| Latest | Greatest | Lobby | Journals | Search | Options | Help | Login |

|

|

|

This topic is archived. |

| Home » Discuss » Archives » General Discussion (1/22-2007 thru 12/14/2010) |

|

| Octafish

|

Sun Oct-12-08 04:34 PM Original message |

| Know your BFEE: Goldmine Sacked or The Best Way to Rob a Bank Is to Own One |

|

Advertisements [?]

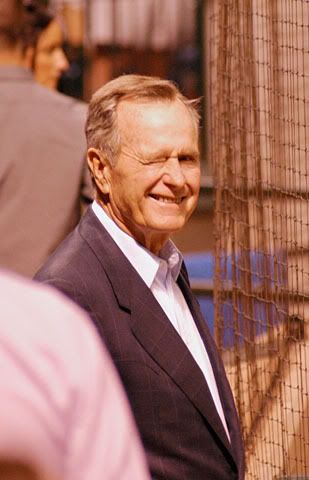

Now that George Walker Bush has emptied whats left of the U.S. Treasury into Wall Streets gargantuan beggars cup, you need to know the name of the fellah who got us into this deregulation mess. His name is George Herbert Walker Bush. Duhbyas daddy. Here he is at the old ball game (or wherever), giving the lensman (or somebody) a nice smile and a great big conspiratorial wink.  Poppy as Veep Back when trickle-down was new, Ronald Reagan appointed Poppy the Veep to a big job. Bush was to head the federal governments efforts to streamline government regulations, including the deregulation of the financial industry. BUSH GROUP'S PROPOSALS ON BANKING REGULATION By EDWARD COWAN (NYT); Financial Desk The New York Times December 24, 1983, Saturday Late City Final Edition, Section 1, Page 39, Column 5, 689 words An Administration working group has agreed on a long list of changes meant to simplify Federal regulation of financial institutions, according to a statement from Vice President Bush's office. The group, which Mr. Bush heads, is striving to send recommendations for legislative proposals to President Reagan within weeks. The ... SOURCE (sorry, no dinero for downloadin today): http://select.nytimes.com/gst/abstract.html?res=FA0C1EFD3E5C0C778EDDAB0994DB484D81 Unfortunately, this also led Uncle Sam to desupervise these same financial industries. In addition to unleashing the age of greed, this desupervision served to benefit a certain class of fraudster a high class, connected fraudster. Two New Words for P.O.d Taxpayers CONTROL FRAUD Control Fraud Lars Christian Smith Conservation Finance James Galbraith mentions in a comment the very useful concept of control fraud introduced by William K. Black, see e.g. When Fragile becomes Friable: Endemic Control Fraud as a Cause of Economic Stagnation and Collapse (pdf),

