Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 5 June 2015

[font size=3]STOCK MARKET WATCH, Friday, 5 June 2015[font color=black][/font]

SMW for 4 June 2015

AT THE CLOSING BELL ON 4 June 2015

[center][font color=red]

Dow Jones 17,905.58 -170.69 (-0.94%)

S&P 500 2,095.84 -18.23 (-0.86%)

Nasdaq 5,059.12 -40.11 (-0.79%)

[font color=green]10 Year 2.31% -0.04 (-1.70%)

30 Year 3.04% -0.03 (-0.98%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)Last edited Thu Jun 4, 2015, 09:43 PM - Edit history (1)

We are back to summer, and I am wiped by the heat, sun and humidity. I get a lot of "fresh air" in my work Tues, weds, thurs. I'm feeling dazed and a bit sunburned.

Posts in the morning...can't stay awake!

Demeter

(85,373 posts)At a time of historic economic inequality, it should be a no-brainer to raise a tax on inherited wealth for the very rich. Yet there’s a move among some members of Congress to abolish it altogether. If you’re as horrified at the prospect of abolishing the estate tax as I am, I hope you’ll watch and share the accompanying video.

Today the estate tax reaches only the richest two-tenths of one percent, and applies only to dollars in excess of $10.86 million for married couples or $5.43 million for individuals. That means if a couple leaves to their heirs $10,860,001, they now pay the estate tax on $1. The current estate tax rate is 40%, so that would be 40 cents. Yet according to these members of Congress, that’s still too much.

Abolishing the estate tax would give each of the wealthiest two-tenths of 1 percent of American households an average tax cut of $3 million, and the 318 largest estates would get an average tax cut of $20 million. It would also reduce tax revenues by $269 billion over ten years. The result would be either larger federal deficits or higher taxes on the rest of us to fill the gap.

This is nuts. The richest 1 percent of Americans now have 42 percent of the nation’s entire wealth, while the bottom 90 percent has just 23 percent. That’s the greatest concentration of wealth at the top than at any time since the Gilded Age of the 1890s. Instead of eliminating the tax on inherited wealth, we should increase it – back to the level it was in the late 1990s. The economy did wonderfully well in the late 1990s, by the way.

Adjusted for inflation, the estate tax restored to its level in 1998 would begin to touch estates valued at $1,748,000 per couple. That would yield approximately $448 billion over the next ten years – way more than enough to finance ten years of universal preschool and two free years of community college for all eligible students.

Our democracy’s Founding Fathers did not want a privileged aristocracy. Yet that’s the direction we’re going in. The tax on inherited wealth is one of the major bulwarks against it. That tax should be increased and strengthened. It’s time to rein in America’s surging inequality. It’s time to raise the estate tax.

Demeter

(85,373 posts)A story from the past shows why neocons are dangerous for the global peace and security ...

Recent documents show that the hardcore branch of the US policy during the Vietnam war, was playing dangerous games with North Vietnam and the Soviets, in order to drag the other side to negotiations.

We see today a similar game played by the neocons in Ukraine and Asia-Pacific. In the new Cold War, neocons are playing more dangerous games with Russia and China, as they try to persuade that they will not hesitate to proceed in a nuclear strike against both their rivals, because they see that the Sino-Russian bloc threatens the US global sovereignty.

From National Security Archive:

“With Madman diplomacy, Nixon and Kissinger strove to end the Vietnam War on the most favorable terms possible in the shortest period of time practicable, an effort that culminated in a secret global nuclear alert in October of that year. Nixon's Nuclear Specter provides the most comprehensive account to date of the origins, inception, policy context, and execution of 'JCS Readiness Test' —the equivalent of a worldwide nuclear alert that was intended to signal Washington's anger at Moscow's support of North Vietnam and to jar the Soviet leadership into using their leverage to induce Hanoi to make diplomatic concessions. Carried out between 13 and 30 October 1969, it involved military operations around the world, the continental United States, Western Europe, the Middle East, the Atlantic, Pacific, and the Sea of Japan. The operations included strategic bombers, tactical air, and a variety of naval operations, from movements of aircraft carriers and ballistic missile submarines to the shadowing of Soviet merchant ships heading toward Haiphong.”

“The authors also recount secret military operations that were part of the lead-up to the global alert, including a top secret mining readiness test that took place during the spring and summer of 1969. This mining readiness test was a ruse intended to signal Hanoi that the US was preparing to mine Haiphong harbor and the coast of North Vietnam. It is revealed for the first time in this book.”

“Another revelation has to do with the fabled DUCK HOOK operation, a plan for which was initially drafted in July 1969 as a mining-only operation. It soon evolved into a mining-and-bombing, shock-and-awe plan scheduled to be launched in early November, but which Nixon aborted in October, substituting the global nuclear alert in its place. The failure of Nixon's and Kissinger's 1969 Madman diplomacy marked a turning point in their initial exit strategy of winning a favorable armistice agreement by the end of the year 1969. Subsequently, they would follow a so-called long-route strategy of withdrawing U.S. troops while attempting to strengthen South Vietnam's armed forces, although not necessarily counting on Saigon's long-term survival.”

