Economy

Related: About this forumWeekend Economists Take Five: December 7-9, 2012

The musical world lost a jazz giant this week.

Dave Brubeck, worldwide ambassador of jazz, dies at 91

http://www.washingtonpost.com/local/obituaries/dave-brubeck-worldwide-ambassador-of-jazz-dies-at-91/2012/12/05/a9fa70e4-3959-11e0-bb8c-90acdd319fdd_story.html

In his seven-decade career, Dave Brubeck was both an artistic and a commercial success, a pianist and composer who expanded the musical landscape and who crossed other borders as one of the world’s foremost ambassadors of jazz.

He had an inventive style that brought international music into the jazz mainstream, but he was more than a musical innovator: He was an American original.

Mr. Brubeck died Dec. 5 at a hospital in Norwalk, Conn., one day before his 92nd birthday. His manager, Russell Gloyd, said Mr. Brubeck was on his way to a regular medical checkup when his heart gave out.

Considered one of the greatest figures of a distinctively American art form, Mr. Brubeck was a modest man who left a monumental legacy. His 1959 recording “Time Out,” with its infectious hit “Take Five,” became the first jazz album to sell 1 million copies. He toured once-forbidden countries in the Middle East and in the old Soviet empire and was honored by presidents and foreign dignitaries.

He wrote hundreds of tunes, including the oft-recorded “In Your Own Sweet Way” and “The Duke.” His quartet, featuring alto saxophonist Paul Desmond, was one of the most popular jazz groups in history, and he kept up a busy performing schedule into his 90th year.

He also composed ambitious classical and choral works, released nearly 100 albums, and remained a charismatic and indefatigable performer into old age. In December 2010, the month Mr. Brubeck turned 90, his quartet won the readers’ poll of DownBeat magazine as the best group in jazz — 57 years after he first won the poll.

A bespectacled cowboy who grew up on a remote California ranch, Mr. Brubeck was known for his complex rhythmic patterns, which he said were inspired by riding his horse and listening to its syncopated hoofbeats striking the ground. He studied in the 1940s with the experimental French composer Darius Milhaud, who encouraged his interest in jazz. Mr. Brubeck was among the first jazz musicians to make wide use of polytonality, or playing in more than one musical key at a time. He was an early advocate of “world music,” adopting exotic sounds that he heard in his travels.

After Mr. Brubeck formed a quartet in the early 1950s, his wife, Iola, suggested that the quartet perform on college campuses, which produced a nationwide sensation, with record sales to match.

“We reached them musically,” he told the New York Times in 1967. “We had no singers, no beards, no jokes. All we presented was music.”

With their curly hair and horn-rimmed glasses, Desmond and Mr. Brubeck looked like professorial brothers and were unlikely jazz stars. The two had an instant musical bond and could anticipate each other’s bandstand improvisations, as Desmond’s ethereal, upper-register saxophone soared above Mr. Brubeck’s driving keyboard attack.

THIS OBIT GOES ON FOR THREE PAGES....THE SONG OUTLASTS THE SINGER

Demeter

(85,373 posts)Dave Brubeck, who died in hospital this morning, the day before his 92nd birthday, didn't write "Take Five", the million-selling tune which defined his career to a large public and remains one of the most famous in jazz.

That was the work of Paul Desmond, the saxophonist in Brubeck’s quartet who played its sinuous solos as Brubeck’s percussive piano swung in 5/4 time. But it was Brubeck who was, as much as anyone, the unlikely, white, bespectacled face of jazz in the 1950s....

Tansy_Gold

(17,857 posts)kickysnana

(3,908 posts)Demeter

(85,373 posts)A Tennessee lawyer who is the mysterious source of millions of dollars in contributions that were steered to national political candidates doubled his investments before Election Day and funneled an additional $6.8 million to a prominent Tea Party group.

William Rose of Knoxville says he's not obligated to disclose the origin of more than $12 million he routed through two nascent companies he owns.

The money went to the FreedomWorks for America "super" political committee, which spent it on high-profile congressional races. Rose made the latest contributions even as news organizations were investigating suspicious donations traced to him during October.

The contributions are emblematic of the murky world of who gives money to politicians after new federal rules allowing unlimited and anonymous donations.

THIS IS SILLY. HE'S NOT THE DONOR, HE'S THE BEARD, THE CONDUIT, THE FRONT MAN....

Fuddnik

(8,846 posts)I guess it's good work if you can get it.

Demeter

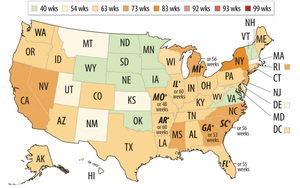

(85,373 posts)The Labor Department's glad tidings Friday about the uptick in job creation last month might morph into bad news next month for many of the long-term unemployed.

That's because the boost in November hiring, with employers adding 146,000 jobs, might make it more difficult for Democrats to argue in favor of having Congress renew the extension of benefits for people out of work more than six months.

As things stand, four in 10 Americans who receive unemployment insurance will lose their extended benefits if federal aid expires as scheduled on Dec. 29.

If that were to happen, "it would be devastating for these unemployed workers and their families; in many cases, this is the only income they have," says Judy Conti, a lobbyist with National Employment Law Project, a group that advocates for low-wage workers. "It's the middle of winter — when people need heat and food and shelter."

But conservatives now have a stronger argument to make when they say the job market is healthy enough to offer opportunities to those who have been out of work a long time. In November, the unemployment rate dropped two-tenths of a point to 7.7 percent, the lowest level in four years....

ONLY IF YOU ARE A DELUSIONAL REPUBLICAN WOULD YOU MAKE THAT CLAIM.

Demeter

(85,373 posts)Self-employment jumped by 163,000 in November.

The unemployment rate fell to 7.7 percent in November, its lowest level since December of 2008. However, the immediate cause was a drop of 350,000 in the size of the labor market as reported employment actually fell by 122,000. The establishment survey reported job growth of 146,000. With the prior two months growth revised downward by 49,000, this brings the average over the last three months to 139,000. This is somewhat worse than the 158,000 average rate of job growth over the last year.

The private sector accounted for almost all the November job growth, adding 147,000 jobs. Average growth over the last three months has been 153,000. All the loss in public sector employment over this period was attributable to decline in employment of 50,000 in local government education. Without the loss of jobs in this sector, government employment would have been essentially flat over the last year.

Retail was the biggest job gainer in November, which added 53,000 in November, 33,000 of which were in clothing. After showing little change for the prior three years, the retail sector has added 140,000 jobs over the last three months, with clothing being responsible for almost half (68,000) of these jobs. Some of these gains are almost certainly the result of changing seasonal patterns with retailers pulling forward holiday hiring. That suggests weaker growth going forward.

Construction employment fell by 20,000, more than reversing a 15,000 gain reported in October. Employment in the sector has been essentially flat over the last year. Manufacturing lost 7,000 jobs. Employment in the sector has been essentially flat since June after rising by 26,000 a month over the prior seven months. Temporary employment rose by 18,000 and health care added 20,000 jobs, slightly less than its average of 26,000 over the last year.

One anomaly was a jump of 14,600 jobs (4.0 percent) in the motion picture industry. This will be reversed in future months.

Women got somewhat more than half the gains (91,000 jobs) over the last month. This reverses the pattern for the last couple of years in which men were coming out ahead. The better job growth for men was not due to the comeback of traditional areas of male employment, such as construction and manufacturing, but rather by men getting a disproportionate share of the jobs created in areas such as retail and health care...

Demeter

(85,373 posts)Today’s jobs report shows an economy that’s still moving in the right direction but way too slowly, which is why Washington’s continuing obsession with the federal budget deficit is insane. Jobs and growth must come first.

The cost of borrowing is so low — the yield on the ten-year Treasury is near historic lows — and the need for more jobs and better wages so high, and our infrastructure so neglected, that it’s insanity not to borrow more to put more Americans to work rebuilding the nation.

Yes, unemployment is down slightly and 146,000 new jobs were created in November. That’s some progress. But don’t be blinded by the hype coming out of Wall Street and the White House, both of which want the public to believe everything is going wonderfully well.

