and show solidarity with our Hellenic sisters and brothers!

Fellow DUers,

Imagine that in this space I wrote an essay blaming the economic troubles of the United States on overpaid union workers, the pernicious influence of ACORN and SEIU, tax-and-spend liberals like Pelosi, lazy tenured teachers, corruption at the “government enterprises” Fannie Mae and Freddie Mac, and deadbeat subprime borrowers.

All of you would attack! In short order I would be banished from the site for promoting outrageous right-wing fictions.

Yet every day many of you, largely unawares, accept or promote equally pernicious myths about the situation in Greece.

You know that politicians, the corporate media and talk radio lie when they make scapegoats of workers and the poor in the United States. Therefore you should at least suspect that they are doing the same in their daily characterization of Greeks as a spoiled, lazy, riotous people whose irresponsibility will wreck the euro and sink the world economy -- and when they call for punitive austerity measures and, if necessary, a political crackdown as the solutions for the "Greek problem."

The sources of such statements and the way they echo common right-wing myths about American economics should alert you at the very least to do your own research before forming an opinion.

Let’s begin with a dozen relatively simple facts -- one for each Olympian god -- that counteract the mythology about Greece in the corporate media of the Anglosphere and Germany. We shall see that Greeks indeed are subjected to a vicious and defamatory mythology, one that no DU members should ever want to propagate.

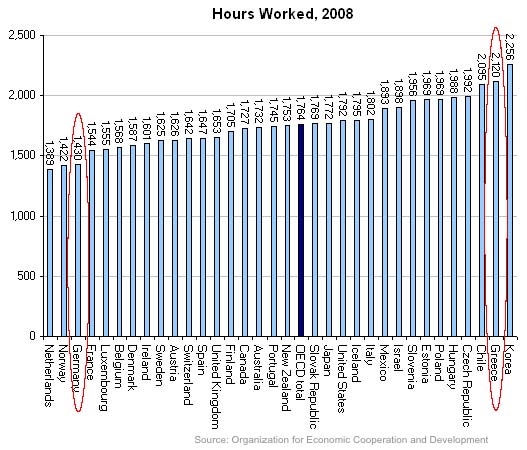

1) People in Greece work harder than in any OECD country other than Korea

The average Greek worker logs 700 more hours in a year than the average German worker. The way these numbers are gathered varies from country to country but the difference is great enough to dispose of the myth of the hard-working Germans called upon to rescue the spendthrift Greeks. Source: OECD,

https://community.oecd.org/community/factblog/blog/2010/05/10/working-9-to-4302) The average Greek wage is 73 percent of the average EU wage. The minimum wage is terrible. 3) Greek pensions are lower than in other OECD countries.

3) Greek pensions are lower than in other OECD countries.As an American-trained Greek economist wrote last week in “The Street,” according to “Eurostat and GSEE data, 60% of Greek pensioners receive less than 600 euros per mo. And 85% receive below 1050 euros per mo. Greek pensions are about 55% of the average eurozone pension, despite inaccurate claims about pensions made in the international media. The usual age for retirement of most people in Greece has been 65 yrs, except for some very special cases in the public sector, which are now being revised upwards –and rightly so- with a new pensions law.”

Source: Polyvios Petropoulos, “Truths and Myths about the ‘Greek Crisis’,” The Street, 18 May 2010, at

http://www.creditwritedowns.com/2010/05/guest-post-truths-and-myths-about-the-greek-crisis.html4) Greek government workers do not really receive “two bonus months” of pay a year.That is a manipulative way of saying that some Greeks receive their annual salary in 14 instead of 12 paychecks. It says nothing about the actual amount. In the past, the government intentionally negotiated legitimate wage raises as “bonus” payments,

precisely so that in a pinch they could claim these were superfluous. Eliminating “bonus” payments is nothing more than a way of cutting already modest annual salaries by one-seventh.

5) The alternative to the small number of early pensions is higher unemployment.Much is made of the supposed scandal that some Greek government workers receive pensions already in their late 50s. This factoid is used to great effect in countries like the United States, where pensions are endangered. It is classic divide-and-conquer. It causes jealousy among those who should instead be fighting for their own economic security. The macroeconomic bottom line, however, is that a few modest early pensions help ease a perpetually difficult job market. In the absence of other changes, later pensions translate into fewer jobs for young people. A few older workers would keep their jobs at higher pay. The country would still have to figure out how to provide for even greater armies of the unemployed than is the case today. That this would be cheaper is doubtful. The point being that early pensions are not a cause of Greek fiscal problems, as they have been depicted in the Greek-bashing propaganda.