“In 1969, the Nixon's administrations long-term goal was to provide President Nguyen Van Thieus government in Saigon with a decent chance of surviving for a reasonable interval of two to five years following the sought-after mutual exit of US and North Vietnamese forces from South Vietnam. They would have preferred that President Thieu and South Vietnam survive indefinitely, and they would do what they could to maintain South Vietnam as a separate political entity. But they were realistic enough to appreciate that such a goal was unlikely and beyond their power to achieve by a military victory on the ground or from the air in Vietnam.”

“Giving Thieu a decent chance to survive, even for just a decent interval, however, rested primarily on persuading Hanoi to withdraw its troops from the South or, if that failed, prolonging the war in order to give time for Vietnamization to take hold in order to enable Thieu to fight the war on his own for a reasonable period of time after the US exited Indochina. In 1969, Nixon and Kissinger hoped that their Madman threat strategy, coupled with linkage diplomacy, could persuade Hanoi to agree to mutual withdrawal at the negotiating table or lever Moscows cooperation in persuading Hanoi to do so. In this respect, Nixon's Nuclear Specter is an attempt to contribute to better understanding of Nixon and Kissinger's Vietnam diplomacy as a whole.”

Full report:

http://nsarchive.gwu.edu/nukevault/ebb517-Nixon-Kissinger-and-the-Madman-Strategy-during-Vietnam-War/

These materials are reproduced from www.nsarchive.org with the permission of the National Security Archive.

DemReadingDU

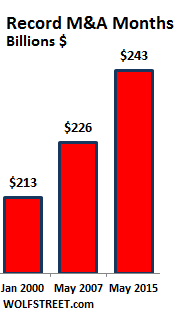

(16,000 posts)Billions in increased prices for the consumers

![]()

DemReadingDU

(16,000 posts)6/5/15 Greece misses IMF payment in warning shot as showdown with Europe escalates

No developed country has ever skipped a payment to the IMF - but Greek sources say they were provoked

By Ambrose Evans-Pritchard

Greece is to take the drastic step of skipping a €300m payment to the International Monetary Fund on Friday, invoking an obscure mechanism in abeyance since the 1970s to bundle all debts due in June and pay them at the end of the month.

It is the first time that a developed country has ever missed a payment to the IMF since the creation of the Bretton Woods institutions at the end of the Second World War.

The news broke after the Athens stock exchange had closed but a bloodbath is feared when the bourse opens on Friday. Yields on two-year Greek bonds spiked 63 basis points to 21.8pc amid mounting fears of a deposit run on Greek banks and the imposition of capital controls as soon as this weekend.

The Greeks accuse the IMF of violating its own rules by colluding in an EMU-led policy that leaves the country with unsustainable debts. Athens is implicity threatening to escalate the situation all the way to a full default to the IMF, setting off a grave institutional and political crisis within the Fund itself.

Syriza leaders say they are unwilling to burn any more of the country’s dwindling cash reserves to pay creditors until there is a credible offer on the table, insisting that their priority is to pay pensions and salaries and avoid default to their own people.

Greece is still a long way from formal default. If the country misses the payment on June 30 – a certainty unless one side or the other blinks – this will then set the clock ticking on a six-week process.

more...

http://www.telegraph.co.uk/finance/economics/11652893/Greece-misses-IMF-payment-in-warning-shot-as-showdown-with-Europe-escalates.html

Demeter

(85,373 posts)By Joe Firestone, Ph.D., Managing Director, CEO of the Knowledge Management Consortium International (KMCI), and Director of KMCI’s CKIM Certificate program. He taught political science as the graduate and undergraduate level and blogs regularly at Corrente, Firedoglake and New Economic Perspectives. Originally published at New Economic Perspectives

So, on May 22, the Trade Promotion Authority (TPA) (“Fast Track”) Bill passed the Senate 62 – 37, with 14 Democrats defecting to the pro-Fast TracK/Trade-Pacific Partnership (TPP) forces.

However, all was not wine and roses for the Administration and Fast Track/TPP proponents in the Senate. First, the pro-TPP forces sustained a temporary defeat on May 12, when the Senate would not approve debating Fast Track, introducing delay into the process. The problem was quickly fixed with agreements to consider and vote on related issues such as Trade Adjustment Assistance, forced child labor, and currency manipulation outside of Fast Track. But nevertheless the glitch was unanticipated, and looked bad for an Administration wanting clear sailing in the Senate for Fast Track. Second, an amendment to Fast Track unexpectedly snuck through the Senate providing for banning or throwing out nations practicing human trafficking. This amendment is regarded as a “poison pill” that will prevent Malaysia from being included in the TPP, with unknown impact on other possible signators.

At a minimum, the Administration, if it is successful in getting Fast Track through the House, will want this amendment eliminated from the bill, making it necessary to either send Fast Track back to the Senate for further amendment bringing it into agreement with the House, or, alternatively, to go to a Conference committee of the two Houses of Congress, where the “poison pill” would be dissolved. Even if one of these alternatives is successful, the result will be harmful to the Administration in two ways. First, will weaken the confidence of the TPP negotiating partners that the President can deliver approval of the final TPP agreement by the Congress. And, second, it will delay getting to a final up or down vote in the Congress which the Administration is anxious to get before the end of this calendar year.

