, regular people motivated to offer up their homes only by neighborly goodwill. The lack of shelter space in Palo Alto—and more broadly in Santa Clara and San Mateo counties, which comprise the peninsula south of San Francisco and around San Jose—is unusual for an area of its size and population. A 2013 census showed Santa Clara County having more than 7,000 homeless people, the fifth-highest homeless population per capita in the country and among the highest populations sleeping outside or in unsuitable shelters like vehicles...

more

Proserpina

(2,352 posts)BREAKING NEWS!

Chattanooga, Tennessee — The Chattanoogan.com news site is reporting that in a lawsuit filed to set aside a tax sale of mortgaged land in Hamilton County, the Tennessee Supreme Court has held that Mortgage Electronic Registration Systems, Inc. was not entitled to prior notice of the sale because MERS did not have an interest in the land that is protected under the Due Process Clause of the U.S. Constitution!

READ THE OPINION HERE: MERS v DITTO_TN Supreme Court rules against MERS! The Tennessee Supreme Court is the first to rule in such a manner!

The site is reporting that the purchaser of the Hamilton County land borrowed money from a MERS member lender, signing a promissory note secured by the property by a deed of trust, which was recorded in the Hamilton County Register of Deeds office. The deed of trust described MERS as “a separate corporation that is acting solely as nominee for [the lender]” and said that MERS was the beneficiary of the deed of trust “solely as nominee” for the lender and any successor to the lender. As is customary in the MERS® System, the originating lender sold the note to another lender. Subsequent to that, the property owners failed to pay their 2006 property taxes, so Hamilton County initiated tax foreclosure proceedings.

The county sent notice of the foreclosure and the tax sale to the borrowers and to the original lender, but not to MERS. Eventually, the property was sold at a tax sale to Carlton Ditto. Just like in the Cabrera, Robinson and Johnston cases in California, after learning of the action, MERS filed a lawsuit to set aside the tax sale, naming Hamilton County and Mr. Ditto as defendants. MERS argued that Hamilton County violated its constitutional right to due process of law by selling the land without notifying MERS. This crap is the same argument propounded in the California cases, where MERS claimed that the deed of trust gave MERS its own independent interest in the Hamilton County property, so it was constitutionally entitled to prior notice of the tax sale. In California, MERS also wanted the courts to rule that the California Quiet Title Statutes were unconstitutional and that the judges who rendered the quiet title judgments in all three cases were civil co-conspirators, something this blogger has learned has infuriated the state judges! (I sure hope MERS doesn’t show up in front of one of them any time soon! LOL)

The trial court ruled against MERS, holding that MERS was merely an agent of the lender without a separate interest in the property, and not entitled to prior notice of the tax sale. MERS appealed to the Court of Appeals, which affirmed the trial court’s decision for a slightly different reason, holding that MERS did not have standing to bring the lawsuit. MERS was then granted permission to appeal to the Tennessee Supreme Court.

The Supreme Court considered whether Hamilton County was required to give MERS prior notice of the tax sale. The Court recognized that the Due Process Clause of the U.S. Constitution generally applies when the government sells a taxpayer’s land to satisfy unpaid taxes, so if the government fails to give the taxpayer such notice, the sale is unconstitutional and void. The Court then considered whether MERS had an interest in the land that was protected under the Constitution. The Court first noted that the deed of trust for the Hamilton County transaction used contradictory language to describe the role of MERS in the property loan transaction; it described MERS as a “beneficiary” but also said that MERS acted “solely as nominee” for the lender. Considering the parties’ roles in the loan transaction, the Court also held that MERS was not in fact a beneficiary but only an agent for the true beneficiary, the note holder, and that MERS acquired no independent interest in the Hamilton County land. Because MERS did not have an interest that was constitutionally protected, Hamilton County was not required to give MERS notice before it sold the land to pay the unpaid tax obligation. For this reason, the Supreme Court affirmed the trial court’s judgment in favor of Hamilton County and the tax sale purchaser, Mr. Ditto.

more

Fuddnik

(8,846 posts)Manny Goldstein got the ax today.

One reason I'll never donate another dime to this shithole.

