Economy

Related: About this forumWeekend Economists "Hello, I Must Be Going!" August 17-19, 2012

Because nobody had a theme, I'll muse free-form on things that have hung around too long already, that we would be glad to see the backside of. Today's header comes from an old Groucho tune I vaguely remember hearing:

Hello I Must Be Going ---lyrics

Groucho:

Hello, I must be going.

I cannot stay,

I came to say

I must be going.

I'm glad I came

but just the same

I must be going.

Margaret Dumont:

For my sake you must stay,

for if you go away,

you'll spoil this party

I am throwing.

Groucho:

I'll stay a week or two,

I'll stay the summer through,

but I am telling you,

I must be going.

And because there is so much of it, I'll be breaking up the monotony with more clips from Animal Crackers, that Marx brothers romp. Please help me out here, as I still have no working speakers (life has been frustrating).

Many others have riffed upon this 1930 tune. There's a new movie this year with that title: Circumstances force a young divorcée to move back in with her parents...

It's an Indy "adult comedy", coming out generally (limited) Sept 7th...

Only a 50 on Rotten Tomatoes--It musta really stunk, even for a chick flick.

The critics seem to think the only reason to see it is the naked swimming...

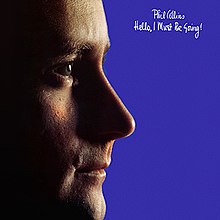

And Phil Collins used this phrase as the title of an album...

I'll see if any of his stuff is on youtube.

And then, there's the economic news that we'd like to see going away: the euro, the Bernank, the Timmeh, the banksters, the AG, and so forth...

Join us in a Farewell to Summer, Farewell to Arms, Fare thee well, my fairy fay!

Yeah, I'll be glad when we've seen the last of those HFT fairies, too.

Demeter

(85,373 posts)But I'm very early...check back later!

Demeter

(85,373 posts)Isn't that precious? I do love European tradition....

rfranklin

(13,200 posts)How he got in my pajamas I don't know!

(Sounds appropriate for a Republican.)

Demeter

(85,373 posts)I HAVE TO CONFESS--I'M GETTING REALLY TIRED OF ANGELA. BET THE GERMANS ARE, TOO. THE GREEKS CERTAINLY THINK IT'S TIME FOR HER TO GO!

http://www.bloomberg.com/news/2012-08-16/merkel-says-germany-backs-draghi-s-conditionality-for-ecb-aid.html

Chancellor Angela Merkel backed the European Central Bank’s insistence on conditions for helping reduce borrowing costs in indebted countries, saying Germany is “in line” with the ECB’s approach to defending the euro.

“Obviously time is pressing” on stamping out the debt crisis, though “on many of these issues we feel we’re on the right track,” Merkel told reporters in Ottawa yesterday at a joint press conference with Canadian Prime Minister Stephen Harper. Euro-area policy makers “feel committed to do everything we can to maintain the common currency.”

Asked about ECB chief Mario Draghi’s announcement that the central bank may return to sovereign bond-buying, Merkel said recent ECB decisions “have made it clear that the European Central Bank is counting on political action in the form of conditionality as the precondition for a positive development of the euro.”

Merkel, facing European pressure to ease bailout terms and allow shared debt as well as calls by global partners to stop contagion, returned to the crisis fight after her summer vacation, using the trip to Canada to make her first public comments on the turmoil in a month. She hailed Canada’s budget and debt discipline as a model for the 17-nation euro area.

BUT ANGELA, DARLING, CANADA IS A CONFEDERATION OF PROVINCES, ALL USING THE SAME GOVERNMENT, AND THE RICH PROVINCES SUPPORT THE POOR ONES....AND THEY DON'T LET THEIR BANKSTERS RUN WILD!

Demeter

(85,373 posts)HOPEY-CHANGEY GOES INTERNATIONAL....CAN'T WAIT FOR AN END TO THAT BS! THE FIX IS NOT IN, GUYS, GET OVER IT!

http://www.reuters.com/article/2012/08/17/us-markets-global-idUSBRE86F00620120817

Global shares edged higher and the dollar rose on Friday after apparent support from German Chancellor Angela Merkel for European Central Bank intervention to calm the euro zone's debt troubles helped buoy investor sentiment for a second day.

U.S. stocks rose only slightly, but a key European index hit a 13-month high on speculation euro zone policy-makers might be closer to resolving their differences and working closely to tackle the more than two-year-old debt crisis...

Fuddnik

(8,846 posts)SUCKERS!!!!!

Demeter

(85,373 posts)I'm hoping that this time next year, Facebook is history.

I'm ruthless when it comes to housecleaning....especially when it's other people's houses...

Tansy_Gold

(17,851 posts)Right up there with pet rocks.

How anyone with half a functioning brain cell can spend HOURS, fucking HOURS a day on that site is totally beyond me.

Po_d Mainiac

(4,183 posts)Income is from ads.

Ads are supposedly, taylored to the posters preferences.

But, not all profiles are actual people.

http://www.facebook.com/pages/Fuck-Goldman-Sachs/18511856150325

and it turns out a ton of ad hits were robo'd

Facefuck can only live by paid (up front) advertising.... which ain't gonna happen.

Saverin didn't head for the border for tax reasons......It was to avoid prosecution

Demeter

(85,373 posts)Prosecution probably would have meant restitution...

Demeter

(85,373 posts)I DON'T THINK ANYONE WILL WEEP WHEN ED DEMARCO TAKES A POWDER...

The Treasury Department’s announcement that it is changing the terms of its four-year-old financial backing for Fannie Mae and Freddie Mac is a boon for mortgage originators, homebuilders and Treasury bonds as it delays reform of the two giant government-seized firms, experts said Friday. The Treasury Department on Friday announced a set of steps to change its financial backing of Fannie FNMA and Freddie FMCC. The agency set up a new arrangement where all profits from the firms make will be provided to the Treasury. The move decimated their shares on the over-the-counter market, with both penny stocks diving by double-digit percentages. This replaces the current system, where Fannie and Freddie pay 10% quarterly dividend payments to Treasury and must borrow from the government every time they don’t have a large profitable quarter. Read more about changes: http://www.marketwatch.com/story/us-treasury-revamps-fannie-freddie-support-deal-2012-08-17

The Treasury also said their massive mortgage portfolios be wound down at an annual rate of 15%, a policy that would have them reduced to $250 billion in assets each by 2018, four years earlier than previously expected. The move comes as many housing indicators are now showing signs of stability and growth, after a housing-bubble burst that left both prices and purchases roughly a third below peak levels. For instance, building permits in July reached their highest level since 2008.

“We see this as positive for housing as it ensures that Fannie and Freddie will remain in business,” said Jaret Seiberg, analyst at Guggenheim Securities in Washington. “Absent Fannie and Freddie, we believe housing finance will become more expensive and less available. That is why this is good news for mortgage originators and homebuilders.”

Mark A. Calabria, director of financial regulation studies at the Cato Institute in Washington, said the new structure makes it harder for a future administrator to place the two mortgage giants into receivership, which would force debt holders such as mortgage-backed securities holders and other investors to take losses...Fannie and Freddie were placed into government conservatorship in September 2008 at the height of the financial crisis. He added that this change in support is part of a broader effort by Treasury Secretary Timothy Geithner to ensure that China continues to buy both U.S. mortgage-backed securities and U.S. Treasury bonds.

“To the Treasury Department, this isn’t just about Fannie and Freddie,” he said. “Losses imposed on MBS debt holders would raise concerns by the Chinese and they would have to be compensated more to buy Treasury bonds.”

“There is a perception that if Fannie and Freddie went into receivership then the credibility of the U.S. government as a whole would be brought into question,” he added.

Seiberg noted that the government’s unlimited support for Fannie and Freddie expires after Dec. 31, 2012.

“The market’s worry is that Fannie and Freddie will exhaust this Treasury capital and default on bond payments,” he said. “Just the fear of this could drive up their borrowing costs, which would require them to seek government capital more quickly. This creates a vicious cycle that Treasury wanted to keep from starting.”