Meanwhile, the action now moves to the House, where the Administration’s chances of passing Fast Track have always been more uncertain than they were in the Senate, and where John Boehner seems reluctant to schedule a vote without significant Democratic support, and also without increasing the likelihood that 40 – 45 tea party Republicans will drop their opposition to the bill in the face of vocal opposition from Rush Limbaugh, Laura Ingraham, Matt Drudge, and tea party media phalanx more generally. There is widespread feeling that if Fast Track and TPP aren’t concluded by the end of the year, then it will be impossible to get Congress to vote on the TPP in an election year, though I wouldn’t discount the possibility that a lame duck Congress might give the lame duck President his fondest wish after the election. So, this sets the House up as the venue for the most intense fight over Fast Track/TPP yet. It is in the House where the until now predominantly progressive legislative public opposition to the TPP could pick up the tea party conservative support needed to defeat the Administration’s proposals and any fig leaf compromises designed to dress them up cosmetically, without changing the reality of corporate dominated ISDS sovereignty over national governments...

...Here, I want to recognize that even though opponents of Fast Track/TPP like myself have to give it all we’ve got to ensure that the House is the graveyard of both, we also must find the energy, time, and resources to plan what we ought to do if and when the House eliminates the poisoned pill and then we have another Fast Track round in the Senate. Such a contingency plan must consider three likely alternative possibilities: that 1) the Senate attempts to pass a revised bill aligning itself with the House, 2) the Senate decides to pursue such an alignment through a Conference committee of both Houses to arrive at a common bill, and 3) the House just accepts the Senate version of Fast Track with its “poison pill.”

*************************

Opponents of the Fast Track bill can make it much more likely that any revision reaching the Senate dies there the second time around by mounting a ferocious period of protesting and more generalized popular resistance prior to second round Senate consideration. This effort needs to be organized enough and intense enough that the impression is conveyed to Senators that an anti-TPP movement that is intense enough to seek reprisals in the 2016 election and beyond against Senators who vote for the bill. Democratic Senators who are defecting from the Democratic majority, as well as the Republicans voting with the corporations must be persuaded that the best thing for them in 2016 is for Fast Track/TPP to just go away, and that this won’t be the result if they pass Fast Track, but only if they kill it.

**************************************

Again, opponents of these national sovereignty, democracy-destroying, “trade” agreements can help to bring about that outcome by increasing the pressure on Representatives in the House and ultimately on the Senators by facing them with a movement. The movement can call out individual Congresspeople and Senators using appeals, frames, and arguments based on job destruction, labor market, environmental, and regulatory impacts of various kinds, political paralysis, budgetary and austerity impacts and others. All these will be effective in varying degrees based on the segments of the voting population being addressed.

But, in my view, appeals based on none of these will be as intensely felt or as widely accepted as those that emphasize TPP and other “trade” agreements undermining national, state, and local sovereignty and replacing it with Investor State Dispute Settlement (ISDS)-based corporate rule. People can have different opinions about all the other issue areas related to the TPP, but except among a truly small number of people, the idea that corporations and the wealthy ought to establish hegemony over national governments backed by popular sovereignty is extraordinarily illegitimate and repellent.

If support for the TPP and other agreements, in light of the proposed powers to be conferred on the ISDS tribunals can be framed as disloyalty to the various nation states negotiating them, then the agreements can be defeated. A movement that can deliver that message, consistently and powerfully, can rout the politicians favoring the TPP, and still win the day. Let us make sure that such a movement takes wings in the coming weeks and sustains its effort for as long as it takes to end this latest threat to democracy.

I CUT OUT A LOT OF THE STRATEGIZING AND SPECULATION, BUT IT'S WORTH YOUR ATTENTION...SEE LINK!

Demeter

(85,373 posts)Yves here. I’m old enough to remember 1987. M&A activity was hot and was clearly the biggest driver of stock prices before the crash.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

Global growth is languishing, corporate revenues too, but CEOs are trying to show they can grow their companies the quick and easy way. Cheap debt is sloshing through the system while yield-hungry investors offer their first-born to earn 5%. And this cheap debt along with vertigo-inducing stock valuations have created the largest M&A boom the US has ever seen, with May setting an all-time record. There may be a sense of desperation among CEOs as the Fed’s cacophony evokes interest rate increases, the first since July 2006. So companies are issuing all kinds of cheap debt while they still can. Bond issuance has totaled over $100 billion per month in the US for the past four months, the longest such streak ever, according to Bank of America Merrill Lynch. And that record issuance doesn’t account for the booming “reverse Yankee issuance,” where US corporations take advantage of the negative-yield absurdity Draghi has concocted in Europe and issue euro-denominated bonds into European markets.

“Issuers should realize that the window to lock in low long-term yields for any purpose is closing,” Hans Mikkelsen, a senior strategist at BofA, wrote in a note, according to the Financial Times. And so in May, M&A deals hit an all-time record of $243 billion.

