Economy

Related: About this forumWeekend Economists Que saudade! Brazil, Part 2 August 28-30, 2015

Que saudade!

The word saudade (sah-ooh-dah-jee) has no direct translation in English, and it's a major source of linguistic pride for Brazilians. Use Que saudade! (kee sah-ooh-dah-jee) when you miss something so desperately, you have a heartache over it. People say Que saudade! when they remember their best friend who's now living far away, or their childhood beach. Brazilians also often say simply Saudades! at the end of e-mails to tell you they're missing you terribly....A Few Favorite Brazilian Portuguese Expressions: http://www.dummies.com/how-to/content/a-few-favorite-brazilian-portuguese-expressions.html

Last weekend, I dragged you through the highlights of recorded history on Brazil up to the 19th century. One of the reasons I was so ignorant about Brazil is because while Brazil was booming, the US was coming apart with the Civil War, so history books focused on events close to home. The US was too busy, in other words, to do much meddling South of the border.

That all changed after a fragile peace was established in these Reunited States...as we shall see.

But what about modern Brazil? Can we get a taste of it without actually flying down to Rio?

The black-and-white film (later computer-colorized) was directed by Thornton Freeland and produced by Merian C. Cooper and Lou Brock. The screenplay was written by Erwin S. Gelsey, H.W. Hanemann and Cyril Hume, based on a story by Lou Brock and a play by Anne Caldwell. Linwood Dunn did the special effects for the celebrated airplane-wing-dance sequence at the end of the film.

The story is silly, but the music! and the Dancing! Special Effects!

Demeter

(85,373 posts)Demeter

(85,373 posts)Brazilian forro dancing

Conde do Forró - DvD Completo 2015 - Full Hd

Demeter

(85,373 posts)( I had another horrible day...in a horrible week)

Brazilian Drinks - What Are the 5 Most Popular?

Here's 5 very popular Brazilian drinks I discovered when I lived in Brazil.

1. Coconut - You may have seen people drinking from a round green object with a straw and wondered what in the world it is. Where I'm from in Alabama, the only coconuts we see are brown in the grocery store. You'll see these sold in the kiosks by the beach. They're sold ice cold and then they cut off the top and give you a straw. Honestly I didn't like it at first but the more I tried the more I liked it. Especially on hot days in Rio, that cold coconut drink hit the spot.

2. Acai - This is another pretty good drink. Its actually more of a slush but its really good. Its not too sweet and is just plain good. It comes from the acai berry and there's nothing like it in the US. If you can get it with granola on top, you definitely need to do it. Make sure you clean your face afterward or you may have purple residue on your face. Just saying.

3. Guarana Antartica - This is a popular soft drink. Gurana is a fruit and they do have a guarana drink that is not carbonated but its not as popular. If you say you want Guarana at a restaurant they'll bring you an Antartica. It's hard to explain but its kind of sweet but not overbearing. I don't drink carbonated drinks very often but I drank these a lot.

4. Caipirinha - This is probably the most popular alcoholic drink you'll find in Brazil. I'm not a drinker really but people I know would drink these a lot. Its made with cachaça, sugar, lime and crushed ice. Cachaça is a type of liquor that comes from fermented sugar cane.

5. Brazilian Coffee - Brazilians love their coffee. Even though I'm not much of a coffee drinker I felt obligated to drink it while I lived in Brazil. They don't like coffee from the US very much. They like their coffee better because it is typically in a smaller amount and much stronger. Almost like a shot of espresso. If you're not much of a coffee drinker like me, enough milk and sugar will make any coffee good.

If you get a chance to visit and experience the Brazil culture, you need to try these 5 Brazilian drinks for sure...

http://www.brazilcultureandtravel.com/brazilian-drinks.html

THERE ARE OTHER BEVERAGES, MORE OR LESS DRINKABLE...

