Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

tpsbmam

tpsbmam's Journal

tpsbmam's Journal

July 16, 2013

(GENTLY for Lester!)

(GENTLY for Lester!)

What a good man. This is his response to being attacked by a crazed woman pissed off that he dedicated "People Get Ready" to Trayvon Martin. Takes me back to all of the people who stood their ground....peacefully......for civil rights. Thank you, Lester, may the love & prayers you're getting from the tons of people who know how wrong this verdict was and how pathetically horrid it was for you to be attacked for honoring Trayvon in that most appropriate way, we're glad you're on the mend and hope all of those healing vibes we're sending out are gently taking hold of you to help you heal.

His Facebook page.

Lester Chambers (or his son) just posted this update to his Facebook pg with a message to all of us

Lester Chambers

Next Day recap... I am sore all over. Beaten but not broken. I can't laugh, sing, hardly talk long or take a deep breath without chest pain.. All my joints ache. My hips feel sore as can be... I haven't been in a fight since I was 15 or 16 back in highschool and 60 years later I am assaulted on stage... I WANT PEACE... PLEASE KEEP THE PEACE... LOVE PEACE AND HAPPINESS

What a good man. This is his response to being attacked by a crazed woman pissed off that he dedicated "People Get Ready" to Trayvon Martin. Takes me back to all of the people who stood their ground....peacefully......for civil rights. Thank you, Lester, may the love & prayers you're getting from the tons of people who know how wrong this verdict was and how pathetically horrid it was for you to be attacked for honoring Trayvon in that most appropriate way, we're glad you're on the mend and hope all of those healing vibes we're sending out are gently taking hold of you to help you heal.

His Facebook page.

July 15, 2013

?7

?7

(Sorry if this has been posted -- didn't see it though I did search.)

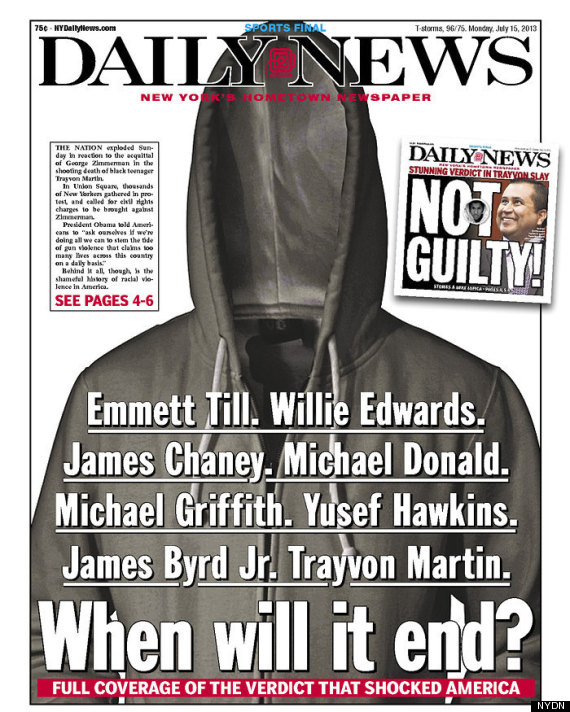

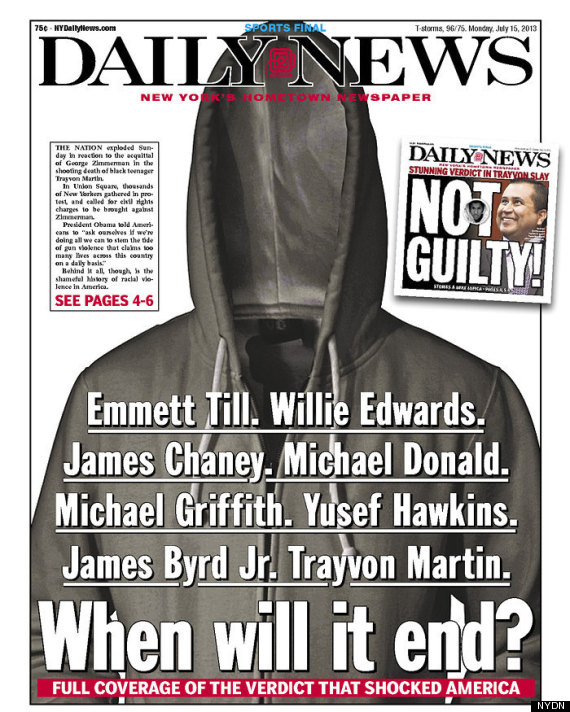

Incredibly powerful.

