Economy

Related: About this forumThe Weekend Economists travel the Yellow Brick Road, November 14-15.

Well, I was going to try to tie this weekends WEE into events yesterday in France, but realized it might take me hours to get up to speed. So, on to the regularly planned Weekend Economists!

==========

Think back to your school years. Remember being assigned a book to read. Now, maybe you actually tried and finished reading that book (good for you), or maybe you just skimmed it, or maybe you just read the Cliff Notes. So now you go into class, knowing that you know this stuff. The teacher starts discussing the assigned book, and you're left pondering, "just what book is he/she talking about? There was nothing like that in the book I read." Yeah, we've all been there.

Fast forward a decade or a dozen (years, not decades), and you become aware on you own that there are certain books, movies, TV shows, even music, that have a hidden meaning beyond that which is obvious. This is the path we are taking today. I, for one, will focus on one book, The Wizard of Oz, mostly because I'm doing this WEE on short notice. But there are certainly numerous other examples. Feel free to join the main discussion, or add your own somewhere down the line.

==========

The Wizard of Oz. Just a children's book, correct? A storm displaces a girl far far away from home, and all she wants is to go home. But there have been several other reinterpretations of this book, the most famous of which follows.

Do remember that this following discussion is about the book. A few things were changed or eliminated in the movie.

==========

The Wizard of Oz as a satirical allegory of money and politics in 1900

Dorothy (and Toto) of Kansas

Dorothy, the protagonist of the story, represents an individualized ideal of the American people. She is each of us at our best-kind but self-respecting, guileless but levelheaded, wholesome but plucky. She is akin to Everyman, or, in modern parlance, "the girl next door." Dorothy lives in Kansas, where virtually everything-the treeless prairie, the sun-beaten grass, the paint-stripped house -- even Aunt Em and Uncle Henry -- is a dull, drab, lifeless gray. This grim depiction reflects the forlorn condition of Kansas in the late 1880s and early 1890s, when a combination of scorching droughts, severe winters, and an invasion of grasshoppers reduced the prairie to an uninhabitable wasteland. The result for farmers and all who depended on agriculture for their livelihood was devastating. Many ascribed their misfortune to the natural elements, called it quits, and moved on. Others blamed the hard times on bankers, the railroads, and various middlemen who seemed to profit at the farmers' expense. Angry victims of the Kansas calamity also took aim at the politicians, who often appeared indifferent to their plight. Around these economic and political grievances, the Populist movement coalesced.

In the late 1880s and early 1890s, Populism spread rapidly throughout the Midwest and into the South, but Kansas was always the site of its most popular and radical elements. In 1890, Populist candidates began winning seats in state legislatures and Congress, and two years later Populists in Kansas gained control of the lower house of the state assembly, elected a Populist governor, and sent a Populist to the U.S. Senate. The twister that carries Dorothy to Oz symbolizes the Populist cyclone that swept across Kansas in the early 1890s. Baum was not the first to use the metaphor. Mary E. Lease, a fire-breathing Populist orator, was often referred to as the "Kansas Cyclone," and the free-silver movement was often likened to a political whirlwind that had taken the nation by storm. Although Dorothy does not stand for Lease, Baum did give her (in the stage version) the last name "Gale"-a further pun on the cyclone metaphor.

The name of Dorothy's canine companion, Toto, is also a pun, a play on teetotaler. Prohibitionists were among the Populists' most faithful allies, and the Populist hope William Jennings Bryan was himself a "dry." As Dorothy embarks on the Yellow Brick Road, Toto trots "soberly" behind her, just as the Prohibitionists soberly followed the Populists.

.....

The Three Amigos

In the hope that the Wizard will help her return to Kansas, Dorothy embarks on the Yellow Brick Road to Emerald City. After traveling several miles, she encounters the Scarecrow, who does not "know anything" because he has "no brains at all." The brainless Scarecrow represents the midwestern farmers, whose years of hardship and subjection to ridicule had created a sense of inferiority and self-doubt. Populist leaders such as William Peffer and "Sockless" Jerry Simpson were often portrayed as deluded simpletons who failed to understand the true causes of their economic plight. The Populists' "stupidity" was also attested to by their apocalyptic rhetoric, conspiracy theories, and radical agenda, which included nationalization of the railroads, a graduated income tax, and the unlimited coinage of silver. Critics scoffed at their overblown rants, mocked their paranoid style, and dismissed their simplistic nostrums as the distempered ravings of "socialist hayseeds."

The picture of the Scarecrow is not so one-sided. His conduct on the journey through Oz is marked by common sense, resilience, and rectitude. He is not so dumb after all. As we learn near the end of the story, the Scarecrow-cum-farmer had brains all along-perhaps brains enough to grasp the true causes of his misery and the basics of monetary policy.

.....

Proceeding down the road, the duo encounter the Tin Woodman. Once healthy and productive, the Woodman was cursed by the wicked Witch of the East, lost his dexterity, and accidentally hacked off his limbs. Each lost appendage was replaced with tin until the Woodman was made entirely of metal. In essence, the Witch of the East (big business) reduced the Woodman to a machine, a dehumanized worker who no longer feels, who has no heart. As such, the Tin Man represents the nation's workers, in particular the industrial workers with whom the Populists hoped to make common cause. His rusted condition parallels the prostrated condition of labor during the depression of 1890s; like many workers of that period, the Tin Man is unemployed. Yet, with a few drops of oil, he is able to resume his customary labors-a remedy akin to the "pump-priming" measures that Populists advocated.

.....

Having liberated the Tin Man, the trio proceeds through the forest, only to be accosted by a roaring lion. He is none other than William Jennings Bryan, the Nebraska representative in Congress and later the Democratic presidential candidate in 1896 and 1900. Bryan (which rhymes with "lion," a near homonym of "lying"![]() was known for his "roaring" rhetoric and was occasionally portrayed in the press as a lion, as was the Populist Party itself. Bryan adopted the free-silver mantra and won the Populists' support in his first race against McKinley. Like the Lion of Oz, Bryan was the last to "join" the party. His defeat in the general election was largely owing to his failure to win the support of eastern workers, just as the Lion's claws "could make no impression" on the Tin Man.

was known for his "roaring" rhetoric and was occasionally portrayed in the press as a lion, as was the Populist Party itself. Bryan adopted the free-silver mantra and won the Populists' support in his first race against McKinley. Like the Lion of Oz, Bryan was the last to "join" the party. His defeat in the general election was largely owing to his failure to win the support of eastern workers, just as the Lion's claws "could make no impression" on the Tin Man.

Although Bryan's supporters considered him courageous, his critics thought him "cowardly" for opposing war with Spain in 1898 and the subsequent annexation of the Philippines. Yet, for anti-imperialists, who counted many Populists among their ranks, Bryan's unpopular stand was courageous indeed. Less courageous, however, were his final decision to vote for annexation (albeit as a tactical move) and his failure to fight vigorously for free silver in the election of 1900, both of which disappointed Populists.

.....

Oz, Emerald City, and the Wacky Wizard

The Land of Oz, with its varied landscape and diverse inhabitants, is a microcosm of America, and Emerald City, its center and seat of government, represents Washington, D.C. In an effort to be made whole, Dorothy and her band travel to the capital to see the Wizard, who presumably has the power to grant them their wishes. The journey to Emerald City corresponds to the Populist effort to acquire power in Washington, and the travelers recall the "industrial armies" who marched on the capital during the depression of 1893-97. The most famous of these, "Coxey's Army," was led by a successful businessman who urged the government to fund public-works programs (most notably a "good roads bill"![]() to alleviate unemployment. Coxey, who hoped to meet with President Cleveland, was arrested for trespassing, and his proposals were ignored. Dorothy and company also face hazards on the road to Emerald City and are turned away by the Wizard, who shows little sympathy for their plight.

to alleviate unemployment. Coxey, who hoped to meet with President Cleveland, was arrested for trespassing, and his proposals were ignored. Dorothy and company also face hazards on the road to Emerald City and are turned away by the Wizard, who shows little sympathy for their plight.

The Wizard, who "can take on any form he wishes," represents the protean politicians of the era, especially the presidents of the Gilded Age. Given the even division of Democrats and Republicans, and the razor-thin majorities of most presidential elections, candidates rarely took clear stands on the issues. As a result, voters often had difficulty in determining what the candidates stood for. The Wizard fits this description, for "who the real Oz is," Dorothy is informed, "no living person can tell." Indeed, when the foursome enter the throne room, the Wizard appears to each in a different form. Like many politicians, he is unwillingly to help them without a quid pro quo: "I never grant favors without some return."

Politicians are also infamous for failing to keep promises, and the great Oz is no different. When Dorothy's party returns after killing the Witch of the West, the Wizard keeps them waiting, then puts them off. By accident, the all-powerful Wizard is exposed and his true identity revealed. Far from a mighty magician, "Oz, the Terrible" is merely a "humbug," a wizened old man whose "power" is achieved through elaborate acts of deception. The Wizard is simply a manipulative politician who appears to the people in one form, but works behind the scenes to achieve his true ends. Such figures are terrified at being exposed; the Wizard cautions Dorothy to lower her voice lest he be discovered and "ruined."

.....

Much much more at the link.....

-----> http://www.usagold.com/gildedopinion/oz.html

==========

So now, tell me. Aren't thing today much like things back then? The eastern bankers oppressing everyday people. Candidates that rarely took clear stands of issues, or today, a candidate that takes every stand on every issue. Workers reduced to machines. A brainless mass of people. People and politicians with no courage at all. It goes on and on.

