General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsEddie Haskell

(1,628 posts)K&R

Kolesar

(31,182 posts)I think there is a scant shortfall "in the single digit percentages".

I am sure there would be an immediate shortfall if the SS Trust Fund is taken "out of the equation".

MannyGoldstein

(34,589 posts)The shortfall projection is based on Timmy Geithner using cooked numbers - it assumes that the economy will stay bad forever, that worker productivity will suddenly drop below what it's been for decades, etc.

If the economy even only partially recovers, SS is all set for at least 75 years.

Kolesar

(31,182 posts)The US is planning to grow its way out of the national debt and to grow a population of workers to support the pensioners.

I must figure this out for my financial planning. The "AARP Report" is not loading fo rme http://www.aarp.org/politics-society/government-elections/info-11-2012/medicare-social-security-presidential-election-opinion.html

MH1

(17,608 posts)Since a couple billion or so ago, actually.

But that's not an immediate problem so I guess we can ignore it.

plethoro

(594 posts)Between you and ProSense I have an index of truth upon which to research and base my stances. The main thing in all these discussion is that Obama DID put Social Security on the table. And that deed, that Jack, can never be put back in the box. I maintain whether Obama goes forward with the chained CPI or not, he will after the first of the year try again in some way to cut Social Security. So our damage to the vote in 2014--which prior to this chained CPI thing was ours to win--is a matter of ranges. If Obama lets further damaging SS attempts lie, we lose 4-6 per cent off the vote. If he goes further pressing for chained CPI again, or "means testing" the damage will be between 10-20 per cent, maybe more. The carryover to 2016 will be less, but only slightly so. This is the way I see it.

savannah43

(575 posts)from the SS trust fund by BushCo to cover the Iraqi War and the tax cuts for the wealthy. Unfunded war my ass! If only one damn politician would be honest about this, I would be greatly relieved.

These facts should also put to rest the fallacy that the two parties cannot agree on anything. The ongoing robbery of senior citizens and disabled people goes on and on and they all pretend it can't be helped. Liars, thieves, and deadbeats.

Merry Christmas, you bunch of weasels.

Dyedinthewoolliberal

(15,593 posts)leaving aside the fact SS doesn't contribute to the deficit, let's talk about why you feel that since it was used as a bargaining chip that it will always be used. Obama can't cut social security unless a majority of the elected officials in both Houses agree. Make sure your Rep and Senators know how you feel.

He was BARGAINING with the R's..........

plethoro

(594 posts)ddddddddd

Jim Lane

(11,175 posts)Per the OP, the writer states of the Trust Fund, "That amount of money alone would fund SS for the next 60 years give or take." That's clearly wrong. The Trust Fund is intended only to cover the year-by-year deficit, i.e., the gap between expenses and FICA tax revenues.

The comment in the OP reflects the general lack of understanding of the point that Social Security is primarily a pay-as-you-go system. The only reason for the Trust Fund is the demographic problem that arises from the baby boom -- or, more precisely, from the end of the boom (the decline in the number of births that began in 1963 or so). If population were constant, or steadily rising, there'd be no need for the Trust Fund, beyond perhaps a small amount to cover minor year-to-year variations.

savannah43

(575 posts)agency or purpose? The USPO never had a deficit until the imposition of the 75 year in advance trust fund for their retirees.

http://articles.courant.com/2012-08-03/community/hcrs-63907hc-statewide-20120731_1_postal-service-payments-postal-accountability

Jim Lane

(11,175 posts)The legislation cited in your linked article imposed a unique requirement on the U.S. Postal Service.

In any event, legal requirements are different from accounting reality. The quotation in the OP gave the impression that, even if all revenue streams immediately stopped, Social Security could meet a 60-year prefunding requirement modeled on the USPS 75-year prefunding requirement. That's not true. It could not do so -- could not come close to doing so.

Of course, there's no sound reason that the USPS or Social Security or any similar plan should ever be subjected to any such requirement.

duffyduff

(3,251 posts)to the early 1980s, when the myth of Social Security going "broke" began.

What happened was the Koch-founded Cato Institute decided to outright lie about Social Security in order to undermine support by claiming there would be a "shortfall" or the system would go broke unless we privatized it.

The "pessimistic projections" will likely never happen because they aren't based on history, but the privatizers don't care about truth.

Yo_Mama

(8,303 posts)MannyGoldstein

(34,589 posts)Who used the cooked numbers that I referred to.