WOW! NY Daily News unbelievably powerful front page following the Zimmerman verdict

?7

?7

(Sorry if this has been posted -- didn't see it though I did search.)

Incredibly powerful.

July 11, 2013

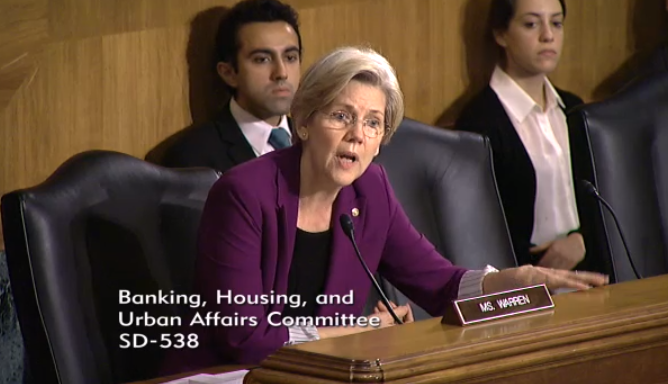

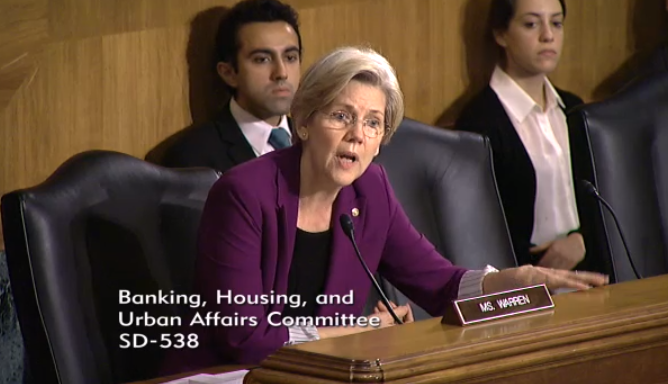

At today’s Senate Banking Committee hearing, Elizabeth Warren introduced the 21st Century Glass-Steagall Act of 2013, co-sponsored by Senators McCain, Cantwell, and King. The bill mirrors the heart of the original 1933 law, which separated traditional banking activity (like checking and lending) from the riskier activity investment banking (like derivatives).

The original law was repealed in 1999 toward the end of the Clinton administration, though the law had been eroding for years leading up to 1999. This repeal was one of several laws passed during that era which allowed the big banks to transform into megabanks, in part creating our current “too big to fail” policy.

This new bill from Senator Warren aims to play a part in reversing this trend so the banks will be smaller. After all, the three biggest banks (Chase, Bank of America, and Citi) are all bloated conglomerate banks that have enormous traditional and investment subsidiaries, so these banks wouldn’t be able to continue as they’re currently instituted. They would be broken up into much smaller firms.

What’s more, the 21st Century Glass-Steagall Act of 2013 will make it so banks cannot gamble with derivatives using depositor’s money like they do today. Currently, anyone who has money at banks like Chase, Bank of America, or Citi is implicitly using that money to help these banks make amplified bets that have the potential to cause another global meltdown. Reintroducing Glass-Steagall will make it so depositor’s money cannot be used for the derivatives market. This would be a major step toward restoring sanity to Wall Street.

Rest at Too Big Has Failed.org

Elizabeth Warren Introduces 21st Century Glass-Steagall Act

At today’s Senate Banking Committee hearing, Elizabeth Warren introduced the 21st Century Glass-Steagall Act of 2013, co-sponsored by Senators McCain, Cantwell, and King. The bill mirrors the heart of the original 1933 law, which separated traditional banking activity (like checking and lending) from the riskier activity investment banking (like derivatives).

The original law was repealed in 1999 toward the end of the Clinton administration, though the law had been eroding for years leading up to 1999. This repeal was one of several laws passed during that era which allowed the big banks to transform into megabanks, in part creating our current “too big to fail” policy.

This new bill from Senator Warren aims to play a part in reversing this trend so the banks will be smaller. After all, the three biggest banks (Chase, Bank of America, and Citi) are all bloated conglomerate banks that have enormous traditional and investment subsidiaries, so these banks wouldn’t be able to continue as they’re currently instituted. They would be broken up into much smaller firms.

