General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsNew Obama ad: 'I believe'

by Jed Lewison

The Obama campaign's newest ad is scheduled to run during the opening ceremonies of the Olympics, which will air tonight on NBC starting at 7:30 PM on tape delay. Mitt Romney will be at those opening ceremonies, but the ad doesn't contain any attacks on Romney. Instead, it features President Obama speaking at a campaign rally talking about what he believes in:

- more -

http://www.dailykos.com/story/2012/07/27/1114296/-New-Obama-ad-I-believe

leftstreet

(36,108 posts)It's not coming back

Ad sounds like something from the 90s

nolabear

(41,963 posts)leftstreet

(36,108 posts)MannyGoldstein

(34,589 posts)But it roared back, starting in 1933.

It can happen again, if we transition from Hoover economics to FDR economics.

demwing

(16,916 posts)That's all, nothing else. Just nonsense.

RedStateLiberal

(1,374 posts)CaliforniaPeggy

(149,620 posts)He is right on target.

Go get 'em, Obama!

Liberal_in_LA

(44,397 posts)Response to CaliforniaPeggy (Reply #3)

Post removed

Scurrilous

(38,687 posts)Response to ProSense (Original post)

Courtesy Flush This message was self-deleted by its author.

MannyGoldstein

(34,589 posts)I believe in fighting tooth and nail for bankers and their bonuses.

I believe in cutting, not slashing, Social Security. Ah, who am I kidding, I demand that it be cut. Grand Bargains are very postpartisan, you know.

I believe in unlimited power to imprison or kill anyone I want. My decision alone.

But hey... who else 'ya gonna vote for? Romney? Give me a break, suckers."

Look, I can live with Obama telling us that Romney sucks. Romney is unbelievably awful. But Obama trotting out his love for the 99% during election cycles is really disturbing, given his track record.

ProSense

(116,464 posts)the stuff I believe trumps lame talking points.

Obama Admin Wins Trade Complaint Against China At WTO

http://www.democraticunderground.com/1002958217

WTO Upholds Obama’s Tire Industry Relief Decision

http://www.democraticunderground.com/discuss/duboard.php?az=view_all&address=433x765194

How to bat down RW attempts to take the heat off Romney for outsourcing

http://www.democraticunderground.com/1002969344

An indictment filed yesterday in federal court in Charlotte, North Carolina charged the former head of Bank of America’s municipal derivatives desk, Phillip Murphy, with conspiracy to defraud the U.S, wire fraud, and conspiracy to make false entries in bank records. From Bloomberg:

http://livewire.talkingpointsmemo.com/entries/former-bofa-exec-indicted-for-fraud

Former Financial Services Executive Indicted for His Participation in a Far-Reaching Conspiracy and Scheme to Defraud Involving Investment Contracts for the Proceeds of Municipal Bonds

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-at-895.html

I believe:

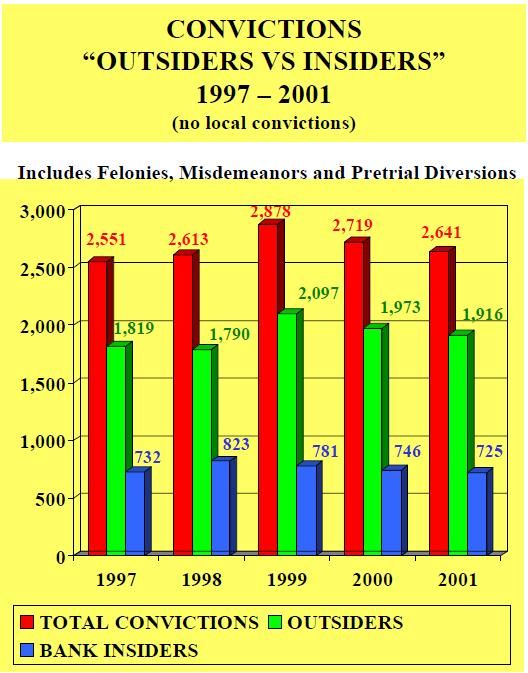

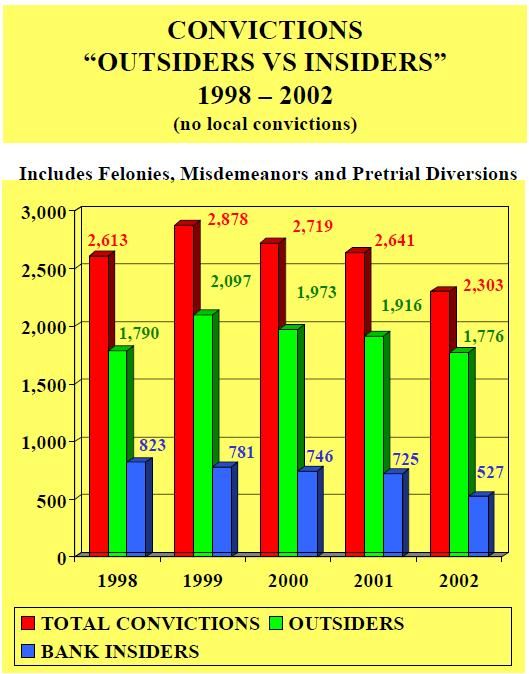

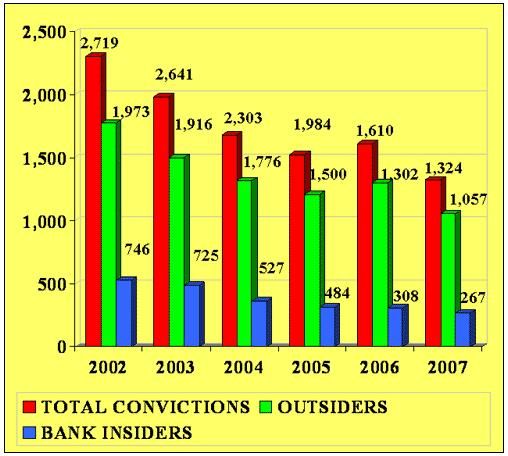

not only does the chart you posted shows that prosecutions started dropping after the repeal of Glass-Steagall, it also shows prosecutions, not convictions. It's also not conclusive because it doesn't state what specifically it includes and appears to be related to bank fraud. Here's the reference:

This category can refer to crimes committed both within and against banks. Defendants include bank executives who mislead regulators, mortgage brokers who falsify loan documents, and consumers who write bad checks. (Here are some recent cases of bank fraud prosecutions.)

Goldman Sachs is not a bank. Still, even if it is bank fraud, it does offer more evidence of Bush's "abysmal" record, as these prosecutions dropped significantly during his Presidency.

The following is from the Financial Institution Fraud and Failure Reports for each fiscal year.

http://www.fbi.gov/stats-services/publications/fiff_00-01

http://www.fbi.gov/stats-services/publications/fiff-2002

(b): Types of Subjects Convicted in FIF Cases During FY 2007*

SUBJECT TYPE NUMBER OF SUBJECTS

Legal Alien 8

Illegal Alien 20

All Other Subjects 1,038

Bank Officer 88

Bank Employee 179

International or National Union Officer 1

President 1

Business Manager 2

Office Manager 2

Financial Secretary 1

Federal Employee - GS 12 & Below 1

State - All Others 1

Local Law Enforcement Officer 1

City Councilman 1

Possible Terrorist Member or Sympathizer 1

Company or Corporation 7

Local - All Others 2

Total 1,354

http://www.fbi.gov/stats-services/publications/fiff_06-07/fiff_06-07

http://www.fbi.gov/stats-services/publications/fiff_06-07/fiff_06-07

Given the above charts and the break out for 2007, it appears that most of the convictions were not bank executives. In fact, the majority were bank "outsiders," likely meaning more bad-check writers and document falsifiers.

Also, bank fraud is separate from corporate fraud, mortgage fraud, and securities and commodities fraud.

