Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

General Discussion

In reply to the discussion: Jacob Lew: Another Brick in the Wall Street on the Potomac (William K. Black) [View all]Octafish

(55,745 posts)21. Wealth Extraction by Theft is very cost-effective. So's owning a bank.

That's what William K. Black wrote.

I borrowed the phrase -- Know your BFEE: Goldmine Sacked or The Best Way to Rob a Bank Is to Own One

Thank you for the heads-up on Dye. His bio shows expertise in the concentrated power in elite institutions from education to business to politics. The Elite Theory reminds me of all the nice people around Leo Strauss, the father of neo-conservatism and idol of the PNAC crowd.

Regarding the protectors of great wealth, an expert:

Wealth, Income, and Power

by G. William Domhoff

University of California at Santa Cruz

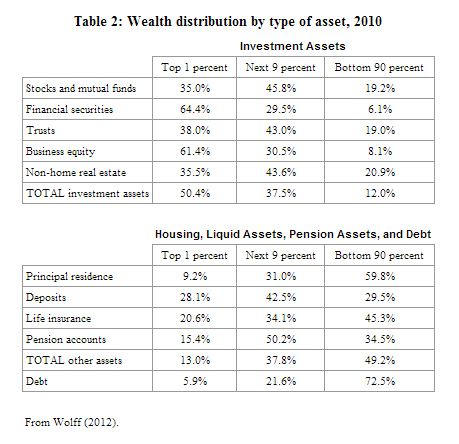

This document presents details on the wealth and income distributions in the United States, and explains how we use these two distributions as power indicators.

Some of the information may come as a surprise to many people. In fact, I know it will be a surprise and then some, because of a recent study (Norton & Ariely, 2010) showing that most Americans (high income or low income, female or male, young or old, Republican or Democrat) have no idea just how concentrated the wealth distribution actually is. More on that a bit later.

As far as the income distribution, the most striking numbers on income inequality will come last, showing the dramatic change in the ratio of the average CEO's paycheck to that of the average factory worker over the past 40 years.

First, though, some definitions. Generally speaking, wealth is the value of everything a person or family owns, minus any debts. However, for purposes of studying the wealth distribution, economists define wealth in terms of marketable assets, such as real estate, stocks, and bonds, leaving aside consumer durables like cars and household items because they are not as readily converted into cash and are more valuable to their owners for use purposes than they are for resale (see Wolff, 2004, p. 4, for a full discussion of these issues). Once the value of all marketable assets is determined, then all debts, such as home mortgages and credit card debts, are subtracted, which yields a person's net worth. In addition, economists use the concept of financial wealth -- also referred to in this document as "non-home wealth" -- which is defined as net worth minus net equity in owner-occupied housing. As Wolff (2004, p. 5) explains, "Financial wealth is a more 'liquid' concept than marketable wealth, since one's home is difficult to convert into cash in the short term. It thus reflects the resources that may be immediately available for consumption or various forms of investments."

We also need to distinguish wealth from income. Income is what people earn from work, but also from dividends, interest, and any rents or royalties that are paid to them on properties they own. In theory, those who own a great deal of wealth may or may not have high incomes, depending on the returns they receive from their wealth, but in reality those at the very top of the wealth distribution usually have the most income. (But it's important to note that for the rich, most of that income does not come from "working": in 2008, only 19% of the income reported by the 13,480 individuals or families making over $10 million came from wages and salaries. See Norris, 2010, for more details.)

This document focuses on the "Top 1%" as a whole because that's been the traditional cut-off point for "the top" in academic studies, and because it's easy for us to keep in mind that we are talking about one in a hundred. But it is also important to realize that the lower half of that top 1% has far less than those in the top half; in fact, both wealth and income are super-concentrated in the top 0.1%, which is just one in a thousand. (To get an idea of the differences, take a look at an insider account by a long-time investment manager who works for the well-to-do and very rich. It nicely explains what the different levels have -- and how they got it. Also, David Cay Johnston (2011) has written a column about the differences among the top 1%, based on 2009 IRS information.)

CONTINUED w/Links...

http://www2.ucsc.edu/whorulesamerica/power/wealth.html

People pay attention to economics when it's put into the numbers that impact them. People also respect honesty, especially if they can check the books.

Obama's Biggest Mistake: Selling Out to the Bankers

The original sin of Obama's presidency was to trust bank-friendly economists and Bush carryovers, whose primary goal was to protect their own past decisions and futures.

New Deal 2.0 / By James K. Galbraith

November 7, 2010

EXCERPT...

But one cannot defend the actions of Team Obama on taking office. Law, policy and politics all pointed in one direction: turn the systemically dangerous banks over to Sheila Bair and the Federal Deposit Insurance Corporation. Insure the depositors, replace the management, fire the lobbyists, audit the books, prosecute the frauds, and restructure and downsize the institutions. The financial system would have been cleaned up. And the big bankers would have been beaten as a political force.

Team Obama did none of these things. Instead they announced “stress tests,” plainly designed so as to obscure the banks’ true condition. They pressured the Federal Accounting Standards Board to permit the banks to ignore the market value of their toxic assets. Management stayed in place. They prosecuted no one. The Fed cut the cost of funds to zero. The President justified all this by repeating, many times, that the goal of policy was “to get credit flowing again.”

SNIP...

These facts were obvious to everybody, fueling rage at “bailouts.” They also underlie the economy’s failure to create jobs. What usually happens (and did, for example, in 1994 - 2000) is that credit growth takes over from Keynesian fiscal expansion. Armed with credit, businesses expand, and with higher incomes, public deficits decline. This cannot happen if the financial sector isn’t working.

Geithner, Summers and Bernanke should have known this. One can be fairly sure that they did know it. But Geithner and Bernanke had cast their lots, with continuity and coverup. And Summers, with his own record of deregulation, could hardly have complained.

CONTINUED...

http://www.alternet.org/story/148770/obama%27s_biggest_mistake%3A_selling_out_to_the_bankers

Politically speaking, one would be amazed at what an economy based on justice, not just-us, would do for the nation.

Heck, if we taxed the rich who've gained most of what's been there to grab over the past 32 years at a fair rate, we'd solve the world's problems.

Edit history

Please sign in to view edit histories.

36 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

RecommendedHighlight replies with 5 or more recommendations

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

RecommendedHighlight replies with 5 or more recommendations

Jacob Lew: Another Brick in the Wall Street on the Potomac (William K. Black) [View all]

Octafish

Jan 2013

OP

The lesson is that just because the president replaces one of the elites doesnt mean he will replace

rhett o rick

Jan 2013

#2

Gee. That's the OPPOSITE of what Dr. Black wrote. Puro Third Way is more like it.

Octafish

Jan 2013

#12

Another banker who profited from the 2008 financial crisis is empowered in the Obama administration

Octafish

Jan 2013

#19

"Failure of Epic Proportions": Treasury Nominee Jack Lew’s Pro-Bank, Austerity, Deregulation Legacy

Agony

Jan 2013

#24

Well it seems, from the articles and the commentary posted on this forum that Romney should have

Purveyor

Jan 2013

#26