What’s more, the 21st Century Glass-Steagall Act of 2013 will make it so banks cannot gamble with derivatives using depositor’s money like they do today. Currently, anyone who has money at banks like Chase, Bank of America, or Citi is implicitly using that money to help these banks make amplified bets that have the potential to cause another global meltdown. Reintroducing Glass-Steagall will make it so depositor’s money cannot be used for the derivatives market. This would be a major step toward restoring sanity to Wall Street.

Rest at Too Big Has Failed.org

July 11, 2013

Suppose a small group of extremely wealthy people sought to systematically destroy the U.S. government by (1) finding and bankrolling new candidates pledged to shrinking and dismembering it; (2) intimidating or bribing many current senators and representatives to block all proposed legislation, prevent the appointment of presidential nominees, eliminate funds to implement and enforce laws, and threaten to default on the nation’s debt; (3) taking over state governments in order to redistrict, gerrymander, require voter IDs, purge voter rolls, and otherwise suppress the votes of the majority in federal elections; (4) running a vast PR campaign designed to convince the American public of certain big lies, such as climate change isn't occurring, and (5) buying up the media so the public cannot know the truth. Would you call this treason?

From RR's Facebook page.

Robert Reich: Just suppose.....

Suppose a small group of extremely wealthy people sought to systematically destroy the U.S. government by (1) finding and bankrolling new candidates pledged to shrinking and dismembering it; (2) intimidating or bribing many current senators and representatives to block all proposed legislation, prevent the appointment of presidential nominees, eliminate funds to implement and enforce laws, and threaten to default on the nation’s debt; (3) taking over state governments in order to redistrict, gerrymander, require voter IDs, purge voter rolls, and otherwise suppress the votes of the majority in federal elections; (4) running a vast PR campaign designed to convince the American public of certain big lies, such as climate change isn't occurring, and (5) buying up the media so the public cannot know the truth. Would you call this treason?

From RR's Facebook page.

July 5, 2013

More at "SENATOR WARREN WON'T BE TAKING YOUR BS"

I need to remember to add a Warren for President tag to my posts. Most awesome addition to the senate in a long, long, long, long, long time!

Charles Pierce - "Dear Beltway Bureaucrats: do not attempt to bullshit Senator Professor Warren.

This never ends well."

The Congress of the United States has determined by inaction to let various people grift over America's college students, and the senior senator from Massachusetts would like to know why in the fk this kind of thing is allowed to happen.

This has been an ongoing thing. One quibble -- this is not something that has "broadened into a critique." This is a continuation of all the issues that SPW has been fighting over her entire public career -- namely, the connivance of big banks and government agencies to jam it to all the rest of us.

On Friday, Warren sent a letter to the CEO of the student lender, accusing Sallie Mae of "piling on" government supported benefits while reaping "big fees" from students. "While Sallie Mae is finding unique ways to profit from government programs, its borrowers are paying interest rates that are far in excess of the low cost of funds supported by the U.S. taxpayers," she wrote. The latest letter marks the newest round in a lengthy back and forth between the freshman senator and the student lender. What began as an inquiry into a low-interest line of credit Sallie Mae received from a government-created bank that primarily exists to support housing, has broadened into a critique of high student loan interest rates in general. "If we are serious about investing in our future, we should help our students pay for their education - not find ways to squeeze more profits from them. I believe it is time to align priorities in Washington with those of the American people," she added in her Friday letter.

This has been an ongoing thing. One quibble -- this is not something that has "broadened into a critique." This is a continuation of all the issues that SPW has been fighting over her entire public career -- namely, the connivance of big banks and government agencies to jam it to all the rest of us.

On Monday, Warren set off the debate, sending a letter to the Federal Housing Finance Agency, which oversees the nation's housing enterprises. In it, she asked why Sallie Mae, a private student loan provider, had received a low interest, $8.5 billion line of credit from the Federal Home Loan Bank of Des Moines. The nation's 12 Federal Home Loan Banks were created in the wake of the Great Depression, with the primary goal of ensuring access to low-cost funding for banks, which in turn could use them to offer affordable mortgages. The banks are owned by the nation's financial institutions, which buy into the banks in exchange for access to the low-cost funds, but are sponsored by the government.

Noting that Sallie Mae made $2.5 billion on student loan interest in 2012, Warren asked the regulator why it should get a 0.23 percent line of credit, while it was charging 25 to 40 times that amount on its own private student loans.

More at "SENATOR WARREN WON'T BE TAKING YOUR BS"

I need to remember to add a Warren for President tag to my posts. Most awesome addition to the senate in a long, long, long, long, long time!

Profile Information

Member since: Sat Sep 9, 2006, 03:59 PMNumber of posts: 3,927