Proserpina

(2,352 posts)but not the reason why...or rather, the ostensible reason why. The reason why is obvious, and will kill the website sure as shooting.

kickysnana

(3,908 posts)Hotler

(11,475 posts)Last edited Sun Dec 20, 2015, 12:37 PM - Edit history (1)

a cubbyhole as we are safe for now, but it is only a matter of time before the stalkers come for us. I look around DU outside of this litle corner and I ask myself "Who the fuck are those people?" ![]()

It used to be we waved to agent Mike. Now we can wave to the HRC enforcers. ![]()

Take my friends, I have a thrist to take care of.

Ghost Dog

(16,881 posts)Some rain for the first time in two months approaching here. ![]()

Very warm, sea & air.

Proserpina

(2,352 posts)How lovely. How are the politics and economy?

Ghost Dog

(16,881 posts)This part of my island is a refuge. Surfers as well as guiris (tourists) and better-off Europeans moving in, Italians especially, keep local economy underwater only up to eyeballs.

Will speak of politics when election results are in.

Saludos Proserpina and to Mom. ![]()

Proserpina

(2,352 posts)Don't choke on the uvas!

Ghost Dog

(16,881 posts)Fuddnik

(8,846 posts)Manny is there, and a lot of other familiar names.

I joined.

DemReadingDU

(16,000 posts)also joined, but new name...bluebird

Proserpina

(2,352 posts)for all I know, they could be the same thing

Hotler

(11,475 posts)Proserpina

(2,352 posts)In a series of speeches, Federal Reserve Governor Jeremy Stein emphasized the importance of financial stability concerns in monetary policy-making. But how does one measure whether threats to financial stability are lurking? Put differently, can we know that there is a credit bubble about to burst? In his speeches, Stein cites the work of two Harvard Business School professors, Robin Greenwood and Samuel Hanson. Their research argues that a good indicator of credit market overheating is the share of all new corporate debt issues coming from low-grade issuers. This measure is based on the quantity of credit issued, not just interest rates. Others focus exclusively on credit spreads, or the interest rate differentials between, say, junk and investment grade firms. Greenwood and Hanson argue that quantities of credit issued by low-grade versus high-grade firms add a lot of power when predicting credit market crashes.

So how big is the risk of a credit market crash today? Robin and Sam were nice enough to send us the updated data through 2013. This chart shows the high yield share of corporate debt issues. Or in other words, the fraction of all corporate debt issues by high yield (or junk) firms:

You can see right away that this variable predicts crashes pretty well. The high yield issue share peaks about two years before major meltdowns we’ve seen in credit markets. So when risky firms are issuing a ton of debt, bad things tend to happen. The high yield share in 2012 and 2013 indicates elevated risk, but not an impending disaster. For example, the 2013 high yield share is still below the peaks seen prior to other credit crashes. This may be driven in part by the fact that investment grade firms are also issuing a ton of debt. So in some sense the denominator is rising so fast that the high yield bond issues cannot keep up with it.

As mentioned above, another measure people use to predict credit market overheating is the interest spread between Baa rated-debt and Aaa rated-debt. If this spread narrows, then credit markets are willing to fund riskier firms at lower interest rates. Here is the chart showing this spread:

Looking at the long history, you can see why interest spreads don’t do as good a job predicting crashes as the high yield share. The interest spread falls before every crash, but the pattern is not nearly as stark as it is with the high yield share of debt issues above. As this chart shows, the interest spread has fallen substantially in 2012 and 2013, but remains slightly above the very low levels it reached before the 2001 recession and the Great Recession...

more

Proserpina

(2,352 posts)(Note: this is an article I wrote for The Progressive for their July/August 2014 issue that was never put online. Because we’re actually starting to see the beginnings of a fallout in high-yield corporate debt, the subject of the article, I thought I would put it online. I think it holds up pretty well.)

“When will the next financial crisis happen, and where will it occur?” This trillion-dollar question remains firmly implanted in the minds of every financial analyst, business reporter and government regulator in America today. If I knew the answer precisely, I could either prevent a lot of suffering or make a lot of money betting on the collapse. I don’t have that answer. The specifics of where and when financial crises will originate are obscure. But we do know that such crises normally result from an excess of risk. Widespread borrowing accumulates somewhere in the financial system, everyone believes it will only lead to profit, and when it goes sour, borrowers cannot cover their debts. From there, our endlessly inter-connected financial system spreads the cascading losses across many institutions, and suddenly everyone becomes afraid to lend for fear of getting caught holding the bag.

