Economy

Related: About this forumSTOCK MARKET WATCH -- Tuesday,16 June 2015

[font size=3]STOCK MARKET WATCH, Tuesday, 16 June 2015[font color=black][/font]

SMW for 15 June 2015

AT THE CLOSING BELL ON 15 June 2015

[center][font color=red]

Dow Jones 17,791.17 -107.67 (-0.60%)

S&P 500 2,084.43 -9.68 (-0.46%)

Nasdaq 5,029.97 -21.13 (-0.42%)

[font color=red]10 Year 2.35% +0.03 (1.29%)

30 Year 3.09% +0.04 (1.31%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)Greek premier Alexis Tsipras threatens Europe's creditors with a "big no" unless they yield on debt servitude... The radical wing of Greece's Syriza party is to table plans over coming days for an Icelandic-style default and a nationalisation of the Greek banking system, deeming it pointless to continue talks with Europe's creditor powers.

Syriza sources say measures being drafted include capital controls and the establishment of a sovereign central bank able to stand behind a new financial system. While some form of dual currency might be possible in theory, such a structure would be incompatible with euro membership and would imply a rapid return to the drachma.

The confidential plans were circulating over the weekend and have the backing of 30 MPs from the Aristeri Platforma or 'Left Platform', as well as other hard-line groupings in Syriza's spectrum. It is understood that the nationalist ANEL party in the ruling coalition is also willing to force a rupture with creditors, if need be.

"This goes well beyond the Left Platform. We are talking serious numbers," said one Syriza MP involved in the draft.

"We are all horrified by the idea of surrender, and we will not allow ourselves to be throttled to death by European monetary union," he told the Telegraph. MORE

BETTER 6 MONTHS LATE THAN NEVER....

mother earth

(6,002 posts)people. This is one highly informative article.

From your link above:

Tasos Koronaki, the party secretary, said on Sunday that attempts to split the party will fail. "The government will not enter into any agreement that is not accepted by the parliamentary group. We are more united than ever," he said.

Finance minister Yanis Varoufakis told Greek television that his country cannot accept an "unachievable fiscal plan" and warned creditors that the minimum damage from Grexit would exceed €1 trillion for the European financial system.

Syriza's Left Platform has studied the Icelandic model, extolled as a success story by the International Monetary Fund itself.

"The Greek banks must be nationalised immediately, along with the creation of a bad bank. There may have to be some restrictions on cash withdrawals," said one Syriza MP.

"The banks will go ape-s*** of course. We are aware that there will be a lot of lawsuits but at the end of the day we are a sovereign power," he said.

Deposit outflows from the banks are running near €400m a day and could at any moment turn into a national bank run. This is alarming in one sense, but it has advantages for Syriza hard-liners.

The immediate problem is landing in the lap of the European Central Bank, which has had to raise its emergency liquidity support (ELAs) for the Greek banks to €83bn. The ECB is ever further on the hook.

While Greek citizens are hiding their money in mattresses or parking it in foreign accounts, the wealth still exists and could be used to replenish new banks in the future.

"The more the deposit flight goes on, the easier Grexit will be," said one Syriza MP. "It is a trump card," said another.

mother earth

(6,002 posts)Going the Icelandic route is no doubt the best way for Greece at this point, yet there is so much folly in the EU for not trying to keep Greece in...they underestimate what this move brings.

Demeter

(85,373 posts)Demeter

(85,373 posts)Puerto Rico is mired in debt and facing default. And US colonialism is one of the main culprits...Puerto Rico, a de facto colony of the US, is usually not in the news outside of the travel and style sections. But as it stumbles towards a September default deadline that threatens to shut down government operations, the island territory has been a fixture in the business press, with headlines like: “Puerto Rico Faces Tough Choices Ahead,” “Puerto Rico Power Authority Deadline Extended,” and “A Desperate Puerto Rico Raises $1.2 Billion in Short-term Financing.”

According to the neoliberal narrative, the rapidly intensifying economic crisis is an open and shut case: Puerto Rico, legally an unincorporated territory of the US, is caught in a debtor’s trap of borrowing to pay for essential operations. And now the bill is coming due. Bloomberg Business likens it to a “consumer using one credit card to pay off another.” But the real story is more complicated, and more connected to Puerto Rico’s colonial relationship with the US. Over the years, the US has treated Puerto Rico as a laboratory for population control, conducted naval war games on the island nation for possible Middle East interventions, and used it as a pre-NAFTA staging ground for corporate megastores to develop consumer bases and exploit low-wage labor. Hitting the island in 2006, Puerto Rico’s economic recession was the culmination of decades of US policies that distorted economic development.

