Economy

Related: About this forumWeekend Economists Vuelvan a Cuba February 13-16, 2015

The stock markets will be closed on Monday, Presidents Day, so we will be offering 3 day Weekend this week....and get a little further in our visit to Cuba...specifically

The economy of Cuba is a centrally planned economy dominated by state-run enterprises overseen by the Cuban government, though there remains significant foreign investment and personal enterprise in Cuba. Most of the means of production are owned and run by the government, and most of the labor force is employed by the state, although in recent years, the formation of cooperatives and self-employment has been encouraged by the Communist Party.

In the year 2000, public sector employment was 76% and private sector, mainly composed by personal property, employment was 23% compared to the 1981 ratio of 91% to 8%. Capital investment is restricted and requires approval by the government. The Cuban government sets most prices and rations goods to citizens. In 2009, Cuba ranked 51st out of 182 with an HDI (Human Development Index) of 0.863; remarkably high considering its GDP per capita only places it 95th. Public services and transportation in Cuba, however, are second-rate compared to more developed counterparts on the mainland. In 2012, the country's public debt was measured at 35.3% of GDP. At the same time, inflation (CDP) was ranked at 5.5%. Furthermore, in the same year, the economy encountered a 3% growth in GDP.

Before Fidel Castro's 1959 revolution, Cuba's capital, Havana, was a "glittering and dynamic city". The country's economy in the early part of the century, fueled by the sale of sugar to the United States, had grown dynamically. Cuba ranked 5th in per capita income in the hemisphere, 3rd in life expectancy, 2nd in per capita ownership of automobiles and telephones, and 1st in the number of television sets per inhabitant. Cuba's literacy rate, 76%, was the fourth highest in Latin America. Cuba also ranked 11th in the world in the number of doctors per capita. Several private clinics and hospitals provided services for the poor. Cuba's income distribution compared favorably with that of other Latin American societies. A thriving middle class, according to PBS, held the promise of prosperity and social mobility.

Cuba had a vibrant but extremely unequal economy, with large capital outflows to foreign investors. The country compared favourably with Spain and Portugal on socioeconomic measures. Furthermore, its income in 1929 was reportedly 41% of the US, thus higher than in some Southern states of the US, such as Mississippi and South Carolina. The country has made significant progress towards a more even distribution of income since the Revolution and being placed under economic embargo by the United States. Following the collapse of the Soviet Union, Cuba's GDP declined by 33% between 1990 and 1993, partially due to loss of Soviet subsidies and to a crash in sugar prices in the early 1990s. Yet Cuba has managed to retain high levels of healthcare and education.

Housing and transportation costs are low and Cubans receive free education, health care, and food subsidies. Corruption is common, although allegedly lower than in most other countries in Latin America. In the book, Corruption in Cuba, Sergio Diaz-Briquets and Jorge F. Pérez-López Servando state that Cuba has "institutionalized" corruption and that state-run monopolies, cronyism, and lack of accountability have made Cuba one of the world's most corrupt states".

History

Prior to the Cuban Revolution, Cuba was one of the most advanced and successful countries in Latin America. Cuba became an exotic and favorite destination for some of America's wealthiest. They came for bouts of gambling, horse racing, golfing and country-clubbing. American tourism became Cuba's flowing source of revenue. Tourism magazine Cabaret Quarterly described Havana as "a mistress of pleasure, the lush and opulent goddess of delights." According to Cuba historian Louis Perez of the University of North Carolina at Chapel Hill, "Havana was then what Las Vegas has become."

Cuba had a one-crop economy whose domestic market was constricted. Its population was characterized by chronic unemployment and deep poverty. United States monopolies like Bethlehem Steel Corporation and Speyer gained control over Cuba's national resources from which they made huge profits. The banks and the country's entire financial system, all electric power production and most industry was dominated by US capital. US monopolies owned 25 percent of the best land in Cuba and more than 80 percent of all farm lands were occupied by sugar and livestock-raising latifundia. 90 percent of the country's raw sugar and tobacco exports was sent to the USA. Before the Revolution most Cuban children were not included in the school system. There was almost no machine-building industry in Cuba. During this period in the 1950s Cuba was as rich per capita as Italy was and richer than Japan.

87 percent of urban homes had electricity, but only 10 percent of rural homes did. Only 15 percent of rural homes had running water. Nearly half the rural population was illiterate as was about 25 percent of the total population. Poverty and unemployment in the rural areas forced desperate residents to migrate to Havana where high levels of crime and prostitution existed. More than 40 percent of the Cuban workforce in 1958 were either underemployed or unemployed. Schools for blacks and mulattoes were vastly inferior to those for whites. Afro-Cubans had the worst living conditions and held the lowest paid jobs.

Demeter

(85,373 posts)In 1959, Fidel Castro seized assets valued at 9 Billion American dollars. During the Revolutionary period Cuba was one of the few developing countries to provide foreign aid. Foreign aid began with the construction of six hospitals in Peru in the early 1970s. The value of those businesses today would be worth 1.89 trillion dollars at the 11.42% rate of growth that the average US company has experienced from 1959 to 2014. But Cuba will have a very difficult time repaying the 1.89 trillion seized due to the extremely weak economic performance over the last half century. Cuba's current annual GDP is roughly 1/20th of the current value of what was seized, illustrating in clear terms the different rates of economic growth of the US and Cuban economy.

Foreign aid expanded later in the 1970s to the point where some 8000 Cubans worked in overseas assignments. Cubans built housing, roads, airports, schools, and other facilities in Angola, Ethiopia, Laos, Guinea, Tanzania, and other countries. By the end of 1985, 35,000 Cuban workers had helped build projects in some 20 Asian, African and Latin American countries.

For Nicaragua in 1982, Cuba pledged to provide over $130 million worth of agricultural and machinery equipment, as well as some 4000 technicians, doctors, and teachers.

In 1986 Cuba defaulted on its $10.9 billion debt to the Paris Club. In 1987 Cuba stopped paying entirely on the $10.9 billion Paris Club debts. In 2002 Cuba defaulted on $750 million in Japanese debts.

Some have attributed Cuban economic growth to Soviet subsidies. However, comparative economic data from 1989 showed that the amount of Soviet aid was in line with the amount of Western aid to many Latin American countries.

The prostitution of children with lax penalization and human trafficking for profit is reported in Cuba as a source country for the global black market industry. Cuba has been ranked in the lowest global rating of Tier 3 which is defined for a government's failure to meet minimum standards to prevent trafficking and are not making significant efforts to do so.

"Special Period"

The Cuban economy is still recovering from a decline in gross domestic product of at least 35% between 1989 and 1993 due to the loss of 80% of its trading partners and Soviet subsidies. This loss of subsidies coincided with a collapse in world sugar prices. Sugar had done well from 1985-1990 and crashed precipitously in 1990-1991 and did not recover for five years. Cuba had been insulated from world sugar prices by Soviet price guarantees.

This era was referred to as the "Special Period in Peacetime" later shortened to "Special Period". A Canadian Medical Association Journal paper claimed that "The famine in Cuba during the Special Period was caused by political and economic factors similar to the ones that caused a famine in North Korea in the mid-1990s, on the grounds that both countries were run by authoritarian regimes that denied ordinary people the food to which they were entitled when the public food distribution collapsed, and priority was given to the elite classes and the military." Other reports painted an equally dismal picture, describing Cubans having to resort to eating anything they could find, from Havana Zoo animals to domestic cats. But although the collapse of centrally planned economies in the Soviet Union and other countries of the Eastern bloc meant that Cuba experienced severe economic difficulties, which led to a drop in calories per day from 3052 in 1989 to 2600 in 2006, mortality rates show a remarkably slight impact on public health thanks to the priority given by the government to maintaining a social safety net.

The government undertook several reforms to stem excess liquidity, increase labour incentives, and alleviate serious shortages of food, consumer goods, and services. To alleviate the economic crisis, the government introduced a few market-oriented reforms including opening to tourism, allowing foreign investment, legalizing the U.S. dollar, and authorizing self-employment for some 150 occupations. (This policy was later partially reversed, so that while the U.S. dollar is no longer accepted in businesses, it remains legal for Cubans to hold the currency.) These measures resulted in modest economic growth. The liberalized agricultural markets introduced in October 1994, at which state and private farmers sell above-quota production at free market prices, have broadened legal consumption alternatives and reduced black market prices. Another (less visible) cause of the economic decline was the decrease in the world demand and world price for sugar, gradually replaced by corn syrup, 30% cheaper, after 1985.

