Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 10 June 2015

[font size=3]STOCK MARKET WATCH, Wednesday, 10 June 2015[font color=black][/font]

SMW for 9 June 2015

AT THE CLOSING BELL ON 9 June 2015

[center][font color=red]

Dow Jones 17,764.04 -2.51 (-0.01%)

[font color=green]S&P 500 2,080.15 +0.87 (0.04%)

[font color=red]Nasdaq 5,013.87 -7.76 (-0.15%)

[font color=red]10 Year 2.44% +0.03 (1.24%)

30 Year 3.16% +0.03 (0.96%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)... “Derp” is a term borrowed from the cartoon “South Park” that has achieved wide currency among people I talk to, because it’s useful shorthand for an all-too-obvious feature of the modern intellectual landscape: people who keep saying the same thing no matter how much evidence accumulates that it’s completely wrong. The quintessential example is fear mongering over inflation. It was, perhaps, forgivable for economists, pundits, and politicians to warn about runaway inflation some years ago, when the Federal Reserve was just beginning its efforts to help a depressed economy. After all, everyone makes bad predictions now and then. But making the same wrong prediction year after year, never acknowledging past errors or considering the possibility that you have the wrong model of how the economy works — well, that’s derp. And there’s a lot of derp out there. Inflation derp, in particular, has become more or less a required position among Republicans. Even economists with solid reputations, whose professional work should have made them skeptical of inflation hysteria, have spent years echoing the paranoia of the goldbugs. And that tells you why derp abides: it’s basically political.

IT'S EVIDENTLY NOT RUNNING AWAY FAST ENOUGH TO QUALIFY FOR KRUGMAN...HE MUST NOT BE EATING MANY CHOCOLATE BARS, NOR TRYING TO BUY A HOUSE OR A CAR (OR A DECENT SUIT, OR ANYTHING BRAND NEW AND OF QUALITY).

I POSIT TO ALL THAT THE INFLATION IS REAL, THAT IT'S KILLING THE 90% OF AMERICA THAT WE BELONG TO, AND THAT WHEN RUSSIA AND CHINA HAVE KILLED THE PETRODOLLAR AND ALL OTHER NATIONS HAVE UNWOUND THEIR DERIVATIVES, THE DOLLAR WILL BE AS WORTHLESS AS THE WEIMAR DEUTCSHMARK WAS FROM 1921-1924....DEMETER

I’ve already mentioned one telltale sign of derp: predictions that just keep being repeated no matter how wrong they’ve been in the past...So derp isn’t destiny. But how can you – whether you’re a pundit, a policy maker, or just a concerned citizen – protect yourself against derpitude? The first line of defense, I’d argue, is to always be suspicious of people telling you what you want to hear.

Thus, if you’re a conservative opposed to a stronger safety net, you should be extra skeptical about claims that health reform is about to crash and burn, especially coming from people who made the same prediction last year and the year before (Obamacare derp runs almost as deep as inflation derp).

DITTO ON OBAMACARE....IT WILL CRASH AND PEOPLE WILL SUFFER AND DIE BECAUSE OF IT. IT TAKES TIME TO TURN AN OCEAN LINER INTO AN ICEBERG...BUT THEY WILL SUCCEED!

But if you’re a liberal who believes that we should reduce inequality, you should similarly be cautious about studies purporting to show that inequality is responsible for many of our economic ills, from slow growth to financial instability. Those studies might be correct — the fact is that there’s less derp on America’s left than there is on the right — but you nonetheless need to fight the temptation to let political convenience dictate your beliefs.

THERE IS NOTHING POLITICALLY CONVENIENT ABOUT INEQUALITY. IT'S DAMN INCONVENIENT.

GET THAT FORKED TONGUE OUT OF YOUR MOUTH, OR BITE IT, PAUL, BEFORE IT BITES YOU!

Demeter

(85,373 posts)Instead of investing in dirty fuels, let’s start charging polluters for poisoning our skies – and then invest the revenue so that it benefits everyone.