May included Charter’s $90-billion acquisition of Time Warner Cable and Bright House. Charter will issue around $30 billion in junk-rated debt to accomplish this, likely the second largest junk-debt deal ever, behind that of TXU in October 2007, which is now in bankruptcy. May also includes Avago’s $37-billion acquisition of Broadcom, the largest tech deal since the dotcom bubble blew up. This pressure to buy drives up prices and premiums, and the “synergies” needed to make these deals work even on paper will be harder and harder to come by. “Synergies” is corporate speak for cost-cutting, so mass layoffs, which will be announced with fanfare to push the shares higher. For these companies, it seems the only way to grow revenues is to acquire other companies, and the only way to grow profits is to cut costs. It’s not productive, hurts the economy, and mucks up the future of the company. But what the heck, it looks good on paper...These deals are financed by a mix of shares, new debt, and cash raised with prior debt issuance – the “dry powder.” Much of this debt is in form of junk bonds and junk-rated leveraged loans, which banks then either sell to loan funds or craftily slice and dice and fabricate into highly-rated collateralized loan obligations (CLOs). Some of these CLOs are then put through the Wall Street sausage maker again to reemerge as tipple-A rated bonds denominated in yen for the Japanese market.

Loading up overleveraged junk-rated companies with more debt – even if it’s still cheap – has consequences down the road: US default rates are creeping up, hitting 2% in May, the highest in 17 months, according to S&P Capital IQ’s LCD:

The report forecast a default rate of 2.5% by December 2015 and 2.8% by March 2016, assuming cheap debt continues to flow without limits. Once the money dries up, defaults will soar. Layoffs and defaults are the bitter aftertaste of M&A booms. Downgrades are now hailing down on these companies. In May, Standard & Poor’s downgraded 41 issuers with total debt of $71 billion, but it only upgraded 18 issuers with total debt of about $43 billion – for a downgrade ratio by count of 2.28x, more than double the ratio of 1.0x in 2014 and 0.89 in 2013. It’s getting messier out there...When our corporate heroes are not busy buying each other’s shares, they’re buying their own shares. In April, S&P 500 companies announced an all-time record of $133 billion in buybacks. It’s attracting the ire of the largest money managers in the world.

Blackrock Managing Director Rick Rieder wrote:

In my opinion, today’s boom is just one economic distortion created by the Federal Reserve’s excessively accommodative monetary policy.

The boom is, in essence, a response to today’s extraordinarily low interest rates….

Using debt to fund buybacks and dividends eventually crowds out long-term investment in the company’s core business and threatens its credit quality, which is, according to Rieder, “what we are seeing today.”

Oh, and we almost forgot, there are other consequences. Blackrock’s Rieder:

Monetary policy wins again.

Demeter

(85,373 posts)http://www.nakedcapitalism.com/2015/06/obamacares-problems-continue-to-fester-cost-complexity-quality-coverage-covered-california.html

By Lambert Strether of Corrente.

California is a bellwether state for such success as ObamaCare has had, as well as for its failures. From the Kaiser Foundation’s recent report (“Coverage Expansions and the Remaining Uninsured: A Look at California During Year One of ACA Implementation”):

Long-time health care reporter Trudy Lieberman argues for a focus on California from her outpost at the Columbia Journalism Review:

It’s not easy to figure out how to monitor the progress of Covered California, the country’s largest state-run health insurance exchange.

Lieberman then goes on to look at coverage of enrollment figures, and the tendency of our famously free press to write the easy benchmark story and print Covered California’s rosy press releases, instead of going out and doing actual reporting; we’ll get the numbers below. Lieberman concludes:

Amen. And I hope readers who have Covered California policies, or Medical, will chime in with their experiences, good and bad...Absent in-depth reporting of people’s real experiences with Covered California, I’ll aggregate the press coverage I can find — there has been an uptick, lately — under the headings of Cost, Complexity, Quality, Coverage, and — saving the juiciest for last — Corruption. Of course, problems in all these areas are functions of ObamaCare’s overweening complexity, which is a result of the broken system architecture required by official Washington’s determination to preserve the private health insurance because markets, instead of adopting the simple, rugged, and proven single payer approach (see here at “largest controlled experiment in the history of the world”).

Cost of the Exchange. In general, the state exchanges are struggling. The Washington Post reports:

Many of the online exchanges are wrestling with surging costs, especially for balky technology and expensive customer call centers [a function of ObamaCare’s complexity] — and tepid enrollment numbers [a function of poor quality]. To ease the fiscal distress, officials are considering raising fees on insurers, sharing costs with other states and pressing state lawmakers for cash infusions. Some are weighing turning over part or all of their troubled marketplaces to the federal exchange, HealthCare.gov, which now works smoothly.

Covered California is no exception. Covered California is running an $80 million deficit, because it’s not making its numbers, of which more below. Meanwhile, Covered California, including the Exchange, is funded — in classic neoliberal fashion — by a fee tacked on to premiums:

So Covered California, in order to hold the line on access fees, is reducing funding on the exchange, reducing funding on outreach, and using up the last of the Federal funds it kept in reserve. Seems rather like a mini-death spiral, doesn’t it? Apparently, they plan to increase enrollment by decreasing marketing and failing to improve the website (also of which more below). Let me know how that works out.

