Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 2 January 2013

[font size=3]STOCK MARKET WATCH, Wednesday, 2 January 2013[font color=black][/font]

SMW for 31 December 2012

AT THE CLOSING BELL ON 31 December 2012

[center][font color=green]

Dow Jones 13,104.14 +166.03 (1.28%)

S&P 500 1,426.19 +23.76 (1.69%)

Nasdaq 3,019.51 +59.20 (2.00%)

[font color=red]10 Year 1.76% +0.03 (1.73%)

30 Year 2.95% +0.05 (1.72%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)In Washington-speak, “means-testing” is a scheme to deny or reduce Medicare and Social Security benefits for people who are “too wealthy” in the name of saving money. It’s a counterproductive, harmful idea, but one that well-intentioned liberals often get snookered into embracing. It’s easy to see why. Economic inequality has exploded to dangerous levels, and the argument for means-testing seems to appeal to a powerful sense that the rich are getting more than their fair share at the expense of everyone else. Combine this with the deficit hysteria promoted by conservatives, and the trap is set.

Don’t fall into it. The truth is that means-testing is a sneak attack on vital programs meant to weaken and eventually destroy them. There’s a reason why an ultra-conservative like Paul Ryan pushed means-testing during the presidential campaign. And there’s a reason why private equity billionaire Pete Peterson, enemy of Social Security and Medicare who served in Richard Nixon's cabinet, makes a special point of bringing up means-testing when he is talking to liberals. Conservatives push means-testing because it’s a highly effective political strategy for getting liberals and progressives to act against their own values and interests -- so effective that some economists billing themselves as liberal, such as Jared Bernstein, a former adviser to the Obama administration, sometimes talk about means-testing as if it’s a reasonable idea. Bernstein recently went on CNBC and said that means-testing “sounded like a good idea” and characterized people opposed to it as “fringe.”

Bernstein’s assertion that means-testing opponents are “fringe” is nonsense. Does that include Paul Krugman of the New York Times, who describesmeans-testing as "an even worse idea, on pure policy grounds, than even most liberals realize"? In researching this article, I communicated with several highly respected economists, including Nobel Prize-winner Joseph Stiglitz, James K. Galbraith, Dean Baker, and Thomas Ferguson. All of them expressed their concerns about means-testing and provided a variety of sound arguments against it. (Bernstein, after being roundly criticized, backtracked in a blog and admitted that means-testing is a bad policy idea and a questionable way to address income inequality. He just forgot that when he was on TV!)

Here are six reasons why you should be on high alert any time you hear the phrase "means-testing" -- whether it comes from government-hating conservatives or liberals who wish to appear “moderate.” The truth is that there is nothing moderate or reasonable about means-testing – or any other plan to weaken Social Security and Medicare:

1. Means-Testing Undermines Progressive Values

2. Means-Testing Won’t Stop at the Wealthy

3. Means-Testing Doesn’t Make Economic Sense

4. Means-Testing Plays into Conservative Deficit Hysteria

5. Creeping Means-Testing Is Already Happening

6. The Coming Old Age Crisis

DETAILS AT LINK

Demeter

(85,373 posts)Demeter

(85,373 posts)Remember what I said about Wall Street workers? Let me refresh your memory:

The finance class actually consists of a bunch of overqualified strip miners. They’re overworked, which might explain the number of bad decisions they make, and their compensation system decouples the consequences of their actions from the actions themselves. They are being paid to make “deals” and the purpose of those deals is to extract “wealth”. In a way, it’s not that much different from getting into the cab of some giant piece of earth moving equipment and mowing down the side of the mountain and then loading that potential ore onto a conveyor belt to be separated from dirt. They live in a “company” town and are paid “company scrip”. It’s a truck system for them as well. The compensation is not proportional to the amount of work they do, they can be fired at will and they’re never going to leave that mountain because they owe their souls to the company store. The more they work, the more compensation in bonuses they are promised but it’s never enough.

Once you think about this metaphor of Wall Street doing the work of strip miners, the present set of circumstances will start to make a lot of sense.

We know that Social Security does not add to the deficit. In fact, we have a trust fund worth almost $3 trillion dollars. Sure, that trust fund has taken a hit in the past four years because so many people are out of work and can’t pay their taxes but once people are working again, the kitty will start to grow again. And if all that is needed is a couple of tweaks to solve the minor shortfall, it’s really not as damaging to the economy or rich people’s ability to spend ungodly amounts of money on themselves as they pretend.

So, it’s not a deficit problem- at least not from the government’s side of things. Sure, Medicare does need to be fixed but that requires some spine stiffening on the part of the Democrats to crack down on providers. Did I tell you about my lab partner’s husband’s 4 hour hernia operation and recovery in the hospital? $70,000. No, that is not a mistake. There’s something truly out of whack when if comes to costs and payments to hospitals, doctors, insurance companies. It’s a real problem. And since the rest of the developed world has found reasonable solutions at much lower costs, it’s moronic for our elected officials to tell us that the costly ACA, with downstream repercussions they failed to study, is the best we can do. Please, do we look stupid to you?