After the US seized the island from Spain at the turn of the nineteenth century, it began destroying Puerto Rico’s agricultural economy — an informal mix of subsistence farmers and small landowners — by allowing US corporations to buy up most of the arable land. By the 1940s, with a militant nationalist movement pushing for independence, the US drew up a plan called “Operation Bootstrap,” replacing the agricultural economy with one powered by light manufacturing, tourism, and services. Designed to enrich US corporations, the economic approach momentarily produced a small middle–class, and throughout the Cold War the US showcased Puerto Rico as an anticommunist alternative to Cuba. Yet because of its colonial status, Puerto Rico was never allowed to negotiate bilateral trade agreements and has had to adhere to fiscal policy directed by the US. External control and extraction of profits stunted the country’s productive base, leading to an economic crisis that the pro-independence left had long predicted.

While Puerto Rico’s problems are often portrayed as having begun with the 2006 recession, its pattern of borrowing to keep the economy afloat began over thirty years ago. In the 1980s, as the mainland recession dragged down Puerto Rico’s economy, the government began taking out loans from US banks to cover deficits. This was compounded by the ten-year phaseout, starting in 1996, of the notorious Section 936 of the IRS tax code, which was designed to stimulate job creation but instead enabled mass cash outflow from the island. (Even today there are stories of bags of cash being driven from the island’s overflow of Walmarts directly to the Luis Muñoz Marín Airport.) Still, Puerto Rico isn’t merely a case of a battered and defenseless island territory being gutted by rapacious outside interests. University of Puerto Rico economics professor Argeo Quiñones Pérez said has doubts about a simple North-South explanation:

This would explain the recent move by Puerto Rico’s centrist governor, Alejandro García Padilla, to raise the sales tax to 11.5% (the highest in the union) from the current 7.5%. Padilla’s austerity agenda, which includes cutbacks in public sector employment, is harming workers already reeling from a 13.7% unemployment rate — especially since the government is now the country’s largest employer, following the exodus of pharmaceutical giants like Pfizer and Lilly and the ongoing shuttering of Sears outlets.

Pacts between US corporations and local elites are not unusual in Latin America, nor are the problems facing Puerto Rico — violent crime, emigration, and economic crisis — that recent. The debt crisis is also not making headlines in the mainstream and business press because the US’s colonial experiment is finally being recognized as an abject failure.

Instead, the newsworthiness of the debt crisis stems from the fact that US investors, acting through hedge funds, are heavily invested in bonds issued by Puerto Rican government agencies, which owe a substantial chunk of the $73 billion. To help service this debt, Puerto Rico began floating bonds that attracted American “mom and pop” investors looking to the municipal bond market to enlarge their retirement nest egg. They were lured by the triple-tax-exempt status of Puerto Rico government-issued bonds (interest paid is free of all city, state, and federal taxes). These investments are now in jeopardy in part because Puerto Rico is having difficulty paying pensions to its government workers — the country currently faces a $34 billion shortfall.

Puerto Rico has thus gotten caught up in a high-stakes financial casino game where its stunted economy and small domestic market fuel manic investing that seeks to avoid taxation at all costs. Like the drunken sailors that once mobbed Havana’s jazz bars, hedge funds such as UBS, Franklin Templeton, and Oppenheimer have rolled the dice that investing in Puerto Rico’s debt will pay off big. But this has created economic chaos. According to the Center for a New Economy (CNE), a moderate Puerto Rican think tank, the ratio of total government debt to GNP grew from about 30% in 1962 to 74% in 1975. Although it decreased to about 60% by 2000, CNE director Sergio Marxauch says that by 2012 the ratio had risen to 100.6%. Puerto Rico’s economy is clearly unsustainable, barely able to generate enough capital to service its debt. When the island began to struggle with its bond payments, Wall Street banks like Barclays and Morgan Stanley swooped in to extract billions in underwriting fees and unfavorable debt swap termination fees.

The exacting toll of hedge fund investors and debt restructuring costs has deepened Puerto Rico’s economic troubles. There’s been a series of downgrades by the same agencies (Standard & Poors) accused of unethically propping up investment ratings of investment houses that played a major role in the 2008 recession. And according to official records, in 2012, the government gave Wall Street banks $4.1 billion in bond payments (principal and interest), derivatives, and issuance costs, or five times what it spent on economic development. Meanwhile, urgent needs like repairing crumbling infrastructure and investing in alternative forms of energy — given the severe crunch at the Puerto Rico Power Authority, which is on the brink of default — have been mostly ignored, save for when the Obama administration briefly distributed federal stimulus funds.

Puerto Rican bonds’ triple-tax-exempt status, which attracted speculators from investment houses like the Oppenheimer Fund, is a product of the country’s colonial relationship with the US. While the tax benefit is only available in certain US states (and one must be a resident of that state to receive it), all municipal bonds issued by US territories and possessions carry the liberal exemption.

Local interest rates have been driven even higher by inflated rates caused by the debt crisis. To add insult to injury, the recent credit downgrades allowed Wall Street to demand hundreds of millions more in short-term lending fees, credit-default-swap termination fees, and higher interest rates. (Between 2012 and 2014, Puerto Rico paid nearly $640 billion to terminate swaps in addition to $12 million annual swap payments.)

