From -

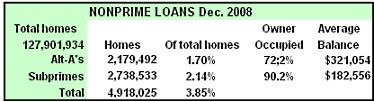

Too little too late - The Money Party at Work Feb 19, 2009 by Michael Collinshttp://www.apj.us/index.php?option=com_content&task=view&id=2226&Itemid=2The nonprime home lending market consists of 2.2 million "Alt-A" home loans to those with good credit who chose "innovative" adjustable rate mortgages plus 2.7 million subprime home loans to those with marginal credit who, often times, used funds to purchase a first home. The total 4.9 million nonprime loans were used to purchase homes that house around 12 to 15 million people.

The total balance due for the five million "nonprime" loans is $1.2 trillion as of December 2008. The loans at risk (60 days overdue) have a balance due of $160 billion (40% for Alt-A's, 60% for subprimes). Preserving home ownership for those at risk in just the nonprime financed homes will eat up the proposed $75 billion package and reduce the Fannie-Freddie funding increase from $200 to $115 billion dollars.

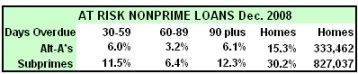

To understand how the future will look, let's examine what happened in the nonprime market in 2008. The following graph shows the risk in just the nonprime loans. Traditional fixed interest loans are less vulnerable at the moment but when GM and Chrysler implode and as small businesses disappear, traditional loans will show up at risk in droves.

The nonprime lone market has 1.2 million loans at risk of entering foreclosure due to substantial arrears in payment. What will change to allow these people to catch up? There's no credit line left, in most cases, and no room for a "second" in a home loan where the current value is less than the loan value.

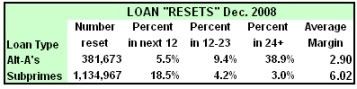

When a nonprime loan "resets," it adds an average of three to six points to the loan payment for Alt-A's and subprimes respectively. It's quite a shock.

"Average Margin" is a specified amount added to the

rate of the mortgage when it "resets" a few years into the loan.

This chart shows the percent of nonprimes resetting in the coming years. In 2009, 630,000 combined nonprime loans will reset to a substantially higher interest, 320,000 in 2010. By 2011, all but 3% the subprimes will have reset. However, starting in 2011, nearly 40% of the Alt-A's, 850,000 in all, are scheduled to reset. Families and individuals in these homes will have a home loan well over the assessed home value and a substantial increase in interest payments. They'll be in a recession economy.