Government efforts to lower subsidies to unprofitable enterprises and to shrink the money supply caused the semi-official exchange rate for the Cuban peso to move from a peak of 120 to the dollar in the summer of 1994 to 21 to the dollar by year-end 1999. Living conditions in 1999 remained well below the 1989 level.

Havana announced in 1995 that GDP declined by 35% during 1989-93, the result of lost Soviet aid and domestic inefficiencies. The drop in GDP apparently halted in 1994, when Cuba reported 0.7% growth, followed by increases of 2.5% in 1995 and 7.8% in 1996. Growth slowed again in 1997 and 1998 to 2.5% and 1.2% respectively. One of the key reasons given was the failure to notice that sugar production had become dramatically uneconomic. Reflecting on the Special period Cuban president Fidel Castro later admitted that many mistakes had been made, "The country had many economists and it is not my intention to criticize them, but I would like to ask why we hadn’t discovered earlier that maintaining our levels of sugar production would be impossible. The Soviet Union had collapsed, oil was costing $40 a barrel, sugar prices were at basement levels, so why did we not rationalize the industry?"

Due to the continued growth of tourism, growth began in 1999 with a 6.2% increase in GDP. Growth in recent years has picked up significantly, with a growth in GDP of 11.8% in 2005 according to official Cuban information. In 2007 the Cuban economy grew by 7.5%, below the expected 10%, but higher than the Latin American average rate of growth. Accordingly, the cumulative growth in GDP since 2004 stood at 42.5%.

Overview on the post-revolution economic performance

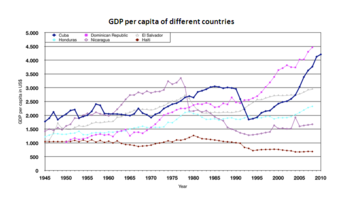

Cuban-born US economist Carmelo Mesa-Lago has published an account on the ?Economic and Social Balance of 50 Years of Cuban Revolution?. According to Mesa-Lago, Cuba’s performance has been overwhelmingly negative with regard to the economic indicators. Cuba’s position fell within the region for 87% of those indicators and for the rest of the 13% it remained the same. According to him Cuba ranked third in the region in 1958 in terms of GDP per capita, surpassed only by Venezuela and Uruguay. It had descended to 9th, 11th or 12th place in the region by 2007. At the same time, Cuba's social indicators showed a more positive development.

Demeter

(85,373 posts)HAPPY VALENTINE'S DAY, ALL!

xchrom

(108,903 posts)(Reuters) - Union pension fund adviser CtW Investment Group on Friday demanded in a letter to key McDonald's Corp directors that the struggling fast-food chain follow up its recent chief executive officer replacement with a turnover of its board.

The demand from CtW comes two weeks after McDonald's announced that Chief Brand Officer Steve Easterbrook would replace Don Thompson in the top job on March 1 and as unions have been seeking to organize fast-food workers and raise wages. The union pension funds that CtW advises hold a small percentage of McDonald's outstanding shares that are worth $268 million.

CtW Executive Director Dieter Waizenegger, in a letter addressed to board Chairman Andrew McKenna and Governance Committee Chairman Miles White, said the replacement of Thompson fell short of what is required to fix the world's biggest restaurant chain by revenue.

Read more: http://www.businessinsider.com/r-mcdonalds-needs-to-shake-up-board-union-fund-adviser-says-2015-2#ixzz3Rih3L5No

bread_and_roses

(6,335 posts)It must be someone here, and I want whomever that is to know it did give me a smile. Smiles being rare these days, I am grateful ... thank you very much! If I had hearts I'd give them to all the SMWers - it's here that you all keep the fires burning.

xchrom

(108,903 posts)NEW YORK (Reuters) - Citigroup Inc, Goldman Sachs Group Inc and UBS AG agreed to pay $235 million in cash to settle U.S. litigation accusing them of concealing the risks of mortgage securities sold by the former Residential Capital LLC before the global financial crisis.

The preliminary settlement with investors who bought the securities was made public on Friday in filings with the U.S. District Court in Manhattan, and requires court approval.

It is separate from a $100 million accord that investors reached in 2013 with ResCap entities and individuals. That accord has won court approval.

In court papers, lawyers for the investors said the $335 million recovery equals 3.05 percent of the face value of the securities at issue, "representing one of the highest recoveries among all mortgage-backed securities class actions."

Read more: http://www.businessinsider.com/r-citigroup-goldman-ubs-in-235-million-mortgage-settlement-2015-2#ixzz3Rikkjypl

Demeter

(85,373 posts)when what we need is REAL change!

xchrom

(108,903 posts)

SERVES 4

INGREDIENTS

¼ cup fresh lime juice

¼ cup fresh orange juice

3 cloves garlic, lightly smashed

1 (3½-4-lb.) chicken, quartered (backbone discarded or saved for stock)

Kosher salt and freshly ground black pepper, to taste

⅓ cup olive oil

1 large green bell pepper, stemmed, seeded, and thinly sliced

1 large white onion, thinly sliced

1 cup dry white wine

1 lb. russet potatoes, peeled and cut into 1" pieces

½ cup jarred alcaparrado or ⅓ cup pimento-stuffed olives and 2 tbsp. capers

¼ cup raisins

1 (8-oz.) can tomato sauce

1 cup frozen peas, defrosted

INSTRUCTIONS

1. Toss lime and orange juices, garlic, chicken, salt, and pepper in a bowl. Cover with plastic wrap; chill 1 hour.

2. Heat oil in an 8-qt. saucepan over medium-high heat. Remove chicken from marinade; pat dry using paper towels and reserve marinade. Working in batches, cook chicken, flipping once, until browned, 8–10 minutes. Transfer chicken to a plate. Add bell pepper and onion to pan; cook until soft, 6–8 minutes. Add wine; cook, scraping up browned bits from bottom of pan, until reduced by half, 5–7 minutes. Return chicken to pan and add reserved marinade, potatoes, alcaparrado, raisins, tomato sauce, salt, pepper, and ½ cup water; boil. Reduce heat to medium-low; cook, covered, until chicken and potatoes are tender, about 45 minutes. Stir in peas before serving.

xchrom

(108,903 posts)

INGREDIENTS

6 oz. bacon, roughly chopped

2 lb. flank steak, cut into 1 ½? strips

Kosher salt and black pepper, to taste

1 medium yellow onion, thinly sliced

1 red bell pepper, thinly sliced

1 Cubanelle or green pepper, thinly sliced

6 oz. tomato paste

1 tbsp. cumin

1 tbsp. dried thyme

1 tbsp. dried oregano

5 cloves garlic, finely chopped

1 bay leaf

½ cup dry white wine

2 cups beef stock

1 (16-oz.) can whole peeled tomatoes, crushed

½ cup halved, pitted green olives

⅓ cup sliced jarred pimiento peppers

3 tbsp. capers, rinsed and drained

1 tbsp. white wine vinegar

¼ cup roughly chopped cilantro

INSTRUCTIONS

Render bacon in a 6-qt. Dutch oven over medium-high heat. Transfer to a plate, leaving fat in pot. Season steak with salt and pepper. Working in batches, cook until browned on both sides, about 6 minutes; transfer to plate. Add onion and peppers; cook until soft, about 4 minutes. Add tomato paste, cumin, thyme, oregano, garlic, and bay leaf; cook until lightly caramelized, about 3 minutes. Add wine; cook, scraping bottom of pot, for 1 minute. Return bacon and steak to pot with stock and tomatoes; boil. Reduce heat to medium-low; cook, covered, until steak is very tender, 2–3 hours. Remove steak, and shred; return meat to pot with olives, pimientos, capers, and vinegar. Cook until sauce is slightly thickened, about 30 minutes. Stir in cilantro before serving.

Demeter

(85,373 posts)The Human Development Index (HDI) is a composite statistic of life expectancy, education, and income indices used to rank countries into four tiers of human development. It was created by Indian economist Amartya Sen and Pakistani economist Mahbub ul Haq in 1990, and was published by the United Nations Development Programme.

The 2010 Human Development Report introduced an Inequality-adjusted Human Development Index (IHDI). While the simple HDI remains useful, it stated that "the IHDI is the actual level of human development (accounting for inequality)" and "the HDI can be viewed as an index of 'potential' human development (or the maximum IHDI that could be achieved if there were no inequality)".