PrMaine

(39 posts)He would be broke.

Yo_Mama

(8,303 posts)That's true. Current annual deficits are running between 45-55 billion, not counting the SS payroll tax cut, which brings the annual deficit to over 150 billion.

savannah43

(575 posts)SS is collected from both the employee and the employer and sent to the feds for deposit into the trust fund. This is for both SS and Medicare. That amount was lowered to half of the usual, and in this economy especially, that little bit of extra money must have seemed worth it to many people. However, it conditioned people to count on that money every pay period. Now, some people who don't think these things through are annoyed that their taxes are being "raised." This maneuver is called, "priming the pump."

The employers lost that money as a "cost of doing business" tax deduction. But a dollar in the hand for profit is better than a tax deduction.

The only reason that SS has any effect on the deficit is that BushCo's "borrowing" money from the trust fund needs to be paid back. If that band of weasels hadn't taken it from the fund, it would have absolutely nothing to do with the deficit. If they destroy SS, then it doesn't have to be paid back and the SS/Medicare deduction doesn't go back up. But wait until you see what you have to pay for private insurance. It'll be much too late to cry about it then.

I wonder if the feds will collect your premiums for private insurance as a payroll deduction, much the same way that they now collect payments for supplemental insurances for private companies from SS checks?

MannyGoldstein

(34,589 posts)Yo_Mama

(8,303 posts)but since it comes straight from the general fund, this is in no sense of the word a source of revenue to the US government with which to pay benefits.

MannyGoldstein

(34,589 posts)True or false:

(Social security revenue from payroll taxes + interest payments from Trust Fund borrowed + the payroll tax cut monies to be restored from the general fund) > Social Security outgo

Or almost equivalently, I think, the Social Security Trust Fund will incease in size this year?

Jim Lane

(11,175 posts)The answer to your true-or-false question is, AFAIK, "True."

What Yo_Mama wrote was: "SS current income from taxes is currently not covering outgo." That also is, AFAIK, true, even if you add in the transfer from the general fund that erases the impact of the payroll tax holiday.