MattSh

(3,714 posts)Dark Side of the Rainbow - Wikipedia, the free encyclopedia

Dark Side of the Rainbow – also known as Dark Side of Oz or The Wizard of Floyd – refers to the pairing of the 1973 Pink Floyd album The Dark Side of the Moon with the visual portion of the 1939 film The Wizard of Oz." [1] This produces moments where the film and the album appear to correspond with each other. The title of the music video mashup-like experience comes from a combination of the album title, the album cover, and the film's song "Over the Rainbow". Band members and others involved in the making of the album state that any relationship between the two works of art is merely a coincidence.[2]

-----> https://en.wikipedia.org/wiki/Dark_Side_of_the_Rainbow

Best parts here...

The whole thing here...

MattSh

(3,714 posts)or so it is hoped...

I need to step away for a while and get outside for a bit, before the anticipated rains start.

See you later.

Post 'em if you've got 'em!

Demeter

(85,373 posts)Last edited Sat Nov 14, 2015, 11:43 AM - Edit history (1)

I had heard a bit about this allegory idea, but never in such detail.

It is very plausible, and I believe Baum confessed to it at one point. If I can track that down, I'll post it.

ON EDIT:

THIS IS A GREAT TOPIC, PERFECT FOR THE WEEKEND AT HAND! NOT TOO HEAVY, NOT TOO LIGHT, FINANCIAL BUT NOT, ETC.

(forgive and forget the sarcasm in the headline...I wasn't quite awake yet)

There's another interpretation, rather far fetched, for Oz, that involved gold vs silver (silver slippers were are clue) and the currency war that William Jennings Bryan gave the Cross of Gold speech about...but I always found that a bit strained.

http://www.ithaca.edu/rhp/programs/cmd/blogs/posters_and_election_propaganda/the_wizard_of_oz_and_the_1896_mckinley-bryan_campa/#.VkdVL17Hn5s

In 1964, Henry Littlefield (a high school teacher in Mount Vernon, New York) published an article in the American Quarterly, which called L. Frank Baum's children's book, The Wonderful Wizard of Oz (published in 1900), a political parable of the United States at the end of the nineteenth century, which focused on the election of 1896.

It was suggested by Littlefield that these Baum characters represented the following people and groups:

Other writers have added to, or challenged, Littlefield's interpretations (see David Parker's article). One, for example, noted that Dorothy's dog, Toto, represented the Prohibitionist teetotalers and that Oz was an abbreviation for "ounce." The silver advocates in 1896 had called for a 16-to-1-ounce ratio of silver to gold. Another thought Dorothy symbolized Mary Elizabeth Lease, a Populist speaker, who was thought to have told Kansas farmers to "raise less corn and more hell." Yet another thought that the book had much to do with imperialism in Asia, with The Wicked Witch of the East being President Grover Cleveland, The Wicked Witch of the West, William McKinley, and The Wizard, the latter's campaign manager, Mark Hanna. And another scholar wrote that The Wicked Witch of the West was Populism itself.

Many still think, however, that the work was mainly about the political battle between silver and gold advocates, after the Great Depression of 1893 in the United States: "Baum, a reform-minded Democrat who supported William Jennings Bryan's pro-silver candidacy, wrote the book as a parable of the Populists, an allegory of their failed efforts to reform the nation in 1896." wrote Parker about this theory...MORE

SIMILAR DEVELOPMENTS AT:

http://www.themoneymasters.com/the-wonderful-wizard-of-oz-a-monetary-reformers-brief-symbol-glossary/

Demeter

(85,373 posts)Why are so many drawn to the Sanders message? It's not because he's a political outsider. (He's a Senator who has spent his entire adult life in politics.) It's not because he's a good Jewish boy from Brooklyn. (Jews make up only about 2% of the American population.) And it's not because he's a self-declared socialist. (Few of us have any idea what that means in today's global economy.)

Rather, it's because so many of us want to stop our entire society from crumbling beneath the destructive power of runaway inequality. Here are 10 crucial economic facts that provide the glue for the Sanders message. (The charts are taken from Runaway Inequality: An Activist's Guide to Economic Justice.)

1. The rich are getting richer, the rest of us are not.

2. Wall Street/CEO Greed

3. The biggest banks are getting bigger.

4. Students are crippled with debt.

5. We lead the developed world in child poverty

6. You can't live on the minimum wage

7. The tax system favors the rich

8. The rich buy the political system

9. "The American Dream" is fading away

10. The largest police state in the world

Taking them on

Perhaps Bernie's biggest applause line is the one that sets us on our course. His campaign cannot succeed in one election. We need to connect with our neighbors and colleagues and help organize and mobilize for change.

"This campaign is sending a message to the billionaire class: Yes, we have the guts to take you on."

Let's hope he's right.

DETAILS ON PROBLEMS AND BERNIE'S PROPOSED SOLUTIONS AT LINK

Les Leopold is the director of the Labor Institute in New York. His latest book is Runaway Inequality: An Activist's Guide to Economic Justice (Chelsea Green, 2015). For bulk orders contact him at [email protected].

Demeter

(85,373 posts)I lost my shirt at euchre, as usual, but the lasagna was acclaimed. When you make lasagna, there's no point to it unless you make a LOT of it...3 households and the Euchre night supplied.

Yesterday's doom and gloom, rain, sleet, wind and cloud are all gone today...but it will still be cools, just not as much. Why, we're out of freezing and on the way to 50F!

antigop

(12,778 posts)Demeter

(85,373 posts)The Mythical Man-Month: Essays on Software Engineering is a book on software engineering and project management by Fred Brooks, whose central theme is that "adding manpower to a late software project makes it later". This idea is known as Brooks' law, and is presented along with the second-system effect and advocacy of prototyping.

Brooks' observations are based on his experiences at IBM while managing the development of OS/360. He had added more programmers to a project falling behind schedule, a decision that he would later conclude had, counter-intuitively, delayed the project even further. He also made the mistake of asserting that one project — writing an ALGOL compiler — would require six months, regardless of the number of workers involved (it required longer). The tendency for managers to repeat such errors in project development led Brooks to quip that his book is called "The Bible of Software Engineering", because "everybody quotes it, some people read it, and a few people go by it".[1] The book is widely regarded as a classic on the human elements of software engineering.[2]

The work was first published in 1975 (ISBN 0-201-00650-2), reprinted with corrections in 1982, and republished in an anniversary edition with four extra chapters in 1995 (ISBN 0-201-83595-9), including a reprint of the essay "No Silver Bullet" with commentary by the author.

https://en.m.wikipedia.org/wiki/The_Mythical_Man-Month

Demeter

(85,373 posts)Britain and the United States carried out a planned drill with leading global firms on Thursday to see how they would respond to a cyber incident in the financial sector.

The test focused on how the world's two biggest financial centers, New York and London, would cope with a cyberattack in terms of sharing information, communicating with the public and handling an incident.

"Confronting the cyber threat is a team effort that requires coordination at all levels. Today's exercise with our U.K. partners is an important step to ensure that we are doing all we can to share threat information, adopt best practices and support our collective resiliency," U.S. Treasury Secretary Jacob Lew said in a statement.

"We train and prepare for the threat of a financial cyber incident," added Britain's finance minister, George Osborne. "And we will continue to work with our partners in the U.S. to enhance our cyber cooperation."

Details of the simulation exercise weren't released.

In addition to Treasury, U.S. participants included: White House National Security Council, Department of Homeland Security, FBI, Secret Service, the Federal Reserve and the Securities and Exchange Commission as well as financial institutions and industry groups...U.S. financial institutions have already been targets of a major hack. Earlier this week, federal prosecutors filed charges against three men accused of orchestrating a massive 2014 cyberattack against JPMorgan Chase & Co. and other financial giants.

SEEMS TO ME THEIR GREATEST VULNERABILITY IS FROM INSIDERS...BUT WHAT DO I KNOW?

Demeter

(85,373 posts)YES, BUT WHAT IS THE POINT? TO TERRORIZE PEOPLE? IS THAT A WINNING STRATEGY?

WHERE'S THE PAYOFF FOR BLOWING YOURSELVES UP IN SUICIDE ATTACKS?

WAS IT THE NATURE OF THE PLAN, OR THE PURPOSE OF THE PLAN, TO DO IT AFTER ALL THE MARKETS WERE CLOSED?

http://www.bloomberg.com/news/articles/2015-11-14/complexity-of-paris-attack-carries-hallmarks-of-trained-fighters

The worst terrorist attack in Europe in a decade shows the expanding global reach of Islamic State militants, well beyond their strongholds in the Middle East.

At least 127 people were killed on Friday in attacks described as an “act of war” by French President Francois Hollande, who blamed the violence on Islamic State. The bloodshed came one day after the group claimed responsibility for killing at least 43 people in its first suicide bombing against Hezbollah’s Beirut stronghold. Its Egyptian affiliate also said it was behind downing the Russian Metrojet aircraft that crashed in Egypt’s Sinai peninsula Oct. 31, killing 224 people.

"The message that Islamic State seems to be sending through the attacks is that its reach is global and that none of its enemies will be spared retaliation," said Lina Khatib, senior research associate at the Arab Reform Initiative in Paris. "Subsequent attacks can, unfortunately, happen almost anywhere" it has supporters, she said.

RETALIATION MAY FEED EGOS AND SOOTH INJURED PRIDE, BUT IT DOESN'T DO A THING FOR THE CIVILIANS LEFT BEHIND WHEN THEIR FIGHTERS GO OFF THE CLIFF...NOT EVEN AN EXTORTION ATTEMPT?

Demeter

(85,373 posts)...There will be questions about how the Paris plot was not foreseen, given U.S. intelligence monitoring of the group’s fighters in places such as the Syrian town of Raqqah, where it’s believed an Islamic State extremist known as “Jihadi John” was killed Friday in an airstrike, said Jane Kinninmont, senior research fellow at Chatham House in London...

ARE WE REDUCED TO "EYE FOR AN EYE"?