The fact is some 350,000 more people stopped looking for jobs in November, and the percent of the working-age population in jobs continues to drop — now at 63.6%, almost the lowest in 30 years. Meanwhile, the average workweek is stuck at 34.4 hours....

jtuck004

(15,882 posts)

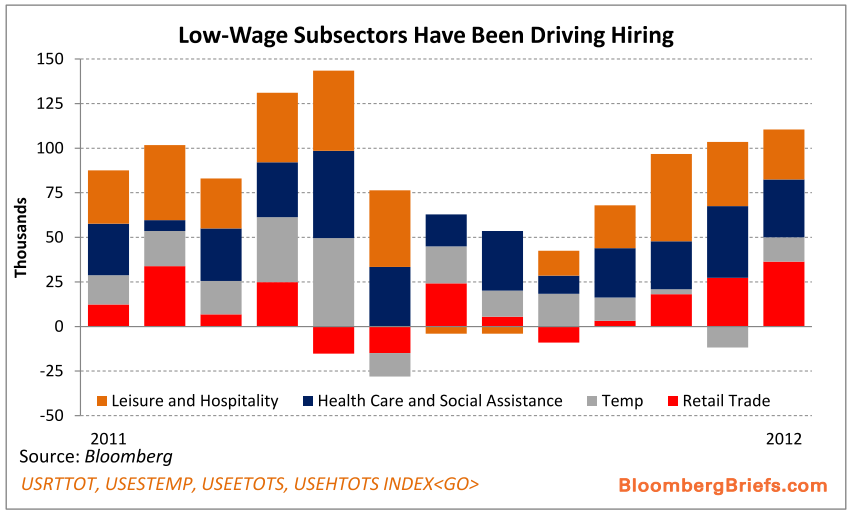

Leisure and hospitality, health care and social assistance, retail and temporary jobs — all low wage sectors — have been responsible for over half (51%) of the private sector job growth the last year.

Weak wage growth is function of slack in the labor force and a lack of negotiating power amongst job holders and seekers.

Here.

People using up their resources, increasing number of working poor.

But then we have the better jobs, second tier at GM, $16 an hr. Almost enough to avoid half-price lunches in the public school program, something half - 50% - of all families qualify for in the Boise school system. Except for the ones that qualify for free because they have even less. for some of them the next meal they get after they leave Friday will be the breakfast they get at school on Monday. Maybe they could send them home with some standardized tests and a peanut butter spread.

Demeter

(85,373 posts)THIS is what poverty sometimes looks like in America: parents here in Appalachian hill country pulling their children out of literacy classes. Moms and dads fear that if kids learn to read, they are less likely to qualify for a monthly check for having an intellectual disability. Many people in hillside mobile homes here are poor and desperate, and a $698 monthly check per child from the Supplemental Security Income program goes a long way — and those checks continue until the child turns 18.

“The kids get taken out of the program because the parents are going to lose the check,” said Billie Oaks, who runs a literacy program here in Breathitt County, a poor part of Kentucky. “It’s heartbreaking.”

This is painful for a liberal to admit, but conservatives have a point when they suggest that America’s safety net can sometimes entangle people in a soul-crushing dependency. Our poverty programs do rescue many people, but other times they backfire.

Some young people here don’t join the military (a traditional escape route for poor, rural Americans) because it’s easier to rely on food stamps and disability payments.

Antipoverty programs also discourage marriage: In a means-tested program like S.S.I., a woman raising a child may receive a bigger check if she refrains from marrying that hard-working guy she likes. Yet marriage is one of the best forces to blunt poverty. In married couple households only one child in 10 grows up in poverty, while almost half do in single-mother households.

...About four decades ago, most of the children S.S.I. covered had severe physical handicaps or mental retardation that made it difficult for parents to hold jobs — about 1 percent of all poor children. But now 55 percent of the disabilities it covers are fuzzier intellectual disabilities short of mental retardation, where the diagnosis is less clear-cut. More than 1.2 million children across America — a full 8 percent of all low-income children — are now enrolled in S.S.I. as disabled, at an annual cost of more than $9 billion...

THIS COLUMN IS CRAP. THE ENTIRE HOUSE OF CARDS IT ERECTS IS CRAP.

IF THERE IS POVERTY, IF PARENTS CANNOT SURVIVE, THEN GET THE PARENTS THE SUPPORT THEY NEED. THIS IS CLINTON'S "END OF POVERTY PROGRAMS" RESULT, AND THE FUZZY THINKING OF SELF-PROFESSED "LIBERALS" UNWORTHY OF THE NAME...

IN MY HUMBLE OPINION, IT IS FAR BETTER TO BE ILLITERATE ON DISABILITY THAN JOIN THE ARMY, SERVE AS A CORPORATION'S MERCENARY, LEARN TO KILL WOMEN AND CHILDREN, GET KILLED, MAIMED OR BRAIN-DAMAGED FOR LIFE BY THE RESENTFUL POPULATIONS YOU ARE TOLD TO SUBDUE, AND THEN SEE YOUR PROMISED VETERAN'S BENEFITS GO UP IN SMOKE.

IT'S BETTER TO BE A SINGLE MOTHER THAN MARRIED TO A MAN WHO DOESN'T LOVE YOU OR YOUR CHILDREN.

WHAT HAS HAPPENED TO THIS SHINING CITY ON THE HILL? IT'S BECOME A WHITED SEPULCHER.

bread_and_roses

(6,335 posts)Goddess, I hate "Liberals." Talk about Whited Sepulchers. Pompous, pontificating slugs - no, even slugs have their place in the natural world - Chris Hedges nailed their useless asses.

AnneD

(15,774 posts)For most of her life, my daughter was raised in a single mom household. I busted my ass to meet her needs, set a good example for her, and see to it she could do for her self when she grew up. I thought more of my responsibilities than my pleasures. I did not want her exposed anymore to her shiftless dad than was necessary.

And yet, if you listen to some numb nuts, single moms are the cause of the fall of America or what ever crises bests us. Well if it is so fucking bad....why don't you help them. Pay parity would be a start. A little time flexibility around the schedule might be helpful. And for God's sake, would it kill you to give the women or men time off with pay when their kids are sick. Many parents I know save their sick days to take off when their kids are sick and they go to work sick.

Just some simple kindness and human charity goes a long way.

Demeter

(85,373 posts)THEY ARE NUTS!

Marriage only works if the people in the marriage work....together.

Those that cannot work with another DO NOT BELONG IN A MARRIAGE!!!

That's why we have murder/suicides, for chrisakes! That's why we have divorce!

That's why we have birth control!

TO PROTECT THE WOMEN AND CHILDREN!

I GET SO FLAMING MAD AT IDIOTS LIKE KRISTOFF, I COULD JUST EXPLODE.

Demeter

(85,373 posts)The Secret Service said on Friday it is under investigation by the Department of Homeland Security over the loss of computer files on the Washington Metro system. In 2008, a contract employee lost two computer tapes on the Metro while transporting them from one facility to another, Secret Service spokesman Edwin Donovan said. The investigation was first reported by CNN and Fox News. The Secret Service notified transit police and the Department of Homeland Security, but were unable to locate the tapes. .

http://dailynewsglobal.com/?p=386740

kickysnana

(3,908 posts)Otherwise some kid would most likely just try to play them and either chuck them or tape over them depending on the medium.

Little Devil on my shoulder says: "Perhaps someone with an agenda needed a shake up in the Secret Service and this would sure do it."

Demeter

(85,373 posts)Demeter

(85,373 posts)AND IN A LAME-DUCK SESSION, MICHIGAN IS RAILROADED INTO A RIGHT-TO-WORK STATE...

SNYDER'S A LIAR. BUT THEN, HE'S A GOP HACK AND A LIBERTARIAN, TO BOOT.

http://www.freep.com/article/20121206/BUSINESS06/121206066/Koch-Brothers-Americans-Prosperity-leading-charge-Snyder-s-right-work-bill

Gov. Snyder's right-to-work initiative has the coordinated support of Americans for Prosperity, the conservative non-profit organization that funded Wisconsin Gov. Scott Walker's efforts to strip that state's public employee unions of their collective bargaining rights.

AFP was founded by wealthy industrialists Charles and David Koch. Their business interests in Wisconsin include a branch of their pulp and paper giant Georgia-Pacific, a coal subsidiary, timber plants and a pipeline network.

The organization's sister organization, Americans for Prosperity Foundation, has produced a 15-page booklet titled "Unions: The Good, the Bad and the Ugly: How forced unionization has harmed workers and Michigan."

AFP also recruited 300 supporters to demonstrate in favor of Gov. Snyder's proposed bill, just as organized unions rallied their members in opposition.