Anyway, back to Wall Street. The Social Security trust fund is solid and fixable and millions of us late boomers paid into the surplus funds to cover our own retirements. What isn’t solid and fixable is the 401K system, which really is a Ponzi scheme. Pretty soon, a lot of aging baby boomers will be taking money out. That’s going to hurt someone’s bottom line. The bonuses and skimming going forward isn’t going to be nearly so lucrative as it was over the past two decades. After the Baby Boom came the Baby Bust in the late 60?s. Looks like The Pill really caught on in a big way.

In the past couple of decades, many companies ditched their pensions for the 401K. Let the kids pay for their own retirements. None of this deferred compensation crap. And life was good for the shareholders and the bankers. But once that money starts to get withdrawn, the salad days will be over. So, Wall Street must get more people into 401Ks or they won’t be able to continue strip mining. The problem is that most people are already in one if their employer offers it. The market is finite and pretty soon will plateau. At some point, the investment portfolios are also going to reach a steady state.

BUT, if you raise the retirement age and keep a lot of older people working, they will be forced to put their money back into the market. Well, they won’t be able to retire until they’re much older than their parents were at retirement. If they have any hope of ever taking time out to go travel or garden, they’re going to have to risk their money in the market, hope that it will pay off so they can get out of the job market before they’re dead and forget about social security.

My theory is that raising the retirement age forces more savings to stay in the market longer and that with a pool of people who can’t retire yet still working, the amount of money going into 401Ks and IRAs is going to go up. Stripville!

It makes sense from a timing perspective. There’s really no need to cut a deal with Republicans right now. The Democrats have enough seats to keep things pretty much unchanged. If the tax cuts expire, it’s going to look bad for Republicans to hold middle class tax cuts hostage in order to satisfy their rich friends. In fact, just about anything the Republicans stamp their feet and insist on is going to look bad for them.

But Obama still wants to cut a deal and make us all a lot poorer as a nation and as individuals. And he really doesn’t have to do this. So, why do it? I think it’s because the strip miners have told him that if he doesn’t, the market is going to start to drop and it will pick up speed and saving the banks is the most important thing ever!!! All serious people agree about this. If he doesn’t cut the social insurance programs in order to prop up the 401K system, it will be all his and the Democrats’ fault when the market finally starts to fall.

Yep, that would suck for seniors who are about to retire so if I were them, I’d start looking around for other places to put that money. But history has shown that Obama and his droogs at Treasury will bend over backwards to please bankers even if it means opening a revolving line of credit for the bankers to the taxpayer cash stream in perpetuity. (Read Neil Barofsky’s book for more horrific details).

It’s been my feeling that the 401K is behind a lot of what’s really messed up in our economy and for some reason, we never hear anyone of sufficient gravitas talking about it. But just imagine what would happen to the economy if we tried to phase it out even if most of us hate it with a white hot passion.

All hell would break loose.

Warpy

(111,305 posts)no matter how high they raise the retirement age. After all, the corporate expiration age used to be 55 and in a sour economy, that's moving downward fast. Some people are now being let go in their late 40s because actuarial tables tell HR that a green kid right out of college who needs 5 years on the job to be effective is still more cost effective than a star employee in his 40s who is starting to cost the insurance plan a few bucks here and there.

That will only leave old people more years to put together some patchwork of jobs so that they can afford to eat and have a place to live. Those 401K plans might be depleted but they won't be added to.

That is the part Wall Street is missing, the fact that jobs with benefits are increasingly for younger workers, only.

Hugin

(33,174 posts)"The Chart" made by that guy in Stalin's gulag which shows the Stock Markets following exactly the number of 45-54 year old participants in the work force? T

he same 45-54 year old workers with the most disposable income no matter how an economist working under the threat of immanent death could slice it?

My theory is that the "Brain Trust" (The article calls them "Strip Miners", which is probably more accurate.) is trying to push the "Boomer Bump" into the future. My news to them is it isn't going to work.

*sigh* But, they'll never learn anything. EVER. ![]()

Warpy

(111,305 posts)that came out of the old USSR, no matter how valid.

However, that chart is pre funny money generated by derivatives trading. The system is so fouled up right now that it's not going to make any sort of sense for a very long time and quite possibly not until after the derivatives crash (and they will), when desperation and starving crowds at the gates cause Washington to wake the hell up and revisit the strict regulation we used to have that prevented smart guys from starting scams.

Also, I've called them "strip miners" for a couple of decades. I'm glad someone was paying attention.

DemReadingDU

(16,000 posts)I thought I bookmarked it, but can't find it.

Warpy

(111,305 posts)if they allow means testing for it, they can expect means testing for other insurance.

"Your accident claim has been denied. Our records show you have enough money in your bank account to buy a new car so your claim is disqualified. Thank you for your business." Never mind the money was being saved for a down payment on a house or for retirement or for a kid's college tuition.

"Your claim has been denied. Our records show you have adequate equity in your home to pay for the chemotherapy treatments. Thank you for your business."