Demeter

(85,373 posts)FROM FEBRUARY--THE PICTURE CAUGHT MY EYE

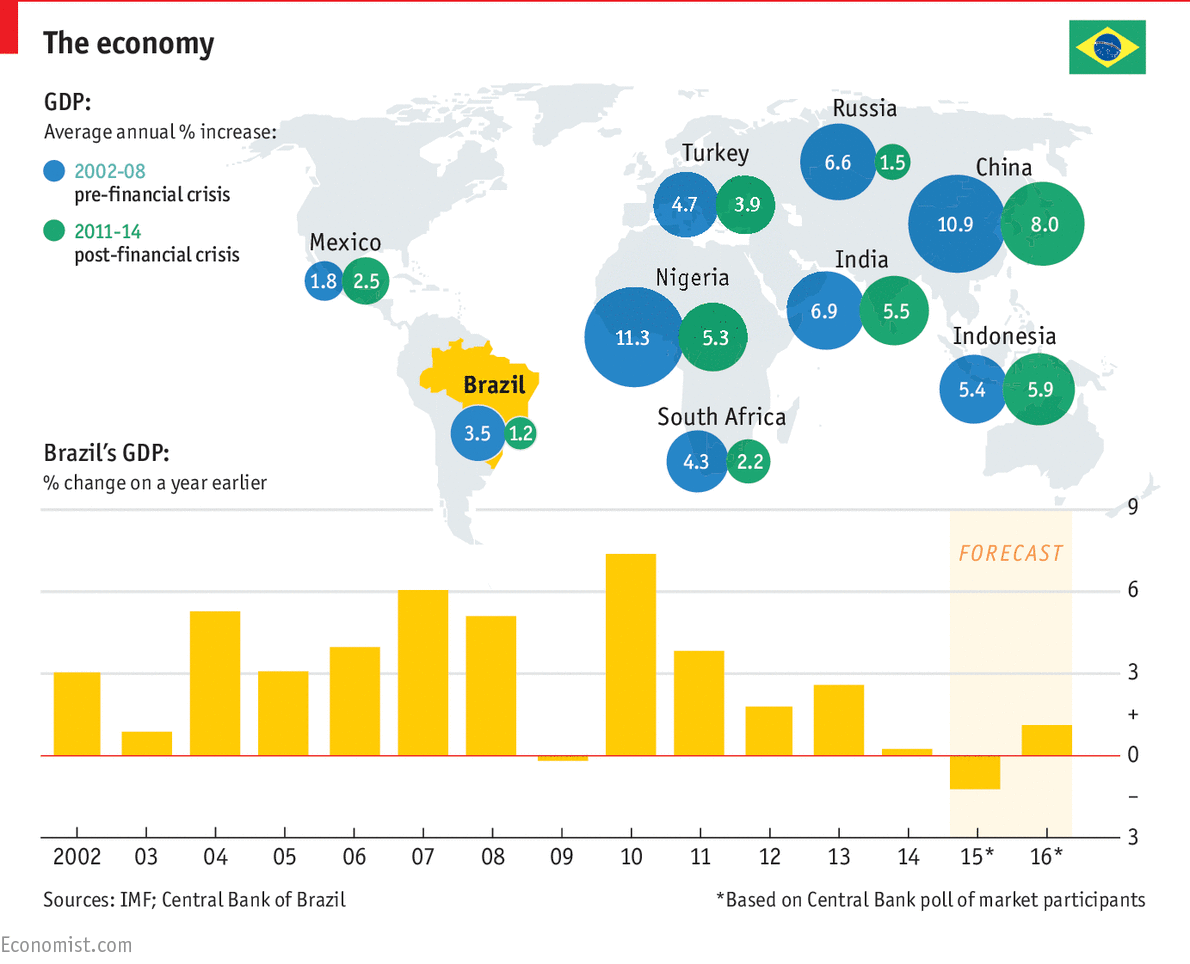

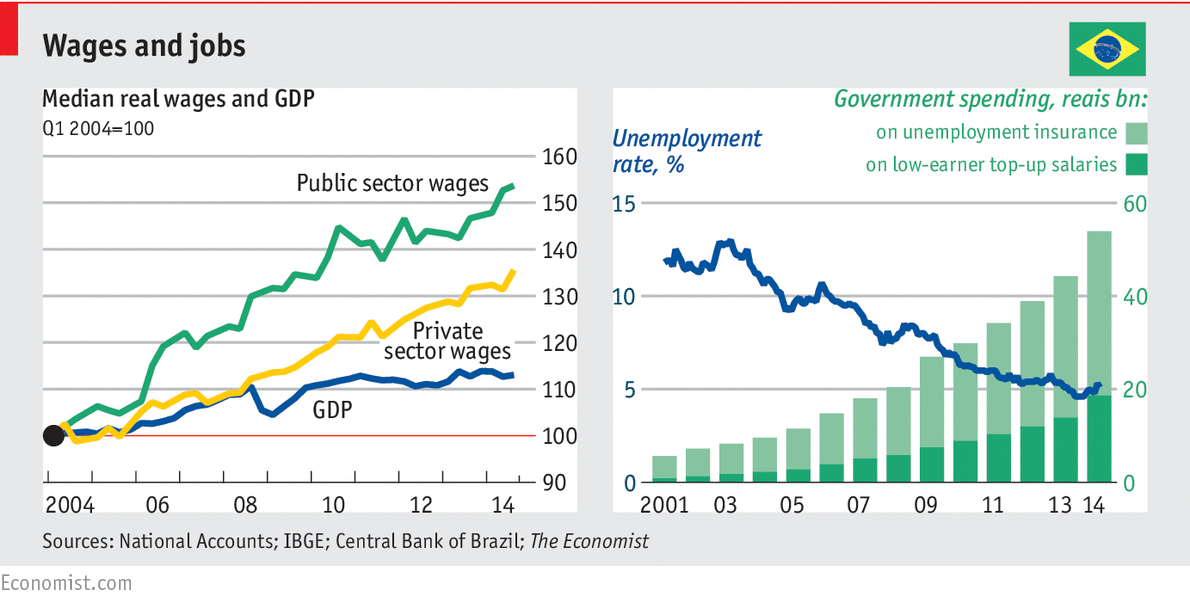

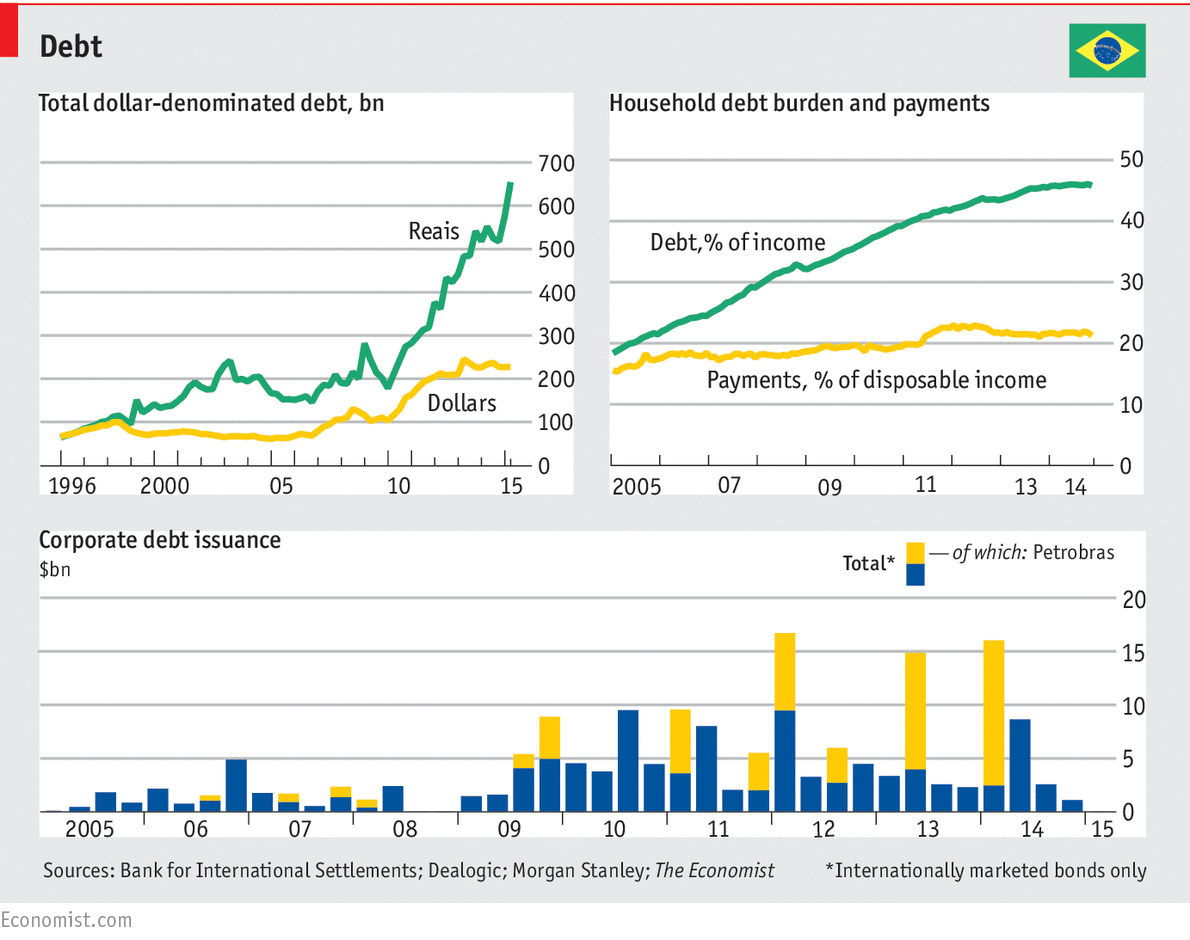

CAMPAIGNING for a second term as Brazil’s president in an election last October, Dilma Rousseff painted a rosy picture of the world’s seventh-biggest economy. Full employment, rising wages and social benefits were threatened only by the nefarious neoliberal plans of her opponents, she claimed. Just two months into her new term, Brazilians are realising that they were sold a false prospectus. Brazil’s economy is in a mess, with far bigger problems than the government will admit or investors seem to register. The torpid stagnation into which it fell in 2013 is becoming a full-blown—and probably prolonged—recession, as high inflation squeezes wages and consumers’ debt payments rise. Investment, already down by 8% from a year ago, could fall much further. A vast corruption scandal at Petrobras, the state-controlled oil giant, has ensnared several of the country’s biggest construction firms and paralysed capital spending in swathes of the economy, at least until the prosecutors and auditors have done their work. The real has fallen by 30% against the dollar since May 2013: a necessary shift, but one that adds to the burden of the $40 billion in foreign debt owed by Brazilian companies that falls due this year.

Escaping this quagmire would be hard even with strong political leadership. Ms Rousseff, however, is weak. She won the election by the narrowest of margins. Already, her political base is crumbling. According to Datafolha, a pollster, her approval rating fell from 42% in December to 23% this month. She has been hurt both by the deteriorating economy and by the Petrobras scandal, which involves allegations of kickbacks of at least $1 billion, funnelled to politicians in her Workers’ Party (PT) and its coalition partners. For much of the relevant period Ms Rousseff chaired Petrobras’s board. If Brazil is to salvage some benefits from her second term, then she needs to take the country in an entirely new direction.

Levy to the rescue?

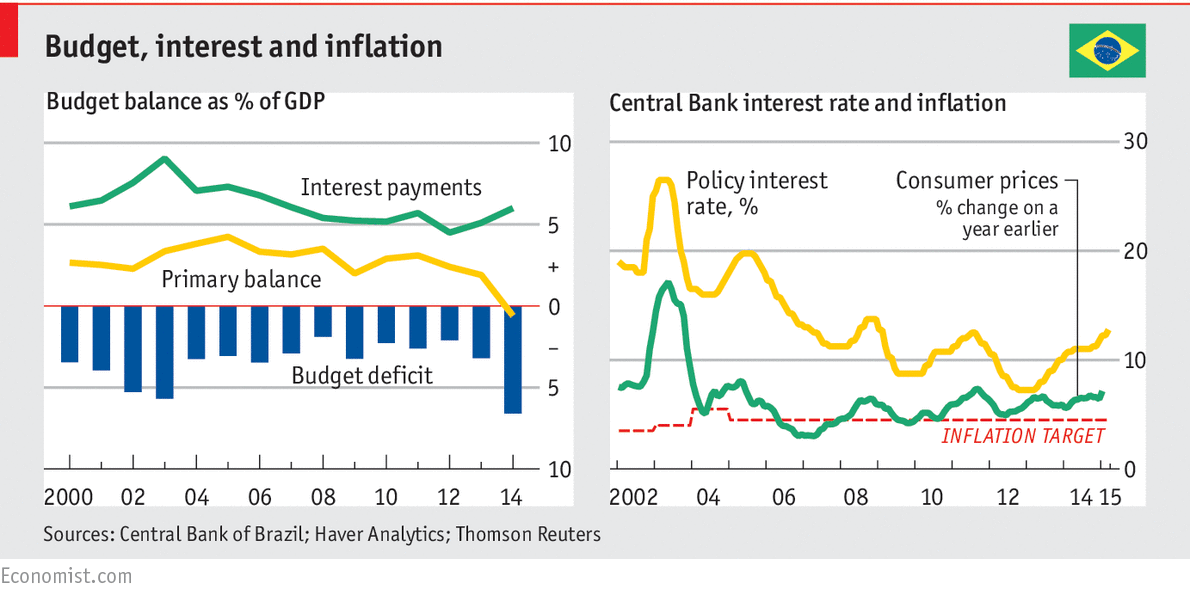

Brazil’s problems are largely self-inflicted. In her first term Ms Rousseff espoused a tropical state-capitalism that involved fiscal laxity, opaque public accounts, competitiveness-sapping industrial policy (see article) and presidential meddling in monetary policy. Last year her re-election campaign saw a doubling of the fiscal deficit, to 6.75% of GDP. To her credit, Ms Rousseff has at least recognised that Brazil needs more business-friendly policies if it is to retain its investment-grade credit rating and return to growth. This realisation is personified by her new finance minister, Joaquim Levy, a Chicago-trained economist and banker and one of the country’s rare economic liberals. However, Brazil’s past failure to deal promptly with macroeconomic distortions has left Mr Levy to grapple with a recessionary trap.

To stabilise gross public debt, he has promised a whopping fiscal squeeze of almost two percentage points of GDP this year. Part of this is coming from the removal of an electricity subsidy and the reimposition of fuel duty. Both measures have helped to push inflation to 7.4%. He also plans to curb subsidised lending by public banks to favoured sectors and firms. Ideally, Brazil would offset this fiscal squeeze with looser monetary policy. But because of the country’s hyperinflationary past, as well as more recent mistakes—the Central Bank bent to the president’s will, ignored its inflation target and foolishly slashed its benchmark rate in 2011-12—the room for manoeuvre today is limited. With inflation still above its target, the Central Bank cannot cut its benchmark rate from today’s level of 12.25% without risking further loss of credibility and sapping investor confidence. A fiscal squeeze and high interest rates spell pain for Brazilian firms and households and a slower return to growth. What makes this adjustment perilous is the political fragility of Ms Rousseff herself. On paper she won a comfortable, though reduced, legislative majority in the October election. Yet the PT is already grumbling about Mr Levy’s fiscal policies—partly because the campaign did not lay the ground for them. Ms Rousseff suffered a crushing defeat on February 1st in an election for the politically powerful post of head of the lower house of Congress. Eduardo Cunha, who vanquished the PT’s man, will pursue his own agenda, not hers. Not for the first time, Brazil may be in for a period of semi-parliamentary government.