Asked how much AFP has contributed to support the right-to-work bill, spokeswoman Annie Patnaude said, "I need to check with my boss, but so far we have offered our supporters cookies and coffee."

Demeter

(85,373 posts)In a sudden change of heart, Michigan Gov. Rick Snyder announced that he would sign so-called "right to work" legislation designed to gut union membership in the auto capital of the world...This is a change in tune for the Governor who previously said that the legislation was not a "policy priority" because it was "too divisive.".....Yesterday in Michigan, Gov. Rick Snyder and his GOP controlled lame-duck legislature pulled a fast one, introducing and then ramming through the House and the Senate so-called "right to work" legislation. The bill was introduced at 11 a.m., passed the House at 5 p.m. by a narrow margin and the Senate at around 6:00 p.m. When the process is complete and the bill is signed, Michigan will become the 24th right to work state.

Why the rush? The GOP majority felt it might not have the votes once the newly elected legislature was seated in January. The bill is designed so it cannot be repealed by popular referendum. (NOVEMBER'S BALLOT INCLUDED A PROPOSAL TO INCORPORATE BARGAINING RIGHTS INTO THE MICHIGAN CONSTITUTION--IT WAS DEFEATED) The Capitol was chaotic today as police pepper-sprayed protesters and locked down the building, forcing Democrats to seek a court order to get the doors open again. "It's not only anti-worker, its anti-democratic," Lansing Mayor Virg Bernero told MSNBC.

Right to work bills prohibit unions from requiring all members to pay dues. The laws make it much harder for unions to organize and exist. They have long been used in the South to push down wages and weaken worker movements. The Michigan bill will apply to both public and private sector unions.

At a time when working families are struggling, the Michigan GOP decided it was a fine time to push for a race to the bottom in wages and working conditions, while at the same time kneecapping their chief opponents in the political arena -- organized workers....

amandabeech

(9,893 posts)It is very difficult for me to even read articles about it because I'm from W. Mich. (as you may recall, Demeter), and have many friends and relatives there.

It's not the same state that I know. Just the tuition at the state universities is unreal compared to what I paid.

Now this.

Demeter

(85,373 posts)And I wish I had some faith that good would triumph...but I 've seen too much of the dark side of Michiganders.

amandabeech

(9,893 posts)That Wisconsin battle was really rough, but with the Koch brothers footing the bill, I'm sure that the pukes will find a way to make things tough.

amandabeech

(9,893 posts)I saw a reference to it over the weekend but didn't bookmark it.

It's not surprising at all, really.

The Koch Brothers are evil, but the De Vos-Prince bunch has done tremendous damage in Michigan and abroad. Pure pond scum.

Demeter

(85,373 posts)With the Scottish National Party in control, independence is on the table. One way Scotland could exercise true economic sovereignty - and control over the national currency, credit and debt - would be to have its own publicly-owned bank, one that served the interests of the Scottish people...The Royal Bank of Scotland (RBS) and the Bank of Scotland have been pillars of Scotland's economy and culture for more than three centuries. So when the RBS was nationalized by the London-based UK government following the 2008 banking crisis, and the Bank of Scotland was acquired by the London-based Lloyds Bank, it came as a shock to the Scots. They no longer owned their oldest and most venerable banks.

Another surprise turn of events was the triumph of the Scottish National Party (SNP) in the 2011 Scottish parliamentary election. Scotland is still part of the United Kingdom, but it has had its own parliament since 1999, similar to US states. The SNP has rallied around the call for independence from the UK since its founding in 1934, but it was a minority party until the 2011 victory, which gave it an overall majority in the Scottish Parliament. Scottish independence is now on the table. A bill has been introduced to the Scottish Parliament with the intention of holding a referendum on the issue in 2014.

Arguments in favor of independence include that it will allow the Scottish people to make decisions for Scotland themselves, on such contentious issues as having nuclear weapons in their seas and being part of NATO. They can also directly access the profits from the North Sea oil off Scotland's coast. Arguments against independence include the fact that Scotland's levels of public spending (which are higher than in the rest of the UK) would be difficult to sustain without raising taxes. North Sea oil revenues will eventually decline.

One way budgetary problems might be relieved would be for Scotland to have its own publicly-owned bank, one that served the interests of the Scottish people. True economic sovereignty means having control over the national currency, credit and debt...

Demeter

(85,373 posts)Fuddnik

(8,846 posts)Demeter

(85,373 posts)Where's the Dim Sum and Rum?

Demeter

(85,373 posts)Last edited Fri Dec 7, 2012, 11:31 PM - Edit history (1)

AND IT'S 8:30 EST. I HAVE TO TAKE THE GRANDPUPPY HOME...BE BACK SOON!\

SO, TAKE 5, ALL!

Demeter

(85,373 posts)THIS JOKER DESERVES A SPECIAL SPOT WITH A STAR ON THE WALL OF SHAME...

http://news.yahoo.com/former-aide-wisconsin-governor-sentenced-embezzlement-case-021804679.html

A former aide to Wisconsin Governor Scott Walker was sentenced to two years in prison on Friday for embezzling tens of thousands of dollar from a fund for families of U.S. soldiers who fought in Iraq and Afghanistan. The aide, Kevin Kavanaugh, was also sentenced to two years of extended supervision and ordered to pay back the $51,200 he embezzled from Operation Freedom, a military appreciation event held each year at the Milwaukee County Zoo. Kavanaugh, who was convicted by a jury in October, worked for Walker when the first-term Republican governor served as Milwaukee County executive.

Kavanaugh, 62, was the treasurer of the Military Order of the Purple Heart, a charity involved in Operation Freedom, from 2006 to 2009. Walker appointed him to serve on the Milwaukee County Veteran Service Commission during Walker's term as county executive. Walker originally ran the Operation Freedom event through his county office. It was later turned over to the Purple Heart organization after Walker received legal advice the event should be handled by a charitable organization.

Tim Russell, another Walker aide, was implicated in the same investigation and pleaded guilty in November to diverting more than $21,000 to his personal bank account.

The investigation is part of a wider probe into Walker's county executive office.

Demeter

(85,373 posts)As the costs of this once-in-a-generation storm mount for America’s east coast, there will invariably be cries that the country is bankrupt, and will therefore be unable to ‘pay’ the cost of reconstruction. Even now, as the news has been unfolding the mainstream neo-liberal ideologues have been out in force preaching that the US government was now facing a major fiscal crisis and its capacity to deal with this event was severely limited. Imagine the reactions of the people in shock after the event to hear the news bulletins telling them that their government was crippled and unable to help. It certainly didn’t go down well after Hurricane Katrina.

The reality is that the claims by the macroeconomists were not ground in any credible theory. It is bad enough they provide this misinformation and lies when unemployment is rising. But when thousands of people are facing the calamity of destruction of the sort being leveled by this historic storm, it is nothing short of being obscene lies – all courtesy of our neo-liberal economist brethren. As long as the budget deficits are filling the spending gap left by external deficits and private domestic saving (as a sector) and the economy is not over-stretching the real capacity of the resource base to respond to this nominal demand in real terms (that is, by producing output) any statements to this effect are to be interpreted as conservative ideological rhetoric.

When the US engages in a war, nobody ever invokes the issue of “affordability” or asks the question, “How do we pay for this?”. Yet somehow in anything having to do with social reconstruction, entitlements, infrastructure, disaster relief, the question invariably arises. But these same conservative ideologues will never, for example, suggest that we send our defence budget over to Beijing to see if those who allegedly “fund” the US will help pay for a war. Congress just appropriates the money, plain and simple. In fact, Wall Street, which has substantially cut its campaign donations for Obama and the Democrats because of their meager proposals to impose more regulation on the financial sector, has been leading this charge of affordability. Yet when the government intervenes with bailouts, Wall Street stands with hat in hand. And when the Fed created literally trillions of dollars to bail out Wall Street’s banks, nobody raised the issue of “offsetting cuts” to pay for. And that is because there is no problem (this is regardless of the question as to whether that was money well spent). The simple fact is that government deficits (facilitated by the central bank crediting bank accounts on behalf of the treasury and accepting some treasury paper for accounting purposes) can continue to fill spending gaps, the only constraint being real resources, rather than “fiscal sustainability” or “affordability”.

