Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 26 August 2015

[font size=3]STOCK MARKET WATCH, Wednesday, 26 August 2015[font color=black][/font]

SMW for 25 August 2015

AT THE CLOSING BELL ON 25 August 2015

[center][font color=red]

Dow Jones 15,666.44 -204.91 (-1.29%)

S&P 500 1,867.61 -25.60 (-1.35%)

Nasdaq 4,506.49 -19.76 (-0.44%)

[font color=red]10 year 2.07% +0.01 (0.49%)

30 Year 2.81% +0.02 (0.72%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)And they were saying it would be out of commission until after Christmas, and gas prices soared almost a dollar in two days?

Well, the word is that refinery is back in service....it's a miracle! Or a federal investigation...I don't know which, yet. But if I find out, I'm gonna post the gory details....

Who was that famous woman journalist/muckraker? Ida Tarbell....such a suggestive name! It would make a great nom de guerre, if ever I need one.

And that's a great Weekend topic---after where the nuts come from.

Fuddnik

(8,846 posts)You're not getting me tombstoned!

Demeter

(85,373 posts)What ARE you talking about? I'm talking about Brazil, which I got up to the time of "Charley's Aunt" (end of the 19th century) (she's from Brazil, where the nuts come from).\

So Ida Tarbell will be for Labor Day weekend.

Fuddnik

(8,846 posts)They export many different varieties.

And no, I haven't had any Martoonies since Friday and I might just have one this evening.

Go ahead, keep it up. I dare you. I triple dog dare you!

Demeter

(85,373 posts)and what am I supposedly keeping up?

While you think about that, I'm going to make supper and feed the Kid, whose nose is red as Rudolph's, poor thing, and not from drinking spirits, either.

DemReadingDU

(16,000 posts)Haven't figured out if this is a good thing, or not

Demeter

(85,373 posts)But nobody ever does....

Hugin

(33,135 posts)I imagine it's because Obama, too.

:snort:

Demeter

(85,373 posts)Millions in energy and utility concessions and Delmarva Power bill credits were thrown into limbo Tuesday by a District of Columbia regulator vote against the $6.8 billion Exelon-Pepco Holdings Inc. merger. D.C. Public Service Commission members rejected the plan after Delaware, New Jersey, Maryland and Virginia had already approved Exelon’s offer of $27.25 per share for Pepco’s stock, along with assumption of Pepco’s debt.

Full approval would have created the Mid-Atlantic’s largest electric and gas utility, with 10 million customers and a $26 billion rate base. Delmarva Power, part of Pepco, would have kept its headquarters in Delaware under the two big companies agreement with the state Public Service Commission...Delmarva has 305,000 Delaware electric customers, along with 126,000 Delmarva natural gas customers in New Castle County. Exelon and Pepco said in a joint statement that the companies would respond once they review their options...

“Everyone tried to secure what we thought was a fair settlement for the public,” Delaware Public Service Commission Executive Director Robert Howatt said. “I think at this point we’re kind of in a wait-and-see perspective. Wait and see what action, if any, Exelon will take.”

Delaware Public Advocate David Bonar, whose office supported the deal after Exelon agreed to improved concessions for Delaware, said this morning that “everybody else in the region is going to have to sit down and reassess their positions” as a result of the D.C. decision. “Or Exelon can fold their tent and go home,” Bonar added. “The ball is in Exelon’s court.”

**********************************************

Pepco Holdings stock was down more than $3.90 per share shortly before 2 p.m., or about 14.5 percent. Exelon Corps stock was off $1.27, or about 3.9 percent at the same time.

I THINK THAT WAS AN EXCELLENT DECISION--BIGGER IS NOT BETTER.

Demeter

(85,373 posts)And you can see by the shape of the curves it was all PPT, all the way, and losing the battle...which brings me to this post:

Perry Mehrling: No One Has a Good Idea of How to Keep the Fed From Having to Rescue Mr. Market Again as Yves Smith called it, or

Toward a robust dealer system of first resort

http://www.perrymehrling.com/2015/08/toward-a-robust-dealer-system-of-first-resort/

Goldman Sachs takes “A Look at Liquidity”, and tells us what they see. Suffice it to say that different people see different things, depending on their vantage point, like the proverbial blind men touching the elephant. Let’s see if we can construct a picture of the animal as a whole from the snapshots provided.

What seems clear is that the bank dealer system of the past is now gone (notwithstanding last-ditch pleading to bring it back). Banks are largely out of that business, guided by new regulations (specifically the “non-risk-based leverage and liquidity rules”), but also motivated by their own experience with the crisis. Banks do not want to be in the position of requiring emergency support from the Fed any more than the Fed wants to be in the position of providing that emergency support.

Ever since the crisis, central banks have been standing in for the pre-crisis bank dealer system, flooding the system with funding liquidity. World-wide QE has essentially bought time for a new more robust dealer system to begin rising from the ashes of the old. However, at the moment that new system is far from complete, even as central banks (led by the Fed) are signalling that they will not be around forever. In normal times the central banks supports the market; only in crisis times does it become the market. What will the new normal times look like?

Steve Strongin talks about how the Fed might respond to the next crisis: “the Fed might have to buy the distressed assets directly and/or other parts of the government might have to step in” (p. 5). That is of course how the Fed responded to the last crisis, as I have myself recounted in my book New Lombard Street. But the necessity for that response shows exactly the inadequacy of the old dealer system–it was not a robust first resort system. That’s why we have junked the old system. The question is whether we can rely on the emerging new system to be more robust.

There is a lot of hype about electronic exchanges, and also Exchange Traded Funds, and some of the hype is warranted. Yes, to the extent that we can make it easier for buyers and sellers to find each other and do business directly, we can do without the now-missing dealer intermediary. In effect, all such measures work by making the broker function more efficient, which is fine if markets are balanced. “But the largest problems are likely to arise when markets are not balanced and under significant net selling pressure…” (p. 5)

THIS PROFESSOR TEACHES ECONOMICS ON LINE! CHECK OUT THE WEBSITE!

Demeter

(85,373 posts)Source: CNBC

U.S. stocks closed lower, after a failed attempt to rally from the Dow's worst 3-day point decline in history, as investor confidence waned amid continued concerns about China and global growth.

The Dow Jones industrial average and the S&P 500 closed about 1.3 percent lower after rallying nearly 3 percent earlier, their biggest reversal to the downside since Oct. 29, 2008. The S&P 500 remained in correction territory after falling there on Monday. The index also posted its first six-day losing streak since July 2012.

"That crash (Monday) was so big and so long since we had one (investors) don't want a repeat of 2008 so they bail out," said Lance Roberts, general partner at STA Wealth Management.