"Condolences on the death of your spouse but your claim for death benefits has been denied. Our records show that you are making an adequate income to support your children alone if you'll just be an adult and move to a cheaper apartment."

You see where that could go. Unfortunately, the Republicans have decades of convincing idiots that Social Security is some sort of welfare, money for nothing, even though recipients have paid into it their whole working lives.

And this is why means testing is a really, really bad idea.

Hugin

(33,174 posts)Exactly, why I am so against the mandate.

Demeter

(85,373 posts)Senate Minority Leader Mitch McConnell (R-KY) and Vice President Joe Biden have reportedly reached an agreement that would solve the tax side of the debate over the so-called “fiscal cliff,” the package of tax increases and spending cuts that will begin automatically at midnight tonight.

Senate Majority Leader Harry Reid (D-NV) and the Democratic caucus have not yet indicated support for the compromise, which extends most of the Bush tax cuts and other tax provisions, and while the Senate may vote tonight, no vote is expected in the House before tonight’s deadline. Here is a breakdown of the different provisions of the reported compromise:

The reported McConnell-Biden compromise does not deal with the spending cuts side of the fiscal cliff, though CNN’s Dana Bash reported that the sequester may simply be delayed for two months. The spending cuts are the part of the fiscal cliff that the Congressional Budget Office says would be the most damaging to America’s economic growth. It also does not include an increase in the debt ceiling, setting up another fight over the coming months like the one that created the fiscal cliff in the first place.

Demeter

(85,373 posts)The deal emerging from the Senate is a lousy one. Let me count the ways:

1. Republicans haven’t conceded anything on the debt ceiling, so over the next two months – as the Treasury runs out of tricks to avoid a default – Republicans are likely to do exactly what they did before, which is to hold their votes on raising the ceiling hostage to major cuts in programs for the poor and in Medicare and Social Security.

2. The deal makes tax cuts for the rich permanent (extending the Bush tax cuts for incomes up to $400,000 if filing singly and $450,000 if jointly) while extending refundable tax credits for the poor (child tax credit, enlarged EITC, and tuition tax credit) for only five years. There’s absolutely no justification for this asymmetry.

3. It doesn’t get nearly enough revenue from the wealthiest 2 percent — only $600 billion over the next decade, which is half of what the President called for, and a small fraction of the White House’s goal of more than $4 trillion in deficit reduction. That means more of the burden of tax hikes and spending cuts in future years will fall on the middle class and the poor.

4. It continues to exempt the first $5 million of inherited wealth from the estate tax (the exemption used to be $1 million). This is a huge gift to the heirs of the wealthy, perpetuating family dynasties of the idle rich.

Yes, the deal finally gets Republicans to accept a tax increase on the wealthy, but this is an inside-the-Beltway symbolic victory. If anyone believes this will make the GOP more amenable to future tax increases, they don’t know how rabidly extremist the GOP has become.

The deal also extends unemployment insurance for more than 2 million long-term unemployed. That’s important.

But I can’t help believe the President could have done better than this. After all, public opinion is overwhelmingly on his side. Republicans would have been blamed had no deal been achieved.

More importantly, the fiscal cliff is on the President’s side as well. If we go over it, he and the Democrats in the next Congress that starts later this week can quickly offer legislation that grants a middle-class tax cut and restores most military spending. Even rabid Republicans would be hard-pressed not to sign on.

Demeter

(85,373 posts)SEND UP ON THE AUTHOR OF GUYS AND DOLLS FOR MODERN STOCK MARKET TIMES. GOOD READ!

Demeter

(85,373 posts)I know that it’s unattractive and bad form to say “I told you so” when one’s advice was ignored yet ultimately proved correct. But in the wake of the Republican election debacle, it’s essential that conservatives undertake a clear-eyed assessment of who on their side was right and who was wrong. Those who were wrong should be purged and ignored; those who were right, especially those who inflicted maximum discomfort on movement conservatives in being right, ought to get credit for it and become regular reading for them once again.

I’m not going to beat around the bush and pretend I don’t have a vested interest here. Frankly, I think I’m at ground zero in the saga of Republicans closing their eyes to any facts or evidence that conflict with their dogma. Rather than listen to me, they threw me under a bus. To this day, I don’t think they understand that my motives were to help them avoid the permanent decline that now seems inevitable.