So all those commentators who think that Hurricane Sandy (or any other natural disaster for that matter) has exacerbated the US fiscal crisis – by which they mean – the government cannot afford to pay for the reconstruction – should now desist. The “problem” that has been keeping them awake at nights is solved. If the bond markets are sick of the corporate welfare that the issuance of government bonds provides them (that is, a risk-free annuity), then the Treasury can just ring up the Fed and tell them to keep crediting those bank accounts. To the extent that there is real problem for the US, it will be the lost capacity that has resulted from the extensive damage. This might limit the speed in which the economy can grow for a while. It is unlikely that there will not be enough real resources available to actually facilitate the reconstruction. If there are then the Government will free to purchase and mobilise them. That won’t stop many “Very Serious People” from using this natural disaster as an excuse to misinform the population on fiscal policy. Count on it.

jtuck004

(15,882 posts)coauthored by James J. Matles and James Higgins. Matles left his machine shop job in the thirties to serve as an industrial union organizer, eventually the general secretary of the United Electrical, Radio and Machine Workers of America, or UE.

Matles to a convention in the late sixties...

"Yes, some people think we're just a bunch of nuts. Why do we have an international union where our officers are living the same lives as the rank-and-file? the fact of the matter is we have always been convinced that if you want to maintain the rank-and-file nature of our union, if you want to maintain democracy in our organization, if you want officers and representatives to whom no shop grievance is too small to handle, no matter whether it affects one worker or one penny, you must have an organization where your officers and your organizer feel like the members and not feel for the members. There is a big difference."

He wasn't wrong then and he isn't wrong now. Wonder what that would do applied to the country?

hamerfan

(1,404 posts)Him and Paul be tearing it up again!

RIP, Mr. Brubeck:

Demeter

(85,373 posts)The Ohio Supreme Court on Wednesday unanimously ruled that a third-party mortgage company cannot foreclose on a property that it did not have a connection to at the time of the initial complaint. The ruling, considered a victory for homeowners, stemmed from a 2009 situation in which a couple in Xenia, in Southwest Ohio, attempted to sell their home through a short sale after falling behind on mortgage payments, only to be forced into foreclosure by a company that later bought their home at a sheriff's sale.

Duane and Julie Schwartzwald bought their house in November 2006 for $251,250. The lender was Legacy Mortgage, which then sold the promissory note and mortgage to Wells Fargo Bank. Duane Schwartzwald lost his job in September 2008 and the couple fell behind in payments. They went into default in January 2009 and in March 2009 Wells Fargo listed the property for a short sale. Within a month the Schwartzwalds were in a contract to sell their home for $259,900.

But then another company, Federal Home Loan Mortgage Corporation, filed a complaint for foreclosure even though the corporation did not yet have any entitlement to the property. In May 2009, the corporation was able secure the promissory note and mortgage from Wells Fargo, and a lower court allowed the foreclosure. The corporation then purchased the home at a sheriff's sale. A state appeals court upheld the lower court's ruling. The Ohio Supreme Court on Wednesday, however, overturned the lower court's ruling and dismissed the foreclosure decree, saying the law clearly requires an entity to have legal standing to a property when a foreclosure complaint is first filed.

By its own admission, the corporation did not, according to court records.

"Federal Home Loan concedes that there is no evidence that it had suffered any injury at the time it commenced this foreclosure action," Justice Terrence O'Donnell wrote for the court. "Thus, because it failed to establish an interest in the note or mortgage at the time it filed suit, it had no standing to invoke the jurisdiction of the common pleas court."

The high court said it does not matter that the company a month after filing its foreclosure complaint secured the promissory note.

"The lack of standing at the commencement of a foreclosure action requires dismissal of the complaint," the court wrote.

Demeter

(85,373 posts)Demeter

(85,373 posts)Junk bonds — debt issued by companies with low credit ratings — are growing junkier by the day, with ever weaker companies issuing bonds for ever riskier purposes. The bonds’ falling quality and rising risk, described recently in The Times by Nathaniel Popper, show gaps in investor protection. They also revive concerns about how private equity owners of companies that issue the bonds are using that money. Demand for junk bonds has soared this year, as both institutional and individual investors have sought higher yields in a near-zero interest rate world. As demand has risen, ever shakier companies have been able to find buyers for their debt, leading to a decline in recent weeks in the average credit rating of junk-bond-issuing companies.

At the same time, the reason for issuing junk debt has changed for the worse. For most of this year, companies used the proceeds from junk bonds to refinance high-rate debt, a move that shores up a company’s financial health. But, in recent weeks, more of the proceeds have gone to pay dividends to private equity owners, a move that can weaken a company by increasing its debt load without strengthening its underlying business. As critics of private equity rightly point out, the result is too often job losses and even bankruptcy, while private equity owners are vastly enriched in the process.

Mr. Popper also found that there has been a big increase in the issuance of bonds with “optional interest payment,” which allow borrowers to skip cash interest payments if the company runs into trouble. That’s a sign that the company has doubts about its ability to repay — scarily reminiscent of the reckless borrowing that characterized the run-up to the financial crisis. Not surprisingly, institutional investors are starting to shun these junkier junk bonds. But individual investors haven’t received the message. They added some $2.1 billion in junk bonds to portfolios in the first three weeks of October, often in retirement accounts, compared with a net outflow of $256 million from institutional investors....

The recent developments in junk bond investing also highlight, again, the dubious practices and privileges of private equity firms. One portfolio manager who buys junk bonds told Mr. Popper that he screened offerings to avoid those that “are going for no productive purpose.” Piling ever more debt on companies with dim prospects of repayment — in order to pay dividends to the private equity owners — would certainly qualify.

Demeter

(85,373 posts)

Demeter

(85,373 posts)Tonight’s Financial Times has a eye-popping story, that the survival of Sharp, one of Japan’s top consumer products manufacturers, is in doubt:

The warning came a day after Panasonic stunned investors by projecting a second consecutive $10bn loss. Panasonic’s share price dropped a further 19 per cent on Thursday.

Sharp and Panasonic, along with Sony, are the most consumer-focused of Japan’s large technology companies. All three have suffered as prices for flatscreen televisions and other household items plunged globally.

A strong yen and competition from lower-cost manufacturers elsewhere in Asia have turned the products that once underpinned their success into financial millstones. Last year, the three groups suffered a combined net loss of Y1.6tn – a figure that Sharp and Panasonic will come close to matching between them this year.

The story correctly notes that an immediate cause of Sharp’s problems are botched investments in liquid crystal display manufacture. But a big, arguably the biggest, part of the story, is how long the yen has remained in nosebleed territory. Most observers thought a yen above 90 would be catastrophic for Japanese exporters, even allowing for the fact that they have moved a lot of production to lower-cost centers elsewhere in Asia. And the yen maintained that price from the crisis onward, and more recently has sustained the astonishing level of above 80 even in the face of intervention by the Bank of Japan. And there’s a reason for that. China has been buying yen, forcing Japan to buy dollars to keep the yen from going even higher. In other words, China has been accumulating yen and shifting the “dollar manipulation” onto Japan. The common view, that China is the largest foreign buyer of US Treasuries, is dated. In 2012 to date, Japan has purchased more, and its dollar reserves nearly equal China’s.

This post from Tim Duy in 2010, “Yen Intervention, or Why Japan is Now Carrying China’s Water,” lays out how this worked:

Since then, Japan’s currency challenge only intensified, culminating in last week’s almost comical complaint from Japanese policymakers:

Japan’s government said it will seek discussions with China over the nation’s record purchases of Japanese bonds as an appreciating yen threatens to undermine an economic recovery.

Japan is closely watching the transactions and will seek to maintain close contact with Chinese authorities on the issue, Vice Finance Minister Naoki Minezaki told lawmakers in Tokyo. Finance Minister Yoshihiko Noda suggested at the same hearing that it’s inappropriate for China to buy Japan’s bonds without a reciprocal ability for Japanese to invest in China’s market.

Did policymakers recognize the irony of their situation? It is not exactly a secret that Japan has made frequents excursions into the currency markets. But apparently they feel that intervention should be limited to Dollar purchases. Surely another Asian nation wouldn’t play the same game on them?

Alas, the Chinese did – under pressure to “loosen” the renminbi – and pushed the Japanese into intervening last night to tame the surging Yen. In effect, the Chinese managed to get the Japanese to do their Dollar buying for them. Honestly, I have a hard time faulting the Japanese. They are facing a serious deflation problem, and pumping Yen into the system is an appropriate response (all though, they might simply sterilize the intervention, which would be, in my opinion, a policy error).