In 2008 that excess risk rose up from subprime mortgages. Today, risk is pooling in a different area: corporate debt. From multinationals to small businesses, corporate debt has exploded over the past two years, alarming regulators and policymakers. “In many ways, this is a test of all the mechanisms that caused the financial crisis,” said one fearful Senate Democratic aide. “If there’s another crisis, this is where it might start.” A clear example of this gold rush can be seen in Apple’s recent $17 billion corporate bond sale, the largest on record and the tech giant’s first since 1996. Apple, with $158 billion in cash reserves, has little need to borrow money. But thanks to several years of low Federal Reserve interest rates, it’s become so cheap for corporations to borrow that big firms who resist just leave money on the table. Tellingly, Apple plans to use the funds not to develop new products or finance new capital investments, but simply to boost returns to shareholders. So the increased borrowing risk doesn’t even improve the economy; it goes straight from the fruits of worker productivity into the accounts of the top one percent.

Much of this corporate debt is more dangerous than Apple’s, however. In fact, Wall Street describes it as “junk bonds,” which offer a higher return because of the higher risk of default. That’s attractive to investors, who have been “reaching for yield” above what safer investments will produce. Since March 2009, the junk bond market has doubled to $2 trillion, as worries about risk have flown out the window. Got an idea for a vegan restaurant on a cow farm or a lingerie shop in a nunnery? No problem, some investor will lend you lots of money. In fact, loading up companies with massive debt is a business strategy for the kinds of companies that will be familiar to anyone who paid attention during the 2012 Presidential election to Mitt Romney’s exploits at Bain Capital. Private equity firms like Bain take over companies and borrow lots of money to make the acquisition, a process known as a leveraged buyout. The assets of the company become the collateral for the loans. This puts the company and all its workers at great risk, because if their operating revenue cannot pay off the high interest payments on the debt, their assets get sold in bankruptcy and everyone loses their jobs. Even in that situation, private equity firms can walk away with a profit, as they put up nothing to acquire the company, and they make their money through management fees. It’s an old story: the big money boys come to town, suck out the value from a company and then leave its dried husk by the side of the road.

Loans in private equity deals are often “covenant-lite” leveraged loans, a type of junk bond that offers fewer safeguards for investors. Given the desperation for higher yields, investors foolishly accept higher risk to get their hands on low-grade corporate debt. So under the terms of these loans, investors do not get informed when the underlying companies run into financial trouble, making it harder to avoid losses. Leveraged loans hit a new record last year, and covenant-lite loans exploded, comprising over half of all leveraged loans, according to the New York Federal Reserve. Demand was so high, in fact, that the spread between “high yield” corporate debt and risk-free securities like Treasury bonds fell to all-time lows, making it even crazier to purchase riskier debt for a small additional reward. Smaller and smaller firms were the beneficiaries of these loans, like Learfield Communications, a media group with $40 million in annual revenues that received an incredible $330 million in covenant-lite loans last October. It’s correct to call this the “subprime of the corporate world.” Deutsche Bank and GE Capital brokered that deal for Learfield, an example of how managing corporate debt has become a profit center for big banks. The Volcker rule and other restrictions from the Dodd-Frank financial reform decreased trading revenues, sending big banks scurrying for other sources of revenue. Big banks profit from all sides of these leveraged buyout deals. They get fees for advisory work from the private equity firms and from the corporations who ultimately issue the debt.

Because they’re so lucrative, banks have ignored regulator concerns around leveraged buyouts. Last March, the Federal Reserve and the Office of the Comptroller of the Currency issued specific guidelines to banks not to finance leveraged buyouts that saddle companies with debt exceeding six times their earnings. Yet 40% of private equity deals this year have vaulted past that ratio, the highest level since before the 2008 financial crisis. Senior Federal Reserve official Todd Vermilyea said in prepared remarks in May that “terms and structures of new deals have continued to deteriorate.”