For more than 30 years, I was very comfortable within the conservative wing of the Republican Party. I still recall supporting Richard Nixon and Barry Goldwater as a schoolchild. As a student, I was a member of Young Republicans and Young Americans for Freedom at the height of the Vietnam War, when conservatives on college campuses mostly kept their heads down...In graduate school, I wrote a master’s thesis on how Franklin Roosevelt covered up his responsibility for the Pearl Harbor attack—long a right-wing obsession. My first real job out of graduate school was working for Ron Paul the first time he was elected to Congress in a special election in 1976. (He lost that same year and came back two years later.) In those days, he was the only Tea Party-type Republican in Congress...After Paul’s defeat, I went to work for Congressman Jack Kemp and helped draft the famous Kemp-Roth tax bill, which Ronald Reagan signed into law in 1981. I made important contributions to the development of supply-side economics and detailed my research in a 1981 book, Reaganomics: Supply-Side Economics in Action...After Reagan’s victory, I chose to stay on Capitol Hill, where I was staff director for the Joint Economic Committee and thought I would have more impact. I left to work for Jude Wanniski’s consulting company in 1984, but missed Washington and came back the following year. Jude was, of course, the founding father of supply-side economics, the man who discovered the economists Robert Mundell and Arthur Laffer and made them famous...I went to work for the Heritage Foundation, but left in 1987 to join the White House staff. I was recruited by Gary Bauer, who was Reagan’s principal domestic policy adviser. Gary remains well known among religious conservatives. Late in the administration I moved over to the Treasury Department, where I remained throughout the George H.W. Bush administration...Afterwards I worked for the Cato Institute and the National Center for Policy Analysis, a conservative think tank based in Dallas. I wrote regularly for the Wall Street Journal editorial page, National Review, and other conservative publications. For 12 years I wrote a syndicated column that ran in the Washington Times, Investor’s Business Daily, the New York Sun, and other conservative newspapers...I supported George W. Bush in 2000, and many close friends served in high-level administration positions. I was especially close to the Council of Economic Advisers and often wrote columns based on input and suggestions from its chairmen, all of whom were friends of mine. Once I even briefed Vice President Dick Cheney on the economy.

But as the Bush 43 administration progressed, I developed an increasingly uneasy feeling about its direction. Its tax policy was incoherent, and it had an extremely lackadaisical attitude toward spending. In November 2003, I had an intellectual crisis. All during the summer of that year, an expansion of Medicare to pay for prescription drugs for seniors was under discussion. I thought this was a dreadful idea since Medicare was already broke, but I understood that it was very popular politically. I talked myself into believing that Karl Rove was so smart that he had concocted an extremely clever plan—Bush would endorse the new benefit but do nothing to bring competing House and Senate versions of the legislation together. That way he could get credit for supporting a popular new spending program, but it would never actually be enacted...I was shocked beyond belief when it turned out that Bush really wanted a massive, budget-busting new entitlement program after all, apparently to buy himself re-election in 2004. He put all the pressure the White House could muster on House Republicans to vote for Medicare Part D and even suppressed internal administration estimates that it would cost far more than Congress believed. After holding the vote open for an unprecedented three hours, with Bush himself awakened in the middle of the night to apply pressure, the House Republican leadership was successful in ramming the legislation through after a few cowardly conservatives switched their votes.

MORE--A LOT OF "I" WASH, BUT ENTERTAINING--SCHAUDENFREUDE FOR BREAKFAST!

Fuddnik

(8,846 posts)Ghost Dog

(16,881 posts)I'm here in UK, just passing through, right now. Doing my best to contribute to this increasingly popular, it would appear, sentiment.

![]()

Oh, but darling, it's so important to bugger the punters out of as much as possible so that we can afford to get our kids into those absolutely essential elite public private schools so that they can have a chance to be members of the buggering (in the purely socio-economic sense, you understand) class too!

Demeter

(85,373 posts)

Demeter

(85,373 posts)Last edited Wed Jan 2, 2013, 07:53 AM - Edit history (1)

I'll let you know after I get the trash out....

Definitely closer to 13 than 2....in fact, the new spread is 13-17F between sites.

Demeter

(85,373 posts)Which way will the markets turn? I'm thinking down.

xchrom

(108,903 posts)xchrom

(108,903 posts)Despite the pain inflicted on consumers as a result of the government’s austerity drive and high unemployment, Economy Minister Luis de Guindos remained reasonably upbeat on the first day of the New Year about what the future holds for Spaniards in 2013.

In an interview with Spanish radio station Cadena Ser, De Guindos said he expects the economy to be growing at a sufficient pace to start creating jobs in the last quarter of this year.

The government is sticking to its forecast of a contraction in GDP of 0.5 percent this year despite estimates by the IMF and the European Commission that put the figure at almost triple. The economy is estimated to have shrunk 1.5 percent last year when unemployment moved above 25 percent.

De Guindos said that if the labor reforms introduced by the Popular Party government of Prime Minister Mariano Rajoy had been applied earlier there would have been one million people fewer out of a job.

Demeter

(85,373 posts)Spain is dead...especially its Rajoy government...why would these people be employed? Spain going to go on relief? If so, why not now, or long before now?

xchrom

(108,903 posts)very strange announcement.

xchrom

(108,903 posts)The ruling Popular Party and the main opposition Socialist Party are close to an agreement on slimming down part of the public administrations to eliminate overlapping responsibilities and reduce costs, insider sources said Tuesday.

The proposed Bases for Local Government Law plans to eliminate some 1,000 municipal associations that provide services to different town halls in the same area. Most of these are destined to disappear, particularly those not charged with clearly executive services.