Note that this post was written shortly after China announced that it was moving to more “market based” rates, which pretty much everyone (save yours truly) thought was a Big Deal, and in the next few months, indeed proved to mean far less in the near term than breathless commentators had thought (all you needed to do was read how the new basket mechanism worked, it was really not hard to foresee this outcome). China had announced this change shortly before Geithner looked likely to designate China a currency manipulator, which served to buy more time. Duy continues by speculating whether Geithner was fooled by this subsequent move (of directing its currency manipulation through the yen) or playing along:

What it all boils down to is this: There apparently is no motivation for global central banks to stop directing capital inflows at the US in an effort to support mercantilist objectives. If it isn’t China, it will be some other economy. And equally apparent, there is no motivation among US policymakers to address such government directed capital flows.

So this outcome was predictable. In some ways, it’s impressive that Japanese manufacturers were able to hold out this long in the face of the the catastrophically high level of the yen. But as someone who worked with the Japanese, I’m sorry to see these great companies on the ropes. Japanese, unlike Americans, respect entrepreneurs because they promote employment, and they also take a craftsman-like pride in high quality production. It’s sad that companies that upheld those values may not make it, in large measure to financial and geopolitical issues (the US unwillingness to rock the boat with China) rather than pure competitive merits.

Update 7:00 AM: I put this in comments, and decided it needed to go in the post proper:

1. China still runs a dirty float. It manages the RMB in a wide band v. a basket of currencies. The dollar is far and away the biggest currency in this basket (IIRC, ~ 60% ). So even though QE in theory weakens the dollar, China will move its RMB price to (substantially) adjust. A modified race to the bottom.

2. Nevertheless, China’s terms of trade with the US have been worsening, not due to the RMB per se, but price increases in China due to inflation. If you have a fixed currency exchange rate, and you have 10% inflation and your trade partners have 0% inflation, your goods will be 10% more costly to them in a year.

3. But sending the yen to the moon has meant (to the extent it can) Japan has gotten hit even worse than China. So while China has lost some exports to US repatriation of manufacturing (yes, that IS happening) and smaller Asian markets (Vietnam, Bangladesh), it has reduced these losses by eating into Japan’s market via goosing the yen.

Demeter

(85,373 posts)...if not for some pesky real-world facts. You see the same corporations peddling this line have already been paying next to nothing in taxes. And instead of creating jobs, they’ve been destroying them. Here are five examples of job-cutting, tax-dodging CEOs who are leading Fix the Debt.

1. Randall Stephenson, AT&T

U.S. jobs destroyed since 2007: 54,000

Average effective federal corporate income tax rate, 2009-2011: 6.3%

2. Lowell McAdam, Verizon

U.S. jobs destroyed since 2007: 30,000

Average effective federal corporate income tax rate, 2009-2011: -3.3%

3. David Cote, Honeywell

U.S. jobs destroyed since 2007: 4,000

Average effective federal corporate income tax rate, 2009-2011: -14.8%

4. Kenneth Frazier, Merck

U.S. jobs destroyed since 2007: 13,000

Average effective federal corporate income tax rate, 2009-2011: 13.2%

5. Terry Lundgren, Macy’s

U.S. jobs destroyed since 2007: 7,000

Average effective federal corporate income tax rate, 2009-2011: 20.7%

DETAILS AT LINK

Demeter

(85,373 posts)Do you ever wonder why it takes the average family 47 years to make as much as a hedge fund honcho makes in one hour?

READ IT AND WEEP

http://www.alternet.org/economy/6-economic-facts-life-america-allow-rich-run-our-wealth?akid=9779.227380.PeIZNu&rd=1&src=newsletter757454&t=4&paging=off

Demeter

(85,373 posts)Good times in the economy mean goods times a few years later for bankruptcy professionals who deal with consumer cases. We saw this from the mid-1990s through the 2000s. The last big party in the bankruptcy world was in 2010 (1.5 million non-business cases filed!), a few years after the end of the last debt binge came to a crashing halt starting in 2007. The reverse is also true. Bad times in the economy make for fewer bankruptcy filings a few years later, which is what we have been seeing lately.

Those of us who blog on Credit Slips get frequent calls from reporters asking about bankruptcy filing statistics, specifically: what do they mean? Filings, which are mostly consumer filings, have gone down steadily for two years now, so it gets hard to come up with anything new to say, as Bob Lawless recently wrote here. When filings go down, reporters new to the bankruptcy beat often think that means the economy must be getting better. Wrong. What drives bankruptcy filings is debt. Decreases in debt are followed a few years later by decreases in bankruptcy, and increases in debt are followed by increases in bankruptcy. The Great Recession that started in 2007 resulted in a great decline in household debt due to a combination of reduced access to credit and consumers voluntarily cutting back on debt-driven spending because of a lack of consumer confidence.

It’s so old hat to talk about the continuing decline in bankruptcy filings, produced by a long process of household deleveraging (meaning taking on less debt and instead paying off old debt), that I’m going out on a limb with a prediction. We may finally be seeing signs of a reversal in progress—consumer confidence going up, which should drive up debt volume, and presto chango, we’ll see more bankruptcy in a few years. Bankruptcy attorneys, take heart: recovery will mean a return to your good times, too, but a few years hence. What are the signs? After rising two months in a row, consumer confidence is the highest it has been since February of 2008, just after the beginning of the Great Recession. Because consumer spending is the single biggest driver of economic activity, growing consumer confidence is closely watched as an indicator of economic expansion. Confidence is still low compared to levels in good economic times, but the trend line is up. On the other hand, superstorm Sandy may shake consumer confidence in the East in the short term, especially among those who lost hours on the job. But soon Sandy is bound to drive huge spending on reconstruction, and some of that will be with borrowed money.

I certainly don't think it is a good thing that growth of our economy depends on debt-driven consumer spending. But as Walter Cronkite signed off every night, often with sardonic intent, "That's the way it is."

In addition to consumer demand, there’s another component to recovery: credit supply. There are signs of upward movement there along with in demand, seen in nonmortgage credit: household debt increased in the second quarter of this year at the highest rate since the beginning of 2008. See here. Mortgage credit is still tight, but overall access to credit (aka debt) seems to be up. Once full steam recovery kicks in, with credit supply meeting demand, bankruptcy filings will be up again, too—in a few years. In 2016 or 2017, the bankruptcy world may be partying like it's 2010.

Demeter

(85,373 posts)SHE'S DREAMING IF SHE THINKS ORDINARY PEOPLE CAN TAKE FIVE MORE YEARS OF THIS...

http://finance.yahoo.com/news/merkel-euro-debt-crisis-last-5-years-more-154045203--finance.html

German Chancellor Angela Merkel says Europe's sovereign debt crisis will last at least five more years.

Merkel says the continent is on the right path to overcome the crisis but "whoever thinks this can be fixed in one or two years is wrong."

Two years ago some heavily indebted European countries were dragged into the turmoil that first gripped global financial markets in 2007.

Greece in particular has been struggling with the austerity conditions imposed on it by countries such as Germany.

But Merkel told a regional meeting of her Christian Democratic Party on Saturday that the time had come for "a bit of strictness."

Otherwise, she says, Europe won't be able to attract international investment.

Demeter

(85,373 posts)Goldman Sachs has dropped 33 partners since it last disclosed the number of elite bankers at the firm, according to regulatory filings. Being a Goldman partner is one of the most coveted positions on Wall Street, unlocking access to a lucrative compensation scheme on top of the prestige the title holds. The bank's partners own more than 11% of shares between them, valued at more than $6bn (£3.7bn).

But as Goldman looks to slash costs, it has cut partners. According to the outgoing chief financial officer, David Viniar, up to 20% of Goldman partners typically leave every two years. High-profile partners including David Heller and Ed Eisler, two co-heads of Goldman's securities business, and Lucas Van Praag, the bank's long-time communications chief, have left the bank. Some partners appear to have chosen to drop their coveted status in favour of retaining their jobs. Since the end of 2010, the bank has cut more than 3,000 employees worldwide as it seeks to reduce annual expenses by $1.9bn.

According to the regulatory filing the bank has 407 partners, with 33 people dropped from the list since February. Two bankers, Mark Schwartz, chairman of the company's Asia-Pacific region, and Richard Phillips, a specialist in natural resources mergers and acquisitions, were added to the latest filing.

Goldman selects new partners every two years. It named 110 in 2010 and is to announce its latest partners on 14 November.