The Dow fell 205 points and S&P 500 closed below 1,900 after falling into negative territory in the last half hour of trade. The Nasdaq Composite failed to hold slight gains and closed 0.44 percent lower.

Read more: http://www.cnbc.com/2015/08/25/us-markets-attempt-recovery.html

COMMENTS FROM POST: Wellstone ruled

Some of those high fliers got their wings clipped.

Watch for the Fed to intervene by Friday. This prearranged market sell off is going to wreck our economy and the Fed is prepared to pump trillions into equities to quell the pending uprising coming from 401 k and IRA holders. Still appears this was prearranged to cover the Chinese Economic collapse.

progree (2,132 posts)

S&P 500: all time high: 2131 on May 21. Now 1868, down 12.3% from the all time high

A market correction is a drop of between 10 and 20%

A bear market is a drop of 20% or more.

Just a little scorecard on where we're at, so far

Turbineguy (20,420 posts)

And the 3 PM announcement from Citibank about interest rate hike had absolutely, positively, no doubt what so ever, nothing to do with that reversal.

$arca$m

One of their big guns said

that the Fed would hike interest rates anyway in September. I saw it on Bloomberg. I think it spooked the (easily spooked) market since one of the Fed governors said earlier that there would probably be a delay.

Star Member herding cats (3,017 posts)

Here you go

Citi: The Fed Will Still Hike in September, But There's One Big Wild Card Ahead

Citi is sticking with its call that the Federal Reserve will hike its policy rate next month.

The bank's economists, led by William Lee, interpreted the Federal Reserve's July minutes differently from other institutions, claiming that monetary policymakers' increased concerns about financial stability cemented the case for a hike in September.

Others institutions have recently pushed back their estimated dates for liftoff in light of international developments and volatility in financial markets emanating from China's decision to devalue the yuan.

Federal funds futures rates imply that the probability of a rate hike has slipped below 30 percent, down substantially from roughly 50 percent last week.

Demeter

(85,373 posts)THE HAMPTONS (The Borowitz Report)—They don’t pay taxes. They circumvent our laws. They get free stuff from the government. They are America’s billionaires, and many would like to see them gone. According to a new survey by the University of Minnesota’s Opinion Research Institute, the American people hold the nation’s billionaires in lower esteem than ever before, and a majority would like to see new laws enacted to deport them.

“They come here, take thousands of our jobs, and export them overseas,” one respondent said, in an opinion echoed by many others in the survey.

“They are part of a shadow economy that sucks billions of dollars out of the United States every year and puts it in Switzerland and the Caymans,” another said.

Images of hedge-fund managers arriving via helicopter in the Hamptons this summer have only reinforced the impression that authorities have turned a blind eye to their movements.

“Many of these people should be in prison, and the government is looking the other way,” one respondent said.

Stirring even more controversy is the billionaires’ practice of having babies in the United States and using the nation’s porous estate-tax laws to pass down untold wealth to the next generation.

“They should leave and take their children with them,” one respondent said.

Even after it is pointed out to respondents that some billionaires, such as Warren Buffett and Bill Gates, have made significant philanthropic contributions to the world, a majority of those polled stubbornly maintained their negative views of billionaires.

“Look, in every group you’re going to have some good ones,” one of the respondents said. “But that doesn’t take away from the fact that the vast majority of these people are destroying this country.”

JUST REMEMBER THAT THEY HAVE TO LEAVE THE LAND, EQUIPMENT, AND CORPORATE CASH BEHIND....

Demeter

(85,373 posts)Proving to be just as flimsy and precarious as many observers had previously warned, the Chinese-made Shanghai Composite index completely collapsed Monday, sources confirmed.

“Sure, it looked fine from the outside, but anybody who saw it up close knew that it was of such poor quality that it wasn’t built to last,” said Allen Sigman of the London School of Economics, adding that the stock market, which he described as a crude knockoff of Western versions, was practically slapped together overnight and featured countless obvious structural weak points.

“They pretty much ignored regulations, and inspections were a joke. The only surprise is that it didn’t fall apart sooner.” Sigman added that he just hopes there weren’t too many people who were hurt in the disaster.

THE ONION, TELLING THE TRUTH IN THE FORM OF A JOKE

Demeter

(85,373 posts)More Americans than ever don't know what they'll be earning next week. That's why we need income insurance...This varied group includes independent contractors, temporary workers, the self-employed, part-timers, freelancers, and free agents. Most file 1099s rather than W2s, for tax purposes. On demand and on call – in the “share” economy, the “gig” economy, or, more prosaically, the “irregular” economy – the result is the same: no predictable earnings or hours. It’s the biggest change in the American workforce in over a century, and it’s happening at lightning speed. It’s estimated that in five years over 40 percent of the American labor force will have uncertain work; in a decade, most of us.

Increasingly, businesses need only a relatively small pool of “talent” anchored in the enterprise – innovators and strategists responsible for the firm’s unique competitive strength. Everyone else is becoming fungible, sought only for their reliability and low cost.

THAT'S WHAT THEY'D LIKE US TO BELIEVE....BUT THE CEOS WILL BE SORRY, AND IT WON'T TAKE VERY LONG, EITHER.

NO LOYALTY, NO RECIPROCITY

AIN'T NO WAY TO RUN A BUSINESS OR A COUNTRY.

DEMETER'S BEEN IRREGULAR SINCE THE KID WAS BORN...AND IT SHOWS!

Demeter

(85,373 posts)a Forbes Guest post written by Harry Frankfurt

Mr. Frankfurt is the author of the NYT #1 bestseller On Bullshit and the upcoming On Inequality, both from Princeton University Press.

http://www.forbes.com/sites/realspin/2015/08/24/lets-get-this-straight-income-inequality-and-poverty-arent-the-same-thing/

There is very considerable discussion nowadays about the increasingly conspicuous discrepancy between the incomes of wealthier Americans and the incomes of those Americans who are less wealthy. President Barack Obama has declared that income inequality is the greatest political challenge of our time. But just what is so awful about economic inequality? Why should we have this great concern, urged upon us by so many politicians and public figures, about the growing gap between the incomes of the richest people in our country and the incomes of those who are less affluent?

The first thing to notice is that economic inequality, however undesirable it may be for various reasons, is not inherently a bad thing. Think about it: We could arrange for the members of a society to be economically equal by ensuring that the economic resources available to each member of the society put everyone equally below the poverty line. To make everyone equally poor is, obviously, not a very intelligent social ambition.

Insofar as people aim for equality (i.e., having the same as others), they are distracted from measuring the specific economic needs that are implied by their own particular interests, ambitions and capacities. The trouble with adopting equality as a social goal, then, is that it is alienating. It diverts people from being guided, in assessing their personal economic circumstances, by the most pertinent features of their own lives; and it leads them instead to measure their economic needs according to the significantly less pertinent circumstances of others.