Cost of the Policies. Let’s recall that “affordable” means that people can afford it. But from Kaiser’s “Coverage Expansions and the Remaining Uninsured”:

Complexity

As should come as a shock to absolutely nobody, layering the insanely complex ObamaCare marketplace on top of the already insanely complex private heath insurance system costs a boatload of money. Health Affairs:

I don’t know about you, but I’d rather see that $1,375 spent on health care, as opposed to being spent on insurance company administrators whose job, after all, is to create profit by denying care, not providing it.

The ACA isn’t the first time we’ve seen bloated administrative costs from a federal program that subcontracts for coverage through private insurers. Medicare Advantage plans’ overhead averaged 13.7 percent in 2011, about $1,355 per enrollee. But rather than learn from that mistake, both Democrats and Republicans seem intent on tossing more federal dollars to private insurers.

$249.3 billion siphoned off by rental extractors. That’s a lot of money! Of course, to us, that’s a bug. To them, it’s a feature!

Quality

Yelp gives Covered California a one-star review. Here are some of the reasons why.

Service. Oddly, or not, Covered California’s doesn’t seem to be collecting, or at least making public, any data on how well policy holders are being served. Kaiser Health News:

Sounds like HAMP.

Actually, Covered California’s lousy renewal numbers would argue that the percentage is “likely” large.

With that, the Chiaji’s story:

Arthur, an immigrant from Kenya who worked in food preparation, hadn’t had coverage since he left his home country, which has a national health insurance program. “Everybody can afford insurance,” said Arthur, 39, who married Kairis in 2013. “And so that’s how I thought it was gonna be in America. That was not the case.”

Life’s little ironies, eh? They sign up with Anthem Blue Cross at one of those outreach “health fairs”:

At the end of June, they finally received their cards and a bill for May, June and July, Kairis said.

They sent in one month’s payment, which they assumed would be for July since they hadn’t even known they were eligible for coverage in May and June. But Anthem told them their payment only covered May, Kairis said.

When Kairis called Anthem to ask whether there had been a mistake, “they said you’re not covered [now] because you have to pay the months before now,” she said.

As she tried to resolve the problem, Anthem told her to hold off paying another bill until the insurer was able to process a change in their income, which would lead to a slightly lower premium. So she waited, but didn’t get another bill. …

Kairis tried to clear things up on the phone with Anthem. “You wait on line for an hour, you get disconnected, they say no one can talk to you and hang up on you,” she said. “It was really frustrating.” When she called Covered California, she said, she got a message explaining operators were busy and she was disconnected.

Kairis estimated that she spent about 20 hours in all trying to figure out their insurance situation. Each time she called, she said, she was told something different.

This is a the “tax on time” Yves talks about. If only Kairis could bill for her time, like one of Covered California’s high-paid cronies consultants!

That would have been $552 for insurance the Chiajis said they never actually had.

There’s a lot to like here, but my favorite part is where Kairis and Arthur assume that the United States has a health insurance system that’s as functional as Kenya’s.

The Exchange. The blog “Insure Me, Kevin” seems to have taken on the task of tracking changes in Covered California’s website for both consumers citizens and insurance companies. Kevin’s conclusion, after this spring’s batch of changes:

Awesome. Emily Bazar of The Center for Health Reporting gives an example of progress that has not been made:

Readers will recall that income-based subsidies are a fundamental aspect of ObamaCare’s system architecture.

But when someone reports an income change, “the person is terminated from the current health plan they’re in and they’re re-enrolled in the same health plan with the new income information,” says Jen Flory, senior attorney for the Western Center on Law & Poverty.

What could go wrong? Well, exactly what went wrong for the Chiajis, as we saw above.

Why does this happen? Because Covered California’s nearly half-a-billion-dollar computer system apparently can’t handle that kind of complexity.

“They didn’t build the system in a way that allowed for such changes,” Flory says.

(Covered California denies this, but Bazar has numerous counter-examples, because she writes an advice column.) What I want to know is, which well-paid crony technical consultant wrote the specifications for Covered California’s website, such that a fundamental requirement of ObamaCare’s system architecture was left out? And who signed off on it? Bazar concludes:

What a mess, where people need to have sane ways to work with an insane system explained to them with nods and winks!

Finding a doctor. Citizens consumers are still being denied care because of Covered California’s narrow networks:

The provider directories from the insurance companies should sort in- from out-of-network doctors, but they aren’t accurate, so at a minimum the patient pays Yves’s “tax on time” by taking a trip to the wrong office, and at worst they get stuck with a huge and unexpected out-of-network bill.

Coverage

Enrollees Covered. Trudy Lieberman looks at how Covered California reports its enrollment numbers in the press, and if I didn’t know better, I’d say they were jiggering the numbers:

Is it the total number of people who have signed up for an insurance plan on the exchange during open enrollment? The rate at which people renew? The number of new sign-ups in a given year? The number of Latino sign-ups? The number of “covered lives”? The number of Californians who have had coverage through the exchange at any point? Or, simply, the overall rate of uninsured adults across the state?

In recent months, Covered California has cited each of these measures to tout its success. And though outside analysts have raised some notes of caution, press coverage has largely followed the lead set by the exchange. The result is coverage that has too often been reactive, short on enterprise, and with missed opportunities to ask some necessary questions. Covered California may ultimately have a success story to tell—but it will need to face some sharper skepticism before we can be sure.