We have history as a guide for what happens when risky corporate debt spikes. Economics professors Atif Mian and Amir Sufi show that increases in low-grade corporate debt almost always leads to recessions and crashes. Right now, low-grade debt is on the way up, but has not peaked at the same levels we have seen prior to other recessions. However, it’s clear that things are moving in the wrong direction, which is why banking regulators have been unusually public in warning about the risks. Daniel Tarullo, a Federal Reserve governor and their point person for financial regulation, said in a speech in February that leveraged loan spikes “raise the possibility for large losses going forward,” and new Fed Chair Janet Yellen has put Wall Street on notice about the worrying trend...

hamerfan

(1,404 posts)Sleigh Ride performed by Brian Setzer and Brad Paisley:

Proserpina

(2,352 posts)Provided the U.S. Congress passes the 2016 appropriations bill on Friday, a major reform of the International Monetary Fund can proceed. But the five-year delay since the changes, meant to give more power to big emerging economies, were proposed makes them less useful in bolstering the IMF's role as the world's most important international financial institution.

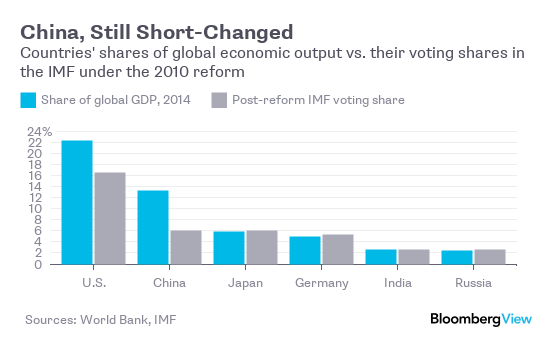

In a changing world, governance of the lender of last resort needed modernizing. Leaders of the Group of 20 agreed in 2010 that individual IMF quotas and voting rights needed to better reflect its members' standing in the world economy. That meant reducing the role of advanced European countries and Gulf states, and increasing that of emerging nations, particularly China:

The reform required U.S. approval of an amendment to make all of the fund's executive directors elected (some are currently appointed). The U.S. wanted to safeguard its standing as the fund's dominant voice; doubling all quotas would achieve that. The changes wouldn't cost the U.S. more money; its commitment would remain at about $170 billion, with the quota increase coming from the extra funds it, like many other countries, provided to the IMF after the global financial crisis of 2008. Congress just needed to approve moving some of that commitment to the quota -- a mere technicality.

IMF critics in Congress, however, opposed the fund's decision to lend to Greece despite grave doubts about its repayment abilities. The IMF had invoked a rule that allowed such lending if a failing country threatened international contagion. To U.S. conservatives, that wasn't their problem; U.S. financial institutions had much less exposure to toxic Greek assets than European ones did, and Europe should take care of its own.

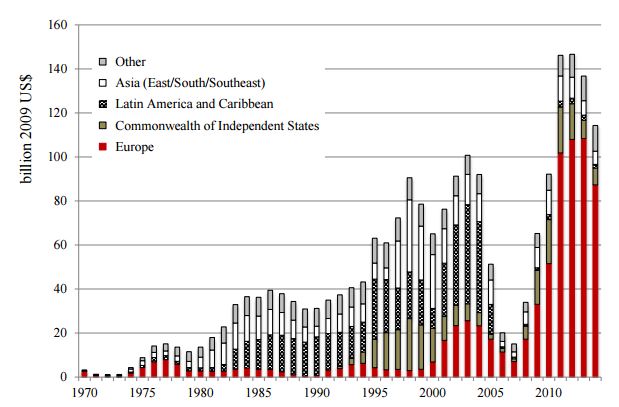

Indeed, Europe has benefited disproportionately from IMF lending in recent years:

Those U.S. objections make little sense now. Greece's latest bailout has proceeded without IMF participation: The fund still doubts that the country can repay its debt, but Greece no longer poses a systemic risk. The European Union turned out to be rich enough to fund Greece's 85 billion euro ($92 billion) rescue package. Besides, a political deal has been struck: The appropriations bill calls on the U.S. representative to the IMF to use his voting power for the repeal of the "systemic exception," which allowed IMF participation in Greece's previous bailout. So the long-delayed rearrangement -- which former IMF Managing Director Dominique Strauss-Kahn called "the most important reform in the governance of the institution since its creation" -- should now go smoothly. It'll be useful to bailout recipients; the doubled quotas will make it easier for the IMF to lend them more, on shorter notice and under more flexible requirements. Yet the changes are probably too little, too late by now. For one thing, the new distribution of voting shares still doesn't do justice to China. Though the U.S., too, has a smaller say than its share of the world economy warrants, the gap between China's economic might and its IMF influence is bigger:

The power redistribution will, no doubt, please China -- an added bonus after the IMF decision to designate the yuan as a reserve currency next year -- but it won't deter Beijing from building alternative institutions such as the Asian Infrastructure Investment Bank. China, huge as it is, cannot afford to put all its eggs in the U.S.-dominated basket. Nor can other big emerging nations, such as India, Russia, Brazil and South Africa. They, with China, have already set up an IMF alternative -- the so-called New Development Bank. It's not going to be particularly important in the coming years, given the economic weakening of Russia and Brazil. Still, the desire for a lending pool independent of the West isn't going away.