It isn’t especially desirable that each have the same as others. What is bad is not inequality; it is poverty. We should want each person to have enough—that is, enough to support the pursuit of a life in which his or her own reasonable ambitions and needs may be comfortably satisfied. This individually measured sufficiency, which by definition precludes the burdens and deprivations of poverty, is clearly a more sensible goal than the achievement of an impersonally calibrated equality.

There is, of course, an evil other than poverty which it is important to avoid. The social undesirability of wide economic inequality does not lie only in a concurrent incidence of poverty. It lies also in the superior political influence, and other competitive advantages, enjoyed by those who are especially well-off. These advantages, when they are deliberately exploited, tend to undermine a fundamental requirement of our constitutionally mandated social order. Accordingly, such anti-democratic misuses of the competitive advantages provided by exceptional wealth must be discouraged by suitable legislative, regulatory and judicial oversight.

It is not inequality itself that is to be decried; nor is it equality itself that is to be applauded. We must try to eliminate poverty, not because the poor have less than others but because being poor is full of hardship and suffering. We must control inequality, not because the rich have much more than the poor but because of the tendency of inequality to generate unacceptable discrepancies in social and political influence. Inequality is not in itself objectionable—and neither is equality in itself a morally required ideal.

THAT'S RIGHT, YOU SANCTIMONIOUS BASTARD...WHEN ONE MAN OR EVEN A GROUP OF THEM CAN BUY THE ENTIRE GOVERNMENT: LEGISLATIVE, EXECUTIVE AND JUDICIAL, THEN EVERYONE ELSE IS IMPOVERISHED BY DEFINITION.

AND THAT'S WHAT WE HAVE TODAY. BERNIE WILL SHOW US IF THERE'S ANY LAST HOPE OF DEMOCRACY--AND IF HE DOESN'T, THEN IT'S A LA LANTERNE!

METHINKS THE AUTHOR JUST DUMPED A LOAD OF BS ON US.

bread_and_roses

(6,335 posts)All I can do is second your "SANCTIMONIOUS BASTARD"

Punx

(446 posts)This implies that we must have lots of poor, so that a "Deserving" few can have plenty. And any other arrangement will "Horror" leave us all in poverty.

Meanwhile they rig the system to their benefit and sit back and talk about how they have earned their station.

Demeter

(85,373 posts)A former JPMorgan Securities analyst was arrested Tuesday and charged for his alleged role in an insider trading scheme that netted more than $600,000 in profit. The Securities and Exchange Commission claims the analyst, 27-year-old Ashish Aggarwal, gathered nonpublic information about acquisition deals from colleagues while working at the firm from 2011 to 2013. He then allegedly tipped off Shahriyar Bolandian, who used the data to trade in personal and family member accounts.

Aggarwal and Bolandian, as well as Kevan Sadigh, surrendered to the FBI on Tuesday morning, the Department of Justice said. They were charged in a federal grand jury indictment with one count of conspiracy to commit securities and tender offer fraud, 13 substantive counts of securities fraud, 13 substantive counts of tender offer fraud and three counts of wire fraud. An arraignment in California federal court was scheduled for Tuesday afternoon.

"Mr. Aggarwal denies the charges against him. He has retained Goodwin Procter to represent him in this matter and intends to vigorously defend himself against these allegations," Aggarwal's lawyer Grant Fondo said in a statement.

The SEC says Aggarwal gleaned nonpublic details about Integrated Device Technology's planned acquisition of PLX Technology and Salesforce.com's planned deal to buy ExactTarget in 2012 and 2013, respectively. The agency alleges he shared it with Bolandian, who in turn tipped off Sadigh. Trading ahead of public acquisition announcements brought in about $672,000 in profit, according to the SEC.

Demeter

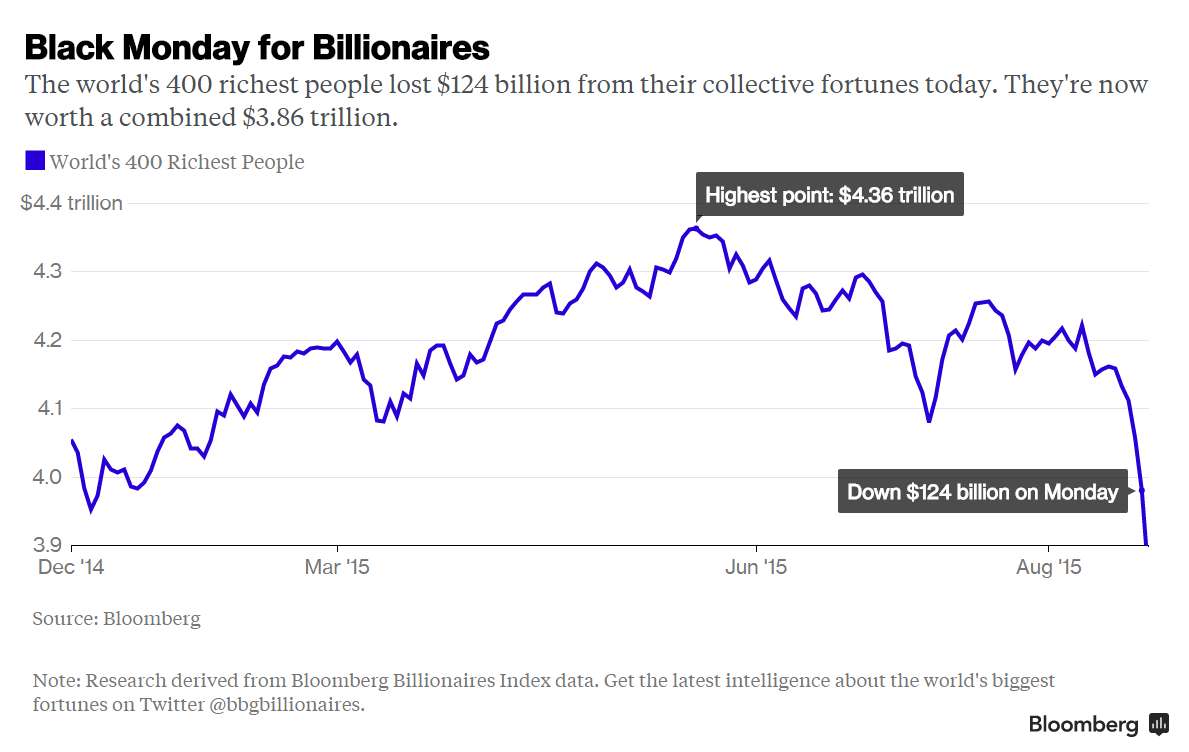

(85,373 posts)http://www.bloomberg.com/news/articles/2015-08-24/the-world-s-richest-people-lost-another-124-billion-on-monday

The global rout continues...VIDEO AT LINK LISTS NAMES AND AMOUNTS

Another $124 billion was wiped off the collective fortunes of the world’s 400 richest people today as the global selloff pushed the Standard & Poor’s 500 Index into its first correction in nearly four years.