Demeter

(85,373 posts)Long off the public radar, digital payment network bitcoin has been gaining momentum this fall, bolstering the views of some advocates that bitcoins will be a mainstream currency worldwide in the not-too-distant future.

The value of a bitcoin surged to more than $400 last week from its low this year of $177.28 in mid-January. Meanwhile, the technology known as blockchain that underlies bitcoin trading is slowly being adopted for uses far removed from currency.

Analysts also are getting more bullish on the bitcoin system.

"We believe bitcoin and its associated blockchain technology have the potential to disrupt the existing financial infrastructure over the next several years, and believe the value of the bitcoin currency will benefit from this trend," Gil Luria, an analyst at Wedbush Securities in Los Angeles, wrote in a research report last week.

For the last three years, the virtual currency has struggled with wild price fluctuations that hit more than $1,100, a murky regulatory status and its use on the Internet's dark side, including drug sales.

http://www.trbimg.com/img-5643d914/turbine/la-g-fi-bitcoins-rise-20151111/600/600x338

I DUNNO, I'M STILL KEEPING BITCOIN IN THE "PET ROCK" CATEGORY OF PHENOMENA...

Demeter

(85,373 posts)WHERE THERE'S NOBODY TO COMPLAIN IF IT FAILS

http://www.reuters.com/article/2015/11/14/us-nasdaq-blockchain-estonia-idUSKCN0T301H20151114?feedType=RSS&feedName=businessNews

Exchange and clearing house operator Nasdaq Inc plans to develop several applications for blockchain, the technology underpinning the digital currency bitcoin, using its Estonian settling and clearing business, a senior Nasdaq executive said on Friday.

The blockchain is a shared distributed ledger that records and stores digital assets. Parties can use the mechanism to transfer those assets and proponents says its use could make it easier to keep track of information and reduce settlement times.

Nasdaq is on track to roll out the technology on its market for private companies, Nasdaq Private Market, later this year, helping firms keep track of the shares they issue and enabling them to almost instantaneously settle transactions, Nasdaq Co-President, Hans-Ole Jochumsen, said in an interview.

The New York-based company is also preparing plans to develop new blockchain applications in Estonia, where Nasdaq owns the Tallinn Stock Exchange, Estonia's only regulated secondary securities market, as well as The Estonia Central Securities Depository (ECSD), he said. The applications will focus on improving the proxy voting process for companies, as well as for company registration and public pension registration, which Nasdaq has a contract to manage with the government of the Baltic country of around 1.3 million.

"It's a smaller country, so it's not very complex in size, and there is a government that is very keen to use technology. They claim that they are in the forefront of using technology in the public center worldwide," Jochumsen said of Estonia.

The ECSD administers share registers for all joint stock companies operating in Estonia, as well as all securities and pension accounts opened in the country. The register includes other electronic securities, such as private company shares, bonds, and securities transactions histories. The ECSD also provides clearing and settlement services for securities trading, payments of corporate dividends and interest, and other securities-related services.

Demeter

(85,373 posts)JUST WHAT THE GLOBAL ECONOMY NEEDS--NOT

http://www.bloomberg.com/news/articles/2015-11-12/shadow-banking-grows-10-driven-by-lenders-in-china-and-ireland

The global assets of the shadow-banking industry grew by $1.1 trillion to about $36 trillion last year, outpacing banks and other financial institutions and driven by growth in the U.S., China and Ireland, according to the Financial Stability Board.

Shadow-banking assets, captured under a new narrower definition designed to better isolate institutions that pose risks to the financial system, amount to 59 percent of gross domestic output and 12 percent of all financial assets in the 26 countries participating in the FSB’s annual survey, the Basel-based regulator said on Thursday.

“Non-bank financing provides a valuable alternative to bank funding and helps support real economic activity,” the FSB said in the report. “However, if non-bank financing is involved in bank-like activities, transforming maturity/liquidity and creating leverage like banks, it can become a source of systemic risk.”

While regulators have reined in excessive risk-taking by banks in the wake of the collapse of Lehman Brothers Holdings Inc. in 2008, they are concerned that lenders might use shadow banking to evade the clampdown and cause risks to build up out of sight of regulators. The Group of 20 nations asked the FSB to keep track of the industry and develop rules to keep it in check...

YUH THINK?

Demeter

(85,373 posts)IN THEIR MIND'S EYE

http://www.reuters.com/article/2015/11/12/g20-fsb-shadowbanking-idUSL8N1375DJ20151112

Global regulators published rules on Thursday to rein in risks in so-called shadow banking by increasing the amount of collateral required to back core transactions in a $137 trillion sector that continues to grow as mainstream banks shrink.

Shadow banking refers to credit creation through the likes of hedge funds, repurchase agreements, pension funds, insurers, and securities financing transactions...Regulators have already imposed tougher capital requirements on mainstream banks after the 2007/09 financial crisis.

The Financial Stability Board (FSB), a regulatory task force for the Group of 20 economies (G20), published final rules on Thursday for regulating "shadow bank" transactions in case risky banking activities migrate to the hitherto less regulated sector.

They are the first set of global "haircuts" that must be applied to securities financing transactions between non-banks. Haircuts refer to how collateral used for backing transactions must be discounted. In a securities financing transaction, a shadow bank borrows cash and has to post collateral in the form of securities such as shares. Under the FSB rules a non-bank would have to post $106 in shares for every $100 borrowed. The bulk of such transactions are conducted between banks or banks and non-banks, and the FSB has already published haircuts for these trades.

Thursday's announcement signals a widening in the scope of shadow bank rules to cover the smaller but growing non-bank to non-bank transactions. "Non-bank financing is a welcome additional source of credit to the real economy," FSB Chairman Mark Carney said. The FSB said it has also extended by a year to 2018 the deadline for applying the new haircuts.

GROWING SECTOR

Separately the FSB updated its figures on the size of the global shadow banking sector and introduced a new, narrower figure for the shadow banking activities it believes could pose risks. The narrow figure excludes firms such as insurers and pension funds, but includes the likes of hedge funds and collective investment vehicles, such as money market funds, which can be susceptible to runs in a crisis. The narrower figure shows that shadow banking grew to $36 trillion, or 12 percent of financial system assets, in 2014. That is up $1.1 trillion on the previous year, the FSB said.

A wider aggregate figure for all shadow banking activities, including pension funds and insurers who lend out their securities, grew by 9 percent to $137 trillion over the past year, representing 40 percent of total financial system assets.

"Perhaps more surprisingly, money market funds experienced 20 percent growth in 2014, largely driven by some euro area jurisdictions and China," the FSB said.

The FSB announcements coincide with a summit of G20 leaders in Turkey next week which will take stock of their regulatory push since the financial crisis. OR IT WOULD HAVE, UNTIL ATTENTION WAS DIVERTED TO SECURITY AFTER PARIS...

antigop

(12,778 posts)Last edited Sat Nov 14, 2015, 03:53 PM - Edit history (1)

I tried to get people's attention on securities lending years ago.

I think people would be shocked to find out what is being done with their 401(k) money.

DemReadingDU

(16,000 posts)Until they are personally affected.

antigop

(12,778 posts)Demeter

(85,373 posts)MAKING NICE WITH OUR ECONOMIC MASTERS...

http://www.bloomberg.com/news/articles/2015-11-13/imf-staff-recommend-yuan-be-included-in-reserve-currency-basket

China’s yuan is poised to enter the big leagues of global currencies, according to the judgment of the International Monetary Fund.

IMF staff have recommended the yuan be included in the fund’s Special Drawing Rights reserve-currency basket, alongside the U.S. dollar, euro, pound and yen, IMF Managing Director Christine Lagarde said Friday. The staff nod makes approval by the fund’s board this month all but certain, as major IMF shareholders including the U.S. have said they will support inclusion if the yuan meets IMF criteria. It would be the first change in the SDR’s currency composition since 2001, when the euro replaced the German deutsche mark and French franc.

The Washington-based fund’s endorsement would mark a major milestone in a decades-long ascent toward international credibility for the yuan, which was created after World War II and for years could be used only domestically in the Communist-controlled nation. Approval probably will make more countries comfortable including the currency in their foreign-exchange holdings, while boosting President Xi Jinping’s drive to open up the world’s second-biggest economy.

Inclusion would also be a bright spot for China in a tumultuous year for its economy, which has been buffeted by slowing growth, a tumbling stock market and a shift by authorities toward a more market-oriented exchange rate. Market turmoil worldwide followed a devaluation of the yuan in August and the government attempted to prop up equities, spurring investors to question the credibility of policy making.

IMF staff members determined that the yuan meets the requirement of being “freely usable,” Lagarde said in an e-mailed statement. The board had rejected including the yuan following the last review, in 2010, concluding the currency didn’t meet the test...

THAT WAS THEN, THIS IS NOW....PEOPLE ALL OVER THE WORLD ARE HAPPY TO TAKE YUAN, SO THE IMF WANTS TO HORN IN ON IT.

Demeter

(85,373 posts)BETTER LATE THAN NEVER...FROM FRIDAY MORNING, BEFORE IT ALL CAME DOWN

http://www.reuters.com/article/2015/11/11/imf-islam-financing-idUSL8N12Z04N20151111#KuXgqlHrzBcWogR6.97

The International Monetary Fund will include Islamic finance in its monitoring of financial sectors around the world, IMF Managing Director Christine Lagarde said on Wednesday, in a sign of the industry's growing economic weight.

"We are keen to pursue this agenda and to further strengthen our policy advice by incorporating best practices for Islamic banking and finance into our surveillance work," Lagarde told a conference on Islamic finance in Kuwait.