Europeans, for their part, are also creating their own emergency infrastructure: advance notice that their role at the IMF would shrink highlighted that their needs in a serious crisis would exceed the fund's ability to help...

Proserpina

(2,352 posts)I haven't seen such lunacy since the last time I tried to read something my crazy great-aunt sent me from the Tea Party (usually I just delete...)

These are seriously sick people. where did they come from? Mom says it's never been this bad before, and she would know.

Hotler

(11,475 posts)Last edited Sun Dec 20, 2015, 08:19 PM - Edit history (1)

I'm going to have to learn that song.

Proserpina

(2,352 posts)I haven't seen her in anything else...but my movie-going is limited by class and work.

Zooey Claire Deschanel (/ˈzoʊ.iː deɪʃəˈnɛl/; born January 17, 1980) is an American actress, singer-songwriter, model, and producer. In 1999, Deschanel made her film debut in Mumford, followed by her role as Anita Miller in Cameron Crowe's 2000 semi-autobiographical film Almost Famous. Deschanel soon became known for her deadpan comedy roles in films such as The Good Girl (2002), The New Guy (2002), Elf (2003), The Hitchhiker's Guide to the Galaxy (2005), Failure to Launch (2006), Yes Man (2008), and (500) Days of Summer (2009).[1][2][3] She also did dramatic turns in the films Manic (2001), All the Real Girls (2003), Winter Passing (2005) and Bridge to Terabithia (2007).[4][5] Since 2011, she has played Jessica Day on the Fox sitcom New Girl, for which she has received an Emmy Award nomination and three Golden Globe Award nominations. USA Today described her performance as "Given a role tailored to launch her from respected indie actor to certified TV star, Deschanel soars, combining well-honed skills with a natural charm."[6]

For a few years starting in 2001, Deschanel performed in the jazz cabaret act If All the Stars Were Pretty Babies with fellow actress Samantha Shelton.[7] Besides singing, she plays keyboards, percussion, banjo, and ukulele.[8] In 2006, Deschanel teamed up with M. Ward to release their debut album Volume One, under the name She & Him which was released in March 2008. Their follow-up album Volume Two was released in the U.S. in March 2010, with their Christmas album A Very She & Him Christmas being released in 2011, Volume 3 in 2013, and Classics in 2014. She also received Grammy Award for Best Song Written for Visual Media nomination for her song "So Long" which featured in Winnie the Pooh soundtrack.

Deschanel is also co-founder of female-focused website HelloGiggles, which was acquired by Time, Inc. in 2015....https://en.wikipedia.org/wiki/Zooey_Deschanel

Proserpina

(2,352 posts)Janet Yellen has taken a huge gamble raising rates alone in the world, with manufacturing in recession and the dollar already too strong for comfort... The global policy graveyard is littered with central bankers who raised interest rates too soon, only to retreat after tipping their economies back into recession or after having misjudged the powerful deflationary forces in the post-Lehman world.

The European Central Bank raised rates twice in 2011, before the economy had achieved “escape velocity” and just as the Club Med states embarked on drastic fiscal austerity. The result was the near-collapse of monetary union. Sweden, Denmark, Korea, Canada, Australia, New Zealand, Israel and Chile, among others, were all forced to reverse course, and some have since swung into negative territory to compensate for the damage.

The US Federal Reserve has waited longer before pulling the trigger, and circumstances are, in many ways, more propitious. Four years of budget cuts and fiscal drag are finally over. State and local spending will add stimulus worth 0.5pc of GDP this year. The unemployment rate has dropped to 5pc. Payrolls have risen by 509,000 over the past two months. The rate of job openings is the highest since the peak of the dotcom boom in 2000. The M1 and M2 money supply figures have switched from green to amber but are not flashing the sort of stress warnings so clearly visible in mid-2008. Yet it is a very murky picture. This is the first time the Fed has ever embarked on tightening cycle when the ISM gauge of manufacturing is below the boom-bust line of 50. Nominal GDP growth in the US has been trending down from 5pc in mid-2014 to barely 3pc.