The origins of the HDI are found in the annual Development Reports of the United Nations Development Programme (UNDP). These were devised and launched by Pakistani economist Mahbub ul Haq in 1990 and had the explicit purpose "to shift the focus of development economics from national income accounting to people-centered policies". To produce the Human Development Reports, Mahbub ul Haq brought together a group of development economists including Paul Streeten, Frances Stewart, Gustav Ranis, Keith Griffin, Sudhir Anand and Meghnad Desai. Working along with Nobel laureate Amartya Sen, they worked on capabilities and functionings that provided the underlying conceptual framework. Haq was sure that a simple composite measure of human development was needed in order to convince the public, academics, and policy-makers that they can and should evaluate development not only by economic advances but also improvements in human well-being. Sen initially opposed this idea, but he soon went on to help Haq develop the Index in the future. Sen was worried that it was going to be difficult to capture the full complexity of human capabilities in a single index but Haq persuaded him that only a single number would shift the attention of policy-makers from concentration on economic to human well-being.

Dimensions and calculation--New method (2010 Report onwards)

Published on 4 November 2010 (and updated on 10 June 2011), starting with the 2010 Human Development Report the HDI combines three dimensions:

A long and healthy life: Life expectancy at birth

Education index: Mean years of schooling and Expected years of schooling

A decent standard of living: GNI per capita (PPP US$)

In its 2010 Human Development Report, the UNDP began using a new method of calculating the HDI. The following three indices are used:

1. Life Expectancy Index (LEI) = \frac{\textrm{LE} - 20}{85-20}

2. Education Index (EI) = \frac{{\textrm{MYSI} + \textrm{EYSI}}} {2}

2.1 Mean Years of Schooling Index (MYSI) = \frac{\textrm{MYS}}{15}[7]

2.2 Expected Years of Schooling Index (EYSI) = \frac{\textrm{EYS}}{18}[8]

3. Income Index (II) = \frac{\ln(\textrm{GNIpc}) - \ln(100)}{\ln(75,000) - \ln(100)}

Finally, the HDI is the geometric mean of the previous three normalized indices:

\textrm{HDI} = \sqrt[3]{\textrm{LEI}\cdot \textrm{EI} \cdot \textrm{II}}.

LE: Life expectancy at birth

MYS: Mean years of schooling (Years that a 25-year-old person or older has spent in schools)

EYS: Expected years of schooling (Years that a 5-year-old child will spend with his education in his whole life)

GNIpc: Gross national income at purchasing power parity per capita

Old method (before 2010 Report)--The HDI combined three dimensions last used in its 2009 Report:

Life expectancy at birth, as an index of population health and longevity

Knowledge and education, as measured by the adult literacy rate (with two-thirds weighting) and the combined primary, secondary, and tertiary gross enrollment ratio (with one-third weighting).

Standard of living, as indicated by the natural logarithm of gross domestic product per capita at purchasing power parity.

The formula defining the HDI is promulgated by the United Nations Development Programme (UNDP).[9] In general, to transform a raw variable, say x, into a unit-free index between 0 and 1 (which allows different indices to be added together), the following formula is used:

x\text{ index} = \frac{x - \min\left(x\right)}{\max\left(x\right)-\min\left(x\right)}

where \min\left(x\right) and \max\left(x\right) are the lowest and highest values the variable x can attain, respectively.

The Human Development Index (HDI) then represents the uniformly weighted sum with ⅓ contributed by each of the following factor indices:

Life Expectancy Index = \frac{LE - 25} {85-25}

Education Index = \frac{2} {3} \times ALI + \frac{1} {3} \times GEI

Adult Literacy Index (ALI) = \frac{ALR - 0} {100 - 0}

Gross Enrollment Index (GEI) = \frac{CGER - 0} {100 - 0}

GDP = \frac{\log\left(GDPpc\right) - \log\left(100\right)} {\log\left(40000\right) - \log\left(100\right)}

Other organizations/companies may include other factors, such as infant mortality, which produces different number of HDI.

HDI trends between 1975 and 2004

OECD

Europe not in the OECD and CIS

Latin America and the Caribbean

East Asia

Arab States

South Asia

Sub-Saharan Africa

2014 report: List of countries by Human Development Index

The 2014 Human Development Report by the United Nations Development Program was released on July 24, 2014, and calculates HDI values based on estimates for 2013. Below is the list of the "very high human development" countries:

The number in brackets represents the number of ranks the country has climbed (up or down) relative to the ranking in 2013 report.

YOU'LL HAVE TO GO TO WIKIPEDIA TO SEE THE CHART

CUBA IS RANKED 44TH AMONGST THE 49 BEST NATIONS...

xchrom

(108,903 posts)

INGREDIENTS

1½ lbs. dried black beans

1 bay leaf

1 sprig fresh oregano

4 tbsp. olive oil

1 tbsp. ground cumin

12 scallions, trimmed and finely chopped

8 cloves garlic, peeled and finely chopped

1 small green bell pepper, cored, seeded, and finely chopped

Salt and freshly ground black pepper

INSTRUCTIONS

1. Sort through beans, discarding any small stones, then rinse under cold running water. Put beans, bay leaf, oregano, and 1 tbsp. of the oil into a large pot, then cover with cold water by 3". Bring to a boil over high heat, then reduce heat to medium-low, and simmer, adding more water as needed to keep beans covered, until beans are tender, about 2 hours.

2. Heat remaining 3 tbsp. of the oil in a small skillet over medium heat. Add cumin, scallions, garlic, and green peppers, and sauté, stirring often, until peppers are soft and scallions are golden, about 10 minutes. Season to taste with salt and pepper, then add to beans. Continue cooking beans, stirring occasionally, for 10–15 minutes. Adjust seasonings. Remove bay leaf before serving. Serve with white rice, if you like.

Demeter

(85,373 posts)If I stop and make breakfast, though, I may not get back to the keyboard until nighttime...

It was a weird night at Euchre for all. I blame it on Friday the 13th. We had a 3 way tie for the worst score (of which yours truly was one) so I got back all my quarters for blown bids, at least. I did successfully play a lone hand, though!

It snowed a little last night. Temperature currently 20F and on a straight downward slope to MINUS TWELVE !!! by this time tomorrow. Not counting wind chills.

I'm not leaving the house for love or money. This is ridiculous.

On further thought, I need a new toilet very soon...perhaps I should go out now and buy it before the temps get much lower...

Demeter

(85,373 posts)in the Latin America Group here at DU by a hard-working and dedicated team of posters, including Judi Lynn and Mika!

xchrom

(108,903 posts)WASHINGTON (AP) -- Regulators have closed a small lender in Georgia, making it the third U.S. bank failure of 2015 following 18 closures last year.

The Federal Deposit Insurance Corp. said Friday that it has taken over Capitol City Bank & Trust Co., based in Atlanta.

The bank operated eight branches and had $272.3 million in assets and $262.7 million in deposits as of Dec. 31.

First-Citizens Bank & Trust Co., based in Raleigh, North Carolina, agreed to assume all of Capitol City Bank's deposits and to buy essentially all of the failed bank's assets.

The failure of Capitol City Bank is expected to cost the federal deposit insurance fund $88.9 million.

U.S. bank failures have been declining since peaking at 157 in 2010 following the financial crisis and the Great Recession.

xchrom

(108,903 posts)LAS VEGAS—The buzz and hammering of construction has returned to this city, which was especially hard hit by the housing bust. The construction workers, however, have not.

At the peak of the boom, Nevada employed 146,000 construction workers, according to the Bureau of Labor Statistics. Now the state employs only 63,000, a 59 percent decrease—and a two-decade low.

That’s led to some labor shortages, says Nat Hodgson, the executive director of the Southern Nevada Home Builders Association. “The actual skilled workers building the houses—it’s a challenge finding them,” he told me. “It’s hard to entice them to come back until we can convince them we’re really going to start growing again.”

It’s not just Nevada. Nationally, construction employment is down 19 percent from its 2007 peak. The decline is particularly stark in areas hard hit by the housing bust. In Arizona, construction employment has fallen 50 percent from its pre-recession peak; in California, employment has dropped 28 percent in the field. In Florida, construction employment is down 40 percent.

Demeter

(85,373 posts)I had a recent correspondence with a carpenter age 58, who reported both age and immigration status discrimination by one of the "finest" (high priced) national building companies of McMansion-style homes.

The decline of immigrants is a matter of record...and the job crisis is the reason.

Think they'll hire local experienced Americans? Think again!