Ed DeMarco, the acting chief of the Federal Housing Finance Agency, backed the revamped Treasury support program. He said the new approach will “help to ensure stability, fully capture financial benefits for taxpayers, and eliminate the need for Fannie Mae and Freddie Mac to continue to borrow from the Treasury Department to pay dividends.” He added that as Fannie and Freddie shrink, the continued payments of a fixed dividend could have “called into question the continued adequacy of the financial commitment” in the previous support structure. DeMarco also backed the faster reductions in the mortgage portfolio.

“The faster reduction in the retained mortgage portfolio will further reduce risk exposure and simplify the operations of Fannie Mae and Freddie Mac,” he said in a statement. Previously, DeMarco raised concerns about reducing the portfolio too fast, saying that a “significantly faster” reduction based on a “congressional mandate” could cost taxpayers unnecessarily.

......................................................................................................................

Calabria added that the new rules will reduce the impetus for Congress to reform Fannie and Freddie. DeMarco said last month that Fannie and Freddie have already cost taxpayers $188 billion. In the second quarter, both Fannie and Freddie were profitable, with Fannie Mae earning $5.1 billion and Freddie Mac earning $3 billion.

westerebus

(2,976 posts)The CATO Institute (the libertarian wing of either dystopian party that comes in both red or blue) endorses a Turbo Timmey move to unload and downsize FREDDY and FRANNIE and the hated evil De Marco welcomes it with open arms?

Some how I don't think this is good news.

Demeter

(85,373 posts)as it is, I'm having trouble just surviving the weekend....

westerebus

(2,976 posts)Po_d Mainiac

(4,183 posts)spoken to Nathan Hale

Po_d Mainiac

(4,183 posts)to get their hands on the above water paper..

The crap in need of snorkels....Hah!

Demeter

(85,373 posts)The United States is increasing its dependence on oil from Saudi Arabia, raising its imports from the kingdom by more than 20 percent this year, even as fears of military conflict in the tinderbox Persian Gulf region grow. The increase in Saudi oil exports to the United States began slowly last summer and has picked up pace this year. Until then, the United States had decreased its dependence on foreign oil and from the Gulf in particular.

This reversal is driven in part by the battle over Iran’s nuclear program. The United States tightened sanctions that hampered Iran’s ability to sell crude, the lifeline of its troubled economy, and Saudi Arabia agreed to increase production to help guarantee that the price did not skyrocket. While prices have remained relatively stable, and Tehran’s treasury has been squeezed, the United States is left increasingly vulnerable to a region in turmoil. The jump in Saudi oil production has been welcomed by Washington and European governments, but Saudi society faces its own challenges, with the recent deaths of senior members of the royal family and sectarian strife in the eastern part of the country, making the stability of Saudi energy and political policies uncertain. The United States has had a political alliance with the Saudi leadership that has lasted for decades, one that has become even more pivotal to Washington during the turmoil of the Arab spring and rising hostilities with Iran over that nation’s nuclear program. (Saudi Arabia and Iran are bitter regional rivals.)

The development underscores how difficult it is for the United States to lower its dependence on foreign oil — especially the heavy grades of crude that Saudi Arabia exports — even as domestic oil production is soaring. It is a development that has alarmed conservative and liberal foreign policy experts alike, especially with oil prices and Mideast tensions rising in recent weeks.

“At a time when there is a rising chance of either a nuclear Iran or an Israeli strike on Iran’s nuclear facilities, we should be trying to reduce our reliance on oil going through the Strait of Hormuz and not increasing it,” said Michael Makovsky, a former Defense Department official who worked on Middle East issues in the George W. Bush administration.

...Many oil experts say that the increasing dependency is probably going to last only a couple of years, or until more Canadian and Gulf of Mexico production comes on line. “Until we have the ability to access more Canadian heavy oil through improved infrastructure, the vulnerability will remain,” said David L. Goldwyn, former State Department coordinator for international energy affairs in the Obama administration. “The potential for an obstruction of the Strait of Hormuz therefore poses a physical threat to U.S. supply as well as a potential price shock on a global level.”...In the United States, several oil refining companies have found it necessary to buy more crude from Saudi Arabia and Kuwait to make up for declining production from Mexico and Venezuela, insufficient pipeline connections between the United States and Canadian oil sands fields, and the fallout from the 2010 BP disaster, which led to a yearlong drilling moratorium in the Gulf of Mexico. ...

Obama administration officials said they were not overly worried for several reasons. In the event of a crisis, the United States could always dip into strategic petroleum reserves; domestic production continues to climb; and Gulf of Mexico refineries could be adjusted to use higher-quality, sweeter crude oil imported from other countries...

Demeter

(85,373 posts)The White House is "dusting off old plans" for a potential release of oil reserves to dampen prices and prevent high energy costs from undermining sanctions against Iran, a source with knowledge of the situation said on Thursday. U.S. officials will monitor market conditions over the next few weeks, watching whether gasoline prices fall after the September 3 Labor Day holiday, as they historically do, the source said. It was too early to detail the size of any release from the U.S. Strategic Petroleum Reserve and other international stockpiles if a decision to proceed was taken, the source said.

Oil prices have surged in recent weeks, with Brent crude prices closing in on $120 a barrel, up sharply from below $90 a barrel in June. The United States and other Group of Eight countries studied a potential oil release in the spring but shelved the plans when prices dropped. As prices rise again, U.S. officials were now collecting information from the market about potential needs and studying futures, production numbers and data on Iranian oil exports.

"The driving force in this is both impact on the economy and impact on the Iran sanctions policy," the source said, noting that Washington did not want rising oil prices to create a windfall for Iran while international sanctions were having an effective impact on its crude exports and revenues.

The United States has not yet held talks with international partners about a coordinated move. The source noted that Britain, France, Germany and other partner nations in the Paris-based International Energy Agency (IEA) were receptive to a potential release a few months ago when conditions were similar. Those countries were concerned about the impact of high oil prices on the global economy and Iran then, and those concerns remain equally relevant now. "The logic behind a potential release in the spring is at least if not ... more true today," the source said...

...MEANING THE "LOGIC" IS NIL...

Within the United States, tapping reserves could spark criticism from Republicans, who would cast it as a political move to boost Democratic President Barack Obama's chances in the November 6 election.

Demeter

(85,373 posts)TransCanada broke ground last week on the southern leg of the Keystone XL pipeline, bucking more than four years of intense opposition to the project from farmers, ranchers and local communities representing thousands of people affected across Texas and Oklahoma. There was no official ribbon-cutting ceremony to inaugurate construction at the pipeline’s staging area last week—in fact, TransCanada’s careful PR control and political pressures led to a virtual media blackout on the subject. Instead, members of the Tar Sands Blockade a broad affiliation of activists opposing the project, traveled Thursday seven miles west of Paris, Texas, to christen the construction site in their own way: with a day of defiance, and the promise of rolling actions for as long as the pipeline plan proceeds.

“TransCanada is putting families that wanted nothing to do with this pipeline in harm’s way,” says blockade organizer Ron Seifert. “Since our leaders and representatives will do nothing to protect our friends and neighbors, the Tar Sands Blockade is calling for people everywhere to join us and defend our local communities from a multinational bully.”

Plans to integrate the proposed Gulf Coast Segment with the existing Keystone System would allow extractors in Canada to send a toxic tar sands slurry to the export market on the Gulf Coast. Creating minimal short-term construction jobs, the expansion of the oil industry will pad the pockets of Gulf Coast refineries—which operate in a foreign trade zone that evades state and federal taxes—while endangering the health and livelihoods of hundreds of communities between Cushing, Okla., and Port Arthur, Tex...TransCanada’s desperate reshuffling of the project, re-routing the pipeline through Oklahoma rather than much-contested Nebraska, came after 1,253 people were arrested in Washington, DC, last fall. The sustained protests at the White House, including another demonstration in November in which more than 12,000 encircled the White House, pushed President Obama to reject the permit for the $7 billion Keystone expansion, stating that not enough time had been given for a proper environmental review. But in March, the president traveled to Cushing, Okla., where he announced plans to expedite the pipeline’s southern portion as part of his “all of the above” energy strategy—leaving landowners, ranchers, indigenous communities and thousands of local citizens in the shadow of the refineries, with the deadly pollution they imply.