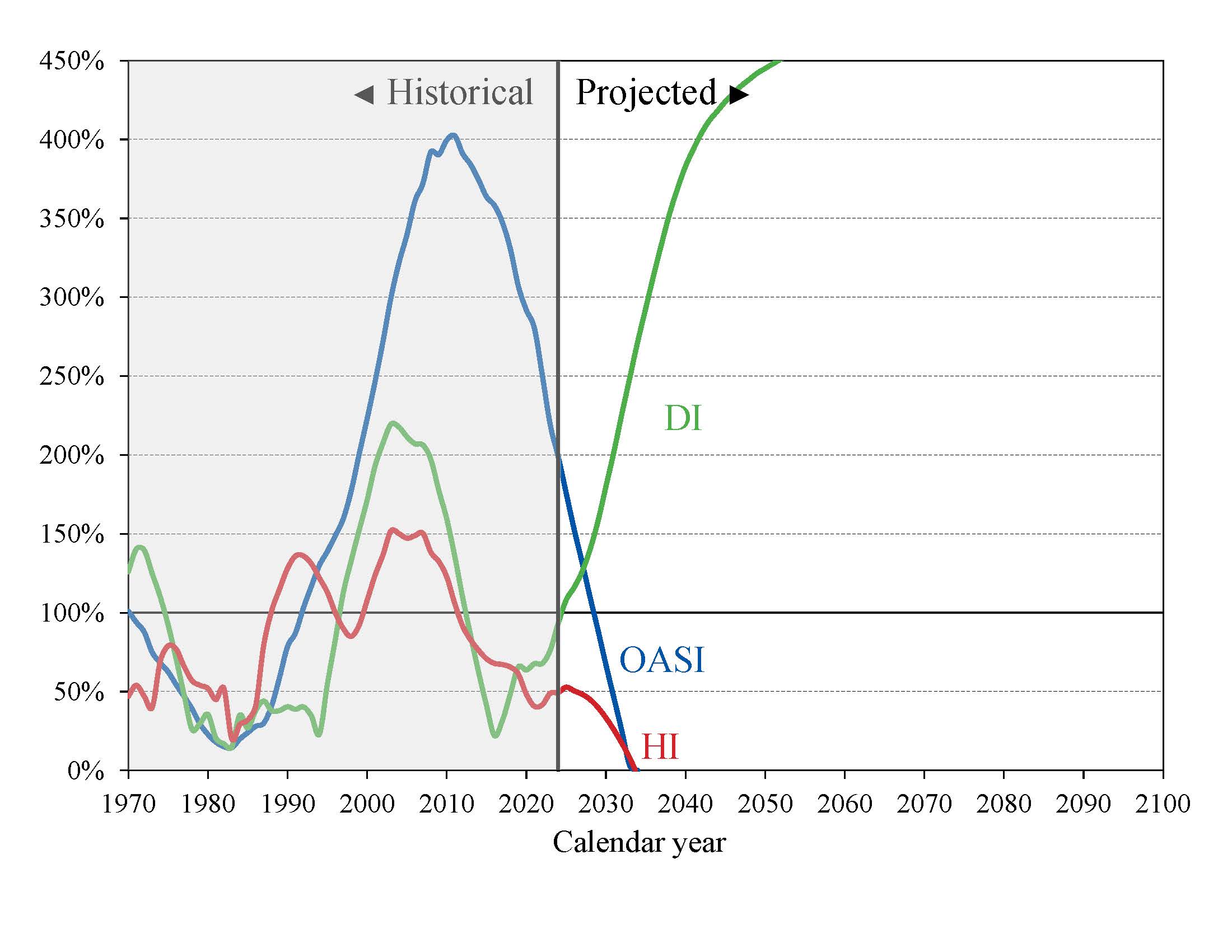

As for the future, projections are always subject to some uncertainty, but I think there's no reasonable doubt about one fundamental point concerning the role of the Trust Fund: Barring a radical change in revenues or expenses, there will come a time within the next several years when current outgo exceeds all sources of revenue (revenue from payroll taxes plus interest payments from the Trust Fund plus any general-fund money transferred to make up for any future payroll tax holidays). That means that the Trust Fund will hit a peak size and will then start to decrease in size. This doesn't represent a problem; it's how the Trust Fund was designed to function, to enable the system to cope with the demographic bulge of the Baby Boom.

The question that's difficult to answer is whether the Trust Fund will be depleted down to zero before the system regains its year-to-year equilibrium (which occurs a few decades from now, when enough of us Baby Boomers have died off). That's where the different projections make a huge difference.

You're certainly right that there are reasons to question the pessimistic assumptions. Nevertheless, to me it makes sense to give those assumptions heavy weight in planning. If the weather forecast is for a 30% chance of rain, I stuff an umbrella into my backpack. That's one reason to favor raising or eliminating the cap on income subject to FICA taxation -- that step would improve the system's fiscal picture.

Of course, talk of Social Security going "bankrupt" is hype. There are Gen X'ers and Millennials who are convinced that they'll never see a dime of Social Security benefits, which is a completely wrong view. Even on the worst-case assumptions for the depletion of the Trust Fund, Social Security would still be able to pay about three-quarters of all benefits due under current law. Furthermore, I very strongly suspect that the political will would exist to fix the problem out of the general fund.

Yo_Mama

(8,303 posts)With the exception that there are two streams of revenue (actual money with which to pay benefits). Those are the payroll taxes and taxes on Social Security benefits.

From the general fund, you take the payment covering the payroll tax cut and the interest payments on the SS trust fund. But the SS trust fund is just an accounting mechanism, which keeps track of all the excess payments that citizens have been making to SS over the decades. It is not a source of funds with which to pay benefits.

This is a cash flow problem, not an accounting problem. Whether the Trust fund is increasing or decreasing is not going to determine whether benefits are cut. What will determine whether benefits are cut is whether the taxes supporting the program plus the ability of the US government to borrow can support the payment of benefits.

This is why I am so against the payroll tax cut. It was dumb and it was a closet undermining of SS.

The only way in which the SS trust funds (OASDI) represent a source of cash payments are that the debt that they represent is included under the US debt limit, and therefore they represent a legal authority to borrow. However the SS trustees can't even access that legal authority directly - Congress must authorize it or Treasury (which is authorized by Congress) must issue the notes. All the SS trustees can do legally is trot over to the general fund, hand them some of the special obligations, and say "gimme money".

So the trust funds really do not matter - they are literally just an accounting mechanism. What matters are US total debt levels and whether we have the collective will to raise the revenues needed to pay benefits. Including intragovernmental debt, US public debt is already above 100% of GDP, so borrowing is not the primary option. Were we ever to do so, the interest rates we would have to pay on new government debt with longer terms would rapidly rise, which would inflict tremendous damage on the US economy.