Last month, the Puerto Rican Government Development Bank said that it might have to forgo debt-servicing payments starting in September 2015. This contradicts a previous statement by García Padilla that any talk of not repaying debts is “folly,” and it could simply be a ploy to coax intervention from a US government (which while slow to act thus far, will ultimately want to avoid the bad publicity of its colonial experiment collapsing). Regardless, the possible moratorium avoids the root of the problem, and is just a band-aid for a hemorrhaging system.

As Quiñones Pérez told me, “If we keep doing the same things that brought us here, we will surely reach default. Austerity will only make the crisis more profound.”

The government’s response to the debt crisis has been sluggish at best. While the tenure of García Padilla’s predecessor, Luis Fortuño, included severe cuts in government employment and Scott Walker–like repression of labor and student protests, García Padilla has embraced a milder form of austerity that nevertheless values privatization and deficit reduction over inequality reduction.

His administration has been unabashedly pro-business: at a April 2014 conference, the secretary of development and commerce, Alberto Bacó, pitched Puerto Rico as a tax shelter for renegade billionaires — the “Singapore of the Caribbean.”

Opening the island up to more external investment capital has also been one of the administration’s central priorities. Puerto Rico’s February 2015 summit, designed to attract US investors, featured former New York City mayor Rudolf Giuliani — peddling his Giuliani Partners consultancy — as its keynote speaker. Giuliani’s appearance, according to Bacó, “reinforces the international recognition of our government’s commitment to economic growth.” A more recent iteration of the event, held in May, focused on investors from Latin America and Spain.

When he isn’t buttering up billionaire hedge-fund managers, García Padilla has focused his attention on trying to restructure the country’s debt in an attempt to protect the country from bankruptcy or default, something it cannot technically do under US law.

Yet while García Padilla is promoting tax breaks and a corporate rate as low as 4 percent — and favors balancing the budgets on the backs of unionized workers like teachers — business has taken umbrage at this move: his La Ley de Quiebra Criolla (The Law of Boricua Default) was immediately challenged by two lawsuits, one filed by Blue Capital Management, and another by Franklin Funds and Oppenheimer Rochester Funds, who together hold about $1.7 billion in bonds issued by the Puerto Rico Electric Power Authority (PREPA).

In February, district court ruling struck the law down as unconstitutional, but Puerto Rico’s government has appealed the decision. A new proposal by the government attempts to restructure PREPA’s debt, but will most likely lead to further rate increases for consumers.

Both Padilla and Pedro Pierluisi, the leader of the pro-statehood party, have advocated for bill called the Puerto Rico Chapter 9 Uniformity Act, but it has languished in the House since February. The business community clearly objects, but even if it passed, it would just mean further severe austerity. The legislation is designed to allow government entities to restructure their debts to get around the lack of bankruptcy protection. Yet that process would most likely entail further cuts in services and pensions.

“If you were to tell me that this law is part of a context where there is major reform of the political and economic system and social relations then I would say, ‘this looks like Argentina’s process,’” Quiñones says. “But this looks more like Detroit — their strategy is to drastically cut retirement funds.”

Puerto Rico’s government, unlike Argentina’s, has shown itself far less willing to confront the unfairness of the US’s economic hegemony and far more willing to follow the neoliberal model of shifting the burden onto workers. Even worse, it cannot file for bankruptcy like Detroit.

Neoliberal prescriptions for righting Puerto Rico’s economic course are pretty consistent. A recent Federal Reserve Bank of New York report entitled “An Update on the Competitiveness of Puerto Rico’s Economy” suggested “Steps Toward Fiscal Sustainability” like stimulating economic growth, reforming the tax collection system (Puerto Rico has a vast underground economy), cracking down on public sector corporations, and of course, striving for a balanced budget. But these pieces of advice, as well as the Obama administration’s opposition to a bailout (which would amount to a scratching-the-surface form of reparations), overlook the dangerous reality of unsustainable debt.

Quiñones suggests something different: “We have to create sustainable economic growth, intervene in evasive local bank practices, the preferential treatment given to the business sector, and end the revolving door between the government, its agencies, the financial world, and corporate law firms.”

The lack of momentum for independence also leaves the status quo or US statehood the principal options, and the two dominant parties have demonstrated a stubborn allegiance to neoliberalism, whether in its cruel or kinder form. Increasingly, voters are disillusioned with the politics that have ruled the island since its takeover by the US.

New political parties like All Puerto Ricans for Puerto Rico, Solidarity Union Movement, and the Working People’s Party (PPT) have emerged as voices of resistance, less concerned about whether Puerto Rico should seek independence or American statehood and more interested in issues like job growth, education, the environment, and race and gender discrimination.