Demeter

(85,373 posts)David and Michelle Haisley from Fort Wayne, Indiana, weren’t happy with the performance of their retirement funds, so they made another investment -- a foreclosed home for $27,000. Haisley, a heating and air-conditioning technician, said he worked on the house before it went into default and decided to make an offer when he saw it listed at about a third the price of surrounding homes. They’ve already found tenants for the house and David said they’ll buy another foreclosure if they can find the right deal.

“It’s an income stream for us, and when it’s time, we’ll sell it and make more money than we could from our 401K,” said Haisley, 49, who rents out the property for $900 a month for an annual return of more than 20 percent, excluding appreciation. “There’s nowhere for prices to go but up, so it seemed like a pretty safe bet.”

As the housing market recovers from the worst bust since the Great Depression, neophyte investors like the Haisleys are following the lead of private-equity firms like Blackstone Group LP, investing in properties they can pick up cheaply, rent and sell when values rise enough. Home prices rose 4.6 percent from a year earlier in August, the biggest gain since the end of the real estate boom in 2006, according to a CoreLogic Inc. index...

“I’d rather buy real estate than gamble on the stock market or get almost no return from putting my money in a bank,” said Barton Wallace, 60, a real estate investor and broker in Hingham, Massachusetts, who owns four rental properties. “I don’t have any problem getting tenants.”

Demeter

(85,373 posts)and I'm not looking forward to it....gray, damp, cold...it's November, for the second month in a row....always November and never Christmas.....

Thanks hamerfan! Your music contributions are always greatly appreciated!

xchrom

(108,903 posts)xchrom

(108,903 posts)

xchrom

(108,903 posts)WASHINGTON (AP) -- Americans swiped their credit cards more often in October and borrowed more to attend school and buy cars. The increases drove U.S. consumer debt to an all-time high.

The Federal Reserve said Friday that consumers increased their borrowing by $14.2 billion in October from September. Total borrowing rose to a record $2.75 trillion.

Borrowing in the category that covers autos and student loans increased by $10.8 billion. Borrowing on credit cards rose by $3.4 billion, only the second monthly increase in the past five months.

The strong rise in borrowing came in a month when Americans cut back on consumer spending, reflecting in part disruptions from Superstorm Sandy.

Response to xchrom (Reply #42)

Name removed Message auto-removed

xchrom

(108,903 posts)Christine Lagarde told the BBC's Katty Kay there would be ripple effects worldwide if the US went over the fiscal cliff

Christine Lagarde has urged US leaders to reach a deal to avoid the "fiscal cliff", warning that the uncertainty was damaging the global economy.

The head of the International Monetary Fund told the BBC that the US had a duty "to try to remove uncertainty and doubt as quickly as possible".

The fiscal cliff refers to US tax rises and spending cuts set to automatically come into force in January.

Demeter

(85,373 posts)If the fiscal cliff stops people from doing idiotic deals, I'm all for it.

And if going over the fiscal cliff puts a barrier in globalism, so much the better.

xchrom

(108,903 posts)At 9 a.m. on Nov. 30, the Treasury Department began auctioning off its shares in seven community banks scattered across the country. Each of these institutions had taken money from the government in 2009 during the financial crisis.

By the time the bidding closed at 6 p.m. Monday, the Treasury had collected about $62 million.

Not a bad outcome, until you consider the government’s original investment: $75 million.

It was not the first time the government walked away with a loss. In 10 similar auctions conducted to date, Treasury has sold off its investments in 84 financial firms, accepting losses of about $241 million.

hamerfan

(1,404 posts)Take The A Train by the Dave Brubeck Quartet.

Dave Brubeck... Piano

Paul Desmond... Alto Saxophone

Eugene Wright... Upright Bass

Joe Morello... Drums

Demeter

(85,373 posts)Looks like all the horrible people came out with a new crop of lies, believing no one will notice, now that the election is over, and the People don't have to be pandered to any longer....

hamerfan

(1,404 posts)Take Five by the Dave Brubeck Quartet (my favorite version):

So damn cool.

Demeter

(85,373 posts)

Demeter

(85,373 posts)I have no work for .... 25 hours!

What shall I do with a free day? Dishes, laundry, cleaning, Xmas cards, bylaws, rehearsal for next week's concert, zzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzzz

DemReadingDU

(16,000 posts)Enjoy the day!

Demeter

(85,373 posts)It's just that I don't know what to do when I'm not over-scheduled....

The Kid is still sick, or the movie would win, hands down.

Demeter

(85,373 posts)Why didn’t Obama cross the road?

What are you, a purist?

{set up} Why didn’t Obama cross the road?

{punchline, always Obama fan rationalization or word salad}

So herewith:

Why didn’t Obama cross the road?

And of course the classics:

Why do you hate Obama?

You’re a racist!

Also too:

Historic indeed, also too transformational.

OTHER READERS SUBMITTED:

AND SO MANY MORE AT LINK

AND FOR VARIETY'S SAKE:

“Romneys such a liar, it’ll turn out he didn’t strap his dog to the car roof after all”

Demeter

(85,373 posts)Corporations have the green light to donate unlimited money to help fund President Obama's second inaugural festivities this January, sources close to the planning tell Politico, a break from the Obama team's decision four years ago to cap donations at $50,000 from individuals and shun corporate cash entirely in the interest of "chang[ing] business as usual in Washington."

Politico's sources say Obama will reject donations from lobbyists and political action committees, as he did for his first inauguration. Team Obama also reportedly plans to screen all corporate donations to eliminate any conflicts of interest, and considers the decision to accept the cash common sense after an election flooded with record-breaking spending:

The cost of an Inauguration can run into the tens of millions. Obama spent $47 million in 2009. And raising that in a matter of six weeks is too difficult without throwing open the flood gates, said the sources, who spoke on condition of anonymity.

WELL, THAT'S ALL RIGHT, THEN

BSBSBSBSBSBSBSBSBSBSBSBSBSBSBSBSBSBS

Demeter

(85,373 posts)Please don’t tell me that these reports in the business press touting Sallie Krawcheck as a front-runner for chairman of the SEC or even a possible candidate to be the next Treasury secretary are true. Who is she? Oh, just another former Citigroup CFO, and therefore a prime participant in the great banking hustle that has savaged the world’s economy. Krawcheck was paid $11 million in 2005 while her bank contributed to the toxic mortgage crisis that would cost millions their jobs and homes. Not that you would know that sordid history from reading the recent glowing references to Krawcheck in the New York Times, the Wall Street Journal and Bloomberg News that stress her pioneering role as a leading female banker—a working mother no less—but manage to avoid her role in a bank that led the way in destroying the lives of so many women, men and their children. Nor did her financial finagling end with Citigroup, as Krawcheck added a troubling stint in the leadership at Merrill Lynch and Bank of America to her résumé.

A woman who would be an excellent choice as the most experienced as well as principled candidate to head the SEC or Treasury is Sheila Bair, former head of the FDIC, who labored to protect consumers rather than undermine them. Indeed, her outstanding book “Bull by the Horns,” chronicling her fight in the last two administrations to hold the banksters accountable, should be required reading for the president and those who are advising him on selecting his new economic team. The SEC is supposed to supervise the banks rather than abet them in their chicanery. And although the Treasury Department has been a captive of Wall Street lobbyists for most of the modern era, one would expect something better from the second coming of Barack Obama. Those are key appointments in determining whether the president can turn around the still-moribund economy by channeling the spirit of Franklin D. Roosevelt. Or will he continue to plod along on the course set by George W. Bush, bailing out the banks while ignoring beleaguered homeowners and the many other victims of this banking-engineered crisis?

Obama was given a pass on the economy by voters only because Mitt Romney was an even more craven enabler of Wall Street greed. But the outlines of the Bush Wall Street payoff remain in place, with the Federal Reserve continuing to bail out the banks with virtually free money and the purchase of $40 billion in toxic mortgage-based bonds every month to add to the more than trillion dollars in that junk that the Fed previously had taken off the banks’ books....The money printing by the Fed is at the heart of the massive debt crisis. But it has been great for the bankers, with compensation at the 32 largest banks slated to hit an all-time high of $207 billion this year, according to a Wall Street Journal estimate. This reward for ripping off the public is almost three times the amount the federal government spends on education. Once again the bankers are blessed for their failures, receiving such wildly excessive compensation despite the fact that banking revenue is down 7.2 percent over the last two years.