However we can raise the revenues needed to pay benefits for decades to come, but instead of looking at this option, it appears that the US government (both parties) has instead chosen the closet default route.

The change to index SS COLAs to C-CPI-U would work in tandem with the Fed monetizing the debt, which is really what QE3 is all about. Monetizing debt causes the US dollar to deflate in value, which shrinks real dollar payments to SS beneficiaries. Changing from CPI-W to C-CPI-U to calculate the annual adjustment would result in a much more rapid decline in "real" SS benefits. So that's what the political powers have chosen.

It is not what we the people must accept, however.

Yo_Mama

(8,303 posts)There is obviously a moral obligation to repay that money to beneficiaries, but Congress has to create a way to do it. As it is now, SS is being funded only a bit from General Revenue, but with ten years, the impact will increase sharply:

http://www.ssa.gov/oact/progdata/assets.html

So we need to raise taxes to create the revenue stream to fund SS & DI & Medicare, because otherwise we won't have the money. The only way to get money out of the "assets" in the trust fund is from general revenue, so then the federal government has to either raise taxes (revenue), cut other spending, or borrow.

Because debt already borrowed is so high a percentage of GDP already, it's evident that we can't "borrow back" all the assets we lent the government.

Senator Hollings famously called the special obligations bonds in the SS trust fund the equivalent of confederate dollars, and he was right. In fact, if a law were passed tomorrow to eliminate the SS trust funds, nothing would change about the funding of SS. Every year the SS trustees would go to the general fund and tell them how much money they needed, and the General Fund would give them the money, which is precisely what happens now.

The trust funds are thus a complete red herring. If Congress has the will to fund SS, it will do so, and if it doesn't have that will, it won't and eventually a financial crisis will force cuts to benefits.

sabrina 1

(62,325 posts)its creditors, in this case the American People. For the first time ever, this is what you are saying, the US Govt will not back its own Treasury Bonds as it has always done, guaranteeing Creditors that they are backed by the 'full faith and credit' of the US Govt??

Does China know about this, or Japan or any of our other creditors, because as soon as the US Govt refuses to back its own Treasury Bonds, we will have a lot more to worry about than SS.

Could you tell us where you got this disastrous information, because that is the ONLY way, the SS Fund does not get reimbursed.

Thanks in advance.

Yo_Mama

(8,303 posts)But you have to understand that the Chinese and all other creditors don't consider a "default" on SS trust funds as anything but a bonus for them, because they own entirely different classes of Treasury obligations.

What's in the "trust funds" are special obligations, which used to be known as non-marketable securities. By law they cannot be sold or otherwise marketed to raise funds directly. Thus they are not "debt" in any way but morally.

Your entire point means the reverse of what you think it does. Here is some info on the "special obligations":

http://aging.senate.gov/crs/ss3.pdf

The special obligations purchased by the Social Security trust fund are backed by “the full faith

and credit” of the U.S. government. This is a promise by the U.S. government to redeem the

securities (debt instruments). Technically, like any other borrower, the federal government could

default on any or all of its outstanding obligations. The implications for the economy, and for the

private market for government securities, of a federal government default on the special

obligations held by the Social Security trust fund would depend on the views of private investors.

The impact would be determined by whether private investors think this is a precursor to a federal

government default on securities held by the public (a general government default). There is no

precedent for a federal government default, which makes it difficult to predict the implications.

The accumulated holdings of the Social Security trust fund, which represent budget authority for

the program, can be viewed as a measure of funds dedicated to pay current and future benefits.

However, when revenues are projected to be below levels needed to pay benefits in 2010, 2011,

and again beginning in 2015,28 these funds will be available to pay benefits only as the

government raises the resources necessary to pay for the securities as they are redeemed by the

Social Security trust fund. The securities are a promise, by the U.S. government, to raise the

necessary funds.29 When the system is operating with a cash flow surplus, the surplus Social

Security revenues (which are invested in government securities held by the trust fund) are used to

fund other government activities at the time. The surplus Social Security revenues, therefore, are

not available to finance benefits directly when the system is operating with a cash flow deficit.