Each ton of carbon that’s released into the atmosphere costs our nation between $40 and $100, and we release millions tons of it every year.

Businesses don’t pay that cost. They pass it along to the rest of us—in the form of more extreme weather and all the costs to our economy and health resulting from it.

We’ve actually invested more than $6 trillion in fossil fuels since 2007. The money has been laundered through our savings and tax dollars.

This has got to be reversed.

We can clean our environment and strengthen the economy if we (1) divest from carbon polluters, (2) make the polluters pay a price to pollute, and (3) then collect the money.

Please see the accompanying video, and share.

Punx

(446 posts)Is on the horizon if TPP/TPA passes. We will be paying them not to pollute even more. And how long can that last? ![]()

It will last as long as there are pushovers in office....which will probably not be very long if TPP passes.

Welcome to SMW! Glad to have you aboard!

Last edited Wed Jun 10, 2015, 09:46 AM - Edit history (1)

Already harassing Wyden and my Representative for their positions on the TTP which is one of my big issues.

I've seen enough high-tech jobs go to China from here in Oregon to know the TTP will end badly for us here. Perhaps it's good we can ship more potatoes but the jobs related to that are not really the equivalent of manufacturing jobs like the one my wife had in a supporting engineering role for high tech equipment. Seems like everything they talk about us exporting is food or natural resources, the same as a third world country. Well we sure are trying to become a "Banana Republic".

imho: Stupid from a business standpoint too, but Carly Fiorina types only look at the bottom line. My wife's company lost 100k on one small manufacturing run of circuit boards from something that my wife would have figured out in 6-8 hours of work. Right there earning her pay for the year. Penny wise and pound foolish.

I have had a fair amount of econ studies though that was a long time ago. Have worked in retail, manufacturing and banking in the past. I'll try to post articles when I come across them.

Demeter

(85,373 posts)The second time for the same Kid...twenty years later, there have been advances in orthodontics that may make a permanent fix for the Kid. Here's hoping! Fool-proof, even for the disabled....that's what is needed.

The delight was that the lady we talked to was from our old stomping ground in NH, and she'd had her orthodontia done by the same doctor as the Kid! She moved to Ann Arbor and is very happy here. (She has beautiful teeth, by the way).

Now I'm trying to figure out the benefits...and which applies to what. Time for more aspirin.

Demeter

(85,373 posts)DON'T HURT YOURSELF ![]()

![]()

http://the-japan-news.com/news/article/0002204753

Leaders of the Group of Seven nations are set to agree on the creation of a system to counter tax evasion and tax avoidance by multinational enterprises, during the G-7 summit meeting to be held in Germany on Sunday and Monday, The Yomiuri Shimbun has learned. G-7 leaders are expected to adopt a joint statement that urges nations to submit to arbitration in regard to conflicts between them over tax issues involving multinational companies, sources said. The arbitrator will be a third, uninterested country.

The mainstream approach to tax evasion by enterprises has usually been to create a subsidiary in a low-tax rate country and to shift profits there. Though companies assert that this is a legal tax-saving measure, G-7 nations see the practice as creating unfair taxation. Thus, the G-7 nations have discussed measures to take.

The joint statement from the summit meeting is expected to incorporate wording to seek strengthened efforts for an arbitration process against tax evasion, they said. Nations involved in tax disputes maintain tax sovereignty as a principle, so they search for a solution through mutual agreements such as bilateral tax treaties. In many cases, however, it takes some time to find a solution as both countries insist on each country’s right to taxation, resulting in a situation that allows tax evasion.

The U.S. Congress said in a 2013 report that Apple Inc. shifted profits to subsidiaries in Ireland, where the corporate tax rate is low, making the country essentially function as a tax haven. Google Inc. and Amazon.com Inc. have also been criticized for similar practices.

The G-7 aims to jointly set as a core rule an arbitration system involving a third country in the hopes of obtaining understanding from emerging nations. However, such emerging nations as India and China are said to have negative views on the idea as they consider an arbitration system with a third party as interfering in sovereignty. The Organization for Economic Cooperation and Development is to draw up rules for the system based on the G-7’s joint statement. The rules are to be set out at a Group of 20 summit to be held in November.