Twenty-four billionaires saw their wealth fall by more than ten figures on Monday, including Bill Gates who dropped $3.2 billion and Jeff Bezos, who fell $2.6 billion, according to data compiled by the Bloomberg Billionaires Index. Mexico's Carlos Slim lost $1.6 billion as his fortune fell to its lowest level since the Index began in 2012.

Sliding markets worldwide have resulted in Chinese shares sinking the most since 2007, Germany's DAX falling into a bear market, and commodities reaching a 16-year low, as Brent crude plunged below $45 a barrel.

Last week’s declines had already seen the world’s 400 richest people lose $182 billion. A decline of $76 billion on Friday had put their fortunes into the red for the year-to-date.

The Bloomberg Billionaires Index takes measure of the world’s wealthiest people based on market and economic changes and Bloomberg News reporting. Each net-worth figure is updated every business day at 5:30 p.m. in New York and listed in U.S. dollars.

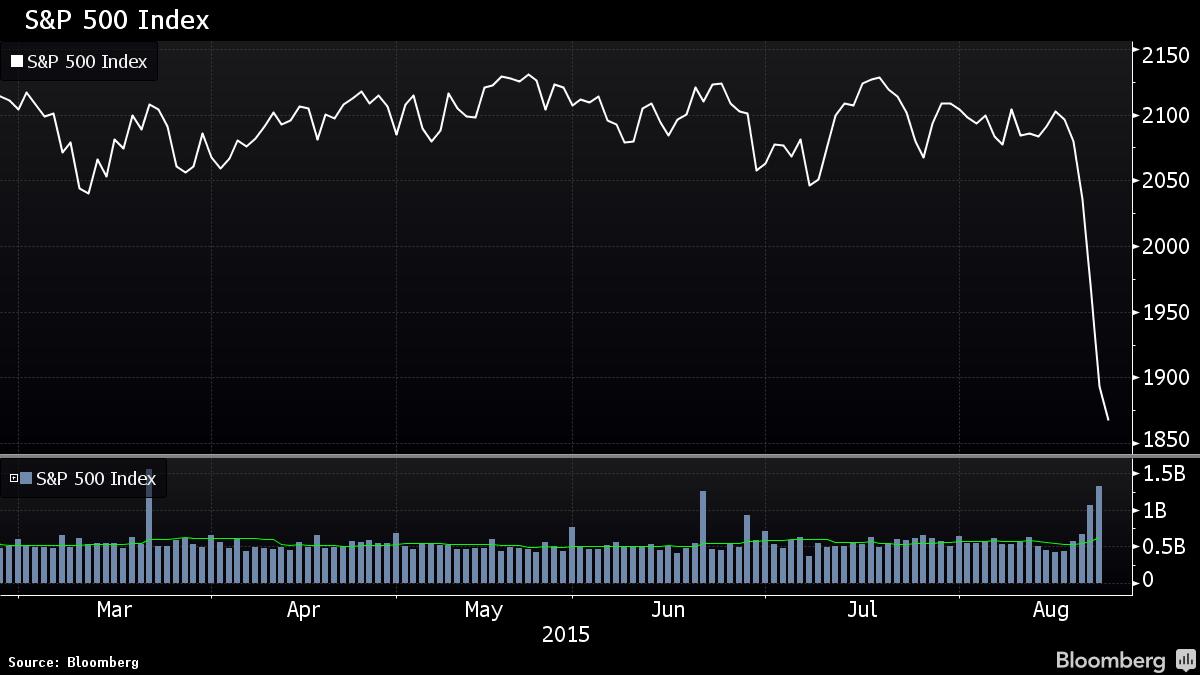

China Anxiety Resurfaces to Torpedo Relief Rally in U.S. Stocks

http://www.bloomberg.com/news/articles/2015-08-25/s-p-500-futures-rally-3-after-worst-2-day-selloff-since-2008

Why Did the Market Rally Evaporate in the Final Hour? VIDEO DISCUSSION AT LINK

A rebound that took the Dow Jones Industrial Average up more than 440 points disappeared in the final hours of trading, with investors giving in to trepidation over what will happen overnight in China amid the most volatile equity markets in four years.

The 30-stock gauge ended down 204.91 points, or 1.3 percent, at 15,666.44 at 4:09 p.m. in New York, and 4 percent below its session high. The peak-to-trough retreat exceeded the loss at Monday’s close, when concern about global growth ignited the worst decline for U.S. shares in four years. The Standard & Poor’s 500 Index went from up 2.9 percent to down 1.4 percent, closing at 1,867.61 as most of the selling occurred after 2 p.m.

“People are nervous about the potential volatility that could erupt or resurface in the market,” said Stephen Carl, principal and head equity trader at Williams Capital Group LP. “They’re not sure what’s going to happen overseas, and that uncertainty is winning out.”

The unwinding disappointed bulls who earlier in the day staked hopes on China’s efforts to inject stimulus into its economy. The central bank today cut interest rates for the fifth time since November and lowered the amount of cash banks must set aside in an attempt to stem the country’s biggest stock market rout since 1996 and a deepening economic slowdown. More than $2 trillion has been erased from American equity values since last Wednesday, breaking a calm in a stock market that before this week had gone almost four years without a 10 percent correction....MORE

http://www.bloomberg.com/news/articles/2015-08-25/citi-the-fed-will-still-hike-in-september-but-there-s-one-big-wild-card-ahead

THE ARTICLE THAT KILLED THE RALLY

Pay close attention to Fischer--Citi is sticking with its call that the Federal Reserve will hike its policy rate next month. The bank's economists, led by William Lee, interpreted the Federal Reserve's July minutes differently from other institutions, claiming that monetary policymakers' increased concerns about financial stability cemented the case for a hike in September. Others institutions have recently pushed back their estimated dates for liftoff in light of international developments and volatility in financial markets emanating from China's decision to devalue the yuan.

Federal funds futures rates imply that the probability of a rate hike has slipped below 30 percent, down substantially from roughly 50 percent last week. So what could move Citi off its September call? China could theoretically serve as a "bunker buster" - but for now, it doesn't look like a big enough deal. However, Fed Vice Chair Stanley Fischer's appearance at the forthcoming Jackson Hole economic policy symposium is the "key wild card," says Lee.