A prime example is Krawcheck’s old bank, Citigroup, whose new CEO this week announced that the company has been forced to engage in a major retrenchment, eliminating 11,000 jobs and closing 84 branches. The bank has been deeply troubled ever since the housing meltdown it helped trigger first began, and it was saved from bankruptcy only by a direct infusion of $45 billion in taxpayer money and a commitment of an additional $300 billion in underwriting of Citigroup’s bad paper...The ugly tale of America’s Great Recession is inextricably entwined with the deplorable practices of Citigroup, the too-big-to-fail bank made legal by Bill Clinton’s signing off on reversing the Glass-Steagall law that prevented the merger of investment and commercial banks. The first beneficiary of the revised law was the newly created Citigroup, saved from bankruptcy a decade later by the taxpayers....I shouldn’t be surprised that Krawcheck would be considered a viable nominee for a central position in managing our economy. After all, her colleague in the top ranks at Citigroup during the years of financial depravity, Robert Rubin, is considered a significant adviser to the Obama administration, and his protégés, led by Treasury Secretary Timothy Geithner, are still directing policy. It was Rubin who pushed through the reversal of Glass-Steagall, an act of betrayal of the public interest that was rewarded with obscene amounts of money when he ultimately took the job of leading the bank he made legal. The very fact that these folks remain influential, as witnessed by Krawcheck being considered to head the SEC rather than being the subject of one of its much-needed investigations, gives further evidence of the enduring but ultimately terminal illness of crony capitalism.

Demeter

(85,373 posts)... I had the opportunity to work with Warren in our respective roles in providing oversight of the bank bailouts, and she never struck me as someone who would keep her head down and mouth shut in the name of serving institutional concerns. Instead, she seemed to be guided by doing what she believed to be the right thing, even if it was not always in her personal interest to do so. One anecdote I recount in Bailout occurred in 2010, just weeks before the enactment of Dodd-Frank and the creation of the Consumer Financial Protection Bureau:

Part of the setup of the new bureau was that it initially would be housed in Treasury, meaning that it would be under the supervision of Geithner. Elizabeth, who is a gifted questioner, had routinely tortured Geithner during his occasional testimony before the Congressional Oversight Panel, and there was open speculation in the press that he was opposing her appointment as director.

A couple of weeks before our lunch I had watched her absolutely pummel Geithner at a hearing. I had thought she might go lightly on him with the Consumer Protection Bureau job still up in the air. After all, she was making no secret of her desire for the job, and the White House had to be watching her every move. But she just lit him up, attacking HAMP’s design as ineffective and pointing out the damage that had been inflicted on families who had suffered through failed trial modifications. I thought it was a remarkably principled act, the exact opposite of what any other person in Washington angling for a high-profile job would have done.

So my bet is that Warren will use her newly minted Senate platform to continue her demonstrated commitment to being a loud and passionate advocate for those whose voice is often not heard in Washington, even if it means offending the sensibilities of some of her new colleagues.

I also think that the Senate has never seen anyone quite like Warren. The experiences she has gained as a lawyer, law professor, bailout overseer and as the founder of the Consumer Protection Bureau set her apart, and have given her all the necessary tools to be a strong and credible counterweight to the often overwhelming influence of the biggest banks and their armies of lobbyists and supplicants....

Read more: http://www.businessinsider.com/elizabeth-warren-as-a-junior-senator-2012-11#ixzz2EYp3L0E1

Demeter

(85,373 posts)The FT has an update on the Greek bailout:

The sticking point:

As a result, Brussels and Washington are 5-10 percentage points apart on where Greece’s debt will stand by 2020, the target date in the rescue programme for returning Athens to sustainable debt levels.

Further complicating negotiations, officials said the IMF is insisting Greek debt levels are reduced to 120 per cent of gross domestic product by 2020, while the European Commission is urging an easing of the target to about 125 per cent by 2022.

If past experience is any guide, the IMF is correct to be skeptical. But the bigger picture here is that the Troika has repeatedly failed to hit this target of 120 percent, and this time will be no different. 120, 125, or 135 percent is more about political posturing than economic reality. With any of these targets, the ongoing waves of austerity are doing nothing more than pushing Greece deeper into a death spiral. Five years of recession and counting. Unemployment above 25%. Still too many sticks, not enough carrots. And remember, the 120 percent target itself does not guarantee safety. It is largely an artifact of wanting to justify the level of Italian debt. From Reuters:

I understand this is considered political dynamite in Europe, but I still think it will be virtually impossible to fix Greece without a direct transfer of resources. A large, official debt forgiveness program. I suspect the alternative - a failed state on Europe's borders - will be more costly in the long-run.

Demeter

(85,373 posts)Greece is set to purchase back about half of its debt owned by private investors, broadly succeeding in a bond buyback that is key to the country's international bailout, a Greek government official said on Saturday. Greek and foreign bondholders offered the targeted 30 billion euros ($38.8 billion) in the deal, which is central to efforts by Greece's euro zone and International Monetary Fund lenders to cut its debt to manageable levels....The buyback accounts for about half of a broader, 40-billion euro EU/IMF debt relief package for Athens agreed in November. The package broadly doubles the average maturity of its rescue loans to almost 30 years and cuts its interest rates by one percentage point to a level far below 1 percent.

Under its terms, Athens will spend up to 10 billion euros of borrowed money to buy back bonds with a nominal value of about 30 billion euros. This is nearly half the 63 billion euros of Greek debt held by private investors eligible for the plan. Since the bonds are to be bought far below their nominal value, the country's net debt burden would fall by about 20 billion euros. A successful buyback will ensure that the IMF, which contributes about a third of Greece's bailout loans, will stay on board of the rescue. It would also unlock the payment of 34.4 billion euros of aid later this month. Athens badly needs that money to refloat its ailing economy by replenishing the capital of its cash-strapped banks and settle arrears with government suppliers. OH, YEAH, THAT WILL DO THE TRICK--NOT

The EU and the IMF have been withholding rescue payments to Greece for six months because it had fallen short of promises to shore up its finances, privatize and make its economy more competitive.

Athens has received 148.6 billion euros in EU/IMF funds since May 2010. It stands to get almost 90 billion euros more by the end of 2014...MORE BS AT LINK

xchrom

(108,903 posts)

Demeter

(85,373 posts)It's latke weather, for sure!

2 cups peeled and shredded potatoes

1 tablespoon grated onion

3 eggs, beaten

2 tablespoons all-purpose flour

1 1/2 teaspoons salt

1/2 cup peanut oil for frying

Directions

Place the potatoes in a cheesecloth and wring, extracting as much moisture as possible.

In a medium bowl stir the potatoes, onion, eggs, flour and salt together.

In a large heavy-bottomed skillet over medium-high heat, heat the oil until hot. Place large spoonfuls of the potato mixture into the hot oil, pressing down on them to form 1/4 to 1/2 inch thick patties. Brown on one side, turn and brown on the other. Let drain on paper towels. Serve hot! makes 10 to 12 latkes

xchrom

(108,903 posts)

xchrom

(108,903 posts)China's economic growth rate may be gathering pace again, as the government released strong industrial output and retail sales figures.

Industrial production rose by 10.1% in November, compared with a year earlier, according to the official data from the National Bureau of Statistics.

This was better than expected, and the strongest performance since March.

At the same time, China's retail sales increased by 14.9%. This was also the best showing for eight months.

Demeter

(85,373 posts)On Nov. 30, 200-plus fast food workers returned to their jobs with major support from the community after a historic strike against the fast food industry took place in New York City last week. Crowds of supporters walked along side strikers as they returned to their shifts to help prevent alienation or punishment from the fast food companies. And such was the case except for one employee who was fired from a Wendy’s located in East New York...Sholanda Montgomery, a single mother working to make ends meet, participated in the one-day strike and, upon her return to work, was fired from the Fulton Mall Wendy’s for “absenteeism.” According to New York Daily News, her manager singled out Montgomery before fellow coworkers and strikers arrived to work. But, after a protest led by the efforts of strike organizers and City Councilman Jumaane Williams took place inside the restaurant where customers were urged to leave the restaurant as way of support, Montgomery was re-hired.

“We weren’t going to give up,” Sherry Jones, a member of New York Communities for Change, said in a New York Daily News article.