The IMF has traditionally focused on conventional banking. But last year it launched discussions with an external advisory group of Islamic finance experts and industry bodies, and this month it published a report on the impact of monetary policies on Islamic banking in Gulf countries. Islamic finance, which bans interest payments and pure monetary speculation, has been growing faster than conventional finance and is estimated to have over $2 trillion of assets globally. It has become important for financial systems in more than 10 countries, accounting for over 15 percent of total financial assets there, Lagarde said. Non-Muslim countries such as Britain and Luxembourg have begun to issue Islamic bonds.

She called on governments in the Gulf and southeast Asia to increase their issues of Islamic bonds in various maturities and to incorporate them into their debt management strategies, in order to provide better pricing benchmarks for a much wider range of issuers. The IMF wants to encourage more consistency among countries in applying Islamic finance rules, fearing that conflicts among jurisdictions could stifle growth and create instability. Lagarde said that to maintain a level playing field with conventional banks, Islamic lenders needed to adapt their capital requirements to account for their profit-and-loss- sharing models. Countries with Islamic finance industries should harmonise tax treatment across jurisdictions and incorporate Islamic finance into international tax treaties, she told the conference, which was organised by institutions including the IMF and Kuwait's central bank.

SOUNDS LIKE APPLES AND ORANGES TO ME...AND ISLAMIC FINANCE STILL HAS NO NEED OF THE INFIDELS.

MORE LIKELY, THE INFIDELS HAVE A NEED FOR THE ISLAMIC FUNDS, AND A DESIRE TO CONTROL...

Demeter

(85,373 posts)GERMANS WANT THE QE TURNED OFF...THE FEAR OF WEIMAR INFLATION STRIKES AGAIN!

http://www.reuters.com/article/2015/11/11/germany-economy-ecb-idUSB4N11702Y20151111#Wv4fZkp7cFeoF8Tw.97

The German government's panel of economic advisers warned on Wednesday that the low interest rate policies of the European Central Bank (ECB) were creating substantial risks for financial stability and could ultimately threaten the solvency of banks and insurers. In its annual report on the state of the German economy, the panel of experts known as the "wisemen", although it now includes one woman, forecast growth of 1.7 percent this year and 1.6 percent in 2016.

The group of five economists described the costs of the refugee crisis as "manageable" for the German government, estimating that the influx would lead to additional public outlays of up to 8.3 billion euros in 2015 and up to 14.3 billion euros next year.

But the council criticised the policies of the ECB in unusually stark language, saying it was creating "significant risks to financial stability."

"If low interest rates remain in place in the coming years and the yield curve remains flat, then this would threaten the solvency of banks and life insurers in the medium term," the council noted in the report.

"The ECB is not taking the looming risks to financial stability into account in its monetary policy decision-making," the council added.

Demeter

(85,373 posts)The European Central Bank is examining whether to buy municipal bonds of cities such as Paris or regions like Bavaria, according to people with knowledge of a possible extension of its one-trillion-euro-plus money printing scheme. This regional bond buying could be one in a series of measures to be rolled out in the coming months, although one of the sources said time was short for a full launch in December and that this would likely come by March next year...

Despite the ECB's scheme of quantitative easing (QE) to buy chiefly state bonds, the euro zone's economy is growing only modestly and the central bank is urgently considering what more it can do to improve it and stagnant price inflation.

As part of preparations for the next rate-setting meeting of policy-setters on Dec. 3, ECB officials are now analyzing whether and how to extend its shopping list to municipal bonds, issued by, say, Madrid or Mainz, or a federal German state...According to data from Thomson Reuters IFR, almost $500 billion of bonds issued by European cities and regions are in circulation. The regions have sold more than $76 billion of bonds over the last year. The city of Paris, for example, has borrowed 4 billion euros ($4.3 billion) in total through such bonds. It recently sold a bond of 300 million euros.

The source said that while some cities were risky, they had the fallback of central governments. Municipal bonds typically have a lower credit rating than governments. It is a fragmented market in Europe, with many small issues. "Some cities in Spain or Italy are bust. But a city will always be there," said the person. "Someone will always pay back the debt. They have the backing of the government and the ability to raise taxes."

******************

Corporate debt, for example, is much sought after and therefore difficult to buy. Buying into stock markets would face opposition because of the risk. The ECB already buys covered bonds and asset backed securities. Any move to buy municipal debt would particularly benefit the German regions that have sold hundreds of billions of euros of bonds and dominate the market, making it even cheaper for them to borrow. But it could also help rejuvenate slack markets such as Italy or Spain although regional borrowings count in calculating a country's overall debt pile and their size is therefore also kept in check.

In the coming weeks, ECB President Mario Draghi hopes to win the backing of a majority of Governing Council, which includes national central bank chiefs, for further steps to shore up the bloc's weak economy. Germany's Bundesbank, which is opposed to any extra money printing, may find it easier to accept the buying of municipal bonds. Because quantitative easing is determined by the relative size of a country in the 19-member euro zone, Germany does most bond buying. Some analysts predict that it could even run out of bonds to buy, as returns dip below the ECB threshold. Putting municipal bonds in the mix could resolve that problem.

"If the ECB wants to extend the bond purchase program, in our view, the ECB needs to include Federal states' bonds," said Hendrik Lodde of DZ Bank.

"With a lengthening of the 'shopping list', Germany can reach the level of overall bond buying intended easier."

Demeter

(85,373 posts)German politicians who failed in previous attempts to have courts derail European Union policy filed lawsuits at the country’s top court challenging the European Central Bank’s 1.1 trillion-euro ($1.2 trillion) asset-purchase program.

Three suits were filed over the last six months, according to Michael Allmendinger, a spokesman for the Federal Constitutional Court in Karlsruhe. Bernd Lucke, the head of political party ALFA, brought a case in September. Ex-lawmaker Peter Gauweiler said in an e-mailed statement that he also filed a complaint last month.

"With its euphemistically so-called Quantitative Easing policy, the ECB is seeking to inflame inflation by printing huge amounts of money," said Gauweiler, who was behind a case that resulted in a ruling from the EU’s top court earlier this year. "This program is economic policy and first and foremost serves private banks from which the ECB purchases problematic loans. It is turning itself into the bad bank of Europe."

Nine months into the bond-buying program, the main goal of spurring inflation toward the ECB’s goal of close to but below 2 percent remains elusive with price increases still largely absent from the 19-nation euro region. With the economy at risk of cooling amid weaker growth in China and a slowdown in global trade, ECB President Mario Draghi has held out the prospect of more stimulus next month, when new consumer-price and growth forecasts will be published...

Demeter

(85,373 posts)European Union nations need to decide by next month on whether a financial-transactions tax is possible among participating countries, Austrian Finance Minister Hans Joerg Schelling said.

Schelling, who leads the group of 11 nations that have signed up to design a joint FTT, said he’ll aim to submit a report in December to all 28 EU nations. So far, he said, talks among participating nations have yielded “clear progress” but also no deal.

“I suppose it’s necessary that we can have a solution” when EU finance ministers meet again on Dec. 8, he told reporters in Brussels on Tuesday. “If there is no solution then, one should discuss just as openly that no decision could be reached. At this stage we still believe a solution is possible.”

Italy continues to push for the tax to include sovereign debt derivatives, while most other nations have agreed to exclude those derivatives along with government bonds, Schelling said. Meanwhile, Slovenia and Estonia want the tax to have a broader cross-border reach to ensure it would raise sufficient revenue to be worthwhile, he said...MORE

Demeter

(85,373 posts)http://www.bloomberg.com/news/articles/2015-11-12/greece-comes-to-a-standstill-as-unions-turn-against-tsipras

..Unions -- a key support base for the prime minister’s Syriza party -- chanted in rallies held in Athens the same slogans Tsipras once used against opponents. Doctors and pharmacists joined port workers, civil servants and Athens metro staff in Greece’s first general strike since he took office in January, bringing the country to a standstill for 24 hours.

As many as 20,000 protesters gathered in central Athens while a small group of anarchists at the tail of the demonstration threw petrol bombs at police officers at around 1:30 pm local time, a police spokesman said, requesting anonymity in line with policy. The police responded with tear gas and stun grenades.

Greece’s biggest unions, ADEDY and GSEE, are holding marches accusing Tsipras of bowing to creditors and imposing measures that “perpetuate the dark ages for workers,” as the country’s statistical agency released data showing that 1.18 million Greeks, or 24.6 percent of the workforce, remained unemployed in August.

The 41-year-old Greek premier, who was among anti-austerity protesters in previous general strikes, is now racing to complete negotiations with creditors on belt-tightening in exchange for the disbursement of 10 billion euros ($10.7 billion) to be injected into banks. Failure to reach an accord with euro-area member states and the International Monetary Fund on policies including primary residence foreclosures, and stricter rules on overdue taxes, would put the solvency of the country’s lenders in doubt.

“The economic policies Tsipras has to implement are definitely harsher than warranted, and also harsher than they would be if it wasn’t for these seven months of brinkmanship and extreme political uncertainty,” said Manolis Galenianos, a Professor of Economics at the Royal Holloway, University of London. “This wasn’t necessary, it could have been avoided, and the government will now implement deeper cuts to achieve less ambitious fiscal targets.”

MORE

Brazil's Petrobras offers wage hike to strikers; union wary

http://www.reuters.com/article/2015/11/12/us-brazil-petrobras-strike-idUSKCN0T104920151112#oKirpLfoj0rqqdQi.97

Brazil's state-led oil company Petroleo Brasileiro SA offered striking workers a 9.54 percent wage hike on Wednesday in an effort to end a 10-day strike and prevent it from causing further production losses.

But union officials said the deal makes almost no concessions on their most important demands. These include calls on Petrobras, as the company is known, to reverse investment cuts and block planned assets sales designed to reduce Petrobras' debt.

At more than $130 billion, the company's debt is the largest in the oil industry.