"If he shows signs of worrying that the transitory downward pressures (commodity and energy prices and the appreciating dollar) are feeding through and becoming entrenched in wages and domestic prices—THAT would be a big event," the economist writes. "His concern would suggest reduced confidence in reaching the Fed inflation target in the medium term."

Insiders Pushed Up Stock Purchases Heading Into S&P 500 Selloff

http://www.bloomberg.com/news/articles/2015-08-25/insiders-pushed-up-stock-purchases-heading-into-s-p-500-selloff

One set of investors who weren’t shy about diving into the stock market in the runup to the current selloff was corporate insiders.

A total of 1,341 officers and directors of American companies purchased their own stock this month while 2,013 sold, according to data compiled by Washington Service and Bloomberg. The ratio of buyers to sellers is poised to reach the highest level since 2011 after more than doubling since April.

The actions aren’t looking very well timed at the moment with the Standard & Poor’s 500 Index sitting more than 6 percent below its average price in August. Still, the buying was at least a vote of confidence in a bull market whose durability has been called into question amid signs of global slowdown and the end of Federal Reserve stimulus.

“Maybe the executives recognize a correction can happen, but they believe in their business enough in terms of longer term to just go ahead and buy in front of it,” said Charles Smith, chief investment officer at Fort Pitt Capital Group Inc. in Pittsburgh, which oversees about $1.8 billion. “That’s bullish.”

OR MAYBE THEY'VE BEEN DRINKING THE KOOLAID....MORE

http://www.bloombergview.com/articles/2015-08-24/how-serious-is-the-stock-market-s-decline-

China's markets set the tone for the day (and perhaps the week) with an 8.5 percent blood-letting. Global stocks followed suit, which came after last week's 5 percent tumble. Rather than tell you that markets are oversold -- you already know that anyway, and oversold markets can become even more oversold -- I want to bring a few interesting data points to your attention...Let's begin with China's markets. That is where much of the turmoil seems to be originating. A little context will go a long way.

One year ago, the Shanghai Stock Exchange Composite Index stood at 2209.46; it's now 3209.91. It closed last year at 3234.67, and peaked this year at 5166.35. To put those returns into percentages:

One year: +45.28 percent

Year to date: -0.77 percent

Year to date peak: +60.95 percent

Peak to trough: -37.87 percent

It is amazing that China is little changed for the year, down less than 1 percent. That gives you some idea of how absurdly inflated its markets had become in a very short time. Its easy money policies and encouragement of middle-class stock speculation (Why does that sound so familiar?) inflated a market boom that (Surprise!) is now unwinding. What those number show is quite telling.

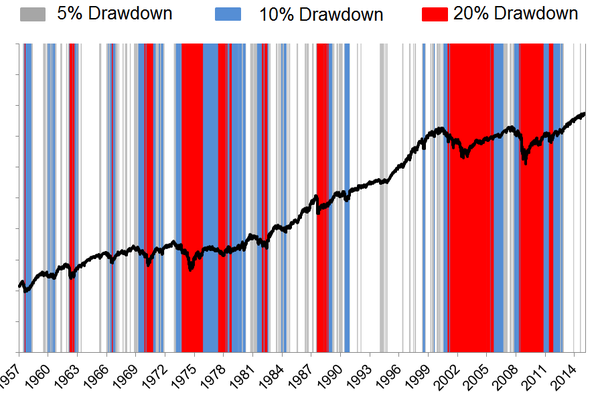

Next, let's move to U.S. The chart below is courtesy of my colleague Josh Brown. It looks at the 5 percent, 10 percent and 20 percent declines in the Standard & Poor's 500 Index since its inception in 1957. There are several fascinating aspects to this data series.

S&P 500 1957 to present drawdowns

Source: The Reformed Broker

First, let's start with the data: From all-time highs, we have seen 48 drawdowns of at least 5 percent. Of that group, a little more than a third of those became a full correction of 10 percent. (That's 17 of the 48, or 35 percent). Of all declines of 5 percent or more, less than one fifth (9 of the 48, or almost 19 percent) became drawdowns of 20 percent or more, the informal definition of a bear market.

If you had to break this 58-year period into market cycles, it is fairly easy to find the secular bull and bear markets just going by the colors. The post-World War II bull market has little of the blue or red corrections, right up until 1968-69 or so. Then we see the colorful period of 1968-1982, a brutal 16-year bear market. That is followed by the bull run from 1982 to 2000, with little in the way of blue or red. From 2000 to 2013, the wide swatch of red tells you that was a bear market. But since then we appear to be in a bull cycle. Charts such as this make it relatively easy to spot cycles visually. Indeed, this is consistent with what we know about secular bear markets, which tend to be characterized by frequent sharp rallies and severe sell offs.*

Ben Carlson (using Ed Yardeni's data) looks at this data somewhat differently. He observes that the average number of double-digit drawdowns has generally been lower each decade since the 1930s. It's noteworthy that the average double-digit decline of the 2000s was even worse than the 1930s, at least in terms of intensity.

Carlson notes how the recency effect leads investors to focus on the wrong things: "Stocks are up over 200% since March of 2009. Instead of celebrating those gains, investors are constantly worried about missing the next 5-10% correction."

Finally, let's put into broader context the frequency of corrections. U.S. markets average one 10 percent correction every 20 months. On average, we should expect these declines to take 71 trading days to play out (about three months).

As discussed above, these occur more frequently during secular bear markets. In the postwar period, one quarter of these occurred during the 1970s and another fifth of them occurred during the 2000s -- both periods were part of a secular bear market.

Note that in the secular bull market that began 1982, there was but one 10 percent correction in the first five years (1982 through the 1987 crash). After the 1987 crash through the March 2000 peak, there were just two corrections of that magnitude, according to Yardeni. As we noted last week, the economy seems to be OK, so this looks more like a correction than anything more serious, but that's just a guess on my part. We should know before the December Federal Open Market Committee meeting.

* For the purposes of our discussion, I am using 10 percent for a "correction," 20 percent for "bear market," and 30 percent for "crash," and 50 percent for "generational crash." These terms are random fabrications with no real meaning other than reflecting our base-10 numeric system.

Stocks in early stages of bear market: Ned Davis

http://www.cnbc.com/2015/08/25/stocks-in-early-stages-of-bear-market-ned-davis.html

In the midst of the Dow's largest three-day point decline in history, one market research firm moved assets to bonds from stocks.

"Given the extent of indicator deterioration, last week's action has moved us closer to the latter conclusion (that the stock market is in the early stages of a bear market)," Ned Davis Research said in a note early Monday.