Stated another way, when the Social Security trust fund runs a cash flow deficit, the trust fund

cashes in more federal government securities than the amount of current Social Security tax

revenues. Because general revenues are used to redeem the federal government securities held by

the trust fund, this results in increased spending for Social Security from the general fund. With

respect to the Social Security program’s reliance on general revenues, it is important to note that

the program is relying on revenues collected for Social Security purposes in previous years that

were used by the federal government at the time for other (non-Social Security) spending needs.

The program draws on those previously collected Social Security tax revenues (plus interest)

when current Social Security tax revenues fall below current program expenditures.

MannyGoldstein

(34,589 posts)Than on other Treasury bonds?

Yo_Mama

(8,303 posts)From the Fed's perspective, that seems to be what they are angling for.

Obviously if you currently hold a lot of long term Treasury obligations, it is greatly in your interest not to have those special obligation bonds turned into real debt. So the current Treasury holders are all rooting for those obligations not to be recognized by floating the trust fund notes as actual market debt.

However that does not require default on the obligation that those notes represent - instead it requires raising a revenue stream sufficient to pay the promised benefits. Over the long term, everyone has looked at the total required and agreed that it can't happen, but over about the next 15 to 20 years it could easily be funded by just raising taxes.

sabrina 1

(62,325 posts)creditors. That is why they try to find deceptive ways to convince people to support some of their devious methods of cutting benefits. It won't work. And if they ever do default, watch what happens in this country. Which is why they will not.

Yo_Mama

(8,303 posts)SC ruled it was a default, but also said no remedy available - so the bondholders took it in the shorts. Bonds were due in 1938 and called in 1934.

sabrina 1

(62,325 posts)facts. SS has more than one source of revenue. One of which is interest on the Bonds you seem to think the Govt is willing to default on. Apparently the Govt will do not such thing and has paid the SS fund, as it pays China and any other creditor, the interest on those bonds every year.

As a result, regardless of any shortfall in SS taxes, which btw, has happened eight times before with no real problem, the SS fund this year, last year and for all the years since the Economic Meltdown, has shown a SURPLUS.

Nice scare tactics there, but fortunately people are now way more informed than they used to be thanks to the ongoing tremendous and effective anti-right-wing propaganda that went unanswered for so long, by dozens of Progressive Orgs, SS advocacy groups, Unions, and of course AARP a huge and powerful organization which stopped Bush in his tracts when he too thought he could fool the American people.

SS is fine. The interest on the bonds and its other sources of revenue will keep it solvent even under the worst conditions, such as the past few years when Wall St. collapsed the economy, for at least two more decades. And when the economy improves of course we can extend that period by a few more decades.

Fact, SS had zero to do with the deficit. It is solvent and therefore should not even be a part of these discussions.

Tens of millions of Americans through various organizations are now making sure the lies about SS are countered effectively so t hat no longer can these false scare tactics have the effect they once had.

And yes, all of the US Govt's creditors will be watching to see if the US defaults on any one of its creditors, which is exactly why it never has and never will.

lumberjack_jeff

(33,224 posts)The "external financial asset" is the same as US treasury bonds purchased by the government of China.

Don't give me that "it's just a worthless IOU" shit.

Either the debt is a big problem or the debt the government owes retirees is worthless. Pick only one.

Yo_Mama

(8,303 posts)What's in the SS trust fund, and also in the federal government retiree trust fund, are "special obligations". These obligations are both bought and sold by different branches of the US government.

Thus they do not add to the total of federal debt held by the public (actual borrowed debt), although they are constrained by the debt limit.

The Fed is telling Congress to default - to modify entitlement programs so as not to actually float that debt.

Our creditors very much do not want that debt to be converted to marketable securities, because then it competes with them for their right to federal government revenues for repayment. If all the special-obligation securities in government trust funds were converted into US Treasury marketable obligations, our current federal debt held by the public would be more than 100% of GDP, which is a level at which private investors get scared about risk.

lumberjack_jeff

(33,224 posts)The distinction between "debt held by the public" and "intragovernmental debt" is a meaningless, bullshit distinction invented by those who think government's debt to retirees is inconvenient.

The trust fund is physical securities in physical file cabinets at SS headquarters.

The government owes this debt to retirees, and it matters not at all if the government issues new public debt to pay off it's intragovernmental debt.

sabrina 1

(62,325 posts)right wing scare tactics, which they have been predicting since the inception of the SS fund, and which have never come to pass.