Demeter

(85,373 posts)The two co-chief executives of scandal-hit European banking giant, Deutsche Bank, have resigned. Juergen Fitschen and Anshu Jain offered their resignations to an emergency meeting of the bank's supervisory board on Sunday, and their resignations were accepted. The bank said John Cryan would become co-chief executive, replacing Mr Jain from 30 June.

Mr Fitschen will remain in post until the annual general meeting in May 2016. After that, Mr Cryan, who has been a member of the bank's supervisory board since 2013, will become the sole chief executive, the bank said. The planned resignations, first reported in the Wall Street Journal, come after a series of scandals affecting the bank, including a $2.5bn (£1.7bn) regulatory fine in connection with the bank's part in the Libor rate rigging affair.

Libor, the London inter-bank lending rate, is a key interest rate in finance, affecting financial contracts worth trillions of dollars. Deutsche is one of several major banks fined after traders were found to have manipulated the rate. Deutsche Bank is also paying $55m (£35.7m) to settle civil charges for allegedly mis-stating financial reports. The US Securities and Exchange Commission (SEC) investigated the bank for the way it accounted for certain assets in reports filed during the financial crisis. The SEC said it over-valued some of these and did not have sufficient collateral to cover potential losses. Deutsche is settling without admitting or denying the charges.

'No confidence'

Deutsche Bank was the target of shareholder anger at its recent annual general meeting (AGM) in May, as concerns have grown over its disappointing profit growth, the fines, and its restructuring plans. Hermes Equity Ownership Services, which holds a stake of almost 5% in Deutsche Bank, called for management changes, with director Dr Hans-Christoph Hirt saying: "We no longer have confidence in the management board."

At the AGM Mr Fitschen admitted: "We have not delivered, so far, the returns you expect and deserve." In April, the bank reported that net income for the first three months of 2015 had halved to €559m (£407m), compared with the same period a year earlier. This is despite the fact that revenue rose by almost a quarter to €10.4bn.

Demeter

(85,373 posts)Deutsche Bank AG shares surged the most in more than two years as investors welcomed a management overhaul at Germany’s biggest bank.

John Cryan, a supervisory board member since 2013, was named the next chief executive officer in a surprise announcement Sunday. He’ll replace co-CEO Anshu Jain at the end of the month and become sole CEO when Juergen Fitschen steps down next May. The shakeup is the latest to sweep aside top management at one of Europe’s largest banks as firms grapple with stricter regulatory scrutiny and higher capital demands. Cryan will inherit a lender plagued by billions of euros in legal costs and questions about its revised strategy. Jain, 52, and Fitschen, 66, missed profit targets and presided over a lagging share performance.

“With John Cryan as CEO, we think that Deutsche is transitioning from one of the least credible management teams in investors’ minds to one of the most highly regarded,” Omar Fall, an analyst at Jefferies LLC in London, wrote in a note to clients. “We do not foresee a dramatic change in strategy or capital raising, but market confidence on delivery should clearly increase.”

The shares jumped as much as 8.2 percent, the biggest intraday advance since April 2013, and traded up 6 percent at 29.27 euros by 11:04 a.m. in Frankfurt. Deutsche Bank’s stock had posted the worst performance among global peers during the co-CEOs’ tenure. The company is valued at about 40.3 billion euros ($44.9 billion), or about 65 percent of its tangible book, indicating it’s worth less than investors should expect to receive if the company liquidated its assets.

Cryan won investors’ respect by helping lead UBS Group AG back from the brink of collapse as chief financial officer during the credit crisis of the last decade. He became CFO in 2008, when the largest Swiss bank was reeling from record losses tied to the U.S. housing market.

“UBS was in a big crisis and Cryan managed it well,” said Dirk Becker, a Frankfurt-based analyst at Kepler Cheuvreux. “His communication was also very good,” winning points with investors, he said.