“I am told the pipeline is so we won't have to buy ‘blood oil,’” says Cherokee activist and Grand River Keeper Earl Hatley, who is co-founder of Clean Energy Future Oklahoma. “The pollution killing First Nations peoples [in Canada] and destruction of their culture by greedy multi-national oil barons is akin to the long ago practice of providing small pox blankets to our people here in America...We native peoples who fight the destruction of the great Boreal Forest for our relatives in Alberta call tar sands blood oil," he says.

Events on Thursday were also staged in Dallas and Houston, where protestors standing in solidarity with rural landowners say TransCanada bullied and manipulated residents across the state, forcing the pipeline’s construction through the use of eminent domain—a legal maneuver that allows corporations to seize private citizens’ property without their consent.

“TransCanada lied to me from day one,” says Susan Scott, a landowner in East Texas whose property will be condemned. “I worked 37 years for my farm, and TransCanada believes it is entitled to a piece of my home.”

While many landowners along the pipeline route in Texas said they signed easement agreements with TransCanada out of fear of being sued, another landowner, Julia Trigg Crawford, is still holding out. Her case went to court in Paris on Friday, with a ruling to be issued shortly. Cases like Crawford’s display the immense legal power and strategies employed by multinational corporations in the fossil fuel industry, whose arguments for eminent domain enable them to continue profiting from the extraction and burning of fossil fuels at the expense of local communities and the climate...

westerebus

(2,976 posts)Guess we're gonna find out.

Demeter

(85,373 posts)AFTER four decades of tyrannical rule by Col. Muammar el-Qaddafi, financed largely by our country’s oil wealth, Libyans have taken steps this summer toward a true democracy. Last month, we got to vote in legislative elections, and this month we experienced the first peaceful transfer of power, from the Transitional National Council to a new national assembly, in our country’s modern history. While we are grateful to the Western countries that helped us topple Colonel Qaddafi last year, something perverse is happening in those countries now. Oil industry lobbyists are using their influence in Washington and Brussels to try to undermine transparency measures that could help prevent future tyrants from emerging. That must not be allowed to happen. When Colonel Qaddafi was in power, I worked for Libya’s state-owned National Oil Corporation, in a position that allowed me to observe corruption firsthand. I helped produce audits that detailed the mismanagement of millions of dollars of oil revenues, including the systematic underpricing of oil and the discounting of prices for select foreign companies. I initiated investigations into why millions of barrels of crude oil went missing from an oil field in 2008; presumably, the proceeds had gone into the pockets of the elite. The regime never explained why it requested the audits, which were never released to the public... Feeling that I had to do something, I naïvely wrote 50 letters denouncing corruption, including three to Colonel Qaddafi’s powerful son Seif al-Islam. The result? I was demoted and suspended without pay. Intelligence agents interrogated me. I received death threats: after an unmarked car slammed into my car, intelligence agents visited me and told me, “Next time could be fatal.”

Today, our allegations of corruption are being examined, but the investigations continue to face obstacles. Earlier this year, based on my reports and those of others, Interpol, at the request of the Libyan government, sought the arrest of the former oil minister, Shukri Ghanem. But on April 29, before he could be detained for questioning, he was found drowned in the Danube River, near his home in Vienna. The Austrian authorities have said they found no indications of foul play, but an inquiry is continuing.

If we are to transform Libya, we must not only investigate the past but also reform the whole relationship between the energy industry and our government. We need to ensure that bidding is fair and open, that deals are transparent and aboveboard and that revenues are used properly. Public disclosure and legislative oversight of contracts and payments are crucial. We cannot meet these goals without help from abroad. Colonel Qaddafi’s rule depended on the collusion of powerful foreign allies who would turn a blind eye to blatant corruption deals involving international oil companies and his regime. America can help prevent such corruption from happening again. The Dodd-Frank overhaul of Wall Street regulations, which President Obama signed into law in July 2010, included a provision, Section 1504, that requires American and foreign companies that are registered with the Securities and Exchange Commission to disclose — country by country and project by project — how much they pay governments around the world for access to their oil, natural gas and minerals. (Federal law already prohibits companies from bribing foreign officials to get or retain business.)

In December 2010, the S.E.C. issued proposed regulations to put Section 1504 into effect. The commission has yet to finalize the rules but is scheduled to take up the matter on Wednesday, at a hearing in Washington. Some of the world’s largest oil and gas companies — along with industry groups like the American Petroleum Institute — are trying to water down the regulations or delay them from taking effect. Some are proposing to exempt resource-extracting companies from having to comply if a foreign government objects, an idea I think of as a “tyrant’s veto.” The industry also claims that complying with the tough disclosure requirements will be costly and may place companies at a competitive disadvantage — but these arguments have been thoroughly discredited, making it hard not to conclude that many would simply prefer to carry on operating in secret.

Po_d Mainiac

(4,183 posts)the SEC's budget ![]()

Demeter

(85,373 posts)

“Vice President Joe Biden announced yesterday that the ticket would guarantee no changes in Social Security.”

It's unclear what effect presumptive Republican presidential candidate Mitt Romney's decision to add Rep. Paul Ryan to his ticket will have on his candidacy, if any. But the choice certainly has had a salutary effect on the Obama re-election campaign.

Naturally, it sparked a full-throated debate on the infamous Ryan and House Republican plan to turn Medicare into a voucher, and force the most vulnerable -- the elderly, the disabled, and seriously ill -- to pay thousands more for health care out of pocket. (The nonpartisan Congressional Budget Office put the estimate at about $6,500 per person.) Democrats generally can only be delighted as Romney and Ryan and House members struggle to explain why they have to destroy Medicare to save it. ("It's a great reform, but don't worry; it only applies to folks under 55 who might not be watching."

First, the president made it clear that his Medicare reforms – unlike those passed by the Republican House and advocated by Romney/Ryan – don't cut guaranteed benefits. Instead they take on the entrenched hospital, insurance company and doctors lobbies to exact savings. This focus – initiated in Obamacare -- is vital if we are to fix our broken health care system which now threatens to bankrupt everyone – families, companies and government at all levels.

Then Vice President Joe Biden announced yesterday that the ticket would guarantee no changes in Social Security. "I guarantee you, flat guarantee you, there will be no changes in Social Security," Biden told patrons of the Coffee Break Café in Stuart, Virginia, "I flat guarantee you." This is good policy. Social Security is not in deficit, and has not contributed to our debt and deficits. Addressing its currently projected long-term shortfall (unlike any other government program, CBO reports it is fully funded through 2038) should not be folded into the deficit hysteria triggered when Wall Street excesses blew up the economy, lifting our debt from 40 to 70 percent of GDP. Any necessary reforms – like lifting the cap on payroll taxes so that millionaires like Romney pay the same rate as their secretaries – should be the product of a bipartisan commission focused on preserving Social Security, not paying for Wall Street's mess...It is also good politics. With companies abandoning pensions, home values (the leading source of middle-class savings) devastated, and fewer families able to save adequately for retirement, more and more Americans will rely on Social Security's guaranteed benefits to provide a lifeline in retirement. The program enjoys popularity across the spectrum – from both Republican and Democratic voters, from conservatives to moderates to liberals. Democrats are well advised to treat Social Security as a sacred trust...In contrast, both Romney and Ryan supported the Bush plan to privatize Social Security, which would have added trillions to our deficits and would devastate retirees when the stock market tanks. It was so unpopular that Bush later regretted making it the priority of his second term...Biden's "guarantee" to defend Social Security now effectively takes Social Security off the table. Democrats gathering in Charlotte at the national convention should ensure that this language is written into the party's platform. The president would do well to reaffirm it in his speech to the convention as he lays out the fundamental choice we face.

Demeter

(85,373 posts)AT THIS POINT, I'D REALLY RATHER HAVE BIDEN AT THE TOP OF THE TICKET...

What Vice President Joe Biden said today was, to use his now-famous phrase, "a big effin' deal." ...We're referring to the comments he made about Social Security in a Virginia coffee shop. From a press corps pool report, as relayed by NBC News:

As if that weren't enough, Biden said it one more time: "I flat guarantee you."