They are no longer willing to wait for Washington’s implementation of the Puerto Rico Democracy Act of 2007 (which was intended to help resolve the status issue). For its part, the PPT is an explicitly socialist formation that has denounced the 11.5% sales tax proposal and education privatization, and endorsed the recent student protests against increased university fees.

García Padilla has not welcomed this threat to the island’s three-party system. His Commonwealth Party has engaged in a harassment campaign to slow down the re-certification process of the PPT, by claiming an unusually high rate of “incompatible signatures” on endorsements submitted by the party. University of Puerto Rico–Carolina professor Manuel Almeida notes that this is “a delaying tactic that will ultimately deny the party federal matching funds,” hampering their ability to air campaign ads.

Once touted as an exception to the rule of poverty in the Caribbean, Puerto Rico finds itself the victim of American imperialism, devoured by the globalizing thrust of finance capital. Corrupt banking and investment practices have cloaked its glaring productivity failure, and local elites benefit from growing inequality.

Any movement for independence must carry an agenda wider than nationalist symbolism and work towards a broad agenda against class, race, and gender marginalization, and for environmental reform. But even before its territorial status is addressed, there is much work to be done to ameliorate the growing effects of acute austerity.

After the music dies down and the dancing stops, Puerto Rico’s fate must be dealt with in a way that recognizes its human rights and dignity and fulfills the modicum of citizenship granted to its inhabitants so many years ago.

SHOULD BE INTERESTING TO SEE HOW THIS PLAYS OUT. GOOD THING WE HAD OUR WEEKEND INTRODUCTION TO THE ISLAND....

Demeter

(85,373 posts)Dealing with medical bills, like waiting for the cable guy or buying a used car, has become a cliché of consumer exasperation. Everything from electricity and phone bills to tax returns and parking tickets migrated to electronic payments years ago, but America's $2.9 trillion health-care economy remains stubbornly stuck in the 1990s. The number of medical bills paid by paper check through the U.S. mail has even increased while payments for all other services have decreased dramatically. Medical payments are the only category to register an increase in paperwork since the start of the 21st century:

Dealing with medical bills, like waiting for the cable guy or buying a used car, has become a cliché of consumer exasperation. Everything from electricity and phone bills to tax returns and parking tickets migrated to electronic payments years ago, but America's $2.9 trillion health-care economy remains stubbornly stuck in the 1990s. The number of medical bills paid by paper check through the U.S. mail has even increased while payments for all other services have decreased dramatically. Medical payments are the only category to register an increase in paperwork since the start of the 21st century:

It’s not just consumers who are paying by mail. Just 15 percent of commercial insurers make payments to medical providers electronically, according to a report last month from PricewaterhouseCoopers Health Research Institute. The largest insurers are usually the best at going digital, but Cigna, with 14.5 million customers, sends only 39 percent of payments electronically. That's because many doctors aren't signed up to receive electronic transfers, according to spokesman Joe Mondy. Aetna and UnitedHealth Group, in contrast, both say around 80 percent of payments are paperless.

Hospitals, medical offices, and insurance companies need an army of workers to push all that paper1, which is also frequently shuffled through middlemen like billing agencies2 and clearinghouses3. One claims clearinghouse, Emdeon, which handles paper billing for many of its health plan clients, spent $87 million4 on postage alone in the first three months of 2015—nearly a quarter of its total revenue—according to financial filings. All this bureaucracy pushed the cost of administering private insurance to $173 billion5 in 2013, according to federal data.

But there’s also the human cost of sending people piles of indecipherable paperwork as they’re recovering from an illness or operation. “You pull your hair and you get frustrated. You don’t understand why it’s all paper and it’s all phone calls and you waste time and you get confused, and it’s all so broken,” says Tomer Shoval, chief executive and co-founder of Simplee, one of several companies trying to streamline medical billing...MORE