The country thus faces its biggest test since the early 1990s. The risks are clear. Recession and falling tax revenue may undermine Mr Levy’s adjustment. Any backsliding may in turn prompt a run on the real and a downgrade in Brazil’s credit rating, raising the cost of financing for government and companies alike. Were Brazil to see a repeat of the mass demonstrations of 2013 against corruption and poor public services, Ms Rousseff might be doomed...

A LOT OF WATER HAS RUN UNDER THE BRIDGE SINCE FEBRUARY....AND THE ECONOMIST IS NEARLY FASCIST IN ITS ATTITUDES....

Demeter

(85,373 posts)

http://www.economist.com/blogs/graphicdetail/2015/03/economic-backgrounder

DOOM AND GLOOM COMMENTARY AT LINK...COMPARED TO MOST NATIONS, INCLUDING OURS, BRAZIL IS DOING PRETTY GOOD.

Demeter

(85,373 posts)This content was originally published by teleSUR at the following address:

"http://www.telesurtv.net/english/news/Brazil-Hundreds-of-Thousands-Protest-Against-Coup-Attempts-20150820-0033.html". If you intend to use it, please cite the source and provide a link to the original article. www.teleSURtv.net/english

From landless peasants to worker unions, Brazilians took to the streets to stop impeachment efforts by the right wing. Around 1 million people from all states of Brazil protested Thursday against attempts to impeach President Dilma Rousseff. The marches were joined by Brazil's leading social movements, including the Movement of Landless Campesinos (MST) and the United Workers' Central (CUT), the largest union in the country and in Latin America.

Organizers made it clear that the marches were in support of democracy and against growing impeachment calls from the country’s right wing. Political parties, including the left-wing opposition Socialism and Liberty Party (PSOL), joined the march. According to O Globo newspaper, at least 876,000 people participated in the demonstrations across the country.

A common theme in the marches was the rejection of Finance Minister Joaquim Levy, a former IMF economist, who has pushed forward austerity policies cutting social programs.

Speakers and marchers also targeted Eduardo Cunha, the head of Congress and former government ally who has been leading calls for impeachment. Cunha was officially charged by the Attorney General's Office on Thursday for money laundering and corruption. The lawmaker allegedly received US$ 5 million from the Petrobras fraud scheme. Cunha, who was under investigation, had claimed that the accusations against him were politically motivated and thus broke off from his party's alliance with the government.

Venezuelan President Nicolas Maduro expressed his support for Rousseff on his Twitter account, posting pictures of late President Hugo Chavez joined by former Brazilian President Lula da Silva.

In Sao Paulo, social movements, worker unions and political parties gathered outside the Lula Institute to express their solidarity with former President Lula da Silva, who some are trying to link to the Petrobras scandal.

Amid the marches in favor of democracy, President Rousseff received German Chancellor Angela Merkel in the Planalto Palace, Brasilia, and signed a series of cooperation agreements between both nations.

Demeter

(85,373 posts)Charge presented by Rodrigo Janot against Eduardo Cunha accuses him of receiving $5m in bribes and money laundering...

Demeter

(85,373 posts)A federal judge in Brazil overseeing a sweeping corruption investigation said on Tuesday there were signs that President Dilma Rousseff's former chief of staff had received bribes. Judge Sergio Moro asked the Supreme Court to authorize an investigation into whether a graft case involving Brazil's planning ministry may have benefited Gleisi Hoffmann, now a senator and still personally close to the president.

Hoffmann has not been formally charged with any wrongdoing.

Moro's investigation, which has mostly focused on a political kickback scheme at state-run oil firm Petrobras over the past 17 months, has already pushed Rousseff's approval rating to single digits and, along with a slow economy, brought calls for her impeachment.

"This is very bad news for Rousseff, at a time she is doing everything to diminish the crisis, news like this brings the crisis even closer to her," said Thiago de Aragao, a partner at Arko Advice, a consulting firm.

Hoffmann served as Rousseff's chief of staff from 2011 to 2014, before leaving to run for senator as a member of Rousseff's Workers' Party.

Rousseff has repeatedly denied knowing about corruption at Petrobras, though she chaired the oil firm's board from 2003 to 2010 when much of the alleged graft took place. Though reports of Hoffmann's involvement hurt Rousseff's image, it is unclear if the investigation into the planning ministry will reach her, said Aragao. Brazilian Vice President Michel Temer said on Tuesday that an impeachment was "unthinkable," the day after he decided to drop the day-to-day political coordination of her government.

The corruption investigation, which has broadened to other state-run companies and ministries, is divided between Moro's court in the southern city of Curitiba, where trials have been ongoing since last year, and the Supreme Court in Brasilia, the only court that can try sitting politicians.

MORE

Demeter

(85,373 posts)Brazilian President Dilma Rousseff plans to reduce the size of her government as part of a plan to shore up support from key allies. The goal is to shut down as many as 10 ministries, sell properties and reduce the number of posts filled by the government, Planning Minister Nelson Barbosa told reporters Monday in Brasilia. The move follows calls by members of her ruling coalition for the government to go beyond unpopular tax increases and welfare spending cuts by trimming the size of the government, which has 39 ministries and appoints about 22,000 officials.

The decision “is a response to the opposition and part of her allies to show the government is willing to bear part of the burden,” said Joao Paulo Peixoto, a political science professor at the University of Brasilia.

Brazil has more ministries than any of the world’s 50 largest economies, according to Augusto Franco, director of consulting firm Casasemquina Assessoria e Consultoria. Brazil is trailed by South Africa, Indonesia and Egypt, which have 35, 34 and 33 ministries, respectively. Franco is former director of Rio de Janeiro-based industry group Firjan. While the move is symbolic of the willingness to shoulder its share of national austerity measures, the impact in the budget will actually be small, Peixoto said. The budget gap in June widened to 8.1 percent of gross domestic product, the largest since November 1998, as an economic slowdown eroded tax revenue.

‘Political Support’

In addition to reducing the number of ministries, the reform plan, to be finalized by next month, will also cut costs within ministries for cleaning and maintenance contracts and combine some secretariats and agencies. “To create the best target from an administrative point of view, from a point of view of political support for the government and efficiency of the public apparatus, we need to hear from all those involved,” Barbosa said.

During her re-election campaign last year, Rousseff criticized the plans of her main opponent, Aecio Neves, to cut the number of ministries to between 21 and 22. The about-face aims to demonstrate that the government accepts the need to submit to its own unpopular measures, said Raul Velloso, director of Brasilia-based ARD Consultores Associados.

“They decided to pay the political price and provide a response to what’s been said -- that the government doesn’t cut its own fat.”

Demeter

(85,373 posts)While a lot of investors were hitting the panic button Monday, a Japanese day trader who’d made a big bet against the market timed the bottom almost perfectly and narrated a play-by-play of the trade to his 40,000 Twitter followers. He claims to have walked away with $34 million.

As financial markets got crazy this week, many people turned cautious. Some were paralyzed. Not the 36-year-old day trader known by the Internet handle CIS.

“I do my best work when other people are panicking,” he said in an interview Tuesday, about an hour after winding up the biggest trade of a long career betting on stocks. He asked that his real name not be used because he’s worried about robbery or extortion. To support his claims, he shared online brokerage statements showing his trades second by second.

CIS had been shorting futures on the Nikkei 225 Stock Average since mid-August, wagering it would fall. By the market close on Monday, a paper profit of $13 million was staring him in the face. He kept building the position. When he cashed out late that night, a collapse in New York had caused his profit to double.

Instead of celebrating, he kept trading. He started betting the market had bottomed. When he finally took his winnings off the table on Tuesday, he tweeted, “That’s the end of my epic rebound trade.” His profit, he said, had almost tripled.

“It was a perfect trade,” said Naoki Murakami, who follows CIS on Twitter and whose markets blog has made him a minor celebrity in his own right.

MORE

Demeter

(85,373 posts)The U.S. Labor Department is leaning toward denying requests for regulatory relief by three big foreign banks that pleaded guilty to manipulating Libor interest rates but want to keep managing retirement accounts for clients. In letters to units of Deutsche Bank, UBS and the Royal Bank of Scotland, the department said it has "tentatively decided not to propose" exemptions sought by the banks due to their "failure to demonstrate that the exemptions would be in the interest of plan clients." The July 16 letters give each bank the opportunity to submit additional materials to make their case and try to sway the department.

"We continue to engage with the DOL through the full application process to provide the information that we believe supports the grant of an exemption," UBS spokesman Gregg Rosenberg said. A Deutsche Bank spokeswoman had a similar comment, noting the bank takes "the concerns in the tentative denial letter very seriously" and is working to address them. A spokesman for RBS had no immediate comment.

Pressure has been mounting on U.S. policymakers to more closely scrutinize regulatory exemptions sought by big banks that break the law. Last year, Securities and Exchange Commission Democratic member Kara Stein issued a scathing dissent against RBS, which had applied to the SEC for regulatory waivers also in connection with the Libor guilty plea. Under federal laws governing securities and retirement accounts, banks that commit crimes or are found liable for civil fraud are banned from managing client plans or certain capital-raising activities. They must seek exemptions in order to continue business as usual. Stein lambasted the agency for granting the bank a waiver, saying too often such requests are rubber-stamped and perpetuate a problem of banks being "too big to bar."

