Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Economy

In reply to the discussion: Weekend Economists in "Perpetual Anticipation" April 13-15, 2012 [View all]Demeter

(85,373 posts)46. Some Observations on the Second Lien Problem

http://www.nakedcapitalism.com/2012/04/some-observations-on-the-second-lien-problem.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

Over the past three years, the big four servicers have been keeping hundreds of billions of dollars of second mortgages on their books (mostly in the form of Home Equity Lines of Credit, or HELOCs). Many of these mortgages would seem effectively worthless, because a home equity line of credit or second mortgage on top of an already deeply underwater first mortgage has no value. You can’t use it to foreclose, because you’d get nothing out of the foreclosure – all of that would go to the first mortgage holder (usually some investor in a pension fund somewhere). It has only “hostage value”, or the ability to stop a modification or write-down from happening. The best way to clean up this situation is to have the regulators (FDIC, OCC, Federal Reserve) simply tell the banks that they must write down their second mortgages on collateral that has been impaired. That way, the incentive problem goes away. By forcing the bank to recognize the loss now, the bank will no longer stop a modification on a first mortgage. And in fact, the regulators pretty much agreed that this is what their examiners should do, when they issued new rules earlier this year on accounting for second liens.

Only, the regulators haven’t done it, because the banks claim their seconds are performing. Bank of America says that these loans are worth 93 cents on the dollar. Several of the other banks don’t break out their loss reserves for seconds, so it’s hard to tell, but I think it’s clear they aren’t reserving enough. We can tell that because the Federal Reserve itself is dramatically overvaluing these seconds. In a stress test, the Fed said in its worst case scenario that the banks would lose only “$56 billion”. These are low numbers. According to their most recent investor report, Wells Fargo alone has $35 billion of second liens behind first mortgages that are underwater.

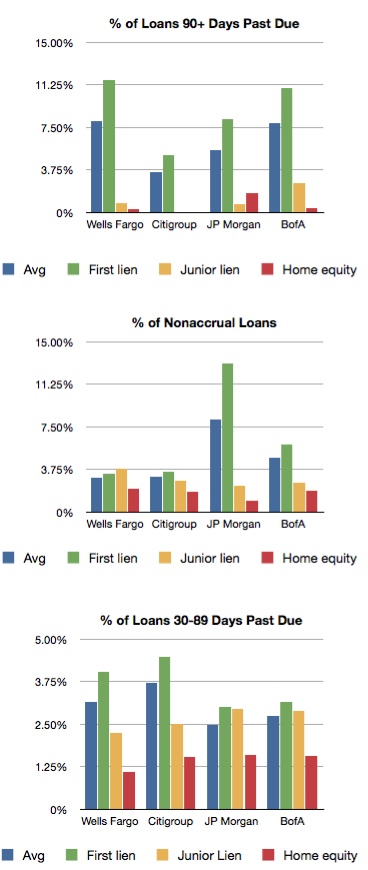

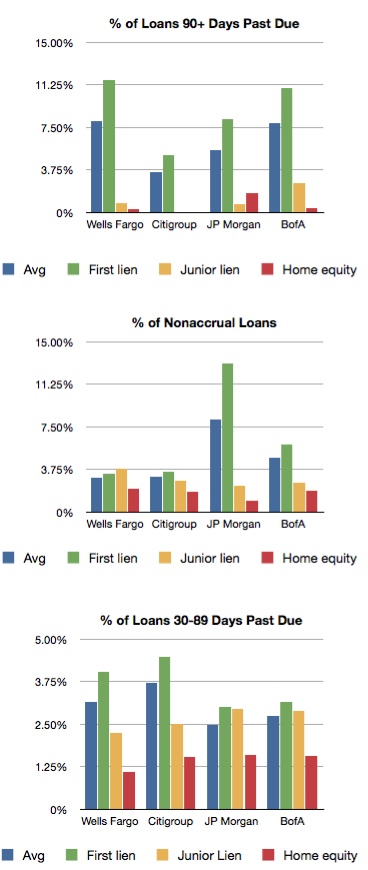

I did an analysis of some of these numbers, downloading FDIC data on the bank holding company level. I’m not a bank accountant, so I ran these numbers by a few people who know what they are doing, and they were not surprised by what I found. Here’ the percentage of loans at various stages of impairment, by loan type. You can see that junior liens and HELOCs do far better than first mortgages, which is puzzling considering that delinquency rates are still at crisis-era levels. Something interesting happens at 90+ days, where essentially no seconds get put into that category. In fact, Citi has zero seconds in the 90+ days past due category, which a Citi rep told me was because they place their 90+ day plus loans in the non-accrual category. And the Citi rep. wouldn’t tell me how much the bank is reserving for these seconds, nor would he tell me how many of these loans are amortizing, or being paid off (more on that later). Citi’s actually in the best shape of any of the banks regarding these seconds, with a book about a third the size of Bank of America, Wells, and JPM Chase.