The following is from the Financial Crimes Report to the Public for each fiscal year:

(Note: The 2005 report does not break out securities and commodities fraud. The 2010-2011 report is the only one that breaks out financial institution fraud. All reports show corporate fraud and mortgage fraud.)

http://www.fbi.gov/stats-services/publications/fcs_report2005/fcs_2005#CORPORATE

http://www.fbi.gov/stats-services/publications/fcs_report2005/fcs_2005#MORTGAGE

_________

http://www.fbi.gov/stats-services/publications/fcs_report2006

http://www.fbi.gov/stats-services/publications/fcs_report2006/financial-crimes-report-to-the-public-fiscal-year-2006#Securities

http://www.fbi.gov/stats-services/publications/fcs_report2006/financial-crimes-report-to-the-public-fiscal-year-2006#Mortgage

___________

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#corporate

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#securities

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#mortgage

______________

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#corporate

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#securities

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#mortgage

____________

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009#securities

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009#mortgage

_____________

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Corporate

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Securities

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Financial-ins

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Mortgage

Pending cases are important because they can still result in convictions.

President Obama’s Financial Fraud Enforcement Task Force STRIKES AGAIN! $200 Million Fraud

http://www.democraticunderground.com/1002844790

I believe:

Dodd-Frank prohibits bank bailouts and gives the FDIC new powers beyond those it had prior to the repeal of Glass-Steagall.

The Federal Reserve and the Financial Stability Oversight Council should use section 121 of the Dodd-Frank Act – which gives the Fed the ability to mitigate the “grave threat” that a financial institution poses by limiting banks’ activities or forcing it to divest assets – to break Bank of America into separate institutions. If crafted properly, these smaller institutions would be less likely to fail, would not endanger the U.S. financial system in the event of failure and would be easier to liquidate in an orderly fashion should it become necessary, the petition said.

http://www.citizen.org/pressroom/pressroomredirect.cfm?ID=3511

Handy graph:

http://www.businessweek.com/magazine/doddfrank-in-one-graph-01122012-gfx.html

I believe:

Former Chief Investment Officer of Stanford Financial Group Pleads Guilty to Obstruction of Justice

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-785.html

Former Corporate Chairman of Consulting Firm and Board Director Rajat Gupta Found Guilty of Insider Trading in Manhattan Federal Court

http://www.stopfraud.gov/iso/opa/stopfraud/NYS-120615.html

Hedge Fund Founder Raj Rajaratnam Sentenced in Manhattan Federal Court to 11 Years in Prison for Insider Trading Crimes

http://www.stopfraud.gov/news/news-10132011.html

CEO and Head Trader of Bankrupt Sentinel Management Indicted in Chicago in Alleged $500 Million Fraud Scheme Prior to Firm’s 2007 Collapse

http://www.stopfraud.gov/iso/opa/stopfraud/ILN-120601.html

Yahoo! Executive and California Hedge Fund Portfolio Manager Plead Guilty in New York for Insider Trading

http://www.stopfraud.gov/iso/opa/stopfraud/NYS-120521.html

Three Former Financial Services Executives Convicted for Roles in Conspiracies Involving Investment Contracts for the Proceeds of Municipal Bonds

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-at-620.html

Former Chairman of Taylor, Bean & Whitaker Sentenced to 30 Years in Prison and Ordered to Forfeit $38.5 Million

http://www.stopfraud.gov/news/news-06302011-2.html

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-342.html

Former Chief Financial Officer of Taylor, Bean & Whitaker Pleads Guilty to Fraud Scheme

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-342.html

Seattle Investment Fund Founder Sentenced to 18 Years in Prison for Ponzi Scheme and Bankruptcy Fraud

http://www.stopfraud.gov/iso/opa/stopfraud/WAW-120210.html

Former Hedge Fund Managing Director Sentenced to 20 Years for Defrauding 900 Investors in $294 Million Scheme

http://www.stopfraud.gov/iso/opa/stopfraud/ILN-111117.html

http://www.stopfraud.gov/news-index.html

I believe:

A key element of the Affordable Care Act (ACA) is the expansion of Medicaid to nearly all individuals with incomes up to 138 percent of the federal poverty level (FPL) ($15,415 for an individual; $26,344 for a family of three in 2012) in 2014. Medicaid currently provides health coverage for over 60 million individuals, including 1 in 4 children, but low parent eligibility levels and restrictions in eligibility for other adults mean that many low income individuals remain uninsured. The ACA expands coverage by setting a national Medicaid eligibility floor for nearly all groups. By 2016, Medicaid, along with the Children’s Health Insurance Program (CHIP), will cover an additional 17 million individuals, mostly low-income adults, leading to a significant reduction in the number of uninsured people.

