General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe Insanity of Not Having a Financial Transaction Tax

http://www.commondreams.org/view/2013/07/22-1

The logic for the tax is indisputable:

1. Financial industry speculation devastated middle-class homeowner wealth.

2. U.S. investors pay zero tax on their speculative transactions.

3. The tax is easy to implement, and is very successful in other countries.

The emotional appeal reaches most of America:

Why should the rest of us pay up to 10% on the necessities of life while risky derivative purchases aren't taxed at all?

Why should kids around the country lose their arts programs while trillions of dollars flow, untaxed, to Wall Street?

On July 8th, 2013, Chicago Political Economy Group (CPEG) member Bill Barclay and Illinois Green Party Chair Rich Whitney presented arguments for the Financial Transaction Tax (FTT) in front of the Illinois Pension Reform Committee. The video is available here (01:29:40), and the slideshow here. Much of the following derives from their work.

byeya

(2,842 posts)Tamps the worst excesses of the stock/bond manipulators.

pampango

(24,692 posts)France, Germany, Spain, Belgium, Finland spoke in favor of the EU proposal. Austria and Spain are also known to support an EU FTT. Nations that oppose the proposal include the United Kingdom, Sweden, the Czech Republic and Bulgaria. Particularly the UK government has expressed strong views about the negative impact of the tax and is expected to use its power of veto to block the implementation of this proposal, unless the tax was to be introduced globally. The likelihood of a global FTT is low due to opposition from the United States. As a way out, advocates of the FTT such as the finance ministers from Germany, Austria and Belgium have suggested that the tax could initially be implemented only within the 17-nation eurozone, which would exclude reluctant governments like the United Kingdom and Sweden. If adopted, the EU FTT would come into effect on 1 January 2014.

In October 2012, after discussions failed to establish unanimous support for an EU-wide FTT, the European Commission proposed that the use of enhanced co-operation should be permitted to implement the tax in the states which wished to participate. The proposal, supported by 11 EU member states representing more than 90% of Eurozone GDP was approved in the European Parliament in December 2012 and by the Council of the European Union in January 2013 with 4 EU members abstaining: Czech Republic, Luxembourg, Malta and the UK. On 14 February, the European Commission put forward a revised proposal for the details of the FTT to be enacted under enhanced co-operation. This proposal must be unanimously approved by the participating states and be reviewed by the European Parliament before coming into force EU member states which have not signed up to the FTT are able to join the agreement in the future.

In June 2013, the Commission announced that a January 2014 launch for the FTT was no longer realistic, but that that it "could still enter into force towards the middle of 2014."

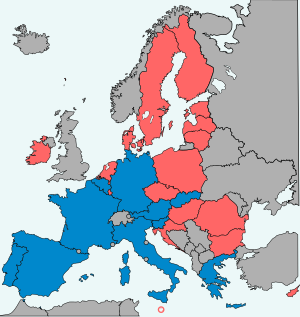

EU Financial transaction tax

Blue - EU members participating

Red -- EU members not participating

http://en.wikipedia.org/wiki/European_Union_financial_transaction_tax

YarnAddict

(1,850 posts)so I'm just asking. Wouldn't that affect our 401k's. IOW, wouldn't that tax be passed onto participants in programs like 401k's that a lot of us are relying on to supplement retirement income? If so, bad idea, IMHO.

byeya

(2,842 posts)you won't feel an appreciable impact.

The big traders buy 1000s of shares, hold them for minutes, and trade them for a slight profit per share but a sizeable profit in aggregate. It's done with high speed computers and crashed the market temporarily about 4 years ago. Your 401k, if it's in honest hands or if you manage it yourself, will be hard pressed to notice an impact.

reformist2

(9,841 posts)Traders were always all about making a buck, but the increasing emphasis on short-term trading and increasing reliance on computers means that old-fashioned words such as "long-term investing" or "value" are becoming irrelevant to the strategies of many funds. That's scary.

byeya

(2,842 posts)a year, the funds have to disclose what they have owned.

If the funds you are interested in say that their annual expenses that you pay are 1%(say) then they already are not doing much, if any, churning.

If a mutual fund, closed or open ended, say that they are a buy and hold fund then they pretty much have to stick to that.

It's the Hedge funds and private money and investment banks that are engaging in these practices unless I am mistaken - and if I am I would certainly like to know.

reformist2

(9,841 posts)High-frequency trading (HFT for short) is pretty much the opposite of investing. Taxing it would put the emphasis back on fewer, longer-term investing strategies, which is what these mutual funds and hedge funds should be doing in the first place.

byeya

(2,842 posts)byeya

(2,842 posts)can imagine the % and what's taxed varies widely. Large economies like Japan and Belgium have an FTT and the USA version lasted until 1966 after a 50 year or so run.

pampango

(24,692 posts)Reform Committee" is below.

http://new.livestream.com/accounts/954563/events/2227525

The power point is at http://www.usagainstgreed.org/FTT_BarclayTestimony_2013.07.08.ppt .

Nye Bevan

(25,406 posts)If I make a profit with a risky stock trade, I don't owe any tax? I am not familiar with that part of the tax code.

indepat

(20,899 posts)social security, Medicare, and the rest of the safety net are ripe for plucking. ![]()