Cryan left UBS in 2011 and joined Temasek Holdings Pte, the Singapore state-owned investment company, as president for Europe, where he worked for two years. He joined Deutsche Bank’s supervisory board in 2013 and has served on the audit and risk committees.

Demeter

(85,373 posts)Suddenly, junk bonds have lost their luster. After providing a haven from the global bond-market selloff, speculative-grade securities have now joined the rout, tumbling almost 1 percent since the end of May. Investors are starting to flee, yanking $1.5 billion from the two biggest high-yield bond exchange-traded funds over the past week, according to data compiled by Bloomberg. This is a reversal in fate for bonds that had gained 4.8 percent in the first five months of 2015 and suggests that junk-bond investors will only tolerate rising benchmark yields for so long before they, too, bail.

“Price action was miserable across risk assets yesterday,” Peter Tchir, head of macro credit strategy at Brean Capital LLC, wrote in a note Tuesday. “It was the first time since yields shot higher that credit markets felt weak.”

Indeed, high-yield bonds were remarkably stable in May as German government bonds led the world’s bond market down 0.5 percent, according to Bank of America Merrill Lynch index data. That same month, global junk notes gained 0.4 percent. And in April, as global bonds fell 0.6 percent, speculative-grade securities handed buyers 1.6 percent.

Part of the risky debt’s erstwhile resilience had to do with oil prices as the rebound in that market bolstered energy-company bonds that had been hammered at the end of 2014. Also, speculative-grade notes tend to have shorter maturities and fatter cushions of extra yield over benchmarks than higher-rated bonds, features that can protect the market in periods of rising rates and climbing inflation.

High-yield debt markets have “shown a degree of resiliency here to the shift in the inflation outlook,” Jeffrey Rosenberg, a managing director at BlackRock Inc.’s, said in a Bloomberg radio interview Tuesday. “That resilience could be challenged if we follow up this bout of higher rates with a shift in” expectations for when the Federal Reserve will lift rates.

Case in point: BlackRock’s $14.3 billion high-yield bond ETF plunged 1.6 percent in the six days through Monday as $940.5 million exited the fund, Bloomberg data show. State Street Corp.’s $10.7 billion junk-debt ETF dropped 1.7 percent, with $571.7 million of withdrawals...

MORE

Demeter

(85,373 posts)Some days, there are too many ideas: Emerging market currency convexity on a log chart, the "bond bear market," Italian GDP, or the latest fight about gold.

Then something comes along that pushes it all aside.

Michael Feroli, of JPMorgan economics has been way, way out in front of the story of a new structural slowdown for the U.S. Economy. He was even pre-New Mediocre, as Madame Lagarde and the IMF carried the JPMorgan caution over to the global economy.

On Surveillance today, he reitered his call for a sub-2% run-rate for America.

And then he dropped a bombshell.