Medicaid does not cover many low-income adults today. To qualify for Medicaid prior to health reform, individuals had to meet financial eligibility criteria and belong to one of the following specific groups: children, parents, pregnant women, people with severe disability, and seniors. Non-disabled adults without dependent children were generally excluded from Medicaid unless the state obtained a waiver to cover them. The federal government sets minimum eligibility levels for each category, which are up to 133% FPL for pregnant women and children but are much lower for parents (under 50% FPL in most states). States have the option to expand coverage to higher incomes, but Medicaid eligibility levels for adults remain very limited (Figure 1). Seventeen states limit Medicaid coverage to parents earning less than 50 percent of poverty ($9,545 for a family of 3), and only eight states provide full Medicaid coverage to other low-income adults. State-by state Medicaid eligibility levels for parents and other adults are available here.

The ACA expands Medicaid to a national floor of 138% of poverty ($15,415 for an individual; $26,344 for a family of three). The threshold is 133% FPL, but 5% of an individual’s income is disregarded, effectively raising the limit to 138% FPL. The expansion of coverage will make many low-income adults newly eligible for Medicaid and reduce the current variation in eligibility levels across states. To preserve the current base of coverage, states must also maintain minimum eligibility levels in place as of March 2010, when the law was signed. This requirement remains in effect until 2014 for adults and 2019 for children. Under the ACA, states also have the option to expand coverage early to low-income adults prior to 2014. To date, eight states (CA, CT, CO, DC, MN, MO, NJ and WA) have taken up this option to extend Medicaid to adults. Nearly all of these states previously provided solely state- or county-funded coverage to some low-income adults. By moving these adults to Medicaid and obtaining federal financing, these states were able to maintain and, in some cases, expand coverage. Together these early expansions covered over half a million adults as of April 2012.

Eligibility requirements for the elderly and persons with disabilities do not change under reform although some individuals with disabilities may become newly eligible under the adult expansion. Lawfully residing immigrants will be eligible for the Medicaid expansion, although many will continue to be subject to a five-year waiting period before they may enroll in coverage. States have the option to eliminate this five-year waiting period for children and pregnant women but not for other adults. Undocumented immigrants will remain ineligible for Medicaid.

- more -

http://www.kff.org/medicaid/quicktake_aca_medicaid.cfm

I believe:

By NCPSSM

<...>

The Supreme Court is wrapping up three days of hearings on the Affordable Care Act today. Seniors with the National Committee’s “Rally Corps” joined other activists on the steps of the Court urging Justices to uphold the health care reform law.

“The truth is the more seniors get the facts about healthcare reform the more they support it. But unfortunately all the partisan bickering surrounding the law’s passage and continuing even now, two years later, has left too many Medicare beneficiaries unaware or misinformed about all the new benefits now available to them thanks to the ACA. Our Rally Corps members understand they’ll end up paying more for their prescription drugs, preventative screenings and higher out-of-pocket costs if the ACA is dismantled so they’re glad to take their case in support of health care reform to the steps of the Supreme Court today. ” Max Richtman, NCPSSM President/CEO

<...>

The Patients Aware campaign, created by the National Committee Foundation, the National Physicians Alliance, and the Herndon Alliance , has built a national network of doctors, nurses, and caregivers to provide information directly to beneficiaries about the Affordable Care Act. Doctors, nurses and other care providers are among the most trusted sources of health care information for seniors and their families and they are leading town hall meetings in communities nationwide to sort the fact from fiction about health care reform’s impact on Medicare beneficiaries. You can get more info about Patients Aware here.

- more-

http://www.ncpssm.org/entitledtoknow/?p=2267

I believe!