The strike, which has cut output from oil fields and refineries, is the biggest at Petrobras in 20 years...MORE

Demeter

(85,373 posts)STRANGER THAN USUAL, THEY MEAN?

http://www.bloomberg.com/news/articles/2015-11-12/five-strange-things-that-have-been-happening-in-financial-markets

...Interesting things have certainly been happening in the underpinnings of global markets—things that either run counter to long-standing financial logic, or represent an unusual dislocation in the "normal" state of market affairs, or were once rare occurrences but have been happening with increasing frequency.

Here's a rundown:

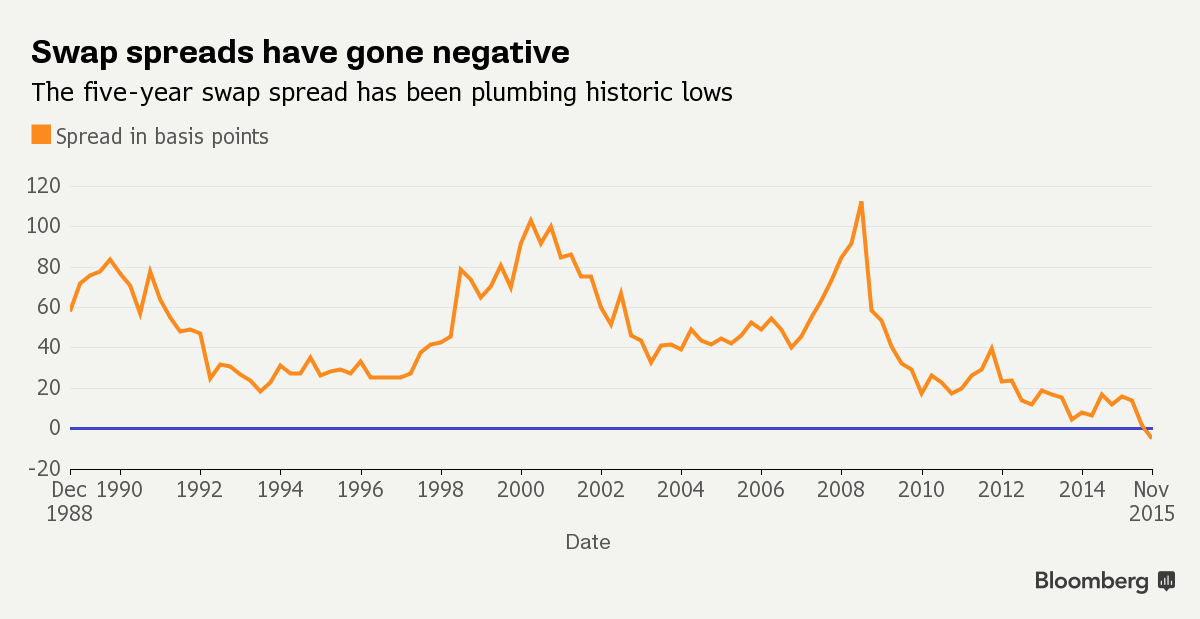

1. Negative swap spreads

...At issue is the fact that swap rates—or rates charged for interest rate swaps—have dipped below yields on equivalent U.S. Treasuries, indicating that investors are charging less to deal with banks and corporations than with the U.S. government. Such a thing should never happen, as U.S. Treasuries theoretically represent the "risk-free" rate while swap rates are imbued with significant counterparty risk that should demand a premium.

That may have changed, however, as new financial market rules require interest rate swaps to be run through central clearing houses, effectively stripping them of counterparty risk and leaving just a minimal funding component. At the same time, funding costs for U.S. Treasuries are said to have gone up due to a host of post-financial crisis rules that crimp bank balance sheets (more on this later) causing costs to go up...

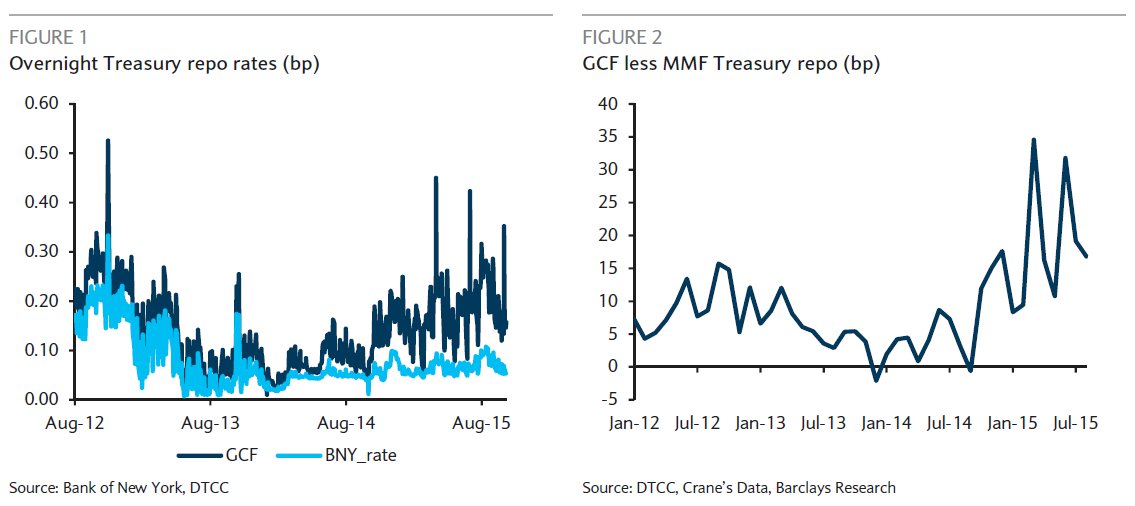

2. Fractured repo rates

The difference between different repo rates has been widening.

Source: Barclays

The repo market is the lubricant for the global financial system, allowing banks and investors to pawn their assets—typically U.S. Treasuries and other high-quality paper—in exchange for short-term financing.

While there used to be little distinction between the rates at which counterparties raised money against their U.S. Treasury collateral, there is now an increasing divergence. "You no longer have a single repo rate," Joseph Abate, Barclays analyst, said in an interview last week. "The market itself is fracturing."

...The repo market is the lubricant for the global financial system, allowing banks and investors to pawn their assets—typically U.S. Treasuries and other high-quality paper—in exchange for short-term financing.

While there used to be little distinction between the rates at which counterparties raised money against their U.S. Treasury collateral, there is now an increasing divergence. "You no longer have a single repo rate," Joseph Abate, Barclays analyst, said in an interview last week. "The market itself is fracturing."

3. Corporate bond inventories below zero

Analysts at Goldman Sachs made waves this week when they highlighted the fact that inventories of some corporate bonds held by big dealer-banks had gone negative for the first time since the Federal Reserve began collecting such data. That means big banks are now net short corporate bonds with a maturity greater than 12 months equivalent to $1.4 billion, bucking the longer-term trend of net positive positions.

The record-breaking event revived a flurry of concerns about so-called liquidity, or ease of trading, in the $8.1 trillion corporate bond market. Similar to the repo market, a confluence of new rules is said to have made it more difficult for banks to hold corporate bonds on their balance sheets. At the same time, years of low interest rates have encouraged investors to herd into corporate bonds and hold onto them tightly.

That has worried some people who fear a lack of liquidity could worsen turmoil in the market, especially if interest rates rise...

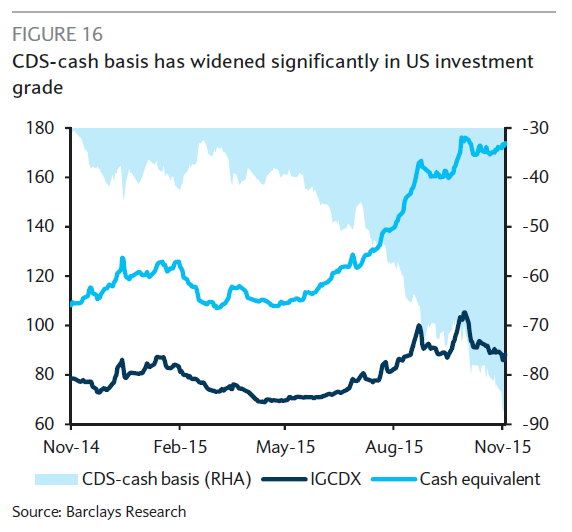

4. Synthetic credit is trading tighter than cash credit

Investors struggling to trade bonds amid an apparent dearth of liquidity have turned to a bevy of alternative products to gain or reduce exposure to corporate debt.

Such instruments include derivatives like credit default swap (CDS) indexes, total return swaps (TRS) and credit index swaptions. The rush for derivatives that are supposed to be more liquid than the cash market they track has produced another odd dislocation in markets.

Above is the so-called basis between the CDX IG, an index that includes CDS tied to U.S. investment-grade companies, and the underlying cash bonds. The basis has been persistently wide and negative in recent years, as spreads on the CDX index trade at tighter levels than cash.

"In exchange for the substantial liquidity of derivative indices, investors are often giving up spread right now, as most indices trade at a negative basis versus the comparable cash market," Barclays' Bradley Rogoff wrote in research published today. "The negative basis right now is near the largest we have witnessed at a time when there was not a funding crisis."

Investors may be ogling such synthetic tools not just because of their purported liquidity benefits but also because of funding benefits, a similar dynamic to the one currently pushing swap spreads into negative territory.

"These dynamics are part of a broader pattern whereby cash bonds that require balance sheet financing underperform their synthetic counterparts (e.g. ... CDX vs. corporate bonds)," Goldman Sachs's Francesco Garzarelli and Rohan Khanna said today in reference to sub-zero swap spreads.

