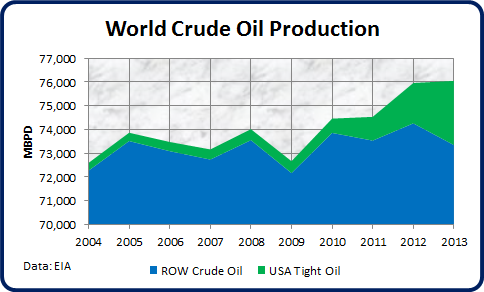

they are pumping a lot. Production shot up there at the end of the year, which is one major factor in the EOY oil price collapse. The market was clearly oversupplied between US gains and Iraq gains.

https://ycharts.com/indicators/iraq_crude_oil_production

http://www.bloomberg.com/news/2015-01-18/aussie-stocks-gain-with-japan-futures-after-oil-surge.html

Iraq is pumping at a record pace of 4 million barrels a day, Oil Minister Adel Abdul Mahdi said. Crude slumped almost 50 percent last year as the U.S. pumped oil at the fastest rate in more than three decades while OPEC resisted calls to cut supply.

Between the US and Iraq alone, we ended 2014 over 2 million more barrels a day than 2013, which overwhelmed demand.

This is from February of 2014:

http://www.reuters.com/article/2014/03/05/iraq-oil-idUSL6N0M22P120140305

Despite worsening violence due to spillover from the war in Syria, Iraq - already OPEC's second-largest producer - is likely to post one of the biggest annual output jumps in its history as BP, Exxon Mobil and other companies tap its southern fields, which are untouched by the unrest.

With many export bottlenecks now cleared at the southern Basra terminals - from which almost all of Iraq's crude is shipped - Baghdad is expected to keep up, or even exceed, the rapid pace of oil sales reached in February - at 2.8 million barrels per day (bpd), a 500,000 bpd rise on the previous month.

Russia also had been expanding production last year - the big drop is likely to curtail new investment and generate roughly flat production over the next couple of years:

http://www.bloomberg.com/news/2015-01-19/russia-confronts-stagnant-oil-production-after-crude-price-slump.html

Russia's output is currently around 10.5 million bbd.

Although the US trajectory was clear in early 2014, I think what took investors by surprise was the Iraqi surge this year. Up until then the theory that the big fluctuations in Libya left uncertainty in supply was at least plausible, but the EOY surge in Iraq just dumped that hypothesis.

If the oil price were to go back up again to $80 a barrel, I think you could see a high level of investment in Russia and of course the US supply would continue to grow.