General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forums15 Fortune 500 Companies Paid No Federal Income Taxes in 2014

15 Fortune 500 Companies Paid No Federal Income Taxes in 2014

By Eric Pianin - April 9, 2015

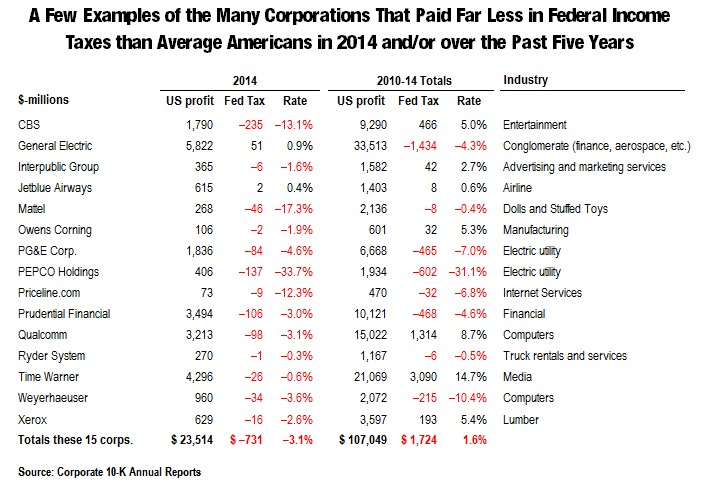

Amid calls for a major overhaul of the federal tax system, a new study shows that 15 major Fortune 500 companies avoided paying taxes on $23 billion in profits in 2014.

Moreover, these companies -- including CBS Corporation, Mattel, Prudential and Ryder System -- paid almost no federal income tax on $107 billion over the past five years.

According to the study by Citizens for Tax Justice, all but two of the companies received federal tax rebates last year. And almost all paid exceedingly low effective tax rates over five years.

There was nothing illegal or improper about what these companies did. They were merely taking advantage of major corporate tax loopholes and provisions long part of the fabric of the U.S. tax code.

~Snip~

http://www.thefiscaltimes.com/2015/04/09/15-Fortune-500-Companies-Paid-No-Federal-Income-Taxes-2014

jberryhill

(62,444 posts)I wonder how that's working out for them.

ProfessorGAC

(64,995 posts)While i'm sure we could corroborate these numbers elsewhere, seems to cast aspersions on the premise when they have Xerox in the lumber business.

FailureToCommunicate

(14,012 posts)not actually discrediting the validity of the analysis.

jberryhill

(62,444 posts)...it just seems that whomever put the table together was sloppy.

But whether that sloppiness carries over into the figures - who knows?

The thing that gets me about these kinds of analyses is exemplified by GE on the list.

We applaud when candidates say "We want to encourage clean energy!" Yay!

GE is in the wind turbine business so, sure, they probably benefit from all kinds of clean energy incentives.

So when we see "GE benefits from tax rules favoring clean energy".... Booo!

Same probably goes for Weyerhauser and all the trees they plant.

Faux pas

(14,665 posts)My Good Babushka

(2,710 posts)this is right above a Clinton group thread singing the praises of GE, upholders of our "moral fabric", five year tax rate of NEGATIVE 4.3%. Wonder if they'll see that.

jberryhill

(62,444 posts)Yes or no - should the US government set up financial incentives to promote renewable energy?

think

(11,641 posts)just a portion of the overall mix GE uses to avoid paying taxes. They have become masters at creating strategies for this sole purpose.

By DAVID KOCIENIEWSKI - MARCH 24, 2011

General Electric, the nation’s largest corporation, had a very good year in 2010.

The company reported worldwide profits of $14.2 billion, and said $5.1 billion of the total came from its operations in the United States.

Its American tax bill? None. In fact, G.E. claimed a tax benefit of $3.2 billion.