"The equity downgrade is primarily a response to the mounting risk indicated by our Global Balanced Account Model," the note said...

http://www.cnbc.com/2015/08/25/make-your-wish-list-for-the-next-crash-najarian-commentary.html

As the Dow, S&P 500 and Nasdaq slammed down on the open Monday, we got a firsthand look at what indiscriminate selling looks like.

The initial trigger was a likely a combination of spillover from Asian and European markets. As these closed at their lows, traders who provided exits (were buyers) had to hedge that long exposure as best they could and that meant selling in U.S. pre-market as well as on the open. This pressure took futures down triple digits which, I imagine, panicked some investors and they entered orders to sell their long positions and cut the pain.

Some were likely prudent enough to offer these trades at a limit price, but a host of others and a clear majority must have entered market orders, meaning they would sell at ANY price. It's this indiscriminate selling, from these individuals and from brokers selling to satisfy margin calls that put the turbo on the market selloff.

In virtually every case we examined using our Heat Seeker technology, the opening price of securities was 3 percent to 7 percent above the lowest traded price, which came within mere moments of the 9:30 am open. Apple for instance opened at $94.87 but immediately traded to $92 (down 3 percent). Facebook opened at $77.03, but traded to $72 (down 6 percent) in minutes. It was this second leg down that took market losses to a paper loss of $1.2 trillion just after the open.

Despite the haphazard selling, some, including our wealth-management firm elected to be buyers on the open. I imagine one reason the buyers jumped in was they were adhering to the Warren Buffett adage, "buy when others are fearful." While this certainly played into our thought process, the primary reason we punched the "buy" button was because stocks on our wish list, which included Disney, Facebook, Exxon-Mobile and Apple were indicated for sale at 2 times the broad market distress. In plain English, if the S&P 500 was selling down 4 percent why was Apple, which closed Friday at $105.76 being indicated at $98, a drop of 7 percent? Or Facebook, which closed at $86.06 being indicated at $77, a drop of 10 percent? To us, this was THE opportunity we had waited for and why we'd kept dry powder....

The Stock Market’s Dive Is Global and Rational By John Cassidy

http://www.newyorker.com/news/john-cassidy/the-stock-markets-dive-is-global-and-rational?mbid=nl_082515_Daily&CNDID=26139401&spMailingID=8014206&spUserID=MzkxMjA1MjAwODQS1&spJobID=743022122&spReportId=NzQzMDIyMTIyS0

In any stock-market dive, two questions immediately arise: How far will it go? And is it justified on the basis of economic fundamentals? Obviously, the two questions are connected, but they aren’t the same.

The only sensible answer to the first question is: “I don’t know.” As the late Paul Samuelson once observed, when a financial market starts falling sharply we move into the realm of the physics of landslides: things become complicated and unpredictable. In some cases, the market’s fall can feed on itself, as it did on Monday, October 19, 1987, when the Dow Jones Industrial Average fell 22.6 per cent. A computer-trading strategy known as “portfolio insurance”—which was originally designed to limit investors’ losses—generated huge sell orders in the futures market, which led to further losses on the New York Stock Exchange, which led to more selling in the futures market. And so on.

In other cases, the falling market reaches a resistance level, and buyers emerge to limit the losses. So far, this swoon, which began last week, looks to be of the benign type, with few signs of outright panic. On Friday, following sharp falls in overseas markets, the Dow fell more than five hundred points, or about 3.1 per cent. On Monday, it fell about a thousand points as soon as it opened, then regained about half of its losses and held on from there. It closed at 15,871.35, a fall of 3.6 per cent. In the course of the past week, it is down 9.5 per cent. That’s a big tumble, to be sure. But the market hasn’t seen a significant correction since 2011, and we were due for one.

Obviously, things could get worse. Whether they do or not depends on whether, in the next few days, the turmoil in the Chinese market continues and signs of financial distress emerge here at home—for example a big hedge fund or financial institution getting into trouble. Bull markets, such as the one Wall Street has enjoyed for the past six years, generate a great deal of risk-taking, which often involves using some hidden type of leverage to enhance returns. As Warren Buffett famously remarked, “Only when the tide goes out do you discover who’s been swimming naked.”

The answer to the second question I raised above, about economic fundamentals, is that the market’s fall is perfectly justified. In a sharp post on Sunday, my colleague James Surowiecki pointed out that stock prices have been rising steadily in relation to earnings. For a quite a while now, analysts who take seriously such valuation ratios as the price-to-earnings ratio and Tobin’s “q” ratio (which measures the price of investment assets relative to their replacement cost) have been warning about a crack in the market. Back in February, Andrew Smithers, a London-based analyst, warned that the U.S. market was trading seventy per cent above its fair value. In May, Bob Shiller, a well-known economist who teaches at Yale, said that there was a “bubble element” to the valuations present in the market.

As always, the issue is timing. Raging bull markets usually go on for longer than skeptics (such as myself) predict that they will, and they rarely end of their own accord. Sometimes, the precipitating event is the prospect or reality of the Federal Reserve deciding to raise interest rates. (That’s what happened in 1987 and 2000.) On other occasions, it takes some sort of shock, such as the collapse of Lehman Brothers, to set things off.

On this occasion, there was a surfeit of proximate causes. For one thing, the era of zero-per-cent interest rates and ultra-cheap money appears to be coming to an end. With G.D.P. growth picking up a bit after another slow start to the year, Wall Street expects the Fed to start raising rates either next month or in December. Then there is what’s happening in the developing world. It’s not just that the Chinese economy is slowing down and prompting the government in Beijing to take countervailing measures, such as trying (and so far failing) to prevent a stock-market bubble from bursting. Brazil is in terrible shape and may be headed for a financial crisis. The Russian economy, hit by sanctions and a collapsing oil price, is also in a slump. Of the original BRIC countries, only India looks to be in good shape.

Even in a country such as the United States, which has a relatively small trade sector compared to many other nations, a “hard landing” for the world economy would negatively impact G.D.P. growth. (Although the big fall in the oil price should offset this somewhat, by boosting consumers’ spending power.) And for U.S.-based multinational companies, which make up the bulk of the Dow and S&P 500, a sustained global slowdown could have a very large impact on revenues and profits. That alone probably justifies the trim applied to stock-market valuations in the past few days.

In short, the economic outlook has dimmed. Global stock markets, which had risen sharply during a prolonged period of easy money, needed to fall to reflect this new reality. That’s what’s happening now, and, given the way markets work, there is always the possibility that they will overshoot on the downside....