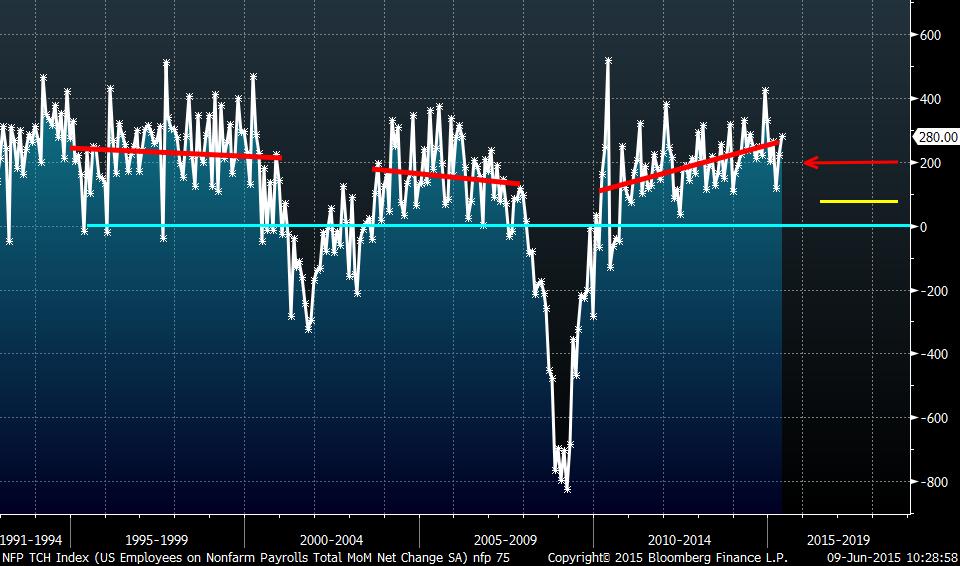

Feroli suggests that without technological progress, America's demographics and subdued productivity will drive "normal" GDP growth even lower. And the pace of job creation in the coming years will fall to around 75,000.

INTERVIEW WITH FEROLI AT LINK

Demeter

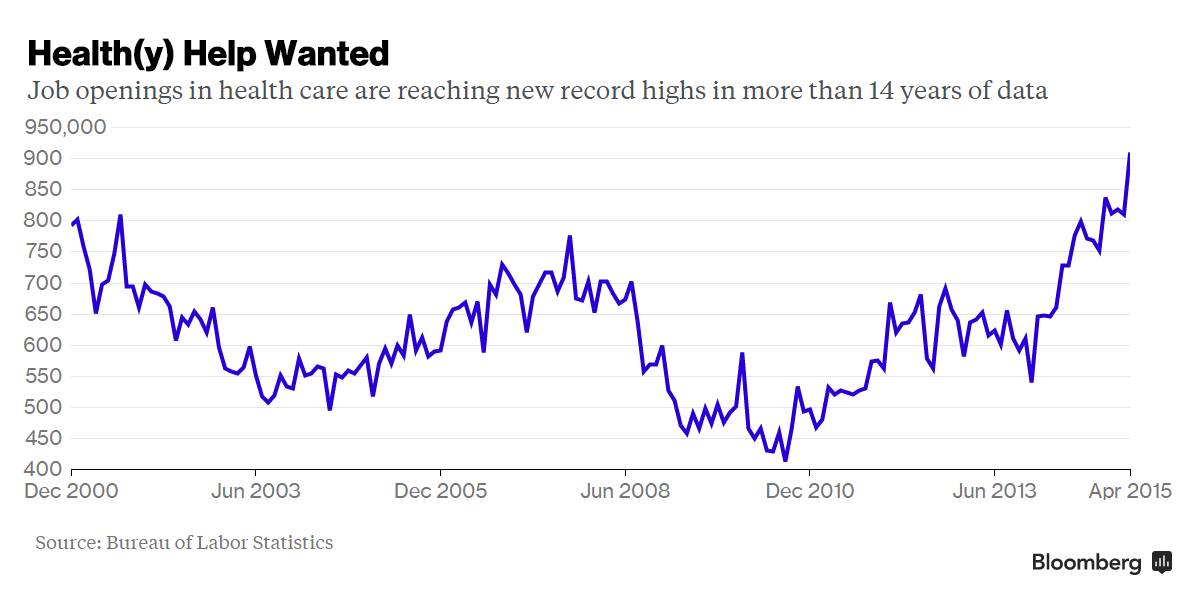

(85,373 posts)Somebody call a doctor.

Job openings in the healthcare industry soared in April to a new record high in more than 14 years of data, while hiring barely budged. It's great news for industry professionals who are seeking work or a pay raise. Here's how much those help-wanted ads have been on a tear:

PUFFERY FOR H1-B WORKER IMMIGRATION...

Demeter

(85,373 posts)The Justice Department is looking into possible fraudulent manipulation of the $12.5 trillion Treasurys market, The Post has learned.

Government lawyers are said to be in the early stages of a probe and have reached out in recent months to at least three of the 22 financial institutions that act as primary government debt dealers to request information, said a person close to one of the banks who was briefed on the matter.

The focus of the probe is on Treasury auctions, a secretive process when interest rates are set for the offerings, the person said.

No single bank has become the focus of the probe, it is believed, and no bank has been accused of any wrongdoing at this time. There is no guarantee that the requests for information will turn up wrongdoing...