The time has finally come to put an end to it all right now. And that is why all those Progressive Orgs have joined the Unions and AARP and other Advocacy groups to stop this in its tracks once and for all. It is a disgrace that the American people continue to have their own Retirement Fund for which they paid attacked, year after year after year. Enough! And to see it here, is just beyond belief.

savannah43

(575 posts)WhoIsNumberNone

(7,875 posts)awoke_in_2003

(34,582 posts)every president that followed.

WhoIsNumberNone

(7,875 posts)awoke_in_2003

(34,582 posts)but no president since has stopped it.

Fla Dem

(23,785 posts)savannah43

(575 posts)Millions will be listening now.

Yo_Mama

(8,303 posts)Consequently, over time the Social Security Trust Funds have included a mix of marketable and non-marketable Treasury securities. Over the years, the proportion has shifted heavily in favor of special obligation bonds as the main asset held by the Social Security Trust Funds. Prior to 1960, the Treasury's policy was to invest primarily in marketable securities, although this policy was not always followed. Since 1960, the policy has been to invest principally in special obligation bonds, unless the Managing Trustee of the funds (i.e., the Secretary of the Treasury) determines that investment in marketable securities would be "in the public interest." In fact, since 1980 no marketable securities have been added to the Trust Funds. (For a more detailed explanation see the Office of the Actuary's Actuarial Note #142.)

Since the assets in the Social Security trust funds consists of Treasury securities, this means that the taxes collected under the Social Security payroll tax are in effect being lent to the federal government to be expended for whatever present purposes the government requires. In this indirect sense, one could say that the Social Security trust funds are being spent for non-Social Security purposes.

A Simple Game

(9,214 posts)raised the rates on Social Security to replace the lost revenue. There should have been little need for a rate increase, the extra workers from the baby boom should have created enough surplus on their own.

It was mostly a ruse to hide the deficit created by the tax cuts.

Yo_Mama

(8,303 posts)The money in the SS trust funds is currently 2.717 trillion, or 2,717 billion:

http://www.ssa.gov/oact/progdata/fyOps.html

The fiscal year outgo (benefits plus costs) was 773 billion. Assuming that outgoes never increased, which is untrue, they are increasing rapidly, the current balance in the trust fund is sufficient to pay about 3.5 years of benefits.

Nonsense like this isn't doing anyone any good. Feel free to believe it if you want, but realize that the impact on fiscal policy will be nil.

LastLiberal in PalmSprings

(12,600 posts)That's a net income of $64 million for FY 2012. Your "3.5 years remaining" is just another attempt to create panic and confusion.

Social Security has nothing to do with the deficit, and shouldn't be included in the current negotiations.

http://goo.gl/gh23a

Yo_Mama

(8,303 posts)But that's not what the FB post said, is it now?

Lordquinton

(7,886 posts)If you ignore your income, you're going to be broke by next week!

Curmudgeoness

(18,219 posts)every year. This past year was the first year that SS had to use more money than it took in. It used interest instead of reinvesting the interest back into the fund. The principle was not touched yet. And yes, it will be, and that was why it was set up.

sabrina 1

(62,325 posts)50 years ago these scare tactics were being used and have not only never ended by they have always been proven to be false.

However, times are changing and the people are now working to end these attacks on SS once and for all. I am proud to have joined the huge coalition of organizations that have joined forces to expose these tactics and to secure the SS fund from the would-be corporate raiders once and for all.

The SS fund has had a surplus every single year since the rest of the economy collapsed.

And this is an outright false statement:

We heard this five, ten, twenty years ago and it never happened, despite the SS fund having a shortfall in its tax revenues. The reason being that SS has more than one source of revenue, which you have conveniently neglected to mention. Lol, I love these debates, been having them for ten years with my right wing friends also. Too bad to see them here though. I suggest you do some more studying on the SS fund so you don't keep posting material here that will only be knocked down as it should be.

We will have a surplus this year and next year also and the fund can pay out its full obligations for the next two decades without anything changing, or without anything being done about it. When the economy improves, that will be extended.

So relax, no one BUT the far right is the least bit worried about the SS fund for the foreseeable future, even those who are pretending they are.

savannah43

(575 posts)lumberjack_jeff

(33,224 posts)"That amount of money alone would fund SS for the next 60 years" should be "that money allows SS to pay retirees what they were promised for the next 60 years"

madrchsod

(58,162 posts)those 8 million jobs that was lost during george bush`s reign and the following deep recession after 2008.