Demeter

(85,373 posts)Yves Smith

After a collapse of negotiations over whether and how to resolve Syriza’s demands for a new deal with the Eurozone with the insistence of its counterparties that the new government adhere to the terms of its existing deal, technical discussions are set to resume Friday. The drop-dead date is Monday, since any extension or modification of the current so-called bailout needs to happen by February 28, when it expires. The lead time is necessary because the Germany Bundestag and the Finnish Parliament must approve any new or extended deal.

Greece has requested a new bridge facility with different terms in place, to carry it over while it hopefully works out a broader new set of arrangements with the Troika. There were widespread reports of unified opposition of the Eurogroup, which are the Eurozone finance ministers, prior to their emergency meeting Wednesday. English language reports painted a confusing picture of what transpired. On the one hand, they continued to depict the two sides as hopelessly far apart on their basic positions. Yet leaks while the meeting was underway indicated that progress was being made, only to lead to the apparent disagreement over a formal statement that led to an shambles at the end of the meeting and no plan to continue working-level talks prior to the Monday deadline....

...Syriza appears to be limited in how much it can retreat from its campaign promises, particularly given the forceful stands it has taken since it has been the lead actor in the new government. So the normal American “surely there is a middle ground when so much is at stake” assumption may not hold, particularly when both sides have little time to propagandize their voters into accepting a significant deviation from stances they previously depicted as inviolable...The big bone of contention has been the Syriza demand that a significant number of terms in the previously-agreed structural reforms be waived or modified; the Germans, Finns, and Dutch in particular have seen that as tantamount to reneging on a deal and therefore not acceptable. It’s also problematic for all the other countries that agreed to austerity, such as Rajoy’s government in Spain, since if itty bitty Greece could get a break, why couldn’t Spain?

A SUMMARY OF CURRENT PRESS FOLLOWS. FROM COMMENTARY:

WanderingMind...there is a Hamburg state election on February 15, in which a far right party seems to have some chance against Merkel’s party. So, according to Kapoor, the Germans are not going to make any truly conciliatory noises until after that election...there are some local elections in Spain before May in which Podemos may put up a strong showing, putting further pressure on the EC to come to terms with Greece...

Re: the Greek debt, Varoufakis essentially says that he doesn’t care what they call it, any alterations of the term or interest rate or both of the current debt due from Greece is a haircut. This indicates that he is more focused on substance than form and will not stand in the way of which label is put on the settlement of that issue. He also makes the point that Greece is a part of Europe and this is a European problem. Like Tsipras in a different context, he states to the interviewer that there is only such intense interest in what happens to Greece because Greece is part of the Eurozone. This, to me, indicates Syriza’s consistent and deep commitment to remaining in the Eurozone and the EC, both because it is part of their mandate and because stubbornly staying in the Eurozone is the best way to force their “European partners” to come to their senses and act rationally. In that sense, it seems to me that part of Syriza’s strategy is to be the squeaky wheel in Europe until they get something they can live with.

MUCH MORE AT LINK

Demeter

(85,373 posts)...The “respectable” government people in the UK and the U.S. (and Ireland) insist that we are experiencing the first virgin crisis – consisting of hundreds of thousands of fraudulent transactions by bankers – in which not a single CEO of the largest banks knew that his bank was a massive criminal enterprise...

A LITTLE INVECTIVE IN THE MORNING, TO GET THE BLOOD PUMPING. THOSE WITH HIGH BLOOD PRESSURE SHOULD NOT READ FURTHER!

from commentary:

VoxFox February 13, 2015 at 12:17 pm

CEOs repeatedly score higher on the psychopathics scale than jailed (professional) criminals.

As George Monbiot pointed out; if a psycho is born into a poor family he will probably end up in jail but a rich psychopath will end up getting an MBA on the way to becoming a CEO.

We have created a society that promotes & rewards psychopaths – no wonder we are in deep foo-doo.

Demeter

(85,373 posts)It doesn’t get any more Orwellian than this: Wall Street mega banks crash the U.S. financial system in 2008. Hundreds of thousands of financial industry workers lose their jobs. Then, beginning late last year(2013), a rash of suspicious deaths start to occur among current and former bank employees. Next we learn that four of the Wall Street mega banks likely hold over $680 billion face amount of life insurance on their workers, payable to the banks, not the families. We ask their Federal regulator for the details of this life insurance under a Freedom of Information Act request and we’re told the information constitutes “trade secrets.”

According to the Centers for Disease Control and Prevention, the life expectancy of a 25 year old male with a Bachelor’s degree or higher as of 2006 was 81 years of age. But in the past five months, five highly educated JPMorgan male employees in their 30s and one former employee aged 28, have died under suspicious circumstances, including three of whom allegedly leaped off buildings – a statistical rarity even during the height of the financial crisis in 2008.

There is one other major obstacle to brushing away these deaths as random occurrences – they are not happening at JPMorgan’s closest peer bank – Citigroup. Both JPMorgan and Citigroup are global financial institutions with both commercial banking and investment banking operations. Their employee counts are similar – 260,000 employees for JPMorgan versus 251,000 for Citigroup.

Both JPMorgan and Citigroup also own massive amounts of bank-owned life insurance (BOLI), a controversial practice that pays the corporation when a current or former employee dies. (In the case of former employees, the banks conduct regular “death sweeps” of public records using former employees’ Social Security numbers to learn if a former employee has died and then submits a request for payment of the death benefit to the insurance company.)

Wall Street On Parade carefully researched public death announcements over the past 12 months which named the decedent as a current or former employee of Citigroup or its commercial banking unit, Citibank. We found no data suggesting Citigroup was experiencing the same rash of deaths of young men in their 30s as JPMorgan Chase. Nor did we discover any press reports of leaps from buildings among Citigroup’s workers.

Given the above set of facts, on March 21 of this year, we wrote to the regulator of national banks, the Office of the Comptroller of the Currency (OCC), seeking the following information under the Freedom of Information Act (See OCC Response to Wall Street On Parade’s Request for Banker Death Information):

The number of deaths from 2008 through March 21, 2014 on which JPMorgan Chase collected death benefits; the total face amount of BOLI life insurance in force at JPMorgan; the total number of former and current employees of JPMorgan Chase who are insured under these policies; any peer studies showing the same data comparing JPMorgan Chase with Bank of America, Wells Fargo and Citigroup.

The OCC responded politely by letter dated April 18, after first calling a few days earlier to inform us that we would be getting nothing under the sunshine law request. (On Wall Street, sunshine routinely means dark curtain.) The OCC letter advised that documents relevant to our request were being withheld on the basis that they are “privileged or contains trade secrets, or commercial or financial information, furnished in confidence, that relates to the business, personal, or financial affairs of any person,” or relate to “a record contained in or related to an examination.”

The ironic reality is that the documents do not pertain to the personal financial affairs of individuals who have a privacy right. Individuals are not going to receive the proceeds of this life insurance for the most part. In many cases, they do not even know that multi-million dollar policies that pay upon their death have been taken out by their employer or former employer. Equally important, JPMorgan is a publicly traded company whose shareholders have a right under securities laws to understand the quality of its earnings – are those earnings coming from traditional banking and investment banking operations or is this ghoulish practice of profiting from the death of workers now a major contributor to profits on Wall Street?

As it turns out, one aspect of the information cavalierly denied to us by the OCC is publicly available to those willing to hunt for it. On March 24 of this year, we reported that JPMorgan Chase held $10.4 billion in BOLI assets at its insured depository bank as of December 31, 2013. We reached out to BOLI expert, Michael D. Myers, to understand what JPMorgan’s $10.4 billion in BOLI assets at its commercial bank might represent in terms of face amount of life insurance on its workers. Myers said: “Without knowing the length of the investment or its rate of return, it is difficult to estimate the face amount of the insurance coverage. However, a cash value of $10.4 billion could easily translate into more than $100 billion in actual insurance coverage and possibly two or three times that amount” said Myers, a partner in the Houston, Texas law firm McClanahan Myers Espey, L.L.P. Myers’ and his firm have represented the families of deceased employees for almost two decades in cases involving corporate-owned life insurance against employers such as Wal-Mart Stores, Inc., Fina Oil and Chemical Co., and American Greetings Corp. (Families may be entitled to the proceeds of these policies if employee consent was required under State law and was never given and/or if the corporation cannot show it had an “insurable interest” in the employee — a tough test to meet if it’s a non key employee or if the employee has left the firm.)