Demeter

(85,373 posts)The U.S. Securities and Exchange Commission was ruled to have probably overstepped its constitutional authority by tapping an in-house administrative judge to preside over an insider-trading case.

U.S. District Judge Leigh Martin May’s decision Monday that the SEC may not have the authority to divert such cases from regular courts halted its action against a Georgia real-estate developer. Charles Hill was accused of profiting from trades made after he received a tip from a friend. He sued in Atlanta federal court to block the administrative action.

May said the SEC’s appointment of an in-house judge, James Grimes, in Hill’s case was “likely unconstitutional.” The Constitution requires that judges be appointed by the president, a department head or the judiciary, May said.

The SEC’s use of administrative proceedings for enforcement actions has drawn increasing scrutiny from securities lawyers in recent months. Critics of the process say it is unfair because the administrative law judges are hired by the SEC, and defendants don’t have the same opportunity to uncover evidence in their favor as they would in federal court....

Demeter

(85,373 posts)HSBC Holdings Plc, Europe’s largest bank, plans to eliminate as many as 25,000 jobs and sell operations in Turkey and Brazil to help restore profit growth.

Under a three-year plan, HSBC will reduce the number of full-time employees by 22,000 to 25,000, or about 10 percent, it said in a presentation to investors on its website on Tuesday. The sale of businesses will lower headcount by a further 25,000, helping cut annual costs by $4.5 billion to $5 billion by the end of 2017. The bank left its profitability target unchanged.

Chief Executive Officer Stuart Gulliver, 56, is looking to restore investor confidence in a bank battered by scandals and surging compliance costs. Since taking over in 2011, he’s announced more than 87,000 job cuts, exited about 78 businesses and reduced the number of countries the bank operates in.

“HSBC is a big bank to move and they’re definitely moving in the right direction,” said Chris White, who helps oversee about 3.9 billion pounds ($6 billion), including HSBC shares, at Premier Fund Managers Ltd. in Guildford, England. “A lot of it feels like it was broadly as expected.”

MORE

Demeter

(85,373 posts)Some observers thought that Greece might get a break in the G-7 summit this weekend. The assumption that the US would be worried that a default and possible Grexit would lead to much greater Russian influence on a strategically-located country, and the US would thus push the Troika to make more concessions to Greece...That dream has failed to materialize. While the G-7 has one more day to run, the statements coming out of it already signal that the assembled nations (U.S., Canada, Germany, France, Japan, Italy and the U.K) are backing the creditor position. This should come as no surprise. The Obama administration changed its position in February from pushing the lenders to come up with more pro-growth policies (meaning give relief to Greece) to stressing that Greece needed to “find a constructive path forward in partnership with Europe and the IMF to build on the foundation that exists.” That was code for “The structural reforms are in place and you need to work from them.” The Obama administration has again come down on the side of pressing Greece to implement structural reforms, and depicts this as a view shared by all G-7 participants. From Bloomberg:

“There was unanimity of opinion in the room that it was important for Greece and their partners to chart a way forward that builds on crucial structural reforms” and returns to growth, White House spokesman Josh Earnest told reporters.

The Tsipras speech to the Greek parliament last Friday has also thrown off what little momentum the negotiations had developed. From the Financial Times:

“I don’t have a personal problem with Alexis Tsipras; quite to the contrary,” Mr Juncker said…“He was my friend, he is my friend. But frankly, in order to maintain it, he has to observe some minimal rules.”…

Mr Juncker also said he had been promised a new counterproposal from Mr Tsipras since the pair met in Brussels on Wednesday and did not want to renew talks until he had received the plan.

Eurozone officials have suggested talks involving Mr Juncker and Mr Tsipras, which could also include Angela Merkel, German chancellor, and François Hollande, French president, may resume on Wednesday, when all four are due in Brussels for a summit with Latin American leaders.

But Mr Juncker said he was cautious about such a timetable if Athens did not present a new way forward.