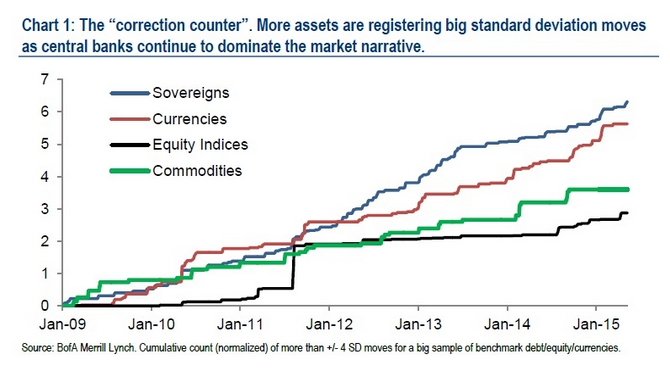

5. Market moves that aren't supposed to happen keep happening

Much of Wall Street runs on mathematical models that abhor statistical anomalies. Unfortunately for the Street, such statistical anomalies have been happening more frequently, with short-term moves in many assets exceeding historical norms.

Barnaby Martin, a credit strategist at Bank of America Merrill Lynch, made this point earlier this year. The number of assets registering large moves—four or more standard deviations away from their normal trading range—has been increasing. Such moves would normally be expected to happen once every 62 years.

While Martin blamed much of the confusion on unexpected decisions by central banks—such as the Swiss National Bank's surprise decision to scrap its long-standing currency cap—there have been sharp market moves with seemingly little reasons behind them. Perhaps the best-known example is Oct. 15, 2014, when the yield on the 10-year U.S. Treasury briefly plunged 33 basis points—a seven standard-deviation move that should happen once every 1.6 billion years, based on a normal distribution of probabilities.

Some market participants have also blamed lower market liquidity for the wild moves. At TD Securities, analysts Priya Misra and Gennadiy Goldberg argued that similar liquidity issues to the ones related to corporate bonds could also be extending into the $12.8 trillion U.S. Treasury market...

6. Volatility is itself more volatile

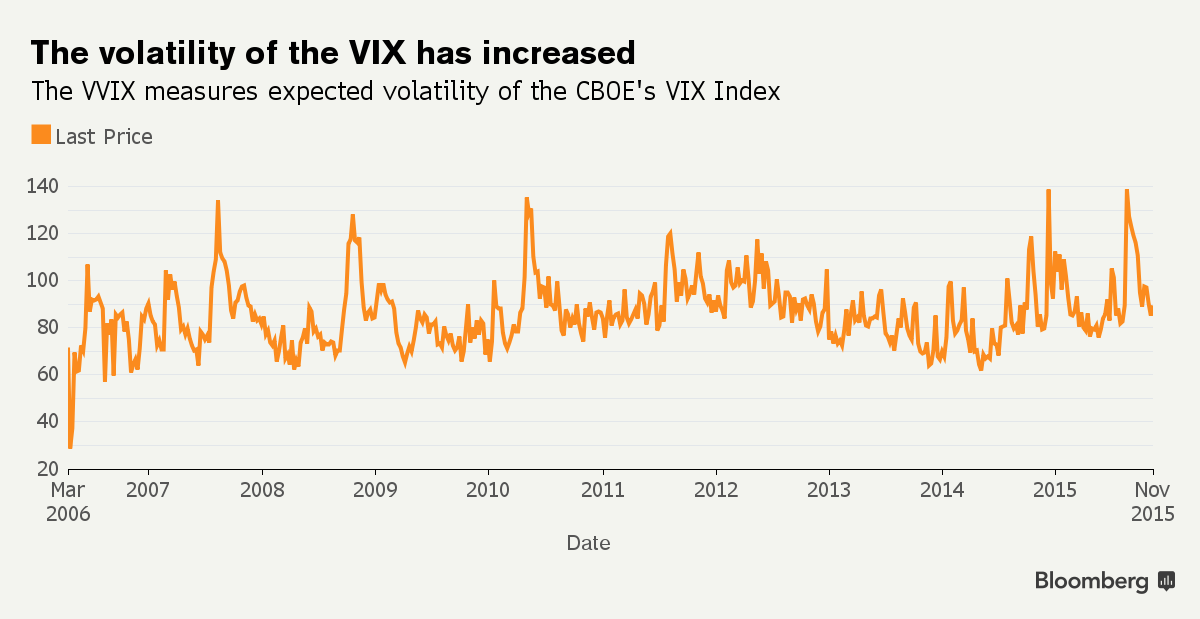

In October 2008, Lehman Brothers had just collapsed, interbank lending had ground to a halt, the repo market seized up, and the future of the entire financial system was in question. At that time, a measure of expected volatility in the Chicago Board Options Exchange Volatility Index, or the VIX, hit 134.87.

In August, 2015 the stock market fell 5.3 percent and the same measure of implied volatility in the VIX closed at 168.75, after reaching an all-time intraday record.

Whatever one's opinions of the stock market selloff, you'd be hard-pressed to argue that global markets were more stressed in August than they were during the depths of the financial crisis. Instead, the vacillations in the VIX underscore a post-financial-crisis trend that has seen volatility explode into its own asset class.

A host of exchange-traded funds, futures, and derivatives products are now enjoyed by both big, professional fund managers and mom and pop retail investors. Meanwhile, some large investors have been pumping up their returns by selling volatility, with Pimco under Bill Gross perhaps the best-known example.

"The volatility market that exists today is much more complex than it used to be; ETFs, indices, futures, and options traded on all of the above have complex relationships that haven't been fully tested," George Pearkes, analyst at Bespoke Investment Group, said in an interview.

He added: "Eventually, as we saw in the wake of last August, equilibrium is found when dislocations occur. But getting there can be complicated. Volatility, in my view, hasn't changed. What's changed is how it's warehoused and shifted."

THOSE LAST TWO ARE MORE GLOBAL, LESS WONKY, AND A SIGN OF GROWING INSTABILITY IN THE GLOBAL ECONOMY...ANOTHER GOOD REASON TO LATCH ONTO ISLAMIC FINANCE! PULL THEM DOWN WITH US.

Demeter

(85,373 posts)Specialist funds dedicated to the once-vaunted BRIC quartet of emerging markets face a bleak future, as many investors have pulled out due to years of collective underperformance by the bourses of Brazil, Russia, India and China.

The sharp decline in assets is forcing managers to close BRIC funds or radically rethink their strategies for the four largest emerging economies. These include Goldman Sachs, whose then chief economist Jim O'Neill coined the acronym in 2001.

The death knell for the sector may now have sounded as Goldman's asset management arm has rolled its BRIC fund into a broader emerging market product, telling the U.S. Securities and Exchange Commission it did not foresee "significant asset growth" for the fund.

Assets at the nine-year-old fund had plunged to below 200 million euros ($215 million), according to Thomson Reuters fund information service Lipper, from around 1.2 billion euros in its 2010 heyday...

Demeter

(85,373 posts)Through the dark world of cybercrime, its tentacles spread everywhere: stock manipulation, money laundering, gambling and more.

Nothing in the annals of corporate hacking compares to the portrait U.S. authorities painted Tuesday of a vast, global crime syndicate -- a mob for the digital age. As described by federal prosecutors, it was an operation of breathtaking scale, involving more than 100 people in a dozen countries, with illicit proceeds stretching into the hundreds of millions of dollars.

At its head is a mysterious Israeli, Gery Shalon -- a 31-year-old from the Republic of Georgia who prosecutors said used aliases, fake passports and banking havens to turn hacking into the backbone of his criminal enterprise.

Much as the mafia gained footholds in construction, shipping, trucking and gambling, Shalon’s organization was a conglomerate that allegedly ran illegal Internet casinos and elaborate pump-and-dump stock schemes, while dabbling in credit-card fraud and fake pharmaceuticals...

MORE

Demeter

(85,373 posts)Greek bank investors are being asked to inject new funds into the lenders for the second time in less than 20 months, even as doubt remains that the country will receive the next round of bailout funds.

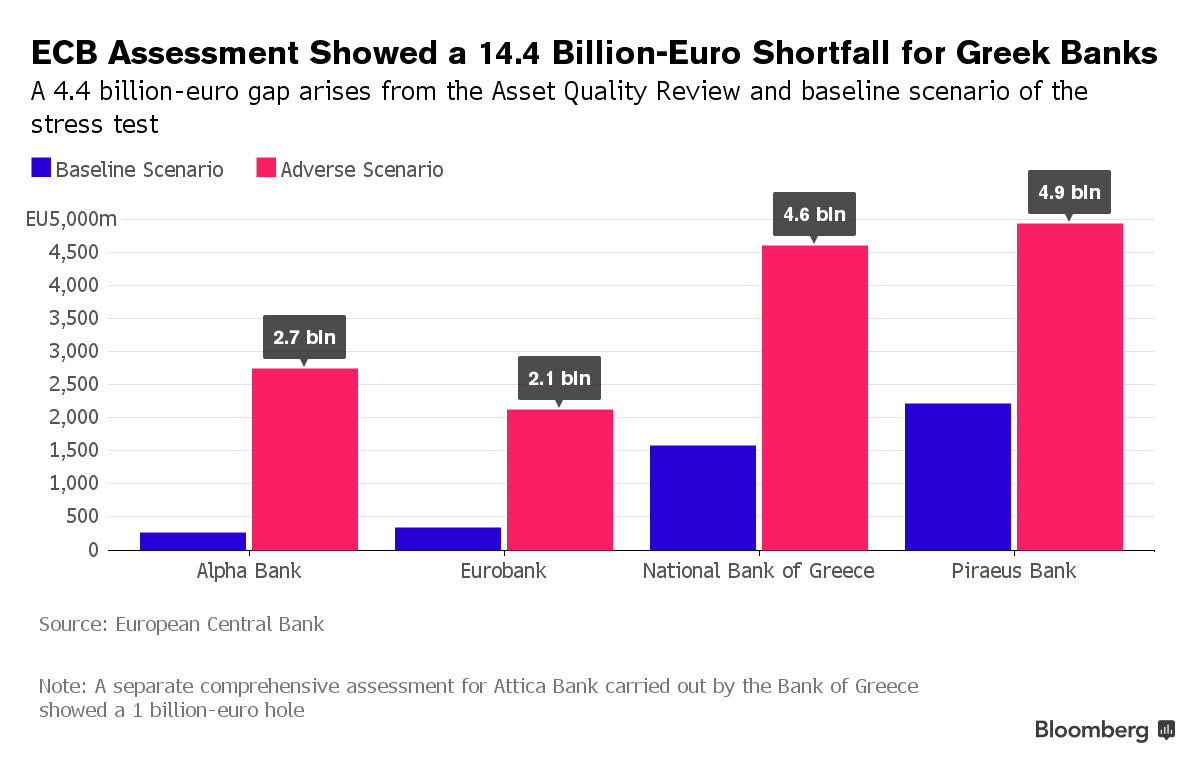

The National Bank of Greece SA and Eurobank Ergasias SA joined Piraeus Bank SA and Alpha Bank AE on Thursday in starting book-building processes as they seek to fill part of 14.4 billion-euro ($15.5 billion) hole in their accounts identified by the European Central Bank. The state-owned Hellenic Financial Stability Fund will contribute the rest from loans from Greece’s latest bailout, but not before imposing mandatory losses or "burden sharing” on shareholders and creditors of the banks.

