General Discussion

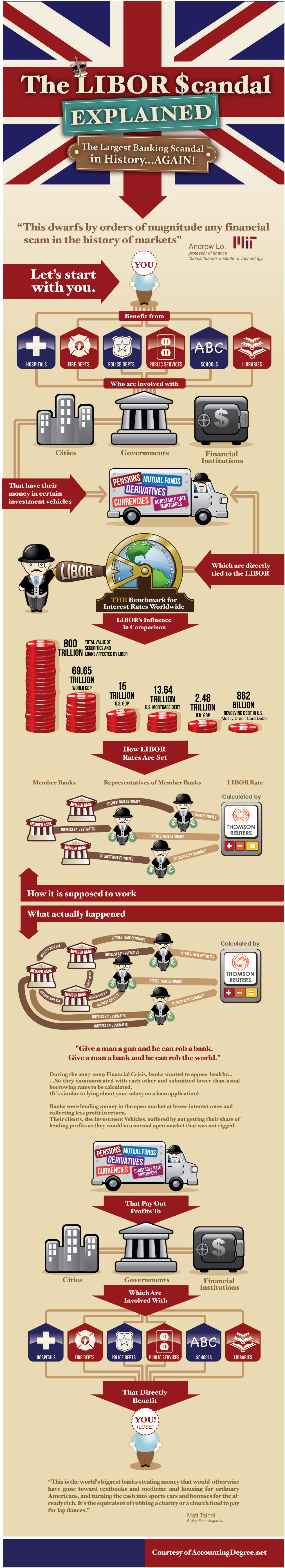

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe LIBOR scandal explained in an infographic

http://4closurefraud.org/2012/07/10/infographic-the-libor-candal-explained-the-largest-banking-scandal-in-history/

KansDem

(28,498 posts)Short of storming the penthouse office suites and hauling the crooks out into the street for "public humiliation?"

Zalatix

(8,994 posts)Hey, we on the DU said this of the Greeks and it's just as applicable to us as it is to them. (As in, absolutely not at all.)

senseandsensibility

(17,000 posts)I hope everyone looks at this.

Huey P. Long

(1,932 posts)New York Times, Gretchen Morgenson Applaud British, Issue Challenge To American Regulators Over LIBOR Scandal

July 9, 11:17 AM ET

By

Matt Taibbi

Morgenson's piece from Saturday, "The British, at Least, Are Getting Tough," wonders aloud why American regulators – Ben Bernanke, cough, cough – don't take a similarly stern approach with our own corrupt bank officials. First, she summarizes what seems to be the mindset of American officials:

"Dirty clean" versus "clean clean" pretty much sums up Wall Street’s view of cheating. If everybody does it, nobody should be held accountable if caught. Alas, many United States regulators and prosecutors seem to have bought into this argument.

This viewpoint has been particularly in evidence since 2008. Time and again, American regulators have appeared to be paralyzed by corruption in cases when most or all of the banks have been caught raiding the same cookie jar. From fraudulent sales of mortgage-backed securities, to Enronesque accounting, to Jefferson-County-style predatory swap deals, to municipal bond bid-rigging, the strategy of American regulators has been to accept "Well, everybody was doing it" as a mitigating factor when negotiating settlements, where that should have made them want to crack the whip even harder.

Why? Because "everybody is doing it" corruption is way more dangerous than corruption involving one or two rogue firms going off-reservation. Regulators who spot that kind of industry-wide problem, to say nothing of cartel-style anticompetitive corruption, should be in a panic: They should always impose serious, across-the-board punishments, and it goes without saying that senior executives responsible have to be removed.

This is exactly what has begun to happen in England, now that the British have gotten wind of this LIBOR scandal, which involves the worst and most serious form of corruption – huge companies acting in concert to fix prices/rates. As the Times explains:

-

http://www.rollingstone.com/politics/blogs/taibblog/new-york-times-gretchen-morgenson-applaud-british-issue-challenge-to-american-regulators-20120709

Trailrider1951

(3,414 posts)Kick for the morning people. Thank you marmar for posting this!