“I would be surprised if I didn’t have any further discussions with Mr Tsipras, but I would like to have the Greek proposal,” Mr Juncker said. “I would like to have time to study it in detail.”

Mr Juncker’s refusal to renew talks with Athens returns the bailout negotiations to a position of stalemate that he and the leaders of Greece’s two other bailout monitors — the International Monetary Fund and the European Central Bank — thought they had broken through just a week ago.

The New York Times added a few tidbits:

Mr. Juncker said he wanted Greece to remain in the euro currency zone but could not “pull a rabbit out of the hat.”…

Mr. Juncker said testily that he was still waiting for Greek proposals to counter an offer rejected by Mr. Tsipras last week…

After Mr. Juncker’s tart remarks and a reminder from Martin Schulz, the German who heads the European Parliament, that an agreement was needed, Greek officials reiterated that there was still no acceptable solution on the table.

Similarly, Merkel effectively contradicted Tsipras’ claim in a speech to the Greek Parliament last Friday that a deal was near. From Bloomberg:

And there was a clear message that Greece needs to relent on its refusal to “reform” pensions. Again from Bloomberg:

“In other words, the Tsipras government also needs to pass the reforms: reform of the pension system, reforms to stop tax evasion, reform of the tax system,” Renzi told reporters at Schloss Elmau. “There is full agreement at the G-7 that everything must be done in order to avoid Greece exiting the euro, but also that Greek citizens, actually the Greek government, must be the first to send a signal.”

The Financial Times reports that a French official said the lenders are willing to throw Greece some bones on the pension front, by allowing Greece to maintain pensions for poorer retirees. However, the government would need to come up with €800 million more in spending reductions to make up for the budget shortfall that would result.* Note also that neither Renzi nor Merkel sound anywhere near as eager as Obama’s spokesman did about the need to get a deal done. As we’ve said for months, there is no solution space on the issue of pensions. This has become an enormously visible issue in the Eurozone lender countries, and their leaders would have to spend an a considerable amount of political capital to support the Greek position, even if they were willing to do that. And in the countries where parliamentary approval is required to release bailout funds, it’s not clear the ruling coalitions could muster the votes, particularly given the late date. There’s not enough time to do the weeks of messaging needed to soften opinion.

Having said that, I’d like to know how anyone pushes Greece absent giving bribes (aka relenting) given that Tsipras has deeply committed himself to his position between his Le Monde op ed and his speech last Friday, plus by being boxed in by the Left Platform. If Tsipras tries snap elections, the Left Platform MPs have threatened to bolt and form a new party. Tsipras would need them to form a new coalition. The new party would have more freedom of action and visibility outside Syriza. Moreover, Tsipras can create an easy excuse for a default by calling elections, either snap elections or more likely a referendum. He could argue, as he has weakly threatened before, that at such an important juncture he can proceed only in accordance with voter wishes. Given the normal minimum times for elections, everything would still be in play by June 30, the IMF default date. In other words, huffing at Greece isn’t going to work any more than Greece huffing at the creditors has, unless the problem is that Greece still believed, despite plenty of evidence to the contrary, that the US and/or the UK would pressure the creditors to relent (Cameron has made very unhappy noises about Grexit risks).

Now Greece may believe that, push come to shove, the creditors will extend the bailout beyond its expiration date of June 30. That means all Eurozone lender nations need to consent, and in some nations, including Germany, parliamentary approval is required. That means arm-twisting would need to start as soon as possible, since voters aren’t keen about giving Greece any breaks. And to make this even more difficult to achieve, the German Bundestag has a recess the week of June 22. Moreover, no deal by June 30, even with an extension of the bailout, means an IMF default, although an IMF default is not a bright white line like a private sector default (again, this is all murky due to the lack of precedents, but it appears that Lagarde does not report the default to the IMF board for 30 days, and certain consequences kick in only then). If Greece is still negotiating, the creditors might be able to fudge loss recognition. But the banking system run will accelerate (bank withdrawals were €700 million on Friday, a level guaranteed to alarm the ECB). Given how long the impasse has gone on, the hardening positions of both sides, Tsipras perversely poisoning relationships with the few allies he as on the creditors side, and the ECB’s position becoming even more uncomfortable, it’s not clear than anything would be gained even if all 18 nations that would need to approve a bailout extension could be persuaded to go along.