Danny Blanchflower, a Dartmouth professor and a former UK rate-setter, said the US labour market is not as tight as it looks. Inflation is nowhere near its 2pc target and the world economy is still gasping for air. He sees a 50/50 chance that the Fed will have to pirouette and go back to the drawing board...

we shall find out if Captain Ahab is still running the ship...

...If she (Yellen) fails, the world is in trouble. We have never been in a predicament where a global recession began with rates already near zero. The Fed typically needs 350 basis points of monetary ammunition to fight a downturn.

The only way out then would be "helicopter money", a potent use of QE to fund fiscal spending directly and inject stimulus straight into the veins of the economy. But that is a saga for another day. She has not failed, yet.

Proserpina

(2,352 posts)Janet Yellen will be blamed by both the right and the left if the economy does not fulfill her hopes. Janet Yellen, the first woman to chair the awesomely powerful Federal Reserve, reminds us of a wicked one-liner made famous by Clare Boothe Luce and Oscar Wilde. “No good deed goes unpunished.” Yellen, who has been trying to do the right thing, bravely defied the conventional opinion of hard-money conservatives. But the Fed chair sets up the central bank to be the convenient political goat if her decision to raise interest rates turns out to be wrong.

The Fed has often played bad guy in managing the national economy and the world’s. As one former chairman put it, central bankers “take away the punch bowl just when the party gets going.” Yellen did so too. But this episode is utterly upside down. The Yellen Fed raised its key interest rate only a tiny bit, in order to demonstrate its confidence in the US recovery, not to hinder it. Financial markets went along with the happy gesture and rallied on the event (though all the market gains were erased by the following day). The trouble is, Yellen’s optimism is founded on a shaky premise. The official unemployment rate, now seemingly relatively low at 5 percent, does not reflect the “new normal,” in which millions have simply stopped looking for jobs or are involuntarily underemployed. Furthermore, wages for working people have remained flat or falling. In other words, the economy is still very soggy, despite nearly a decade of easy money with borrowing rates held near zero, thanks to Fed policy. This was a great time for stock-market investors (but not working people), and they have enjoyed the bubble of rising share prices while it has lasted. Yellen wants to restore “normal,” but the question is, for whom?

Now that it’s raised the federal funds rate for the first time in almost a decade, the Fed has to manage the downside risk—the risk of undercutting the struggling recovery—and that may prove to be far more treacherous. The US economy looks healthier, but it exists in a world economy that is still threatened by deflation—falling prices, slowing growth, and vulnerable debtors. We are still in the era of deleveraging—still working off the false enthusiasms that led to the financial crash of 2008. Once again, the United States is playing locomotive, but the United States itself is a weakened, chastened engine. Yellen’s wishful posture is doubtless grounded in hard facts and sincere convictions. Nevertheless, she will be blamed by both the right and the left if the economy does not fulfill her hopes. The central bank might once again become the fall guy for economic failure, though the blame should rightly be shared with elected politicians, Republicans and Democrats.

It does seem unfair that the Federal Reserve may be punished by events when it alone was trying to do the right thing during the crisis by stimulating economic growth with cheap credit. Meanwhile, the elected sides of government—the president and Congress—were obsessed with the wrong-way objective of reducing federal debt and spending. With few exceptions, politicians of both parties were refighting an old ideological battle. That is, they were pulling in the opposite direction from the Fed, guaranteed to make things worse if they succeeded. As a longstanding critic of the central bank’s conservative biases, I found myself in the odd circumstance of leading cheers for the Fed. For several years under Ben Bernanke, and then again under Janet Yellen, Fed governors discreetly implored the elected politicians to intervene with aid to reduce the mountain of failed mortgage debt or adopt easier terms for debt forgiveness. Neither the Obama White House and Treasury nor Republican leaders in Congress were willing to respond in meaningful ways.

In fact, both political parties acted as though they didn’t hear what the Fed was telling them: Get real. Spend money, lots of it. The Federal Reserve will back up your efforts with easy money and low interest rates. Instead, President Obama and GOP leaders preached a scolding reactionary sermon of debt reduction and fiscal restraint. The Fed eventually stopped asking. Yellen decided the central bank could no longer continue to keep the spigot open for money creation, so she gently prepared Wall Street not to overreact when the Fed finally did raise interest rates....