Under the National Labor Relations Board (NLRB), employees have the right to participate in activity outside a union as stated:

In reality, employers have fired employees under the radar for other “disciplinary reasons.” This loop hole leaves employees boggled down with “retaliation cases” that could take months if not years to settle in court all while being out of work or forced to take time off. The Fast Food Workers Committee has filed such various grievances with the NLRB against fast food companies for threats and retaliation bestowed on employees pre-strike. Since Montgomery’s firing went public and was eventually reversed within hours, it is said that the community’s support is breaking ground in the Fast Food Forward Campaign. No other punishments have occurred since the one-day strike against the fast food industry. And in the minds of many activists, the community is the backbone for this ongoing campaign, not the law.

xchrom

(108,903 posts)Danny Alexander has told multinational firms that paying tax is an obligation, not "a voluntary choice" they can make to please their customers.

The chief secretary to the Treasury was speaking in regard to Starbucks, which last week said it would voluntarily pay more UK corporation tax.

Mr Alexander told the BBC's Andrew Marr Show that the government was continuing efforts to tackle tax avoidance.

He said this work was taking place both in the UK and abroad.

Demeter

(85,373 posts)Better known as drones, Unmanned Aerial Vehicles piloted by military in the U.S. hunt and kill suspected enemy combatants abroad. Now the drones are coming home to beef up local law enforcement. But people across the U.S. are pushing back, contending that domestic drones could invade personal privacy or chill free speech by monitoring political activities.

“They want to use it for intelligence gathering – that’s spying,” Linda Lye of the Northern California American Civil Liberties Union told media at a hastily called press conference Dec. 4 outside the Alameda County administration building in downtown Oakland. That morning, the Alameda County sheriff’s request for the Alameda County Board of Supervisors’ acceptance of Homeland Security grant funds for a drone was almost buried in a 66-item meeting agenda. But when the Northern California ACLU – a member of Alameda County Against Drones – learned of the sheriff’s request, they called the press conference to expose a process they said ignored the community. The sheriff subsequently removed his request from the agenda. And so, rather than a cursory board review, the supervisors’ Public Protection Committee will hold a comprehensive discussion on the drone question in January.

“Public policy should not be made by stealth attack,” Lye said, calling for debate on “the important questions of whether a drone is even appropriate in our community and if so, what safeguards should be in place before we buy a drone.”

Speakers at the press conference pointed to special circumstances in Oakland that call for protection against law enforcement abuse.

“When we see in the (sheriff’s Jul. 20 application to Homeland Security) that the drones could be used for large crowd control, naturally everybody thinks of Occupy Oakland,” said Trevor Timm of the Electronic Frontier Foundation, referring to alleged police abuse of Occupy activists.

The Alameda County Sheriff’s Department is just one of many law enforcement agencies across the country lining up for free money for drones from Homeland Security. They often point to popular uses for the technology, such as searching for missing children or escaped convicts. But those concerned with privacy issues note that the technology allows drones to peer through walls and ceilings, monitor cell phone calls and texts, read license plates, recognise faces and record a person’s every move. Some domestic drones, like the ShadowHawk acquired by Monterey, Texas, are able to carry “less lethal” weapons, such as tear gas and rubber bullets.

As the Afghanistan war winds down, the defence industry is intensifying its push for domestic drones, which Susan Aluise, writing in investorplace.com, calls the “next market opportunity”.

“Just when you think the (drone) market cannot go any higher, it does,” says Forecast International’s unmanned vehicles analyst Larry Dickerson, quoted on the Defense Professionals website. “No matter how many systems are built, operators want more.”

Dickerson estimates the industry’s value over the next decade at 70.9 billion dollars, with the civilian market worth 600 million to one billion dollars. The industry is fueled by a 60-person congressional Unmanned Systems Caucus whose members have pocketed some eight million dollars in drone-related campaign contributions over the past four years, according to a Hearst Newspaper and Center for Responsive Politics investigation. Citizens concerned with drone misuse are lobbying local officials. Buffalo, New York and Portland, Oregon activists want their city governments to ban drones entirely from airspace above the city. Syracuse, New York petitioners are calling for an ordinance that “declares Syracuse and its airspace to be a SURVEILLANCE DRONE FREE ZONE wherein such drones are banned from airspace over the City of Syracuse until Federal legislation is adopted that adequately protects the population as guaranteed by the Fourth Amendment to the U.S. Constitution.”

SEATTLE IS ALREADY DRONED...SEE LINK

Demeter

(85,373 posts)For more than a year, politicians have been fighting over whether to raise taxes on high-income people. They rarely mention that affluent Americans will soon be hit with new taxes adopted as part of the 2010 health care law. The new levies, which take effect in January, include an increase in the payroll tax on wages and a tax on investment income, including interest, dividends and capital gains. The Obama administration proposed rules to enforce both last week.

Affluent people are much more likely than low-income people to have health insurance, and now they will, in effect, help pay for coverage for many lower-income families. Among the most affluent fifth of households, those affected will see tax increases averaging $6,000 next year, economists estimate....To help finance Medicare, employees and employers each now pay a hospital insurance tax equal to 1.45 percent on all wages. Starting in January, the health care law will require workers to pay an additional tax equal to 0.9 percent of any wages over $200,000 for single taxpayers and $250,000 for married couples filing jointly. The new taxes on wages and investment income are expected to raise $318 billion over 10 years, or about half of all the new revenue collected under the health care law.

Ruth M. Wimer, a tax lawyer at McDermott Will & Emery, said the taxes came with “a shockingly inequitable marriage penalty.” If a single man and a single woman each earn $200,000, she said, neither would owe any additional Medicare payroll tax. But, she said, if they are married, they would owe $1,350. The extra tax is 0.9 percent of their earnings over the $250,000 threshold. Since the creation of Social Security in the 1930s, payroll taxes have been levied on the wages of each worker as an individual. The new Medicare payroll is different. It will be imposed on the combined earnings of a married couple.

Employers are required to withhold Social Security and Medicare payroll taxes from wages paid to employees. But employers do not necessarily know how much a worker’s spouse earns and may not withhold enough to cover a couple’s Medicare tax liability. Indeed, the new rules say employers may disregard a spouse’s earnings in calculating how much to withhold. Workers may thus owe more than the amounts withheld by their employers and may have to make up the difference when they file tax returns in April 2014. If they expect to owe additional tax, the government says, they should make estimated tax payments, starting in April 2013, or ask their employers to increase the amount withheld from each paycheck. In the Affordable Care Act, the new tax on investment income is called an “unearned income Medicare contribution.” However, the law does not provide for the money to be deposited in a specific trust fund. It is added to the government’s general tax revenues and can be used for education, law enforcement, farm subsidies or other purposes. Donald B. Marron Jr., the director of the Tax Policy Center, a joint venture of the Urban Institute and the Brookings Institution, said the burden of this tax would be borne by the most affluent taxpayers, with about 85 percent of the revenue coming from 1 percent of taxpayers. By contrast, the biggest potential beneficiaries of the law include people with modest incomes who will receive Medicaid coverage or federal subsidies to buy private insurance.

Wealthy people and their tax advisers are already looking for ways to minimize the impact of the investment tax — for example, by selling stocks and bonds this year to avoid the higher tax rates in 2013.

OKAY--CAN WE NOW CALL IT BY ITS TRUE NAME:

THE UNAFFORDABLE HEALTHCARE PLAN?

Demeter

(85,373 posts)Despite hints in recent days that President Obama and House Speaker John A. Boehner might compromise on the tax rate to be paid by top earners, a host of other knotty tax questions could still derail a deal to avert a fiscal crisis in January.

The math shows why. Even if Republicans were to agree to Mr. Obama’s core demand — that the top marginal income rates return to the Clinton-era levels of 36 percent and 39.6 percent after Dec. 31, rather than stay at the Bush-era rates of 33 percent and 35 percent — the additional revenue would be only about a quarter of the $1.6 trillion that Mr. Obama wants to collect over 10 years. That would be about half of the $800 billion that Republicans have said they would be willing to raise.

That calculation alone suggests the scope of the other major tax issues to be negotiated beyond tax rates. And that is why many people in both parties remain unsure that a deal will come together before Jan. 1. Without agreement, more than $500 billion in automatic tax increases on all Americans and cuts in domestic and military programs will take hold, which could cause a recession if left in place for months, economists say.

“The question is making sure that we hit a revenue target that’s required for a truly balanced deficit-reduction plan,” said Representative Chris Van Hollen of Maryland, the senior Democrat on the House Budget Committee. “And when the president and all of us say this is a question of math, we mean it. It’s very hard to make the numbers work without the top rates going back to the full Clinton-era levels.”

MORE

Demeter