Demeter

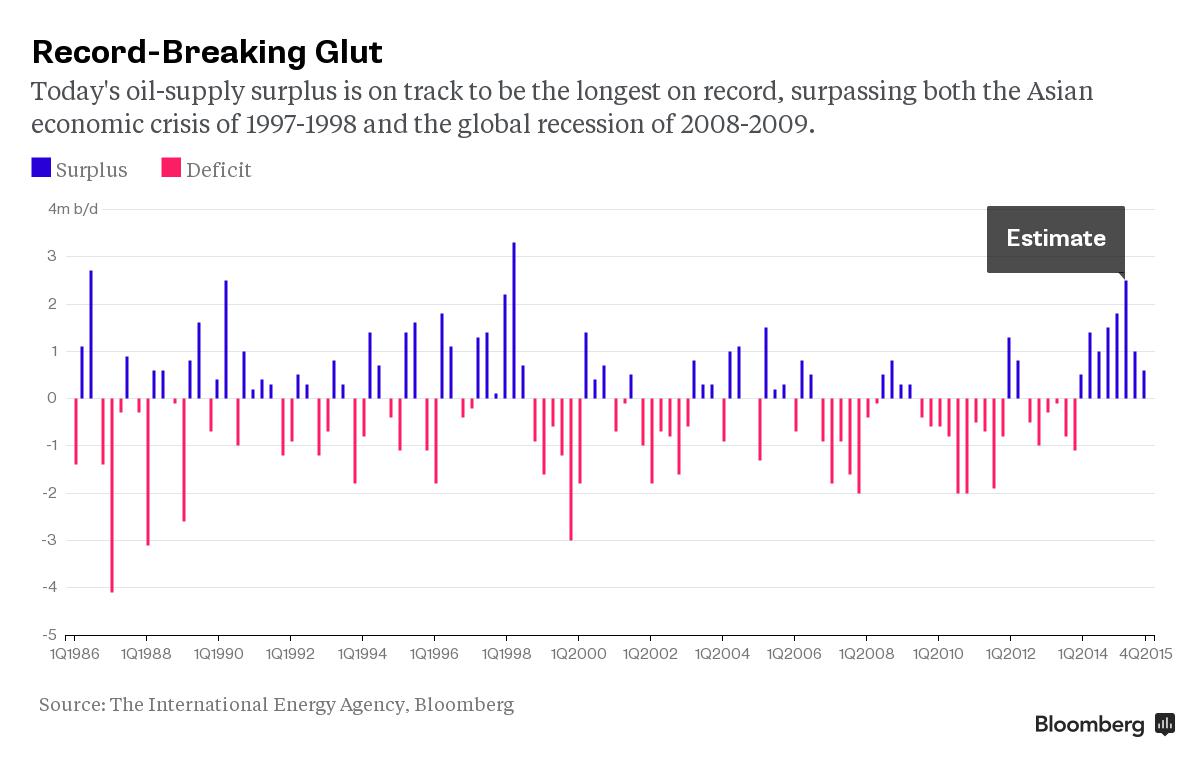

(85,373 posts)The world is on the brink of the longest-lasting oil glut in at least three decades and OPEC’s quest for market share makes it almost unavoidable.

Oil supply has exceeded demand globally for the past five quarters, already the most enduring glut since the 1997 Asian economic crisis, International Energy Agency data show. If the Organization of Petroleum Exporting Countries were to keep pumping at current rates it would become the longest surplus since at least 1985 by the third quarter, the data show.

There are few signs the 12-nation group will cut back. Saudi Arabia, OPEC’s biggest member, will probably increase production to intensify pressure on U.S. shale drillers, Goldman Sachs Group Inc. predicts. OPEC’s supplies may be swollen further this year if Iran reaches a deal with world powers to ease sanctions on its exports, Commerzbank AG says.

“It seems to be taking longer for the oil surplus to clear, and, even without the return of Iran, IEA data indicates it could last for the rest of the year,” said Eugen Weinberg, head of commodities research at Commerzbank in Frankfurt. “Any expectations the oversupply will be gone by 2016 don’t look justified at this stage.”

MORE

Demeter

(85,373 posts)VIDEO AT LINK

Hank Greenberg won his fight to hold the U.S. responsible for the bitter pill it forced down the throat of American International Group Inc. But that’s about it. The judge who called illegally onerous the terms of AIG’s $85 billion bailout -- hatched during the depths of the financial crisis -- also ruled that without it investors would probably have gotten nothing. As a result, he awarded Greenberg’s Starr International Co., AIG’s biggest investor at the time, no money.

“In the end, the Achilles’ heel of Starr’s case is that, if not for the government’s intervention, AIG would have filed for bankruptcy,” U.S. Court of Claims Judge Thomas Wheeler said Monday. “AIG’s shareholders would most likely have lost 100 percent of their stock value.”

Still, the scathing nature of Wheeler’s government critique may chasten regulators in future crises. The split-decision sets up the possibility that both sides will appeal, prolonging for months or years their battle over the U.S. response to the 2008 economic calamity...What began as a long-shot case by Greenberg and Starr gained credibility as the government repeatedly failed to get it dismissed. Last year’s trial in Washington was a showpiece for Starr’s lead lawyer, David Boies. He grilled Ben Bernanke, Hank Paulson and Timothy Geithner on government decision-making, as the judge repeatedly ruled in Greenberg’s favor. A key ruling allowed internal e-mails to come out at trial showing Fed lawyers trying to avoid an AIG shareholder bailout vote “we don’t control.” One attorney for the Fed at Davis Polk & Wardwell observed on Sept. 17, 2008, in the midst of the AIG takeover, that the government “is on thin ice and they know it. But who’s going to challenge them on this ground?” Greenberg had sought as much as $40 billion in damages for shareholders. Though the absence of an award may temper Wheeler’s dramatic rebuke of the government handling of the bailout, the ruling may still limit the Federal Reserve’s ability to deal with the next crisis.