What does it mean when those words come from the Vice President of an Administration that's been talking for years about a deal to cut Social Security? A lot. Could the Vice President have been "off the reservation," as the saying goes, speaking unscripted words that don't have the White House's full backing? Possibly, but it seems unlikely. These words sound like they were pretty well thought out: "Hey, by the way, let's talk about Social Security." And the Vice President said "I guarantee you" - not once, not twice, but three times.

SO, LET'S HEAR A CONFIRMATION FROM THE OTHER GUY

It's true that the President has spoken about making cuts to Social Security as part of a larger deal, even saying things like this (unwisely, in our opinion): " Okay, we'll make some modest adjustments that are phased in over a very long period of time. Most folks don't notice 'em." We criticized him for those words then, and if he repeats them we'll criticize him again. But this is a sign that the White House's thinking may have shifted now that Paul Ryan's in the race. Not only has the Republican Party shown that its most intransigent wing is now in the ascendancy, making a post-election deal unlikely, but the Ryan nomination makes it easier to draw a clear distinction between the parties on Social Security and Medicare.

Ryan may be laying low on Social Security right now, but he's on record as supporting the unpopular plan to privatize it. Legislation he co-sponsored in 2005 would have allowed workers to divert up to 40 percent of their contributions into private accounts - accounts that would have enriched Wall Street bankers and then would have been devastated by the financial crisis those bankers created in 2008. Ryan's Social Security plan would have drained nearly five trillion dollars from the Social Security Trust Fund which Americans rely upon for future benefits, according to Social Security's Chief Actuary. It would have cut guaranteed benefits by nearly 40 percent when it was fully implemented. Ryan's bill would have funneled billions to Wall Street bankers - and this supposedly "fiscally serious" politician's plan would have forcedthe government to borrow $1.2 trillion which it wouldn't have been able to repay until 2083. That makes this the perfect time for the Administration to describe a stark difference between its ticket and the GOP's: They'll cut your Social Security and we won't. They'll privatize it to make bankers rich off the public dime - think of it as another bailout - and we won't. They'll drive the nation deeper into hock to benefit their rich friends, and we won't.

And the White House can even add, as Vice President Biden did: We flat out guarantee it...It would make sense for the White House's calculus to include letting Joe Biden take the heat for a while before the President makes his case. Of course, as we've already said, Biden could simply be off-message. If so, the President's campaign is likely to incur real damage if his team tries to walk it back. But it seems more likely that this a prelude to comments from the President in which he'll explain how he has "evolved" on this issue. That seems much more likely - and much smarter. A firm stance in defense of Social Security - and then Medicare - could be spun off into a number of winning themes for the White House, such as:

Of course, the White House could say all the right things about Social Security - and then make that December deal and cut it anyway. But when candidates "flat out guarantees" something, that gives citizens a lot of leverage to pressure them with after the election. Citizen action was able to stop the President from offering Social Security cuts in his 2010 State of the Union message. It can work again, especially if the White House makes a clear stance like this a central part of its campaign. Could there be a fight in December? Sure -- but this makes it much more likely that we could win that fight. And enough talk about fighting. Let's have a swords-into-plowshares moment. Right now I'm givin' it up for Joe Biden and the Administration. Biden said the right thing, and he said it straight up, without weasling or waffling. Keep on saying it, Mr. Vice President, and get the President and the rest of the team to join you. Everybody will win that way.

Say it is so, Joe, and we'll be right behind you.

Demeter

(85,373 posts)National media attention has focused on Rep. Paul Ryan’s (R-WI) drastic restructuring of the Medicare program, detailing the Vice Presidential candidate’s efforts to transform the current benefit guarantee into a “premium support” program for future enrollees.

But Romney/Ryan’s most devastating changes would impact programs that serve society’s most vulnerable citizens. American who rely on Medicaid, food stamps and Pell grants won’t be afforded the luxury of retaining their existing benefits, should Romney and Ryan implement their plans; these programs would experience immediate reductions if the Ryan budget becomes law (via CBPP):

1. CUTS FOOD STAMPS BY $133 BILLION: Ryan’s budget would send the Supplemental Nutrition Assistance Program (SNAP, or food stamps) back to the states as a block grant and cut the program by $134 billion. According to the Center on Budget and Policy Priorities, “an average of almost 10 million people would have to be cut from the program in the years from 2016 through 2022 to achieve the required savings.” If the cuts were to come from benefits, rather than kicking families out of the program, “All families of four — including the poorest — would see their benefits cut by about $90 a month in fiscal year 2016, or more than $1,100 on an annual basis.” Ryan continually claims that the food stamp program is “unsustainable,” even though the numbers show that’s simply not the case.

2. CUTS MEDICAID BY 1/3%: Ryan would treat Medicaid in the same way: transform the exiting matching-grant financing structure into a pre-determined block grant that will not keep up with actual health care spending and send it back to the states. This would shift some of the burden of Medicaid’s growing costs to the states, forcing them to — in the words of the CBO — make cutbacks that “involve reduced eligibility for Medicaid and CHIP, coverage of fewer services, lower payments to providers, or increased cost sharing by beneficiaries—all of which would reduce access to care.” The reductions to Medicaid kick in right away: between 2013 and 2022, the budget makes $1.4 trillion in cuts to Medicaid —a 34 percent reduction. As a result, states could reduce enrollment by more than 14 million people, or almost 20 percent—even if they are were able to slow the growth in health care costs substantially.

3. 30 MILLION AMERICANS WOULD LOSE HEALTH COVERAGE: Romney and Ryan would repeal the Affordable Care Act, including the subsidies for middle-class Americans to purchase coverage and the expansion of the Medicaid program for lower-income Americans. As a result, more than 30 million Americans would lose access to insurance. The popular regulations that prohibit insurers from denying coverage to people with pre-existing conditions and rescinding coverage would also be repealed.

4. CUTS PELL GRANTS FOR 1 MILLION STUDENTS: Ryan consistently claims that increases in financial aid are driving up the cost of higher education, even though evidence doesn’t back him up. The budget Ryan authored, according to an analysis by the Education Trust, would eliminate Pell Grants entirely for one million students. In 2011, 74 percent of Pell Grant recipients had family incomes of $30,000 or less. These cuts would come despite the fact that the price of a college degree has skyrocketed 1,120 percent over the last three decades.

Demeter

(85,373 posts)By naming Paul Ryan as the Republican vice presidential nominee, Mitt Romney has endorsed what used to be known as "voodoo economics" — and restored that special brand of Republican superstition to the center of national debate.

To take Ryan seriously, as all too many pundits and politicians insist we must, requires everyone to behave as if the plans he produced as House Budget Committee chairman represent a meaningful effort to improve the nation's fiscal future. Sooner or later, however, real analysts will scrutinize the Ryan budget using honest math instead of humbug and magic. In fact, they already have done so — and that is where the myth of Ryan as a serious, scrupulous and bold reformer begins to disintegrate.

As close observers know, the Wisconsin congressman wants to cut taxes for the wealthiest Americans even more sharply than George W. Bush, whose tax policies caused the bulk of the deficits that provoke so much righteous anger among Republicans like Ryan today. In Ryan's budget, his tax cuts leave an enormous revenue gap, even with the absurdly destructive spending cuts he also proposes. But according to Ryan, we need not worry that his plan will increase fiscal deficits as well as the deficits it will assuredly worsen in infrastructure, education, health care, environmental quality, consumer protection and scientific research. He says that his tax cuts, which naturally favor the wealthiest Americans, will pay for themselves by creating a huge, rapid spurt of economic growth — which will result in higher tax revenues to cover the deficit. Where have we heard this before? There was the original Reagan version, and then later the Bush version, which relied on a gimmick called "dynamic scoring" to create the same fake equation. Ryan's version is updated slightly, claiming that if Congress removes enough loopholes and tax expenditures, the resulting spurt of growth will reach 5 percent, 10 percent or even more.

Let us turn now to the respected professionals at the Congressional Budget Office and the Center on Budget and Policy Priorities, who are too polite to simply laugh at Ryan. They took him seriously enough to examine his assertions with care, only to find that the research he cites doesn't support his assumptions — and that most economists still don't buy his theories. They also noticed that Ryan never specifies which loopholes and expenditures he expects to end. That must be why Romney, who has offered similarly foggy plans for tax reform, feels Ryan is such a kindred spirit...