Demeter

(85,373 posts)DEMETER'S ONE FINANCIAL THEOREM---EVERYTHING GOLDMAN SACHS SAYS IS A LIE--TAKE THE OPPOSITE MEANING!

http://www.marketwatch.com/story/why-goldman-thinks-the-sp-500-is-headed-for-an-11-rebound-2015-08-25

READS LIKE A GOSSIP COLUMN...GO SEE

Demeter

(85,373 posts)August 24, 2015: Markets opened lower by nearly 1,100 points on Monday after a rotten night in Shanghai and a equally rotten morning in Europe. Only 22 stocks on the NYSE traded in the green minutes after the opening bell this morning. But from a low of around 5% down, the Dow 30 came back strong to trade nearly flat before sinking again as the closing approached. WTI crude settled below $39 a barrel and Brent traded at around $43 a barrel. Shortly before the closing bell the DJIA traded down 2.34% for the day, the S&P 500 traded down 2.83%, and the Nasdaq Composite traded down 2.44%.

The DJIA stock posting the largest daily percentage loss ahead of the close Monday was UnitedHealth Group Inc. (NYSE: UNH) which traded down 4.10% at $111.51. The stock’s 52-week range is $80.72 to $126.21. Trading volume was more than 50% higher than the daily average of around 4.1 million. The company had no specific news today.

Exxon Mobil Corp. (NYSE: XOM) traded down 3.51% at $69.60. The stock’s 52-week range is $66.55 to $100.31, and the low was posted today. Trading volume was more than double the daily average of around 12 million. The company had no specific news today, but low crude oil prices hammered the stock.

McDonald’s Corp. (NYSE: MCD) traded lower by 3.06%% at $94.15. The stock’s 52-week range is $87.50 to $101.88, and the low was set today. Trading volume was more than double the daily average of around 5.4 million. Like nearly every other equity today, McDonald’s had no news, it just happened to be in the way of sellers.

The Goldman Sachs Group Inc. (NYSE: GS) traded down 2.80% at $182.49. The stock’s 52-week range is $171.26 to $218.77. About 5.4 million shares traded hands today, more than double the daily average of about 2.5 million. The company is the most heavily weighted of the Dow 30 stocks at 7.62% of the index’s value. All 30 Dow stocks are on track to close lower today.

StoneCarver

(249 posts)I appreciate your posts. You give us the data. But I do miss (guiderglider, dixiegirl, grirlgonemad, warpy, etc.) the people telling us what it all means. I think the data are pretty overwhelming this is a correction -not a crash. the easy money is gone. Sorry you MTF-ing day traders. The discount window will have an interest rate charge -and thankfully a cost for future investments. This will bring discipline to the markets once again. After it all settles, it will be time to invest again. Companies are worth money because they make money -period! (Remember those crazy dot.com companies? where the P/E's were zero?)

The "smart money" was out two months ago when Bill Gross recommended "pulling some money off the table". I wish more people listened to Bill Gross and Mohamed El-Eiran (PIMCO). Thanks Bill and Mohamed. A few people have your backs.

Stonecarver

Joe Chi Minh

(15,229 posts)Demeter

(85,373 posts)Joe Chi Minh

(15,229 posts)Roland99

(53,342 posts)Demeter

(85,373 posts)If U.S. stocks extend their losses, traders will get a moment to catch their breath.

The thousands of companies listed by the New York Stock Exchange and Nasdaq Stock Market will pause for 15 minutes if the Standard & Poor’s 500 Index plunges 7 percent before 3:25 p.m. New York time. The benchmark got close earlier, falling as much as 5.3 percent.

Market-wide circuit breakers were installed after the 1987 crash to prevent losses from snowballing. The levels that trigger a halt have varied over the years, with a rule change in 2013 lowering the threshold to 7 percent.

The S&P 500 pared its drop to 2.5 percent at 11:38 a.m. New York time on Monday, slumping to 1,921.22. It would take a retreat to 1,832.92 to initiate the automatic pause today, according to NYSE spokeswoman Sara Rich.

Another circuit breaker kicks in if the S&P 500 extends its losses to 13 percent before 3:25 p.m. If the plunge reaches 20 percent at any point during today’s session, the entire stock market will shut for the rest of the day.

Demeter

(85,373 posts)I HAVE SOME SUGGESTIONS!

1. DECLARE PEACE IN YEMEN AND GET OUT

2. STOP FUNDING TERRORISM AND OVERTHROW OF GOVERNMENTS

3. PUT THE HOUSE OF SAUD ON A BUDGET

http://www.bloomberg.com/news/articles/2015-08-25/saudi-arabia-said-to-seek-advice-on-budget-cuts-after-oil-s-rout-idrana9e

Saudi Arabia is seeking advice on how to cut billions of dollars from next year’s budget because of the slump in crude prices, according to two people familiar with the matter.

The government is working with advisers on a review of capital spending plans and may delay or shrink some infrastructure projects to save money, the people said, asking not to be identified as the information is private. The government is in the early stages of the review and could look at cutting investment spending, estimated to be about 382 billion riyals ($102 billion) this year, by about 10 percent or more, the people said. Current spending on areas such as public sector salaries wouldn’t be affected, the people said.

The Arab world’s largest economy is expected to post a budget deficit of almost 20 percent of gross domestic product this year, according to the International Monetary Fund. With income from oil accounting for about 90 percent of revenue, a more than 50 percent drop in prices in the past 12 months has put pressure on the nation’s finances. The country has raised at least 35 billion riyals from local bond markets this year, the first time it has issued securities with a maturity of over 12 months since 2007.

“This is a response to the lower oil prices but also to the fact that capital spending has been growing strongly over the past few years,” Fahad Alturki, chief economist and head of research at Jadwa Investment Co., said by phone from Riyadh Tuesday. “Although a cut in capital spending will impact economic growth, the non-oil sector is not as reliant on government spending as it was 20 or 30 years ago.”

MORE

Demeter

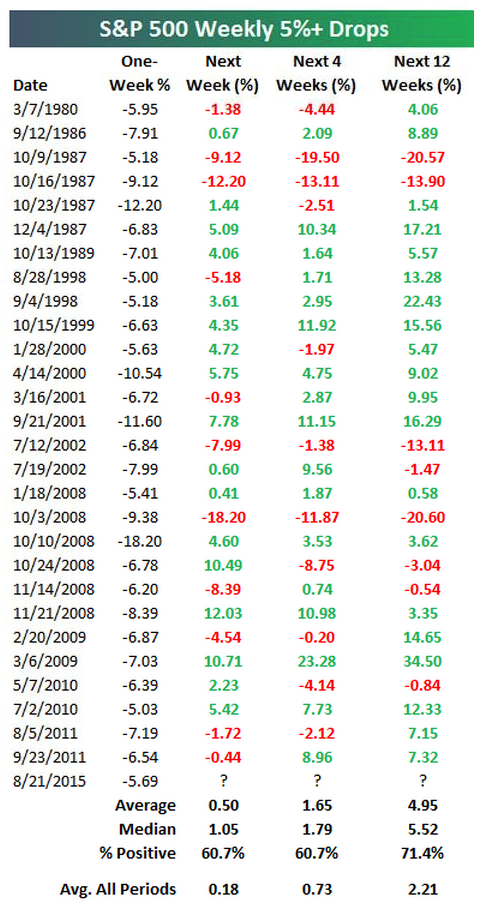

(85,373 posts)Last week was a brutal one for the Standard & Poor's 500 index, with stocks tumbling more than 5 percent for the first time since 2011. The bloodbath is continuing today.