“It is a huge loss for the government because it calls into question its actions in the crisis, and more importantly, calls into question what it will have latitude to do in future crises,” said Erik Gordon, a business professor at the University of Michigan in Ann Arbor.

Starr sued the U.S. in November 2011, claiming the government broke the law by insisting on 80 percent of AIG stock and imposing a 12 percent interest rate on the loan. Wheeler agreed, saying that while the Fed had authority to make an emergency loan to AIG, it didn’t have the authority to take shares in exchange for it. The government countered the demands were justified since the loan was high-risk. As evidence, government lawyers cited similar terms in a private rescue that fell through over doubts about AIG’s ability to repay. Though the bailout ballooned to $182 billion, AIG returned to the black and repaid the assistance in 2012, leaving the government with a $22.7 billion profit. Current AIG shareholders were worried the insurer would be “on the hook for payment to reimburse the Treasury and Greenberg,” said Josh Stirling, an analyst with Sanford C. Bernstein. “The judge found a way of splitting the baby.”...Nevertheless, Stirling said, the government may still appeal.

“They don’t want the precedent to stand that the courts are going to second-guess bailouts,” he said. “Public policy is generally that bailouts are necessary to preserve safety, security and economic order.”

He concluded that Wheeler’s decision “should lead investors to be more skeptical about implicit government backstop.”

An appeal by Starr is also possible. According to Dennis Kelleher, head of the financial advocacy group Better Markets, Greenberg wasn’t looking to win without something to show for it.

“They weren’t suing for a moral victory,” Kelleher said. “They were suing for cold hard cash.”