MannyGoldstein

(34,589 posts)I don't have as much time as you do, so I propose that we pick *one* of your topics and explore it.

Pick one.

ProSense

(116,464 posts)"Wow. Sorry I caused you so much trouble!"

...no trouble at all!

I believe!

![]()

MannyGoldstein

(34,589 posts)ProSense

(116,464 posts)"So pick one, and let's discuss it."

...are you trying to hijack the thread?

Never mind.

My pick: Medicaid expansion

The President's health care law expanded the program to 16 million people, the biggest expansion since it was launched in 1966.

Posted by Sarah Kliff

<...>

While the stakes are high for the White House, the territory is by no means uncharted. Washington has twice faced off with states over federal health care expansions, when Medicaid initially launched in 1965 and with the Children’s Health Insurance Program in 1997. In both cases, all 50 states ultimately signed up – but not without some wrangling.

<...>

Medicaid got a chilly reception when it launched in January 1966. It was up to the states to decide whether to participate and only six initially signed up: Hawaii, Illinois, Minnesota, North Dakota, Oklahoma and Pennsylvania. Twenty-seven followed suit later that year. Across the country, governors weighed the boon of new federal dollars — Washington would foot half of Medicaid’s bill — against the drawback of putting state money into a new program.

Nascent Medicaid programs quickly faced threats: Republican legislators in the New York introduced a bill in 1967 calling for the state to “live within its means” and repeal its Medicaid program.

<...>

Over time, however, the lure of federal dollars proved strong enough to win over resistant states. Eleven joined the program in 1967. Another wave of eight, largely Southern states came on board in 1970. Arizona proved the last holdout, not joining Medicaid until 1982.

- more -

http://www.washingtonpost.com/blogs/ezra-klein/wp/2012/07/09/six-governors-say-they-will-opt-out-of-medicaid-how-long-will-they-hold-out/

States stand to lose a lot more than Medicaid funding by refusing the expansion

http://www.democraticunderground.com/1002914241

ProSense

(116,464 posts)MannyGoldstein

(34,589 posts)Will follow up tomorrow.

Can you look up a figure for me, though? Will the number of Americans in poverty since Obama took office grow by less than the the 16 million new Medicaid recipients you claim? Let's make sure that it's better than breakeven.

ProSense

(116,464 posts)Will follow up tomorrow.

Can you look up a figure for me, though? Will the number of Americans in poverty since Obama took office grow by less than the the 16 million new Medicaid recipients you claim? Let's make sure that it's better than breakeven.

...don't you look it up after you get some rest.

Here's a hint: If people meet the poverty thresholds, they qualify for Medicaid. So your question doesn't really make sense. In fact, it appears to be a non sequitur.

Never challenge someone to a debate and then disappear.

MannyGoldstein

(34,589 posts)If that number stays the same - and there's no reason to believe it is true unless Obama and Congress abandon Hoover economics - we'll have about 12 million more Americans in poverty in 2014 than when Obama first took office. A little less than the 16 million that you claim RomneyObamaCare will add to the roles.

But let's say that your supposition is correct, that all people get Medicare once they're in poverty, and RomneyObamaCare adds 16 million people beyond the 12 million added by government economic policy. Let's take a look at what that will cost, vs. whet it would have cost if Obama followed through on his promise to create public-option health insurance.

Got to run off to a commitment now, but I'll do these numbers later.

ProSense

(116,464 posts)But let's say that your supposition is correct, that all people get Medicare once they're in poverty, and RomneyObamaCare adds 16 million people beyond the 12 million added by government economic policy. Let's take a look at what that will cost, vs. whet it would have cost if Obama followed through on his promise to create public-option health insurance.

Got to run off to a commitment now, but I'll do these numbers later.

I suppose you're questioning the 16 million without considering the fact that the law now applies Medicaid to poor adults without children, federal workers with children who were previously ineligible, and also increases the income limits beyond current poverty levels.

99Forever

(14,524 posts).. it's time our candidates for the most powerful job on the planet tell us in clear. no uncertain terms what they are going to do to stop the domestic threat each of us faces from random, unprovoked gun violence.