2016 Postmortem

Related: About this forumFor Those That Think Nothing Can Be Done Against Wall Street's Lawyer...

A) YOU are an enabler to the corruption.

And...

B)

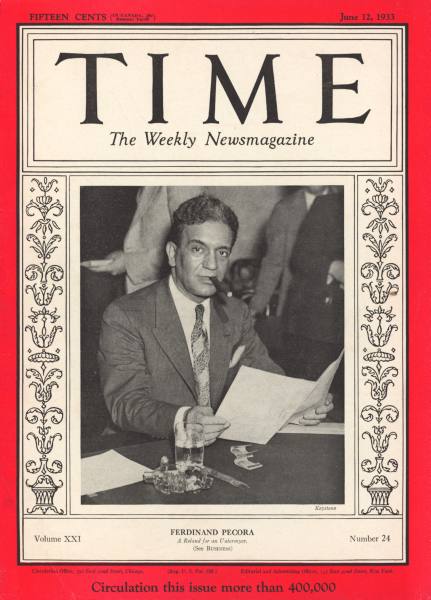

As reiterated by U.S. Securities and Exchange Commission (SEC) Chairman Arthur Levitt during his 1995 testimony before the United States House of Representatives, the Pecora Investigation uncovered a wide range of abusive practices on the part of banks and bank affiliates. These included a variety of conflicts of interest, such as the underwriting of unsound securities in order to pay off bad bank loans, as well as "pool operations" to support the price of bank stocks. The hearings galvanized broad public support for new banking and securities laws. As a result of the Pecora Commission's findings, the United States Congress passed the Glass–Steagall Banking Act of 1933 to separate commercial and investment banking, the Securities Act of 1933 to set penalties for filing false information about stock offerings, and the Securities Exchange Act of 1934, which formed the SEC, to regulate the stock exchanges.

The Banking Committee's hearings ended on May 4, 1934, after which Pecora was appointed as one of the first commissioners of the SEC.

In 1939 Ferdinand Pecora published a memoir that recounted details of the investigations, Wall Street Under Oath. Pecora wrote: "Bitterly hostile was Wall Street to the enactment of the regulatory legislation." As to disclosure rules, he stated that "Had there been full disclosure of what was being done in furtherance of these schemes, they could not long have survived the fierce light of publicity and criticism. Legal chicanery and pitch darkness were the banker's stoutest allies."

Link: https://en.wikipedia.org/wiki/Pecora_Commission

cantbeserious

(13,039 posts)eom

Ron Green

(9,822 posts)you're gonna try to get over. It's the way the system is built.

Scuba

(53,475 posts)Sancho

(9,067 posts)Breaking up US banks would do nothing. Closing tax loopholes might help. Most big banks are not in the US, and most influential money is not in the US. The US can't "break up" international banks, and without Congress cannot change the possibility of "influence". The GOP in Congress will not cooperate, some other international countries will not cooperate, and US Law has little or no way to reach into the offshore tax havens. Even the list below doesn't mention that there is more money in the Caribbean than in NYC! Check it out:

http://www.huffingtonpost.com/news/offshore-tax-havens/

https://en.wikipedia.org/wiki/List_of_largest_banks

2 China China Construction Bank Corporation

3 United Kingdom HSBC Holdings

4 China Agricultural Bank of China

5 United States JPMorgan Chase & Co.

6 France BNP Paribas

7 China Bank of China

8 Japan Mitsubishi UFJ Financial Group

9 France Crédit Agricole Group

10 United Kingdom Barclays PLC

11 United States Bank of America

12 Germany Deutsche Bank

13 United States Citigroup Inc

14 Japan Japan Post Bank

15 United States Wells Fargo

16 Japan Mizuho Financial Group

17 United Kingdom Royal Bank of Scotland Group

18 China China Development Bank

19 France Société Générale

20 Spain Banco Santander

http://www.huffingtonpost.com/2013/04/29/wealthy-stashing-offshore_n_3179139.html

The global super-rich are stashing trillions of dollars offshore with the help of some of the world's biggest banks, putting billions of dollars out of the taxman’s reach and masking wealth inequality's true heights.

Wealthy people were hiding between $21 and $32 trillion in offshore jurisdictions around the world as of 2012, according to a 2012 study from the Tax Justice Network, an organization which aims to promote tax transparency. The study, highlighted by a recent Bloomberg News report, found that more than $12 trillion of that money was managed by 50 international banks, many of which received bailouts during the financial crisis, according to James Henry, the study’s author.

“There’s a lot more missing wealth in the world than we had known about from previous estimates,” Henry told The Huffington Post. “The real scandal is not all these individual scandals but the fact that world’s policy makers who know about this stuff, have basically done nothing.”

These are included for FYI as part of recent history:

On June 20, 2012, Davis Polk lawyers Randall Guynn and John Douglas spoke on a teleforum entitled, “Solving the ‘Too Big to Fail’ Problem: Resolution Authority vs. Chapter 14.” The event was hosted by The Federalist Society for Law and Public Policy Studies’ Financial Services & E-Commerce Practice Group, and explores the Too Big to Fail problem in the post-Dodd-Frank era.

http://www.fed-soc.org/multimedia/detail/solving-the-too-big-to-fail-problem-resolution-authority-vs-chapter-14-podcast

http://www.c-span.org/video/?327191-3/washington-journal-roundtable-doddfrank-financial-law