A LITTLE MORE

Demeter

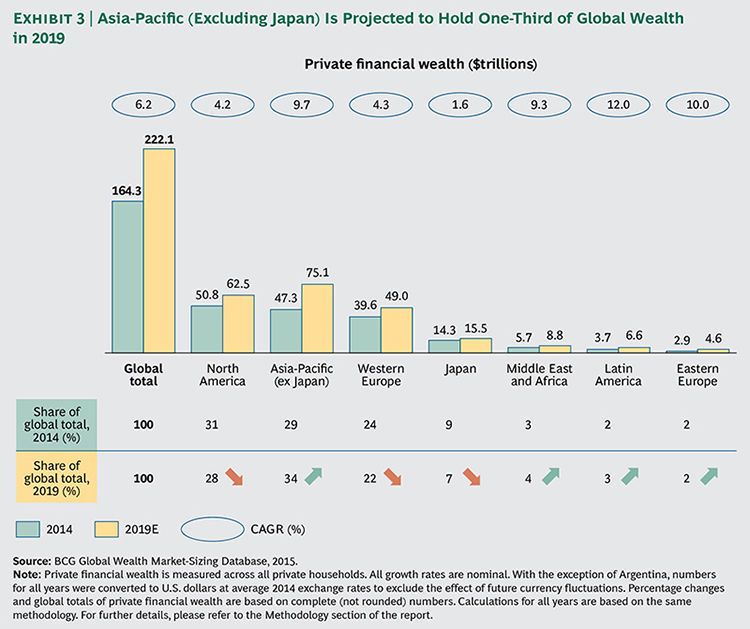

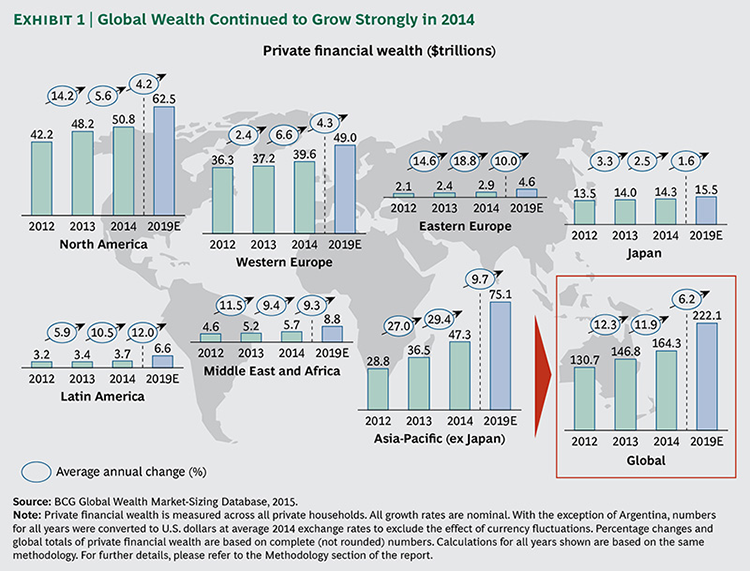

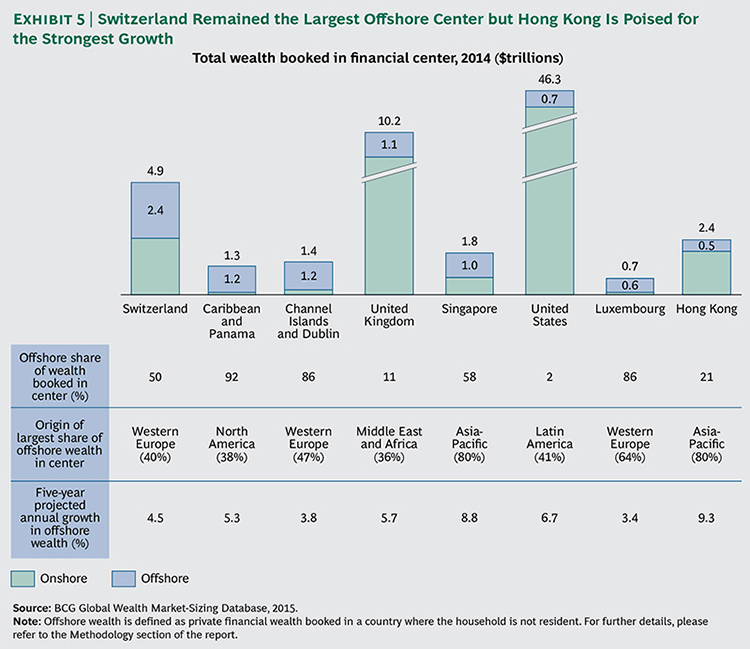

(85,373 posts)AND WHY SHOULDN'T IT? NO FACTORIES, NO JOBS, NO WORKERS, NO INCOME, NO PROFITS TO SKIM....NO WEALTH FOR THE WEST! THE VELOCITY OF MONEY IN THE WESTERN ECONOMY IS APPROACHING ZERO.

http://www.bloomberg.com/news/articles/2015-06-16/asia-pac-wealth-overtakes-europe-s

The region recorded the fastest growth in wealth last year, with China alone minting a million new millionaires...

Here's a statistic that won't please Thomas Piketty -- millionaire households held 41 percent of global private wealth last year, up from 40 percent a year earlier. They're projected to hold 46 percent of global private wealth in 2019.

The U.S. still had the most number of millionaire households in 2014 (7 million), followed by China (4 million), and Japan (1 million). When it comes to the density of millionaires, Switzerland came out top with 135 out of every 1,000 households having private wealth greater than $1 million. Bahrain (123), Qatar (116), Singapore (107), Kuwait (99), and Hong Kong (94), rounded out that list, showing when it comes to wealth, smaller is better.

For Europe's private bankers, the report has a warning: "Switzerland will need to reinvent itself to resist the threat from fast-developing Asian booking centers as preferred locations for offshore wealth,'' it said. Hong Kong and Singapore accounted for 16 percent of global offshore assets in 2014 and are expected to grow in prominence.

MORE

Demeter

(85,373 posts)...Since the Fast Tracked 1994 North American Free Trade Agreement revealed what really was at stake with the arcane Nixon-era procedure, getting any Congress to delegate years of blank-check Fast Track authority has been a very hard sell. Since 1988, only Presidents Ronald Reagan and George W. Bush persuaded Congress to grant the multi-year Fast Track delegation President Barack Obama seeks. In 1998, 171 House Democrats and 71 GOP rejected President Bill Clinton's request. As a result, Congress has only allowed Fast Track to go into effect for five of the past 21 years.

Given past trade pacts have resulted in significant American job loss, the small bloc of Democratic Senators willing to support Fast Track authority insisted the 2015 bill include an extension of Trade Adjustment Assistance (TAA). TAA is a program that provides retraining benefits for workers who lose their jobs to trade that was first enacted during the Kennedy administration. GOP leaders also had to make a promise, already broken, to win over the deciding bloc of Senate Democrats, that votes to reauthorize the Export-Import Bank would be scheduled before it expired at the end of June.

Many GOP Senators and Representatives oppose TAA, which provides glaring evidence of our current trade policy's damage in the form of a casualty list of the millions of Americans losing their jobs to bad trade policy. Major conservative groups, such as the Heritage Foundation, decry it as a welfare program for unions. And both have waged a fierce effort to kill the Ex-Im Bank.

To top it off, the GOP congressional leadership added a $700 million cut to Medicare to offset the cost of the TAA program -- undoubtedly egged on by GOP campaign consultants eager to revive the deadly effective 2012 and 2014 campaign ads against Democrats attacking them for cutting Medicare in the context of an Obamacare pay-for provision. (They expected that the Democrats would vote for TAA and the GOP against, a perfect 2016 election set up.)...