As it turns out, the $10.4 billion significantly understates the amount of money JPMorgan has tied up in seeking to profit from workers’ deaths. Since Wall Street banks are structured as holding companies, we decided to see what type of financial information might be available at the Federal Financial Institutions Examination Council (FFIEC), a federal interagency that promotes uniform reporting standards among banking regulators. The FFIEC’s web site provided access to the consolidated financial statements of the bank holding companies of not just JPMorgan Chase but all of the largest Wall Street banks. We conducted our own peer review study with the information that was available.

Four of Wall Street’s largest banks hold a total of $68.1 billion in BOLI assets. Using Michael Myers’ approximate 10 to 1 ratio, that would mean that over time, just these four banks could potentially collect upwards of $681 billion in tax free income from life insurance proceeds on their current and former workers. (Death benefits are received tax free as is the buildup in cash value in the policies.) The breakdown in BOLI assets is as follows as of December 31, 2013:

Bank of America $22.7 billion

Wells Fargo 18.7 billion

JPMorgan Chase 17.9 billion

Citigroup 8.8 billion

In addition to specifics on the BOLI assets, the consolidated financial statements also showed what each bank was reporting as “Earnings on/increase in value of cash surrender value of life insurance” as of December 31, 2013. Those amounts are as follows:

Bank of America $625 million

Wells Fargo 566 million

JPMorgan Chase 686 million

Citigroup 0

Given the size of these numbers, there is another aspect to BOLI that should raise alarm bells among both regulators and shareholders. The Wall Street banks are using a process called “separate accounts” for large amounts of their BOLI assets with reports of some funds never actually leaving the bank and/or being invested in hedge funds, suggesting lessons from the past have not been learned.

On May 20, 2008, Bloomberg News reported that Wachovia Corp. (now owned by Wells Fargo) and Fifth Third Bancorp reported major losses on failed gambles with BOLI assets. “Wachovia reported a $315 million first-quarter loss in its bank-owned life insurance program, known as BOLI, because of investments in hedge funds managed by Citigroup Inc. Fifth Third said in a lawsuit filed last month that it had losses of $323 million from Citigroup’s Falcon funds, which slumped more than 50 percent in the past year as the subprime market collapsed.” Citigroup’s Falcon Strategies hedge fund had lost as much as 75 percent of its value by May 2008.

Following are the names and circumstances of the five young men in their 30s employed by JPMorgan who experienced sudden deaths since December along with the one former employee:

- Joseph M. Ambrosio, age 34, of Sayreville, New Jersey, passed away on December 7, 2013 at Raritan Bay Medical Center, Perth Amboy, New Jersey. He was employed as a Financial Analyst for J.P. Morgan Chase in Menlo Park. On March 18, 2014, Wall Street On Parade learned from an immediate member of the family that Joseph M. Ambrosio died suddenly from Acute Respiratory Syndrome.

- Jason Alan Salais, 34 years old, died December 15, 2013 outside a Walgreens in Pearland, Texas. A family member confirmed that the cause of death was a heart attack. According to the LinkedIn profile for Salais, he was engaged in Client Technology Service “L3 Operate Support” and previously “FXO Operate L2 Support” at JPMorgan. Prior to joining JPMorgan in 2008, Salais had worked as a Client Software Technician at SunGard and a UNIX Systems Analyst at Logix Communications.

- Gabriel Magee, 39, died on the evening of January 27, 2014 or the morning of January 28, 2014. Magee was discovered at approximately 8:02 a.m. lying on a 9th level rooftop at the Canary Wharf European headquarters of JPMorgan Chase at 25 Bank Street, London. His specific area of specialty at JPMorgan was “Technical architecture oversight for planning, development, and operation of systems for fixed income securities and interest rate derivatives.” A coroner’s inquest to determine the cause of death is scheduled for May 20, 2014 in London.

- Ryan Crane, age 37, died February 3, 2014, at his home in Stamford, Connecticut. The Chief Medical Examiner’s office is still in the process of determining a cause of death. Crane was an Executive Director involved in trading at JPMorgan’s New York office. Crane’s death on February 3 was not reported by any major media until February 13, ten days later, when Bloomberg News ran a brief story.

- Dennis Li (Junjie), 33 years old, died February 18, 2014 as a result of a purported fall from the 30-story Chater House office building in Hong Kong where JPMorgan occupied the upper floors. Li is reported to have been an accounting major who worked in the finance department of the bank.

- Kenneth Bellando, age 28, was found outside his East Side Manhattan apartment building on March 12, 2014. The building from which Bellando allegedly jumped was only six stories – by no means ensuring that death would result. The young Bellando had previously worked for JPMorgan Chase as an analyst and was the brother of JPMorgan employee John Bellando, who was referenced in the Senate Permanent Subcommittee on Investigations’ report on how JPMorgan had hid losses and lied to regulators in the London Whale derivatives trading debacle that resulted in losses of at least $6.2 billion.

Demeter

(85,373 posts)By now, there have been so many banker-related suicides that it has become a moot point of i) tracking them all or ii) trying to find a pattern.

And yet, one name continues to stand out: JPMorgan.

The bank which has been most prominent among the list of “suicided” bankers notched one more casualty over the weekend when “a JPMorgan Chase & Co. employee strangled and stabbed his wife to death before turning the knife on himself, according to police who are treating the couple’s death in Bergen County, New Jersey as a murder-suicide.”

Bloomberg reports the gruesome details according to which Michael A. Tabacchi, 27, and his wife, Iran Pars Tabacchi, 41, were found dead Friday about 11:30 p.m. in the bedroom of their Closter home after a 911 call placed by the husband’s father, Bergen County Prosecutor John Molinelli said in an interview...It wasn’t a nail-gun this time. It was a knife:

Demeter

(85,373 posts)Demeter

(85,373 posts)YVES: ...There is simply not enough acknowledgement of the structure of work, that highly paid roles almost without exception involve highly specialized skills. If you cannot find someone who wants those particular skills, you then are forced to look for work that draws on your more general skills (selling, managing people, being a data jockey, manual labor) where you are less differentiated from other candidates and where the prevailing pay levels are lower. Studies like this also fail to consider that demand for these higher-paid jobs can drop for protracted periods of time. For instance, being a derrickhand in the late 1970s oil boom was one of the highest paid jobs in the US. A colleague with a college degree made more than I did as a new associate (with an MBA) at Goldman. When the oil market went splat, many of those jobs did too. Similarly, in the late 1980s, when the LBO boom stopped, employment in M&A contracted by 75% and did not fully recover for a good 5+ years. I’m sure readers can cite similar examples from other fields.

And this article fails to consider a new phenomenon: the vogue among employers for astonishingly narrow job specifications, as in a strong predisposition to hire only people who are doing virtually the same job at a highly similar company, and the usual bias towards stealing people who are currently employed from competitors rather than hiring the jobless.

By Pawel Krolikowski, postdoctoral research fellow at the Population Studies Center, University of Michigan. Originally published at VoxEU

Workers who suffer job displacement experience surprisingly large and persistent earnings losses. However, standard labour market models fail to explain such a phenomenon. This column explains the persistence of workers’ earnings losses by arguing that displaced workers face higher separation probabilities in new jobs, and take substantial time to find their ideal job. The framework also matches empirical findings on the shares of average earnings losses following displacement that are due to reduced employment and lower wages.

Displacements (e.g. layoffs) in the US affect many participants in the labour market. As an example, during the height of the Great Recession, around seven million workers with at least three years of tenure experienced a job loss due to layoff (Bureau of Labour Statistics 2010). In conjunction with this high incidence of displacement, there exists long and distinguished literature documenting large and persistent earnings losses associated with displacement (see, for example, Jacobson et al. 1993, and Davis and von Wachter 2011, henceforth DV). Although estimates differ, economists typically find that even 20 years after displacement, annual earnings are 10 to 20% below pre-displacement earnings.

Classical labour market theories fall woefully short in explaining this phenomenon as all workers receive the market-clearing wage, and there is no involuntary unemployment. This implies that displaced workers’ earnings should recover immediately. The standard workhorse model of frictional unemployment (Mortensen and Pissarides 1994) also implies small earnings losses as observed average job-finding rates in the US are high, and all workers receive identical wages when employed (DV). Furthermore, although DV show that a model that features cross-sectional wage dispersion (Burgess and Turon 2010) can produce nontrivial earnings losses, this framework cannot quantitatively account for the depth and persistence of observed displaced worker earnings losses. The literature sees the inconsequential nature of job loss in these models as a major shortcoming, hindering economists’ understanding of why high unemployment creates concern among policymakers.