These second liens are doing really, really well. Oddly well.

So how valuable are these seconds? I took a look at the expansion of the second lien book for the top four servicers (you can see my spreadsheet here). Basically there was a massive expansion of these second liens from 2007-2008, and then a very slow reduction of the books from 2009 onward. The banks extended a lot of credit in 2008, and have been withdrawing it ever since. But it’s not as if their loan books are entirely going down because the loans are being paid back. They are going down because some of it is being paid back, and some is being charged off. There’s a mix of healthy payoffs and unhealthy charge-offs. That means we can sort of assess how healthy these loans are overall by looking at the mix. And indeed, for the top four banks, the trend is positive. From 2009 to 2010, for instance, Wells reduced its second lien exposure by $4B. But it wrote off $5B of second liens! That means it was actually extending more loans than it was paid back, even as its loan book shrank. Very bad. JP Morgan, Bank of America, and Citi weren’t quite as bad, but their experience with second liens from 2009-2010 wasn’t good. This improved the next year. The latest data we have is that from the end of 2010 to the end of 2011, Wells reduced its HELOC book by $7B, with $3B or 45% of that being charge-offs. Citi’s percentage was roughly 40% ($2B reduction, $900M in charge-offs), JPM’s percentage was roughly 20% ($7B in reductions, $1.9B in charge-offs), and Bank of America was roughly 40% ($9B in reduction, $3.6B in charge-offs). There are other reasons to think these liens aren’t worth 93 cents on the dollar and should be written down. For instance, Ed DeMarco recently discussed second liens behind Fannie/Freddie loans. Here’s what he said.

That’s a lot to write off. And I’ve seen a securitization of quality Countrywide second mortgages that were actually securitized, and so do not face the same accounting fraud and conflict of interest problems. On that trust, losses were upwards of 30%, so far. The real question here is data. We don’t know a lot about this market, and the banks like it that way. They don’t have to write down their seconds, they don’t have to take a big capital hit, and the OCC gets to continue its love affair with the banks. But I suspect, based on what I’ve seen here, that examiners should begin to demand more information from their banks on whether these second liens are really worth what they say they are worth. Otherwise, the foreclosure crisis will continue, investors and homeowners will continue to bear losses, and blight will spread as vacant homes continue to have their copper wiring stripped out.

Over the past three years, the big four servicers have been keeping hundreds of billions of dollars of second mortgages on their books (mostly in the form of Home Equity Lines of Credit, or HELOCs). Many of these mortgages would seem effectively worthless, because a home equity line of credit or second mortgage on top of an already deeply underwater first mortgage has no value. You can’t use it to foreclose, because you’d get nothing out of the foreclosure – all of that would go to the first mortgage holder (usually some investor in a pension fund somewhere). It has only “hostage value”, or the ability to stop a modification or write-down from happening. The best way to clean up this situation is to have the regulators (FDIC, OCC, Federal Reserve) simply tell the banks that they must write down their second mortgages on collateral that has been impaired. That way, the incentive problem goes away. By forcing the bank to recognize the loss now, the bank will no longer stop a modification on a first mortgage. And in fact, the regulators pretty much agreed that this is what their examiners should do, when they issued new rules earlier this year on accounting for second liens.

Only, the regulators haven’t done it, because the banks claim their seconds are performing. Bank of America says that these loans are worth 93 cents on the dollar. Several of the other banks don’t break out their loss reserves for seconds, so it’s hard to tell, but I think it’s clear they aren’t reserving enough. We can tell that because the Federal Reserve itself is dramatically overvaluing these seconds. In a stress test, the Fed said in its worst case scenario that the banks would lose only “$56 billion”. These are low numbers. According to their most recent investor report, Wells Fargo alone has $35 billion of second liens behind first mortgages that are underwater.

I did an analysis of some of these numbers, downloading FDIC data on the bank holding company level. I’m not a bank accountant, so I ran these numbers by a few people who know what they are doing, and they were not surprised by what I found. Here’ the percentage of loans at various stages of impairment, by loan type. You can see that junior liens and HELOCs do far better than first mortgages, which is puzzling considering that delinquency rates are still at crisis-era levels. Something interesting happens at 90+ days, where essentially no seconds get put into that category. In fact, Citi has zero seconds in the 90+ days past due category, which a Citi rep told me was because they place their 90+ day plus loans in the non-accrual category. And the Citi rep. wouldn’t tell me how much the bank is reserving for these seconds, nor would he tell me how many of these loans are amortizing, or being paid off (more on that later). Citi’s actually in the best shape of any of the banks regarding these seconds, with a book about a third the size of Bank of America, Wells, and JPM Chase.