Since then, Democratic members of Congress have urged the SEC and the Labor Department to more closely scrutinize the activities of law-breaking banks before granting exemptions. At the Labor Department, banks with criminal convictions must apply for exemptions to permit them to continue managing retirement accounts. The Labor Department reviews the request and if ample evidence is provided, it will then propose an exemption and give the public a chance to weigh in before finalizing it.

Already this year the Labor Department has held one public hearing over a request by Credit Suisse for an exemption, after it pleaded guilty to conspiring to help U.S. citizens dodge taxes. Deutsche Bank, meanwhile, actually has two requests pending before the department. In addition to the request related to the Libor matter, it is also requesting an exemption following a 2011 indictment for manipulating the Korean stock market. On Aug. 24, the department proposed granting the bank a temporary exemption in advance of a Sept. 3 verdict in the South Korea case.

The Labor Department's tentative denial of the other three exemption requests connected to the Libor cases was reported earlier by Politico.

Demeter

(85,373 posts)A major ruling handed down on Thursday by the U.S. National Labor Relations Board could give unions greater bargaining power by enabling them to negotiate directly with large parent companies like McDonald’s that rely heavily on franchisees and contractors. The board in a 3-2 decision ruled that an existing standard that said companies only qualify as “joint employers” of workers hired by another business if they had “direct and immediate” control over employment matters was outdated and did not reflect the realities of the 21st century workforce. The ruling said parent companies can be held liable for labor violations committed by franchisees and contractors even when they have only indirect control. It is expected to impact a broad range of U.S. industries built on franchising and contract labor, from fast food and hospitality to security and construction.

Business groups and lawyers strongly criticized the ruling, saying it would force companies to the bargaining table even when they have little say over working conditions. "The NLRB’s actions today will subject employers to increased uncertainty, liability for workplaces that they don’t actually control, and ramped up pressure tactics to ease union organizing," said Glenn Spencer, a vice president at the U.S. Chamber of Commerce. The decision could also make it easier for unions and workers to win higher wages and better working conditions since they would be negotiating directly with parent companies.

Business groups have said such a ruling, which came in the case of waste management company Browning-Ferris Industries Inc, would endanger companies that rely on franchising, contracting and supply chains, and kill jobs. Michael Lotito, a lawyer at Littler Mendelson in San Francisco who works with industry groups, said companies will have two main options moving forward: take more control over workers, which would upend existing business models, or back away and risk losing control over brand identity. “The NLRB has totally upset the apple cart with respect to an understanding over accepted business risk,” he said.

Browning-Ferris, which the board said is a joint employer of workers at a California recycling plant who were hired by a staffing agency, can appeal the ruling. But a court could overturn this particular decision while leaving the standard adopted by the board on Thursday intact, said John Raudabaugh, a professor at Ave Maria Law School in Florida and former NLRB member.

If it stands, the ruling is likely to have a direct impact on a series of pending NLRB cases against McDonald's Corp (MCD.N) and dozens of its franchisees around the country. The fast food giant has argued that it is not a joint employer because it does not hire and fire franchise workers, and Thursday's decision may complicate the company's argument. Unions and others who support the change say the decision is necessary to bring companies that indirectly control working conditions to the bargaining table, and to curb the use of "permanent temps" who are paid less and do not get the same benefits as ordinary employees.

The ruling also means franchises and smaller companies that provide workers will be insulated from liability when labor violations are triggered by corporate policies, said Jeanne Mirer, a lawyer who authored a brief in the case on behalf of the Communication Workers of America and workers' rights groups. "Now the arrangement can be put back into balance in a way that gives fuller protections to workers and the leased company," she said.

Demeter

(85,373 posts)Post a bunch so I have something to read in the morning!

Hotler

(11,420 posts)the Obama and Hillary can do no wrong crowd over in Jonestown, oh what fun. I do know I will need a shower afterwards, but that will just cool me off for some well needed sleep. Two days away from the shit-hole office will be greatly welcomed.

Fuddnik

(8,846 posts)If I drink that stuff, I need a bail bondsman handy.

Fuddnik

(8,846 posts)I saw this on the news last night, and found this article with a link to the settlement page. You can file online in about 30 seconds, and have your choice of $25 in cash or $50 in free tuna. I took the tuna.

Sorry Charlie.

-----------------------------------------------------------------------

CLEVELAND, Ohio -- If you bought a can of StarKist tuna in recent years, you may have netted less fish than promised.

Thanks to a recent legal settlement, you can convert that tiny loss into a small fortune in tuna. Though StarKist Co. denies any wrongdoing, it settled the suit by offering to pay consumers either $25 in cash or $50 in fish.

The settlement applies to customers who bought even one 5-ounce can of chunk light or solid white tuna, in oil or in water, between Feb. 19, 2009 and Oct. 31, 2014. Recognizing that most people would not keep tuna receipts for more than five years, the settlement allows for a kind of honor-system filing, via the Web site tunalawsuit.com.

Filing a false claim would be perjury. All claims must be filed by Nov. 20. According to the lawsuit, the federal government sets standards for how much of various kinds of tuna must be contained in a "5-ounce" can.

The plaintiff in the lawsuit, Patrick Hendricks, of Oakland, California, had samples tested to see whether they met that standard.

For Chunk Light Tuna in Water, the standard is 2.84 ounces of pressed cake tuna. StarKist provided an average of only 2.34 ounces, the suit says. That's a difference of only half an ounce, but it's 17.3 percent below the legal standard.

For solid white tuna in water, there was a 6.83 percent shortfall; for solid white tuna in oil there was a 3.7 percent shortfall; and for chunk light tuna in vegetable oil the shortfall was 1.1 percent, the suit alleged.

http://www.cleveland.com/business/index.ssf/2015/08/starkist_settles_canned_tuna_l.html#incart_most-read_

MattSh

(3,714 posts)Must spread our wisdom to the wider world, even if it resists!

Demeter

(85,373 posts)Still making it in Kiev?

Demeter

(85,373 posts)That big so-called rally at the market close WEDNESDAY was not a rally but a short squeeze. That’s when the hedge funds that have put on short positions size up the amount of stock for sale at the close of trading and, if the amount is light, they decide to close out their short positions by buying stock to cover. On Tuesday, there was approximately $3.5 billion in orders to sell at the close, resulting in the late day selloff. WEDNESDAY, there was only about $500 million to sell, making it risky to hold short positions, thus the short squeeze driving the Dow up 619 points at the close.

Expect to see a lot more of these spikes, up or down, in the last two hours of trading.

Assessing just how large the bubble has grown in U.S. markets as a result of the Fed’s zero-bound interest rate strategy since December 2008, Tan Teng Boo, founder and CEO of Capital Dynamics appeared on a Bloomberg Television segment this morning and summed up our new market bubble in a few words. Boo said just five U.S. stocks — Apple, Google, Microsoft, Facebook, and Amazon — are worth more than the Frankfurt, Germany stock market, which represents the fourth largest economy in the world.

We did the math after the past week’s selloff and yesterday’s big spike higher. At yesterday’s close, the market caps for the levitating five are as follows: Apple $625.532 billion; Google, $440.767 billion; Microsoft, $341.594 billion; Facebook, $245.795 billion and Amazon, $234.215 billion. The total market cap for the five — $1.889 trillion.

All five of these stocks have one thing in common: they all trade on the Nasdaq stock market. That’s the market that gave you the 2000 bust that erased $4 trillion from investors’ pockets in dot-com and tech blowups as well as the stock market that oversaw a massive price rigging cartel for more than a decade. On July 17, 1996, the U.S. Justice Department charged most of the largest firms on Wall Street (iconic brands like Merrill Lynch, JPMorgan and predecessor firms to Citigroup) with price fixing on Nasdaq. The firms were deemed so untrustworthy going forward that as part of its settlement the Justice Department required that some Wall Street traders’ phone calls be tape recorded when making Nasdaq trades. The Justice Department also gave itself the right to randomly show up and listen in on the traders’ calls...Today, some of the same firms that were charged with price rigging on Nasdaq have been charged with similar cartel activity in rigging the Libor interest rate benchmark and/or foreign currency trading. But that has not prevented these firms from operating their own Dark Pools, effectively unregulated stock markets, where the highfliers mentioned above are traded in darkness.

Wall Street On Parade previously conducted a study of trading in Apple stock in Dark Pools for the weeks of May 26 through June 23, 2014. (Until last year, data on Dark Pool trading had not been available to the public.) We reported as follows on that study in June of this year:

“Goldman Sachs has also been an enabler to Apple taking on debt to finance its stock buybacks. Goldman Sachs was the co-lead manager with Deutsche Bank in April of 2013 when Apple launched a $17 billion corporate debt offering in order to buy back its shares and increase its dividend. Apple’s $17 billion debt deal was the largest in corporate history at that point. Goldman was also Apple’s advisor in 1996 when the company was warding off bankruptcy and Goldman managed its $661 million convertible debt offering.

“Could taking on debt and buying back shares become an addiction? One year after the April 2013 $17 billion debt deal by Apple, Goldman Sachs and Deutsche Bank co-led another $12 billion debt offering for Apple in April of 2014. So far this year, Apple has issued $6.5 billion in debt in February and another $8 billion on May 6. Goldman Sachs & Co., Bank of America Merrill Lynch and J.P. Morgan were involved in Apple’s May offering, which was specifically earmarked for share buybacks and dividends.”