Demeter

(85,373 posts)Generations of Americans have worked together to build our nation's Social Security system. Each citizen contributes through a lifetime of work, and each is entitled to claim an assured benefit to see him or her through retirement and old age, or in the event of a serious disability or the death of a working parent or spouse. The vast majority of Americans support this system, because it works. In an economy where most are dependent on wages, Social Security insures a worker and his or her dependents can continue to get a portion of those wages during old age or if death or disability strikes.

Much controversy currently surrounds a radical federal budget overhaul designed by Representative Paul Ryan of Wisconsin and overwhelmingly backed by House Republicans. The Ryan plan calls for trillions of dollars in cuts in Medicaid and other safety-net programs for low-income and disabled Americans. It also goes after Medicare, one of the pillars of middle-class retirement, aiming to turn it into a voucher system that would force the typical retiree to pay about $6,000 more per year just to get the same benefits Medicare now guarantees.

What about Social Security? Ryan would effectively gut that program, too, supposedly to address a looming national fiscal crisis. But in fact Social Security's long-term shortfall is manageable, and we need to invest more not less in this effective system.

How Ryan Plans to Undermine Social Security

Because Social Security is so popular, the 2011 Ryan budget backed by almost all House Republicans tip-toes around planned changes in the program -- and simply includes procedural changes that would "fast track" modifications and make it possible for legislators to accept them without full political accountability. When procedural tricks are put in place, we have to ask why. What changes do Representative Ryan and his colleagues have in mind? In each of the past two years, Ryan has issued documents about the GOP's long-term budget plans. Neither has the force of law yet, but the preferred changes in Social Security are clear:

• Along the lines of a proposal former President George W. Bush unsuccessfully advocated in 2005, Ryan would move toward giving all Social Security beneficiaries a basic pension set at a low level and largely unrelated to each person's prior wages. Beyond that, people would have to fend for themselves, supplementing their modest benefits from savings or paid work.

• Ryan praises the idea of increasing Social Security's early and normal retirement ages to ages 64 and 69 respectively -- and he would also further lift these ages in the future based on how much longer an average American lives. This may sound fair, but there are big drawbacks. Many workers who do jobs involving physical labor do not live anywhere near as long as lawyers or managers who sit in offices, so raising the age of eligibility for Social Security can take their retirement away. More important, though, for all older Americans, a higher age for claiming Social Security simply amounts to a big across-the-board benefit cut. A "retirement age" of 69 translates into approximately a 13 percent cut for everyone, even for workers who work until age 70 or beyond (and that cut would be in addition to the 13 percent cut that all Americans younger than 52 will experience because the retirement age is already scheduled to move to age 67 for them).

Ryan argues that individuals should save more for their retirement, and proposes allowing them to place in retirement savings accounts up to a third of what they now pay for Social Security. Savings accounts are a good thing, but we should never confuse savings and insurance. Social Security was designed to provide a certain core benefit that everyone can count on for all the years they live between retirement and the end of life. No individual can know how long that will turn out to be, and it is just not realistic to expect most people to save enough for all or most of what they may need over an uncertain span after employment. One can outlive savings but not an insurance annuity like Social Security. Inflation can devastate savings, but not Social Security benefits as Americans now know them, which are regularly adjusted for inflation. Unexpected drops in the stock market can greatly diminish the value of savings, but not Social Security...

Demeter

(85,373 posts)I keep hearing that Mitt Romney's pick of Paul Ryan "enables the country to have the debate it needs to have," or "permits us to have a grownup discussion," or "finally presents America with a real choice." The New York Times oped page proclaims: "Let the Real Debate Begin!"

Debate? What debate?

Romney isn't even standing by Ryan's budget plan. He's been distancing himself from it from the moment he tabbed Ryan for the ticket. "I'm the one running for President," he keeps saying in response to reporters' questions about whether he agrees with Ryan. Not even Ryan will say publicly what the Romney economic plan entails. "We haven't run the numbers yet," he repeats – as if there were numbers in the Romney plan to run. But the numbers in Romney's plan are like the numbers in Romney's tax returns — they're invisible to anyone who might have an interest in knowing.

But even if Romney were to adopt Ryan's budget plan intact we still wouldn't have a real debate because Ryan's own plan itself lacks specifics that add up. None of the budgets Ryan has come up with as chair of the House Budget Committee indicate which tax loopholes he'd close and exactly which programs for lower-income Americans he'd eliminate in order to balance the budget. Ryan claims that his revenue targets can be met by "broadening the tax base," but he hasn't said how he'd do it. He's insisted on keeping two of the biggest loopholes that overwhelmingly favor the wealthy —the preferential tax rates on capital gains and dividends.

In fact, Ryan's budget is larded with so much defense spending and so many tax cuts for the wealthy that it doesn't even lower the debt — when exposed to realistic assumptions. It baldly assumes that tax cuts for the rich will generate revenues totaling 18.4 percent of the economy over the next decade. That's supply-side nonsense. When the non-partisan Tax Policy Center looked at Ryan's budget plan, it calculated that revenues would average only 16.3 percent over the decade — $4 trillion less. Under that revenue estimate, Ryan's budget would increase debt as a share of the economy for more than four decades – pushing the public debt to over 175 percent of GDP by 2050...We can't even have a clear debate about programs like Medicare, because Romney and Ryan seem determined to sow as much confusion as possible about their proposed voucher system. (At least Romney says his own approach to Medicare is "almost identical" to Ryan's.) They've been charging all week that President Obama's Affordable Care Act "robs" Medicare of more than $700 billion over the next decade. In reality, the Romney-Ryan plan saves exactly the same amount. But it does so by shifting costs to seniors whose vouchers won't keep up with the projected cost of health care. Obama's savings come from reduced payments to medical providers. What's really driving Medicare costs – as well as future federal budget deficits – is the increasing costs of health care overall, combined with aging boomers. But don't expect a debate over how to rein in healthcare costs because Romney and Ryan haven't put forward a healthcare plan. All they want to do is repeal the Affordable Care Act, leaving 50 million Americans without health insurance coverage.

MORE RIGHTEOUS RAGE

**********************************************************

Robert B. Reich, one of the nation’s leading experts on work and the economy, is Chancellor’s Professor of Public Policy at the Goldman School of Public Policy at the University of California at Berkeley. He has served in three national administrations, most recently as secretary of labor under President Bill Clinton. Time Magazine has named him one of the ten most effective cabinet secretaries of the last century. He has written thirteen books, including his latest best-seller, “Aftershock: The Next Economy and America’s Future;” “The Work of Nations,” which has been translated into 22 languages; and his newest, an e-book, “Beyond Outrage.” His syndicated columns, television appearances, and public radio commentaries reach millions of people each week. He is also a founding editor of the American Prospect magazine, and Chairman of the citizen’s group Common Cause. His widely-read blog can be found at www.robertreich.org.

Demeter

(85,373 posts)Romney's team is trying to muddy the waters around Medicare, but they face an uphill climb.

In May, the Romney team promised a laser-like focus on the economy. But that was then and this is now. This week, Romney changed the conversation when he caved to his right flank and chose Paul Ryan as his running mate, a man known for a budget proposal that's so toxic voters in focus groups, “simply refused to believe any politician would do such a thing.”

BELIEVE IT, MY FRIENDS, AND THAT'S JUST FOR YEAR 1!

MUCH MORE AT LINK

Demeter

(85,373 posts)THE TEA PARTY IS ANOTHER INSTITUTION PAST ITS SELL DATE...SORRY, AUNTIE, BUT IT HAD TO BE SAID. YOU CAN STOP SENDING ME THOSE CREEPY FORWARDS IN EMAIL...

The message, put up earlier this month, was paid for by We the People of Marshall and Fulton counties, a tea party group. The head of the organization, Don Nunemaker of Plymouth, said late last week that the message was meant as a call for action at the ballot box on Election Day, Nov. 6.