...Under the House rules, if the GOP House leaders want to call for a revote on TAA, it must occur by Tuesday night. Or they must pass an extension to extend that option. For a TAA revote to succeed more than 90 Representatives would have to flip to supporting TAA. Passing the TAA half of the bill would then enact Fast Track. But that seems improbable for the pro-Fast Track GOP, given their own views on TAA to say nothing of the political peril that would cause given the passionate opposition by conservative groups. Plus, there is plenty of ire about how the procedural gimmick imploded. Because before the Fast Track bill was derailed, the rule enacting the Medicare cuts was narrowly passed on an almost party-line vote. So, instead of putting all of the Democrats on the record for Medicare cuts, the GOP leadership put all but 34 House GOP on the record voting for big Medicare cuts.

A LITTLE MORE...BUT THIS IS THE MEAT

KEEP CALLING YOUR REPS! DON'T LET UP THE PRESSURE!

Demeter

(85,373 posts)Despite Social Security being the backbone of most Americans' retirement, we have a tremendous lack of basic knowledge about the program and its benefits, according to a MassMutual survey of more than 1,500 respondents. About 72 percent failed a true/false quiz about basic Social Security facts -- including not even knowing the age they need to be to collect full retirement benefits.

The survey data reveals that perhaps the greatest Social Security deficit in this country is the lack of education around the retirement benefits of the program, noted a MassMutual press release on the survey. Yet nearly one-third of retirees receive almost all of their retirement income from the system and nearly two-thirds receive more than half of their retirement income from Social Security.

The MassMutual survey found that only eight percent of Americans consider themselves very knowledgeable about Social Security. And that perception mirrors reality: Only one respondent out of 1,513 answered all the questions correctly.

Michael R. Fanning Executive Vice President, U.S. Insurance Group, MassMutual had this analogy for The Huffington Post: “Nobody would take a long drive for a summer weekend getaway without first checking that they had enough gas and maybe taking a look under the hood to check the oil, yet as Americans prepare for the ‘get away’ of retirement -– and retirements are lasting an average of 30 years -– an alarming few even know where to look when it comes to checking the ‘gas gauge’ on their Social Security benefits.”

What were some of the biggest misconceptions:

1. Citizenship is a requirement.

Three-quarters of survey respondents thought citizenship was necessary to receive Social Security retirement benefits. It is not.

2. Retirement age is 65 for everyone.

More than 7 in 10 -- 71 percent -- of the respondents believed that full retirement age is 65. It is not. It varies depending on your birth year.

3. You can continue to work without penalty if you begin collecting retirement benefits early.

Benefits are offset by earnings until you reach 66. If you’re younger than full retirement age during all of 2015, Social Security will deduct $1 from your benefits for each $2 you earn above $15,720. More than half of those surveyed (55 percent) incorrectly believe that they can continue working while collecting full Social Security retirement benefits regardless of their age.

Want to know more? You can try the quiz here: https://www.massmutual.com/~/media/files/ss_quiz.pdf

tclambert

(11,085 posts)The non-citizen benefits I didn't know about. The questions about minor children and divorced people I didn't know. A couple of others, I basically guessed the right answer. So, three wrong, and two unsure out of ten. That's a bad score. However, in my own defense, none of those questions apply to me or any retirees I know, and some of the questions had nuanced answers, which they simplified to true or false using different criteria. For instance, the answers to the questions about continuing working and about divorce were really "sometimes true, sometimes false depending on the details," yet they rounded one to false and one to true.

Demeter

(85,373 posts)and you are correct---there are too many loopholes, exceptions and so forth. Treating people differently based on age, sex, etc....it's discrimination!

Demeter

(85,373 posts)DemReadingDU

(16,000 posts)6/15/15 CVS buys Target pharm biz for $1.9B

CVS Health (CVS) will acquire big-box retailer Target's (TGT) pharmacy and clinic business for $1.9 billion, the companies said Monday.

The deal comes a little less than a month after CVS entered into an agreement to acquire Omnicare, for about $12.7 billion, in a move to expand its presence in the senior care market.

More than 1,660 Target pharmacies in 47 states will be rebranded as CVS/pharmacy. Target's clinics, nearly 80 in total, will be renamed MinuteClinic.

The retailers are getting cozier on another front, too. Target will seek five to 10 locations for new small-format Target Express stores that would also have a CVS/pharmacy inside.

"This long-term strategic relationship will certainly benefit the patients, the employees and the shareholders of both companies," CVS Health CEO Larry Merlo said in a conference call.

CVS will offer comparable positions to all of Target's 14,000 pharmacy and clinic workers. Target appeared to leave the door open for cuts at the corporate level, however, saying it will "further evaluate the business impact and related support needs at its headquarters locations."

The deal comes as Target is reassessing its business priorities in a bid to sharpen its strategy in a dynamic competition with online retailers such as Amazon.com and big-box rivals such as Walmart.

more...

http://www.usatoday.com/story/money/2015/06/15/cvs-health-target-pharmacy-acquisition/71239452/

Demeter

(85,373 posts)We'll see how it goes.