6) Entry to the euro was a bad idea for Greece -- and a good one for German business.Prior to the euro, the comparatively lower Greek wages and pensions were more tolerable because the cost of living in Greece was lower. Currency union prompted rationalization of prices across the eurozone. The cost of living in Greece is no longer significantly lower than in other euro countries, even as Greece has been subjected to direct competition with euro-priced German products, resulting in higher trade deficits. Greece no longer has the means to improve its competitive advantage via currency devalution. German export industries have benefited (also in the other euro countries) while Greece has suffered even greater capital flight than has always been the case. Germans have no business complaining about the euro as a disadvantage to their country now that Greece has been forced into the corner by the policies that were advantaging German business.

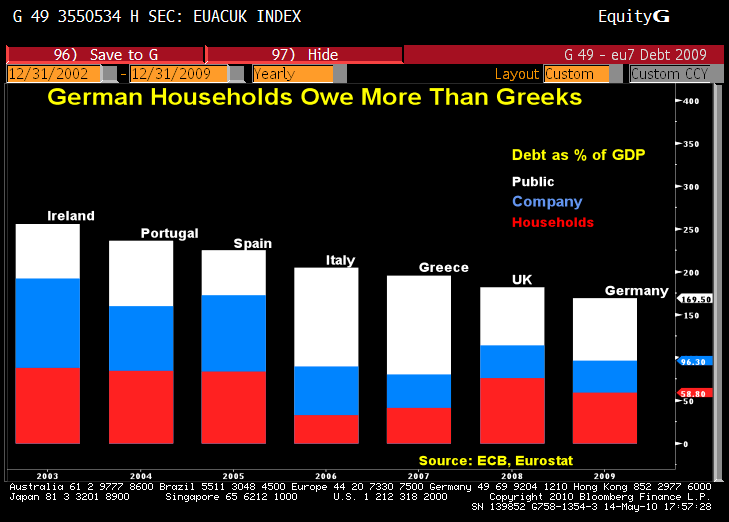

7) German households carry far more debt than Greek households.

(NOTE: A common way economic pictures are distorted is by focusing on public debt without including corporate and household debt. Here we see that by the debt-to-GDP standard, Greece’s total debt is not much higher than the UK’s and lower than all of the other EU countries said to be in crisis, although Greek public debt is higher. The red blocks denote household debt. Note that German households have accumulated far more debt than the supposedly profligate (though underpaid!) Greeks. Given Germany’s higher per capita GDP, that means an even larger difference in absolute totals.)

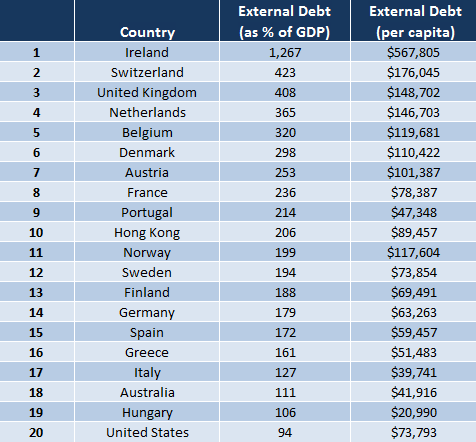

8) Greece’s external sovereign debt - that owed to foreign creditors - is lower than Germany’s

This is true both of the absolute per-capita debt and by the debt-to-GDP standard. In absolute terms, Greece’s per capita sovereign debt is also lower than that of the United States.

9) The Greek deficit is lower as a percentage of GDP than the projected British deficit.10) Greece has not been offered a bailout.The EU and IMF have offered a package of new loans attached to extreme austerity conditions. The program is not a giveaway, it merely shifts around Greek obligations. It is not the debt restructuring or “haircut” for bondholders that is the only solution for an ultimately unpayable debt.

Furthermore it will not work, despite the harsh conditions it imposes on pensioners who must now make do with 450 euros a month -- or not! -- and many other disasters for the working class. Pavlopoulos writes,

“The claim made in the IMF documents is that the “program” (including the inhuman austerity conditions and targets) is “achievable”, “feasible” and “sustainable”. On this point, however, the IMF of course has not been able to convince some of the most prominent economists and commentators (Krugman, Feldstein, Stiglitz, Rogoff, Eichengreen, Johnson, Roubini, Rodnik, Buiter, Reinhart, Fitoussi, Wyplosz, Wolf, Munchau, among others, mentioned here in no particular order.) All are saying in one way or another that the numbers do not add up. In other words, the arithmetic shows that even with this IMF/EU package, the Greek debt is not sustainable. (See in particular Buiter’s latest 65-page research report ‘Sovereign Debt Problems in Advanced Industrial Countries’.)”