He was vague about the threat voters are to “remove,” saying it’s up to individual voters to glean what they will from the message. He didn’t immediately return a call Monday seeking comment on the demonstration plans.

First, it's easily construed as a call for a military coup, which is as un-American as if gets. Second, these people believe they own the military and use it as a weapon against the rest of us. It's a very creepy dynamic.

That ad is by the same people who insisted that the Democrats are trying to keep military voters in Ohio from voting. This stuff is going on under the radar so far. This election won't be a national security election so I suppose it may not rise to the surface. But these wingnuts are keeping their partisan military fetish alive (as opposed to the more mainstream rah-rah of the Democrats which is bad enough) and it will come roaring back as soon as an opportunity presents itself.

If people think that Obama ordering bin Laden's death along with the rest of his tough national security policies have forever retired the advantage Republicans have on these issues, they need to ask Bill Clinton whether balancing the budget and leaving a surplus resulted in the Democrats never having to face the "tax and spend" label again.

Demeter

(85,373 posts)WELL, TECHNICALLY, FUKUSHIMA IS ALREADY "GONE", BUT THE CONSEQUENCES ARE FOREVER...

http://www.nationofchange.org/fukushima-they-knew-1345037631

Here was the handwritten log kept by a senior engineer at the nuclear power plant:

Wiesel was very upset. He seemed very nervous. Very agitated. . . . In fact, the plant was riddled with problems that, no way on earth, could stand an earth- quake. The team of engineers sent in to inspect found that most of these components could "completely and utterly fail" during an earthquake.

"Utterly fail during an earthquake." And here in Japan was the quake and here is the utter failure.

The warning was in what the investigations team called The Notebook, which I'm not supposed to have. Good thing I've kept a copy anyway, because the file cabinets went down with my office building ....

WORLD TRADE CENTER TOWER 1, FIFTY-SECOND FLOOR

MORE AT LINK

Fuddnik

(8,846 posts)Demeter

(85,373 posts)NOW THIS IS MORE THAN POSSIBLE...IT IS LIKELY THE REAL TRUTH BEHIND ALL HIS COYNESS. AS IF 13% TAX RATE (LESS THAN THE IMPOVERISHED) IS ACCEPTABLE.

http://truthout.org/buzzflash/commentary/item/11684-did-romney-possibly-commit-fraud-on-his-2009-taxes-but-received-amnesty

In a brilliant critique of an NBC interview with a defiant Ann Romney who disdainfully refused to release any further family income taxes, Lawrence O'Donnell raises the interesting prospect that the real smoking gun may be that the GOP presidential candidate committed a felony by sequestering taxable income offshore.

This is speculation, of course, because as Ann Romney has said, she and Mitt won't release more income taxes because it will provide the public with "ammunition." Of course, as O'Donell points out, there is only ammunition if there are improprieties.

Beyond Harry Reid's claim of informed knowledge that that Romneys have paid no income taxes for a period of ten years in the recent past, the most compelling possible scenario is that in 2008 many of the nation's 1% paid little or no income tax because they took large capital gain losses as offsets against capital gain profits due to the crash of Wall Street. Romney quite possibly, given his inclusion in the plutocracy, was among those who paid no income tax.

But, as O'Donnell pointed out, the year 2009 even looms larger on the horizon. (Remember that Romney has only released a 2010 income tax return with the vague offering to release his 2011 income taxes at some undesignated point in the future.) Given that most of Americans paid their taxes by August 15th, the indefinite delay in sharing his 2011 income taxes raises the question of why he just won't release his 2009 IRS filing, which is completed.

Here may be the answer: Romney may have taken advantage of a 2009 IRS amnesty period to disclose income hidden in offshore accounts but subject to US taxation. The amnesty offer allowed such persons to escape potential criminal prosecution for tax evasion...

Demeter

(85,373 posts)If this theory is incorrect and unfair to the Romneys, all Mitt has to do is release his 2009 returns to prove the contrary.

http://ih0.redbubble.net/image.11599248.7572/sticker,375x360.png

Demeter

(85,373 posts)SO WE ARE JUST GOING TO HAVE TO FIGURE OUT HOW TO MAKE THEM CARE--EVEN IF IT MEANS REPLACING THEM WITH US!

http://www.motherjones.com/kevin-drum/2012/08/congress-really-truly-doesnt-care-about-middle-class

Martin Gilens has done some very interesting work on the way that politicians respond to public opinion, and his key result is that Congress doesn't really care much about the poor (no surprise) and cares only modestly about the middle class (a bit of a surprise). What they care about are the upper middle class and the rich.

Today he puts up a chart that gives this result a bit more nuance. The blue bars represent middle-income voters, and during election years they have a moderate amount of influence. Not as much as the well-off, but when an election is imminent politicians pay at least some attention to the preferences of the middle class (and, to a smaller extent, the poor).

So when do the rich get their payoff? Answer: during non-election years, when no one is paying attention. In those years, members of Congress respond solely to the preferences of the well-off. What's more, laws passed during non-election years are more durable:

To summarize: In election years we throw a few sops to the 90%. During non-election years, we cut back the funding for those sops and pass the legislation that the top 10% want passed. Welcome to America.

Demeter

(85,373 posts)HE'S PROBABLY THE LAST HONEST REGULATOR/ADMINISTRATOR IN DC, AND ALAS, HE MUST BE GOING....

http://www.reuters.com/article/2012/08/14/us-usa-drought-lending-idUSBRE87D0VE20120814?feedType=RSS&feedName=domesticNews

U.S. agriculture has plenty of financial reserves to get through the worst drought in more than 50 years, the top regulator of U.S. farm banks says. But Leland Strom, chief executive officer of the Farm Credit Administration, said the drought now affecting more than half of U.S. counties has set off alarm bells across the government as grain prices soar, livestock and ethanol and dairy producers are squeezed, and food inflation fears rattle economic planners.

"This has a potentially longer term impact because of that 3, 4, 5 percent rise in food prices," Strom told Reuters in an interview, referring to recent food inflation estimates by the U.S. Agriculture Department and Federal Reserve.

"I don't think it's very often that Treasury officials talk inside the halls of the Treasury about agricultural issues every day. But I think they are doing that right now."

Strom, who took over leadership of FCA in 2008 just months before the U.S. financial crisis shook the economy, has guided the government-sponsored entity (GSE) to its strongest financial position in history. FCA oversees the Farm Credit System (FCS) -- a network of 85 banks and associations across the country with $180 billion in loans that account for about half of all lending to U.S. farmers. FCS has also built up a capital reserve of $32 billion. But Strom, whose term ends on October 13, said that looking ahead he was concerned about the climate - both the political and the environmental.

This summer's stalemate in Congress over finishing a new five-year U.S. farm bill does not bode well for negotiations on big tax hikes and spending cuts due at end-year, especially with the November election hardening postures in Congress, he said.

"I know the staffs of the ag committees are supposedly back in Washington working furiously while all the members of the chambers are out on the August recess," Strom said. "They have got 12 or 13 legislative days on the calendar between now and the election. That's not a big time window for them to finish a farm bill."

The current farm bill expires on September 30.

"For farmers and ranchers the only thing they really ask for is: give us certainty so we know and can plan to put in this coming fall's wheat crop, plan for next spring's corn and soybean crop, rice crop. Give us some idea of certainty," said Strom, who owns a farm in northern Illinois...

"When I look at the European Union debt situation and our fiscal cliff looming here at the end of this year and what potential market disruption could occur down the road, I'm quite concerned as a regulator that we need to get our house in order in the U.S.," Strom said.

FCS raises funds through debt securities, not deposits, so Strom is worried that foreign and domestic investors will hammer U.S. securities including GSE notes if Congress does not act.

Egalitarian Thug

(12,448 posts)Groucho (and the Marx Bros. in general) always rate a rec!

Egalitarian Thug

(12,448 posts)Demeter

(85,373 posts)I am immensely fond of the Marx brothers...which is ridiculous, on the face of it.

I keep wondering where MattSh is...

Demeter

(85,373 posts)We finally know the real winner of the euro crisis. It's Australia.