**************************************

People should ask themselves if the current divided and cloistered power arrangement is legitimate. Why do bankers—the very largest bankers—have this special position? More important, people should ask themselves if a reformed, small-d democratic system—fully accountable and visible—would produce better decisions for the entire country, not just the privileged few.

Now he's talking like a Bernista!

Proserpina

(2,352 posts)a pink and turquoise sunrise sets the frosted rooftops outside my window a-sparkling...it's almost up to 24F! Winter has come for the weekend, but we are promised a coming week of rain and above freezing (60F on Weds!) temperatures (if only slightly, after that). So far, no rain forecast for Xmas Eve or Day...but no snow, either. Sigh. At least I'm done with finals.

bread_and_roses

(6,335 posts)This is simply the best, smartest, sanest party going - an academy, a refuge, a salon, a good nightclub all rolled into one. Here's a holiday toast to all of you, and may the spirit of Hanukkah, Alban Arthan, Chaomos, Kwanza, Juul, Diwali, Christmas, Festivus, Yule, be with you all year.

Proserpina

(2,352 posts)Last edited Sun Dec 20, 2015, 09:42 AM - Edit history (1)

She's enrolled over at JPR...as are many old friends. I think the exodus is about to start, at which point she can post over there, and I can go back to my youthful activities...

I'm taking my sister to Star Wars---9:30 in the morning!

hamerfan

(1,404 posts)Stay safe, have fun, and maybe we'll do this again next year!

PS... Proserpina, could you PM me and let me know what JPR stands for? I'm clueless AND live under a rock.

Proserpina

(2,352 posts)It's no great secret, unlike some alternate venues we could mention....

At least there's safety under a rock...and when ignorance is bliss, 'tis foolish to be wise.

or a wiseguy!

Hotler

(11,475 posts)safe haven from the darkness and the meaness form Jonestown and the outside world. It would be awesome if we all could get together for a group hug and a peace prayer and a toast.

![]()

![]()

Did someone mention beer???? ![]()

Proserpina

(2,352 posts)Fuddnik

(8,846 posts)Hotler

(11,475 posts)Hotler

(11,475 posts)A very powerful scene. Must of had onions attached cause my eyes are a mist. For some reason it made me think of all things that I loved and held dear that I have lost. I miss my mom the most.

![]()

I had a couple of good bird dogs and a Manx tomcat that come in second.

Proserpina

(2,352 posts)Ghost Dog

(16,881 posts)This fear has solid grounds, for sure… that’s the problem with it. Modern world challenges are piling on our heads, growing vast and vital, while citizens fearfully watch the not only powerless, but also counter intuitive posturing of their leaders. When citizens start knowing more about what should be done than their decision makers, panic settles in.

Thus, political alternative solutions spring up all over our continent, as a result of the absolute requirement of change felt by the Europeans:

. strengthening of radical rightist parties in France (FN), Austria (FPÖ), the Netherlands (Geert Wilders), Germany (AfD)… mechanically benefitting from the migration and terrorist panic. These parties too are rooted in peoples’ problematic reactions, but their idea of order makes them very accessible to an alliance with the « establishment », which in the end will have no difficulty adopting their views (Cameron’s and Theresa May’s UK, supposedly « ganged up » against UKIP, but in fact they were clinging like mussels to their privileges of the reigning cast[9], provides a vivid example of this);

. emerging of communitarian, xenophobic, racist, homophobic… radical movements (Pegida in Germany, Poland, Denmark…) which organize protests and counterprotests degenerating into violence…

In this context, real threats are beginning to be directed toward the general public in the hypothesis of electoral successes granted to these parties: a general of the British army promises mutiny in the event Corbyn takes power in England[10], the City warns against Ed Miliband’s election[11], Blair predicts the end of the Labour party if Corbyn is elected as its head[12], French « bosses’ boss » announces that electing the FN will be a catastrophe for the French economy[13], French Prime Minister talks about « civil war » in case of a victory of the FN[14], the Portuguese government begs the Lefts Alliance to not question pro-NATO and pro-Euro policies conducted by the country until now… after having been close to succumbing to the temptation of barring this Lefts Alliance from taking over the Parliament as they were entitled to do considering electoral results[15].