Another of the highfliers, Amazon, whose market cap is larger than AT&T, is still trying to figure out how to generate profits. Here’s a few headlines describing its struggles:

December 18, 2013: International Business Times: “Amazon: Nearly 20 Years In Business And It Still Doesn’t Make Money, But Investors Don’t Seem To Care”;

October 23, 2014: New York Times: “Amazon’s Investments Are Piling Up, as Big Losses”;

October 24, 2014: Bloomberg Business: “…the company yesterday posted its biggest quarterly net loss since at least 2003…”

As for Facebook, all you need to know is that its Price-to-Earnings Ratio (PE Ratio) is an astronomical 88.97 at yesterday’s close.

One of the Bloomberg Television anchors who was interviewing Tan Teng Boo, Angie Lau, noted that those five stocks had led the big rally yesterday and said “those still seem like safe haven plays.”

Calling Apple and Amazon and Facebook “safe haven plays” is like comparing Donald Trump to the Dalai Lama. Let’s hope American investors are smarter today than they were going into the dot.com bust in 2000 and the 2008 crash.

Demeter

(85,373 posts)Financial markets have all but shut the door to a Federal Reserve rate hike in September, following a rout in stocks, currencies and commodities this past week, but economy watchers are only now warming up to the idea — in public at least. UniCredit And Credit Agricole on Thursday became the latest major forecasters to change their September call, following Barclays’ move earlier this week to delay predictions for the first U.S. rate hike in nearly a decade by six months to March 2016.

By all accounts, the slow-but-steady trickle of forecast revisions is set to repeat what happened earlier this year when the consensus for a hike in the Fed Funds Target Rate in Reuters polls shifted to September from June. At that time, it was triggered by a surprise contraction in the U.S. economy in the first quarter, while now, it’s the slump in global financial markets, led by fears China’s economy is fast losing steam. And one other very clear hint from a permanent voter on the Federal Open Market Committee. William Dudley, New York Fed President, effectively ruled out a September rate hike on Wednesday by saying:

But an initial rate hike “could become more compelling by the time of the meeting as we get additional information on how the U.S. economy is performing and (on) international financial market developments, all of which are important to shaping the U.S. economic outlook.

UniCredit, now expecting a December lift-off, wrote:

After it was the impact of the adverse weather – coupled with uncertainty over the impacts of the stronger USD and low oil prices – that caused the delay from June to September, it is now concerns about China and the related financial market turmoil.

Only one week ago, before these concerns escalated, a September rate hike still looked like a done deal.

The change in tone from UniCredit, one of the more bullish banks on the prospects of the U.S. economy, is telling because it raises the chance of banks who already were less optimistic to revise their official call as well.

On Dudley’s candid remarks, UniCredit has this to day:

Credit Agricole, now predicting a hike in October, wrote:

It might be easier to accomplish this in October rather than December, which historically tends to have less liquid markets. The FOMC could set up market expectations at the September FOMC meeting for a hike later this year and re-emphasize that every FOMC policy meeting is “live”.

If the inter-meeting data met expectations, the FOMC could pull the trigger in October and use an unscheduled press conference to emphasize that the rate normalization would be quite gradual and express the Committee’s confidence that the US economic outlook was strong enough to begin to remove the exceptionally accommodative monetary policy in place.

Stocks, commodities and currencies globally swung wildly this week, rising and falling by huge amounts on successive days. That in turn has called into question the Fed’s long-telegraphed plans to raise rates. Believers in a move next month argue the Fed is unlikely to be swayed by this market volatility and will keep its eyes firmly on the U.S. economy. For the most part, it’s in decent shape, although manufacturing has taken a beating following the dollar’s massive rally since last summer that has made U.S. goods less attractive in global markets. The problem is, with markets doing what they’re doing, the bar for what the Fed will consider strong enough data to hike has just been raised. Inflation, too, is tame, at just 0.2 percent in July, and is likely to drag lower for longer owing to falling oil and commodity prices.

There is still some time before the momentous meeting next month. But if the slump in financial markets lasts, particularly in U.S. stocks, it is sure to weigh heavily on the Fed’s decision in just a few weeks.

Demeter

(85,373 posts)Abstract

Globally, interest rates have been extraordinarily low for an exceptionally long time, in nominal and inflation-adjusted terms, against any benchmark. Such low rates are the most remarkable symptom of a broader malaise in the global economy: the economic expansion is unbalanced, debt burdens and financial risks are still too high, productivity growth too low, and the room for manoeuvre in macroeconomic policy too limited. The unthinkable risks becoming routine and being perceived as the new normal.

This malaise has proved exceedingly difficult to understand. The chapter argues that it reflects to a considerable extent the failure to come to grips with financial booms and busts that leave deep and enduring economic scars. In the long term, this runs the risk of entrenching instability and chronic weakness. There is both a domestic and an international dimension to all this. Domestic policy regimes have been too narrowly concerned with stabilising short-term output and inflation and have lost sight of slower-moving but more costly financial booms and busts. And the international monetary and financial system has spread easy monetary and financial conditions in the core economies to other economies through exchange rate and capital flow pressures, furthering the build-up of financial vulnerabilities. Short-term gain risks being bought at the cost of long-term pain.

Addressing these deficiencies requires a triple rebalancing in national and international policy frameworks: away from illusory short-term macroeconomic fine-tuning towards medium-term strategies; away from overwhelming attention to near-term output and inflation towards a more systematic response to slower-moving financial cycles; and away from a narrow own-house-in-order doctrine to one that recognises the costly interplay of domestic-focused policies. One essential element of this rebalancing will be to rely less on demand management policies and more on structural ones, so as to abandon the debt-fuelled growth model that has acted as a political and social substitute for productivity-enhancing reforms. The dividend from lower oil prices provides an opportunity that should not be missed. Monetary policy has been overburdened for far too long. It must be part of the answer but cannot be the whole answer. The unthinkable should not be allowed to become routine...

Full text FOLLOWS; SEE LINK

Demeter

(85,373 posts)YES! AFTER SETTING THE HOUSE ON FIRE, LET'S BOLT THE DOORS AND BAR THE WINDOWS!

...EVEN THE US DOESN'T PRECLUDE THE POSSIBILITY OF SPLITTING UP THE COUNTRY INTO REGIONALS, DESPITE THE CIVIL WAR....

https://www.marketnews.com/content/update-coeure-ez-needs-reforms-affirm-euro-irreversible

Eurozone institutions need to reaffirm that the single currency is irreversible now that the Greece crisis has raised prospect that a country could exit the euro area, European Central Bank Executive Board member Benoit Coeure said Thursday.

"The euro area is an irreversible project," Coeure said in a speech in Paris. "This statement is all the more necessary as the recent negotiations concerning Greece have let the evil genie of a country exiting the euro area (even temporarily) out of the bottle."

Coeure said a Eurozone exit by any state "would inevitably lead economic actors to wonder who would be next, with all the potential destabilising effects that such speculation could entail. The genie will not be put back in its bottle once and for all until it is clear that such a risk will not rear its head again."

Coeure said that the Eurozone's institutional framework is not currency sufficient to complete economic and monetary union. Banking union needs to be finalized, he said, and the Eurozone's inefficient intergovernmental decision-making process needs to be overhauled. Confidence in the euro currency remains high but that is mostly due to the credibility the ECB's monetary policy, Coeure said.

"The ECB's fundamental objective is to protect the euro, hence it is imperative that we fulfil our mandate by keeping inflation below, but close to, 2%, which explains all of our monetary policy decisions during the crisis," he said.

Coeure said that "monetary policy can support growth but it cannot create it in a lasting way." And he warned that "the effectiveness and legitimacy of euro area governance will not be increased by placing excessive demands on the central bank - quite the opposite."

The Eurozone must stop trying to achieve integration "by crisis" and instead establish a common growth strategy based on aggregate position of the euro area and not on nationalist posturing, Coeure said.

SOUNDS LIKE THE GREEKS SHOULD HAVE CALLED THE EUROZONE'S BLUFF

Demeter

(85,373 posts)Liu Weiqin swapped rural poverty for life on the dusty fringes of China’s capital eight years ago hoping – like millions of other migrants – for a better future. On Thursday she will board a bus with her two young children and abandon her adopted home.

“There’s no business,” complained the 36-year-old, who built a thriving junkyard in this dilapidated recycling village only to watch it crumble this year as plummeting scrap prices bankrupted her family.

“My husband will stick around a bit longer to see if there is any more work to be found. I’m taking the kids.”

Weeks of stock market turmoil have focused the world’s attention on the health of the Chinese economy and raised doubts over Beijing’s ability to avert a potentially disastrous economic crisis, both at home and aboard. The financial upheaval has been so severe it has even put a question mark over the future of premier Li Keqiang, who took office less than three years ago. Following a stock market rout dubbed China’s “Black Monday”, government-controlled media have rejected the increasingly desolate readings of its economy this week.

“The long-term prediction for China’s economy still remains rosy and Beijing has the will and means to avert a financial crisis,” Xinhua, the official news agency, claimed in an editorial. Meanwhile, Li told the state TV channel CCTV that “the overall stability of the Chinese economy has not changed”.

The evidence in places such as Nanqijia – a hardscrabble migrant community of recyclers about 45 minutes’ drive from Tiananmen Square – points in the opposite direction.

“It’s the worst we’ve seen it. It’s even worse than 2008,” said Liu Weiqin, who like most of the village’s residents hails from Xinyang in south-eastern Henan province, one of China’s most deprived corners.

“When things were good we could earn 10,000 yuan [£1,000] a month. But I’ve lost around 200,000 yuan since last year,” added Liu, who was preparing to leave her cramped redbrick shack for a 10-hour coach journey back to her family home with her eight-year-old son, Hao Hao, and five-year-old daughter, Han Han.