Would you believe it if I told you that Australia's financial sector is worth more than the eurozone's financial sector? Well, it doesn't matter if you believe it or not. It's true. The technical term for this is "jaw-dropping." The chart below, from Cullen Roche of Pragmatic Capitalism, puts it all in rather stunning picture perspective. It turns out that depressions aren't so good for banks.

A big chunk of this shouldn't surprise us. European banks loaded up on subprime debt. Australian banks didn't. European banks made their own bad real estate loans. Australian banks didn't. And European banks are sitting on top of piles of dodgy sovereign debt. Australian banks aren't.

But this doesn't really make sense. It explains why Europe's financial sector fell much more in 2008 than Australia's financial sector did, but it doesn't explain why Europe's has kept falling and Australia's hasn't. The answer, as always, is that it's about the economy. Commodity exports -- thanks, China! -- have powered Australia, while the eurozone has self-immolated in a crisis of the common currency. What does that have to do with banks? Well, financial contracts assume that incomes will steadily go up. When incomes -- and the economy -- do not grow as expected, debts that should not have gone bad go bad.

Something incredibly bad and incredibly rare has happened to Europe's periphery since 2008. The total size of their economies have fallen. So-called nominal GDP, which is just inflation plus real growth, usually increases 5 percent a year -- and that's what banks count on when they make loans. If the economy grows less than that, otherwise creditworthy borrowers will have a harder and harder time paying back their debts. Including governments. The chart below looks at nominal GDP "growth" (or lack thereof) in Australia and Europe's periphery since 2008. As Evan Soltas said, Europe's problems are nominal.

Australia's nominal GDP has grown at a healthy rate. Europe's has not. That simple fact explains why Australia's banks have rebounded from the financial crisis and Europe's banks have not. Until or unless Europe gets its nominal GDP back to something close to trend, its financial sector will keep falling behind Australia's (and everybody else's). In other words, Europe's banking crisis will only end when Europe's economic crisis does -- which in turn is being held back by its banking crisis. It's a never-ending cycle of awful that only the European Central Bank can break. Maybe they will.

PERSONALLY, I WOULDN'T BET ON IT.

Demeter

(85,373 posts)This crisis is not going away. Officially begun late in 2007, nearly five years later, no end is in sight. Trillions in government-funded bailouts and interventions failed to do the trick. The private sector's hyped resilience disappeared. "Recoveries" proved weak, uneven and short-lived. The president who rode the crisis into power risks being ridden out by its persistence.

It is difficult to imagine and impossible to count all the costs of this persistence. Consider, just for examples, (1) damaged physical and mental health of the unemployed, (2) rising anxiety about increasingly insecure jobs and benefits, (3) strained and destroyed relationships, (4) interrupted or aborted educations and (5) lost skills and job connections. Consider, too, the gross inefficiencies (tens of millions of unemployed alongside trillions in unused raw materials, tools, equipment, offices, factories and stores; millions of empty homes alongside millions of people rendered homeless by the crisis).

Five major reasons shape this crisis's persistence:

The success of those campaigns yields the current situation. No opposition yet exists (the Occupy movement is a first step) comparable to what was achieved in the 1930s and early 1940s. Having first destroyed its working class' defensive organizations, US capitalism now can and does impose on that class the immense social costs of its latest extreme periodic convulsion. Hence, the crisis persists and becomes a central economic and political issue of our time.

********************************************

Richard D Wolff

Richard D. Wolff is Professor of Economics Emeritus, University of Massachusetts, Amherst where he taught economics from 1973 to 2008. He is currently a Visiting Professor in the Graduate Program in International Affairs of the New School University, New York City. He also teaches classes regularly at the Brecht Forum in Manhattan. Earlier he taught economics at Yale University (1967-1969) and at the City College of the City University of New York (1969-1973). In 1994, he was a Visiting Professor of Economics at the University of Paris (France), I (Sorbonne).

Fuddnik

(8,846 posts)Fuddnik

(8,846 posts)

xchrom

(108,903 posts)

xchrom

(108,903 posts)UK companies are slowing, amid signs that the shareholder rebellion against excessive pay packages is influencing decisions on remuneration.

Total pay growth among FTSE 100 chief executives slowed last year to an average of 14 per cent and a median of 8.5 per cent to stand at £3 million, according to Incomes Data Services, the research group.

This was much lower than an earlier report on director’s pay published in October, which showed an average rise of 43 per cent to £3.86 million for chief executives, IDS said.

If median figures are used – the halfway point between the largest and smallest rise - the October report recorded an increase calculated at a more modest 16 per cent.

xchrom

(108,903 posts)Once again this year, Sigmar Gabriel joined with the unions in demanding an increase in taxes paid by the wealthy to ensure a fairer distribution of the burden of the crisis. For the social-democrat leader, the imposition of further demands on the rich is a matter of “social patriotism”. However, at the other end of the political spectrum the Christian-Democrats and the liberals were quick to step up to the plate to defend the better off, and to accuse Gabriel of wheeling out a well-worn socialist routine. As a result, debate on this issue has now assumed the wearisome air of an electoral squabble.

But we should not be beguiled by this impression. Over the years, the issue of growing disparities in wealth and incomes has evolved to the point where it is no longer a simple matter of equality. The reality is that these disparities are one of the main causes of the current crisis.

The increase in wealth that is concentrated in the hands of a small minority has meant that a considerable proportion of national income is now feeding a demand for financial products, and reducing the level of investment in goods and services.

Foolhardy investments

The well-off in Europe invest in bonds issued by banks, property companies and states, like Ireland, Portugal, Greece and Spain, which offer attractive rates of interest. In so doing, they have financed ill-judged investment on an enormous scale – the construction of housing and motorways that remain unused and other foolhardy infrastructure projects – that these countries would never have been able to undertake on their own.

xchrom

(108,903 posts)NEW YORK (AP) -- It's not just in your head. Mondays really are the worst.

Monday is the only day the stock market is more likely to fall than to rise. The Dow Jones industrial average has been down 10 of the past 11 Mondays. And the two worst days in market history are both known as Black Monday.

There's no single reason why Mondays are so blue. Then again, there's no single reason the market rises or falls on any given day, driven as it is by the whims of traders placing millions of individual buy and sell orders.

Some anecdotal evidence comes to mind: Companies are prone to release bad news on Friday nights, when fewer people are paying attention. Monday is the first day investors can react.

xchrom

(108,903 posts)Carthage, Tunisia

Wikileaks founder Julian Assange has made an admirable habit of enraging western governments over the last few years, particularly the United States.

Most notably, his release of classified diplomatic documents in 2010 proved ruthlessly embarrassing, shining a spotlight on the absurd, petty little world of international relations.

Ever since, the US government has done everything it can to stop him. Short of assassination. They shut down his website, but mirror sites instantly popped up. They sought legal action, but their efforts have been impeded by the bureaucratic deftness of his attorneys. They froze his bank accounts… but donations have poured in from all over the world.

Along the way, Uncle Sam co-opted a number of allied nations to set aside their principles for the sake of US interests–Switzerland rolled over immediately and shuttered Assange’s bank accounts.

Australia (his home country) has remained conspicuously silent on the matter, raising not a single word of protest in his defense. One high ranking Aussie politician even publicly suggested that Assange should be killed.

Read more: http://www.sovereignman.com/expat/the-west-has-just-become-a-giant-banana-republic-8497/#ixzz23tZJ8H9j

Fuddnik

(8,846 posts)How long can it be before El Presidente sends in Seal Team Six?

xchrom

(108,903 posts)xchrom

(108,903 posts)The number of bad loans listed at Spanish banks jumped to a record high level in June, according to figures released Friday by the Bank of Spain.

The historic figure was registered during the same month that the Spanish government asked the European Union for a bailout for its financial institutions.

The value of dubious credit jumped to 164.36 billion euros in June, which is equal to an unprecedented 9.42 percent of the banks’ total loan portfolio, central bank said.

This figure was up sharply from the 8.96-percent share of total loans recorded in May, and was the largest bad-loan ratio recorded since the central bank began compiling the series of data in 1962.

xchrom

(108,903 posts)

Shouting "workers united to fight unemployment," more than 400 farm laborers began on Thursday the first of a series of long marches across the Andalusia region, which will take them to a number of different provinces over the coming days.

