Mini Option ARMs - Second Mortgage Homeowner Program: Bailing out the Home Equity Withdrawal Machine.

Last week U.S. Treasury Secretary Timothy Geithner and HUD Secretary Shaun Donovan sent a forceful letter to mortgage servicers that essentially stated that they were not pleased with the amount of loan modifications taking place. Now I find it hard to believe that our U.S. Treasury with its brotherhood with the Federal Reserve has a hard time advocating such a simple policy. They have the power to circumvent the mortgage industry and Wall Street given that they have bailed out these sectors of the economy. Did they conveniently forget that we nationalized (whoops, put into conservatorship) Fannie Mae and Freddie Mac which now is the U.S. mortgage industry?

Yet in this bread and circus show we get another example of who is really running the show. The U.S. Treasury and Federal Reserve are working for Wall Street and the banking industry, not the American public. One of the baffling items in the Making Homes Affordable initiative is the desire to help out with second lien mortgages. After reading the details of the program, I couldnt help but have the Jack in the Box commercial theme running in the background,

mini option ARMs! First lien, second lien, and what else? The solution apparently is to make these loan mods into Alt-A or option ARM products. By the way, those Alt-A loans are now imploding at a higher rate than subprime with bigger balances. Who would have figured giving out toxic nuclear waste mortgages would cause so much pain?

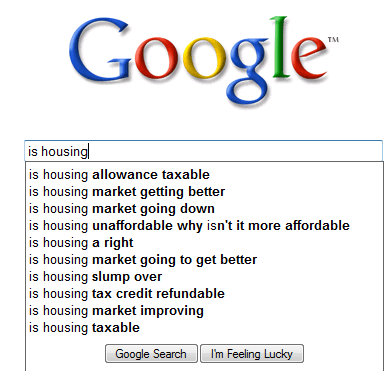

The irony must be clear to others because people take out second liens on their homes to make them more unaffordable. That is, they increase the overall debt they owe. In the real world people are still doubtful of the future of housing:

http://www.doctorhousingbubble.com/mini-option-arms-second-mortgage-homeowner-program-bailing-out-the-home-equity-withdrawal-machine/

http://www.doctorhousingbubble.com/mini-option-arms-second-mortgage-homeowner-program-bailing-out-the-home-equity-withdrawal-machine/