FHA Loans the Choice of Housing Comrades. How Government Backed Loans are creating Another Problem for the Housing Market.

Bless our real estate addicted society. You would think that a housing crash unlike anything seen since the Great Depression would teach us some lessons. It has been two years since the recession started and a decade long housing bubble. The first thing you would probably remove from the market is the toxic mortgage sector. Somehow in the mind of the politicos and Wall Street, the idea of allowing low down payment mortgages is still part of the turbo capitalist psyche. Recent data from FHA loans is abysmal. In fact, we are seeing subprime like trends. Recent data is suggesting that it is only a matter of time before the FHA goes to the American people for a bailout.

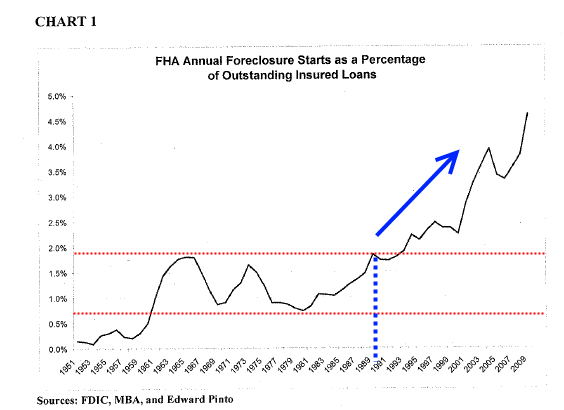

What is troubling is that instead of stopping the problem, lenders are ramping up their FHA backed loans since banks are hoarding money like packrats. On Thursday Edward Pinto, a financial services consultant and also a former chief credit officer of Fannie Mae (1987 1989) gave testimony to the U.S. House of Representative Housing and Community Opportunity Subcommittee. So Mr. Pinto must know something about credit risk. The first chart presented is absolutely astounding:

From 1951 to about 1990, FHA annual foreclosure starts stayed below 2 percent. The range was tight. However, from 1990 to our current bust the FHA annual foreclosure rate has doubled and shows no signs of stopping. You would think that with Alt-A loans and option ARMs we realized how bad it was to give people loans with little or no money down or having Warren Buffet as a co-signer when you work at Wal-Mart. Precaution unfortunately is not being taken. In fact, the government is basically stepping in to make up for the lack of toxic mortgage lenders instead of creating a more stable mortgage system.

http://www.doctorhousingbubble.com/fha-loans-the-choice-of-housing-comrades-how-government-backed-loans-are-creating-another-problem-for-the-housing-market/