So the message is clear: Greece needs to show some real movement in its position in order for the bailout funds to be released. It’s hard to see how that happens.

____

* Note that the New York Times has a broader statement, and from Juncker, which would seem to give it more clout: “In fact, Mr. Juncker said, he had stressed that a cut in pensions could be negotiable if Greece offered alternative savings.” However, given the firm statement from Renzi that Italian voters could not be expected to support Greece having more generous pensions than they do, it seems pretty clear that Greece is still expected to make substantial reductions in pensions.

Demeter

(85,373 posts)While the cost of college education in the US has reached record highs, Germany has abandoned tuition fees altogether for German and international students alike. An increasing number of Americans are taking advantage and saving tens of thousands of dollars to get their degrees...More than 4,600 US students are fully enrolled at Germany universities, an increase of 20% over three years...Each semester, Hunter pays a fee of €111 ($120) to the Technical University of Munich (TUM), one of the most highly regarded universities in Europe, to get his degree in physics. Included in that fee is a public transportation ticket that enables Hunter to travel freely around Munich. Health insurance for students in Germany is €80 ($87) a month, much less than what Amy would have had to pay in the US to add him to her plan...

To cover rent, mandatory health insurance and other expenses, Hunter's mother sends him between $6,000-7,000 each year...

MUCH MORE INFO AT LINK

Demeter

(85,373 posts)Iceland is considering ways to end capital controls after a vote in parliament to tighten financial regulations. The government has outlined proposals to unfreeze assets worth 1,200bn krona ($9bn), subject to a 39% tax.

Capital controls, such as those to restrict money flowing in and out of the country, were imposed in 2008 after the country's biggest banks collapsed. The government thinks the economy has recovered sufficiently to end controls.

"These proposals contemplate addressing these risks through a combination of the payment of a voluntary stability contribution together with other measures designed to attenuate the release of crowns that have been trapped behind the capital controls and augment the foreign currency reserves of the Central Bank of Iceland," it said in a statement.

The government imposed the controls in 2008 after the collapse of the country's three biggest banks - Glitnir, Landsbanki and Kaupthing - saw Iceland's national currency, the krona, plunge in value.

Foreign currency for holidays abroad is still tightly controlled.

OF COURSE, BECAUSE THAT'S SO MUCH MONEY! UNLESS ONE WENT ON A LIFE-LONG VACATION, THIS SEEMS PETTY

Demeter

(85,373 posts)

DemReadingDU

(16,000 posts)Our criminal justice needs to be reformed.

500% increase in profits!

Punx

(446 posts)Take off with the election of Raygun. The war on drugs as mentioned, and the beginning of the criminalization of being poor. And a media inspired backlash at so called "liberal" weak on crime crap which resulted in harsher penalties. Remember the "Dirty Harry" movies. Central theme of bumbling bureaucrats letting criminals off the hook.

Add in "For Profit" prisons as well. An abomination if there ever was one.

Demeter

(85,373 posts)Cash-strapped consumers are being shown a new place to find money: their driveways.

Short-term lenders, seeking a detour around newly toughened restrictions on payday and other small loans, are pushing Americans to borrow more money than they often need by using their debt-free autos as collateral.

So-called auto title loans — the motor vehicle version of a home equity loan — are growing rapidly in California and 24 other states where lax regulations have allowed them to flourish in recent years.

Their hefty principal and high interest rates are creating another avenue that traps unwary consumers in a cycle of debt. For about 1 out of 9 borrowers, the loan ends with their vehicles being repossessed.

http://www.trbimg.com/img-55738a77/turbine/la-fi-g-auto-title-loans/650/650x366

THERE ARE ALWAYS SHEEP TO BE SHORN, I GUESS

Demeter

(85,373 posts)Wednesday is my worst day, too. Stay cool, folks.