The initiative also calls for a cap on the salaries of the mayors of large cities to levels similar to those of secretaries of state, which are 67,055 euros annually. Currently, 14 mayors of provincial capitals, including Madrid, Barcelona, Bilbao and Zaragoza, earn salaries of around 100,000 euros a year when the head of the central government and his ministers receive 70,000. The legislation will also impose limitations on the wages of councilors.

The government believes the initiative could save some 3.5 billion euros a year by removing overlapping functions of different levels of government.

xchrom

(108,903 posts)

From itinerant Yankee peddlers crisscrossing the U.S. after the Civil War, to Dale Carnegie’s bestselling books on the art of salesmanship, American capitalism has often been driven by new advances in the plying of wares. Arthur Miller’s 1949 Pulitzer Prize-winning play, “Death of a Salesman,” placed the occupation at the heart of the American middle class and its longing for social mobility.

Patricia Sims spent most of the last 20 years selling on the road, pitching products for software companies. Two years ago she traded frequent flier perks for a job that relies on Internet meetings and social media.

“When I started in sales, anyone who did inside sales was thought of more as a telemarketer, someone who would call on consumers and bother people eating dinner,” said Sims, 51, who now works in Charlotte, North Carolina, for ON24 Inc., selling services such as webcasting to businesses. “As time and technology progressed, it’s just made sense to do that big presentation virtually.”

From itinerant Yankee peddlers crisscrossing the U.S. after the Civil War, to Dale Carnegie’s bestselling books on the art of salesmanship, American capitalism has often been driven by new advances in the plying of wares. Arthur Miller’s 1949 Pulitzer Prize-winning play, “Death of a Salesman,” placed the occupation at the heart of the American middle class and its longing for social mobility.

“By the mid-20th century the salesman is really the center of what the country is all about and becomes sort of the archetypal American,” said Walter Friedman, author of the book “Birth of a Salesman: The Transformation of Selling in America” and director of the Business History Initiative at Harvard Business School in Boston, Massachusetts. “Selling became so mainstream that it sort of defined the possibilities of what this country was all about.”

xchrom

(108,903 posts)WASHINGTON (AP) -- While the tax package that Congress passed New Year's Day will protect 99 percent of Americans from an income tax increase, most of them will still end up paying more federal taxes in 2013.

That's because the legislation did nothing to prevent a temporary reduction in the Social Security payroll tax from expiring. In 2012, that 2-percentage-point cut in the payroll tax was worth about $1,000 to a worker making $50,000 a year.

The Tax Policy Center, a nonpartisan Washington research group, estimates that 77 percent of American households will face higher federal taxes in 2013 under the agreement negotiated between President Barack Obama and Senate Republicans. High-income families will feel the biggest tax increases, but many middle- and low-income families will pay higher taxes too.

Households making between $40,000 and $50,000 will face an average tax increase of $579 in 2013, according to the Tax Policy Center's analysis. Households making between $50,000 and $75,000 will face an average tax increase of $822.

corkhead

(6,119 posts)Roland99

(53,342 posts)xchrom

(108,903 posts)PARSIPPANY, N.J. (AP) -- Avis is buying Zipcar for $491.2 million, expanding its offerings from traditional car rentals to car sharing services.

Car sharing has become a popular alternative to traditional rentals in metropolitan areas and on college campuses, allowing members to quickly procure a vehicle for quick trips. Zipcar, which was founded in 2000, has more than 760,000 members. It went public in 2011.

"By combining with Zipcar, we will significantly increase our growth potential, both in the United States and internationally, and will position our company to better serve a greater variety of consumer and commercial transportation needs," said Avis Chairman and CEO Ronald Nelson.

Bringing the Avis fleet into play will also help Zipcar meet high demand on weekends, Avis said, when most people make a run to the grocery store or run other errands.

xchrom

(108,903 posts)LISBON, Portugal (AP) -- Bailed-out Portugal's president has asked the country's Constitutional Court to check whether new austerity measures included in this year's state budget are lawful.

The government says the steep tax hikes and welfare cuts in its 2013 spending plan are needed to pull the country out of its debt hole. Portugal needed a (EURO)78 billion ($103 billion) bailout in May 2011 to avert bankruptcy as it was engulfed by the eurozone's financial crisis.

President Anibal Cavaco Silva said in his annual New Year's message broadcast late Tuesday that he signed the budget into law because Portugal cannot afford a political crisis.

But, with opposition parties promising to challenge the budget in the courts, the head of state said he wanted to make sure the steps taking away long-standing entitlements are permissible

xchrom

(108,903 posts)NICOSIA, Cyprus (AP) -- Cyprus' president says he would refuse any request by international lenders to sell off state-owned companies as part of a finalized agreement to bail out the crisis-hit country.

Dimitris Christofias said Wednesday he has "no intention" of consenting to privatizations. A draft of the bailout deal with the European Commission, the European Central Bank and the International Monetary Fund says Cyprus will have to consider privatizations if it's debt is deemed unsustainable.

