2016 Postmortem

Related: About this forumHow Romney Paid ZERO U.S. Federal Income Taxes. Could it really be this simple?

http://www.dailykos.com/story/2012/08/27/1124853/-How-Romney-Paid-ZERO-U-S-Federal-Income-Taxes-Could-it-really-be-this-simple....

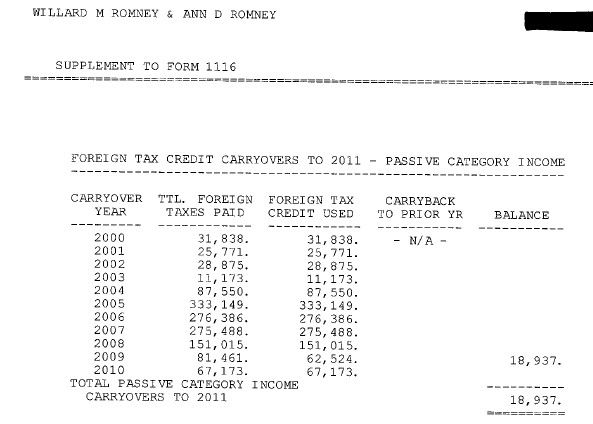

Look at the Passive Income Schedule. Every year he uses the entire amount as a credit because there is no limit on how much of the income taxes paid to foreign countries on passive income that you can use to off-set your U.S. Income Taxes. If this is the rule, and Romney is all about taking advantage of all the rules to save on taxes, why didn't he use all of the 2009 Foreign Income Taxes paid to off-set his U.S. Taxes owed? Why is there $18,937 carried forward?

Maybe I'm just over-simplifying this. I'm not a tax expert, but I sure would like a tax expert to explain to me why Romney carried forward $18,937 in 2009 because the only reason I can think of is that the $67,173 brought him to owing the U.S. Treasury ZERO dollars in 2009, and so he had to carry the remaining balance of $18,937 forward. ............

Angry Dragon

(36,693 posts)unblock

(52,185 posts)and then, under amnesty, he declared the swiss account but also some swiss taxes paid?

but then, why wouldn't he claim the full foreign tax credit when he amended his return?

one possibility might be that the terms of the amnesty forbade this, but that seems unlikely.

the other possibility would be if he were in a higher tax bracket when he did the amending and wanted the credit in that year instead of 2009. possible, but not very likely.

i'm not a tax guru, but form 1040 seems straightforward enough on this point. you take as much credit as you have taxes at that point on the form. if you didn't use all of it, you must have had zero taxes.

unless there's some limitation on foreign tax credits that i'm not aware of.

unblock

(52,185 posts)Maximum Allowable Foreign Tax Credit

Your foreign tax credit cannot exceed your US tax liability multiplied by a percentage. The percentage is your total foreign-source income divided by your total worldwide income. You must figure the allowable amount by various categories of income. Examples of income categories include investment income and wages.

http://taxes.about.com/od/taxhelp/a/ForeignTaxCred.htm

so if 2/3rds of his income was from overseas, then he can only zero out 2/3rd of his tax liability using foreign tax credits; any leftovers would be carried forward. but he'd still be left with 1/3rd of his original tax liability.