MORE

Demeter

(85,373 posts)Tuguan village in remote Yunnan province feels about as far from the turbulence of modern China as you can get. A one-lane, bumpy dirt road runs through it, past whitewashed farmhouses, most with a painting of flowers and bamboo on the outside wall and traditional sweeping rooftop eaves. Tuguan is home to some 170 families of the Bai ethnic minority, who grow table grapes and tamarinds. During steamy afternoons, most residents loll in the shade or nap in their house to escape the heat.

But on a hot day in June, one spot in Tuguan is bustling. At the local convenience store, a dozen sun-tanned villagers are clustered around a new Lenovo computer and wall-mounted flatscreen Skyworth monitor, checking out the latest online deals on mobile phones, toothpaste, pesticide dispensers, and more, all for sale on Alibaba Group’s new rural e-commerce platform.

Zhang Yibin , a lanky, chain-smoking grape farmer with two gold teeth, has bought a fan, a pesticide dispenser, and a 13,600 yuan ($2,122) Zongshen three-wheel motorcycle online in the less than two months since Alibaba opened a Taobao rural service center in town. (Taobao is Alibaba’s consumer e-commerce business.) “Online, the price is cheaper, the choice is better, and it is far more convenient,” Zhang says, noting he didn’t have to make the half-day trip to the dealer to get his three-wheeler, which he uses to move irrigation pipes and haul fertilizer. He says he wants to sell his grapes online “to everyone in China.”

China’s e-commerce market had revenue of 2.79 trillion yuan in 2014, an increase of 49.7 percent from the previous year. But in the global market rout on Aug. 24, Alibaba’s stock fell 3.5 percent in New York, for the first time dropping below its initial public offering price of $68. The company’s slowing growth and China’s decelerating economy have made investors anxious...

MORE

...The bottom line: Alibaba is spending 10 billion yuan building a network of e-commerce centers in rural China.

Demeter

(85,373 posts)Warren Buffett’s Berkshire Hathaway Inc. disclosed a $4.5 billion stake in Phillips 66, the Houston-based oil refiner, as the billionaire investor’s company increases its bet on the energy industry.

Berkshire held almost 58 million shares after purchases this week, or more than 10 percent of the total outstanding, according to a regulatory filing issued Friday by Buffett’s Omaha, Nebraska-based company. Phillips 66 closed at $77.23 on Friday in New York.

Buffett and his deputy investment managers, Todd Combs and Ted Weschler, are known for making large, contrary bets on stocks. The latest wager comes amid a slump in crude prices, driven by concerns that a supply glut will persist.

“Berkshire’s made a clear statement about how they view the oil business,” said Cliff Gallant, an analyst at Nomura Holdings Inc. “They seem to be taking the long view that demand for fuel is going to come back.”

MORE

Demeter

(85,373 posts)Hedge funds have been speculating on lawsuits, a new form of financial engineering that some business interests say encourages wasteful courtroom warfare. Now two top Republican senators—Chuck Grassley of Iowa and John Cornyn of Texas—have a few questions of their own. The lawmakers announced a move to start "examining the impact of third-party litigation financing is having on civil litigation." Their starting point is not one of enthusiasm.

"Litigation speculation is expanding at an alarming rate," Grassley, chairman of the Senate Judiciary Committee, said in a joint statement released on Thursday. "And yet, because the existence and terms of these agreements lack transparency, the impact they are having on our civil justice system is not fully known."

Grassley and Cornyn, the Senate majority whip, sent letters to three of the largest commercial litigation finance firms—Burford Capital, Bentham IMF, and Juridica Investments—requesting details on the cases they finance, the terms of their investments, and their returns. Burford in particular has helped move lawsuit finance into the corporate mainstream. While its most notorious, and least successful, investment supported a class-action lawsuit against Chevron in Ecuador, Burford mainly finances suits initiated by major companies and handled by big corporate law firms such as Simpson Thacher & Bartlett, King & Spalding, and Latham & Watkins. Burford and its competitors invest in lawsuits in exchange for a share of any recovery. The U.S. Chamber of Commerce, for one, has derided this activity as "a sophisticated scheme for gambling on litigation" that allegedly fuels abusive suits and creates conflicts of interest. Litigation finance firms counter that they enable legitimate claims that otherwise would sit dormant on the books of their corporate clients.

With new attention from the Senate, and the prospect of public hearings, which sometimes follow from committee inquiries, we may learn more about the pros and cons of spreading investments in litigation.

MattSh

(3,714 posts)The Archdruid Report: The Last Refuge of the Incompetent (The conclusion of the article)

What makes the failure of the climate change movement so telling is that during the same years that it peaked and crashed, another movement has successfully conducted a prerevolutionary campaign of the classic sort here in the US. While the green Left has been spinning its wheels and setting itself up for failure, the populist Right has carried out an extremely effective program of delegitimization aimed at the federal government and, even more critically, the institutions and values that support it. Over the last fifteen years or so, very largely as a result of that program, a great many Americans have gone from an ordinary, healthy distrust of politicians to a complete loss of faith in the entire American project. To a remarkable extent, the sort of rock-ribbed middle Americans who used to insist that of course the American political system is the best in the world are now convinced that the American political system is their enemy, and the enemy of everything they value.

The second stage of the prerevolutionary process, the weaving of a network of alliances with pressure groups and potential power centers, is also well under way. Watch which groups are making common cause with one another on the rightward fringes of society these days and you can see a competent revolutionary strategy at work. This isn’t something I find reassuring—quite the contrary, in fact; aside from my own admittedly unfashionable feelings of patriotism, one consistent feature of revolutions is that the government that comes into power after the shouting and the shooting stop is always more repressive than the one that was in power beforehand. Still, the way things are going, it seems likely to me that the US will see the collapse of its current system of government, probably accompanied with violent revolution or civil war, within a decade or two.

Meanwhile, as far as I can see, the climate change movement is effectively dead in its tracks, and we no longer have time to make something happen before the rising spiral of climate catastrophe begins—as my readers may have noticed, that’s already well under way. From here on in, it’s probably a safe bet that anthropogenic climate change will accelerate until it fulfills the prophecy of The Limits to Growth and forces the global industrial economy to its knees. Any attempt to bring human society back into some kind of balance with ecological reality will have to get going during and after that tremendous crisis. That requires playing a long game, but then that’s going to be required anyway, to do the things that the climate change movement failed to do, and do them right this time.

With that in mind, I’m going to be taking this blog in a slightly different direction next week, and for at least a few weeks to come. I’ve talked in previous posts about intentional technological regression as an option, not just for individuals but as a matter of public policy. I’ve also talked at quite some length about the role that narrative plays in helping to imagine alternative futures. With that in mind, I’ll be using the tools of fiction to suggest a future that zooms off at right angles to the expectations of both ends of the current political spectrum. Pack a suitcase, dear readers; your tickets will be waiting at the station. Next Wednesday evening, we’ll be climbing aboard a train for Retrotopia.

Complete story at - http://thearchdruidreport.blogspot.co.uk/2015/08/the-last-refuge-of-incompetent.html

MattSh

(3,714 posts)Rutgers University Warns Students - "There Is No Such Thing As Free Speech" | Zero Hedge

Ironically, U.S. college campuses are rapidly becoming the least free, most censored places in the country. Many people have commented on this, including high profile, enormously talented comedians such as Chris Rock and Jerry Seinfeld. In fact, Chris Rock was so appalled that he stopped playing colleges because audiences had become “too conservative” Before getting all bent out of shape, this is what he meant:

Not in their political views — not like they’re voting Republican — but in their social views and their willingness not to offend anybody. Kids raised on a culture of “We’re not going to keep score in the game because we don’t want anybody to lose.” Or just ignoring race to a fault. You can’t say “the black kid over there.” No, it’s “the guy with the red shoes.” You can’t even be offensive on your way to being inoffensive.

Although I’ve touched upon this subject before, I haven’t given it nearly the amount of attention it deserves. That said, I would suggest rereading a powerful post published earlier this summer, A Professor Speaks Out – How Coddled, Hyper Sensitive Undergrads are Ruining College Learning. Here’s an excerpt:

Things have changed since I started teaching. The vibe is different. I wish there were a less blunt way to put this, but my students sometimes scare me — particularly the liberal ones.

I once saw an adjunct not get his contract renewed after students complained that he exposed them to “offensive” texts written by Edward Said and Mark Twain. His response, that the texts were meant to be a little upsetting, only fueled the students’ ire and sealed his fate. That was enough to get me to comb through my syllabi and cut out anything I could see upsetting a coddled undergrad, texts ranging from Upton Sinclair to Maureen Tkacik — and I wasn’t the only one who made adjustments, either.

The current student-teacher dynamic has been shaped by a large confluence of factors, and perhaps the most important of these is the manner in which cultural studies and social justice writers have comported themselves in popular media. I have a great deal of respect for both of these fields, but their manifestations online, their desire to democratize complex fields of study by making them as digestible as a TGIF sitcom, has led to adoption of a totalizing, simplistic, unworkable, and ultimately stifling conception of social justice. The simplicity and absolutism of this conception has combined with the precarity of academic jobs to create higher ed’s current climate of fear, a heavily policed discourse of semantic sensitivity in which safety and comfort have become the ends and the means of the college experience.

Moving along to today’s post, I want to highlight two different stories that I came across today demonstrating just how far “higher education” has cratered in recent years. First, let’s turn to Rutgers University, whose “Bias Prevention & Education Committee (BPEC)” recently put out an alert that began with the following statement:

(It's right there, in the fine print). Of course I'd like to point out that all censorship has it's costs and consequences too, especially self-censorship.