As Bespoke Investment Group points out, a weekly drop of more than 5 percent has only happened 28 other times since 1980. If you're trying to decide what to do this week, maybe Bespoke's chart will help. It gives you a look at what happened in the S&P 500 in the weeks following a 5 percent decline. On average, the market is relatively flat the next week, up 1.65 percent over the next four weeks, and up close to 5 percent over the next 12 weeks. Also important to note is that 60 percent of the time, the index moves higher the following week.

Some of the standout years include huge drawdowns of more than 20 percent over the next 12 weeks in 1987 and 2008. On the opposite side of the spectrum, there were massive turnarounds in 1998 and 2009.

Demeter

(85,373 posts)If it's true that the market hates uncertainty, than the Federal Reserve is on its way to becoming public enemy No. 1.

Wall Street can't seem to make up its collective mind about when the U.S. central bank is going to start raising interest rates, with strategists and economists stuck on September and traders focused on a later date, possibly not until 2016.

The latest salvos in the intensifying debate came from Citigroup and JPMorgan Chase, both of which opined Tuesday that the first rate hike in nine years likely will come next month.

"Notwithstanding the declining probability for a September move priced in the fed funds market, signs of market containment and lack of prolonged global systemic fallout implies the September timetable for a Fed liftoff remains," William Lee, head of North America economics at Citigroup, said in a note to clients.

MORE

Demeter

(85,373 posts)Aug 21 (NYT) — Rand Paul said something funny the other day. No, really — although of course it wasn’t intentional. On his Twitter account he decried the irresponsibility of American fiscal policy, declaring, “The last time the United States was debt free was 1835.”

Which consequently was followed by the worst depression in US history.

But is the point simply that public debt isn’t as bad as legend has it? Or can government debt actually be a good thing?

Believe it or not, many economists argue that the economy needs a sufficient amount of debt out there to function well.

Yes, to offset desires to not spend income (save) when private sector borrowing to spend isn’t sufficient, as evidenced by unemployment.

Yes, it’s called unemployment, which is the evidence that deficit spending is insufficient to offset desires to not spend income. Something economists have known by identity for at least 300 years.

But the power of the deficit scolds was always a triumph of ideology over evidence, and a growing number of genuinely serious people — most recently Narayana Kocherlakota, the departing president of the Minneapolis Fed — are making the case that we need more, not less, government debt.

Why?

This is the right answer- because the US public debt, for example, is nothing more than the dollars spent by the govt that haven’t yet been used to pay taxes. Those dollars constitute the net financial dollar assets of the global economy (net nominal savings), as actual cash, or dollar balances in bank accounts at the Federal Reserve Bank called reserve accounts and securities accounts. Functionally, it is not wrong to call these dollars the ‘monetary base’. And a growing economy that generates increasing quantities of unspent income likewise needs an increasing quantity of spending that exceeds income- private or public- for a growing output to get sold.

Wrong answer. It’s never about ‘when the price is right’. It is always a political question regarding resource allocation between the public sector and private sector.

Wrong answer. Yes, there is a serious infrastructure deficiency. The right question, however, is whether the US has the available resources and whether it wants to allocate them for that purpose.

I agree it’s a good time to fund infrastructure investment, due to said deficiencies.

However, whether or not it’s a good time to increase deficit spending is a function of how much slack is in the economy, as evidenced by the unemployment rates, participation rates, etc. And not by infrastructure needs.

And my read based on that criteria is that it’s a good time for proactive fiscal expansion.

Nor in any case is deciding whether or not to increase deficit spending rightly about whether or not to increase borrowing per se for a government that, under close examination, from inception necessarily spends or lends first, and then borrows. As Fed insiders say, ‘you can’t do a reserve drain without first doing a reserve add.’

Wrong, they are telling is something about what level market participants think the fed will target the Fed funds rate over time.

Right answer- deficit spending adds income and net financial assets to the economy to support sufficient spending to get the output sold.

Wrong answer. Net govt spending provides in the first instance provides dollars (tax credits) in the form of dollar deposits in reserve accounts at the Federal Reserve Bank. Treasury securities are nothing more than alternative deposits in securities accounts at the Federal Reserve Bank for those dollars. Both are equally ‘safe’.

But all of that supposedly brilliant financial engineering turned out to be a con job: When the housing bubble burst, all that AAA-rated paper turned into sludge. So investors scurried back into the haven provided by the debt of the United States and a few other major economies. In the process they drove interest rates on that debt way down.

Rates went down in anticipation of future rate setting by the fed.

What investors did was reprice financial assets. Investors can’t change total financial assets. The total only changes with new issues and redemptions/maturities.

True, but cutting rates doesn’t fight recessions. In fact low rates reduce interest income paid by govt to the economy, thereby weakening it.

That would be evidenced by an increase in the issuance of higher risk securities, but there has been no evidence of that. In fact, it was $100 oil that at the margin drove the credit expansion that supported GDP growth, as evidenced by the collapse when prices fell.

It would more likely very modestly strengthen it from the increase in the govt deficit due to the increased interest income paid by govt to the economy. However, I’d prefer a tax cut and/or spending increase to support GDP, rather than an interest rate increase. But that’s just me…

Mr. K isn’t wrong, but again I’d rather just have a larger tax cut to get to the same point, but, again, that’s just me…

True, and this author…

True but for differing reasons. It’s never about investors pleading. It’s always about the public purpose behind the policies.

The larger problem with this editorial is that the wrong reasons it gives for what’s largely the right policy are out of paradigm reasons that the opposition routinely shoots down and shouts down, easily convincing the electorate that they are correct and the ‘headline left’ is wrong.

Feel free to distribute

http://moslereconomics.com/2015/08/22/krugman-on-debt/

Roland99

(53,342 posts)Nasdaq 4,698 +192 4.25%

S&P 500 1,941 +73 3.93%

GlobalDow 2,311 +39 1.69%

[font color="red"]Gold 1,124 -1 0.05%[/font]

Oil 39.08 +0.48 1.24%

Demeter

(85,373 posts)Mark me as not impressed. The wheel is still rigged, the table crooked, and we are screwed.