My job market paper proposes a model in the spirit of Jovanovic’s (1979, 1984) matching model where workers displaced from relatively stable jobs take time to find similarly high-quality matches and encounter substantial risk of subsequent job loss following an initial displacement. These simple features can account for the vast majority of the depth and persistence of displaced worker earning losses (Krolikowski 2014).

Reduced Employment and Lower Wages

As far as post-displacement employment goes, the framework captures the following intuition. Compared to their stable job prior to the job loss, workers might not be as well matched in their first job coming out of non-employment. This results in tentative new employment relationships that are subject to a high probability of ending quickly. This leads to workers’ ‘spinning their wheels’ for a few years as they face repeated separations into non-employment after the initial displacement. This serial correlation in separations coincides with previous empirical work, where multiple additional job losses are found to be an important part of the workers’ post-displacement experiences (Stevens 1997), and I document the same phenomenon using data from the Panel Study of Income Dynamics (PSID).

The second part of the explanation for protracted post-displacement earnings dynamics is the presence of match-specific human capital and on-the-job search. This means that workers randomly get outside employment offers while working, and can move to better paying jobs over time. These features of the model deliver a ‘job ladder’ whereby newly hired workers start out in jobs with relatively low wages and move up the wage distribution via search on the job. This concept prolongs earnings recovery after displacement as non-employed workers enter poor employment relationships and search for better matches while employed.

When choosing the length of this job ladder, I use data on the amount of residual wage dispersion in the economy. Hornstein et al. (2007) measure residual wage dispersion within local geographic areas and 3-digit occupations, controlling for gender, race, education, and experience.1 Although estimates vary, these authors find that, even after controlling for various factors, similar workers can be paid very different wages. In the model, I attribute all of this residual wage dispersion to frictions in the labour market....MORE

THE COMMENTARY IS ALSO ENLIGHTENING

Demeter

(85,373 posts)...On December 17, 2014, having apparently decided that the United States could pursue its hemispheric interests more effectively by normalizing its relations with Cuba, President Barack Obama announced his country’s willingness to restore full diplomatic relations between the two countries. This marked an obvious landmark not only in U.S.-Cuba relations, but in Washington’s relations with the entire continent. More than ever, U.S.-Cuba relations may now be seen as a test case of Washington’s determination to replace intimidation with leadership/hegemony in its relations with Latin America.

U.S. hemispheric priorities including economic and energy integration, a multilateral hemispheric dialogue with emerging powers, the accommodation of Bolivarian elites, immigration, public security, and drug policy have all been undermined by the lack of a stable U.S.-Cuba relationship. Obama’s initiatives toward Cuba are thus best understood as an attempt to better the possibilities of U.S. leadership in the Western Hemisphere.

The United States wants to be able to rely on a hemispheric order that is supportive of liberal-democratic hegemony and a regional market economy, and the components of such an order are falling into place. Not even the turn to the left of the past decade can be considered a deviation from this tendency. In Brazil, the left has governed with developmentalist policies, compatible with the preponderant role of a market economy. Similarly, the Bolivarian economic order rejects neoliberal fundamentalism, but despite its rhetoric of “socialism of the 21st century,” its economic policies can be located within a framework driven by the market.

In the political sphere, there are now multiparty competitive elections in every country of the region. Cuba is the only country on the continent where an important political actor (the party-state) exercises power without competing with other legally constituted parties. It is true that elections do not always take place on a level playing field throughout the region, and from country to country there are biases that frequently depend on the constitutional framework. But in general, even those actors who question representative democracy regularly participate in electoral politics and take pride in the opportunity to gain power and influence by running for office.

With his December 17 announcement, President Obama began rewriting the official U.S. narrative about post-Revolutionary Cuba. The announcement transformed the official U.S. discourse on Cuba from a story that defined the country as a threat to U.S. security to one that portrays Cuba as a developing country in transition. With the passing of Cuba’s revolutionary generation, the new narrative holds, the country will immerse in a series of political and economic changes that the United States is well positioned to encourage. Obama’s message seeks to influence Cuban policymakers in the midst of this transition, favoring pro-market positions of new leaders, and measures directed to support emerging non-state economic sectors within Cuba’s economic reform.

MORE--NONE OF IT GOOD FOR CUBA OR THE USA, IMO

Last edited Sat Feb 14, 2015, 11:48 AM - Edit history (1)

And give back Gitmo. But Guantanamo, gained by invading Cuba by force and obtaining it at gunpoint, is Cuba's largest port to the east, so impeding progress for eastern Cuba and giving it back will always be denied. Yet they have the stones to call out the 'invasion of Crimea' by Russia, (disregarding an overwhelming vote to leave Ukraine) as a war-crime.

MattSh

(3,714 posts)Moncrief Oil International dropped a $1.37 billion lawsuit against Russian oil and gas giant Gazprom after a key piece of evidence, produced by the US company, turned out to be fake, Bloomberg reports.

The case was dismissed with prejudice against Moncrief on Monday, ending years long litigation, according to Baker Botts, a Houston-based law firm representing the Russian company.

Moncrief Oil International sued Gazprom for backing out of a joint venture to develop a natural gas field in Siberia, also accusing the Russian company of using stolen trade secrets. However, the Texas-based company managed to produce only one document supporting its claim.

Known as Trial Exhibit 1, the document allegedly dated to 2004. But a simple Google search by Baker Botts attorneys revealed that an image used in the document was created almost a decade later, in 2012.

Complete story at - http://sputniknews.com/business/20150203/1017702860.html

polly7

(20,582 posts)They really need to be just a tad sharper with their evidence.

Demeter

(85,373 posts)Not every court and prosecution is as corrupt as ours.

polly7

(20,582 posts)MattSh

(3,714 posts)Russia and Egypt might soon exclude the US dollar and use their national currencies in the settlement of accounts in bilateral trade, Russian President Vladimir Putin said in an interview to Egyptian media ahead of his Monday visit to the country.

The issue of abandoning the dollar in trade is “being actively discussed,” Putin told Al-Ahram daily newspaper ahead of his two-day trip to Egypt. The Russian president was invited for a bilateral meeting by his Egyptian counterpart Abdul Fattah al-Sisi.

“This measure will open up new prospects for trade and investment cooperation between our countries, reduce its dependence on the current trends in the world markets,” Putin said.

“I should note that we already use national currencies for trade with a number of the CIS [Commonwealth of Independent States] states, and China. This practice proves its worth; we are ready to adopt it in our relations with Egypt as well. This issue is being discussed in substance by relevant agencies of both countries.”

Egypt is a long-time and trusted partner of Russia and the relationship between the two countries has been rapidly developing, the Russian president said.

“The volume of bilateral trade has increased significantly over the past years: In 2014, it increased by almost half compared to the previous year and amounted to more than $4.5 billion,” he said urging for this trend to be strengthened.

He also praised the development of “mutually beneficial and effective” cooperation in the sector of agriculture. “Egypt is the major buyer of Russian wheat, Russia provides about 40 percent of grain consumed in the country; as for us, we import fruits and vegetables.”

Complete story at - http://rt.com/business/230447-russia-egypt-trade-dollar-drop/

Demeter

(85,373 posts)Gary Owens, the droll, baritone-voiced announcer on "Rowan & Martin's Laugh-In" and a familiar part of radio, TV and movies for more than six decades, has died. He was 80.

The veteran voiceover star died Thursday at his Los Angeles-area home, his son, producer Scott Owens, said Friday. Gary Owens had struggled with complications from diabetes, which he had since childhood, family spokeswoman Vicki Greenleaf said Friday.

Owens hosted thousands of radio programs in his long career, appeared in more than a dozen movies and on scores of TV shows, including Lucille Ball and Bob Hope specials. He also voiced hundreds of animated characters, was part of dozens of comedy albums and wrote books.

On "Laugh-In," the 1968-73 sketch show starring Dan Rowan and Dick Martin, Owens was shown on camera in a parody of an old-school announcer, with his hand cupped firmly over his ear. But his voice was always the real thing, rich and authoritative...MORE

http://apnews.excite.com/article/20150214/us-obit-gary-owens-faf1807d91.html

MattSh

(3,714 posts)Since the Department of Defense began offering soldiers Viagra in 1998, spending on the male enhancement drug has grown noticeably, with more than half a million dollars’ worth of the pills purchased last year.