Complete story at - http://www.zerohedge.com/news/2015-08-27/rutgers-university-warns-students-there-no-such-thing-free-speech

Demeter

(85,373 posts)“Your largest wealth creator for the top end has been inflation in financial assets,” Charles Peabody, a bank analyst at Portales Partners, told the Wall Street Journal. “You’re now seeing wealth destruction,” he said.

On Wednesday, the S&P 500 soared nearly 4%, its largest percentage gain since 2011, after having spent a whopping two days in a correction, its first since 2011. On Monday, I’d written, “We’re expecting a rally topped off by a majestic short squeeze in the near future.” And we’re getting that. But the index is still down 5.8% year-to-date, and 3% for the 12-month period. Quite a change from the relentless double-digit uptrend of the past several years.

Margin debt is a big force behind stock prices. It’s the great accelerator, on the way up and on the way down. When investors buy stocks with money they don’t have and that the broker creates for them, it drives up stock prices, and makes room for more margin debt as higher stock prices allow investors to borrow even more against the same number of shares. It’s wonderful. But when stocks tank, already spooked investors may be forced to sell to pay down their margin debt to stay within the limit. Forced selling drives down prices further, which begets more forced selling. Some of that happened last week, and particularly this Monday when the Dow plunged over 1,000 points at the open.

Margin debt has a nerve-racking habit of running up sharply and then peaking right around the time stocks crash. In the last sixteen years, there have been three majestic spikes, each greater than the prior one.

But there are other forms of margin debt, including loans backed by portfolios of stocks, bonds, mutual funds, ETFs, and other securities. The loans can be used not to buy more securities, but to buy man-toys, make a down-payment on a mortgage for a home or an investment property, start a business, blow on a big vacation, or whatever. This type of loan allows investors to draw money out of the markets without having to sell securities. The Wall Street Journal reported that, “according to lending executives at brokerage firms and analysts,” clients would be allowed to borrow “40% or less of the value of concentrated stock positions or as much as 80% of a bond portfolio.”

It was a good deal for everyone. Investors loved it because, as asset prices were getting inflated year after year, they could borrow more and more against their very same portfolios, draw the money out, and live the good life. Financial advisors love it because they get paid a fee for their clients’ assets in their account, regardless of the loans drawn against those assets, and this fattened the fees. And banks and brokerages loved it because they scooped easy interest income off the loans, and they marketed them aggressively. With all entities eager to do these loans, nothing stopped margin balances from ballooning into dangerous proportions. At Morgan Stanley, these types of loans have shot up 37% year over year, to $25.3 billion as of June 30. At BofA Merrill Lynch these loans soared by 14.2% year over year to $38.6 billion. At Wells Fargo’s wealth unit, these loans and classic margin loans combined soared 16% to $59.3 billion. According to the Journal, “the biggest brokerage firms have all reported higher securities-based loan balances or higher client-loan asset totals, each quarter for more than two years.” These client-loan asset totals include both securities-based loans and the classic margin accounts. These securities-based loans have become so popular, have been marketed so aggressively, and entail so much risk for clients that the Financial Industry Regulatory Authority (FINRA) has put them, as the Journal put it, on “its so-called watch list for 2015.”

Then the equation fell apart. Energy stocks and bonds crashed, even those of some large companies like Chesapeake. Some have reached zero. All kinds of other stocks and bonds have gotten eviscerated over the past few months, even tech darlings like Twitter or biotech giant Biogen. Portfolios with a focus on the wrong momentum stocks took a very serious hit. And margin calls went out. The Journal:

Other banks too sent out margin calls, including U.S. Trust, Morgan Stanley, and Wells Fargo, according to the Journal. With margin calls mucking up the scenario, spooked investors are trying to lower their leverage before they’re forced to, and the boom in securities-based lending appears to be over. And the wealth units of the banks that gorged on these loans are likely to see their profits dented.

If that continues, a much crummier thing happens: margin balances reverse. And the last two times they did after a majestic record-breaking spike, the stock market crashed.

MattSh

(3,714 posts)As I honestly don't remember, here it is (again?).

Lies You Will Hear As The Economic Collapse Progresses

It is undeniable; the final collapse triggers are upon us, triggers alternative economists have been warning about since the initial implosion of 2008. In the years since the derivatives disaster, there has been no end to the absurd and ludicrous propaganda coming out of mainstream financial outlets and as the situation in markets becomes worse, the propaganda will only increase. This might seem counter-intuitive to many. You would think that the more obvious the economic collapse becomes, the more alternative analysts will be vindicated and the more awake and aware the average person will be. Not necessarily...

In fact, the mainstream spin machine is going into high speed the more negative data is exposed and absorbed into the markets. If you know your history, then you know that this is a common tactic by the establishment elite to string the public along with false hopes so that they do not prepare or take alternative measures while the system crumbles around their ears. At the onset of the Great Depression the same strategies were used. Consider if you've heard similar quotes to these in the mainstream news over the past couple months:

John Maynard Keynes in 1927: “We will not have any more crashes in our time.”

H.H. Simmons, president of the New York Stock Exchange, Jan. 12, 1928: “I cannot help but raise a dissenting voice to statements that we are living in a fool’s paradise, and that prosperity in this country must necessarily diminish and recede in the near future.”

Irving Fisher, leading U.S. economist, The New York Times, Sept. 5, 1929: “There may be a recession in stock prices, but not anything in the nature of a crash.” And on 17, 1929: “Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months.”

W. McNeel, market analyst, as quoted in the New York Herald Tribune, Oct. 30, 1929: “This is the time to buy stocks. This is the time to recall the words of the late J. P. Morgan… that any man who is bearish on America will go broke. Within a few days there is likely to be a bear panic rather than a bull panic. Many of the low prices as a result of this hysterical selling are not likely to be reached again in many years.”

Harvard Economic Society, Nov. 10, 1929: “… a serious depression seems improbable; [we expect] recovery of business next spring, with further improvement in the fall.”

Here is the issue – as I have ALWAYS said, economic collapse is not a singular event, it is a process. The global economy has been in the process of collapse since 2008 and it never left that path. Those who were ignorant took government statistics at face value and the manipulated bull market as legitimate and refused to acknowledge the fundamentals. Now, with markets recently suffering one of the greatest freefalls since the 2008/2009 crash, they are witnessing the folly of their assumptions, but that does not mean they will accept them or apologize for them outright. If there is one lesson I have learned well during my time in the Liberty Movement, it is to never underestimate the power of normalcy bias.

Complete story at - http://www.alt-market.com/articles/2678-lies-you-will-hear-as-the-economic-collapse-progresses

Demeter

(85,373 posts)DemReadingDU

(16,000 posts)Edit to add Brandon Smith 6 part series

3/4/15 One Last Look At The Real Economy Before It Implodes - Part 1

http://www.alt-market.com/articles/2528-one-last-look-at-the-real-economy-before-it-implodes-part-1

3/11/15 One Last Look At The Real Economy Before It Implodes - Part 2

http://www.alt-market.com/articles/2534-one-last-look-at-the-real-economy-before-it-implodes-part-2

3/18/15 One Last Look At The Real Economy Before It Implodes - Part 3

http://www.alt-market.com/articles/2539-one-last-look-at-the-real-economy-before-it-implodes-part-3

4/9/15 One Last Look At The Real Economy Before It Implodes - Part 4

http://www.alt-market.com/articles/2563-one-last-look-at-the-real-economy-before-it-implodes-part-4

4/16/15 One Last Look At The Real Economy Before It Implodes - Part 5

http://www.alt-market.com/articles/2568-one-last-look-at-the-real-economy-before-it-implodes-part-5

4/22/15 One Last Look At The Real Economy Before It Implodes - Part 6 - Solutions

http://www.alt-market.com/articles/2572-one-last-look-at-the-real-economy-before-it-implodes-part-6-solutions

Demeter

(85,373 posts)"Corporations and governments only do two things relatively well — lying and stealing. One always enables the other."

Hotler

(11,420 posts)Last edited Sat Aug 29, 2015, 03:09 PM - Edit history (1)

Demeter

(85,373 posts)World oil prices roared back to $50 a barrel in the second day of a frenetic short-covering rally on Friday, with violence in Yemen, a storm in the Gulf and refinery outages helping extend the biggest two-day rally in six years. Oil had tumbled in tandem with stocks over much of the past week, hitting 6-1/2-year lows below $40 a barrel as Chinese financial tumult stoked fears of slowing growth. Oil rallied on Thursday as equities rebounded, but on Friday oil kept pushing higher even as equity markets were calm. Dealers said a handful of emerging risks fed oil's gains. Warplanes from a Saudi-led coalition killed 10 people in air raids over Yemen; Tropical Storm Erika moved closer to Florida, prompting worries about oil and gas installations in the U.S. Gulf.

Brent, the global oil benchmark LCOc1, closed up $2.49, or 5 percent, at $50.05, after nearly reaching $51 a barrel. It gained 10 percent on the week. U.S. crude's front-month contract snapped an eight-week losing streak, rising $2.66, or 6.3 percent, to settle at $45.22 a barrel. At its session high, it was up more than $3, or 7 percent at nearly $46. For the week, it rose 12 percent.

"A severely oversold and shorted oil market is creating a bid for covering," said Chris Jarvis, analyst at Caprock Risk Management in Frederick, Maryland.

U.S. crude's 17 percent gain over the past two sessions was the second largest in 25 years. Yet prices remain at half their year-ago level. Traders noted a lingering global glut of oil supplies, and said the rally was largely fueled by a rush by market players to exit a crowded bearish trade. Late on Friday, U.S. data showed that big hedge funds had slightly increased their bullish net long bets on U.S. crude in the week through Tuesday. But gross short positions barely dipped, leaving a near record number of bearish bets poised to cover as prices turned higher later in the week...MORE

MattSh

(3,714 posts)When Yanis Varoufakis was elected to parliament and then named as Greek finance minister in January, he embarked on an extraordinary seven months of negotiations with the country’s creditors and its European partners.