“The recapitalization of Greek banks, perhaps the most critical problem for the Greek state today, has entered its most critical stage,” Emilios Avgouleas, professor of international banking law and finance at the University of Edinburgh, and Levy Institute President Dimitri B. Papadimitriou, said in a report on Thursday. “Instead of repeating the mistakes of the past, recapitalization should create an environment of hope amidst renewed efforts to repair the Greek economy.”

The fundraising comes as uncertainty hangs over the Greece’s own access to funds. A disbursement of as much as 10 billion euros from the European Stability Mechanism to the HFSF, which will backstop private capital injections with state funds, will only take place if the government reaches an agreement with creditors over a set of milestones detailed in the country’s bailout agreement.

Demeter

(85,373 posts)http://triplecrisis.com/the-disaster-of-greek-austerity-part-1/

Sticking with Austerity

For six years now Greece has lived under unprecedented austerity policies demanded by its lenders and accepted by a succession of governments. The social and political reality created by austerity was sharply shown by two events that occurred on the same day in October.

- First, a report on poverty and social exclusion in Greece was released by Eurostat, the European statistical service, indicating that, in 2014, 22.1% of the population lived in conditions of poverty, 21.5% were severely materially deprived, while 17.2% lived in families with very low work intensity. Altogether, 36% of the population faced one or more of these terrible conditions. The percentage was 7.9% higher than in 2008.

- Second, the Greek parliament approved a new piece of legislation imposing further austerity measures as demanded by its creditors – primarily the EU and the IMF – to meet the terms of Greece’s recent, third, bailout agreement. The new package involves cutting 14.32bn euros of public spending, while raising 14.09bn euros in taxes over the next five years. The measures will affect primarily private-owned businesses, homeowners and employees close to retirement.

Austerity policies were first adopted in 2010 as a “solution” to the economic crisis that burst out in 2009-10. Severe cuts in public spending, deep reductions in wages and pensions, enormous tax increases, and a stripping back of labor protections have sought – presumably – to stabilize the economy and gain the confidence of financial markets. In practice the measures have plunged the Greek economy into a prolonged recession that has had the disastrous social implications outlined by Eurostat. Unfortunately, the current Greek government, formed by the left-wing SYRIZA party, appears determined to keep the country on the same path.

The Crushing Burden of Unemployment

In the course of the recession the Greek economy has shrunk by more than 25%. At present more than one in four of the workforce is currently unemployed (one in two among the youth), and more than one million jobs have disappeared. The prospects for improvement, given the third bailout, are dim at best...

Brain Drain

Since the unemployment rate for people with tertiary education is current just under 20% – the highest in the world – it is no surprise that more than 200,000 young Greeks have already left the country in search of better opportunities abroad...

Collapse of Production

The austerity policies have also led the country’s productive sector to near collapse. The decline in industrial production after 2008 reached a staggering 35%. Industrial production in Greece is currently below 10% of its GDP...

“Reality has shown that the austerity measures applied across Europe are not the most effective response to the crisis”, says Costas, a civil engineer from Patra, the third largest city of Greece in the southern region of the Peloponnese. Costas is 45 years old and a former member of SYRIZA, the current governing party

“No other country in the Eurozone has had to impose such far-reaching austerity programs”, he says, “and I just don’t see how the Greek society can sustain the burden of yet another bailout”.

The policy is simply not working even on its own terms. After five years of austerity and three bailout agreements, Greece’s national debt currently amounts to 320bn euros – it is right where it was in 2010. But the ratio of its debt to GDP has shot up to 174%, and it is projected to rise to 200%. The country’s destroyed economy would never be able to sustain this huge volume of debt.

MORE AT LINK, MORE TO FOLLOW IN THIS SERIES

Demeter

(85,373 posts)European creditors want to extract more blood from a stone, in this case Greece.

Greece and its lenders are again at odds over the latest “bailout” funds, which is €2 billion that was scheduled to be approved for release by the famed Eurobgroup (remember them? That’s all the Eurozone finance ministers) on Monday. But a precondition for getting more dough was that Greece show enough “progress,” as in either have implemented or have committed to a sufficiently large number of “reforms”. “Reform” is Eurocrat-speak for austerian blood-letting. The creditors see Greece as coming up short. As we’ve pointed out repeatedly in our coverage of Greece, the lenders are hell-bent on seeing Greece remake its economy in ways that are guaranteed to make their loans fail, or perhaps more accurately, produce even greater losses than if they allowed for more investment and spending, rather than insist on punitively high budget surpluses and other destructive measures.

Why this fixation on implementing failed policies? The reasons vary by actor, but they include: delusion (as in they believe austerity “works” as in makes economies better), political necessity/survival (governments that implemented austerity programs at high costs to their citizens can’t be seen to be letting the greatest profligate, Greece, get off easy), a fixation with morality (Greece must suffer pour decourager les autres). But irrespective of the proximate causes of what looks like an exercise in sadism dressed up as economic orthodoxy, the creditors appear united, or at least united enough, to cram yet another set of punitive reforms on the already prostrated Greeks. Here are the big issues where the two sides remain far apart:

- Foreclosures. As part of the banking system bailout, the Troika wants more writeoffs of bad loans. They insist on a related measure, of lowering the value of homes that are subject to foreclosure from €200,000 to €120,000

- Increasing tax collections

- Increasing the VAT on private schools to 23%. I’m a bit mystified by Syriza fighting this measure if “private schools” are academies for the wealthy. But if the Greek Orthodox Church operates primary and secondary schools, as the Catholic Church does in the US, it could affect a much larger number of students at much lower levels of family income. Input from informed readers appreciated. Mind you, Syriza is proposing to find the funds to cover up this income loss elsewhere, but apparently have yet to satisfy the lenders on this point.

As anyone who remembers the US foreclosure crisis will attest, almost without exception foreclosing on homes leads to higher losses than keeping the homeowner in place. There’s no reason to think the results will be any different in Greece. First, foreclosed properties cost money to secure and maintain and often deteriorate rapidly. In Greece, unlike the US, you have much greater risk of civil disobedience with foreclosures, in the form of squatting or vandalism (and we had plenty here that was purely economic, such as stripping homes of copper and appliances). Second, who will buy these properties? Foreigners are at risk of being threatened physically. And the idea of buying properties and turning them into rentals for the displaced homeowners hasn’t worked out for investors in the US, where we’ve had a so-so economic recovery and a strong bounce in house prices in the weakest markets. The outcomes would clearly be worse in Greece. And that’s before you get to the offset of higher social costs from more homelessness.

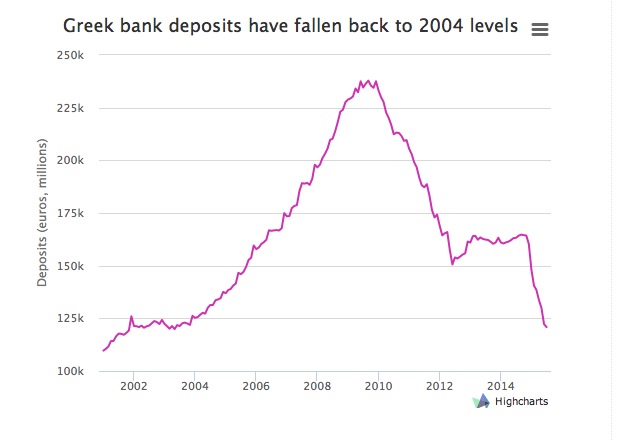

Similarly, it might have occurred to the creditors that the threat of a bank holiday, which then took place, led many citizens to pull as much as possible out of their bank accounts. So Greece, which already had a large black market economy, has if anything more cash in circulation to facilitate even more domestic tax evasion. One can argue that the taxable economy is in a death spiral. The more the creditors insist on higher VAT, the greater the incentive to deal in cash to avoid the VAT, which means lower VAT receipts than projected, which leads the creditors to call for higher tax rates. Greece already has a huge problem with tax avoidance; the current program for dealing with it reads like a prescription to make matters worse. Even tourists are wising up. A contact recently vacationed in Greece and took tons of cash, and got substantial price breaks and much happier vendors/service providers as a result.

Needless to say, Greeks are not putting their cash back in banks. From the Telegraph:

Tsipras is again trying to resolve the impasse at the “political” level, meaning going to Merkel Hollande, and Juncker. This has a Groundhog day feel...So Greece is caught between a Scylla and a Charybdis. But unlike the myth, there’s no evidence that a path exists to navigate between them.