The Pentagon issued 60 contracts worth a total of $504,816 for Viagra in 2014, the Washington Free Beacon reported. All 60 contracts were awarded to Cardinal Health Inc., a pharmaceutical distribution company based in Dublin, Ohio.

Last year, the Pentagon also ordered $3,505 worth of Levitra and $14,540 of Cialis, two other popular erectile dysfunction drugs, the Free Beacon reported.

The contracts were filed under “Troop Support.”

Since the Department of Defense began offering Viagra to soldiers as a medical benefit in 1998, the price of the drug has grown from $10 a pill to $25 a pill.

Back in 1998, the military’s policy only allowed for six pills a month per patient, and the DoD said they would “not replace lost or stolen pills.”

Complete story at - http://sputniknews.com/military/20150210/1018031452.html

Demeter

(85,373 posts)I wonder if I could get a federal subsidy for aspirin...seeing as the US Govt. causes most of the pain.

Demeter

(85,373 posts)British judge Guy Newery ordered the release of 226 million euros of Argentine debts under European law, withheld by New York judge Thomas Griesa.

The ruling accepted the request made by George Soros and Perry Capital.

The 226 million euros were deposited in June last year by the Argentine Government in the Bank of New York Mellon, that following Griesa's order, withheld the payment.

Read more: http://www.telam.com.ar/english/notas/201502/4337-the-british-judiciary-ordered-the-release-of-funds-held-by-griesa.html

CROSSPOST FROM http://www.democraticunderground.com/10141014102

MattSh

(3,714 posts)A week ago we explained that yet another conspiracy theory, one involving virtually every geopolitical hotzone, from Saudi Arabia, to Russia, the United States, Qatar, Syria, ISIS, and Ukraine, has become fact when our speculation from last September, namely that the plunge in oil was an choreographed move between the US and the Saudis (even if Kerry realized - we hope - that it meant a recession for the US energy producing states and a collapse in the only vibrant US industry of the past decade: shale), one seeking to dislodge Russian control over the Syrian government and to facilitate the passage of a Qatar pipeline under Syrian territory.

This is what the NYT said: "Saudi Arabia has been trying to pressure President Vladimir V. Putin of Russia to abandon his support for President Bashar al-Assad of Syria, using its dominance of the global oil markets at a time when the Russian government is reeling from the effects of plummeting oil prices."

The NYT added:

Saudi Arabia and Russia have had numerous discussions over the past several months that have yet to produce a significant breakthrough, according to American and Saudi officials. It is unclear how explicitly Saudi officials have linked oil to the issue of Syria during the talks, but Saudi officials say — and they have told the United States — that they think they have some leverage over Mr. Putin because of their ability to reduce the supply of oil and possibly drive up prices.

That's the quo. As for the quid, it is as we predicted:

Any weakening of Russian support for Mr. Assad could be one of the first signs that the recent tumult in the oil market is having an impact on global statecraft. Saudi officials have said publicly that the price of oil reflects only global supply and demand, and they have insisted that Saudi Arabia will not let geopolitics drive its economic agenda. But they believe that there could be ancillary diplomatic benefits to the country’s current strategy of allowing oil prices to stay low — including a chance to negotiate an exit for Mr. Assad.

"Russia has been one of the Syrian president’s most steadfast supporters, selling military equipment to the government for years to bolster Mr. Assad’s forces in their battle against rebel groups, including the Islamic State, and supplying everything from spare parts and specialty fuels to sniper training and helicopter maintenance."

To be sure, the Chairman of the Russian State Duma International Committee Alexei Pushkov promptly rejected all the NYT allegations, writing on his Twitter account:

“There were no negotiations with the Saudis to decrease oil production in exchange for Moscow’s refusal to support Assad. Hoax.”

... but that was to be expected - after all it is not as if the two powers are on friendly terms, plus the NYT leak was meant to push the fulcrum of leverage away from Russia. What is certain, however, is that Putin couldn't care less about his "friend" Assad, but he cares very much about Gazprom preserving its near-monopolistic dominance as marginal energy provider to Europe of last resort, one which gives Russia as much leverage over the bulk of Europe as the ECB's printing press, if not much more: Draghi's outside money only reaches about 1% of the population; Gazprom's heat reaches everyone.

Complete story at - http://www.zerohedge.com/news/2015-02-10/how-russia-plans-retaliate-saudi-driven-collapse-oil

Demeter

(85,373 posts)1. Believe anything out of Saudi Arabia.

2. Change his mind about his Syrian policy.

He's got better ways to make the Sheiks cry Uncle (Uncle Sam, of course--who won't lift a finger, by the way, thanks to 9/11)

MattSh

(3,714 posts)I put this together about 1/2 hour after the NY Times News Alert.

OK, so we all know what's going to happen next, right? Ukraine and the USA will (sneak around / break / defy / do what they want / walk all over) this agreement, and as the war continues, the USA, the EU, NATO, and Ukraine will all blame Russia because they're not controlling the separatists. Yep, stop me if you think you've heard this one before.

Demeter

(85,373 posts)Results from a Federal Reserve stress test of large banks, examining how much capital is on hand and risk management, is due March 11. The results will detail Fed objections, if any, to each bank's plan for returning capital to shareholders

http://r.smartbrief.com/resp/gvgPBYvBbTCNjfyXCicOlvCicNTsHR?format=standard

Demeter

(85,373 posts)WHAT? THE NSA CAN'T FIND THIS OUT FOR THEMSELVES? SLACKERS!

http://www.reuters.com/article/2015/02/13/us-usa-cybersecurity-exclusive-idUSKBN0LG2GR20150213

President Barack Obama is set to sign an executive order on Friday aimed at encouraging companies to share more information about cybersecurity threats with the government and each other, a response to attacks like that on Sony Entertainment. The order sets the stage for new private-sector led "information sharing and analysis organizations" (ISAOs) - hubs where companies share cyber threat data with each other and with the Department of Homeland Security.

It is one step in a long effort to make companies as well as privacy and consumer advocates more comfortable with proposed legislation that would offer participating companies liability protection, the White House said...Obama will sign the order at a day-long conference on cybersecurity at Stanford University in the heart of Silicon Valley....

"We believe that by clearly defining what makes for a good ISAO, that will make tying liability protection to sectoral organizations easier and more accessible to the public and to privacy and civil liberties advocates," said Michael Daniel, Obama's cyber coordinator, in a conference call with reporters.

The move comes as big Silicon Valley companies prove hesitant to fully support more mandated cybersecurity information sharing without reforms to government surveillance practices exposed by former National Security Agency contractor Edward Snowden. Cybersecurity industry veterans said Obama's anticipated order would be only a modest step in one of the president's major priorities - the defense of companies from attacks like those on Sony and Anthem Inc. Obama has proposed legislation to require more information-sharing and limit any legal liability for companies that share too much. Only Congress can provide the liability protection through legislation. Businesses are unlikely to share a lot of timely and "actionable" cyber intelligence without liability relief, said Mike Brown, a vice president with the RSA security division of EMC Corp.

"Until that gets resolved, probably through legislation, I'm not sure how effective continued information-sharing will be," said Brown, a retired Naval officer and former cyber official with the Department of Homeland Security.

Senator Tom Carper, the top Democrat on the Senate Homeland Security committee, introduced a bill this week that incorporates much of Obama's plan. But Republicans control Congress, and they have yet to sign on to the idea.

"This is an urgent matter and we are working with anyone that we can up on the Hill to make that happen," said Daniel, who had not yet reviewed Carper's bill.

Getting a bill through Congress will require at least the support of big Silicon Valley companies such as Google Inc and Facebook Inc. Those companies, however, have refused to give full support to cybersecurity bills without some reform of surveillance practices exposed by Snowden that have hurt U.S. technology companies' efforts to win business in other countries...Google, Facebook and Yahoo are not sending their chief executives to the Stanford conference because of the rift, according to an executive at a major technology company. Apple Inc Chief Executive Tim Cook will give an address. Obama also will meet privately with some executives on Friday. They are expected to press again for surveillance reform and support for strong encryption, which some in the administration have faulted recently on the grounds that it enables criminals and terrorists to hide their activity. Big technology companies and a host of startups have been beefing up encryption in Snowden's wake to make blanket intelligence collection overseas more difficult.

AHA! MORE COVER FOR CORPORATIONS BETRAYING THE PUBLIC TO THE NSA....AND THE CORPORATIONS ARE FIGHTING BACK!