Pavolopoulos then points out: “Nor did the IMF convince the markets with this package,” which we saw in their reaction since. “In fact,” he says, “I am beginning to believe that

nothing will convince them.” He attributes this to the irrationality of the markets.

And I agree with his belief that nothing will sway the markets, though for more fundamental reasons. As long as the conditions of global capital flows are set up such that players with no stakes in a country can make more money from watching that country burn than from investing in it -- or from merely leaving it alone to smolder in its own problems -- they will continue to light the fires.

This is what Europe doesn’t want to deal with, but must finally acknowledge. “Free” or unregulated world capital markets are never going to work to the advantage of sovereign states. The drive always will be to break them down, turn incipient problems into far greater ones so that the bond vigilantes can reap awesome windfalls.

11) Cuts in public spending during a recession are likely to increase public deficits.This may seem counter-intuitive, but that is exactly what happened last year in Ireland as a result of the harsh austerity measures instituted there (naturally to the applause of the bond markets and the bankster criminals who bear the greatest responsibility for the world economic disaster). Removing the stimulus of public spending during a recession merely caused the Irish economy to shrink further, resulting in lower tax revenues, higher spending on the unemployed, a higher deficit and a higher debt-to-GDP ratio.

In other words, the bank-approved Irish package was a failure in every way, but a failure that benefits the banks naturally will be designated for implementation in other countries. (You would think that people never heard of Keynes, and are not aware that the Great Depression was overcome by extreme deficit spending. Though in the end this was due to World War II, because conservative resistance impeded the New Deal until the Japanese vote at Pearl Harbor forced the issue, one hopes this time a better way will be found.)

12) The former long-time head of the Bundesbank itself says Greek debt should have been restructured, and the program offered instead was “to save the banks and the rich Greeks.”Here’s a short excerpt from Karl Otto Pöhl’s interview this week with DER SPIEGEL at

http://www.spiegel.de/international/germany/0,1518,druck-695245,00.htmlSPIEGEL: The German government has said that there was no alternative to the rescue package for Greece, nor to that for other debt-laden countries.

Pöhl: I don't believe that. Of course there were alternatives. For instance, never having allowed Greece to become part of the euro zone in the first place.

SPIEGEL: That may be true. But that was a mistake made years ago.

Pöhl: All the same, it was a mistake. That much is completely clear. I would also have expected the (European) Commission and the ECB to intervene far earlier. They must have realized that a small, indeed a tiny, country like Greece, one with no industrial base, would never be in a position to pay back €300 billion worth of debt.

SPIEGEL: According to the rescue plan, it's actually €350 billion ...

Pöhl: ... which that country has even less chance of paying back. Without a "haircut," a partial debt waiver, it cannot and will not ever happen. So why not immediately? That would have been one alternative. The European Union should have declared half a year ago -- or even earlier -- that Greek debt needed restructuring.

SPIEGEL: But according to Chancellor Angela Merkel, that would have led to a domino effect, with repercussions for other European states facing debt crises of their own.

Pöhl: I do not believe that. I think it was about something altogether different.

SPIEGEL: Such as?

Pöhl: It was about protecting German banks, but especially the French banks, from debt write offs. On the day that the rescue package was agreed on, shares of French banks rose by up to 24 percent. Looking at that, you can see what this was really about -- namely, rescuing the banks and the rich Greeks.

SPIEGEL: In the current crisis situation, and with all the turbulence in the markets, has there really been any opportunity to share the costs of the rescue plan with creditors?

Pöhl: I believe so. They could have slashed the debts by one-third. The banks would then have had to write off a third of their securities.

SPIEGEL: There was fear that investors would not have touched Greek government bonds for years, nor would they have touched the bonds of any other southern European countries.

Pöhl: I believe the opposite would have happened. Investors would quickly have seen that Greece could get a handle on its debt problems. And for that reason, trust would quickly have been restored. But that moment has passed. Now we have this mess.

Having dealt with a selection of the more common myths, let’s take a look at what’s really happening in Greece -- and Europe and the world.The Greek ruling elite is corrupt, not unlike our own. Historically the rich have kept their money abroad and avoided paying almost any taxes. That is a major cause of Greece’s particular problems. Capital leaves the country, which is left with a weak industrial base and dependence on foreign tourism and public sector spending.

The euro accelerated the process, as we touched upon above.

To get by, it’s true that the underpaid, overworked majority of Greeks engage in the hidden economy with vigor -- although in this as well, we should counter the mythology by nothing that Germany's cash-only economy is estimated to be of a roughly equivalent proportion to that of Greece.