On July 6, Greek voters backed his hardline stance in a referendum, with a resounding 62 percent voting No to the European Union’s ultimatum. On that night, he resigned, after Prime Minister Alexis Tsipras, fearful of an ugly exit from the euro zone, decided to go against the popular verdict. Since then, the governing party, Syriza, has splintered and a snap election has been called. Varoufakis remains a member of parliament and a prominent voice in Greek and European politics.

When asked about Tsipras’s decision to trigger a snap election, inviting the Greek public to issue their judgement on his time in office, Varoufakis said:

If only that were so! Voters are being asked to endorse Alexis Tsipras’s decision, on the night of their majestic referendum verdict, to overturn it; to turn their courageous No into a capitulation, on the grounds that honoring that verdict would trigger a Grexit. This is not the same as calling on the people to pass judgment on a record of steadfast opposition to a failed economic program doing untold damage to Greece’s social economy. It is rather a plea to voters to endorse him, and his choice to surrender, as a lesser evil.

Nine leading academics asked questions to a man who describes himself as an “accidental economist.” His answers reveal regrets about his own approach during a dramatic 2015, a withering assessment of France’s power in Europe, fears for the future of Syriza, a view that the party is now finished, and doubts over how effective the socialist politician Jeremy Corbyn could be if he wins leadership of Britain’s Labour party.

Complete story at - http://www.theatlantic.com/international/archive/2015/08/yanis-varoufakis-greece-eu/402580/

Demeter

(85,373 posts)What a bitter, bitter result to live with...and the personal betrayal!

MattSh

(3,714 posts)Yves here. We pointed out, before water scarcity was on most people’s radar, that potable water is the world’s most constrained resource, and absent major policy/technology changes or changes in population growth, demand is set to exceed supply by 2050. So expect water wars to become more common and deadly.

By Christopher Stakhovsky, an EU energy policy consultant based between Paris and Kiev with over 30 years experience working with EU institutions. Originally published at OilPrice

In 1862 the eminent Prussian statesman Otto von Bismarck delivered a speech on behalf of his King, Wilhelm I, to the State Diet stressing the need for military preparedness. At the close of this speech, he spoke what became his most famous words, “Not through speeches and majority decisions will the great questions of the day be decided, but by iron and blood.”

On the banks of a chilly river some 4,600 km away, a gigantic dam sits unfinished, the victim of a process of speeches and votes between rivals far more bitter than Prussia ever faced – Uzbekistan and Tajikistan.

One side is dependent upon the water flowing past the dam, while the other desperately needs the electricity the dam could provide, and, as you will see, both sides have compelling arguments in their favor. Already in a state of “cold war” over this and other issues, is the collision between the two inevitable? Can this issue be decided only by blood and iron?

The Rogun Dam was originally conceived in 1959 as just one of several hydroelectric projects to be built throughout the Soviet Union. Developed in an era of gigantic Soviet projects, construction began along the banks of the Vakhsh River in 1976 but was not complete by the time of the collapse of the Soviet Union in 1991.

Complete story at - http://www.nakedcapitalism.com/2015/08/conflict-over-water-in-central-asia.html

Demeter

(85,373 posts)The Pentagon’s new Law of War Manual – a 1,200-plus page document issued in June by the Defense Department’s Office of the General Counsel – is barbaric. The Manual is so bad that one of the leading experts on the law of war (Dr. Francis Boyle) – who wrote the Biological Weapons Anti-Terrorism Act of 1989, the American implementing legislation for the 1972 Biological Weapons Convention, served on the Board of Directors of Amnesty International, and teaches international law at the University of Illinois, Champaign – says :

This Law of War Manual reduces us to the level of Nazis. There’s no other word for it.

Boyle also says the Manual:

Reads like it was written by Hitler’s Ministry of War.

Why is the Manual so bad?

Manual Authorizes Slaughter of Innocent Civilians

Because – according to Boyle – the Manual allows massacres of civilian populations. The most comprehensive previous such document – the 1956 Pentagon field manual – assumed that any deliberate targeting of civilians was illegal and a war crime.

Reporters Can Be Assassinated

And the Manual treats allows reporters to be treated as “unprivileged combatants”, who can be assassinated.

Boyle points out that this retroactively legalizes assassination of reporters, such as Al Jazeera reporters during Iraq war. Boyle notes that even a SPY would be treated better, and given a trial.

(As we’ve previously noted, the U.S. government treats real reporters as terrorists. Because the core things which reporters do could be considered terrorism, in modern America, journalists are sometimes targeted under counter-terrorism laws.)

Manual Authorizes Barbarous War Crimes

Boyle also says the Manual authorizes the following barbarous war crimes:

(1) Warfare with nuclear weapons. Specifically, the manual states:

There is no general prohibition in treaty or customary international law on the use of nuclear weapons.

This flies in the face of the United Nations Charter, which – as noted by the World Court in its Advisory Opinion on the Legality of the Threat or Use of Nuclear Weapons – makes even threatening to use nuclear weapons a war crime.

This is also particularly worrisome because – as documented in Towards a World War III Scenario, by Michel Chossudovsky – the U.S. is so enamored with nuclear weapons that it has authorized low-level field commanders to use them in the heat of battle in their sole discretion … without any approval from civilian leaders.

(2) Depleted uranium. The use of depleted uranium can cause cancer and birth defects for decades.

(3) Landmines.

(4) Cluster bombs.

(5) Napalm, which is banned under Protocol III of the 1980 UN Convention on Certain Conventional Weapons.

(6) Expanding hollow-point bullets, banned under the 1868 St. Petersburg declaration.

(7) Herbicides, like Agent Orange in Vietnam.

The Good News

The good news – according to Dr. Boyle – is that both Congress and the president have power to revoke the Manual.

So – if we stand up and raise holy hell – we might be able to walk back from the fascist path we’re heading down. And we can prove that we’re not the rogue nation that the rest of the world thinks we are.

Demeter

(85,373 posts)Once global assets roll over for good, it’s important to recall that somebody owns these assets all the way down. These owners are called bagholders, as in “left holding the bag.”

Those running the rigged casino have to select the bagholders in advance, lest some fat-cat cronies inadvertently get stuck with losses.

Demeter

(85,373 posts)All non-taxation of estates at death is feudal; it’s systematic continuation of feudalism, into our own era.

Here’s a good example to show this: U.S. National Public Radio’s (NPR’s) reporter Lourdes Garcia-Navarro, headlined on August 25th, “For Brazil’s 1 Percenters, The Land Stays In The Family Forever,” and she reported that, in that country, the aristocracy own half of the land, and that whenever a building on their land is sold, 2.5% of the sale price must go to the land’s owner, the heir-aristocrat, in a perpetual tithing-system to the hereditary Portuguese aristocracy (including the Roman Catholic Church), who have descended from the Portuguese colonizers to whom Portugal’s king had granted the land 515 years ago, in payment for their having conquered the native Indians and stolen their land for the king. The king didn’t give them all of what these conquistadors had stolen for him, but only what he felt they deserved for their services, of theft from the people who had previously owned the land, or lived on it. (Among the receiving aristocracy was the Roman Catholic Church, for its services assisting these thefts, by approving them — declaring them to reflect God’s will.)

Back in that time and territory, there was little in the way of paper deeds, etc.; there wasn’t even much in the way of writing-implements and paper, with which to record ownership; so, these “thefts” (which NPR’s reporter carefully declines to call by that clear term, saying instead — paraphrasing what she was told by one of the aristocrats — “back then, it made sense: It was a way of supporting the whole colonial enterprise,” which was an enterprise of stealing the natives’ land, which fact, again, she doesn’t explicitly assert to be the case, because she doesn’t want her audience to understand what she is actually talking about — what “the whole colonial enterprise” actually consisted of, which is something that all aristocracies, including America’s aristocracy and the big donors to NPR want to hide — and so a Brazilian aristocrat instead explains the rationale for it, as best he can, in this “journalism”) — these thefts were therefore unrecorded, just as was everything; and this is the reason why “supporting the whole colonial enterprise” can even be presented as having been good, instead of criminal, which it actually was. The victims were conveniently ignored by historians, with few exceptions, such as David E. Stannard’s magisterial 1992 American Holocaust: The Conquest of the New World, which book reconstructs some of this disgusting history, throughout the Western Hemisphere, and not only in Brazil. As Stannard said in his Prologue, “We must do what we can to recapture and to try to understand, in human terms, what it was that was crushed, what it was that was butchered. It is not enough merely to acknowledge that much was lost. So close to total was the human incineration and carnage in the post-Columbian Americas, however, that of the tens of millions who were killed, few individual lives left sufficient traces for subsequent biographical representation.”

In Europe, the recording of deeds went back as far as ancient Rome, but in “the New World,” invading Europeans created everything anew, with no regard for rights of people who had long been living there before them: natives were instead treated more like slaves, when they were not ignored altogether, or simply slaughtered to clear land.

So: Portugal’s king established Brazil’s entire feudal system, which still drains the country. Burdened by such ongoing siphoning-off of the nation’s productivity, Brazil competes at a disadvantage in international markets, but this is a disadvantage that’s shared by many other nations, too. It’s shared in every nation that allows children to inherit their parents’ estate tax-free or else at a lower taxation-rate than applies to earned income, so that heirs are tax-advantaged there, over people who earn their living instead of having had it given to them. Earned income should always be taxed at a lower rate than unearned income. But, in a feudal system, unearned income is taxed less than earned income is.