A real danger is to see the European « establishment » put an end to ongoing political developments, interrupting democratic processes. Cases of patent attacks on our democracies have probably already occurred: the latest election in Poland which « unexpectedly » put into power a dinosaur of the « world-before », Duda, was labeled a « coup » by someone as respectable as the head of the European Parliament, Martin Schulz[16].

Temptations to cut public wi-fi in France[17], experiments of bank account closings conducted by Barclays in Cyprus[18], rapprochement between internet giants and member states in the name of terrorism[19], etc… Some sort of a collusion between private and public sectors is taking place, threatening civil liberties… with the consent of increasingly terrorized populations. State of emergency declarations make things easier.

As regards the European level, it is mostly its greater inertia that gives the feeling it resists better, as suggested by Martin Schulz’s recent remarks, “is there any chance the European Parliament saves us?”. In fact, while six months ago the EU was still proposing projects of political union, fiscal union, infrastructure plans, some real Euro zone governance, etc…, it has now also started surfing the wave of fear to consolidate its might: Fortress-Europe is now its main project, one moreover conducted manu militari, with threats of exclusion sent to the states which would waver in abandoning these last remnants of sovereignty[20].

But at the same time, what else can be done? The fact is that these measures coincide with a demand of the European public. The problem lies in the fact that it is now too late to do anything else than react. Future generations will judge and condemn us, but the ongoing great derailment of democracy in Europe is the result of twenty-five years of negligence/powerlessness by the European leadership.

EU democratization could have taken place like leaders in the 80s had planned. The migration wave could have been avoided if Europe had resisted this last folly of US Middle-Eastern policy, consisting of getting rid of one more dictator in Syria, at the price of additional chaos, moreover this time without giving ourselves the means for it. IS, this frustrated dream of regional integration turned into a nightmare, could also have been avoided, or at least limited, had Europe resisted regarding the previous point.

The turning point in both cases is in 2013, the last year of the Barroso 10-year mandate… also the year from which the Ukrainian crisis sprang. Two years later, in 2015, the harm is done on all fronts. Windows of opportunity for Europe to take the right paths at the right moment have closed. There is no good solution any more, nor even good players around.

On this last aspect, our team is increasingly struck by the evolution of partner countries such as Russia or Turkey. Russia in particular, this Russia which Europe can no longer do anything with other than pinch its nose and follow, is very different from the Russia we snubbed in 2013. At the time, Putin was conducting a charming offensive directed at Europe, displaying a desire for Europeanization: Olympics, human rights, potential Nobel Peace Prize for his role in the Syrian crisis… the Putin of that time was playing by European rules, with the request of being recognized as a peer. The way he and his country were treated in 2014 compelled him to tilt toward China, relegate his efforts in the field of human rights to a lower priority, develop the greatest contempt for Europeans… and now that we have come to his views, Europe has to play by his rules. Wonderful success!

Somehow, the Turkey of Erdogan followed a similar path. The first Erdogan, eager to represent a modern and democratically moderate Islam, couldn’t resist the dramatic crises that hit his country and which are partly due to Europe’s failings. He too has developed the greatest contempt for this pusillanimous and irresolute Europe, and he proved it by not even caring to join the EU-Turkey Summit organized last month, sending instead his Prime Minister, Davutoglu[21].

In one year, the year 2014, Europe lost all prestige on the international scene. Its former allies (US, Israel, Saudi Arabia…) appear more and more clearly as sources of the many difficulties endangering the planet, and it is now compelled to move closer to other partners (Russia, Turkey…), formerly neglected and treated as inferiors, today harvesting scorn and disdain from countries who couldn’t care less about making any effort of democratic compatibility with Europe.

This crisis has happened, changes took place… but Europe lost the handle. It is left with fear, the reason why our team has become extremely pessimistic that Europe will manage to escape a new period of retrenchment which will be implemented by the « establishment » itself, in association with its accomplices, in order « to avoid chaos » to the European continent...

/More (scroll down)... http://geab.eu/en/the-big-comeback-of-dark-europe-the-geab-is-celebrating-its-10-year-anniversary-in-the-dark-2/

Proserpina

(2,352 posts)The Europeans are going to have to give up their folly and ditch the euro. Otherwise, it's back to the Middle Ages...or worse!

Ghost Dog

(16,881 posts)they'll impose an inquisition.

Proserpina

(2,352 posts)Until next year,