A series of scandals over more than a decade have revealed a riot of bribe payments to Greek officials, especially by foreign corporations -- including German giants like Siemens -- in exchange for sweetheart contracts and policy favors.

Under the conservative New Democracy government, members of this compromised political class conspired with Wall Street banks, prominently Goldman Sachs, to hide a burgeoning Greek debt, although this meant higher debt service for Greece and thus only exacerbated the problems down the line. Apres moi, the deluge: This and other accounting tricks were revealed when ND was voted out last year, triggering the present crisis.

That became the signal for the bond vigilantes to descend. Since the crisis broke, Greece has been under relentless attack by the financial press of the Anglosphere (the Financial Times has featured it almost every day as a front page story) as short-selling bond traders have cashed in on Greece’s misery without having any stake whatsoever in the country. They have forced the country’s interest rates higher and made the problem all the more intractable.

The propagandists of completely free capital markets are not just looking at Greece, of course. They would like to discipline all of Europe for the unforgivable sin of having maintained working social welfare systems for its peoples. To them Greece is the wedge by which Continental Europe should finally be forced into the neoliberal fold. The conservative governments of Germany and France are playing into that strategy in a short-sighted fashion that may indeed break up the euro, as the less competitive countries will no longer be able to sustain it.

They seem blind to the reality that in the end, they will have to act to defend their own countries against the same practices that are sinking Greece, and that are being prepared for the next phase of the attack -- on Spain, Portugal, and Italy. Europe faces a choice between the future of its union and the well-being of its peoples, and the approval of the bond markets who brought on the economic crisis in the first place.

The time has come to contemplate things that are heresies under neoliberal capitalism but mere common sense in the real world: reimposing a system of currency controls, such as the Bretton Woods regime under which the capitalist world actually saw its greatest period of prosperity for the people from World War II until the early 1970s. (My idea of what the world really needs is more far-ranging than that, but this would be a start to stop the bleeding.)

The Greek crisis is the world crisis. We all know that it’s not by coincidence that dozens of countries have simultaneously been hit by the same financial tsunami and economic depression that originated, above all, with the multiple gargantuan frauds of Wall Street and the inherent dynamics of uncontrolled capitalism. Countries around the world are carrying unsustainable debts in large part because of those frauds.

The banks that are still borrowing for zero percent from the Federal Reserve under the absurd terms of the US banking bailout expect to sink that into government bonds that yield more than three percent -- or in Greece’s case, six to ten percent -- and to have repayment of all public debts enforced by the US Treasury, the IMF, or in Greece’s case Germany and France, the EU and the IMF. The skin must come out of the people who have the least.

In the past, sovereign debt crises like Greece’s have been dealt with by default and restructuring. Default is not always the disaster that the bond markets and their corporate propagandists at CNBC want us to believe. It was the only thing that truly rescued Argentina in 2002, during a comparable crisis.*

Argentina is not a paradise as a result, but it’s far better off than it was under the austerity plans it suffered through under the aegis of the IMF. Argentina’s default was followed by growth and relative relief for its people. It happened only because those people rioted against injustice and toppled a series of five presidents within a few months before one of the men on the presidential merry-go-round, Kirchner, finally had the guts to tell the IMF to fuck off and give Argentinean bondholders a haircut -- instead of starving his people to please the bond markets.

Argentina, like Greece, like the United States and most other countries, had actually paid off a sum comparable to the original principals borrowed. It’s the compound interest that makes these debts unsustainable -- all the more so at a time when governments take on greater debts to save the very banks to which they owe the debts! Once a country starts falling behind, compound interest practically guarantees that it will fall further and further back on a treadmill of payments.

This is insanity. The Greeks striking and fighting on the street are not demanding “ponies,” they are defending themselves and their children. They are refusing to labor only for the bond markets and to force an eternal debt on their children. They are your brothers and sisters on the front lines of a fight that is happening everywhere in the world -- a fight that will intensify in the United States as we go forward. You should hope that they do indeed force their government to back down, to reject the EU-IMF plan, to impose a haircut on the bondholders, and finally, if necessary, to restore sovereignty over their own currency -- and a monetarist even as famously hardline as Germany’s former head banker Pöhl knows it.

* TOTALLY SIDE NOTE: An aversion to countries making use of the national equivalent of bankruptcy procedures when no other option is left to them would seem strange coming from a country that recognizes the individual right to bankruptcy, and in which that right was used at one point in their careers by both of its most celebrated business men of the past century: Walt Disney and Henry Ford.