These second liens are doing really, really well. Oddly well.

So how valuable are these seconds? I took a look at the expansion of the second lien book for the top four servicers (you can see my spreadsheet here). Basically there was a massive expansion of these second liens from 2007-2008, and then a very slow reduction of the books from 2009 onward. The banks extended a lot of credit in 2008, and have been withdrawing it ever since. But it’s not as if their loan books are entirely going down because the loans are being paid back. They are going down because some of it is being paid back, and some is being charged off. There’s a mix of healthy payoffs and unhealthy charge-offs. That means we can sort of assess how healthy these loans are overall by looking at the mix. And indeed, for the top four banks, the trend is positive. From 2009 to 2010, for instance, Wells reduced its second lien exposure by $4B. But it wrote off $5B of second liens! That means it was actually extending more loans than it was paid back, even as its loan book shrank. Very bad. JP Morgan, Bank of America, and Citi weren’t quite as bad, but their experience with second liens from 2009-2010 wasn’t good. This improved the next year. The latest data we have is that from the end of 2010 to the end of 2011, Wells reduced its HELOC book by $7B, with $3B or 45% of that being charge-offs. Citi’s percentage was roughly 40% ($2B reduction, $900M in charge-offs), JPM’s percentage was roughly 20% ($7B in reductions, $1.9B in charge-offs), and Bank of America was roughly 40% ($9B in reduction, $3.6B in charge-offs). There are other reasons to think these liens aren’t worth 93 cents on the dollar and should be written down. For instance, Ed DeMarco recently discussed second liens behind Fannie/Freddie loans. Here’s what he said.

However, for Enterprise loans that are underwater and seriously delinquent, the population from which HAMP primarily draws, about half of the loans have subordinate liens. Therefore we believe that well over a quarter of this population, perhaps nearly half, have an associated subordinate lien.

That’s a lot to write off. And I’ve seen a securitization of quality Countrywide second mortgages that were actually securitized, and so do not face the same accounting fraud and conflict of interest problems. On that trust, losses were upwards of 30%, so far. The real question here is data. We don’t know a lot about this market, and the banks like it that way. They don’t have to write down their seconds, they don’t have to take a big capital hit, and the OCC gets to continue its love affair with the banks. But I suspect, based on what I’ve seen here, that examiners should begin to demand more information from their banks on whether these second liens are really worth what they say they are worth. Otherwise, the foreclosure crisis will continue, investors and homeowners will continue to bear losses, and blight will spread as vacant homes continue to have their copper wiring stripped out.

Edit history

Please sign in to view edit histories.

73 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

RecommendedHighlight replies with 5 or more recommendations

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

RecommendedHighlight replies with 5 or more recommendations

Lobbyist on Rep. Waters as Chair of Fin. Services Com.: “Just the name sends shivers up the spine”

Demeter

Apr 2012

#3

George Soros: Eurozone Crisis Has Entered “A Less Volatile but Potentially More Lethal Phase”

Demeter

Apr 2012

#4

Why isn’t DOJ seeking money damages in e-books price-fixing case? (COULD IT BE....CORRUPTION?)

Demeter

Apr 2012

#13

Victory in Oakland County Transfer Tax Case Paves Way for Other Michigan Suits Against Fannie and Fr

Demeter

Apr 2012

#16

Bank of America Launches Test “Mortgage to Lease” Program – Should We Be Impressed?

Demeter

Apr 2012

#20

So let's see, people paid all of the closing costs, down payments, taxes, insurance and the myriad

mbperrin

Apr 2012

#26

Foreclosure Fraud Activist Lisa Epstein Runs for Clerk of Courts in Palm Beach County

Demeter

Apr 2012

#51

The Dallas Fed Is Calling For The Immediate Breakup Of Large Banks Joe Weisenthal

Demeter

Apr 2012

#25

It’s Not a Crime to Break a Terms of Service Agreement (So It’s Okay to Never Read Them)

Demeter

Apr 2012

#36

Next Great Depression? MIT study predicting ‘global economic collapse’ by 2030 still on track

Demeter

Apr 2012

#53

4 Massive Government Bubbles; 3 Major Events That Will Burst The Bubbles (GLD, SLV, TZA, SDS, FAS)

Demeter

Apr 2012

#58

A Response To Ben Bernanke’s ‘Misunderstanding’ About The Gold Standard (GLD, SLV, IAU, SGOL)

Demeter

Apr 2012

#54

Soaring Oil price & weakening US economy-On the Edge with Max Keiser-03-23-2012

Demeter

Apr 2012

#57