~Snip~

While General Electric is one of the most skilled at reducing its tax burden, many other companies have become better at this as well. Although the top corporate tax rate in the United States is 35 percent, one of the highest in the world, companies have been increasingly using a maze of shelters, tax credits and subsidies to pay far less.

~Snip~

Over the last decade, G.E. has spent tens of millions of dollars to push for changes in tax law, from more generous depreciation schedules on jet engines to “green energy” credits for its wind turbines. But the most lucrative of these measures allows G.E. to operate a vast leasing and lending business abroad with profits that face little foreign taxes and no American taxes as long as the money remains overseas.

~Snip~

The assortment of tax breaks G.E. has won in Washington has provided a significant short-term gain for the company’s executives and shareholders. While the financial crisis led G.E. to post a loss in the United States in 2009, regulatory filings show that in the last five years, G.E. has accumulated $26 billion in American profits, and received a net tax benefit from the I.R.S. of $4.1 billion.

But critics say the use of so many shelters amounts to corporate welfare, allowing G.E. not just to avoid taxes on profitable overseas lending but also to amass tax credits and write-offs that can be used to reduce taxes on billions of dollars of profit from domestic manufacturing. They say that the assertive tax avoidance of multinationals like G.E. not only shortchanges the Treasury, but also harms the economy by discouraging investment and hiring in the United States.

~Snip~

Value to Americans?

While G.E.’s declining tax rates have bolstered profits and helped the company continue paying dividends to shareholders during the economic downturn, some tax experts question what taxpayers are getting in return. Since 2002, the company has eliminated a fifth of its work force in the United States while increasing overseas employment. In that time, G.E.’s accumulated offshore profits have risen to $92 billion from $15 billion.

~Snip~

Read more:

http://www.nytimes.com/2011/03/25/business/economy/25tax.html

My Good Babushka

(2,710 posts)Renewable startups in the U.S., that pay taxes in the U.S. and hire U.S. citizens and get their equipment manufactured in the U.S. should definitely get incentives. Multi-billion dollar global corporations that shield themselves from taxes, no. If they want to take a risk and expand into renewable energy, they are well able to absorb that risk. If we want competition we can not keep armoring enormous global corporations with subsidies and tax incentives that obliterate green start-ups, smothering real U.S. economic growth in the cradle.

lpbk2713

(42,753 posts)Their profits greatly outweigh their "taxes".

Link:

Initech

(100,063 posts)silvershadow

(10,336 posts)Land of Enchantment

(1,217 posts)major news media are represented here. I'm going to bookmark this thread so I can really study it later. Thanks!

lancer78

(1,495 posts)If it is Gross Profit, then I see no problem with the amount of taxes paid. One thing to remember, is that if a company suffers losses in one year, they can carry that loss forward for 10-20 years to reduce their future tax bills.

Jopin Klobe

(779 posts)... kind of like this? ...

"On Monday of this week, the US Department of Justice announced that BP will pay $20 billion in civil and federal penalties and fines resulting from its role in the oil spill. This total amount was approved by Judge Carl Barbier who has overseen much of the litigation from the Deepwater Horizon disaster. Judge Barbier ordered that the $20 billion, which includes a $5.5 billion Clean Water Act violation fine, be paid out over 16 years at a rate of $1.3 billion per year."

"But here's the story that the Justice Department didn't want the public to know: 75% of this fine is tax deductible for BP, meaning that US taxpayers will foot most of the bill for the largest oil spill in history."

[link:http://www.truth-out.org/opinion/item/35553-corporate-and-political-corruption-the-lessons-not-learned-from-the-deepwater-horizon-disaster|

lancer78

(1,495 posts)almost all business expenses are tax-deductible. Which is a good thing. If a business was taxed by its gross instead of net, then you would have a lot of companies unable to pay their tax bill at all. I am surprised it is only 75%. It should be 100%.

Bonhomme Richard

(9,000 posts)corporate taxes are too high.

I am so tired of the bullshit.