Economic theory about fraud is underdeveloped, core neo-classical theories imply that major frauds are trivial, economists are not taught about fraud and fraud mechanisms, and neo-classical economists minimize the incidence and importance of fraud for reasons of self-interest, class and ideology. Neo-classical economics understanding of fraud is so weak that its policy prescriptions, if adopted wholly, produce strongly criminogenic environments that cause waves of control fraud. Neo-classical policies simultaneously make control fraud easier and more lucrative, dramatically reduce the risk of detection and prosecution by maximizing systems capacity problems, and encourage crime by making it easier for fraudsters to neutralize the social and psychological constraints against deceit and fraud. Thus the paradox: neo-classical economic triumphs produce tragedy SOURCE: http://conservationfinance.wordpress.com/2007/03/06/control-fraud/ The Bush Commissions work resulted in the right conditions. DE-REGULATION MEANS DE-SUPERVISION The Best Way to Rob a Bank Is to Own One How Corporate Executives and Politicians Looted the S&L Industry By William K. Black Preface In 2003, the United States Department of Justice reported that property crimes had continued their trend and fallen to an all time low. In fact, property crimes have surged to an all-time high since Enron collapsed in late 2001. The reason for the contradiction is that the Justice Department does not count serious property crimes because it excludes white-collar crimes from its data keeping. A wave of frauds led by the men who control large corporations, what I term "control fraud," caused the massive losses from property crimes. In the 1980s, a wave of control frauds ravaged the savings and loan (S&L) industry. I was a regulator during the heart of that crisis. As the book shows, I had an uncanny ability to end up in the wrong place at the wrong time and a talent for getting powerful politicians furious at me. After the crisis, I went back to school at the University of California at Irvine to learn to be a criminologist. I knew that the S&L crisis had grown out of systemic fraud. My dissertation studied California S&L control frauds. This book arose from my concerns that we had failed to learn the lessons of the S&L debacle and that the failure meant that we walked blind into the ongoing wave of control frauds. The defrauders use companies as both sword and shield. They have shown themselves capable of fooling the most sophisticated market participants and academic experts. They are financial superpredators who use accounting fraud as a weapon and a shield against prosecution. Several factors make control frauds uniquely dangerous. The person who controls a company (or country) can defeat all internal and external controls because he is ultimately in charge of those controls. Fraudulent CEOs do not simply defeat controls; they suborn them and turn them into allies. Top law firms, under the pretense of rendering zealous advocacy to the client, have helped fraudulent CEOs loot and destroy the client. Top-tier audit firms are even more valuable allies (Black 1993e). Every S&L control fraud, and all of the major control frauds that have surfaced recently, were able to get clean opinions from them. Control frauds, using accounting fraud as their primary weapon and shield, typically report sensational profits, followed by catastrophic failure. These fictitious profits provide the means for sophisticated, fraudulent CEOs to use common corporate mechanisms such as stock bonuses to convert firm assets to their personal benefit. In short, they camouflage themselves as legitimate leaders and take advantage of the presumption of regularity (and psychic rewards) that CEOs receive. Fraudulent CEOs can transform the firm and the regulatory environment to aid control fraud. They can use the full resources of the firm to bring about these changes. Control frauds frequently make (directly and indirectly) large political contributions. They may lobby in favor of deregulation or tort reform, or seek to remove the chief regulator. They can place the firm in the lines of businesses that offer the best opportunities for accounting fraud. This generally means investing in assets that have no readily ascertainable market value and arranging reciprocal "sales" of goods, which can transform real losses into fictional profits (Black 1993b). It can also mean, however, targeting poorly regulated industries. They can make the firm grow rapidly and become a Ponzi scheme. The result is a dangerous package that appears healthy and legitimate but is not and that has extraordinary resources available for use by a fraudulent CEO. Control frauds have shown the ability to fool the most sophisticated market participants. They can be massively insolvent and still be touted by experts as among the very best firms in the world. The conventional economic wisdom about the S&L debacle assumed that "high flier" S&Ls existed solely because of deposit insurance. Scholars asserted that private market discipline would prevent any excessive risk taking in industries that had no government guarantee. This view was incorrect: S&L control frauds consistently showed the ability to deceive uninsured private creditors and shareholders. Elliot Levitas, one of the commissioners appointed to investigate the causes of the debacle as part of the National Commission on Financial Institution Reform, Recovery and Enforcement (NCFIRRE), emphasized this point in 1993, but no economist took him seriously. The current wave of control frauds has proved his point conclusively. The scariest aspect of control frauds, however, is that they can occur in waves, causing systemic damage. The S&L debacle was contained before it damaged our overall economy, but this book explains how near a thing that was. Waves of control fraud have occurred in many nations, often with devastating consequences. Russia's privatization campaign was ruined by such a wave. CONTINUED http://books.google.com/books?id=SI3F8wEuT24C&pg=PA32&lpg=PA32&dq=reagan+administration+banking+deregulation&source=web&ots=UjIZ1kdNve&sig=VJz7Y8ZC7VUhzLTRxTWEhyGGOlM&hl=en&sa=X&oi=book_result&resnum=4&ct=result#PPA37,M1 WHICH MEANS DE-FRAUDING THE MOPES No wonder John McCains so chummy with Joe Lieberman. Need a hint? Arthur Andersen? ENRON? Dishonesty, Greed and Hypocrisy in Corporate America.  