Cypriot banks, which took huge losses on bad Greek debt and loans, are estimated to need up to (EURO)10 billion ($13.19 billion) in rescue money. That's more than half the country's economy, raising questions whether the government will be able to handle the debt. Cyprus' eurozone partners will decide on the country's bailout deal on Jan. 21.

xchrom

(108,903 posts)When Jacopo Mingazzini's customers step off the plane in Berlin, they like to mix business with pleasure. First, the real estate broker's employees chauffeur the Italians to the city's top tourist attractions. Then they take the visitors to Wedding, a residential area in Berlin that is central if not particularly chic.

The potential buyers are on a tight schedule. Mingazzini's employees sometimes show them up to five apartments a day. The negotiations are conducted in Italian, and demand is high. Of the 1,200 apartments Mingazzini has sold this year, 150 were bought by Italians seeking to invest their savings in German real estate, which is seen as crisis-proof. "They know full well that if they buy an apartment that's currently being rented for €5 ($6.60) a square meter (about $0.60 a square foot), they can charge a lot more on a new lease," Mingazzini says.

The method being used by Italian teachers and lawyers to protect themselves against the euro crisis is causing turmoil in Germany's capital. Berlin's housing market is going haywire as local rents explode. Since 2007, average rents in the western part of the city have gone up by 20 percent, and other major cities are now experiencing the same development. Even apartments in second-tier cities have become nearly unaffordable for people with average incomes. Those seeking a new apartment in Hamburg, Munich, Berlin, Frankfurt, Düsseldorf or Cologne can expect to pay at least 25 percent more than they are accustomed to paying for the same size and standard of apartment elsewhere.

This is bad news for anyone hoping to move to a different city for a job or to attend a university. People who want to move around have to be prepared to pay for it, and couples planning to have children are scaling back their space requirements. The German Renters' Association (DMB) estimates that there is a shortage of about 250,000 apartments nationwide, and the latest government report on the housing sector concludes that a growing number of cities and regions "are likely to experience bottlenecks."

Demeter

(85,373 posts)ask Merkel

xchrom

(108,903 posts)Germany’s leading opinion pollster has said it is far from certain that this general election year will end with Angela Merkel as chancellor.

Dr Renate Köcher of the prestigious Allensbach Institute has dismissed the widespread view in Berlin that Dr Merkel is a shoo-in for a third term leading a second grand coalition with the opposition Social Democrats (SPD).

“I’m amazed how many people today seem to assume we’ll have another grand coalition after the next election,” said Dr Köcher yesterday. “That’s a possible scenario but another is an SPD-Green coalition . . . they only need two to three points to win a majority, so in that sense the race is open.”

With nine months to polling day, Dr Köcher said the least likely election result was a return of the current coalition of Dr Merkel’s Christian Democrats (CDU) with the liberal Free Democrats (FDP).

xchrom

(108,903 posts)***SNIP

BRIC growth was a fluke, Sharma says, fueled by the waning of the wave of economic crises in the late-90s and subsequent "global flood of easy money."

And now?

...there is a lot less foreign money flowing into emerging markets. The global economy is returning to its normal state of churn, with many laggards and just a few winners rising in unexpected places.

The main culprit is China, whose population "is simply too big and aging too quickly" to sustain its breakneck growth, he says. We can instead expect a "three-to-four percent slowdown" there.

Read more: http://www.businessinsider.com/morgan-stanleys-ruchir-sharma-on-brics-2013-1#ixzz2GpELM3qL

xchrom

(108,903 posts)A long-awaited deal to avoid a US fiscal crisis prompted a global stock market rally today, with shares and commodities rising sharply across Europe and Asia.

After a last minute scramble, US politicians last night approved a plan to prevent huge tax increases and delay spending cuts that together would have pushed the world's largest economy off the "fiscal cliff" and into a likely recession.

The agreement handed a clear victory to US president Barack Obama, who won re-election on a promise to address budget woes in part by raising taxes on the wealthiest Americans. His Republican antagonists were forced to vote against a core tenet of their anti-tax conservative faith. By a vote of 257 to 167, the Republican-controlled House of Representatives approved the bill.

The Senate passed the measure earlier in a rare New Year's Day session and Mr Obama said he will sign it into law shortly.

Demeter

(85,373 posts)Does the world delude itself that everything is back to "normal"? All fixed, etc.? Or is this just an excuse for privateering and irrational exuberance?

xchrom

(108,903 posts)first was the euro crises is over now this.

mean while the banks and financial houses are still driving things into the ground.

xchrom

(108,903 posts)Cypriot EU presidency. As Ireland assumes the rotating presidency in January, there are expectations it will create an opportunity to open a new page in Turkey-EU relations.

Turkish EU affairs minister Egemen Bagis says Ireland’s EU presidency will be an historic turning point in regard to Turkey-EU relations. He is hopeful Turkey’s bid to join the European Union will accelerate during the presidency in the first half of next year.

The country first submitted an application for full membership of the European Union in 1987, having had ambitions that date back to 1959. It has been negotiating for membership ever since.

Many Turks believe that Europe is missing out on a fast-growing economy that could give the EU a much-needed boost.

xchrom

(108,903 posts)Irish manufacturing activity expanded for the 10th month running in December, albeit at its slowest pace in four months as growth in new orders weakened, a survey showed today.