MORE BAD NEWS AT LINK

Demeter

(85,373 posts)U.K. prosecutors charged 10 former Deutsche Bank AG and Barclays Plc employees with manipulating a benchmark interest rate, including high-profile trader Christian Bittar, with an 11th facing indictment as soon as next week.

Six traders from Deutsche Bank employees and four from Barclays were charged with conspiracy to manipulate the Euribor benchmark, the Serious Fraud Office said in a statement Friday. Another trader listed anonymously in court documents may also be charged, according to three people familiar with the case.

Alongside Bittar, those linked to Deutsche Bank are Andreas Hauschild, Joerg Vogt, Ardalan Gharagozlou, Achim Kraemer and Kai-Uwe Kappauf. Former Barclays employees Colin Bermingham, Carlo Palombo, Philippe Moryoussef and Sisse Bohart also face charges.

The SFO won the first conviction by trial tied to benchmark manipulation in August, when former UBS Group AG trader Tom Hayes was found guilty of rigging the London interbank offered rate and sentenced to 14 years in prison. Banks and other financial institutions have paid about $9 billion in fines tied to Libor and other key rates. One other person has pleaded guilty in the Libor probe...MORE

Demeter

(85,373 posts)Demeter

(85,373 posts)Demeter

(85,373 posts)Adair Turner, Chairman of the Board of the Institute for New Economic Thinking and former Chairman of Britain’s Financial Services Authority (2008-13), is the author of a new book that takes aim at economic and political orthodoxies, Between Debt and the Devil: Money, Credit, and Fixing Global Finance. As Turner sees it, policy makers and economic thinkers across the globe remain in thrall to the belief that only unfettered financial markets deliver the best for societies. The resulting bias favors fixed rules and mathematical models often wildly out of touch with real world conditions. Turner calls for a reality check — the recognition that circumstances change, that the future is uncertain, and that we need flexible approaches to shifting market circumstances at a time of inequality and instability. He warns that taboos against printing money and disproportionate fears of fiscal deficits are keeping central banks from taking crucial measures to stimulate economies. These taboos and fears also make us blind to the threat of out-of-control private debt and credit wasted on real estate and speculation rather than growth that lifts everyone. For Turner, thinking radically is the most practical way forward.

Lynn Parramore: You’ve noted that economies have become dangerously focused on credit in recent decades and that rising inequality is connected to this trend. Can you explain the link?

Adair Turner: If you look back at the story of advanced economies over the 20 years before 2007, you see an interesting pattern. During that period, the total value of national income — what economists call “nominal GDP,” meaning income unadjusted for inflation —grew at about 5 percent per year in a reasonably steady fashion. The central banks patted themselves on the back and said: This is great! Things are running smoothly. We’ve got the “Great Moderation.”

Yet during all of that time, the value of all credit, unadjusted for inflation, grew at about 10 to 15 percent per year. At the time, it seemed like we needed that pace of credit growth, but when you think about it, if your credit is going to grow at 10-15 percent per year in order to get your 5 percent GDP growth per year, eventually you’re going to have a problem. This isn’t a stable system. In my view, one of the reasons that it seemed that credit had to grow faster than total income was rising inequality.

LP: Why are people borrowing more when inequality is rising?

AT: The richer people, when they get another $100,000, or another million, or 10 million, don’t tend to spend it as much as the poorer people would if they got another $100 or $1,000 or $5,000. All the empirical evidence suggests that the rich tend to consume a lower proportion of income than middle and lower-income people. So rising inequality can lead to a major problem with the demand for goods and services. The rich aren’t spending their additional money, so overall, more money gets taken out of the economy. Unless the richer people decide to invest their money, there would be a slowdown in the economy. This idea goes back to economists like John Maynard Keynes and Alvin Hansen.

But before 2007, we didn’t have a slowdown. Instead, the savings of the rich ended up going through the financial system and being lent to middle and lower-income people, who had 30 years of no real income increase whatsoever. The figures for the U.S. are really quite startling. If you look at the bottom 20 or 25 percent of the population, their real wages haven’t gone up for about 35 years! Meanwhile, the incomes of the top 1 percent have gone up 200 percent. This is a dramatic increase. The savings at the top have to go somewhere. At the bottom, there is a group of people who don’t feel that they’re participating in the growing prosperity, so they become very vulnerable to the delusion that if they borrow the money and buy a house, they’ll make up for their lack of real wages by house prices always going up.

LP: For a while, it seemed to work. People felt like their house was the ticket to prosperity.

AT: Yes, for the decade leading up to 2007, a whole lot of people who weren’t getting raises felt that they were doing ok because they managed to buy a house that was going up in price. But it all came to an end, a catastrophic end. Rising inequality can create a more highly leveraged economy, and it can then make the economy vulnerable to a crash like 2008. And in that crash, the really malign thing is that the crash itself tends to further increase inequality because it tends to be the people at the lower end of the wealth distribution who were highly leveraged and had to borrow lots of money to buy their house. In the downswing, they lose all the wealth they’ve got.

There’s a wonderful illustration of this by Atif Mian and Amir Sufi in their book, House of Debt. They show that the process of debt-fueled booms and busts is a very effective way of periodically redistributing wealth from the poor to the rich.

LP: What can we do about this? Are we making any progress in stabilizing the financial system and getting all this private debt and inequality under control?

AT: I do think that we need far more radical policies than we’ve had so far. I spent 4 ½ years of my life from September, 2008 to March, 2013 deeply involved in all of the details of the re-regulation of the global financial system. I was the chair of the main policy committee of the international Financial Stability Board and deeply involved with designing Basel III, which overhauled rules on banking. I was knee-deep in the nitty-gritty. I would defend what we’ve done and I think that the job we did has helped make the financial system itself more stable, and therefore less likely to cause a rapidly-developing crisis of the sort that developed in 2007-8.

That is the good news, but I think we’ve made almost no progress at all in dealing with the fundamental drivers of economies that are too reliant on debt. We have not dealt with the fundamental fragilities that arise from inequality, from the bias of the lending system towards real estate, and from global imbalances. I think we are still stuck in a post-crisis malaise — you see it less in the U.S. but you can clearly see it in Europe or Japan. Even in the U.S., the pace of job creation has picked up, but employment rates are still well below what they were in 2007. Real wages have not gone up. The capitalist system is not delivering those decade-after-decade increases it promised. We’re not where we should be in terms of our national economies. We don’t know how to get out of this malaise and I think we now have to consider more radical policies. That’s key to moving forward, particularly in Europe and Japan.

We need more radical policies so that we don’t just repeat the debt-fueled booms all over again and do another blow-up in 2025 or 2035.

LP: If you could wave a magic wand and put one of these radical policies into action, which would you choose?

AT: Today, because the Eurozone is in a very vulnerable position, I would like to see a small, coordinated fiscal expansion in all the countries of the Eurozone simultaneously. We would have to do it in that coordinated fashion across all member states because there isn’t a central federal budget within the Eurozone system. We could have a proportionally equal fiscal expansion in each of the member countries, financed as a one-off by the European Central Bank. Now if you print that, many people in Germany will just sort of explode over their morning coffee! But I have argued this in Germany and I have very good relationships with many German economists. Lots of them share my analysis of how we got it into this mess but they are very wary of agreeing to my proposal for how we get out.

LP: Do you think it could really happen, this expanding of public spending?

AT: There’s a very particular reason why this won’t happen in Europe. You asked me if I could wave a magic wand, right? Waving a magic wand means that you are free from all the classic, nasty, tricky bits of politics. In Europe, those are even more difficult than in any other country. Suppose you said, ok, I’m going to expand public expenditure in all these countries simultaneously. The German taxpayer, with perfect legitimacy, will say: Do you promise me that this public expenditure is honest and clean, and not some of the corrupt practices that we’ve seen in Greece? Can you really credibly promise me that this is one-off? That it will be moderate? That having agreed to it this year, you won’t come back next year and say, oh, let’s do a bit more of it? Convincing people is difficult enough even in one country with one central bank and one electorate that feels it’s part of one nation.

To achieve that degree of coordination and trust within the extraordinary, wonderful, and yet difficult thing that is the European Union — it is probably just impossible. What I say in the book is that the Eurozone will have to progress to a much greater degree of federalization with an element of a federal budget, federal taxation, and federal expenditure. If it can’t agree to that, it would be better to break up.

There need to be changes in who does what. There need to be changes to the constitution of Europe. I fault myself: I didn’t get it right in the late 90s. I was, in principle, in favor of European monetary union. But I think the experience has clearly shown that this is an incomplete political and economic union. The unsustainability of the political constitutional form has made the impact of the debt overhang even worse in the Eurozone than in countries such as the U.K. or the U.S. In the latter two, debt overhang has still created huge problems, but they haven’t been multiplied and made even worse by an inappropriate set of constitutional structures.

LP: To move forward, do we need to fundamentally change the way we think, particularly about the financial system?

AT: My work suggests two particular areas which economic theory has not paid enough attention to. One it used to pay attention to, and then it forgot. This strange amnesia concerns the role of the banking system in creating credit, money and purchasing power. It is absolutely fundamental to how a monetary economy works.

There were economists of the early 20th century like Knut Wicksell, Friedrich Von Hayek, and John Maynard Keynes to whom that was obvious. Also Irving Fisher, Henry Simons, and Milton Friedman in his earlier writings. Then something very odd happens in the 1960s and 70s — economists stopped talking about the banking system and the credit system. We then develop a set of modern monetary economics—whether New Keynesian Economics or New Classical Economics — where we imagine that we can think about the dynamics of the macroeconomy without a rich understanding of the banking system and without understanding that the banking system creates credit, money and purchasing power.