The first stage of the march, some 20 kilometers between the towns of Jódar and Jimena, was led by United Left (IU) coalition mayor and regional deputy Juan Manuel Sánchez Gordillo, and the leader of the Andalusian Union of Workers (SAT), Diego Cañamero. Several SAT members were arrested last week for their Robin Hood-style looting of supermarkets in Écija and Arcos de la Frontera.

"We want a special plan for employment in the fields, the turning over of public farms that are not being used, and a basic income for the 350,000 families in Andalusia who don't have any type of financial protection," said Sánchez Gordillo, who was one of the instigators of the supermarket raids. The IU politician hasn't been charged given his immunity as an elected official.

"Squatters"

The laborers are also demanding that the government stop throwing off families who have been squatting on empty plots owned by the state. Some of the "squatter" families, including children, are taking part in the marches.

DemReadingDU

(16,000 posts)Eerily quiet around the Internets, at least where I've been reading.

Demeter

(85,373 posts)I'd like to make that permanent. It's much more peaceful and productive that way.

Expect all hell to break loose in September. After Labor Day, if they are feeling fear or charitable, before if TSHF is bad for Obama.

Demeter

(85,373 posts)...I wonder if voters and candidates might benefit if more politicians took real vacations. If they went somewhere, for at least a short time, where no one knows them; where they don't have to ask for votes, money or spout talking points.

Politicians from, say, Muleshoe, Texas, might go to the South Side of Chicago; and politicians from Santa Monica could go to Mussel Shoals, Ala. They might feel free to wear something brightly patterned in Hawaii — or something sombre in charcoal gray, if they're from Hawaii. They can dribble hot sauce on their T-shirts, and sit on a rock and stare into space without worrying about NASA's budget.

They can talk to people without trying to impress them, and listen to people without trying to figure a way to agree with them. They can dabble and dip into whatever — knitting, wind-surfing or flower arranging — without worrying that someone will draw some inference from something they do for fun.

Instead of reading important policy tomes or history to instruct and inspire them, a politician might feel free on vacation to go to a yard sale and pick up a trashy book — take that any way you like — a bodice-busting romance, a sinister thriller or old P.G. Wodehouse stories featuring Gussie Fink-Nottle...

Demeter

(85,373 posts)Aries (3/21-4/19)

Not every day can be a great day, as these next 24 hours may prove to you. Aside from an overall lack of pizzazz in your environs, there won't be much development in any of your projects. But one dud of a day doesn't have to get your down. After all, variety is the spice of life -- and not every spice is delicious. Treat this day as simmer time on a stew that will eventually be quite delicious. Be patient and trust that when things are meant to be, they'll be.

xchrom

(108,903 posts)

Demeter

(85,373 posts)I'm not sure about anything.

xchrom

(108,903 posts)(Reuters) - Smaller euro zone countries that have retained top credit ratings through the region's crisis squabbled on Friday over whether struggling nations like Greece that threaten the currency union's stability should be kicked out.

Top Austrian and Finnish politicians insisted they were committed to keeping the union intact after ministers from junior coalition parties said they were preparing for a break-up of the bloc, or called for countries that broke promises to be thrown out.

The mixed messages contrasted with a show of solidarity late on Thursday from western Europe's most powerful politician, German Chancellor Angela Merkel, which raised investor hopes that the bloc might finally be getting a grip on its problems.

Speaking in Ottawa, she said declarations from European Central Bank President Mario Draghi, who last month pledged to do whatever it took to save the euro, were "completely in line" with the approach taken by European leaders.

Demeter

(85,373 posts)Austrians AND Finns are prideful folks. That's about all they have...

(bitter ex-wife of a Finn, speaking from experience)

Demeter

(85,373 posts)It appears that Biden may have been allowed to go off the reservation because--to put it bluntly--the Democratic ticket is facing massive defeat in November.

I REALLY HATE THE IDEA OF USING SOCIAL SECURITY AS A HAIL MARY PASS!

I think it is cynical, despicable, disrespectful of the People AND the Process, akin to not prosecuting banksters, to undoing Glass-Steagal, to night-time bombings in Cambodia. If Social Security had been respected as the Third Rail it is, things would not have gotten to this point in the first place.

It is inherently un-Democratic.

And IMHO, it's probably too late.

And so many kool-aid drinkers wonder why Obama isn't better loved...

While one COULD make the case for n-dimensional chess, this is people's lives he's playing with. There was no sign that the joyride to destruction of the middle class was going to be derailed in the end, until the GOP put Paul Ryan, the official clown of the GOP's intellectual pretensions, on the ticket.

Oh, and that op-ed? You can read it here:

http://www.nytimes.com/2012/08/18/opinion/blow-dark-road-to-the-white-house.html

One would have hoped that ONE party could have taken the High Road...wouldn't it have been better to win an election because of who you are and what you've done, not because one was "the lesser of two evils"?

kickysnana

(3,908 posts)kickysnana

(3,908 posts)Demeter

(85,373 posts)kickysnana

(3,908 posts)Today is just not a good day for such a decision. Thanks though.

Demeter

(85,373 posts)I thought we were talking astrology, not fundraising....![]()

I don't donate more than my time and effort. If that's not enough for Skinner, it's his loss.

kickysnana

(3,908 posts)Demeter

(85,373 posts)Demeter

(85,373 posts)...This thought flashed through our minds yesterday while reading this article in Spiegel Online....

http://www.spiegel.de/international/business/investors-preparing-for-collapse-of-the-euro-a-849747.html

The story looked at some banks and companies in Europe preparing for a collapse of the euro, which could have the perverse effect of helping to bring about currency’s crash....That sparked a thought in our usually sugar-addled minds: Would the euro effectively cease to function before it was officially recognized? What’s the point of having a cross-border common currency if nobody will take it across their borders? This gets to the heart of what makes a currency work. What makes a so-called fiat currency like the euro (and the dollar, for that matter) work is the faith of the people using it. Greece’s expulsion from the euro has gone from being an unmentionable to being widely expected. If and when that happens, the only question will be how many other dominoes fall...

Keep an eye on this, because it sounds like a meme in progress. Over at MarketWatch, Matthew Lynn takes the thought one step further, arguing that the euro is dead already:

This is more than just a semantic point. It is also important for investors to grasp.

When a currency stops working the damage done to the economy is immediate. Trade stops flowing. Investment gets postponed. Capital flees. Very quickly, unemployment starts to rise, and output declines.

That is precisely what is happening in the euro zone right now.

Lynn notes London real-estate agents are getting “non-stop” calls from wealthy euro-zone property buyers looking for a safe place to park their money, and that Swiss banks are stuff with money exiting Italy and even Germany. “Everybody with any significant wealth wants at least part of it outside the euro zone because they are worried the currency might one day implode.”

MORE

Demeter

(85,373 posts)The Washington Supreme Court ruled unanimously ... that the mortgage industry’s controversial document-recording system lacked authority to start out-of-court foreclosures and might have violated state consumer protection laws. The state’s highest court ruled that lenders could not foreclose on homeowners in the name of the Mortgage Electronic Registration Systems Inc. It found that MERS did not meet Washington's definition of a beneficiary and could not foreclose on behalf of a lender that holds the mortgage note.

“Simply put, if MERS does not hold the note, it is not a lawful beneficiary,” the court wrote in an opinion written by Justice Tom Chambers and released today.

The Oregon Supreme Court also is considering whether MERS can be a beneficiary under Oregon law, said Rick Fernandez, an attorney in Lake Oswego whose cases are before the court...In July, the Oregon Court of Appeals ruled that lenders could not use MERS to skirt state law requiring that all mortgage sales be recorded in county offices before launching out-of-court foreclosures.

Washington's court today also found that MERS's involvement in robo-signing mortgage documents, among other behaviors, appeared to violate Washington’s Consumer Protection Act. But consumers must try such claims on a case-by-case basis, the court said...MERS spokeswoman Janis Smith noted that Thursday's decision applies only to non-judicial foreclosures done outside a courtroom, the process lenders typically use. MERS voluntarily changed its rules in July 2011 to stop foreclosures in its name, she said.