According to the latest NCB Manufacturing Purchasing Managers' Index, the rate of growth in manufacturing slipped to 51.4 in December from 52.4 a month earlier, weighed down by weak domestic demand and higher energy costs.

"As a result of the strength in exports, total new business grew again in December, albeit at the slowest rate since February," said Philip O'Sullivan, chief economist at NCB Stockbrokers. "The underlying trends remain positive," he said.

The sub-index measuring new orders fell to 50.9 from 51.9 in November, the lowest level since February, but it remained above the 50 line that separates growth from contraction.

xchrom

(108,903 posts)France’s socialist government has vowed to continue squeezing the rich, despite the rejection of its controversial 75 per cent tax rate by the country’s constitutional council.

President François Hollande was forced to axe his 2013 budget proposal to impose the high marginal rate on incomes above €1 million when the council struck it down on Saturday.

But Pierre Moscovici, finance minister, said the 75 per cent rate was an important element in what he called the government’s policy of social justice. He insisted the council ruling was a technical, not fundamental, objection and promised to introduce a revamped proposal in the new year.

“Our objective is to maintain an exceptional, temporary tax for the most rich,” he said. He “respected” criticism of the government’s tax policy, including from abroad, but it had been exaggerated, he said.

xchrom

(108,903 posts)U.K. manufacturing unexpectedly expanded at the fastest pace in 15 months in December as domestic demand improved, indicating some strength in the economy at the end of 2012.

A gauge of factory activity rose to 51.4 from a revised 49.2 in November, Markit Economics and the Chartered Institute of Purchasing and Supply said in London today. The median forecast of 29 economists in a Bloomberg News survey was for a reading of 49.1, unchanged from November’s initially reported level. The pound stayed higher against the dollar after gaining to its strongest level in 16 months.

The report reduces the chance the U.K. will succumb to triple-dip recession after the economy resumed expansion in the third quarter and tensions related to the euro-region debt crisis eased. Still, Markit noted that companies remain “cautious” and the Bank of England has forecast only a gradual recovery through 2013. A separate report showed euro-area manufacturing continued to shrink last month.

“The sector found some stability at the very end of 2012,” said Samuel Tombs, an economist at Capital Economics Ltd. in London. Still, “with the recession in the euro zone set to deepen and consumers at home on course to be hit by a further bout of relatively high inflation, 2013 is shaping up to be another tough year for U.K. manufacturers.”

xchrom

(108,903 posts)Singapore's economy has averted a technical recession, as it reported better-than-expected growth data for the fourth quarter.

The economy expanded 1.1% in the October to December period, from a year earlier, advance estimates showed.

On a quarter-on-quarter basis, the economy grew 1.8%. That is up from a 6.3% contraction in the third quarter.

Growth was boosted by a rebound in the services industries, which include retail, finance and insurance sectors.

xchrom

(108,903 posts)India has rolled out an ambitious plan for a cash payout of subsidies to the poor in 20 districts, officials say.

Finance Minister P Chidambaram said the scheme would benefit more than 200,000 people initially, and would cover the entire country by the end of 2013.

Authorities say it will bring the country's poorest citizens "into the mainstream".

But opposition parties have accused the government of "bribing the voters" ahead of the 2014 general elections.

xchrom

(108,903 posts)The giant insurance company that became the recipient of one of the biggest—and least popular—bailouts in history has a message for the American taxpayer: Hey, thanks a lot!

Just weeks after the Treasury sold off its final stake in AIG and closed out one of the ugliest chapters of the 2008 financial crisis, the recipient of $180 billion in capital injections and loans is launching a new public relations offensive to try to rebuild a, shall we say, strained relationship with the American public.

The advertising campaign is titled “Thank You America,” the company said in a news release Monday, and it debuts New Year’s Day. It spotlights the insurers’ employees “telling AIG’s story and sharing their pride in the company,” and showing how the company has helped America rebuild after devastation, such as in Joplin, Mo. after a devastating tornado and in the aftermath of Hurricane Sandy. Look for the ads in college football bowl games, NFL playoff games, and news shows including The Today Show, Good Morning America, and 60 Minutes.

Now that taxpayers have sold off their stake in the company—and made a tidy $22 billion in profit in the process—it is perhaps not surprising that AIG wants to re-cast its image. It is reminiscent of the memorable Clint Eastwood Chrysler commercial in last year’s Super Bowl that was managed to make buying a car from another bailed-out company (and one now run by Italians!) feel like a patriotic duty (“This country can’t be knocked out with one punch,” Eastwood growled. “We get right back up again and when we do the world is going to hear the roar of our engines.”

DemReadingDU

(16,000 posts)1/2/13 Stocks Soar on 'Fiscal Cliff' Deal

U.S. stocks extended their gains on Wednesday, with the Dow up 2 percent, after lawmakers agreed a deal to avoid massive tax hikes and spending cuts that had threatened to hurt economic growth.