Come to think of it, it explains why McCains friends with Phil Gramm, the ultraconservative deregulator from Texas. ENRON and the Gramms THE FINE PRINT. Something very important we dont want to miss or forget. The Best Way to Rob a Bank Is to Own One: How Corporate Executives and Politicians Looted the S&L Industry William K. Black Excerpt... pp. 32- DESUPERVISION Pratts desupervision of the industry compounded the disaster his deregulation caused. Desupervision helped make the industry ideal for control fraud. First, and most disastrously, Pratt froze and then reduced the number of examiners. This was a terrible mistake, but Pratt was not alone in making it. President Reagans first act was to freeze new hires. The Office of Management and Budget (OMB) wanted the Bank Board to reduce its examiners and supervisors. President Reagan appointed Vice President Bush to head his financial deregulation task force. Bush recommended that financial regulators rely more on computer analyses of industry financial statements and cut both the frequency of examinations and the number of examiners. Martin Lowy (1991, 36) says that Pratt fought with the administration for new examiners and was denied them. SOURCE: http://books.google.com/books?id=SI3F8wEuT24C&pg=PA32&lpg=PA32&dq=reagan+administration+banking+deregulation&source=web&ots=UjIZ1kdNve&sig=VJz7Y8ZC7VUhzLTRxTWEhyGGOlM&hl=en&sa=X&oi=book_result&resnum=4&ct=result#PPA37,M1 Well. Surely, this bailout is an aberration, correct? Wrong. ITS ONLY THE BEGINNING. THERES MORE. A LOT MORE.  Taking up Poppys mantel of the wonders of computerized banking is this techy whiz-kid, a young veep straight out of Goldman Sachs, tapped to figure out how to best implement the bailout billions. Picked to direct the Wall Street bailout: Who is Neel Kashkari? By Alex Lantier 8 October 2008 WSWS.org On October 6 US Treasury Secretary Henry Paulson named Neel Kashkari to head the Treasurys new Office of Financial Stability (OFS). The OFS is charged with paying out $700 billion to Wall Street banks and other financial firms in exchange for their failed mortgage-backed assets, under the terms of the bailout signed into law by President Bush on October 3. Kashkaris identity is thus a matter of considerable public interest. Only 35 years old, Kashkari joined the Treasury in 2006 as a Senior Advisor to US Treasury Secretary Henry M. Paulson, according to his official Treasury Department biography. At the time, Paulson was giving up his job as CEO of Wall Street investment bank Goldman Sachs to join the Treasury. The biography continues, Prior to joining the Treasury Department, Mr. Kashkari was a Vice-President of Goldman Sachs & Co. in San Francisco, where he led Goldmans IT Security Investment Banking practice, advising public and private companies on mergers and acquisitions and financial transactions. Despite his high rank, Kashkari has only a few years of experience in finance. After initially studying aerospace engineering at the University of Illinois, he worked at defense firm TRW on contract projects from the US space agency NASA, before switching careers and attending the Wharton School of Business in Philadelphia. He joined Goldman Sachs after graduating from Wharton in 2002. Once at the Treasury, Kashkari helped prepare the recently passed bailout. The Wall Street Journal wrote, Mr. Kashkari was part of the Treasury team that negotiated the asset-repurchase program with Congress <...> He was also one of the originators of the plan. Last year, he and Phillip Swagel, assistant secretary for economic policy, crafted a proposal called break the glassreferring to the emergency nature of using such a toolwhich envisioned Treasury buying bad loans and other assets. Kashkaris history highlights the extraordinary influence of Goldman Sachs, a firm that stands massively to benefit from the bailout its former executives have organized at the Treasury. Not only does Goldman now have the option of unloading its failed mortgage-backed assets on the Treasury, but it stands to make large sums from carrying out the actual transactions of the bailout program itself. CONTINUED http://www.wsws.org/articles/2008/oct2008/kash-o08.shtml Gee. Nice work, if you can get it. Which makes for some, uh, some coincidence: From the time Poppy served as Prunefaces veep to his present Dim Sons administration, the BFEE has been chief overseer and protector and primary abuser and beneficiary of the nations treasure. Its hard to find someone more connected through blood and pen and purse to the powers-that-be in Wall Street and Washington, D.C. than GHW Bush. Poppys father was U.S. Senator Prescott Sheldon Bush. Ol Pres was in the investment banking business with Allen Dulles and W. Averell Harriman. Their address was 1 Wall Street, Brown Brothers Harriman. From there, in the days after World War I, they invested heavily in Germany. In the process, their concern grew to powerful heights while they helped rebuild the German economy and enriched those who financed the rise of Adolf Hitler.  DUers have discussed this aspect of Bush directed fiscal policy and its impact on the current politico-economic reality, as well: Know your BFEE: Scions of the Military Industrial Complex Know your BFEE: Spawn of Wall Street and the Third Reich So. The Chief of Foxes minding the henhouses of treasure from Wall Street to the U.S. Treasury, for a good part of the last three decades, have been named Bush. And those people running the cash register, counting the receipts, issuing the I.O.Us and running the printing presses have had their strings pulled by people connected to a Bush. No wonder the U.S. Treasury keeps getting looted and our resources plundered. And, thanks to the recent bailout plan, things look to be that way for a long time to come. Interesting who got into computers for other things, like counting votes. As on Wall Street, it makes sense to bank with the BFEE, longterm. Trust them, so to speak, to do whats right for their own position, profit and power. It only follows, they are the folks whove made control fraud into an art form and the national policy.  Conspiratorial Wink (detail) by Michael Samuels |

| Printer Friendly | Permalink | | Top |

| Home » Discuss » Archives » General Discussion (1/22-2007 thru 12/14/2010) |

|

Powered by DCForum+ Version 1.1 Copyright 1997-2002 DCScripts.com

Software has been extensively modified by the DU administrators

Important Notices: By participating on this discussion board, visitors agree to abide by the rules outlined on our Rules page. Messages posted on the Democratic Underground Discussion Forums are the opinions of the individuals who post them, and do not necessarily represent the opinions of Democratic Underground, LLC.

Home | Discussion Forums | Journals | Store | Donate

About DU | Contact Us | Privacy Policy

Got a message for Democratic Underground? Click here to send us a message.

© 2001 - 2011 Democratic Underground, LLC