Demeter

(85,373 posts)WELL, WASN'T THAT THE WHOLE POINT OF THE EXERCISE? AND THE FEES?

MUST BE THE WRONG PEOPLE WHO WILL BE PAYING OUT...AND BAD UNDERWRITING PRACTICES STRIKE AGAIN!

http://www.reuters.com/article/2015/02/12/markets-greece-cds-idUSL5N0VL2FK20150212

Private holders of Greek default insurance could be in for a payout of over $750 million if Greece defaults on debt owed to the European Central Bank or other public-sector creditors, lawyers said. Worries of a default have resurfaced as Athens is in a stand-off with its international lenders over its plans to end austerity measures agreed under its 240 billion euro bailout deals.

Greek credit default swaps (CDS) paid out more than a net $3 billion after privately-held debt was restructured in March 2012. Default worries are now focused on debt held by public institutions such as the International Monetary Fund, European Union and ECB. Investors who hold the relatively small amount of Greek government debt that remains in private hands may still get a payout if they have used CDS to protect themselves - even if Athens defaults only on repayments to the public institutions.

Payouts are made when the International Swaps and Derivatives Association (ISDA), which administers the CDS payment process, declares a "credit event". But with no precedent for sovereign default on publicly-held debt triggering CDS payments, many market participants have been uncertain whether their default insurance would pay out in such a scenario. Lawyers specialising in derivatives say it would. "It doesn't make any difference whether it's held by a governmental entity or not," said Simon Firth, derivatives partner at law firm Linklaters. "If there is a failure to pay in relation to any borrowings of ... Greece, and the failure to pay exceeds a million dollars or its equivalent in the local currency, once any grace period has expired, that's a credit event."

However, a special provision introduced soon after the 2012 restructuring says any obligation undertaken by Greece before Feb. 1, 2012 would not trigger CDS payments. This means any default on IMF repayments due in the next few months is unlikely to trigger CDS, as most of the funds were part of the first of Greece's two bailouts agreed in 2010. The second bailout was agreed soon after the restructuring and no repayments are due in the near future. But the repayment to watch is a 3.5 billion euro bond expiring in July which is held by the ECB. As part of a deal to avoid losses on its Greek debt holdings, the ECB swapped in March 2012 the Greek bonds it then held for new ones that were not part of the restructuring.

The other condition for triggering CDS is that the failure to repay debt is not part of a voluntary agreement between Greece and the ECB, EU or IMF. CDS would be triggered only if the debt that is restructured is held by at least four different entities, said David Benton, co-head of the Global International Markets Group at lawyers Allen & Overy. "If you've got a loan or bond that is made just by the ECB for example then if they restructure that's not going to trigger a credit event," said Benton, who has advised ISDA on CDS documentation.

Greek CDS payments were triggered in 2012 after the government introduced retroactive collective action clauses to make it easier to force bondholders to take a loss. ISDA decisions on credit events depend on the assessment of its Determinations Committee, requiring approval by 80 percent of its members - 15 banks or funds active in the CDS market. Data from the Depository Trust & Clearing Corporation show there are 752 Greek CDS contracts, worth over $2 billion. But on a net basis - buyers of CDS can also be sellers - payments would total $763 million.

Rules introduced in November 2012 mean that only holders of Greek bonds can seek protection via CDS. BlackRock, Loomis Sayles and Carmignac Gestion are among the asset management firms that hold Greek bonds, according to Thomson Reuters eMAXX. Greek five-year CDS traded at 1,727 basis points on Thursday, meaning it costs $1.7 million annually to insure $10 million of Greek debt, data from Markit showed.

Demeter

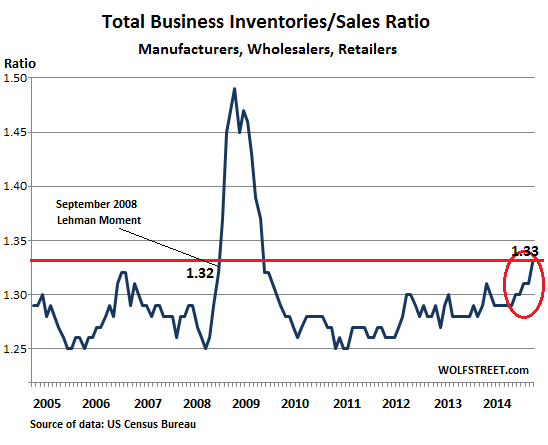

(85,373 posts)Yves here. Given how many QE-induced distortions we have in the economy, I’m not certain the spike in inventories (in isolation) is as telling a symptom as it was last time around. But most analysts took note of how much of last quarter’s GDP figures reflected both a big increase in inventories and a negative GDP deflator, and they expect the next quarter or two to be less robust.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

...It’s tough out there for companies that have to deal with the over-indebted, under-employed, strung-out American consumers with fickle loyalties and finicky tastes, who have been subjected to this corporate cost-cutting for years. And so retail sales, according to the Commerce Department, dropped a seasonally adjusted 0.8% in January. That’s on top of a 0.9% decline in December. The hitherto inconceivable is happening: folks are saving money on gas, but not everyone is immediately spending all that money! It’s so inconceivable that I warned about it and other effects of the oil price crash two months ago: “Wall Street promises a big boost to US GDP,” I wrote. “What have these folks been smoking?” But even excluding gasoline sales, retail sales were flat last month after edging down 0.2% in December. And sure, some of the savings from gasoline will be spent eventually, but there are plenty of Americans with enough money left over every month to where their spending patterns aren’t influenced by the price of gas.

But this report, an advance estimate that is subject to potentially large revisions, covers only spending at retailers and restaurants, a portion of total consumer spending, which includes healthcare and anything else that consumers pay out of their noses for. And year-over-year, retail sales actually rose 3.3%, with food services sales up 11.3%, auto sales up 10.7% thanks to prodigious subprime financing, while sales at gas stations sagged 23.5%. So from just the retail sales report, the consumer situation remains murky. But there is another gauge that is moving deeper and deeper into the red. It has been deteriorating consistently since last summer. A couple of days ago, I reported that wholesale inventories were ballooning in relationship to sales, a red flag in our era when just-in-time delivery and lean inventories have been honed into an art to minimize how much working capital and physical space gets tied up. The crucial inventories-to-sales ratio for wholesalers had reached the highest level since the financial crisis.

Now the Commerce Department released total business sales and inventories for December, which include sales and inventories at retailers, wholesalers, and manufactures – the entire channel. And it’s even worse. Combined sales by retailers, wholesalers, and manufacturers, adjusted seasonally but not for price changes, dropped 0.9% from November, and was up only 0.9% from December 2013 – not even beating inflation. Retailers were able to keep their inventories stable in relationship to sales, which inched up 2.6% year-over-year. So the inventories-to-sales ratio remained at 1.43. Further up the channel, wholesalers saw sales rise only 1.43%, but their inventories stacked up, and the inventories-to-sales ratio hit 1.22, up from 1.16 a year earlier. And manufactures? That great “manufacturing renaissance” in the US? Year over year, sales declined 0.9%, but inventories rose 2.7%, and their inventories-to-sales ratio jumped to 1.34 from 1.29 a year earlier. For all three combined, the inventories-to-sales ratio rose to 1.33 in December, after climbing methodically since summer. The last time it was rising to this level was in September 2008 – the Lehman Moment – when sales up the entire channel were beginning to grind to a near halt, a terrible condition that morphed into the Great Recession. That propitious September, the inventories-to-sales reached 1.32, still a smidgen below where it is today:

Optimistic merchants and manufacturers expect sales to rise. They plan for it and order accordingly. If sales boom and draw down inventories, the inventories-to-sales ratio remains lean. That’s the rosy scenario. But that hasn’t been happening recently. In our less rosy reality, sales are not keeping up with expectations, and inventories are piling up. The increase in inventories adds to GDP, and so from that point of view, they beautify the numbers. But from the business point of view, growing inventories caused by lagging sales can turn into a nightmare. And unless sales can somehow be cranked up for all businesses across the entire country to bring down these inventories, orders to suppliers will be trimmed – and that ricochets nastily around the economy with all kinds of unpleasant secondary fireworks.

“Here in Houston a number of projects have been canceled, engineers are put on ‘hold,’ and everyone is waiting for the other shoe to drop,” an engineer in the energy sector wrote. “Not pushing the panic button by any means” is how the Texas banking regulator phrased it. But it’s looming in front of everyone...

Demeter