The Dow Jones industrial average <.DJI> was up 262.45 points, or 2.00 percent, at 13,366.59. The Standard & Poor's 500 Index <.SPX> was up 29.79 points, or 2.09 percent, at 1,455.98. The Nasdaq Composite Index <.IXIC> was up 77.45 points, or 2.57 percent, at 3,096.97.

http://finance.yahoo.com/news/wall-street-set-rally-wake-fiscal-pact-135204296--finance.html

elleng

(131,028 posts).At 11:02 AM ETMarkets »

S.&P. 500

1,453.23

+27.04

+1.90%Dow

13,353.05

+248.91

+1.90%Nasdaq

3,091.90

+72.39

+2.40%

Roland99

(53,342 posts)Demeter

(85,373 posts)haven't cracked the bottle yet...and it's a paper night, so...maybe tomorrow?

Demeter

(85,373 posts)On January 1, just before 2 AM, the Senate overwhelmingly agreed to pass a bill that will avert the Fiscal Cliff. The House approved it later that night.

The bill is pretty straightforward. Income tax rates will only rise on those making over $400K (liberals wanted $250K, GOP wanted no taxes to rise). Spending cuts will be delayed for 2 months to give the sides more time to address them.

So why is the bill 157-pages long?

Because when Washington does business and passes a huge bill, there are all kinds of little other pre-existing tax things most Americans have never heard of, but which needed to be extended, that also get into the bill. It's just how it works.

1. There's a provision extending a tax policy related to Puerto Rican rum.

2. And a tax credit for 2- and 3-wheel electric vehicles.

3. Something having to do with (bio) Diesel Fuel.

4. An extension of some special rules for the film and television business.

5. A gift to the car-racing world.

6. Help to asparagus farmers.

AND THAT'S JUST A SAMPLE OF THE LINT THAT THIS BILL PICKED UP

Read more: http://www.businessinsider.com/whats-in-the-fiscal-cliff-bill-2013-1#ixzz2Gq9cNhzk

Demeter

(85,373 posts)Demeter

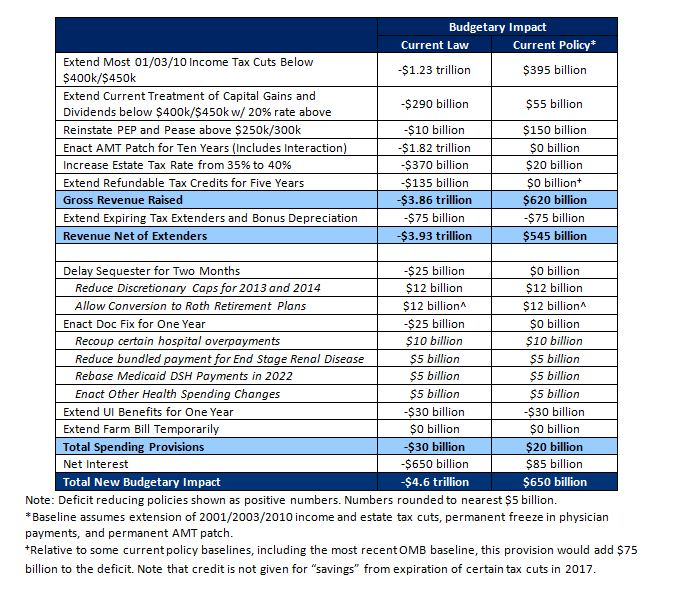

(85,373 posts)In short, the package would permanently extend most of the 2001/2003/2010 tax cuts for incomes below $400,000/$450,000 while letting the ordinary rate above that threshold rise to 39.6 percent and the capital gains and dividends rates to 20 percent; it would increase the estate tax rate from 35 to 40 percent; it would permanently patch the AMT; and it would extend various “tax extenders” for 2012 and 2013. On the spending side, the package would delay the sequester for two months, enact a doc fix for a year, extend unemployment benefits for a year, extend the farm bill for a year, and enact about $50 billion in spending and revenue offsets to pay for the sequester delay and doc fix.

Based on more recent estimates, CRFB estimates that the entire package would increase deficits by about $4.6 trillion over the next ten years compared to current law projections (assuming everything expires or activates as called for) but would decrease deficits and debt by about $650 billion compared to more realistic current policy projections. These revised estimates continue to show that debt would remain on a upward path over the next ten years -- reaching 79 percent of GDP by 2022 – if policymakers are unable to offset a repeal of the sequester and Sustainable Growth Rate. That would be a slight improvement over the CRFB Realistic Projections, which show debt rising to over 81 percent by 2022. Clearly, lawmakers will need to go further, however, to put in place much more savings.

Below is our effort to roughly estimate the parameters of the deal.

So what’s to like and dislike about the deal? Below we explain:

The Good

The Bad

The Ugly

TOO BAD, LOSERS!

Fuddnik

(8,846 posts)And Amerika?

Demeter

(85,373 posts)unless you prefer stripes....

Fuddnik

(8,846 posts)Help to asparagus farmers.

Demeter

(85,373 posts)siligut

(12,272 posts)We'll see. We shall see.