Coverage Growth. Awful. The health insurance consultancy Avalere ran its own numbers and concluded:

Explains that one-star rating, eh? And awful in relative terms, as well. Los Angeles Times:

Unequal Coverage. As we showed here, here, here, here, here, and here (“Obama’s Relentless Creation of Second Class Citizens”) consumers’s citizens’ access to life-saving health care under ObamaCare is random with respect to income, age, jurisdiction, and a host of other factors, including education level, language, and race. California was and is no exception. Kaiser:

I continue to see no moral justification for treating the lives and health of presumably equal citizens so unequally, except the ideological requirement to preserve the market in private health insurance. (Note that even the Fiscal Times has moved on from TINA, and actually mentions — dread words — single payer.)

IF YOU CAN STAND IT, THERE'S EVEN MORE AT LINK

Demeter

(85,373 posts)http://www.huffingtonpost.com/2015/06/02/obamacare-provider-directories_n_7496662.html?utm_hp_ref=business&ir=Business

ACTUALLY, READING THE ARTICLE WILL SHOW NOTHING OF THE KIND

Demeter

(85,373 posts)ALONG WITH EVERYTHING ELSE IN OBAMACARE

http://www.huffingtonpost.com/2015/06/02/obamacare-medical-device-tax_n_7498348.html?utm_hp_ref=business&ir=Business

BUT! NO SINGLE PAYER UNIVERSAL COVERAGE FOR US!

Demeter

(85,373 posts)First Tennessee Bank agreed to pay $212.5 million to resolve a case involving Federal Housing Administration-insured mortgage lending, the U.S. Justice Department said on Monday.

Benjamin Mizer of the Justice Department's Civil Division said First Tennessee's "reckless underwriting has resulted in significant losses of federal funds and was precisely the type of conduct that caused the financial crisis and housing market downturn."

In April, First Tennessee, the regional bank for First Horizon National Corp, said it would pay $212.5 million to settle claims of mortgage lending violations related to the home loan business, which the company sold in 2008. The loans were issued from Jan. 1, 2006, through Dec. 31, 2008.

A Justice Department statement said the settlement resolved allegations that First Tennessee failed to comply with FHA origination, underwriting and quality control requirements.

It said First Tennessee failed to report any deficient mortgages to the FHA and caused the agency to insure hundreds of loans that were not eligible for insurance, resulting in substantial losses for the FHA when it later had to pay insurance claims on those loans.

Demeter

(85,373 posts)U.S. banks are poised to score a victory in their fight to keep regulators from pinching the billions of dollars in fees they charge consumers who overdraw their accounts. After studying overdraft fees for more than three years, the Consumer Financial Protection Bureau is leaning against subjecting banks to tough new rules that would cap the size of charges or limit how frequently they can be imposed on consumers, said two people briefed on the agency’s work. More likely, when the CFPB proposes regulations later this year or in early 2016, it will probably bar lenders from reordering transactions in a way that triggers overdrafts and also require better disclosure of policies that allow consumers to avoid the fees, said the people who asked not to be named because the agency hasn’t finalized its rules. The new regulations the CFPB is considering would probably disappoint consumer groups, which have railed against overdraft fees as abusive with examples of $5 lattes suddenly costing more than $40. The charges amount to a short-term loan -- though with interest rates exceeding 4,000 percent -- when debit-card transactions push customers’ account balances below zero.

‘Unfair, Deceptive’

“The unfair, deceptive and abusive nature of bank overdrafts calls for deliberate, strong action by the CFPB,” said Sarah Ludwig, co-director of the New Economy Project, a New York advocacy group.

Moira Vahey, a CFPB spokeswoman said the agency is “carefully weighing what consumer protections” are needed on overdrafts.

“No decisions have yet been made,” Vahey said in an e-mail. “We will continue our work to understand and address practices that put consumers at risk, and are committed to a fair and open process.”

Overdraft fees have been a focus at the CFPB since the regulator’s creation under the 2010 Dodd-Frank Act. The agency named its first softball team “The Overdrafts” and in 2012, in one of his first actions as the agency’s director, Richard Cordray initiated a far-reaching review of the charges. As the CFPB dug into the issue, banks deluged the agency with arguments that consumers actually like being able to overdraw their accounts. And while JPMorgan Chase & Co., Bank of America Corp. and Wells Fargo Co. generate the most fees, the fiercest lobbying has come from small banks that say the revenue is crucial to their survival. Community banks have clout with U.S. lawmakers, many of whom have dozens of small lenders based in their congressional districts.

“There would be a fierce backlash if the CFPB gets too prescriptive here, and that would play badly in Congress,” said Camden Fine, chief executive officer of the Independent Community Bankers of America, a Washington-based industry group.

Fine said he has warned the CFPB that overdraft fees help support branch networks, which could be at risk from stringent regulation. Vahey, the CFPB spokeswoman, said that the agency wants to “fully understand the overdraft practices at banks and credit unions of different sizes, a goal that has been encouraged by small institutions.”

The U.S. banking industry is on pace to collect more than $10 billion of the fees this year, with JPMorgan, Bank of America and Wells Fargo each generating more than $350 million of revenue from the charges in the first quarter, according to SNL Financial. Regulators require banks with more than $1 billion of assets to disclose their overdraft revenue.

Perhaps undercutting the need for tough CFPB rules is that analysts at Jefferies say the revenue is declining. The Federal Reserve required in 2010 that customers agree to overdraft protection before banks can apply it to their accounts. Unless consumers opt in, any transactions that would lead to a negative balance are declined. That regulation, and the fact that customers can now easily check bank balances through smartphone apps, has eroded earnings, Jefferies’ analyst Ken Usdin and his colleagues wrote in a report last month. They also concluded that the revenue is less critical for banks than it was almost a decade ago. Overdraft fees made up 2 percent of banks’ revenue and one-third of service charges in the first quarter of this year, down from 6 percent of revenue and two-thirds of service charges in 2006, according to Usdin’s report. That’s played out even though the median penalty assessed for overdrawing an account has risen 33 percent to $36 over the same time period.

One option the CFPB is considering would try to improve disclosure of opt-in policies, as studies by consumer groups have shown banks may not make it clear enough that customers can decline overdraft protection and avoid fees, the people said. Another would govern the order in which banks process transactions, the people said. Since 2011, Bank of America, JPMorgan and Wells Fargo have had to pay hundreds of millions of dollars to settle lawsuits that accused them of manipulating the order of debit-card transactions to boost overdraft fees. Regulations in general could cut into bank revenue, the Jefferies analysts wrote, “but much depends on the types of changes.”

Demeter

(85,373 posts)

DemReadingDU

(16,000 posts)Demeter

(85,373 posts)Too many articles are hand-wringing, speculation without any factual basis, or pure propaganda. It takes longer to read and then figure out if posting it would be doing anything to improve the knowledge base...or do anyone a favor.

It's funny...with the windows open, birdsong pours into the house. I try to imagine what it sounded like, when dinosaurs roamed the earth. Did they, like their descendant birds, serenade the dawn? The thought gives me goose bumps.

DemReadingDU

(16,000 posts)Interesting thoughts.

As far as reading, I am always behind. But if/when the electric grid is cyber-hacked and is taken down, I will have plenty printed out to catch up on, lol!

Fuddnik

(8,846 posts)I can't post the video from here so here's the link.

http://www.democracynow.org/2015/6/5/from_occupying_banks_to_city_hall

DemReadingDU

(16,000 posts)Demeter

(85,373 posts)Get enough raindrops together, and you get a flood that washes away the sewage we are swimming in...

Demeter

(85,373 posts)...The dramatic bust in a Zurich hotel last week of FIFA executives is «just the beginning», top US law enforcement officials have warned. British authorities have also jumped on the bandwagon with their own announced probe into financial irregularities at the World Cup organiser. With seven FIFA officials arrested so far and seven more indicted, and the US authorities vowing to pursue others in the footballing federation over alleged financial corruption, it can be anticipated that this scandal will run and run into interminable extra-time.

An ulterior political agenda behind the apparent American-led crackdown on the international footballing federation could very well be the desire by US and British governments to scupper the 2018 World Cup venue in Russia. Both the Americans and the British lost out when Russia won the bid back in 2010 to host the forthcoming quadrennial tournament, following last year’s event in Brazil. A re-run of the selection process would give the US and Britain a second chance to pitch their bids, and with a generated cloud hanging over Russia due to the FIFA scandal, they both stand a better chance of winning if it comes to a re-selection. The sporting event is highly coveted, being the most popularly watched on the planet – even exceeding the Olympics. Billions of dollars are at stake for corporations, from construction, hospitality, sportswear and media. There is also the immense national prestige that comes with hosting the global spectacle. A second, more important, political objective for Washington and its British ally is to augment their ongoing campaign to isolate Moscow over the Ukraine crisis. The West accuses Vladimir Putin’s government of annexing Crimea last year and they have mounted a barrage of economic sanctions on Russia seemingly in retribution. Washington and London have been most gung-ho among Western countries in pushing the anti-Russian agenda over Ukraine. President Putin has shown no sign of weakening under this relentless Western pressure. Moscow denies any impropriety over Ukraine. Indeed, it accuses the West of fomenting an illegal coup in that country and of trying to use the resulting conflict as a way to destabilise Russia. Moscow has retaliated to Western sanctions by imposing its own bans on European trade exports and, in recent days, imposing travel restrictions on 89 European Union parliamentarians. So, very plausibly, the Americans and their trusty British ally are using the issue of alleged corruption in World Cup organising body, FIFA, as a stalking horse to further get at Russia over the geopolitical tensions in Ukraine.

US law enforcement officials at the highest level – including attorney-general Loretta Lynch and FBI chief James Comey – say their investigation into FIFA will continue until all suspicions of corruption in the organisation are uncovered. This high-level US involvement in targeting FIFA strongly suggests a political direction being given by the Obama administration. The concerted nature of the American corruption onslaught against FIFA also points to a top-level decision to go after the Swiss-based federation. The British government, from prime minister David Cameron to his foreign secretary Philip Hammond, quickly stepped into the FIFA scandal following the American lead, making highly unusual public calls for the federation’s president Sepp Blatter to resign.

Both the timing of the US-launched corruption probe – in the week of FIFA’s annual conference and leadership election – plus the way that senior American and British officials, not to mention the publicity of Western news media, have weighed-in to rebuke FIFA suggests that it is all part of a coordinated political campaign authored at the highest level of government. That, in turn, suggests that there is an ulterior political agenda behind the supposed criminal crackdown on FIFA, and that the ulterior agenda is the Western objective to undermine Russia. Another measure for assessing the credibility of the US-led corruption campaign against FIFA is to put the alleged wrongdoing in perspective with other known spheres of financial corruption. Few people believe that FIFA is free from sleaze and dodgy kickbacks. With so much corporate advertising at stake and broadcasting rights for global media audiences, it would be naive to assume that large wads of money have not crossed palms with a wink and a nod. The US authorities are throwing a book of charges at the organisation, ranging from bribery to commercial fixing, racketeering to tax evasion. It is claimed by the Americans that the corruption at FIFA amounts to $150 million.

That sounds like a lot of sleazy money, but this figure pales in significance to the amount of corruption and criminality attributable to Wall Street banks and other Western financial institutions. For example, British bank HSBC alone has been caught running tax evasion, money-laundering for drug cartels and other illicit schemes that is estimated at $180 billion – or more than a thousand-fold the scale of criminality alleged at FIFA. Wall Street banks, including JP Morgan, are accused of massive, systematic rigging of gold price markets all in a shady bid to shield the US dollar value. That criminality, affecting the price of basic commodities and livelihoods for billions of people worldwide, is estimated to be in the order of trillions of dollars – or a thousand, thousand-fold the FIFA debacle. Moreover, these same banks, along with a slew of other global names – Citibank, Bank of America, Goldman Sachs, Barclays, Deutsche Bank, Credit Agricole among many others – were all directly responsible for the explosion in toxic financial derivatives that made their executives multimillionaires but which led to the global financial and economic meltdown in 2008.

That meltdown – which persists seven years on from its inception – has resulted in millions of lives ruined from unemployment and the collapse of pensions and savings funds. Added to that are the myriad social hardships and crippled lives from the ensuing austerity imposed on the general Western public to pay for the financial catastrophe – a catastrophe that was deliberately and recklessly engineered by the major banks, hedge funds and other capitalist investment agencies. As Michel Chossudovsky writes in his co-authored book, The Global Economic Crisis: «The meltdown of financial markets in 2008-2009 was the result of institutionalised fraud and financial manipulation. The ‘bank bailouts’ were implemented on the instruction of Wall Street, leading to the largest transfer of money wealth in recorded history, while simultaneously creating an unsurmountable public debt».

It is probable that generations of children to come will be forced to pay for the trillions of dollars of debt that was created by American and European banks, which have now been offloaded on to the public by governments in so-called «bail-outs». Make no mistake, thousands of people have already died from the austerity that Western governments have imposed on their public in order to pay for the corporate fraud, tax evasion, fixing and embezzlement that has taken place in front of our eyes on a massive scale in the order of trillions of dollars. Yet in the face of this gargantuan, genocidal criminality not one board member or executive from the major banks involved in precipitating the global crash has been charged, let alone prosecuted or imprisoned. In fact, the Wall Street banking elite and their counterparts in the City of London are among the main political donors that helped to re-elect Barack Obama and David Cameron. The belated focus of American and British authorities on the alleged wrongdoings at FIFA can thus be readily seen as both ludicrous and laughable when we compare that with the absolute dearth of interest by these same authorities in applying law enforcement where it ought to be applied – on the Wall Street and City of London banksters...Until Washington and London governments go after priority financial crime in their midst, then anything they say about FIFA can be taken as very wide off the mark.

http://www.strategic-culture.org/news/2015/06/03/never-mind-fifa-how-about-crackdown-banksters.html

Demeter

(85,373 posts)- Washington’s attack on world soccer is following the script of Washington’s attack on the Russian-hosted Sochi Olympics. The difference is that Washington couldn’t stop the Olympics from being held in Sochi, and was limited to scaring off westerners with lies and propaganda. In the current scandal orchestrated by Washington, Washington intends to use its takeover of FIFA to renege on FIFA’s decision that Russia host the next World Cup.

This is part of Washington’s agenda of isolating Russia from the World.

This Washington-orchestrated scandal stinks to high heaven. It seems obvious that the FIFA officials have been arrested for political reasons and that the recently overwhelmingly-reelected FIFA president, Sepp Blatter, was forced to resign by Washington’s threats to indict him as well. This can happen because Washington no longer is subject to the rule of law. In Washington’s hands, law is a weapon that is used against everyone, every organization, and every country that takes a position independent of Washington.

This clears the deck for Washington and its British lapdog to take over FIFA, which henceforth will be used to reward countries that comply with Washington’s foreign policy and to punish those who pursue an independent foreign policy.

The only hope for South America, Asia, and Russia is to form their own World Cup and turn their backs on the corrupt West....

MORE AT: http://www.informationclearinghouse.info/article42036.htm